Research on Carbon Futures Forecast and Related Asset Impact

Analysis Based on ARIMA-GARCH and RBF Contribution Analysis

Wenhui Wang

1

, Xinhang Wu

2

and Yifan Wu

3,*

1

School of Finance, Zhejiang University of Finance & Economics, 310018, Hangzhou, China

2

School of Statistics, Southwestern University of Finance and Economics, 611130, Chengdu, China

3

School of Mathematics, Sun Yat-Sen University, 510275, Guangzhou, China

Keywords: Carbon Futures, ARIMA-GARCH Model, RBF Neural Network, Contribution Analysis.

Abstract: To studies the trend of carbon futures price and influencing factors. In this paper, the EU carbon financial

emission market carbon trading settlement price EUA is selected as the research object. Based on the carbon

futures price data from 2008 to 2021, this paper constructs an Autoregressive Integrated Moving Average-

generalized autoregressive conditional heteroscedasticity model to Forecast the price of carbon futures in the

next three months. On this basis, the RBF (Radial Basis Function) neural network is constructed, and seven

indexes such as stock index and crude oil price were selected from the aspects of energy and finance to analyze

the contribution of the carbon price. The results are as follows: The ARIMA-GARCH model predicts that

EUA prices will increase significantly in the next three months. The stock market is the most influential

economic factor, followed by energy. Finally, this paper puts forward corresponding policy suggestions

according to the results.

1 INTRODUCTION

Under the severe form of global warming, carbon

emission has attracted increasing attention from the

international community. The European Emissions

Trading System, established by the European Union

in 2005, is the world's most extensive carbon

emissions trading system, in which carbon futures

have proved to be not only an essential tool for

people to cope with climate change but also an

effective method for producers and consumers to

manage and hedge risks. (Tang, Wang, Li, Yang &

Mi 2020) In 2020, China will strive to achieve the

goal of carbon peak by 2030, achieve carbon

neutrality by 2060, and start constructing a national

carbon trading market. The experience and lessons of

the European Union in carbon finance are of great

reference significance for China to build a tough

carbon finance market.

There is a wide range of studies on carbon

finance, and this paper considers EUA carbon

futures. The main research direction of EUA

literature is the price of EUA spot futures, including

price prediction, market arbitrage, energy prices, and

the impact of economic factors. In terms of price

prediction, Yah Architects et al. (Yahşi, Çanakoğlu &

Ağralı 2019) used an artificial neural network and

decision tree algorithm to predict carbon prices using

Brent crude oil futures, coal, electricity, and natural

gas prices, as well as DAX and Standard & Poor's

indexes as explanatory variables. In the aspect of

market arbitrage, researchers hope to find a pricing

model of the carbon price and explain the underlying

mechanism of the carbon price. Stefan (Trück &

Weron 2016) found that participants were willing to

pay an additional risk premium in the futures market

to hedge against the increasing volatility of EUA

prices. In terms of energy price factors, Dutta (Dutta

& Anupam 2017) assessed the impact of the oil

market on carbon prices and concluded a strong

correlation between implied fluctuations in the oil

market and carbon prices. Qiang et al. (Ji, Zhang &

Jiang-bo, et al. 2018) proved that Brent crude oil

price plays an important role in influencing carbon

price changes and risks. For example, in terms of

economic factors, Yuan (Yuan & Yang 2020), using

generalized autoregressive - dynamic copulas,

connects the model to study financial market

uncertainty and asymmetric risk spillover between

the carbon market. It is concluded that systemic event

occurs, the uncertainty of the stock market than the

uncertainty of the crude oil market in risk transfer to

the carbon market showed a more significant impact.

Wang, W., Wu, X. and Wu, Y.

Research on Carbon Futures Forecast and Related Asset Impact Analysis Based on ARIMA-GARCH and RBF Contribution Analysis.

DOI: 10.5220/0011757600003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 731-738

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

731

To forecast and study the EU carbon futures

EUA, this paper establishes the ARIMA-GARCH

model based on the EUA price data of January 7,

2008, solstice, and May 18, 2021, and carries out the

forecast for the next 12 weeks. The RBF neural

network model is established based on the EUA price

data of March 22, 2010, solstice, and June 3, 2021,

to explore the influence mechanism of economic and

energy factors on carbon futures price and the degree

price change.

