Forecast Model of Stock Market Trend Based on International

Market and GRU-Attention

Chenyu Sun*

Capital Normal University (Beijing), Beijing, China

Keywords: International Market, GRU, Attention, Seq2Seq, Stock Prediction.

Abstract: Linkage effect of the international market is one of the most common phenomena of the stock market. In

order to better study the stock market prediction, this paper proposes a stock market index prediction model

based on the international major stock markets and GRU-attention. The international market is evaluated

through rolling correlation, and the correlation coefficients are ranked on market data, index data, capital flow

and international indexes to form multi-dimensional features. Using the Seq2Seq framework, the Attention

mechanism is added to the GRU model to prevent the model from ignoring the key feature information of

important time nodes. This article conducts experiments on the Shanghai Stock Exchange Index, and uses six

indicators: Mean Absolute Error (MAE), Root Mean Square Error (RMSE), Coefficient of Determination(R

2

)

Directional Symmetry (DS), Correct Up-trend (CU) and Run-time After evaluation, compared with the model

in this paper, the accuracy of the model in predicting the upward trend is effectively improved, and the

calculation overhead is reduced at the same time.

1 INTRODUCTION

Driven by the wave of the world economy, China's

financial market has ushered in unprecedented

development opportunities, and has gradually

occupied an important position in the international

financial market. With the gradual stabilization of

China’s financial market, in the face of increasingly

complex financial stock data, comparing artificial

intelligence and stock market analysis methods,

because traditional qualitative analysis relies too much

on the ideas and behaviors of investors, it is gradually

unable to Satisfy its needs for obtaining high returns

and avoiding risks. How to predict the future trend of

the stock market, better judge the stock trend, and

reduce investment risks to obtain high returns have

become issues that many researchers pay close

attention to.

The research on the stock market has always been

a key issue in the research of China's financial market.

China's stock market is affected by many factors.

Since the emergence of the stock market, relevant

scholars at home and abroad have conducted a lot of

research on the stock market forecast. From an

economic perspective, researchers mainly conduct

research on the stock market through fundamentals

and technology. However, because traditional

measurement models are becoming more and more

difficult to carry out a reasonable description, and

cannot effectively reflect the correlation between the

various dimensions of the stock market, this puts

forward higher requirements for the researchers of the

stock market. With the gradual development of

artificial intelligence technology, traditional financial

analysis methods such as MACD (Kang, 2021),

candlestick chart (Siriporn, 2019) have gradually been

replaced by neural networks (Alfonso, 2020) and deep

learning (M. Nabipour, 2020). Predicting the future

trend of the stock market through the stock market and

historical data associated with the stock market is the

main research direction of the stock market in the

computer field. Karolyi and Stulz (Karolyi, 1996) and

Forbes and Rigobon (Fortes, 2002) studied the stock

market volatility responses of major East Asian

countries under the background of the financial crisis.

Studies have shown that during the financial crisis,

countries closely related to capital and trade have a

certain degree of contagion in the financial market. In

other words, when a financial crisis occurs, the

macroeconomic environment of the risk-receiving

country is Stable, there is no attack by speculative

capital, a sharp decline in one market will also affect

the sharp decline in another market. Ajab (Ajab, 2019)

72

Sun, C.

Forecast Model of Stock Market Trend Based on International Market and GRU-Attention.

DOI: 10.5220/0011730500003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 72-79

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

used a multivariate GARCH model to conduct a

linkage study on the stock markets of the United

States, China, the United Kingdom and other countries

and the Gulf Cooperation Council countries. The

study found that the internal stock markets of the Gulf

Cooperation Council countries have significant

positive correlations and are affected by Sino-US

stock markets. The spillover effect of volatility in

other countries is obvious.

For the translation alignment problem, Liang et al.

