Force Majeure and Insurance of Risks of Economic Emergencies

Oleksandr O. Trush

1,2 a

, Dmytro A. Gorovyi

1 b

and Yuliya V. Bogoyavlenska

2,3 c

1

National Technical University “Kharkiv Polytechnic Institute”, 2 Kyrpychova Str., Kharkiv, 61002, Ukraine

2

Zhytomyr Polytechnic State University, 103 Chudnivska Str., Zhytomyr, 10005, Ukraine

3

Masaryk University, 507/41a Lipov

´

a Str., Brno, 602 00, Czech Republic

Keywords:

Insuperable Force, Force Majeure, Insurance, Risks, Economic Emergencies, Liability.

Abstract:

The paper deals with the actual problem of developing new insurance products in the conditions of hybrid

military actions and the application of economic sanctions. For modern Ukraine the “hybrid military actions”

from the “neighbor-state” are actually for nine years. However, there are some legal issues on the way to a

clear understanding of the difference between “insuperable force” and “force majeure”. It is also caused by

misreading of the legal system from the representatives of different sectors, despite a good history of national

insurance companies formation and development. Thus, in the paper authors present the results of correct

understanding and usage of mentioned categories, pay attention to risks with grants in project management,

and unclose ways for development of new products according to economic situation and market needs.

1 INTRODUCTION

Emergencies cause great losses, both to the country’s

economy, to companies (enterprises), and to individ-

uals. The means of avoiding emergencies are usually:

means of preventing their occurrence, means of min-

imizing their consequences and insurance (which can

also be partially attributed to the means of minimiza-

tion). Nevertheless, insurance still stands aside from

the means of minimization, since it has both the orig-

inal and the initial result is cash. While the rest of

the means of minimization is associated with the ad-

ditional expenditure of material resources.

In the practice of the EU countries, North Amer-

ica, Southeast Asia and Australia, the majority of

companies (enterprises) and individuals insure their

activities and property against the occurrence of

emergencies. However, in Ukraine, the share of fi-

nancing measures to minimize the impact of emergen-

cies through insurance payments made by specialized

insurance companies is still slowly growing, despite

the full-scale aggression of Russian Federation, and

projects to be realized instead of. This is mostly due

to the fact that protection from emergency situations

of the population (individuals) by means of insurance

a

https://orcid.org/0000-0001-9578-9451

b

https://orcid.org/0000-0002-0416-3857

c

https://orcid.org/0000-0003-4101-7127

is provided on a voluntary basis (Code of Civil Pro-

tection of Ukraine, 2013), and most Ukrainians avoid

this (but legal entities (companies and enterprises) do

it). Therefore, each person must decide for him on the

need to insure his property (life, means of activity or

health) in order to receive compensation for damages

in the case of an emergency.

2 ANALYSIS OF THE PREVIOUS

PUBLICATIONS

In many scientific publications (Bublik, 2009; Roma-

nenko, 2007; Hargrave, 2022) and in practice, insur-

ance is considered as a means of minimizing the im-

pact of natural and man-made emergencies. Accord-

ing to Article 49 of the Code of Civil Protection of

Ukraine (Code of Civil Protection of Ukraine, 2013)

the purpose of civil protection insurance is:

1. property insurance of businesses and people

against damages caused by an emergency, acci-

dent or emergency response operations;

2. insurance compensation on behalf of businesses

operating high-risk facilities to third parties or

their property and other legal entities for the dam-

ages caused by a potential emergency that oc-

curred at such facilities.

80

Trush, O., Gorovyi, D. and Bogoyavlenska, Y.

Force Majeure and Insurance of Risks of Economic Emergencies.

DOI: 10.5220/0011931500003432

In Proceedings of 10th International Conference on Monitoring, Modeling Management of Emergent Economy (M3E2 2022), pages 80-89

ISBN: 978-989-758-640-8; ISSN: 2975-9234

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

Regarding international level, the aspect of the in-

ternational cooperation presented in (Dorussen et al.,

2018; Bar

ˇ

c et al., 2020). Assessing the capabilities

of civil protection and preparing recommendations on

how to implement these approaches presented in re-

search of Kalynenko et al. (Kalynenko et al., 2020)

only in 2020.

3 PROBLEM STATEMENT

Meanwhile, according to the above mentioned Code

of Civil Protection of Ukraine (Code of Civil Pro-

tection of Ukraine, 2013) there are also social and

military emergencies, which, namely, in Ukraine are

most often considered as “reasons of a force majeure

essence”, and therefore they are not the cause (rea-

son) of the “insured event”.

But there is a problem regarding correct under-

standing categories for the correct insurance. As

well as regarding correct implementation, especially

nowadays.

The scientific novelty of the research is in forma-

tion of fundamentals for the disclosing and searching

for the appropriate instruments of economic risks in

Ukraine, for the possibility of effective management

of emergent economy. It is due to the fact that “force

majeure” has no one definition in modern Ukrainian

legislation and it is the reason why such traditional

instruments like insurance are not widely spread on

the market of risks of economic emergencies, and this

problem should be solved especially nowadays.

4 RESULTS

As there were mentioned above, the term “force ma-

jeure” was not officially enshrined in the legislation of

Ukraine until recently, which gave rise to constant dis-

cussions about a clear interpretation of its definition

(Sosnin, 2014). Thus, in the Civil Code of Ukraine,

instead of the concept of “force majeure”, which has

a global perception, the concept of “force majeure

circumstances”’ appeared. In accordance with Art.

