Analysis and Modeling of Globalization Processes in the Period of Crisis:

The Impact of Military Actions in Ukraine on World Financial Markets

Hanna B. Danylchuk

1 a

, Liubov O. Kibalnyk

1 b

, Oksana A. Kovtun

2 c

, Oleg I. Pursky

3 d

,

Yevhenii M. Kyryliuk

1 e

and Olena O. Kravchenko

1 f

1

The Bohdan Khmelnytsky National University of Cherkasy, 81 Shevchenko Blvd., Cherkasy, 18031, Ukraine

2

University of Educational Management, 52A Sichovykh Striltsiv Str., Kyiv, 04053, Ukraine

3

Kyiv National University of Trade and Economics, 9 Kyoto Str., 02156, Kyiv, Ukraine

Keywords:

Globalization Processes, World Financial Markets, Oil, Gas, Currency Market, Crisis, Wavelet Entropy, a

War in Ukraine.

Abstract:

This research is applied. The article attempts to model and analyze the impact of the war in Ukraine on the

world’s globalization processes. This topic is relevant, but still little researched. Using the wavelet entropy

method, models were built for the markets of natural gas, oil, gasoline, currency pairs EUR/USD, GBP/USD.

Wavelet entropy is an indicator-precursor of crisis phenomena. The obtained results allow us to conclude that

the war in Ukraine is a factor of crises in the studied markets and a factor that led to the reformatting of the

world economic space.

1 INTRODUCTION

At the turn of the 20th-21th century, the problems and

theoretical and methodological approaches of fore-

casting, analysis, and modeling of globalization pro-

cesses under the influence of crisis phenomena of

various etymologies are the objects of scientific re-

search by scientists. The genesis of globalization the-

ories from the Keynesian to the neoliberal model in

the 20th century, which led to the construction and

development of the post-industrial economy, testifies

to its crisis in the modern world, as humanity faced

such problems and manifestations of social life as po-

litical, social, economic instability (wars, the coron-

avirus crisis, the realization of the rights of nations

to self-determination, the fight against hunger, the so-

cial stratification of the population by income level)

and the challenges of human interaction with nature –

ecological, energy, raw material, food, demographic

crises.

All these challenges led to the conclusion that in

a

https://orcid.org/0000-0002-9909-2165

b

https://orcid.org/0000-0001-7659-5627

c

https://orcid.org/0000-0002-0159-730X

d

https://orcid.org/0000-0002-1230-0305

e

https://orcid.org/0000-0001-7097-444X

f

https://orcid.org/0000-0002-8776-4462

the 21st century economic growth trends will remain,

but they will acquire a new direction due to the fact

that services and their role in the world economy will

change qualitatively, and their rapid digitalization will

take place, and the vector of scientific and technolog-

ical progress will change.

To date, globalization processes are associated

with such trends as the division of world markets

into core and periphery, which leads to the emer-

gence of conflicting interests between hegemon coun-

tries and “peripheral” countries; integration of na-

tional economies and peoples into a single system

with the emergence of powerful regional associations;

polarization of incomes in connection with the objec-

tive tendency to increase production volumes, growth

of labor productivity; efficient and quick movement of

capital and speculative activities of the financial elite;

the emergence of contradictions between the virtual

and real sectors of the economy; the need to unite in

order to oppose international terrorism, world crises,

etc.

Thus, according to the famous French economist,

Nobel Prize laureate Maurice Alle, “the comprehen-

sive globalization of trade between countries with sig-

nificantly different wage levels (according to the ex-

change rate of currencies) cannot but ultimately lead

everywhere – both in developed and less developed

176

Danylchuk, H., Kibalnyk, L., Kovtun, O., Pursky, O., Kyryliuk, Y. and Kravchenko, O.

Analysis and Modeling of Globalization Processes in the Period of Crisis: The Impact of Military Actions in Ukraine on World Financial Markets.

DOI: 10.5220/0011932400003432

In Proceedings of 10th International Conference on Monitoring, Modeling Management of Emergent Economy (M3E2 2022), pages 176-184

ISBN: 978-989-758-640-8; ISSN: 2975-9234

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

countries – only to unemployment, falling rates of

economic growth, inequality, poverty. It is neither in-

evitable, nor necessary, nor desirable” (Vedernikova,

2017).

We can partially agree with this statement, since

globalization processes, in addition to positive effects

on the development of the world economy, in particu-

lar monetary and financial systems, also have negative

ones, namely: a decrease in the degree of sovereignty

and economic, political, energy independence of in-

dividual countries; the rapid spread of financial crises

from one region to another, the significant impact of

political, food, and energy crises on the economy of

dependent countries (for example, since the begin-

ning of the war in Ukraine and with the blockade of

its seaports, the possibility of a food crisis in grain-

importing countries has arisen), an increase forced

migration, rising unemployment.