(Liang, 2020) proposed an attention mechanism based

on the seq2seq model, which independently calculates

the attention score between the encoding state and the

decoding state, and can obtain the one-to-one

relationship between the encoding state and the

decoding state. relationship. The experimental results

show that the attention distribution of this model is

wider than other models, and it can cover more

original information. Shen et al. (Shen, 2018) used the

gate-controlled recurrent unit (GRU) neural network

model to predict stock indexes such as Hang Seng.

The experimental results show that compared with the

traditional neural network model and support vector

machine method, the prediction accuracy of the GRU

model is higher.

2 THEORIES AND MODELS

2.1 Rolling Correlation Coefficient

The rolling correlation coefficient can evaluate the

correlation between time series features of different

dimensions, thereby reflecting the degree of linear

correlation between different time series. The

calculation formula is as follows:

[

]

()

cov , [ ]

()

var( [ ] var( ( )

tk

ty kx y

x

ty kx y

δ

+

=

⋅+

(1)

Among them, t represents the reference variable, y

represents the time, and x is the number of advance

and lag periods of k. A positive value of x indicates

that k is advanced, and a negative value of x indicates

k lag. The value of x can be judged and selected

according to the maximum value of the correlation

coefficient.

2.2 Gated Recurrent Unit Model

The Gated Recurrent Unit (GRU) model consists of

two gates, the update gate (z

t

) and the reset gate (r

t

).

The model can capture the long-term association

relationship in the time series, and can effectively

address the problem of gradient disappearance. Its

input is determined by the output of the hidden layer

at the previous moment and the current input, and the

output information is the hidden layer at the next

moment. information. The reset gate can be used to

calculate the output of candidate hidden layers. Its

purpose is to control how many hidden layers from the

previous moment are retained by the model. Updates

can be used to control the output information of how

many candidate hidden layers are added to obtain the

output of the current hidden layer. The update gate can

be considered as a combination of input gate and

forget gate in LSTM neural network. The calculation

formula is as follows:

()

1txzthztz

zWxWhb

α

−

=++

(2)

Among them, ht-1 represents the state information

at the previous moment, and the calculated value of z

t

will be between zero and one. When the value of z

t

approaches 0, it means that the current state is relative

to the previous one. The less information retained at a

moment, the more it approaches one.

The function of the reset gate r

t

is to determine how

much output information from the previous moment

needs to be retained, and the calculated value is

between zero and one. After that, tanh will generate an

alternate state, as shown below:

()

1txrthrtr

rWxWhb

α

−

=++

(3)

()

~

1

tanh ( * )

t

tttr

hWxUrhb

−

=+ +

(4)

Therefore, the hidden state h

t

at time t can be

expressed.

ℎ

=

1 −𝑧

*ℎ

+ 𝑧

*ℎ

~

(5)

2.3 Seq2Seq-Attention Model

The main application problem of the Seq2Seq model

is the study from sequence to sequence. It first

appeared in the field of machine translation and has

achieved great results in this field. This model belongs

to an Encoder–Decoder network structure, in which

the role of the Encoder framework is to convert a

variable-length sequence into a fixed-length vector for

expression, and the function of the Decoder is to

convert this fixed-length sequence The vector is

converted into a variable-length target sequence.

The Seq2Seq model is mainly built based on a

cyclic neural network, which is composed of Encoder,

Decoder and semantic vector C, where the output of

Decoder can be expressed as formula (6) and formula

(7).

11

(,,)

ttt

s

fy s C

−−

=

(6)

1

(,,)

ttt

y

gy sC

−

=

(7)

Forecast Model of Stock Market Trend Based on International Market and GRU-Attention

73

Attention

Input

Output

GRU GRU GRU GRU

GRU GRU GRU GRU

Encoder Decoder

Figure 1: Seq2Seq-Attention Structure chart.

Start

Get stock market and stock market related data

Market data Index data

International

index

Money

flows

Rolling average

international index

Rolling average

of money flows

Rolling correlation Rolling correlation

Ranking of correlation

coefficients

Encoder

GRU

Attention

layer

Stock market

forecast results

End

Decoder

GRU

Figure 2: Combine the international market and GRU-Attention flow chart.