617 of the Civil Code of Ukraine, “A person who has

violated an obligation is released from liability for

violation of an obligation if he proves that this vi-

olation occurred as a result of an incident or force

majeure. It is not considered a case, in particular,

of non-compliance with its obligations by the coun-

terparty of the debtor, lack of goods on the mar-

ket necessary for the fulfillment of the obligation,

lack of necessary funds from the debtor” (Tsyvilnyi

kodeks Ukrainy, 2003). Art. 218 of the Commer-

cial Code of Ukraine also provides a definition of

“insuperable force” (“force-majeure”), and specifies

a list of circumstances that are not related to force

majeure: “A party to economic relations shall be li-

able for non-performance or improper performance

of an economic obligation or violation of the regu-

lations of economic activity, unless it proves that it

has taken all measures to prevent an economic of-

fence. Unless otherwise provided by law or agree-

ment, for breach of economic obligation an economic

entity shall bear economic and legal liability, unless it

proves that proper performance of the obligation was

impossible due to irresistible force, that is extraordi-

nary circumstances beyond control under these con-

ditions of economic activity. Breach of obligations by

the offender’s counterparties, deficiency of goods in

the market required to fulfill the obligation, absence

of required funds in a debtor shall not be classified as

such circumstances” (Hospodarskyi kodeks Ukrainy,

2003). Thus, in their essence and the circumstances

the appearance of the concept in both codes coincide.

However, the Supreme Economic Court of

Ukraine in its one letter No. 01-2.2/279 of 09.09.2001

“Remarks to the Commercial Code of Ukraine” ex-

plained that the concepts of “force majeure” and “in-

superable force” are not identical, since “the defini-

tion of the category of force majeure circumstances

in part 2 of this article may cover not only events

in public life, that is, the impossibility of fulfilling

obligations as a result of targeted actions of persons

who are outside the scope of the obligation (for exam-

ple, embargo on export-import operations, hostilities,

strikes, riots), but also natural phenomena that belong

to a different category of circumstances that exempt

from liability, namely insuperable force. Identifying

these fundamentally different reasons for exemption

from liability is legally wrong. The category of in-

superable validity embodies only natural phenomena,

which, due to their exclusivity, inevitability and un-

predictability, determine the limitation of liability for

damage in cases determined by law. Moreover, in-

superable validity as a basis for limitation of liability

can take place only in non-contractual (tort) legal re-

lations and in cases of violation of contractual obliga-

tions, if it is directly provided for by law (for example,

in cases provided for in Article 418 of the Commer-

cial Code). At the same time, the category of force

majeure covers only exceptional events of public life,

which the parties themselves on dispositive grounds

define in the contract as the right to exemption from

further fulfillment of the obligation by agreement, if

such events occur during the term of the contract. The

parties may provide in the contract innocent liability

Force Majeure and Insurance of Risks of Economic Emergencies

81

for non-fulfillment or improper fulfillment of obliga-

tions, but limit it to cases of force majeure provided

for in the contract. Common to the circumstances of

insuperable force and force majeure is only their ex-

ternal nature of influence on the causal-results chain

of activity of participants in specific legal relations,

that is, these circumstances are beyond the control

of the participants in legal relations” (Supreme Eco-

nomic Court of Ukraine, 2001). Consequently, there

was confusion about the interpretation of the terms

“force majeure” and “insuperable force”.

The concept of “force majeure circumstances (cir-

cumstances of insuperable force)”, that is, already re-

lated to each other, was defined only in 2020 in the

law, which is not directly related to this concept, – the

Law of Ukraine “On Amendments to Certain Legisla-

tive Acts of Ukraine Aimed at Preventing the Emer-

gence and Spread of Coronavirus Disease (COVID-

19)” (COVID-19, 2020). Due to this law, amend-

ments were made to the Law of Ukraine “On the

Chambers of Commerce and Industry in Ukraine”

(On Chambers of Commerce and Industry in Ukraine,

1998), by 1998. Since 2014, the law states that the

Chamber of Commerce and Industry of Ukraine “con-

firms force majeure circumstances (circumstances of

insuperable force) as well as trade and port customs

adopted in Ukraine upon the request of business en-

tities and natural persons; certifies force majeure cir-

cumstances in accordance with the terms and condi-

tions of agreements upon the requests of business en-

tities engaged in housing construction (customers, de-

velopers)”. And from 17.03.2020, Art. 14-1 of this

Law, defined: “Force majeure circumstances (force

majeure circumstances) are the extraordinary and un-

avoidable circumstances that objectively unable to

fulfil the obligations stipulated in the terms and con-

ditions of the agreement (contract, treaty, etc.), obli-

gations under the legislative and other regulatory acts,

namely: the threat of war, armed conflict or a serious

threat of such conflict, including but not limited to en-

emy attacks, blockades, military embargoes, actions

of a foreign enemy, general military mobilisation,

military actions, declared and undeclared war, actions

of a public enemy, indignation, acts of terrorism, sab-

otage, piracy, riots, invasion, blockade, revolution,

mutiny, insurrection, mass riots, curfew, quarantine

established by the Cabinet of Ministers of Ukraine,

expropriation, forced seizure, seizure of enterprises,

requisition, public demonstration, blockade, strike,

accident, illegal actions of third parties, fire, explo-

sion, long breaks in transport operation, regulated by

the terms of relevant decisions and acts of state au-

thorities, the closure of sea straits, embargo, ban (re-

strictions) of export/import, etc. as well as caused

by the exceptional weather conditions and natural

disasters, namely: epidemic, strong storm, cyclone,

hurricane, tornado, hurricane, flood, snow accumula-

tion, ice, hail, frost, freezing of the sea, straits, ports,

passes, earthquake, lightning, fire, drought, subsi-

dence and landslide, other natural disasters, etc.”.

In principle, such a definition has the power to

stop all insurance activities in Ukraine, because it

classifies almost all insurance incidents related to so-

cial, natural or man-made emergencies as force ma-

jeure circumstances.

In international practice, force majeure circum-

stances are determined in accordance with Article 79

of the UN Convention on Contracts for the Interna-

tional Sale of Goods (UN, 1980), according to which

“A party shall not be liable for non-fulfillment of any

of its obligations if it proves that it was caused by an

obstacle beyond its control and that it was unreason-

able to expect this obstacle to be taken into account

when concluding a contract or to avoid or overcome

this obstacle or its consequences”.