Today, the highest level of globalization is ob-

served in the financial and investment sphere, when

financial flows in the world economy are redistributed

through financial markets, which are mostly not re-

lated to real markets for goods and services – all this

periodically leads to the emergence of financial crises

that practically destroy individual financial systems

and markets, lead to socio-economic, demographic,

financial instability. For example, the current re-

gional financial crises in the USA, China and other

major players, the global coronavirus crisis, the con-

sequences of which are felt in all spheres of society to

this day.

The financial crisis at the beginning of the 21st

century was partially offset by the financial invest-

ments of various regions of the world in the US econ-

omy and the wars in Afghanistan and Iraq launched

by NATO countries in response to the terrorist acts

of September 11, 2001. These wars led to the active

development of the military industry of the United

States and, through inter-industry connections, had a

positive effect on their economy.

Because of the war in Ukraine and in connection

with the provision of military aid to it, the military-

industrial complex of the United States and certain

European countries are currently increasing their pro-

duction volumes, therefore they need additional fi-

nancial investments, which cannot but affect the state

of global and regional financial markets. Therefore,

the relevance of the proposed research topic is be-

yond doubt, and scientists and state managers need to

have a toolkit that will allow them to follow the trends

of the further development of the globalized financial

system, and in particular, financial markets.

Therefore, the issues of analysis and modeling of

globalization processes in crisis periods, which affect

the state and development of financial markets, are be-

coming particularly relevant. Considerable attention

is paid to the outlined scientific problem in the publi-

cations of both foreign and domestic scientists. Thus,

the relationship between the bankruptcy rate of bank-

ing institutions and the deepest financial crisis in the

emerging market of Turkey was investigated with six-

teen different performance indicators using two alter-

native methods of stochastic analysis – frontier analy-

sis (SFA) and data coverage analysis (DEA) (Isik and

Uygur, 2021). The authors prove that efficiency indi-

cators, as a rule, gradually deteriorate before a crisis,

reach a “bottom” during a crisis and recover after a

crisis.

Statistical analysis of financial relationships dur-

ing the European sovereign debt crisis is used to

model the movement of yields on the bond market

(Campos-Martins and Amado, 2022). The resulting

model allowed the authors to draw conclusions about

the long-run and short-run contagion effects. Namely,

it has been proven that in peripheral countries after

the most acute phase of the sovereign crisis, there is a

long-run contagion effect.

Many studies are devoted to the modeling of yield,

volatility, the profitability of various financial instru-

ments and the degree of their risk in financial mar-

kets using a wide range of methods. Thus, in the

article (Labidi et al., 2018), the authors investigate

the cross-quantile relationship between stock returns

in developed and emerging markets with the study

of time-varying characteristics using recursive sample

estimates. The obtained results, based on the cross-

quantile approach, show a heterogeneous quantile re-

lationship of US, UK, German and Japanese stock re-

turns to the returns of emerging market stocks. Sys-

tematic risk, according to the authors, as a rule, does

not explain the dependence structure of regional and

local markets, as it remains practically unchanged in

the conditions of financial, geopolitical and economic

uncertainties. Moreover, the cross-quantile correla-

tion varies over time, especially in the low and high

quantiles, indicating its tendency to jumps and breaks

even in a stable dependence structure.

The multiplicative error model (MEM) is pro-

posed for modeling the dynamics of illiquidity in fi-

nancial markets (Xu et al., 2018). The authors em-

pirically investigated the side effects of illiquidity and

volatility in eight developed stock markets during and

after the global financial crisis. It was found that

the stock markets are interdependent both in terms of

volatility and illiquidity, and in most of them, there

is an increase in their side effects during the crisis.

The authors conclude that illiquidity is a more impor-

tant channel of shocks in stock markets compared to

Analysis and Modeling of Globalization Processes in the Period of Crisis: The Impact of Military Actions in Ukraine on World Financial

Markets

177

volatility, and that the impact of illiquidity in US mar-

kets on other stock markets is significant.

GARCH models (ARMA-GARCH, ARMA-

EGARCH and ARMA-FIGARCH) were used to

study the impact of COVID-19 on the precious

metals market (Bentes, 2022). The results of the

study showed the presence of long memory in this

market in the periods before and during the crisis.

Conclusions were made regarding the significant

impact of COVID-19 on the volatility of the precious

metals market.