However, it can be seen from the above two

formulas that Seq2Seq still has problems when the

input sequence is too long, and the weight of effective

information will be reduced in this calculation.

Therefore, it is necessary to introduce the Attention

mechanism to solve this problem. The Seq2Seq

framework structure diagram combined with the

Attention mechanism is shown in Figure 1.

Which is an expression of attention mechanism.

1

x

T

qqpq

q

cah

=

=

(8)

The above formula is a weighted average of the

hidden state of the Encoder layer.

A score is calculated by adding the hidden state of

the Decoder and the hidden state of the Encoder. The

score is mainly used to calculate the weight of the

hidden state of the Encoder.

1

*tanh( * * )

ij t t

eV WhUs b

−

=++

(9)

At the same time, the weight corresponding to each

Encoder's hidden state is calculated.

1

exp( )

exp( )

x

qp

qp

T

ql

l

e

a

e

=

=

(10)

Calculated by the above formula, the GRU-

Attention model can predict the future by inputting

time series. Due to the correlation between the

Chinese stock market and the international market, a

stock market trend prediction model combining the

international market and GRU-Attention is proposed

to predict the future of the stock market. Trend

forecasts.

3 MODEL BUILDING COMBINED

WITH THE INTERNATIONAL

MARKET AND GRU-Attention

3.1 Combine the International Market

and GRU-Attention Model

Framework

The flow chart of the model combining the

international market and GRU-Attention proposed in

this paper is shown in Figure 2. The specific

construction process of the model is as follows:

(1) Data acquisition: Obtain data related to the

Shanghai Stock Exchange Index in the financial

market and international stock market data through the

Tushare financial data platform. Due to the imbalance

of holidays in the international stock market, there

may be problems with certain national data during

some holidays, so it is necessary Fill in the missing

values. Since each country index should maintain the

data value of the previous trading day during the

market break, it is necessary to fill in the missing

values downward.

(2) Data selection: Carry out rolling correlation

analysis on the processed data, obtain the rolling

correlation between the index closing price and return

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

74

rate of the international stock market relative to the

Shanghai stock index, and sort the market data,

indicator data, and rolling by the correlation

coefficient. The average international index and the

rolling average capital flow are evaluated.

(3) Data prediction: Sort the index data by

correlation coefficients, obtain the dimensional

features with a higher degree of correlation, and put

the multi-dimensional features into the GRU-

Attention model to predict the future stock market

trend, and through many experiments Compare the

real value with the predicted value to adjust the model

parameters to reduce the prediction error.

3.2 Evaluation Index

In order to combine the international market and the

training model in the GRU-Attention model to

evaluate the fit and analyze the degree of error. The

model data is evaluated through MAE, RMSE, and R

side. The calculation formulas for MAE, RMSE and

R

2

are as follows:

(1) MAE represents the average value of absolute

error, which can reflect the error between the predicted

value and the true value.

,,

1

1

n

pre i true i

i

MAE x x

n

=

=

|

−

|

(11)

(2) The deviation between the observed value and

the true value measured by RMSE.

2

,,

1

1

()

n

pre i true i

i

RMSE x x

n

=

=−

(12)

(3) R

2

is a reaction model of the goodness of fit,

fitting effect as the representative value closer to 1

more excellent.

2

,,

2

1

2

,,

1

()

1

()

n

pre i true i

i

n

mean i true i

i

xx

R

xx

=

=

−

=−

−

(13)

In order to better evaluate the future forecast data,

the real value and predicted value are analyzed

through MAE, RMSE, DS and DU. The larger the

value of DS and CU, the closer the stock market trend

predicted by the model is to the real stock market

trend.

(1) DS represents the probability that the predicted

future stock market trend will be the same as the actual

trend.

()

()

,,1,,1

1

1 0

100

,

0 Other

N

pre i pre i true i true i

kk

i

xx xx

DS

n

−−

=

−−≥

=∂∂

(14)

(2) CU represents the probability of the correct

upward forecast trend in the predicted future stock

market trend.

