Data Analytics on Media Reports of Semiconductor Chip Shortage

Shuting Shan

1, a

, Xiaoyue Li

2, b

, Sen Lin

3, c

and Feibo Chen

4, d

1

Project Management Group, Dangqu Technology Co. Ltd., Ningbo, Zhejiang, China

2

MIT Supply Chain Management Program, Massachusetts Institute of Technology, Cambridge, MA, U.S.A.

3

Line-haul Road Transportation Lab, Ningbo China Institute for Supply Chain Innovation, Ningbo, Zhejiang, China

4

MIT-Ningbo Supply Chain Management Program, Ningbo China Institute for Supply Chain Innovation,

Ningbo, Zhejiang, China

Keywords: Chip Shortage, Capacity, News Report, Data Analytics, Content Analysis.

Abstract: The global chip shortage has been hitting many industries. This paper presents the results of a data analytics

study of media reports of chip shortage. The analysis was mainly based on an examination of different

publications from 2020 to 2021. This paper firstly introduces the concept of chip and its manufacturing

process, then evaluates the nature, extent, and impact of the chip shortage, and finally reviews the historic

chip shortage cases. This paper provides insights for researchers and practitioners, for example, improving

processes and controlling inventory better to attenuate the chip shortage.

1 INTRODUCTION

A Chip, also known as a microchip, an integrated

circuit or monolithic integrated circuit, is defined as

“a circuit in which all or some of the circuit elements

are inseparably associated and electrically

interconnected” (JEDEC). Every final product of the

chip goes through the process of designing, building

and selling, which involves a great number of

different corporate hands. Chips can be manufactured

either by an in-house fab, or by an external foundry.

For example, Intel as an independent device

manufacturer (IDM), designs the chips by its

engineers and manufactures the chips on its own fabs.

Similarly, companies such as IBM and XilinX, they

design and produce the chips using their own

factories. But they also make chips for other

companies. However, other companies such as Brand

X are fabless chip companies, they use an

independent foundry. Fabs and foundries need to

purchase manufacturing tools and heavy equipment

from a variety of tool suppliers located in America,

Europe, and Asia. Some market leaders are Applied

Materials, Tokyo Electron Limited (TEL), Nikon and

KLA. Similarly, the necessary raw materials also

need to be purchased from outside vendors, including

silicon wafer, photomasks, gases, photoresists, other

substrates, wet, ancillaries and deposition materials

(N. Zlatanov, 2004). While large companies may

have solutions to material shortages, small and

medium enterprises (SMEs), such as SSL

Corporation in Ningbo, suffers from significant chip

shortage since it is dedicated to the production of

automotive camera modules.