In the international courts’ practices regarding the

definition of “force majeure” the question often de-

pends on which system of law is applied – precedent

(Anglo-American) or constitutional (Roman, conti-

nental). For example, “English law distinguishes

between two main means of protection by a party

that has committed non-performance of the contract

due to insuperable force. These circumstances, al-

though they result in the release of a party from lia-

bility, are fundamentally different from force majeure

in that they are non-contractual instruments, while

force majeure is introduced by the contract” (Kurylo,

2019). That is, no “non-contractual means of pro-

tection against liability for improper performance of

the contract due to insuperable force under English

law do not work if the parties include a force majeure

clause in the contract”.

Thus, insurance requires the most clear definition

of force majeure in insurance contracts to develop

a single consolidated position of the insurer, policy-

holder and reinsurer (if necessary).

Contra Anglo-American law in the continental

law, force majeure exempts from liability for improper

performance of a contract only temporarily: “French

civil law, which follows Roman law, professes the

principle of liability for violation of a contractual

obligation in the presence of guilt (with certain ex-

ceptions). Reference to force majeure is not required

if the non-fulfillment of the contract occurred in the

absence of guilt on the part of the party to the con-

tract that violated it” (Kurylo, 2019). That is, from

the side of insurance companies, non-fulfillment of

the contract becomes possible only for a certain pe-

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

82

riod of time, while the fault of the company itself is

absent. This actually makes it impossible to insure

economic risks, because when insuring funds against

depreciation of inflation, the insurance company will

not be to blame if it gives insurance payments with

impaired funds.

Despite the confusion of the “force majeure”

meaning in Ukraine, its definition in practice is sim-

pler, which greatly simplifies its recognition in the in-

surance market. The regulations for certification by

the Chamber of Commerce and Industry in Ukraine

and by it’s regional chambers of the force majeure

circumstances (insuperable force circumstances) pro-

vide that in order to recognize and confirm force

majeure circumstances (insuperable force circum-

stances), the documents provided by the applicant

must indicate:

1) “the extraordinary nature of such circumstances

(are exceptional and are beyond the influence of

the parties);

2) unpredictability of circumstances (their occur-

rence and consequences could not be foreseen, in

particular, at the time of the making of the rele-

vant agreement, before the term of the obligation

or before the occurrence of a tax duty);

3) inevitability (insuperability) of the circumstance

(of the event and / or its consequences);

4) causal-results chain between the circumstance /

event and the inability of the applicant to fulfill

his specific obligations (according to the contract,

agreement, law, regulation act, act of local gov-

ernmental institutions, etc.)” (On Chambers of

Commerce and Industry in Ukraine, 1998).

Thus, mentioned legal conflicts significantly affect

the sphere of insurance against emergencies, since the

sphere of liability, depending on the cause and con-

sequences of the emergency, may differ significantly.

Especially in specific types of emergencies.

In the publications (Trush and Gorovyi, 2018;

Trush et al., 2019) another type of emergencies is de-

fined depending on the cause of their occurrence –

economic emergency: “As an emergency of economic

character (economic emergency) can be considered a

situation that is the result of erroneous economic ac-

tions of the government, the action of economic sanc-

tions by other countries, hybrid hostilities, inflation,

impoverishment of the population and loss of savings,

unemployment and bankruptcy of enterprises and or-

ganizations, the exit of investors from the country, de-

preciation of the national currency and securities”.

For this type of emergencies the principles of in-

surance are not currently used, but ‘the signs’ of such

an emergency that cannot be used as force majeure

conditions in accordance with the current legislation

of Ukraine. Force majeure are social reasons that will

cause a social emergency, which in turn will entail

an economic emergency. And directly appearance of

economic emergencies – namely, inflation (and for

export-oriented countries, such as Japan, deflation),

bankruptcy, unemployment, loss of savings (accord-

ing to their purchasing power), exit of investors from

the country, depreciation of the national currency and

securities, – could be insured events, and are not con-

sidered as force majeure circumstances. At the same

time, “war, hostilities, invasion of troops, insurrec-

tion, civil unrest, confiscation, forced seizure, req-

uisition, seizure or damage to property by order of

the government or other authority are not insurance

events and exclude compensation for possible dam-

ages under an insurance contract” (Hroshi, 2022).

But, in practice in Ukraine these terms of the contract

apply only if martial law or a state of emergency is

introduced in the country or in its part in accordance

with the procedure described by the Law of Ukraine

“On the Legal Status of the State of Emergency” (On

the Legal Status of the State of Emergency, 2000).

That is, “until the statement and entry into force of

an official decision, insurers have no legal grounds to

refer to such cases (even if in fact those actions that in-

herently agree with the above definitions take place)”

(Trush and Gorovyi, 2018). Also, “attention should

be paid to the fact that in almost all contracts of vol-

untary land transport insurance, in the section of the

basements of refusing to pay insurance compensation,

there is a pp. stating that hostilities, riots, acts of ter-

ror, civil unrest are direct basements for the insurer’s

refusal to pay insurance compensation” (Protsenko,

2016).

Thus, if the condition of the contract was pre-

cisely the insurance of certain economic emergen-

cies, then the insurance company must compensate

for the losses. At the same time, some of the eco-

nomic emergencies are already included in the list of

circumstances of unforeseen force. Consequently, in

theory, you can insure against them in the insurance

company, but the receipt of payments from it can be

appealed, since they are included in the list of insu-

perable force. So, the ‘circumstances of economic

emergencies’ we divide into:

1. Can be insured:

1.1) erroneous economic actions of the government

(however, it must be clearly stated in the con-

tract what exactly should be considered as a

wrong action);

1.2) inflation;

1.3) impoverishment of the population and loss of

savings;

Force Majeure and Insurance of Risks of Economic Emergencies

83

1.4) unemployment;

1.5) bankruptcy of enterprises and organizations;

1.6) depreciation of the national currency and secu-

rities;

1.7) exit of investors from the country (but must be

clearly stated in the contract, what exactly is

meant).

2. Included in the list of irresistible forces in

Ukraine:

2.1) economic sanctions of other countries;

2.2) hybrid military operations.