()

()

()

,,1, ,1 ,,1

1

1

1 0 0

100

,

0 ther

N

prei prei truei truei prei prei

kk

i

xx xx xx

CU

n

−− −

=

−−≥−>

=∂∂

且

O

(15)

4 THE EXAMPLE ANALYSIS

4.1 Data Acquisition

In this paper, the Shanghai Composite Index is

selected as the reference object of the prediction

model. By calling the Tushare big data platform, the

market data, index data, international index data and

capital flow in the Shanghai Composite Index from

January 5, 2015 to 2020-12-31, a total of 37

dimensional data features, including 1464 pieces of

data. As part of the data may be empty when

calculating rolling correlation and return rate, we

choose 2016-1-4 as the starting point. The data from

2016-1-4 to 2020-6-30 was used as the training set to

train the model, and the data from 2020-6-30 to 2020-

12-31 was used as the test set to test the prediction

effect.

4.2 Data Selection

The rate of return data of the above international

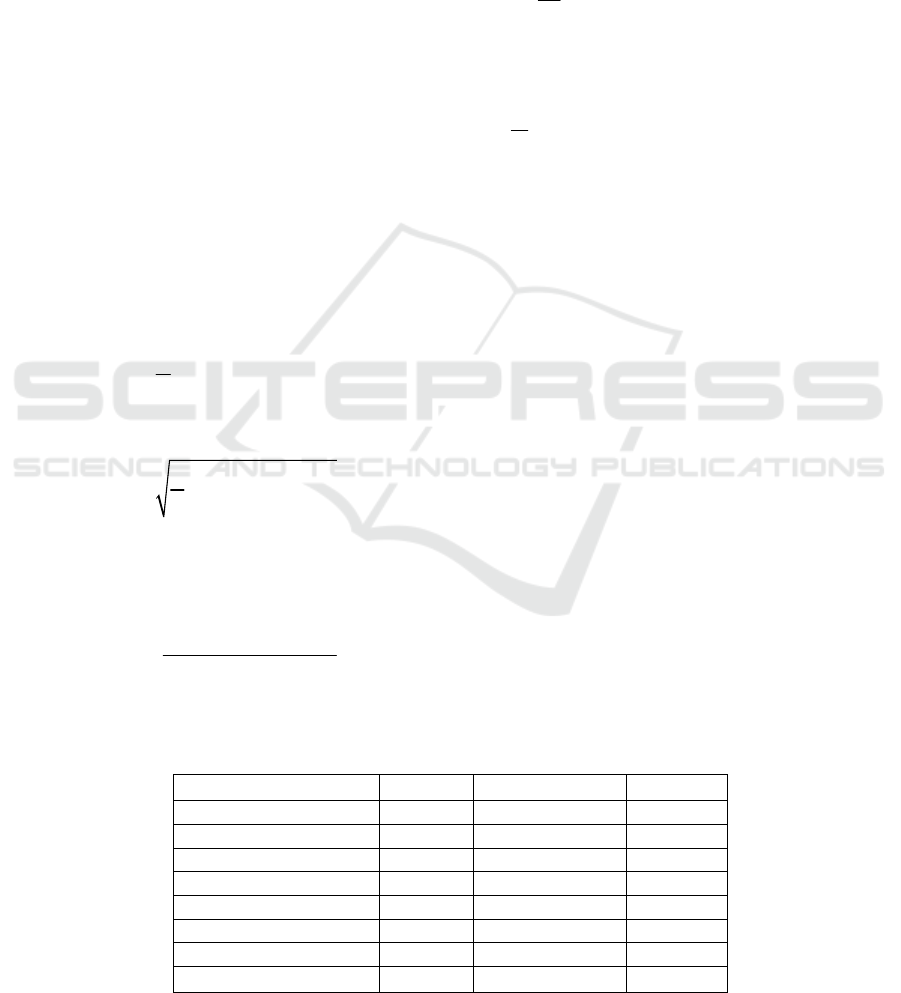

Table 1: Rolling correlation feature.

