Research on the Relationship between Enterprise Internationalization

Level and Performance Based on Multiple Regression and Hausman

Test: Taking Electronic Manufacturing Industry as an Example

Zizheng Wang*

School of Economics, Shandong University, Jinan city, Shandong Province, 250100, China

Keywords: Internationalization of Enterprises, Enterprise Performance, Electronic Manufacturing Enterprises.

Abstract: Since the Belt and Road Initiative has been implemented, China has delivered more and more goods to the

world in the past ten years as the world's largest exporter. Meanwhile, today's China not only needs to export

more goods to foreign countries, but also needs higher quality development. Therefore, in the past decade,

which development phase of China's “going out” enterprises is in? To what extent has the continuous sale of

products in the international market helped the development of enterprises? Based on the sample of some

listed companies in China's electronic manufacturing industry from 2015 to 2019, this paper uses multiple

regression and Hausman test to determine the panel data fixed effect model for regression, so as to analyze

the nonlinear relationship between the degree of internationalization of international enterprises and enterprise

performance. The results show that there is a U-shaped relationship between Chinese electronic

manufacturing enterprises internationalization degree and their performance, that is, they tend to reduce the

benefits of enterprises in the short term and gain higher benefits in the long term. Based on the results, the

paper puts forward some policy suggestions: the state should give some tax incentives to enterprises that want

to operate internationally to resist the initial risks of operation, and at the same time, encourage enterprises to

operate internationally, which has important practical significance for the long-term development of

enterprises.

1 INTRODUCTION

1.1 Research Background

According to the "China's foreign direct investment

communique of 2019" jointly issued by the Ministry

of Commerce, the National Bureau of statistics and

the State Administration of foreign exchange, China's

foreign investment level has maintained the second

level of flow in the last few years. At the same time,

China's foreign investment also has the

characteristics of large coverage, diversified fields

and expanding world influence. In this background,

enterprises as the main force of foreign investment,

their ultimate goal is to expand their international

business and world influence, and ultimately achieve

the effect of improving the overall performance.

Meanwhile, in this context, the country is

constantly implementing the policy of opening up.

Enterprises are encouraged to actively integrate into

the trend of national opening up and world economic

globalization in various ways. For example, Haier

sets up factories overseas, Huawei exports products

directly, Lenovo merges part of the business of IBM,

a well-known foreign enterprise and so on. Many

enterprises are looking for ways that are suitable for

them to expand their business departments in

overseas markets and ultimately maximize the

benefits of enterprises.

In the process of expanding overseas market and

obtaining overseas profits, enterprises will also face

many risks. For example: all kinds of costs necessary

for enterprises to expand overseas business,

differences in cultural systems between domestic and

abroad, suppression of foreign enterprises in order to

maintain their domestic market such as tariffs. At the

same time, enterprises' international business also

needs to bear a lot of opportunity costs, that is, in

order to enhance the funds needed overseas, they

must sacrifice the funds of domestic business. Can

this part of funds that could have been put in China

bring higher performance to enterprises? How will

Wang, Z.

Research on the Relationship Between Enterprise Internationalization Level and Performance Based on Multiple Regression and Hausman Test Taking Electronic Manufacturing Industry as

an Example.

DOI: 10.5220/0011753400003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 627-634

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

627

expanding international business change the

performance in the long run? In this regard, many

domestic and international scholars have made

analyses, their main conclusions are that the degree

of internationalization and enterprise performance

are positively correlated, negatively correlated, U-

shaped relationship, n-shaped relationship and so on.

On this basis, some scholars also explain the

potential reasons for the different results. The

mainstream view is that the effect of enterprise

internationalization level on performance is related to

the maturity of the country's industry and the ability

of technological innovation. For the early scholars

who take the more developed regions as samples

(such as the multinational enterprises in the United

Kingdom and the United States), because the

enterprises in these regions have better maturity and

advanced technology, the improvement of

internationalization will tend to help them obtain

more economic benefits; on the contrary, for the

scholars who take the enterprises of developing

countries as samples in the empirical research,

because these enterprises lack maturity and advanced

technology, they need to adapt to the world

environment, the improvement of inter-

nationalization level will make the enterprises show

a decline trend of enterprise profits at the initial stage.