Looking further, we should pay attention to infla-

tion, its dynamics, and emergencies.

Deeply, the categories of ‘cause’ and ‘effect’ gen-

eralize one of the concrete and specific forms of rela-

tions, from a philosophical point of view. Thus, every

event or group of events creates interacting phenom-

ena; meanwhile, phenomena act for/regarding other

reason. In its turn, the cause itself generates conse-

quence. That creates a chain of causal relations be-

tween individual groups, defined “emergencies”.

The economic impact of emergency is changing.

At the same time, exactly the same problem could

be solved as well during long time as immediately.

From national example, the government did not stop

quickly the sustainable growth rate of foreign curren-

cies during 2014 in Ukraine, – and it had been already

the period of war against Ukraine stared. Moreover,

the opposite case: panic on the currency market at the

end of December 2018 was resolved in a few days.

In general, the economic growths of emergency

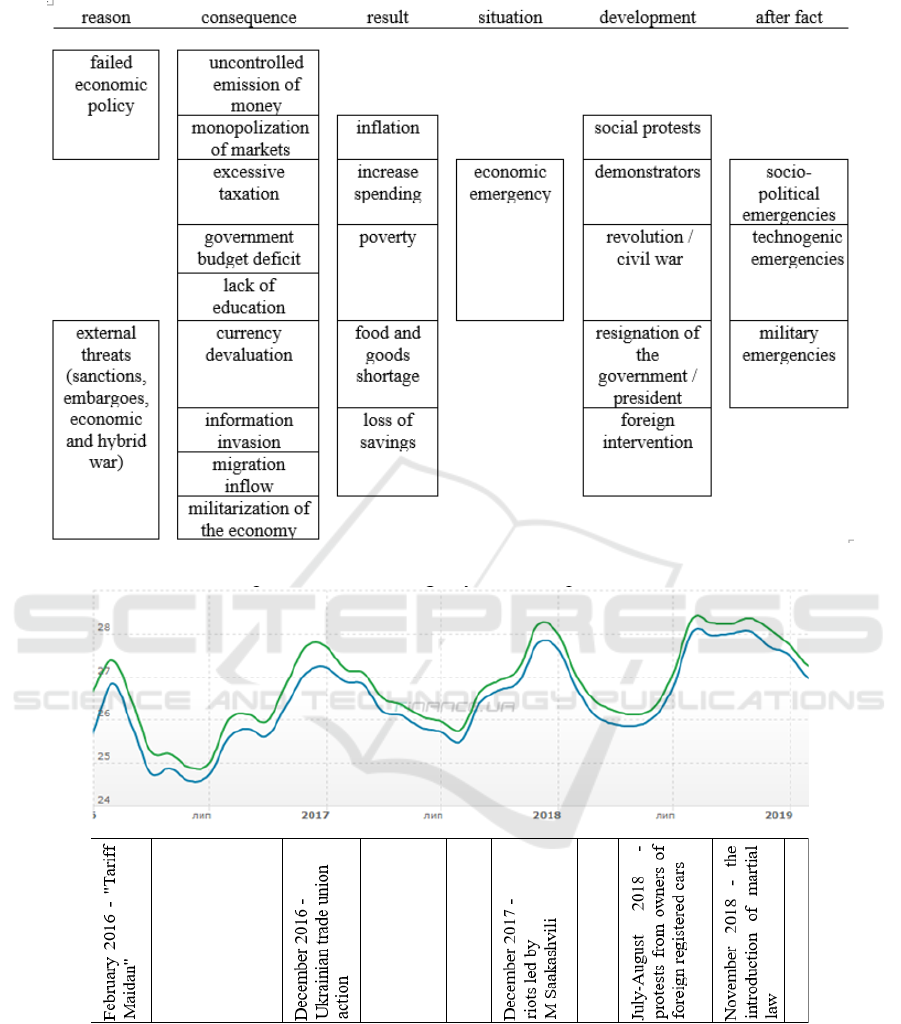

can be represented as it shown in figure 1.

As it can be seen, there are two main

causes/reasons of the economic impact emergency de-

pends on the “source” – external or internal. The con-

sequences made on the base of (Pettinger, 2021), de-

fine the traditional causes of inflation, trade deficit,

loss of savings (uncontrolled printing of money, cur-

rency devaluation, fiscal deficit, excessive taxation,

monopolization of markets).