2 ANALYTICS ON MEDIA

REPORTS

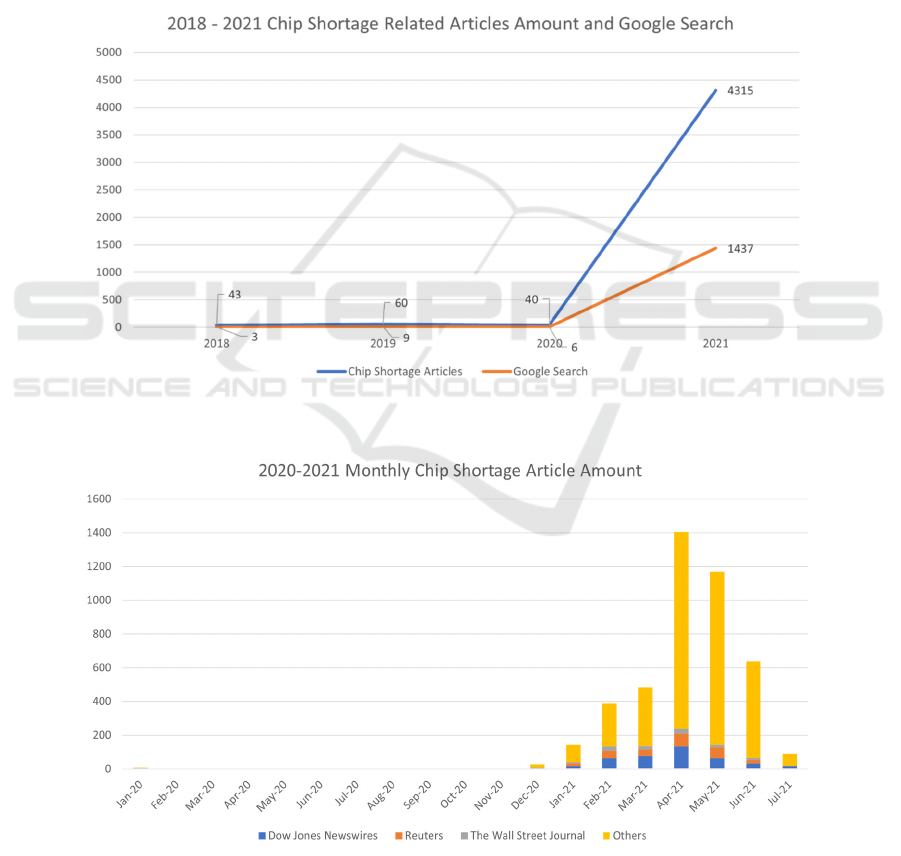

A Google search was performed to produce an

overview of popularity of the chip shortage topic. The

search result trend is presented in Fig. 1. We used a

preliminary set of key words to search and download

the full text related chip shortage from different

publications such as the Dow Jones Newswires, the

Reuters, the Wall Street Journal and other

publications from 2020 to 2021. The results shown in

Fig. 2 indicate that enterprises worldwide have been

battling the semiconductor shortage since December

2020. In the past three decades, the global markets

had witnessed the chips shortage constantly mainly

due to the increasing demand or natural disasters.

However, the sustained shortage are partially due to

underinvestment due to the significant cost of

opening a chip factory (Chou, 2007). For instance, in

2011, supplies of silicon wafers and other raw

materials used for chip-making were disrupted due to

the earthquake and subsequent tsunami in Japan

174

Shan, S., Li, X., Lin, S. and Chen, F.

Data Analytics on Media Reports of Semiconductor Chip Shortage.

DOI: 10.5220/0011732400003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 174-178

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

(Brown, 2011). However, the pressure during 2020-

2021 comes from both demand and supply sides,

including surging demand, stagnant semiconductor

capacity growth in past decade, shrinking

semiconductor manufacturing labor market (Skanda,

2013) and higher supply chain vulnerability

(“Semiconductor Contract Manufacturing Services

Worldwide 1996”, 2013); (Lee, 2021). Additionally,

unlike historic chip shortage cases, multiple

disruption events such as pandemic, trade war and

natural disasters also add pressure and constrains on

semiconductors production successively.

3 2021 CHIP SHORTAGE

The chip shortage during 2020-2021 was caused by

multiple disruption including imbalance between

increasing demand and stagnant supply, shrinking

labor market, high supply chain vulnerability, trade

war and natural disasters. The combination of the

disruptions added much more pressure and

constraints on chip production and have more global

impacts, while past chip shortages were mainly

caused by single event thus impacted less regions and

industries.

Figure 1: Google Search Results About Chip Shortage, 2018-2021.

Figure 2: Number of Chip Shortage Reports by Month, 2020-2021.

Data Analytics on Media Reports of Semiconductor Chip Shortage

175

The steady rise of chip demand slightly declined

in 2019. At the start of 2020, the rollout of 5G was

expected to create a surge in demand for chips in

mobile industry. There were also predictions of

increasing demand of chips in automotive and

industrial applications. Unexpectedly, due to Covid-

19 pandemic, there was a surge in demand for laptops

and servers for staff working remotely and children

home-schooled. Data from Bureau of Economic

Analysis illustrated that in 2020 the spending of

computer and peripheral equipment increased by 30

percent from $120 billions to nearly $160 billion

(Printed Electronics Now, 2021). The revenue of

semiconductor industry increased by 10.8 percent to

$464 billions from 2019 to 2020, demonstrated by

IDC data (Issue Alert, 1986).

Geopolitical factor also played a role when

Huawei Technologies, ZTE, and other Chinese firms

have been sanctioned by the Trump administration.

