Study on the Influence of Government Subsidy on Farmers'

Willingness to Purchase Typhoon Index Insurance

Fang Song

1,2

, Xinyuan Wang

2

and Xuerong Xu

1, *

1

Fujian Agriculture and Forestry University, College of Economics and Management, Fuzhou 350001, China

2

Concord University College, Fujian Normal University, Fuzhou 350001, China

Keywords: Government Subsidy, Typhoon Index Insurance, Purchase Intention, Influence Factor.

Abstract: The purpose of this paper is to analyze the influencing factors of farmers' willingness to buy typhoon index

insurance from the perspective of government subsidy policy. In particular, the authors develop the binary

logistic regression model based on the survey data of 124 aquaculture farmers in Fujian Province. The results

showed that the age, input cost and the number of disasters affecting production except typhoon had a negative

effect on the willingness of aquaculture farmers to buy typhoon index insurance. In turn, the number of losses

due to typhoons in the past five years, attitude towards typhoon index insurance and satisfaction with subsidy

policy have a positive impact on the willingness of aquaculture farmers to buy typhoon index insurance. This

study helps to improve the risk guarantee system of aquaculture farmers and the government's subsidy policy.

1 INTRODUCTION

The aquaculture industry is an important part of

China' s agriculture. Its output value accounts for 3.5

% of the total agricultural output value, and the total

production can reach 60% of the total world

aquaculture. However, in the contrast to the

prosperity of aquaculture, the development of

aquaculture insurance market in China is lagging

behind. As an industry with strong natural attributes,

aquaculture is affected by typhoon, drought, high

temperature, floods and other natural disasters, and

the situation of “poverty caused by disasters” is

endless. Moreover, in the aquaculture insurance

system is not complete, the huge losses caused by

disasters are almost borne by farmers themselves, the

industry's ability to resist risks is very weak.

Therefore, farmers and even the entire aquaculture

market demand for aquaculture insurance is

increasingly urgent.

In recent years, many scholars have studied the

influencing factors of farmers' willingness to

purchase agricultural insurance. Zheng et al.(2018)

investigated 1280 fishermen in three coastal cities of

*

Corresponding author. Fujian Agriculture and Forestry University,College of Economics and Management, Fuzhou

350001,China.

E-mail: 31401969@qq.com.This paper is a phased research result of The National Social Science Fund Project “Statistical

Analysis of the Evaluation Index and Formation Mechanism of Rural Revitalization in China” (No. 19BTJ047)

China, and found that the degree of loss, fishermen' s

awareness of insurance and personal education have

a positive effect on purchase intention, but income

and breeding years have a negative impact on

purchase intention (Zheng, Zhao, 2018). Liu et al.

(2019) took a group of farmers who had suffered

excessive floods as the observation objects, and on

this basis, they searched for the second group of

observation objects who had not suffered floods but

had basically the same other conditions. Through the

investigation and study of the two groups of objects,

they concluded that farmers with corresponding

disaster experience had higher insurance purchase

intention (Liu, Tang, Ge, et al., 2019).

In addition, Oduniyi et al.(2020) used the

conditional value assessment method to locate the

influencing factors of farmers' willingness to buy

livestock index insurance, and found that farmers'

breeding experience, age, education, marital status,

awareness of insurance and family status have a

significant impact on purchase intention (Oduniyi,

Antwi, Tekana, 2020). Ali et al. (2020) randomly

sampled the northern region of Togo, West African

countries, and selected 704 farmer households as the

596

Song, F., Wang, X. and Xu, X.

Study on the Influence of Government Subsidy on Farmers’ Willingness to Purchase Typhoon Index Insurance.

DOI: 10.5220/0011752700003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 596-601

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

respondents to observe the specific factors that affect

the purchase intention of weather index insurance of

the respondents. The analysis shows that the length of

the drought period is the most important factor (Ali,

Egbendewe, Abdoulaye, et al., 2020). Budhathoki et

al. (2019) took the low-lying areas of Nepal as the

research area. Through investigating 350 farmers in

the region, they concluded that the main reason for

the low coverage of local agricultural product index

insurance was related to the pricing of insurance and

government subsidies (Budhathoki, Lassa, Pun, et al.,

2019).