Index Day Index Day

North bound 6 HIS 72

HIS_yield 20 Nikkei 225 120

Nikkei 225_yield 61 S&P 500 94

SH-HK Stock Connect 6 FCHI 120

KOSPI_yield 67 IXIC 91

Euro stoxx 50 120 DJIA 68

GSPTSE, FTSE 100 62 KOSPI 120

Xetra DAX 120

Forecast Model of Stock Market Trend Based on International Market and GRU-Attention

75

Figure 3: International index heat map.

indexes are calculated, and the rolling correlation

analysis of the international indexes, the rate of return

of the international indexes and the capital flow data

is carried out for 2-120 days. The weak correlation

features are excluded, and the characteristics in the

following table are selected and the average value of

the multi-day data is taken.

Heat maps are drawn for the above features

through correlation sorting, as shown in Fig. 3.

According to the heat map, it can be seen that only

GSPTSE, Kospi_yield and Nikkei 225_yield have a

high correlation with the Shanghai Composite Index.

Therefore, these three characteristics are selected as

the input characteristics of the international index.

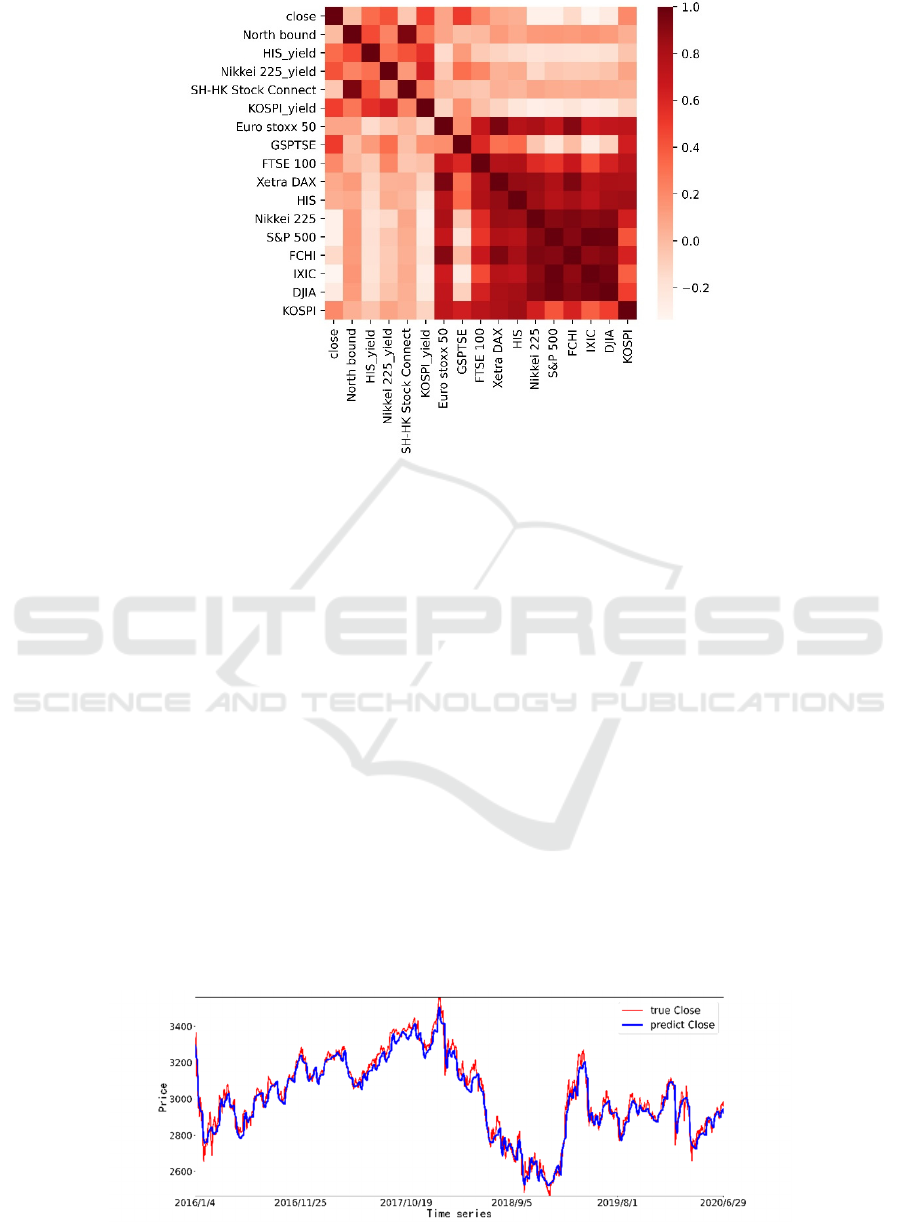

4.3

Prediction of Data

Dimensional features with high correlation were

obtained through the selection of the above indicators,

and the multi-dimensional features were put into the

GRU-Attention prediction model. In order to ensure

the operation effect of the model, model parameters

need to be adjusted and grouping experiments are

conducted on the model.

Experiment 1: First, the number of stacked layers

of the model was set as 1 layer, the number of

iterations was set as 300, and the learning rate was set

as 0.0001. Because neurons will be lost randomly in

the process of training the model, however, this

operation will cause instability of the predicted results,

so the dropout layer is added to optimize the neural

network, and the dropout_rate is set as 0.3.

After the above parameters are determined, the

corresponding model is established to achieve relative