Those companies started to stock up chips for 5G

smartphones and other related electronic devices.

Also, American enterprise cannot access to the chips

made by China’s Semiconductor Manufacturing

International Corporation after the federal

government listed the firm on the entity list.

The lead time for many semiconductors is more

than one year in 2021, compared with 14 weeks in

2018 (K. Ian, 2021). The lead time were expected to

continuously widen. Some key reasons are that the

semiconductor industry are highly underinvestment

and underemployment.

To respond to the increasing demand of chips, the

semiconductor industry is continuous increasing fab

capital investment. Some semiconductor

manufacturers had increased capital budget on

building new fabs. For instance, Taiwan

Semiconductor Manufacturing Company (TSMC)

increased its capital spending budget to $26 billion.

South Korean, with Samsung as one of the leading

semiconductor enterprises, has announced significant

investment, $451 billions investment package in

semiconductor development (G. Matthew, 2021).

However, experts believe that it would take more than

5 years to fund and build a new semiconductor fab,

which cannot immediately ease the shortage (K. Ian,

2021).

Along with persistent underinvestment in

semiconductor industry, it would be no surprise that

the labor market trend of semiconductor industry

would be consistent with the investment trend. Data

from the Bureau of Labor Statistics has shown that

the employment was peaked in 2000 along with the

tech boom and never recovered after the recession in

2001 (Skanda, 2013). In 2020, the number of

employees in semiconductors and related devices

manufacturing is only half of it in 2000.

Apart from underinvestment and

underemployment, there are some other disruptions

leading to the chip supply chain disruption. For

instance, in July in 2020, a fire at Japanese factory led

to a cut off of fiberglass used for printed circuit board

(Chelsey, 2020). In late October in 2020, a fire at

Asahi Kasei Microdevices (AKM) semiconductor

factory led to supply chain interruption for some end-

products (TTI, 2021).

With panic, lockdowns, and general uncertainty

rolling across the globe under the Covid-19

pandemic, the shipping of the parts for chip-making

has been disrupted. Especially, infections at some key

points in the semiconductor supply chain in Taiwan

would worse globally chip shortage. Outbreaks at

some key ports lead to global shipping delays of

semiconductor parts (Xie, 2021).

Semiconductor manufacturing capacity shifted

from evenly-distributed-worldwide to Taiwan-

dominated, leading to higher supply chain

vulnerability. There are three or four semiconductor

foundries accounting for the global chip supply with

TSMC and Samsung dominating the business. The

estimated revenue of TSMC was $12.9 billion for the

first quarter of 2021 (Yang, 2021).

4 HISTORIC CHIP SHORTAGE

CASES

Historic chip shortages are caused by single reasons

instead of the combination of economic, political and

social reasons, which is different from 2021 chip

shortage. We list these shortages in reverse

chronological order.

In 2012, with booming smartphone market, there

was an increasing demand of chips. Qualcomm, one

of the largest chip makers, underestimated its demand

of Snapdragon S4 chips. Qualcomm's manufactures

cannot secure enough supply to meet the orders of

this chip, which lead to chip shortage (Clark, 2012).

In 2011, semiconductor enterprises have

experienced supply disruption, which is caused by

Fukushima earthquake and subsequent tsunami. On

the demand side, there was an increased demand in

automotive industry while sluggish demand of chip

used in PC. In terms of the supply, Fukushima

earthquake and tsunami disrupted the supply of

silicon wafers and other raw materials used for chip-

making, leading to the 2011 chip shortage (Matsuo,

2015).

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

176

Back in 2004, there is a CDMA shortage from the

mobile phone industry and card chip shortage from

the bank industry with card technology updated. In

terms of the mobile industry, during the first half of

2004, the demand by mobile network operators has

continued unbated, especially with the introduction

of 3G network service and more storage space needed

for data storage. Also, Chinese operators continued to

stock up chips to avoid unexpected tighten supply of

chips. In terms of the bank industry, bank converted

magnetic stripe payment cards to more smarter and

secure cards (Clark, 2004).