2 PRICE ANALYSIS OF CARBON

FUTURES

2.1

Policy Analysis

The fourth phase of the EU's EUETS program begins

in 2021. This phase will bring stricter rules, with a

new target of cutting emissions by 40% by 2030. To

meet the target, the industries covered by the EU's

Emissions Trading Scheme would have to cut their

emissions by 43% from 2005 levels. The total quota

would have to fall by 2.2% a year from 2021 and by

1.74% in the third phase. Industries under the EU's

Emissions Trading Scheme will reduce emissions by

an additional 556m tonnes over the next decade.

Therefore, it is essential to study the factors of carbon

price fluctuation and the degree of change. The study

on the EU carbon futures price in this paper can

enrich the methods of studying the carbon financial

market and provide a good reference for investors to

avoid risks and policymakers to stabilize the carbon

financial market.

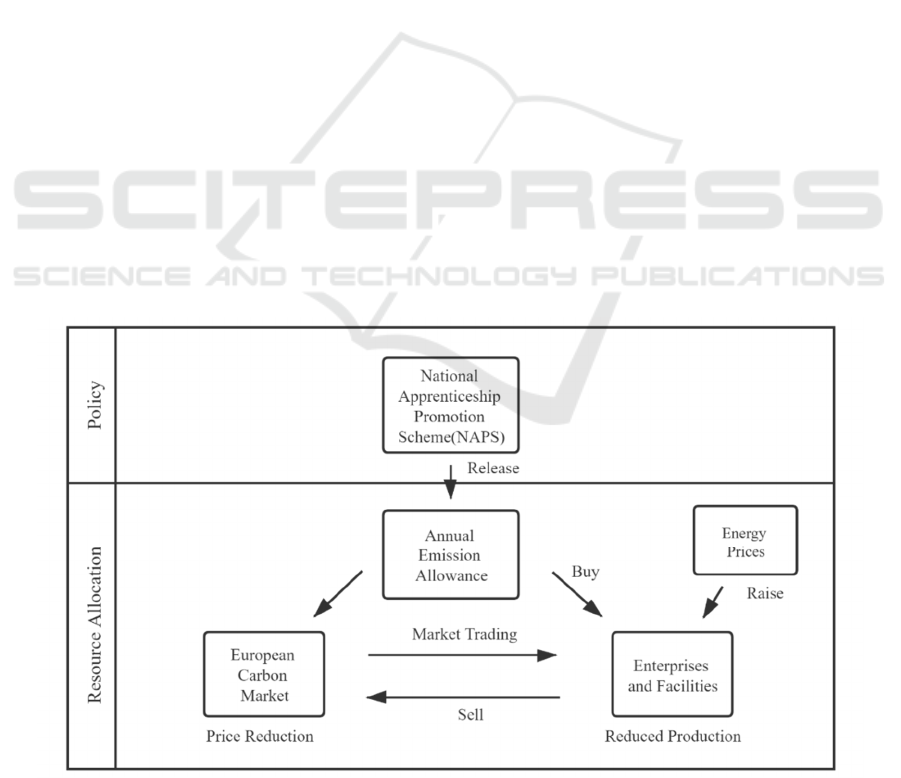

2.2 Analysis of Influencing Factors

2.2.1 Energy Price Factors

Energy supply and demand will affect companies'

production behaviour, which will affect the carbon

price. From a supply point of view, market

participants can obtain the amount of carbon dioxide

allotted annually from the National Distribution

Plans (NAPS). From the perspective of demand,

enterprises and facilities can choose to pay for the

carbon emission right according to their energy

consumption level and buy and sell the quota

according to their actual emissions. When the price

of energy changes, the price of related products will

also change, and enterprises will adjust their

production level accordingly, affecting carbon

emissions. Actual emissions depend on the type of

energy. The schematic diagram is shown in Figure 1.

Among them, the crude oil price is the continuous

price of Brent crude oil futures. At present, more than

65% of the world's physical crude oil is priced by the

Brent system. Brent, whose main customers include

refineries in northwest Europe, is a good proxy for

the cost of oil for European energy inputs.

Figure 1: Schematic diagram of price impact.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

732

Natural gas price is the natural gas futures price

at the National Equilibrium Point (NBP) in the UK.

The prices of various trading markets in the EU are

correlated and interactive. Among them, NBP is the

most representative market, which can be used to

represent the natural gas cost of energy input in

Europe.