1.2 Research Significance

From a practical point of view, with the continuous

opening up of China and the gradual maturity and

saturation of the domestic market, many enterprises

want to improve their profits by expanding the

international market, but the fact is that few have

heard that some domestic enterprises have

significantly improved their performance by

occupying a certain share of the international market,

and become influential in the world. Therefore, some

academic empirical analyses can help domestic

enterprises to analyze whether the current

development level of enterprises can support the

enterprise's international strategic behavior, and

analyze the potential risk factors of going to the

international market, so as to help enterprises allocate

idle resources more accurately, provide reference for

the enterprise's strategic objectives, and finally

realize the maximization of enterprise profits; in

addition, analyses can help relevant government

departments analyze how to formulate relevant

policies, let the government know how to support the

enterprises that want to open the international market,

and finally provide practical guidance for the

internationalization strategy of Chinese enterprises.

From a theoretical point of view, many scholars

tend to use the enterprises in developed countries as

samples, which makes some conclusions inconsistent

with the situation of domestic developing enterprises.

Therefore, many different results are obtained, which

are not compatible with the actual situation in China.

This paper takes the electronic manufacturing

enterprises with the highest proportion of overseas

income of China's Listed Companies in 2019 as the

sample to verify the relationship between

internationalization level and enterprise performance,

which can enrich some domestic research samples in

this field and provide valuable reference for future

research.

1.3 Literature Review

Under the background of the gradual rise of

international trade in the 20th century, many scholars

analyze data or create theories to study the

relationship between internationalization degree and

enterprise performance. And most of the early studies

tend to have a positive correlation between enterprise

performance and internationalization level.

Among them, the earliest tended to use large

enterprises in developed countries as samples. The

more representative theoretical research was the

monopoly advantage theory proposed by Hymer in

1971. He believes that enterprises can finally make

greater profits in international operation through the

previously accumulated advantages by accumulating

technical advantages, advanced management mode

and economies of scale (Thomas, 1977). After that,

many scholars further used data for empirical

research. For example, Grant (1987) used the panel

data of large British enterprises from 1971 to 1984 for

regression analysis (Grant, 1987), and Kim (1993)

obtained the data of 125 American enterprises in the

Forbes list from 1982 to 1986 for analysis (Kim,

1993). All of them came to the conclusion that there

is a positive correlation between enterprise

performance and internationalization level. At the

beginning of the 21st century, under the background

of China's accession to the WTO and the expansion

of international trade, Xue Youzhi (2007) also

analyzed the manufacturing enterprises in Jiangsu

Province from 2002 to 2004 in 2007. He also found

that the internationalization of manufacturing

enterprises can significantly promote enterprise

performance (Xue, Zhou, 1990).

With the deepening of research, scholars continue

to come up the idea that there may be a negative

correlation or U-shaped, inverted U-shaped and

horizontal S-shaped between enterprise performance

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

628

and internationalization level. For example, Collins

(1990) made a comparative analysis of 133 of the

world's top 500 enterprises and found that there was

a negative correlation between enterprise

performance and internationalization in developing

countries (Wang, Hu, 2006). Wang Guoshun and Hu

Sha (2006) conducted an empirical study on

manufacturing export-oriented listed enterprises in

Shanghai and Shenzhen, and also came to the

conclusion that enterprise internationalization has a

negative impact on performance (Lu, Beamish,

2001). After that, scholars also continue to realize

that the internationalization level and performance of

enterprises may not be a simple linear relationship,

that is, there can be a threshold. After exceeding this

threshold, there may be a quadratic parabolic

relationship. For example, Lu (2001) and others'