In terms of supply of chip, Qualcomm has

controlled about 88 percent of the CDMA chipset

market, but experienced supply constraints and

resulted in unable to meet certain orders. The CDMA

chip market as a whole experienced a tightens supply.

Qualcomm's supply constraints may give rival

CDMA chip suppliers a chance to compete in the

market (Clark, 2004).

In 2000, the explosion of cellular phones,

technically sophisticated toys and personal

computers has caused unprecedented demand for

semiconductors. The capacity of chipmakers such as

Intel Corp., Advanced Micro Devices, and Fujitsu

Ltd cannot meet the explosion demand of chips. Chip

lead time doubled from 30 to 40 days to 60 to 90 days.

The chip shortage has forced toy manufacturers

delaying introduction of some interactive toys until

the following year. For instance, Sony has to cut in

half the number of PlayStation 2 game console. In

computer industry, the computer chip shortage was

driven by corporate demand for personal computers.

AMD holds an estimated 17 percent market share

with 82 percent for Intel. The increased demand of

microprocessor, booming server sales as companies

built and expanded website worsen the chip shortage

(“Semiconductor Contract Manufacturing Services

Worldwide 1996”, 2013).

In 1988, the chip shortage was caused by high

demand of the personal computer market and

tightening supply due to US-Japan semiconductor

trade agreement. The agreement demonstrated Japan

agreed to limits its exports of semiconductors, mainly

the "dynamic random access memory" (DRAM)

chips, to the U.S. Back in 1985, the U.S

manufacturers has imported record number of chips

from Japan to meet their needs for personal

computers. Japanese firms accounted for 92 percent

of the sales of the whole chip sales in the U.S. market

(Flamm, 2007).

5 CONCLUSION

This paper presents the results of a data-driven

investigation of media reports regarding chip

shortage. Historic chip shortages are caused by single

reasons instead of the combination of economic,

political and social reasons, which is different from

2021 chip shortage. From our analysis on media

reports, yield problems and other forms of

uncertainties could also lead to more incidents of chip

shortage, and appropriate supply chain design could

alleviate these uncertainties (Cai, 2017; Li, 2021; Ji,

2020). Process improvement and better inventory

control may potentially attenuate the chip shortage

problem. (Li, 2018; Li, 2019)

REFERENCES

A. Skanda and W. Alex, “Supplying Demand: The Chip

Shortage in Macro Context.” http://archive.

computerhistory.org/resources/access/text/2013/04/10

2723332-05-01-acc.pdf (accessed Aug. 16, 2021).

B. Li and A. Arreola‐Risa, “On minimizing downside risk

in make‐to‐stock, risk‐averse firms,” Nav. Res. Logist.,

vol. 68, no. 2, pp. 199–213, 2021.

B. Li, Q. Zhu, and R. Miao, “Economic Analysis of

Acceptance Inspection Sampling: Combining

Incentives with Policy Optimization for Process

Improvement,” in 2018 2nd International Conference

on Data Science and Business Analytics, ICDSBA,

2018, pp. 111–114.

B. Li, L. Sen, and C. Miyoshi, “Design and optimization of

risk-averse inventory control system with supply-side

uncertainty: Randomness, computation, and air freight,”

in 2019 International Conference on Economic

Management and Model Engineering, ICEMME, 2019,

pp. 377–380.

C. Brown and G. Linden, Chips and change: how crisis

reshapes the semiconductor industry. MIT Press, 2011.

D. Chelsey, “Nittobo Plant Fire to Impact ABF Substrate

Supply,” 2020. https://pcdandf.com/pcdesign/index.

php/editorial/menu-news/fab-news/14839-nittobo-plan

t-fire-to-impact-abf-substrate-supply (accessed Aug.

16, 2021).

D. Clark, “Corporate News: Qualcomm Is ‘on Track’ To

Ease Chip Shortage,” Wall Street Journal, 2012.

https://www.wsj.com/articles/SB10000872396390444

873204577535344117368640 (accessed Aug. 16,

2021).