Scholars have analyzed the influencing factors

based on different perspectives and theoretical

systems. However, due to the differences in

geological conditions, climate environment and the

degree of development of agricultural insurance in

different countries and regions, the factors affecting

purchase intention are also different. Most of the

existing literature focuses on the empirical research

of agricultural products in cotton, vegetables, grain

and other planting industries, and the research on

aquaculture insurance is insufficient (Tang, Yang,

Ge, et al., 2019; Roder, Hudson, Tarolli, 2019;

Mutaqin, Usami, 2019; Sarwary, Senthilnathan,

Vidhyavathi, et al., 2020; Shee, Azzarri, Haile, 2020).

Fujian Province is China's second longest land

coastline provinces, land coastline up to 3752

kilometers, accounting for about one sixth of the

country. There are many kinds of aquatic products in

the sea area, and a large number of aquatic organisms

with economic value. However, Fujian Province is

also a severely affected area by typhoon disasters,

which often brings a huge blow to farmers who have

invested high cost in the early stage. In response to

this situation, Fujian Fisheries Mutual Insurance

Association, jointly with Fujian Branch of China Life

and Property Insurance, tailored and launched the

aquaculture typhoon index insurance for the

aquaculture industry in Fujian Province, which was

officially issued and promoted throughout the

province in 2017. With the support of the

Government, the project incorporates a policy

dividend project to support agriculture and benefit

farmers, enjoying 30-40 percent of all levels of

financial subsidies, which greatly reduces the cost of

farmers' purchase. According to the latest “Pilot

Scheme of Typhoon Index Insurance for Aquaculture

in Fujian Province in 2020”, the provincial financial

subsidy of typhoon index insurance is 20% of the total

premium, and the minimum financial subsidy at the

city and county levels is 10%. Conditional cities can

increase the proportion of subsidies according to their

own conditions.

Presently, in order to attract aquaculture farmers

to buy the typhoon index insurance, the government

invested a lot of financial resources. So can these

subsidies increase the purchase intention of

aquaculture farmers as expected? What factors affect

farmers' purchase intention besides financial

subsidies? The exploration of these problems is

helpful to improve the relevant policies of policy-

oriented agricultural insurance, and provide reference

for whether the government provides subsidies and

benefits and what path to subsidize. This paper takes

aquaculture typhoon index insurance as the research

object, analyzes the influencing factors of farmers'

insurance purchase intention by the binary logistic

model based on the micro survey data of aquaculture

farmers in Fujian Province.