stability after 300 iterations. The prediction model is

generated to forecast the training data and test data

respectively. The experimental results of the training

data are shown in Fig. 4 and the experimental results

of the test data are shown in Fig. 5.

Figure 4: Prediction results of training data in Experiment 1.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

76

Figure 5 Prediction results of test data in Experiment 1.

Figure 6: Prediction results of training data in Experiment 2.

Figure 7: Prediction results of test data in Experiment 2.

Experiment 2: Change the number of stacked

layers of the model to 2, change the learning rate to

0.0005, and set the dropout_rate of the dropout layer

to 0.4. The experimental results of the training data are

shown in Fig. 6, and the experimental results of the

test data are shown in Fig. 7.

The comparative evaluation indexes of

Experiment 1 and Experiment 2 are shown in the

following table.

Table 2: Evaluation of experimental training data.

Evaluation

index

MAE RMSE R

2

1 34.14 45.03 0.96

2 30.64 40.98 0.97

Lift ratio 10.25% 8.99% 0.01%

Table 3: Evaluation of experimental test data.

Evaluation

index

MAE RMSE DS CU

1 35.70 50.73 43.65% 47.69%

2 32.26 46.21 55.56% 58.57%

Lift ratio 9.63% 8.91% 27.29% 22.81%

Can be seen from table 2 and table 3, results, the

contrast experiment on the indicators are improved,

especially on the test data of the DS and CU index,

27.29% and 22.81% respectively of ascension, it is

very important for the prediction problem of the stock

market is concerned, the most important thing for

investors is timing of buy and sell stocks, In

Experiment 2, the correct rate of trend prediction can

reach more than 50%. For investors, they can choose

a good time to make an effective judgment on the

stock market and thus avoid risks.

.

Forecast Model of Stock Market Trend Based on International Market and GRU-Attention

77

Figure 8: Comparison of model prediction results.

Table 4: Comparative analysis of model prediction results.