D. Clark, “Qualcomm Profit Surged in Quarter; Chip

Demand, Royalties from Cellphone Makers Helped

Drive Earnings,” Wall Street Journal, 2004. https://

www.proquest.com/newspapers/qualcomm-profit-surg

ed-quarter-chip-demand/docview/398925124/se-2?ac

countid=12492 (accessed Aug. 16, 2021).

Data Analytics on Media Reports of Semiconductor Chip Shortage

177

G. Matthew, “South Korea’s semiconductor splurge could

turn the chip shortage into a surplus,” 2021.

https://techmonitor.ai/technology/south-korea-chip-

investment-samsung-sk-hynix-chip-shortage (accessed

Aug. 16, 2021).

H. Matsuo, “Implications of the Tohoku earthquake for

Toyota ׳ s coordination mechanism: Supply chain

disruption of automotive semiconductors,” Int. J. Prod.

Econ., vol. 161, pp. 217–227, 2015.

JEDEC, “integrated circuit.” https://www.jedec.

org/standards-documents/dictionary/terms/integrated-

circuit-ic (accessed Aug. 16, 2021).

J. Cai, M. Zhong, J. Shang, and W. Huang, “Coordinating

VMI supply chain under yield uncertainty: Option

contract, subsidy contract, and replenishment tactic,”

Int. J. Prod. Econ., vol. 185, pp. 196–210, 2017.

K. Ian, D. Wu, and D. Pogkas, “How a Chip Shortage

Snarled Everything from Phones to Cars,” 2021. https://

www.bloomberg.com/graphics/2021-semiconductors-

chips-shortage/ (accessed Aug. 16, 2021).

K. Flamm, “5. Measurement of DRAM Prices: Technology

and Market Structure,” in Price measurements and their

uses, University of Chicago Press, 2007, pp. 157–206.

N. Zlatanov, The Evolution of Making Semiconductors.

2004.

Printed Electronics Now, “IDC: Worldwide Semiconductor

Revenue Grew 10.8% in 2020 to $464 Billion,” Print

edelectronics now, 2021. https://www.printedele

ctronicsnow.com/contents/view_breaking-news/2021-

05-11/idc-worldwide-semiconductor-revenue-grew-

108-in-2020-to-464-billion/ (accessed Aug. 16, 2021).

Q. Ji, S. Zhou, B. Li, and Z. Chen, “Component ordering

strategies in assembly systems with uncertain capacity

and random yield,” Appl. Math. Model., vol. 88, pp.

715–730, 2020.

“Semiconductor Contract Manufacturing Services

Worldwide 1996” http://archive.computer

history.org/resources/access/text/2013/04/102723332-

05-01-acc.pdf (accessed Aug. 16, 2021).

“Semiconductor Protectionism: Goodbye Mr. Chips,”

Citizens a Sound Econ. Issue Alert, vol. 9, p. 2, 1986.

TTI, “Asahi Kasei Microdevices Fire.” https://www.

tti.com/content/ttiinc/en/resources/akm-fire.html

(accessed Aug. 16, 2021).

Y. C. Chou, C. T. Cheng, F. C. Yang, and Y. Y. Liang,

“Evaluating alternative capacity strategies in

semiconductor manufacturing under uncertain demand

and price scenarios,” Int. J. Prod. Econ., vol. 105, no. 2,

pp. 591–606, 2007.

Y. N. Lee, “2 charts show how much the world depends on

Taiwan for semiconductors,” 2021. https:// www.

cnbc.com/2021/03/16/2-charts-show-how-much-the-

world-depends-on-taiwan-for-semiconductors.html

(accessed Aug. 16, 2021).

Y. Xie, C. Paris, and S. Yang, “Fresh Covid-19 Outbreaks

in Asia Disrupt Global Shipping, Chip Supply Chain,”

Wall Street Journal. https://www.wsj.com/articles/the-

global-logistics-logjam-shifts-to-shenzhen-from-suez-

11623403801 (accessed Aug. 16, 2021).

S. Yang and J. Yang, “TSMC Sets Up for Soaring Chip

Demand,” Wall Street Journal, 2021. https://www.

wsj.com/articles/tsmc-sets-up-for-soaring-chip-dema

nd-11618486965 (accessed Aug. 16, 2021).

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

178