The coal price is based on the spot price of coal

for the next month's delivery in

Antwerp/Rotterdam/Amstor (ARA) at various

European ports. The coal trading price index is

published weekly, representing the cost of imported

coal in northwest Europe.

As the primary source of carbon emissions and

the main entity to purchase carbon emission quotas,

power enterprises will greatly impact the carbon

market. However, the power price factor is not

correlated with carbon emissions as other energy

variables, and the power conversion variable can be

given by Equation (1). P is the cost of carbon

emissions of the balance. 𝑃

and 𝑃

are the

corresponding price of coal and natural gas at the

corresponding time point.𝑀

𝑎𝑛𝑑 𝑀

are the carbon

emissions for each 10

units of electricity

generated by two different power generation

methods.𝐾

and 𝐾

are conversion variables, which

are related to the type of settlement currency, unit

commodity quantity, and power generation

efficiency. The P of the equilibrium point is the target

power conversion.

CG

CG

CG

PP

PM PM

kk

×+ =×+

(1)

2.2.2 Economic Factors

Economic factors will lead to the fluctuation of

carbon futures prices. Carbon emission permits are

the production costs of enterprises with high energy

consumption. The rise and fall of the price of carbon

emission permits may affect a particular industry, and

the prosperity degree of the industry will also affect

the carbon price. For example, the stock market

index mainly reflects the profit expectation of

enterprises and investors' optimism about the

prospect of economic development, which will affect

the production of enterprises and thus affect carbon

emissions. However, different markets have different

paths and degrees of influence.

The economic factors used in this paper include

the CRB index price that reflects the bulk commodity

market. The CRB index includes the price fluctuation

of the core commodity, which is widely used to

observe and analyze the price fluctuation of the

commodity market and the macro-economic

fluctuation and reveal the future trend of the macro-

economy to a certain extent.

The Stoxx 50 Index, which reflects the stock

market, is a weighted average index composed of 50

super blue-chip stocks listed in the capital markets of

12 countries such as France and Germany, which are

members of the European Union. The financial

securities circles regard the index as an indicator of

the overall situation of the share prices of large listed

companies in the eurozone.

The Traxx Europe International Credit

Derivatives Index, which reflects the bond market,

comprises one hundred and twenty-five (125) liquid

European entities with investment-grade credit

ratings. It can be regarded as a benchmark index for

the continental bond market, and investors can use it

to obtain the latest developments in the European

bond market.

3 EUA FORECAST BASED ON

ARIMA-GARCH

𝐴𝑅𝐼𝑀𝐴

𝑝, 𝑑, 𝑞

(summation autoregressive moving

average model) is a method with high short-term

prediction accuracy. It is composed of difference

order, autoregressive model, and moving average

model. The non-stationary time series of the ARIMA

model is transformed into the ARMA model by d-

order difference. The form of the model is:

(2)

),0(~

2

σε

WN

t

(3)

Meanwhile, the data stationarity should be tested

before using the 𝑨𝑹𝑰𝑴𝑨(𝒑, 𝒅, 𝒒) model.

The generalized autoregressive conditional

heteroscedasticity model (GARCH) is mainly aimed

at autocorrelation, which can effectively fit the

current conditional variance with long-term

correlation. 𝑮𝑨𝑹𝑪𝑯(𝒑, 𝒒) model satisfies:

(4)

(5)

(6)

This paper uses the EU carbon futures settlement

price (EUA) to establish an ARIMA-GARCH model

and uses this model to forecast the EUA price in the

next three months.

tt

d

BxB

ε

)()( Θ=∇Φ

ttt

u

ε

σ

=

==

−−

++=

q

i

p

i

itiitit

u

11

22

0

2

σβαασ

)1,0(~ N

iid

t

ε

Research on Carbon Futures Forecast and Related Asset Impact Analysis Based on ARIMA-GARCH and RBF Contribution Analysis

733

Figure 2: RBF Philosophy diagram.

4 RBF NEURAL NETWORK

RBF neural network is a kind of local approximation

neural network, which usually has only one hidden

layer. The process of mapping the data of the input

layer to the hidden layer applies the idea of the kernel

function, which is nonlinear. The transformation of

the hidden space pointing to the output layer is linear.