Empirical Research on 164 small and medium-sized

enterprises in Japan from 1986 to 1997 shows that the

internationalization level and performance of

enterprises show a similar U-shaped relationship

(Zhang, Chen, 2017). Domestic scholars Zhang

Xiaotao and Chen Guomei (2017) also draw a

conclusion that the two show a U-shaped relationship

by analyzing the data of 180 Chinese enterprises from

2010 to 2014 (Geringer, Beamish, Dacosta, 1989);

Through the transaction cost theory, many scholars

believe that the increasing transaction scale will lead

to the rising cost, so it presents an inverted U-shape,

and use empirical research to verify this result. For

example, Geringer (1989) conducted an empirical

study on the top 100 large enterprises in the United

States and Europe from 1977 to 1981, and obtained

the conclusion that the internationalization level and

performance of enterprises show an inverted U-

shape.

On the basis of combing the previous domestic

and foreign scholars' existing literature on enterprise

performance and internationalization, it is found that

at different time points, using the data of different

types of enterprises in different countries, the

relationship between enterprise internationalization

level and performance is also different. So the

purpose of this paper is to analyze the interna-

tionalization level and enterprises performance on the

basis of conforming to China's economic environ-

ment conditions, so as to get a convincing conclusion.

2 RESEARCH DESIGN

2.1 Samples and Data Sources

This paper takes the electronic manufacturing

enterprises listed in Shanghai and Shenzhen A-share

market from 2015 to 2019 as the research sample. In

order to ensure the authenticity and reliability of the

research data, the sample is selected in strict

accordance with the following principles: 1) remove

the enterprises that need special treatment due to

abnormal financial data, mainly including St

enterprises. 2) Eliminate the enterprises with missing

data in a certain year. 3) Exclude the enterprises

whose overseas sales revenue accounting for less than

10% of the total sales, that is, the internationalization

level is still at a low level. After selecting, 525

observations of 105 electronic manufacturing

enterprises were obtained. The sample data are

mainly from CSMAR database. Stata12.0 software

was used for data processing.

2.2 Research Hypothesis

According to the theory of first-mover advantage and

the theory of post inferior position proposed by

economist Watson, the first country can accumulate

intangible wealth such as corporate reputation, brand,

culture, and excellent system because of its earlier

occupation of the market, and its economic activities

are also more easily supported by local governments

and have environmental advantages. The resources

also have obvious advantages because they enter the

market first, so the market left to the later entrants is

not large. At this time, there are many barriers to

enterprises in the developing countries when they

enter the international market, such as the lack of

advanced enterprise system and technology, so the

enterprises in the latter developing countries have a

great disadvantage in the early stage of

internationalization because of their high costs

According to the theory of international production

compromise, enterprises must have the advantages of

ownership and internalization in their export

activities. The ownership advantage requires

enterprises to have more advantages in technology or

scale than host enterprises. Internal advantages

require enterprises to have the ability to reduce risks

and obtain information locally. Only after the two

points can be fully met can enterprises choose to

export internationally. According to the research of

many domestic scholars, most of the enterprises in

China are still in the early stage of inter-

nationalization, facing the burden of opening up the

market with high cost. At this time, the investment of

enterprises is generally greater than the profits.

To sum up, this paper predicts that there are many

difficulties in the internationalization of domestic

enterprises at this stage, so the growth of

internationalization tends to cause negative returns to

enterprises in the initial stage. At the same time, it is

Research on the Relationship Between Enterprise Internationalization Level and Performance Based on Multiple Regression and Hausman

Test Taking Electronic Manufacturing Industry as an Example

629

predicted that with the continuous progress of

enterprise internationalization, after gradually

accumulating a certain reputation and forming a

mature enterprise system, the strategic significance

and overall benefits of domestic enterprise

internationalization will gradually highlight.

Therefore, this paper puts forward the following

hypothesis

H0: Internationalization degree and performance

of Chinese Enterprises show a U-shaped relationship.