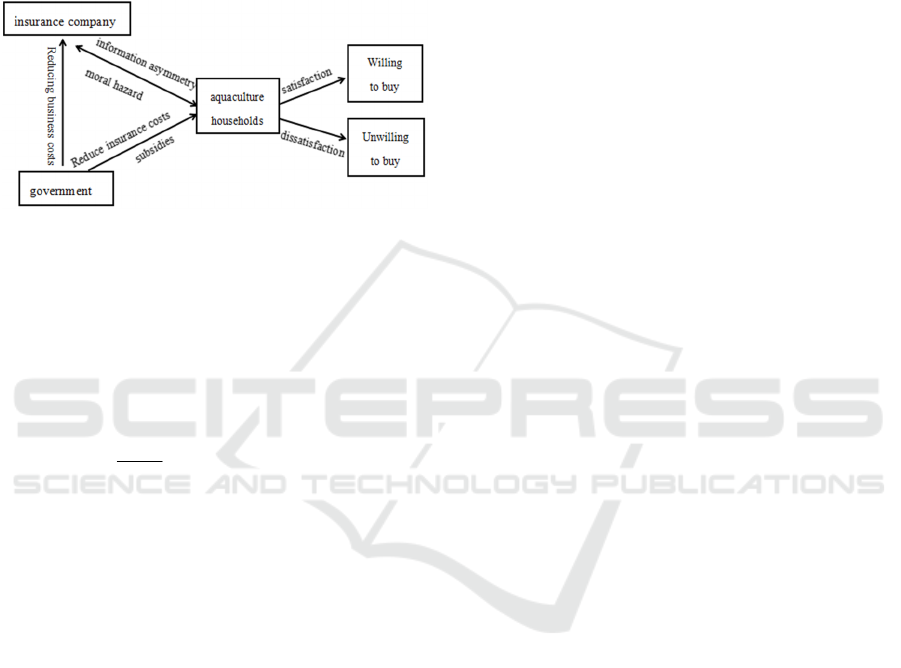

2 MECHANISM ANALYSIS

AND MODEL

CONSTRUCTION

2.1 Mechanism Analysis

2.1.1 Mechanism 1: From the Perspective of

Welfare Economics Theory

Traditional welfare economics believes that

increasing the total national income on the production

side and reducing the inequality of income

distribution on the distribution side could improve the

social economic welfare. Through the support and

promotion of typhoon index insurance, the

government establishes a reasonable financial

subsidy system to purchase farmers' fees, which can

improve the participation of aquaculture farmers in

typhoon index insurance, enhance the ability of

farmers to resist risks, and ensure the smooth progress

of the breeding process and the final production

income. This is conducive to the development of

agricultural economy, realize the redistribution of

agricultural part of national income, thereby

increasing the overall welfare of whole society.

2.1.2 Mechanism 2: Market Failure Theory

Perspective

Aquaculture typhoon index insurance as an example

of a class of agricultural insurance market, due to the

existence of moral hazard caused by information

asymmetry, the insurance company's business costs

increase, resulting in the insurance company related

business exit or increase premiums. However, at the

Study on the Influence of Government Subsidy on Farmers’ Willingness to Purchase Typhoon Index Insurance

597

same time, increasing premiums also means that the

cost of farmers' purchase increases, which cannot

meet the insurance needs of farmers, and ultimately

leads to the failure of the relevant agricultural

insurance market. Therefore, the government reduces

the input costs of insurance companies and

aquaculture farmers through financial subsidies and

policy support, so as to solve market failure to a

certain extent.

Figure 1: Influence Mechanism of Financial Subsidies on

Purchase Intention of aquaculture households.

2.2 Model Construction

In order to study the impact of government subsidies

on the purchase intention of aquaculture farmers for

typhoon index insurance, the following binary

Logistic regression model was constructed:

++=

=

n

1

ii0

x

-1

ln

μββ

p

p

Y

(1)

In this model, Y is the dependent variable, when

Y=1, the farmers are willing to purchase the

insurance, in turn, when Y=0, they are unwilling to

buy. P is the probability of aquatic farmers purchasing

typhoon index insurance, and (1-P) is the probability

of non-purchase. The independent variables Xi (i=1,

2,..., n ) represents the factors that may affect

purchase intention. This model select government

subsidies as the key variables, select the age of

aquaculture farmers, farming area, annual investment

cost, the number of losses due to typhoon in the past

five years, in addition to typhoon, there are several

disasters affecting production, the understanding of

typhoon index insurance as the control variable.

0

β

is

the intercept items,

i

β

( i = 1, 2,..., n ) is the coefficient

of each factor, reflecting the influence of each factor

on purchase intention, and μ is the random

disturbance term.

3

DATA SOURCE AND

DESCRIPTIVE STATISTICS

3.1 Data Source

The data used in this study were collected through a

questionnaire of aquaculture farmers in Fujian

Province conducted in 2021.The authors visited

Ningde, Xiapu, Changle, Luoyuan, Lianjiang,

Zhangpu and other major aquaculture producing

areas in Fujian Province, and investigated the

varieties including abalone, clam, yellow croaker,

spotted fish et,al. The survey mainly includes four

parts:(1) the basic characteristics of aquaculture

farmers, namely age and education level:(2) the

aquaculture related information of farmers, including

aquaculture area, annual cost of aquaculture and

annual income;(3) the typhoon disaster situation of

farmers, including the number of losses due to

typhoon in the past five years, the maximum loss

caused by typhoon and several disasters affecting

production in addition to typhoon;(4) the farmers'

awareness of the typhoon index insurance and

whether they are satisfied with the proportion of

government subsidies. After excluding disqualified

questionnaires, 124 valid responses were obtained.