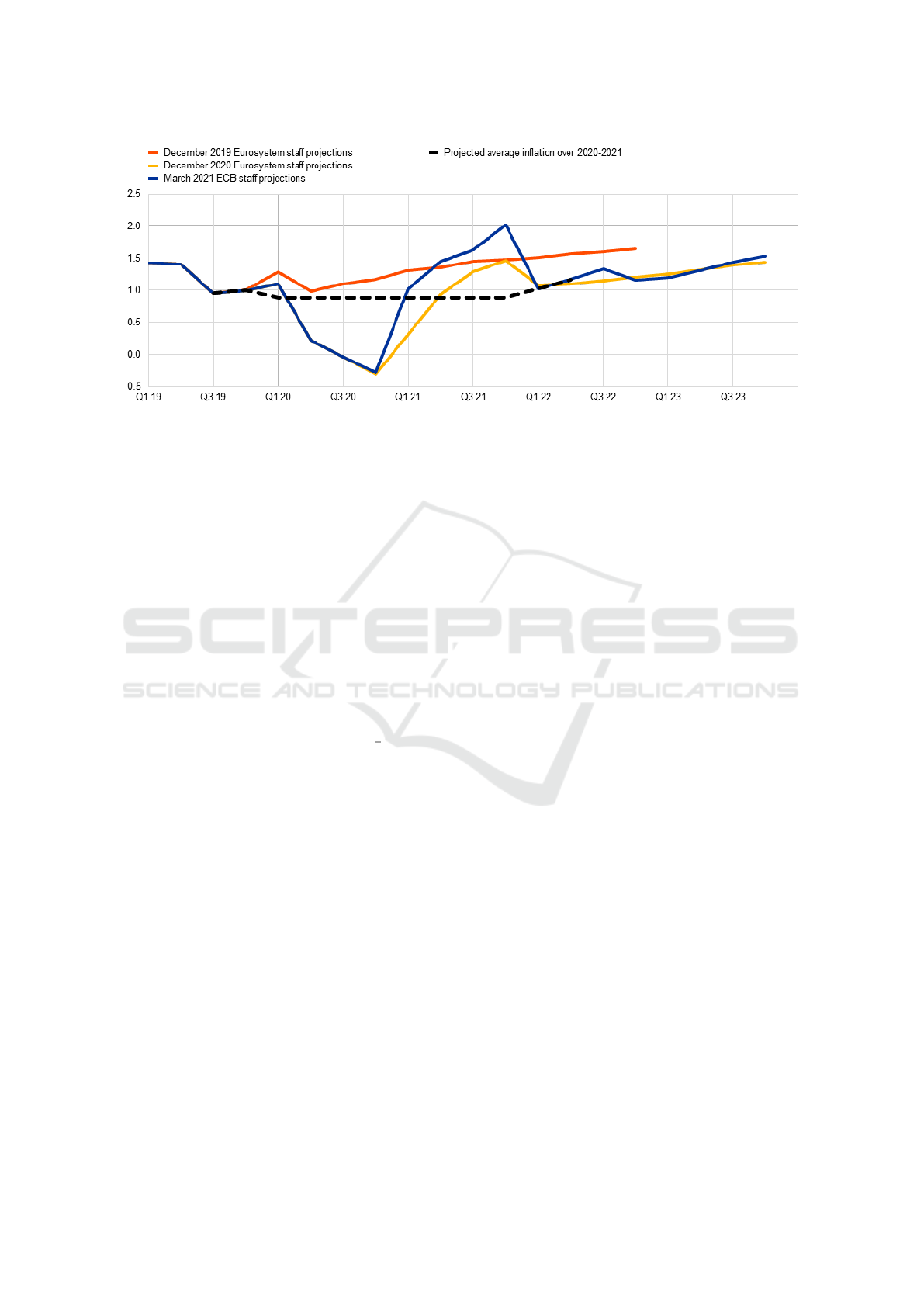

Consideration of the causes of significant fluctu-

ations Ukrainian hryvnia in 2017-2018 years makes

us identify another consequence of the economic

emergencies – ‘information invasion’. Huge changes

(‘jumps’) of the hryvnia / US dollar and euro dur-

ing the period are not fluctuating economic indica-

tors of the state (GDP, index of production, consumer

price index, etc.) or even obtaining or not of macro-

financial assistance from the IMF, the US, EU, etc.

However, it coincides with the declared opposition

protests and the spread of false information in the

media by country-aggressor. Comparison the change

of hryvnia / US dollar with information events in the

country is presented on figure 2.

That is, the preparation and sharing in the media

of an informational event (which may later lead to the

onset of an economic emergency) still leads to signif-

icant fluctuations in the exchange rate and creates the

ground for the economic emergencies.

For example, emergency from the reason of pan-

demic caused such changes of inflation in EU (fig-

ure 3) (Lane, 2021).

Related issues, namely in the context of shaping

the sustainable development, were deeply researched

by Ukrainian famous scientists (Semerikov et al.,

2020). Risk assessment on the mesoeonomics levels

(Pursky et al., 2021) are in the center of future re-

searches as well, especially for after-war reconstruc-

tion of Ukraine.

Today in Ukraine, insurance services are pro-

vided by many insurance companies. As a rule,

they offer a standard set of services for life insur-

ance against accidents, health insurance (including

tourist insurance), property insurance against emer-

gencies, movable property insurance (including car

owner’s liability), insurance of agricultural produc-

ers against adverse weather conditions, medical insur-

ance, etc. However, some insurance companies also

offer specific types of insurance comparable to eco-

nomic emergency insurance:

• credit limit insurance, flight cost compensation

for the passenger, notary liability insurance, third

party liability insurance (Credo, 2022);

• insurance of cases related to transportation: cargo

insurance, forwarder and transport operator lia-

bility insurance, carrier liability insurance (PZU

S.A., 2022);

• reimbursement of cases related to cyber incidents,

which caused stoppage of the production – cyber

risks, the need to recover data (INGO, 2022), etc.

However, quite rarely insurance companies agree

with the voluntary payment of insurance compen-

sation, taking into account inflation losses (av-

topomich.com, 2016). Although earlier it was infla-

tion that was the object of insurance. In the early

1990s, with the onset of Ukraine’s independence and

the rapid inflation of the old currency (‘karbovantsy’),

some insurance companies (for example, (Verbyanyi,

2012)), offered insurance of savings against deprecia-

tion caused by rapid inflation. Now there are no such

offers on the Ukrainian market.

Another option of the ‘lost’ instrument of insur-

ance of economic emergencies in Ukraine can be con-

sidered insurance of non-repayment of bank loans,

which can be used as a guarantee of loan repayment

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

84

Figure 1: Scheme of emergency economic growths.

Figure 2: Comparison of change of hryvnia / US dollar with information events in Ukraine (charts.finance.ua, 2022).

(instead of a more common pledge of property or

guarantees of third parties) (Katranzhy and Maryna,

2020). However, this form has not found its distribu-

tion due to a number of reasons (Chaykovskiy et al.,

2001):

• “commercial banks cannot make extensive use

of loan insurance today because they have well-

founded doubts about the reliability and solvency

of insurance companies, although there is an an-

nual mandatory disclosure of balances;

• high insurance premiums demanded by insurance

companies cause an increase in production costs

due to insurance payments, which in turn leads to

an increase in prices for goods and services;

Force Majeure and Insurance of Risks of Economic Emergencies

85

Figure 3: Selected (B)MPE projections for inflation.

• the procedure for issuing an insurance contract

is complicated, which requires banks to work

responsibly analytically to reconcile insurance

rates, the nature of liability, and the transfer of in-

surance documents necessary for him to allow a

regression claim against the borrower”.