The high-dimensional conditional Value-at-Risk

(CoVaR), which is based on the LASSO-VAR model,

is used to study the systemic risks of financial conta-

gion in crisis situations using the example of oil mar-

kets and G20 stock markets (Liu et al., 2022). The au-

thors proved that in the event of a crisis in the oil mar-

kets, the stock markets of those countries that are con-

nected with oil production will experience the greatest

shocks.

Changes in the environment and depletion of nat-

ural resources have led to investment in renewable

energy sources, and therefore to the need to analyze

herd (collective) behavior in this market (Chang et al.,

2020). In the article, the authors presented the results

of testing the collective behavior of the renewable en-

ergy market using an empirical model during the pe-

riods of the global financial crisis and the coronavirus

crisis. The authors proved the herd behavior of mar-

ket participants during periods of crises in the oil mar-

kets. As a result, there is an invigoration of collective

behavior in the stock markets as well. Attention is

also paid to the study of contagion and the emergence

of risks from fossil fuel energy markets to renewable

energy stock markets.

One of the modern trends in monitoring, model-

ing and forecasting financial markets in crisis periods

is the use of tools of nonlinear dynamics – fractal,

recurrent, entropy, wavelet analyses, quantum model-

ing, etc. Thus, fractal and entropy analysis methods

were used when modeling the cryptocurrency mar-

ket in the conditions of the corona crisis (Danylchuk

et al., 2020). The use of these methods made it pos-

sible to draw conclusions about cryptocurrency mar-

ket trends and identify crisis situations. The wavelet

entropy method, which was also used in the study,

made it possible to conduct predictive analysis of the

cryptocurrency market. The authors emphasized the

universality of the methods for identifying crisis phe-

nomena regardless of the nature of the crisis.

The article (Bielinskyi et al., 2021) is devoted to

the identification of special conditions in the cryp-

tocurrency market. The authors classified and adapted

quantitative indicators to this market, analyzed their

behavior in the conditions of critical events and well-

known cryptocurrency market crashes.

Danylchuk et al. (Danylchuk et al., 2019) use en-

tropy methods to determine the investment attractive-

ness of countries. For this purpose, regional stock

markets are studied, as they are a reflection of the

economies of countries.

Quantum modeling, namely the heterogeneous

economic model, has been applied to stock markets

(Kuzu et al., 2022). With the help of “measurement

of the temperature of the series” crisis periods in the

markets were detected. This model made it possible

to adequately compare the features of the flow and

consequences of various crises.

Modeling the impact of geopolitical risks on the

state and dynamics of financial markets under condi-

tions of crises of various natures is a little-researched

field. This issue becomes especially relevant in the

context of the creation of political and economic al-

liances and recent political crises. The article (Choi,

2022) presents the results of using the method of mul-

tiple and partial wavelet-coherent analysis regarding

the influence of geopolitical problems on stock mar-

kets in the countries of Northeast Asia. Abdel-Latif

and El-Gamal (Abdel-Latif and El-Gamal, 2020) in-

vestigate the global dynamic interrelationship be-

tween the prices of petroleum products, oil, financial

liquidity, geopolitical risk and economic indicators of

the economies of countries dependent on oil exports.

For this purpose, the authors use the global vector au-

toregression (GVAR) model.

In the conditions of a full-fledged war in Ukraine,

a special vector of scientific research is aimed at iden-

tifying the impact of the political and socio-economic

crisis on the state and dynamics of world financial

markets, which is reflected in a number of publica-

tions. Boungou and Yati

´

e (Boungou and Yati

´

e, 2022)

provide empirical evidence of the negative impact of

the war in Ukraine on the profitability of the global

stock market. The largest decrease in the indicator

was demonstrated by the markets of those countries

geographically bordering Ukraine and Russia, as well

as countries that condemned the war.

The impact of the war in Ukraine on financial mar-

kets is studied in the article (Lo et al., 2022) from the

point of view of the dependence of the studied coun-

tries on Russian goods. The authors note that the war

has increased instability in markets for all countries,

but its degree is directly proportional to a country’s

dependence on Russian goods.

Boubaker et al. (Boubaker et al., 2022) came

to the conclusion that more globalized markets were

more affected by the war in Ukraine. However, the

US market showed growing trends, Asian markets did

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

178

not react to this crisis.

So, modern crises of political, social, military and

pandemic nature have led to a certain change in glob-

alization trends in financial markets, which requires

more detailed research and analysis from scientists.

Classical methods of analysis and modeling do not

always allow adequate assessment and forecasting of

these processes, and therefore, there is a need to use

a complex, interdisciplinary approach to solving this

scientific task.

2 RESEARCH METHODS

In this study, the wavelet entropy method is used to

model and analyze the impact of the war in Ukraine

on globalization processes using the example of the

gas, oil, petroleum products, and currency markets.