3.2 Descriptive Statistics

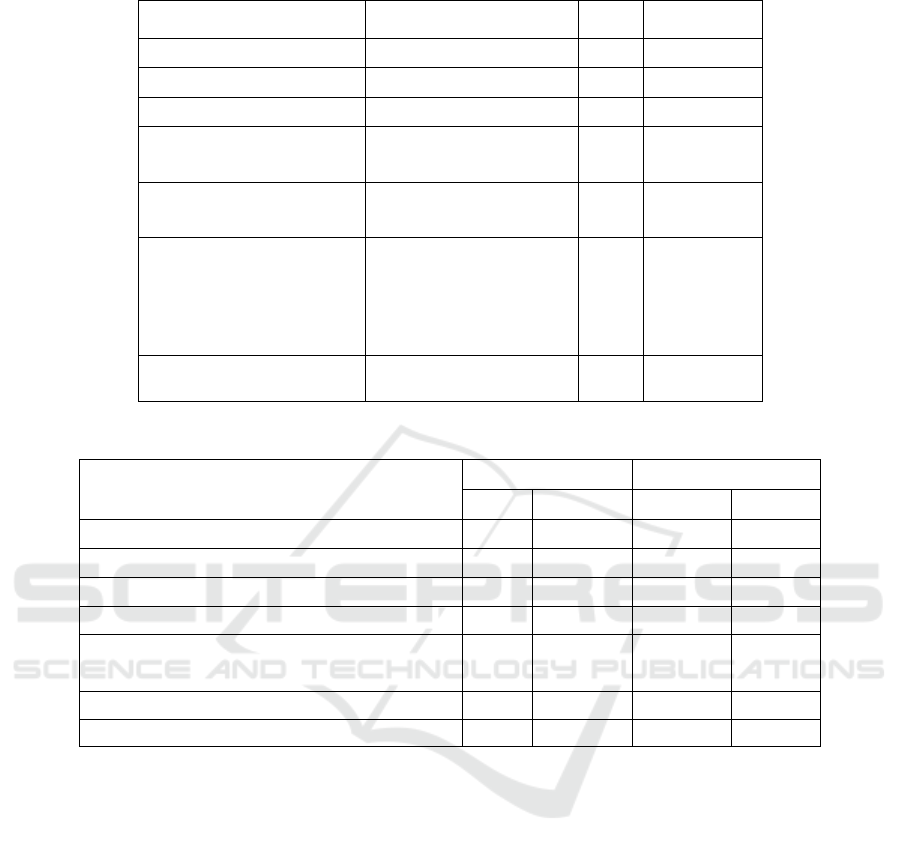

Table 1 shows the descriptive statistics of seven

variables. The age span of aquaculture farmers

involved in the survey is large, and the youngest is 22

years old and the oldest is 75 years old. Aquaculture

information is represented by aquaculture area and

cost logarithm. Raising area due to varieties, funds

and other factors affect the individual gap is large, the

maximum reaches 185 acre and the minimum is only

1 acre. When farmers have invested a large amount of

money as a cost, paying premiums means that the cost

of expenditure will be further expanded, and the cost

of many farmers includes part of the borrowing. The

additional cost means that more money will be

borrowed, which virtually increases the degree of

another risk. Typhoon disaster situation is divided

into two control variables : the number of losses due

to typhoon in the past five years and several disasters

affecting production except typhoon. It can be seen

from Table 1 that each aquaculture farmer

participating in the survey has suffered four typhoon

attacks in the past five years on average. Due to the

different geographical locations and geographical

conditions, the number of wind disasters has reached

the maximum of nine.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

598

Table 1: Descriptive statistics of variables.

Variable Operational Definition Mean

Std.

Deviation

Age Years old 43.43 11.92

aquaculture area Acre 33.57 27.78

Log(cost) The logarithm of actual cost 3.02 .68

Number of typhoon losses

over the past five years

Number 4.02 2.32

Number of disasters affecting

production other than

t

yp

hoons

Number 1.45 0.87

Attitude towards typhoon

index insurance

1=Completely unimportant,

2=unimportant,

3=not essential

4=more important,

5=very important.

3.27 1.01

Satisfaction with government

subsidy policy

0=No,1=Yes 0.73 0.45

Table 2: Comparison of characteristics of aquaculture farmers willing and unwilling to buy typhoon index insurance.

Variable

Mean Std. Deviation

willing unwilling willing unwilling

age 41.24 49.21 11.27 11.83

aquaculture area 37.97 21.94 30.60 12.63

Log(cost) 3.20 2.56 0.59 0.68

Number of typhoon losses over the past five years 4.72 2.18 2.10 1.82

Number of disasters affecting production other

than typhoons

1.09 2.41 0.53 0.86

Attitude towards typhoon index insurance 3.71 1.97 0.74 0.72

Satisfaction with government subsidy policy 0.94 0.18 0.23 0.39

By comparing the data in the Table2, it can be

found that individual characteristics of two groups of

farmers willing and unwilling to buy typhoon index

insurance are significantly different : the age of

aquaculture farmers who are unwilling to buy

insurance is 8 years old on average higher than that of

those who are willing to buy insurance. The

aquaculture area and cost of the unwilling group were

16 acre and 1.7 less than the willing group,

respectively. In addition, the willing group has

experienced an average of two more wind disasters

that have caused losses over the past five years, while

the unwilling group has experienced an average of

two disasters affecting production other than

typhoons. In terms of attitude towards typhoon index

insurance, the willing group believes that the

insurance is more important than the unwilling group.