The interaction of commercial banks and insur-

ance companies today is more common in the con-

sumer market, where insurance companies reimburse

the bank that provided the consumer loan funds in

case of impossibility of returning funds by the bor-

rower in case of damage or malfunction of the goods

under which the loan was taken (Shchedryi, 2005).

We also appeal to insurance of projects’ grant

risks, as the last half of the year makes recipients

think: to do them or not. For example,

2

3

of socio-

economical grants were on the way to give money

back to grantholders. For example, we note what

exactly written in grant agreements, namely by the

British Council – “the party shall be released from re-

sponsibility for non-performance or improper perfor-

mance of its obligations under agreement, if this non-

performance or improper performance was caused by

unforeseen circumstances of force-majeure, occurred

after execution of the Agreement due to emergency

reasons, which could not be either forecasted or pre-

vented by reasonable measures. Such circumstances

include events that are in spite of the parties’ will,

i.e. on which the parties have no influence and/or

control and, therefore, for which they cannot be re-

sponsible. Such circumstances, inter alia, encompass

natural calamities (for instance, earthquakes, inunda-

tion, flood, freezing, etc.), fires, other natural catas-

trophes and social cataclysm, strikes, acts of terror-

ism, warfare, war, etc. Such circumstances also in-

clude civil disorders, acts/inauspicious acts of govern-

ment or other state bodies, blockade, embargo, other

international sanctions, other negative acts of states,

etc., which a respective party is not in connection

with and which it has no influence upon. The party

that is unable to perform obligations under this agree-

ment shall within five calendar days notify the other

party of the onset and cessation of force majeure. The

presence and duration of force majeure is to be con-

firmed by the competent and assigned authorities in

the manner prescribed by the applicable legislation

in force. In the event of force majeure execution of

the agreement shall be postponed for the time of du-

ration of force majeure circumstances. If the force

majeure lasts more than three months, either of the

party may terminate this agreement in respect of the

scope of outstanding services by serving the written

notice”. In contrast, in Ukrainian practice, accord-

ing to the rules of insurance companies, “emergency

states, special, or military emergences; civil disorders,

revolutions, insurrections, uprisings, strikes, putsch,

lockout, terrorist act; nuclear incident, exposure to

ionizing radiation, radiation pollution; illegal actions

of state bodies, local governments, officials of these

bodies” basicly were called “exclusion from insured

cases” (PZU S.A., 2022).

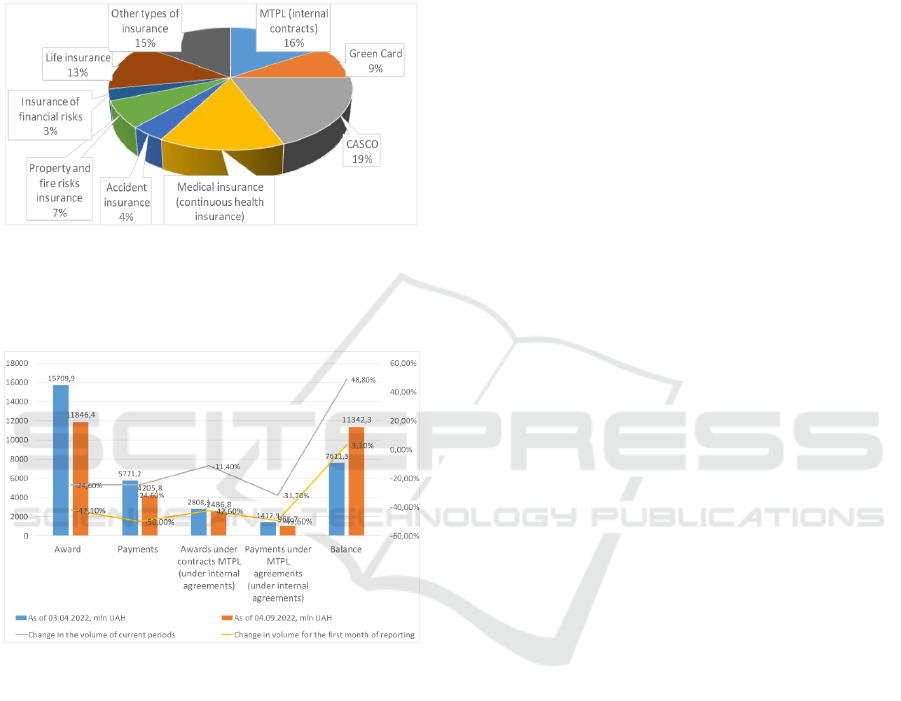

Regarding cases with insurance compensation the

National Bank of Ukraine fixed 127 non-life in-

surance companies (01.09.2022). The total signed

awards in the first half of 2022 compared to the first

half of 2021 decreased by almost a third (-28%) and

amounted to 17.8 billion. UAH. – at the same time,

the reduction in volumes to a greater extent took place

in the segment non-life (-29%); the volume of insur-

ance payments/reimbursements paid in the first half

of this year also fell proportionately in non-life seg-

ment (-32%). In the structure of the insurance port-

folio, the volumes of insurance of property and fire

risks (-60%), financial risks (-64%) and CASCO (-

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

86

30%) decreased the most. The drivers of non-life in-

surance business support were “Green Card” (+ 76%),

MTPL (-13%), accident insurance (-16%). Insurance

portfolio for the first half of 2022 by type of insur-

ance presented in figure 4, and changes in activity vol-

umes (21.03-04.09.2022), non-life, presented in fig-

ure 5 (National Bank of Ukraine, 2022).

Figure 4: Insurance portfolio for the first half of 2022 by

type of insurance in Ukraine (National Bank of Ukraine,

2022).

Figure 5: Changes in activity volumes (21.03-04.09.2022),

non-life (National Bank of Ukraine, 2022).