2.3 Variable Selection and

Measurement

2.3.1 Dependent Variable

In order to accurately measure the profits of

enterprises, domestic and international scholars

widely use financial performance or market

performance. This paper uses the return on assets

(ROA) in financial performance, that is, net profit

after tax / total assets to measure.

2.3.2 Independent Variable

In the empirical analysis of the degree of

internationalization of enterprises, most scholars

measure the degree of internationalization of

enterprises by the proportion of overseas assets,

overseas sales revenue and overseas employees.

Because China's enterprises are still mainly export-

oriented at this stage, the author chooses the

proportion of overseas sales revenue to the total sales

revenue to measure.

2.3.3 Controlled Variable

This paper selects four controlled variables: (1) asset

liability ratio. It is an important index to measure the

performance of an enterprise, which is obtained from

total liabilities / total assets. The enterprises with

higher asset liability ratio will be more cautious in

internationalization, and tend to reduce the risk of

internationalization to reduce the risk of debt. (2)

Enterprise scale. Measured by the natural logarithm

of assets at the end of the year, larger enterprises will

have more strength and need to expand overseas

business and increase their transnational behavior. (3)

Enterprise age. That is, the year of accounting report

minus the year of establishment. Older enterprises

tend to have more experience and survive for a longer

time, which indicates that they have stronger

management ability and more time to implement their

strategies. (4) Research intensity. That is the

proportion of research investment in total operating

revenue. Research is very important for the

development of a country, an industry or an

enterprise. Enterprises with higher research

investment tend to pay more attention to long-term

development and interests, have more ambition for

development, and are more likely to implement

internationalization strategy.

2.4 Research Model

Referring to the literature of domestic scholars, this

paper sets up the regression equation (1):

ROA=β0+β1Fsts+β2Fsts2+β3Debt+β4Size+β5Age+

β6Rd+ai+θit (1)

In the equation, ROA represents enterprise

performance , β0 is a constant term, Fsts is the

degree of internationalization of an enterprise, Fsts2

is a quadratic term to measure the degree of

internationalization of an enterprise, which is used to

test the convexity and convexity of an enterprise,

Debt is the asset liability ratio of an enterprise, Size

represents the scale of the enterprise, age represents

the age of the enterprise, and Rd represents the

Research intensity of the enterprise, ai is a constant

random interference term in time, θit It is a random

interference term that will change with time.

2.5 Multiple Regression and Hausman

Test

Multiple regression refers to using more than two

independent variables to find their relationship with

the dependent variables, and hausman test is a

significance test for the difference between two

estimators of the same parameter in order to obtain

more accurate estimation results.

In this essay, we first use the established multiple

regression model to explore the diversification results

that affect enterprise profits. Then, according to the

random effect and fixed effect of panel data, the two

estimators are obtained and analyzed by Hausman

test.

3 EMPIRICAL ANALYSIS

3.1 Descriptive Analysis

The descriptive statistics of the whole sample data in

2015-2019 are shown in the table below.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