It is nonlinear for the data itself, but for the

corresponding parameters, it is linear, which will

significantly simplify the solution of the parameters,

so it has a great advantage in the learning speed

compared with the traditional BP neural network.

The hidden node of the RBF neural network uses

the distance between the input mode and the centre

vector as the independent variable of the function and

uses the radial basis function as the activation

function. In most cases, the Gaussian function is used

as the radial basis function. The corresponding

activation functions are as follows:

)

2

1

exp()(

2

2

imim

cxcxR −−=−

σ

(7)

𝒙

𝒊

is the vector corresponding to the original

explanatory variable, while 𝝈

𝟐

is the variance of the

Gaussian function. The expression from the input

layer to the hidden layer is as follows:

)exp(

j

j

j

D

cX

z

−

−=

(8)

In the above formula, 𝑪

𝒋

can be regarded as the

centre vector corresponding to the 𝒋 th hidden layer

neuron, which is composed of the central

components of all 𝒙 in the input layer connected by

the 𝒋 th neuron in the hidden layer. 𝑫

𝒋

is the width

vector of the j th neuron in the hidden layer. The

linear expression from the hidden layer to the output

layer is:

=

=

p

i

jiji

zy

1

ω

(9)

−=

m

j

ijj

cyd

P

2

1

σ

(10)

RBF neural network has a considerable performance

on dealing with the details of related variables, with

a good effect on various financial data with large

time series fluctuations. In this paper, based on the

RBF model, through the contribution analysis of

European economic indicators and energy prices

related to EUA, the influence of seven explanatory

variables on EUA price fluctuation is obtained.

5 RESEARCH ON CARBON

FUTURES FORECAST AND

RELATED ASSETS IMPACT

ANALYSIS BASED ON

ARIMA-GARCH AND RBF

NEURAL NETWORK

5.1 Carbon Futures Forecast Based on

ARIMA-GARCH

Daily EUA carbon futures settlement price is all from

the WIND database, from January 7, 2008, to May

18, 2021, with 3440 samples. The calculated average

value of every five days is taken as weekly data, and.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

734

Table 1: Stationarity test results.

ADF test

Critical value

0.01

Critical value

0.05

Critical value 0.10 P-value Lag order

-18.11 -3.44 -2.87 -2.57 2.54e

-30

3

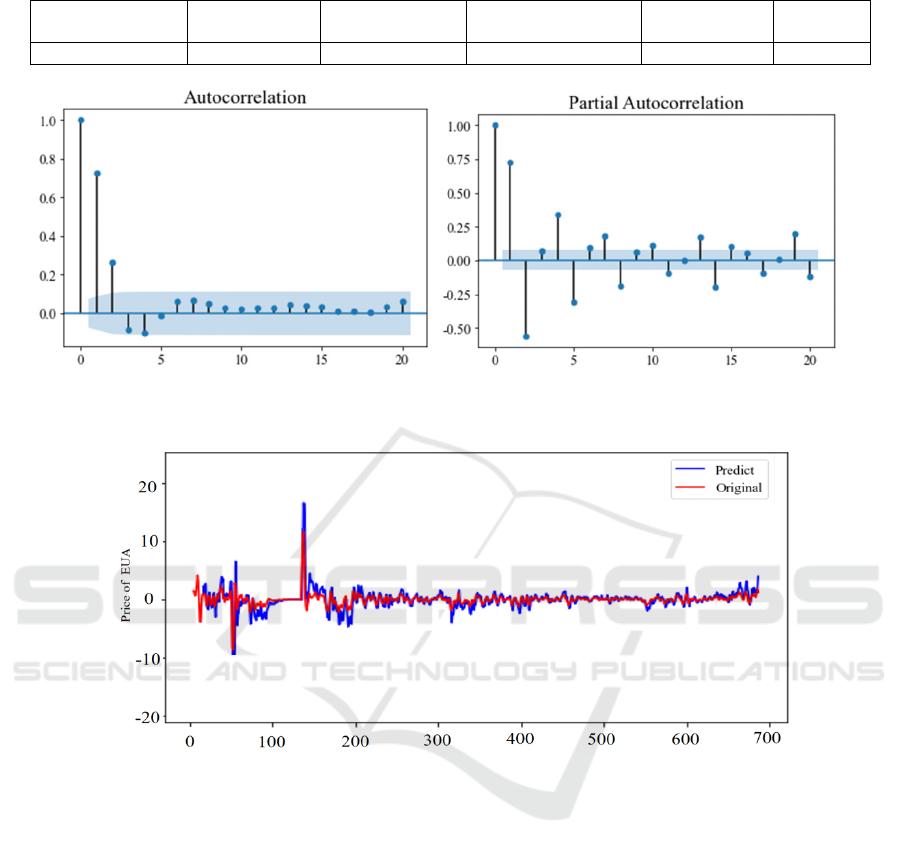

(a)ACF (b)PACF

Figure 3: ACF PACF Schematic Diagram.