Evaluation index MAE RMSE DS CU Run-time

GRU-Attention 32.26 46.21 55.56% 58.56% 418.09

LSTM-Attention 33.77 44.74 54.76% 57.33% 476.68

LSTM 39.56 52.84 42.06% 46.48% 245.42

GRU 39.15 52.25 47.62% 51.39% 238.18

Single-GRU-Attention 39.00 54.48 46.03% 50.00% 410.97

4.4 Comparison of Model Prediction

Results

In order to verify the rationality of the prediction of

GRU-Attention model combined with international

market proposed in this paper, this paper selects four

other models for comparison. The selection of the

model is mainly based on the following three aspects:

1) Select a single LSTM and GRU neural network, and

use the learning ability of its own algorithm to predict

the data. 2) The LSTM-Attention model was selected

to compare the training time and error effect of the

model between LSTM and GRU neural network. 3)

The GRU-Attention model with a single feature was

selected to analyze the advantages of multi-

dimensional features Through the comparison of the

above models, the prediction trend of each prediction

model can be clearly seen from Fig. 8 and Table 5. By

comparing the performance of each model, it can be

seen that compared with the single LSTM and GRU

model, the prediction model with the Attention

mechanism has a significant increase in running time,

but the prediction error rate is significantly smaller

than that of the single model. Especially for DS and

Cu indexes, the model with Attention mechanism was

more accurate in predicting trends. Similarly,

compared with the single-dimensional GRU-

Attention model, although GRU-Attention model has

no advantage in running time, it is better than the

single-dimensional model in predicting error rate and

accuracy of trend. Compared with the LSTM-

Attention model, there was no significant difference in

the prediction effect, but in terms of running time, the

GRU-Attention model was significantly more

efficient.

5 CONCLUSION

This paper proposes a stock market trend prediction

model based on the international market and GRU-

Attention. The above index data are used as

experimental samples, and MAE, RMSE, and R

2

are

used as evaluation indicators for training data, and

MAE, RMSE, DS, and CU are used as evaluation

indicators for test data. Through GRU-Attention to

predict the relevant data of the international market

and the Shanghai Stock Exchange, it is verified that

this model has a lower error rate and a higher

operating efficiency than other forecasting models.

There is still room for improvement in its overall

forecasting ability. Later, it will consider introducing

public opinion data and domestic and foreign news as

input data, increasing its input dimension, and

considering adding a two-way neural network to a data

set with richer text information to reduce errors.

Improve the accuracy of trend forecasting.

REFERENCES

Alfonso G, Ramirez D R. Neural Networks in Narrow

Stock Markets[J]. Symmetry, 2020, 12(8):1272.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

78

Ajab A. Alfreedi. Shocks and Volatility Spillover Between

Stock Markets of Developed Countries and GCC Stock

Markets [J]. Journal of Taibah University for Science,

2019, 13(1): 1-9.

Fortes K, Rigobon R. No Contagion, Only

Interdependence: Measuring Stock Market

Comovements [J]. The Journal of Finance, 2002, 57(5):

2223-2261.

Karolyi A, Stulz M.Why do markets move together? An

investigation of US-Japan stock return co-movements

[J]. Journal of Finance, 1996, 51(3): 951-986.

Kang ByungKook. Improving MACD Technical Analysis

by Optimizing Parameters and Modifying Trading

Rules: Evidence from the Japanese Nikkei 225 Futures

Market [J]. Journal of Risk and Financial Management,

2021, 14(1).

Liang Z, Du J, Li C. Abstractive social media text

summarization using selective reinforced Seq2Seq

attention model[J]. Neurocomputing, 2020, 410:432-

440.

M. Nabipour, P. Nayyeri, H. Jabani, et al. Deep Learning

for Stock Market Prediction [J]. Entropy, 2020, 22(8).

Siriporn Thammakesorn, Ohm Sornil. Generating Trading

Strategies Based on Candlestick Chart Pattern

Characteristics[J]. Journal of Physics: Conference

Series, 2019, 1195(1).

Shen G, Tan Q, Zhang H, et al. Deep Learning with Gated

Recurrent Unit Networks for Financial Sequence

Predictions [J]. Procedia Computer Science, 2018,

131:895-903.

Forecast Model of Stock Market Trend Based on International Market and GRU-Attention

79