630

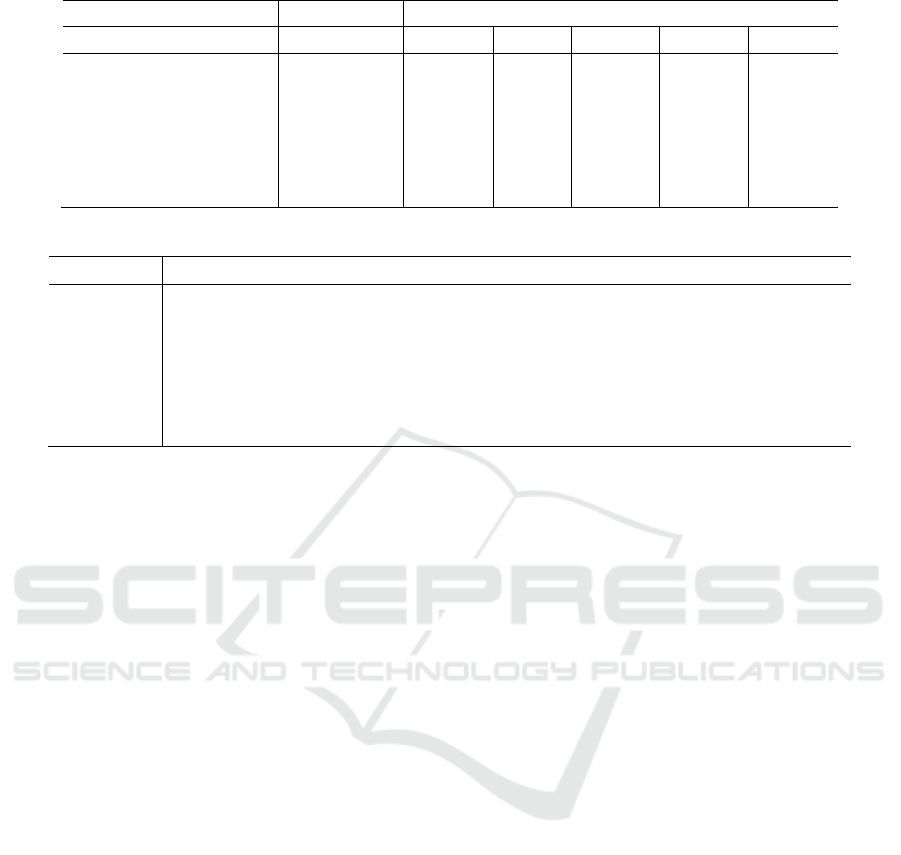

Table 1: Descriptive statistics of whole sample mean.

Variables Sample size Mean

Year 2015 2016 2017 2018 2019

Enterprise performance 105 4.876 5.343 5.354 3.933 3.683

Internationalization level 105 41.918 41.481 40.443 39.995 37.841

Asset liability ratio 105 0.363 0.371 0.391 0.415 0.419

Enterprise size 105 20.316 20.560 20.746 20.841 20.841

Enterprise age 105 15.952 16.952 17.952 18.952 19.952

Research intensity 105 6.728 6.825 6.521 6.846 7.036

Table 2: Correlation among variables.

ROA Fsts Debt Size Age Rd

ROA 1

Fsts -0.0138 1

Debt -0.1614 -0.0679 1

Size 0.1021 0.3915 0.5838 1

Age -0.0389 -0.1308 0.1451 0.1054 1

Rd -0.0277 -0.0307 0.1898 -0.1887 -0.1215 1

As can be seen from the table, from the average

point of view, the average proportion of overseas

sales revenue of the electronic manufacturing

enterprises after selection is very high, about 40%.

And due to the selecting conditions, the lowest is

more than 10%; at the same time, the average survival

age of such enterprises is about 20 years. Combined

with the data, the average life span of group

enterprises in China is 7-8 years, and that of private

enterprises is only 3.7 years, which indicates that the

average life span of international enterprises is longer

than average; the asset liability ratio is about 40%,

which is lower than 63% of the average asset liability

ratio of Chinese enterprises which shows that the

average debt ratio of international enterprises is

relatively low. In addition, the ratio of research

investment to total operating income is about 7%.

From the perspective of trend, the mean value of the

proportion of overseas income decreases year by

year, but the asset liability ratio increases year by

year. It can be preliminarily seen that the

internationalization behavior of enterprises may tend

to let enterprises bear more costs and more liabilities

at the initial stage. Therefore, from the perspective of

internationalization trend, enterprises tend to slowly

reduce the degree of internationalization.

Before using panel data for more detailed

regression analysis, this paper also conducted

correlation test on the main variables, and the results

are shown in the table 2.

The correlation coefficient in the table also

preliminarily verifies the conclusion of descriptive

statistics, that is, there is a negative correlation

between international operation and enterprise

performance. On this basis, in order to ensure the

authenticity of the regression, it is necessary to verify

the relationship between the independent variables.