Figure 4: Fitting renderings.

the carbon futures price data are processed for 688

sets of data. Before establishing the ARIMA model,

the ADF test method is used to carry on the

stationarity test to the weekly data. See Table 1.

The results show that after the third-order

difference of the weekly average EUA price data, the

ADF test value of the EUA price sequence is less than

the critical value of 1% confidence interval under the

confidence of 1%, 5%, and 10%. The p-value is much

less than 0.1, showing that the EUA price data is

stable. Autocorrelation diagram (ACF) and partial

autocorrelation (PACF) diagram are used to

determine the Model parameters of the ARIMA

model, which can be seen in Figure 3.

By observing chart (a), it is found that the AR part

of the weekly average EUA price is a trailing order of

order 5, that is, AR (5). By observing graph (b), it is

found that the MA part of the sequence shows a

typical uncensored property. On this basis, this paper

uses the BIC criterion to determine the order of the

ARIMA model accurately. By comparing the BIC

values of ARIMA(4,3,1) , ARIMA(4,3,2) ,

ARIMA(5,3,1), ARIMA(5,3,2) , the final model is

ARIMA(5,3,1) . Confirm the corresponding

parameters and determine the model for forecasting

futures as follows. Meanwhile, the relevant results

can be found in Figure 4.

𝑥

1.1974𝑥

0.5213𝑥

0.5213𝑥

1.2979𝑥

1.2979𝑥

𝜀

7.7025𝜀

(11)

The white noise test was carried out on the

residual data, and the result showed that the residual

sequence was not white noise, indicating that the

information in the data was not fully extracted. On

this basis, GARCH (1,1) model was established for

Research on Carbon Futures Forecast and Related Asset Impact Analysis Based on ARIMA-GARCH and RBF Contribution Analysis

735

the residual sequence in this paper. The model is as

follows:

𝛔

𝐭

𝟐

= 𝟎. 𝟒𝟕𝟑𝟖 + 𝟎. 𝟑𝟒𝟗𝟏𝛍

𝐭𝟏

𝟐

+ 𝟎. 𝟒𝟗𝟕𝟏𝛔

𝐭𝟏

𝟐

(12)

On this basis, the model is used to predict the

carbon futures EUA price in the next 12 weeks, and

the results are shown in Table2.

Table 2: Forecast data for the next 12 weeks.

Week1 Week2 Week3 Week4

20.37 22.81 22.67 22.51

Week5 Week6 Week7 Week8

24.97 24.84 24.69 27.14

Week9 Week10 Week11 Week12

27.02 26.87 26.88 29.33

The RMSE value of the residual sequence of the

relevant data is calculated, and the fitting effect of the

model is judged. The calculated result was

RMSE=2.89, indicating that the fitting effect of the

model was good and the reliability of the prediction

results was extensive. From the forecast results, the

EU carbon futures price is on an upward trend in a

short period, which may be affected by a series of

factors, such as the European political situation, good

EU policy guidance, financial market fluctuations,

etc. Therefore, carbon futures investors and related

enterprises need to make an optimal decision by

considering all aspects of factors when investing.

5.2 Contribution Analysis of Related

Assets Based on RBF Neural

Network

The prices of crude oil, natural gas, coal, and CRB of

commodities, iDraxx of bonds, and STOXX 50 index

of stocks used for contribution analysis are all derived

from the Wind database. There are 2876 observation

time points based on the settlement price and closing

index corresponding to the trading day from March

22, 2010, to June 3, 2021, in which bond-related data

show a tiny proportion of breakpoints and outliers.

Numerous interpolations are carried out by using

multiple interpolation methods and the K-means

clustering method. The SWITCH power conversion

variables are obtained by solving the formula (1).

Descriptive statistics of 7 types of variables can be

found in Table 3.