The gap between the two groups was the largest in

whether they were satisfied with the subsidy policy.

94% of the farmers in the willing group were satisfied

with the subsidy policy provided by the government,

while only 18% of the farmers in the unwilling group

were satisfied. Preliminary reflects the aquaculture

farmers' subsidy policy satisfaction has a strong

positive impact on purchase intention.

4 RESULTS ANALYSIS

SPSS23.0 and STATA15.1 soft wares were used for

binary logistic regression analysis of each variable.

The heteroscedasticity, multicollinearity and

robustness of the model estimation results are tested

and necessary corrections are made. Table 3 shows

the final results:

Study on the Influence of Government Subsidy on Farmers’ Willingness to Purchase Typhoon Index Insurance

599

Table 3: Regression results of the binary logistic model.

Variable Coefficients t-value

p

age

-0.1218*** -2.93 0.003

aquaculture area

-0.0059 -0.17 0.865

Log(cost)

-3.6110*** -3.43 0.001

Number of typhoon

losses over the past five

years

1.2999** 2.17 0.03

Number of disasters

affecting production

other than typhoons

-2.8333** -2.36 0.018

Attitude towards

typhoon index insurance

7.0043*** 3.36 0.001

Satisfaction with

government subsidy

p

olic

y

9.6218*** 4.49 0.000

Constant

-5.6351 -1.23 0.217

Note:***,** reflect the 1%, 5%significance levels,

respectively

Individual characteristics of aquaculture farmers have

a negative effect on the willingness to buy typhoon

index insurance, and the statistical results are very

significant, which means that when the age of

aquaculture farmers is older, the willingness to buy

insurance will also decrease accordingly. This may be

because older farmers have lower acceptance of new

things than younger farmers. Older farmers seldom

use computers, smart phones and other equipment in

daily life, so they have fewer opportunities to contact

emerging insurance. Moreover, older farmers often

have richer farming experience, which helps them

avoid risks and resist disasters, so they have lower

demand for insurance.

The statistical results of aquaculture area are very

insignificant, contrary to the original expectations.

The reason may be due to the different varieties and

product value of farmers. The results of cost

logarithm factor are significant under 1 % confidence

interval, and the results have a negative impact on

purchase intention. Further analysis can be found that

aquaculture farmers with higher cost often have

longer farming experience, accumulated a lot of

farming experience, and have more solid disaster

resistance. Moreover, the scale of aquaculture

farmers' early investment costs is huge. If they buy

property insurance, it will be a additional investment

which will cause great economic pressure to them.

Therefore, this factor has a negative impact on

farmers' willingness to buy insurance.

The two variables of typhoon disaster are

significant within 5 % confidence interval. The

number of losses due to typhoons in the past five

years has a positive impact on purchase intention, and

more affected aquaculture farmers have a higher

purchase intention than3.669 times less affected

farmers. When aquaculture farmers lost more times

due to typhoon in recent years, it means buying

typhoon index insurance will be a wise choice. The

other variable has a negative effect on purchase

intention in the direction of several disasters affecting

production except typhoon. The types and times of

disasters that aquaculture farmers may encounter in

the breeding process are different due to different

breeding varieties and breeding regions. When the

types of disasters that aquaculture farmers face are

more, and the damage ability of each disaster is

equivalent, the cost-performance ratio of for a single

disaster will be weakened.

The attitude towards typhoon index insurance

pass the significance test at the level of 1%, and have

a positive effect. The corresponding coefficient is

large, and the occurrence ratio is 1101.327.

Therefore, when the coefficient is positive, it shows

that aquaculture farmers believe that the higher the

value and importance of typhoon index insurance, the

stronger the purchase intention. In fact, farmers'

awareness of the importance of typhoon index

insurance depends largely on whether they

understand the insurance itself and the size of their

risk awareness. When farmers understand the

insurance content more clearly and deeply, the

positioning of its importance will also change

accordingly.