From the table, except that the correlation coefficient

between asset liability ratio and enterprise size is

higher, which is 0.5638, the absolute value of the

correlation coefficient between each variable is under

0.4. In order to more accurately ensure that there is

no strong correlation between independent variables,

the author further calculated the variance expansion

coefficient (VIF), and obtained that the variance

expansion coefficient is 1.51, which is far less than

10. Therefore, the author verifies that there is no high

correlation between independent variables, and on

this basis, the author carries out the regression

analysis of panel data.

3.2 Regression Results and Analysis

After confirming that there is no strong correlation

between the variables, the author uses stata12.0

software to test the panel data with fixed effect model

and random effect model respectively, in order to

determine the relationship between the electronic

manufacturing enterprises and the degree of

enterprise internationalization. In order to test which

of the two models fits the equation better, this paper

uses Hausman test to select the model. The results are

as follows:

Research on the Relationship Between Enterprise Internationalization Level and Performance Based on Multiple Regression and Hausman

Test Taking Electronic Manufacturing Industry as an Example

631

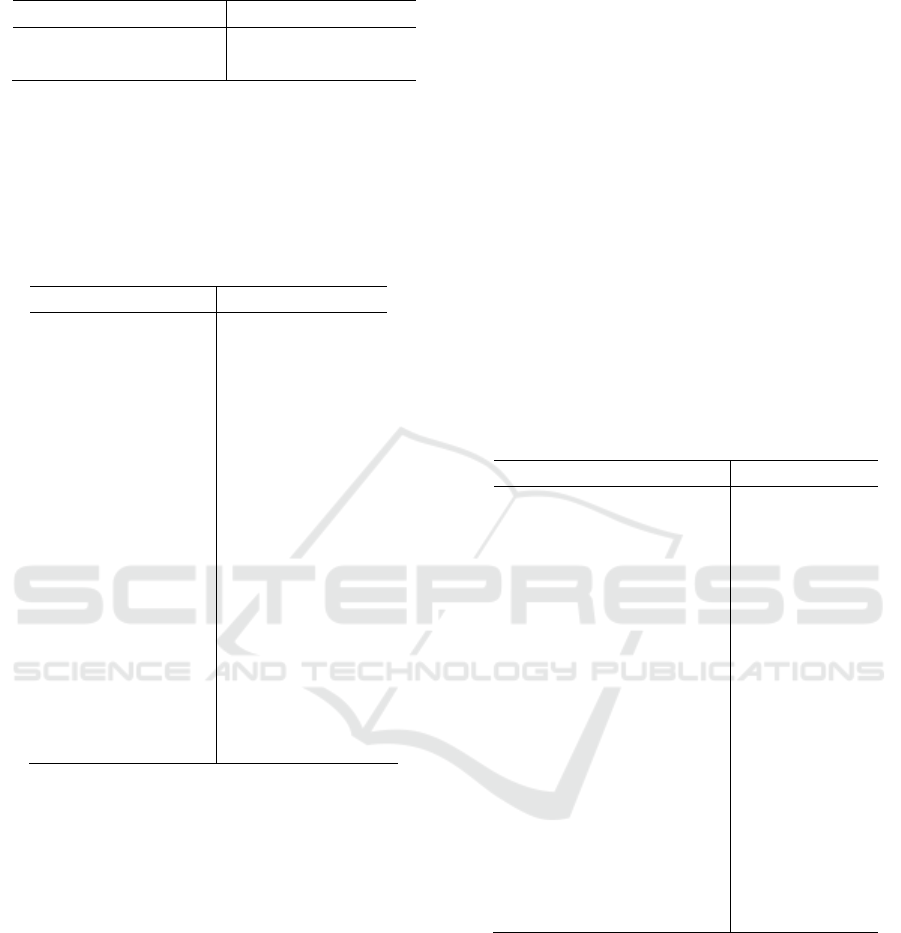

Table 3: Results of Hausman test.