A relatively optimal RBF network model is

constructed, in which the number of nodes in the

input layer is the number of the input layer is 7 of the

input variables, corresponding to the corresponding

index of the normalized influencing factors, the

output is the EUA price, and the number of nodes in

the output layer is 1. In the model construction, 69.6%

of the data points were selected as the training set.

30.4% of the data points were selected as the test set.

The best performance was achieved when the

Softmax function was selected as RBF, and the

hidden layer had 99 neurons.

The training error and test error corresponding to

the RBF carbon futures price model are less than

0.1%, and the model shows good robustness. The

fitting effect between the measured price and the

predicted price can be seen in Figure5. The scattered

points are concentrated on both sides of the straight

line with a As can be seen from the figure, the slope

of the predicted results are close to 1, indicating the

constructed model can accurately predict the carbon

futures price.

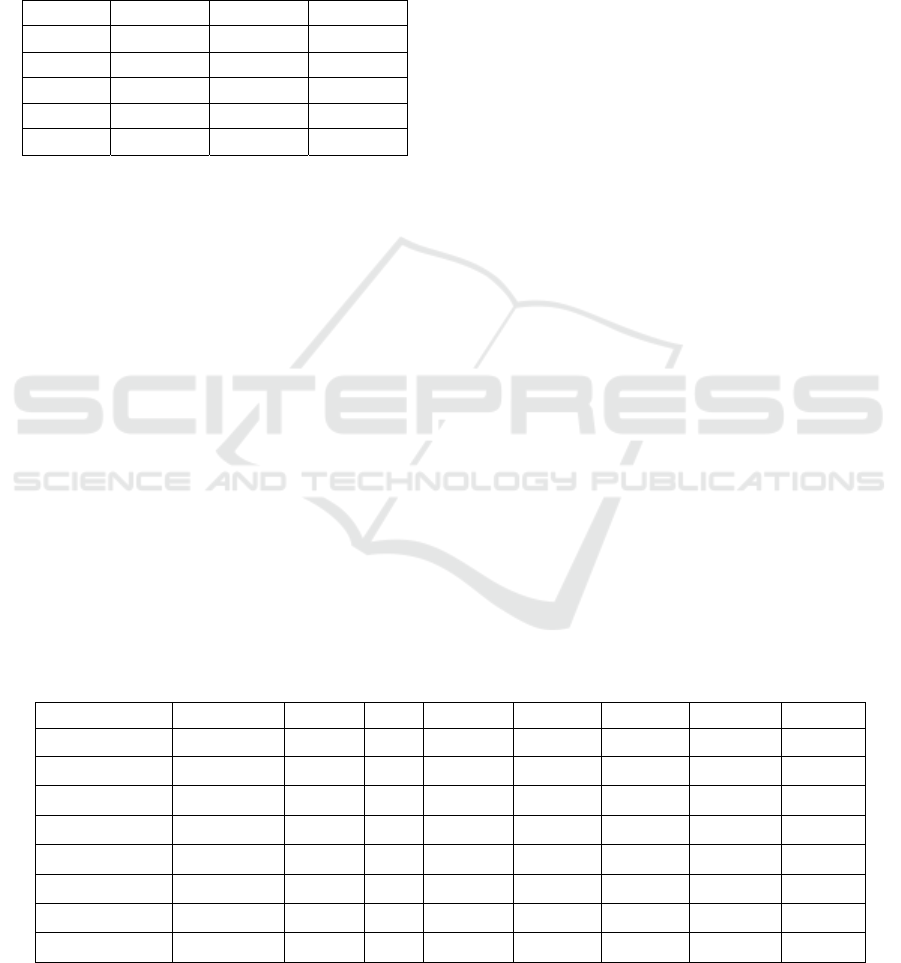

Table 3: Descriptive statistics of explanatory variables.

Variations Symbol Mean Std Min Max Median Skew Kurt

EUA EUA 12.90 0.17 2.7 56.49 8.07 1.50 2.32

Stoxx50 STOCK 3104.1 7.92 1995.01 4088.5 3137.1 -0.31 -0.52

Oil Price OIL 76.20 0.50 19.33 126.65 69.02 0.21 -1.30

Gas Price GAS 50.05 0.28 8.74 77.86 51.13 -0.38 -0.61

COAL Price COAL 78.51 0.40 38.55 131.50 78.55 0.36 -0.44

CRB COMM 232.48 1.15 106.28 370.56 200.87 0.30 -1.28

iTraxx BOND 82.46 0.64 41.26 207.96 71.73 1.14 1.34

Balance P ESWITCH 91.50 0.83 -6.38 185.70 86.05 0.34 -0.5

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

736

Figure 5: The fitting price corresponds to the EUA scatter diagram.