The positive solutions for further development and

for giving the most relevant results depend on pos-

sibility to change fast, to modernize organisation of

all business-processes (Bogoyavlenska and Berezh-

nytskiy, 2020), being resilience to economic shocks

(Bruneckien

˙

e et al., 2018). Moreover, new finances

instruments, namely “innovation vouchers” develop-

ing too fast (Kl

´

ımov

´

a and

ˇ

Z

´

ıtek, 2020). In addition,

according to American experts “by 2025, cyber in-

surance volume is expected to reach 15to20 billion.

However, cyber liability insurance is a niche market,

with risks that are largely underinsured. (. . . ) The

COVID-19 pandemic took a toll on the decades-long

growth in merger and acquisition insurance. For in-

stance, in the first quarter of 2020 alone, deal value

and volume dropped by around 30%. Global premi-

ums income shrank by 3.8% in 2020 due to the pan-

demic. In addition, property and casualty premiums

went down by 2.9%. In a similar vein, life insurance

premiums were down by 4.4%. According to the Na-

tional Association of Insurance Commissioners, 83%

of all business interruption policies have virus ex-

clusions. Moreover, 98% of such policies include a

property damage requirement. However, the question

that remains is whether the virus itself can be equated

to physical damage to property. This will likely be

thrashed out in a lawsuit against the insurers and de-

cided on a case-per-case basis.” (Andre, 2022). In this

way, and because the insurance industry is a grow-

ing sector, we are thinking of the necessity of creat-

ing new products for the insurance market (in hybrid

military actions conditions it is very necessary).

5 CONCLUSIONS

Thus, partly due to the reasons and consequences of

economic emergencies today in Ukraine in one form

or another, it is possible to insure the risks associated

with inflation, unemployment, impoverishment of the

population and loss of savings, bankruptcy of enter-

prises and organizations, depreciation of the national

currency and securities.

The circumstances of insuperable force (force ma-

jeure) are hybrid military actions and the application

of economic sanctions by other countries.

And such reasons for economic emergencies as

the withdrawal of investors from the country and the

erroneous economic actions of the government have

not yet been offered by anyone as an object of insur-

ance. Therefore, they can be the direction of further

research of both scientists and practitioners in order

to find new insurance products.

REFERENCES

Andre, L. (2022). 60 Insurance Statistics You Must

Read: 2022 Market Share Analysis & Data . https:

//financesonline.com/insurance-statistics/.

avtopomich.com (2016). Yak styagnuty inflyatsi-

ini vtraty zi strahovoi. http://web.archive.org/

web/20220519053023/https://avtopomich.com/

jak-stagnutu-peny-zi-strahovoji/.

Bar

ˇ

c, M., Łabuz, P., and Michalski, M. (2020). Civil

protection in crisis situation. Naukovyy visnyk

L’otnoyi akademiyi. Seriya: Ekonomika, menedzh-

ment ta pravo, 1(1):182–192. https://doi.org/10.

33251/2707-8620-2020-2-182-192.

Bogoyavlenska, Yu. an Svirko, S. and Berezhnytskiy,

D. (2020). Ensuring flexibility in management

Force Majeure and Insurance of Risks of Economic Emergencies

87

decision-making and digitalisation of management

at innovative enterprises and startups. Market In-

frastucture, 1(49):83–K87. https://doi.org/10.32843/

infrastruct49-16.

Bruneckien

˙

e, J., Palekien

˙

e, O., Simanavi

ˇ

cien

˙

e, v., and Rap-

sikevi

ˇ

cius, J. (2018). Measuring Regional Resilience

to Economic Shocks by Index. Engineering Eco-

nomics, 4(29):405–418. https://doi.org/10.5755/j01.

ee.29.4.18731.

Bublik, M. I. (2009). Upravlinnia systemoiu strakhuvannia

zbytkiv vid nadzvychainykh sytuatsii. In Upravlin-

nia u sferakh finansiv, strakhuvannia ta kredytu: Tezy

dopovidei II Vseukrainskoi naukovo-praktychnoi kon-

ferentsii (m. Lviv, 18-21 lystopada 2009 r.), pages

48–50, Lviv. Vydavnytstvo Natsionalnoho univer-

sytetu “Lvivska politekhnika”. http://ena.lp.edu.ua/

bitstream/ntb/7754/1/18.pdf.

charts.finance.ua (2022). Arkhiv hotivkovoho kursu USD.

https://charts.finance.ua/ua/currency/cash/-/0/usd.

Chaykovskiy, Y. I., Tyrkalo, R. I., and Limanskyi, A.

(2001). Insurance of the credit risk of commer-

cial banks. Visnyk Ternopilskoi akademii narodnoho

hospodarstva, (15):51–53. http://dspace.wunu.edu.

ua/jspui/handle/316497/13193.

Code of Civil Protection of Ukraine (2013). Code of Civil

Protection of Ukraine. https://zakon.rada.gov.ua/laws/

show/5403-17?lang=en#Text.

COVID-19 (2020). On Amendments to Certain Legislative

Acts of Ukraine Aimed at Preventing the Emergence

and Spread of Coronavirus Disease (COVID-19).

https://zakon.rada.gov.ua/laws/show/530-20#n38.

Credo (2022). Additional Liability Company “Insurance

Company ”Credo””. http://skcredo.com.ua/.

Dorussen, H., D., M., and Tago, A. (2018). Civil protection:

Enhancing resilience through collaboration. In Kirch-

ner, E. and Dorussen, H., editors, EU–Japan Security

Cooperation, pages 127–144. Routledge, London, 1st

edition. https://doi.org/10.4324/9780429456114-8.

Hargrave, M. (2022). What Is a Force Majeure Con-

tract Clause, and How Does It Work? https://www.

investopedia.com/terms/f/forcemajeure.asp.

Hospodarskyi kodeks Ukrainy (2003). Hospodarskyi

kodeks Ukrainy. https://protocol.ua/ru/gospodarskiy

kodeks ukraini/.

Hroshi (2022). Chy mozhut strakhovyky posylatys na fors-

mazhor i vidmovliaty u vyplatakh? https://cutt.ly/

m0VO4QF.

INGO (2022). Strakhuvannia kiber ryzykiv. https://ingo.ua/

straxovanie-kiber-riskov.