Coef.

Prob 0.0001

Chi-square test value 27.53

SO reject the original hypothesis: random effect is at

the significance level of 1%. Therefore, the fixed

effect model regression was selected. The analysis

results of fixed effect model are shown in the table

below.

Table 4: Influencing factors of enterprise performance

(fixed effect).

Independent variable Coefficient

Fsts -0.384

(-3.49)

Fsts2 0.003

(3.16)

Debt -27,999

(-6.84)

Size 2.63

(2.47)

Age -0.325

(-1.35)

Rd -0.773

(-4.53)

Constant term -18.803

(-1.05)

Sample size 105

R square within group 0.1165

F value

Prob

3.64

0.0000

From the fixed effect model fitting results, except

for the age of the enterprise, each variable is

significant at the 5% significance level, and the F

statistical value of the joint regression is also

significant. The first and second lines of the table

report the first and second order conditions of the

internationalization level on the enterprise

performance. The first-order coefficient is

significantly negative, which means that the

performance of electronic manufacturing enterprises

will decrease by 0.38% when the internationalization

level of electronic manufacturing enterprises

increases by 1%; but at the same time, in the long run,

the quadratic coefficient of enterprises is significantly

positive, which verifies the hypothesis at the

beginning of this paper to a certain extent: the

internationalization level of enterprises and

performance present a U-shaped relationship of first

decreasing and then increasing. At the same time,

according to the preliminary test of quadratic

coefficient in this paper, it is 0.003. According to the

formula, when the internationalization level of

enterprises reaches about 64%, it can reach the lowest

point of U-shape, and turn losses into profits.

3.3 Robustness Check

At present, the main methods of robustness test are:

(1) adjusting the classification of data (such as

adjusting the observation year of panel data); (2)

replace variable with related variable (3) different

measurement methods (such as GMM) are used to

test whether the results are robust. This paper mainly

adopts the second method, by replacing ROA with

ROE, that is, net profit after tax / shareholders' equity,

to measure the enterprise performance, to verify the

robustness of the above results. The results are as

follows:

Table 5: Regression results of robustness test (fixed effect).

Independent variable Coefficient

Fsts -0.766

(-4.19)

Fsts2 0.006

(3.63)

Debt -51.494

(-7.11)

Size 5.278

(2.95)

Age -0.738

(-1.83)

Rd 1.143

(-4.00)

Constant term -42.566

(-1.42)

Sample size 105

R square within group

F value

Prob

0.1158

3.42

0.0000

In the fixed effect model replaced by dependent

variable, except that the coefficient of variables

changed slightly, the sign and significance level of

other variables were consistent with the above.

Therefore, this study is reliable.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

632

4 CONCLUSIONS AND

SUGGESTIONS

4.1 Main Conclusions

In the 43 years since 1978 when China implemented

the "reform and opening up" policy, the state has

constantly put forward various reform policies and

adhered to the principle of continuous opening up and

mutual benefit. On this basis, all industries in our

country continue to absorb foreign advanced

knowledge, while also selling our goods to the world.

And China as a typical late developing economy.

Which stage is the internationalization behavior of

domestic enterprises in now? How does the

increasing overseas sales affect the profits of

enterprises at this stage? All above has become

valuable research topics.

Based on the existing analysis of the relationship

between internationalization degree and

performance, By using multiple regression and

Hausman test, this paper analyzes the

internationalization degree of Chinese electronic

manufacturing enterprises and the evolution of

various important indicators over time, and draws the

conclusion that the internationalization department of

Chinese enterprises at the present stage is not mature

enough. At the same time, in the long run, there is a

U-shaped relationship between internationalization

degree and enterprise performance. Specifically

speaking, in order to open up the international

market, due to the first mover advantages of

enterprises in other developed countries, the barriers

to entry and the immature factors of our own, Chinese

enterprises will face a huge entry cost in the initial

stage of setting up an international department, and

the short-term performance of enterprises will tend to

decrease due to the improvement of the degree of

internationalization. After that, with time elapsing,

after the internationalization behavior of enterprises

has gradually established a certain market reputation,

adapted to the international market habits, and

formed a perfect internationalization system, the

internationalization behavior of enterprises will tend

to bring greater benefits to enterprises.