Figure 6: Contributions of explanatory variables.

The contribution of seven types of related assets can

be vividly analyzed by Figure 6.

(1) from the perspective of various indicators at

the economic level, the stock index has the most

significant impact on the trend of carbon futures

prices, and the rise of the stock index often indicates

that the overall economic trend is developing for the

better, which effectively promotes enterprises to

participate in quota market trading, so carbon futures

price will also be higher. The fluctuation of the

commodity index will also affect the trend of carbon

futures because there is always a direct correlation

between the flow speed of commodities and the

carbon emissions produced by enterprises.

(2) Three different energy prices are of the same

importance to the final carbon futures price in the

energy market. The crude oil price has a significant

positive impact on the carbon futures price. The

fluctuation of this price will often prompt large

chemical enterprises to adjust their quota demand.

Electrical switching variable importance degree on

natural gas and coal, the influence of the lower than

the price of crude oil, but in fact, power conversion

variable is affected by many factors, such as the

maximum power limit of power plant units, the

government's macro-control of national electricity

price and many other factors. It can not carry all the

information about the raw material adjustment of the

power plant according to the carbon futures price

under the ideal condition. The power conversion

variable is directly linked to the overall supply and

demand of carbon emission rights, and its

contribution to EUA price will be more obvious.

Research on Carbon Futures Forecast and Related Asset Impact Analysis Based on ARIMA-GARCH and RBF Contribution Analysis

737

6 CONCLUSION

This paper aims at the trend of European carbon

futures price, and its influencing factors take the EUA

price trend from 2008 to 2021 as the research object,

extracts the information from the residual term of

time series model by constructing ARIMA-GARCH

model, and obtains the prediction result with good

fitting effect. RBF neural network is used to

contribute quantitative analysis. The specific

conclusions are as follows :

(1) This paper uses EUA price data of 2008 and

2021 to forecast the carbon futures price in the next

12 weeks. According to the forecast results, the

settlement price of carbon futures is still in the rising

stage in the short term, which may be affected by a

series of factors such as the supply relationship of

carbon quotas, market arbitrage speculation, and

relevant policies.

(2) The stock market has the most considerable

influence among economic factors, and its

contribution reaches 0.215. Among other factors,

commodity market has a more significant impact on

economic factors, while bond has a minor impact on

economic factors. As for energy, different energy

sources have similar effects on prices, with crude oil

having the most considerable impact. The actual

contribution of the power conversion variable switch

to carbon futures prices is likely to be underestimated

due to many factors.

REFERENCES

Ai Ming, Wang Hailin, Wen Wukang, & Pan Xunzhang.

(2018). Analysis of the factors affecting the price of EU

carbon futures. Environmental Economics Research,

3(03), 19-31.

Dutta, & Anupam. (2017). Modeling and forecasting the

volatility of carbon emission market: the role of outliers,

time-varying jumps and oil price risk. Journal of

Cleaner Production, S095965261732807X.

Mustafa Yahşi, Ethem Çanakoğlu & Semra Ağralı (2019)

Carbon price forecasting models based on big data

analytics, Carbon Management, 10:2, 175-187.

Qiang, Ji, Dayong, Zhang, & Jiang-bo, et al. (2018).

Information linkage, dynamic spillovers in prices, and

volatility between the carbon and energy markets.

Journal of Cleaner Production.

S Trück, & Weron, R. . (2016). Convenience yields and risk

premiums in the EU‐etc—evidence from the Kyoto

commitment period. Journal of Futures Markets, 36(6),

587-611.

Tang, L. Wang, H. , Li, L. , Yang, K. , & Mi, Z. . (2020).

Quantitative models in emission trading system

research: a literature review. Renewable and

Sustainable Energy Reviews, 132, 110052.

Yuan, N., & Yang, L. . (2020). Asymmetric risk spillover

between financial market uncertainty and the carbon

market: a gas–DCS–copula approach. Journal of

Cleaner Production, 259(1), 120750.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

738