Kalynenko, L., Sliusar, A., Fomin, A., and Borysova, A.

(2020). Capability of civil protection. Scientific bul-

letin: Civil protection and fire safety, (1(9)):4–13.

https://doi.org/10.33269/nvcz.2020.1.4-13.

Katranzhy, L. L. and Maryna, A. S. (2020). Strakhuvan-

nia yak sposib harantuvannia bezpeky bankivskoho

kredytuvannia. Ekonomika, upravlinnia ta ad-

ministruvannia, (1(91)):116–122. https://doi.org/10.

26642/ema-2020-1(91)-116-122.

Kl

´

ımov

´

a, V. and

ˇ

Z

´

ıtek, V. (2020). Enhancement of in-

novation collaboration via innovation vouchers. In

G

´

al, Z., Kov

´

acs, S. Z., and P

´

ager, B., editors, Flows

of Resources in the Regional Economy in the Age

of Digitalisation, Proceedings of the 7th CERS Con-

ference, pages 618–629, Hungary, Sopron. Hungar-

ian Regional Science Association. http://real.mtak.hu/

116284/7/cers-kotet-2020.pdf.

Kurylo, Y. (2019). Teoriia fors-mazhoriv: yak dovesty ob-

stavyny neperebornoi syly u riznykh krainakh: Yakym

chynom tse pytannia rehuliuie anhliiske, frantsuzke ta

ukrainske pravo. https://cutt.ly/r0VAghM.

Lane, P. R. (2021). Inflation dynamics during pan-

demic. https://www.ecb.europa.eu/press/blog/date/

2021/html/ecb.blog210401

∼

6407b23d87.en.html.

National Bank of Ukraine (2022). Ohliad strakhovoho

rynku Ukrainy za I pivrichchia 2022 roku: Nahliadovi

dii bezvyiznoho nahliadu u liutomu - veresni 2022

roku ta priorytetni napriamy nahliadu pid chas dii voi-

ennoho stanu v Ukraini. https://forinsurer.com/files/

file00728.pdf.

On Chambers of Commerce and Industry in Ukraine

(1998). On Chambers of Commerce and Industry

in Ukraine. https://zakon.rada.gov.ua/laws/show/671/

97-%D0%B2%D1%80?lang=en#Text.

On the Legal Status of the State of Emergency (2000).

On the Legal Status of the State of Emer-

gency. https://zakon.rada.gov.ua/laws/show/1550-14?

lang=en#Text.

Pettinger, T. (2021). Causes of Inflation. https:

//www.economicshelp.org/macroeconomics/inflation/

causes-inflation/.

Protsenko, A. (2016). Force-majeuerni obstavyny v komer-

cijnyh dogovorah. Yurydychna hazeta. https://tinyurl.

com/mvkwsn5j.

Pursky, O. I., Dubovyk, T. V., Buchatska, I. O., Lut-

senko, I. S., and Danylchuk, H. B. (2021). Com-

putational method determining integral risk indica-

tors of regional socio-economic development. In Kiv,

A. E., Soloviev, V. N., and Semerikov, S. O., ed-

itors, Proceedings of the Selected and Revised Pa-

pers of 9th International Conference on Monitor-

ing, Modeling & Management of Emergent Economy

(M3E2-MLPEED 2021), Odessa, Ukraine, May 26-

28, 2021, volume 3048 of CEUR Workshop Proceed-

ings, pages 225–234. CEUR-WS.org. http://ceur-ws.

org/Vol-3048/paper20.pdf.

PZU S.A. (2022). Strakhova kompaniia PZU Ukraina.

https://www.pzu.com.ua.

Romanenko, Y. (2007). Rynok strahuvannya: tendencii ta

problemy. Personal, (1). http://www.personal.in.ua/

article.php?ida=426.

Semerikov, S., Chukharev, S., Sakhno, S., Striuk, A.,

Osadchyi, V., Solovieva, V., Vakaliuk, T., Nechy-

purenko, P., Bondarenko, O., and Danylchuk, H.

(2020). Our sustainable coronavirus future. E3S Web

Conf., 166:00001. https://doi.org/10.1051/e3sconf/

202016600001.

Shchedryi, P. (2005). Praktyka strakhuvannia kredytiv,

nadanykh indyvidualnym kliientam, v bankivskii sys-

temi ukrainy. Strakhova sparava. https://forinsurer.

com/public/05/01/01/1761.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

88

Sosnin, D. (2014). Fors-mazhorni obstavyny v komertsi-

inykh dohovorakh: shcho varto peredbachyty? https:

//news.dtkt.ua/law/contractual-relationship/31389.

Supreme Economic Court of Ukraine (2001). Remarks to

the Commercial Code of Ukraine. https://tinyurl.com/

2p8a9ypz.

Trush, O. O. and Gorovyi, D. A. (2018). Economic com-

ponent in the causes and consequences of emergen-

cies. European Journal of Management Issues, 26(3-

4):126–135. https://doi.org/10.15421/191813.

Trush, O. O., Gorovyi, D. A., and Goncharenko, O. M.

(2019). Research of factors, which may leed

to economic emergency appearance. Financial

and credit activity problems of theory and prac-

tice, 3(30):283–292. https://doi.org/10.18371/fcaptp.

v3i30.179637.

Tsyvilnyi kodeks Ukrainy (2003). Tsyvilnyi kodeks

Ukrainy. https://protocol.ua/ua/tsivilniy kodeks

ukraini/.

UN (1980). Konventsiia Orhanizatsii Obiednanykh Natsii

pro dohovory mizhnarodnoi kupivli-prodazhu tovariv

vid 11 kvitnia 1980 roku. https://zakon.rada.gov.ua/

laws/show/995 003?lang=en#Text.

Verbyanyi, V. (2012). Pervye korporatsii. Forbes.ua,

(10). http://www.ukrrudprom.com/digest/Pervie

korporatsii.html.

Force Majeure and Insurance of Risks of Economic Emergencies

89