4.2 Policy Suggestion

The conclusion of this paper has a very important

practical significance for the government, the

enterprises that are implementing the

internationalization strategy and the enterprises that

want to implement the internationalization.

For the government, it should realize that Chinese

enterprises are still in the primary stage of socialism.

At this time, enterprises that want to go abroad will

face great costs. Therefore, if government want to

continue to cultivate some internationally influential

enterprises, it should continue to introduce a series of

reform policies, such as giving some tax incentives to

multinational enterprises and reducing financing

costs. One belt, one road, and other big policies

should be adopted to reduce the pressure of

enterprises in the initial stage of international

operation and improve the survival rate of

enterprises.

For the enterprises that are implementing

internationalization, they should actively deal with all

kinds of problems in the process of

internationalization. From the empirical research,

internationalization behavior can promote the

improvement of enterprise benefit and value in the

long run. With the continuous development of

economic globalization and the continuous saturation

of domestic market in many industries, enterprises

need to expand their competitiveness in order to

continuously achieve profits. The broad international

market brings many challenges as well as

opportunities for development. Enterprises with

international operations should focus on long-term

interests and overcome the difficulties encountered in

the initial stage of internationalization.

For the enterprises that want to enter the

international market, they should first objectively

evaluate the business status and strength of the

enterprises, so as to determine the feasibility of

entering and the strategic objectives of the

enterprises. Because international operation in the

early stage will have a greater negative impact on the

performance of enterprises, and for the enterprise

itself, continuous operation and profit is the first goal.

Therefore, whether they can bear the initial cost of

international operation is the first consideration for

such enterprises. They should not be tempted by the

international market and make a wrong assessment of

their current strength.

REFERENCES

Geringer J M, Beamish P W, Dacosta R C. Diversification

strategy and internationalization: Implications for mne

performance[J]. Strategic Management Journal, 1989,

10(2):109-119.

Grant, Robert M. Multinationality and Performance among

British Manufacturing Companies[J]. Journal of

International Business Studies, 1987, 18(3):79-89.

Kim W C, Burgers H W P. Multinationals\" Diversification

Research on the Relationship Between Enterprise Internationalization Level and Performance Based on Multiple Regression and Hausman

Test Taking Electronic Manufacturing Industry as an Example

633

and the Risk-Return Trade-Off[J]. Strategic

Management Journal, 1993, 14(4):275-286.

Lu J W, Beamish P W. The internationalization and

performance of SMEs[J]. Strategic Management

Journal, 2001, 22(6-7):565-586.

Thomas G. Parry. The International Operations of Nationa

l Firms: A Study of Direct Foreign Investment. Stephe

n Herbert Hymer[J]. 1977, 85(5) : 1096-1098.

Wang Guoshun, Hu Sha. Enterprise internationalization

and business performance: An Empirical Study of

Chinese Manufacturing Listed Companies [J]. Systems

engineering, 2006 (12): 80-83.

Xue Youzhi, Zhou Jie. Product diversification,

internationalization and corporate performance --

Empirical Evidence from Chinese Manufacturing

Listed Companies [J]. Nankai management review,

2007 (03): 79-88Collins, Markham J. A Market

Performance Comparison of U.S. Firms Active in

Domestic, Developed and Developing Countries[J].

Journal of International Business Studies, 1990,

21(2):271-287

Zhang Xiaotao, Chen Guomei. Research on the impact of

internationalization degree and OFDI location

distribution on Enterprise Performance -- Based on the

evidence of China's A-share listed manufacturing

enterprises [J]. International business (Journal of

University of foreign economics and trade), 2017 (02):

72-85.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

634