As a key variable, the satisfactory of the subsidy

policy is significant under 1% confidence interval,

and the coefficient is the largest and positive of all

variables involved in the model, which means that

when aquaculture farmers are satisfied with the

subsidy policy provided by the government, their

willingness to buy typhoon index insurance will also

increase accordingly. At the same time, combined

with Table 2, it can be found that 94.44 % of the

farmers who are willing to buy the typhoon index

insurance are satisfied with the subsidy policy, while

only 17.65 % of the farmers who are unwilling to buy

the insurance group are satisfied with the

government's subsidy policy. The gap between the

two groups is as high as 5.35 times, which largely

reflects the important influence of the subsidy policy

in the decision whether the aquaculture farmers will

eventually buy the typhoon index insurance.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

600

5 CONCLUSIONS AND

IMPLICATION

The results show that :age, cost logarithm, the number

of losses due to typhoon in the past five years, several

disasters affecting production except typhoon,

attitude to typhoon index insurance and satisfaction

with subsidy policy are the six control variables

affecting purchase intention. Age, cost logarithm and

the directions of several disasters affecting yield

except typhoon are negative, and the other three are

positive. According to the research results, the

following suggestions are put forward :(1) The

typhoon index insurance should set different rates

according to the differences in breeding varieties to

meet the insurance needs of different types of

farmers; (2) Insurance companies should promote a

correlation system of aquaculture disaster insurance

such as typhoons and floods, red tide, and give

diverse concessions according to the correlation of

different disasters, so that the farmers reduce their

insured cost; (3) The fishery mutual insurance

associations should promote the relative natural

disaster insurance according to the breeding varieties,

and improve the farmers' awareness and risk

awareness of disaster insurance; (4) Governments

should enrich the ways of subsidies, such as the more

innovative “agricultural insurance + credit” policy

and so on. Diversified subsidy channels could

promote the purchase intention of farmers, and attract

more insurance buyers and provide a solid guarantee

for aquaculture.

REFERENCES

Ali, E.; Egbendewe, A.; Abdoulaye, T.; et al. Willingness

to pay for weather index-based insurance in semi-

subsistence agriculture: evidence from northern

Togo[J]. Climate Policy, 2020: 1-14.

Budhathoki, N.; Lassa, J.; Pun, S.; et al. Farmers' interest

and willingness-to-pay for index-based crop insurance

in the lowlands of Nepal[J]. Land Use Policy, 2019, 85:

1-10.

Liu, X; Tang, Y; Ge, J; et al. Does experience with natural

disasters affect willingness-to-pay for weather index

insurance? Evidence from China [J]. International

Journal of Disaster risk reduction, 2019, 33: 33-43.

Mutaqin,D.; Usami,K. Smallholder farmers' willingness to

pay for agricultural production cost insurance in rural

West Java, Indonesia: A contingent valuation method

(CVM) approach[J]. Risks, 2019, 7(2): 69.

Oduniyi, O.; Antwi, M.; Tekana, S. Farmers' Willingness to

Pay for Index-Based Livestock Insurance in the North

West of South Africa[J]. Climate, 2020, 8(3): 47.

Roder,G.; Hudson,P.; Tarolli,P. Flood risk perceptions and

the willingness to pay for flood insurance in the Veneto

region of Italy[J]. International Journal of Disaster Risk

Reduction, 2019, 37: 161-172.

Sarwary,M.; Senthilnathan,S.; Vidhyavathi,A.; et al. Socio-

economic Impact of Climate Change, Adaptation and

Determinants of Willingness to Pay for Crop Insurance

in Central Agro-climatic Zone of Afghanistan[J].

Current Journal of Applied Science and Technology,

2020: 83-92.

Shee,A.; Azzarri,C.; Haile,B. Farmers’ willingness to pay

for improved agricultural technologies: Evidence from

a field experiment in Tanzania[J]. Sustainability, 2020,

12(1): 216.

Tang,Y; Yang,Y; Ge,J; et al. The impact of weather index

insurance on agricultural technology adoption evidence

from field economic experiment in China[J]. China

Agricultural Economic Review, 2019, 11(4):622-641.

Zheng, H.; Mu, H.; Zhao, X. Evaluating the demand for

aquaculture insurance: An investigation of fish farmers'

willingness to pay in central coastal areas in China [J].

Marine Policy, 2018, 96: 152-162.

Study on the Influence of Government Subsidy on Farmers’ Willingness to Purchase Typhoon Index Insurance

601