The method of wavelet transformations is proposed

for the analysis of periods in time series with the

aim of detecting the evolution of parameters (Foster,

1996). Wavelet analysis based on wavelet entropy al-

lows obtaining information about dynamic complex-

ity (Sello, 2003).

We can describe wavelet entropy based on the

work of Zunino et al. (Zunino et al., 2007). When

studying the time series, which consists of sample val-

ues x

i

, i = 1, ..., M, when using a set of scales 1, ..., N,

we will get a wavelet transformation (expansion)

X(t) =

N

∑

j=1

∑

k

C

j

ψ

j,k

(t) =

N

∑

j=1

r

j

(t), (1)

r

j

(t) contains information about the series X in scale

2

j−1

and 2

j

.

Application of the theory of Fourier expansions

allows us to determine the energy on each scale using

E

j

= ||r

j

||

2

=

∑

k

|C

j

(k)|

2

. (2)

The total energy of the series can be calculated by

E

tot

= ||X||

2

=

N

∑

j=1

∑

k

|C

j

(k)|

2

=

N

∑

j=1

E

j

. (3)

The next step is to determine the relative wavelet

energy

p

j

=

E

j

E

tot

, (4)

which provides hidden characteristics of the series in

time and frequency spaces.

Using the concept of Shannon entropy, we can de-

termine the normalized total wavelet entropy

E

W T

=

−

∑

N

j=1

p

j

ln p

j

X

max

. (5)

The improvement of the wavelet entropy calcu-

lation algorithm was the use of a window procedure

(Quiroga et al., 1999). The following formula is used

to calculate the wavelet energy for a time window

E

(i)

j

=

i·Ł

∑

k=(i−1)L+1

|C

j

(k)|

2

, i = 1, ..., N

T

. (6)

The total energy in the window is calculated by

E

(i)

tot

=

−1

∑

j=−N

E

(i)

j

. (7)

The change in time of relative wavelet energy and

normalized total wavelet entropy is obtained by

p

(i)

j

=

E

(i)

j

E

(i)

tot

, E

(i)

W T

−1

∑

j=−N

p

(i)

j

·

ln p

(i)

j

X

max

. (8)

3 RESULTS AND DISCUSSIONS

Oil is considered to be the benchmark of world eco-

nomic activity. The price of crude oil reflects such

market properties as stability/volatility and liquidity.

The article examines the oil, gas and gasoline

market. The most popular grades of oil are Brent

and West Texas Intermediate (WTI). For this purpose,

daily values of Brent and WTI brand oil indices, natu-

ral gas and gasoline for the period from January 2015

to September 2022 were used. All calculations were

performed in Matlab. Calculation parameters: win-

dow width 100 points, step – 10 points. Calculations

were made according to the official website Yahoo Fi-

nance (Yahoo Finance, 2022).

In figures 1, 2 shows the dynamics of indices. Ar-

rows indicate the periods of 2020 (the beginning of

the coronavirus pandemic) and 2022 (the beginning

of the war in Ukraine).

From figures 1, 2 we can note 2020 a drop in oil

and gasoline indices. And in 2022, all indices expe-

rienced a rapid decline. The situation regarding 2020

is quite obvious and understandable. The announce-

ment of the pandemic halted and slowed down eco-

nomic activity. Demand for oil and gasoline fell.

The fall in 2022 is due to various factors, but in our

opinion, the war in Ukraine should be considered the

main one. Although the events unfold on the territory

of Ukraine, the consequences are felt by almost all

countries. European Union countries, Great Britain,

the USA, Turkey, etc. support Ukraine not only with

military aid, but also with the introduction of political

and economic sanctions. Russia was a strong player

in the oil and gas markets. The introduction of sanc-

tions, the refusal of Russian gas forces the market and

Analysis and Modeling of Globalization Processes in the Period of Crisis: The Impact of Military Actions in Ukraine on World Financial

Markets

179

Figure 1: Comparative dynamics of oil (Brent and WTI)

and gas indices.

Figure 2: Dynamics of the gasoline index.

all market participants to quickly reorient themselves

and reformat connections (e.g. increasing oil produc-

tion in Norway, expected deliveries from Nigeria and

Venezuela).

The use of wavelet entropy is due to the illustrative

nature of this indicator and its predictive properties.

The formation of three increasing entropy wavelet

waves is a proven indicator-precursor of crisis phe-

nomena of various natures (Soloviev et al., 2010). As

soon as the third wave exceeded the maximum of the

second wave, it can be argued that the market is wait-

ing for a crisis ahead. The maximum of the third wave

is a crisis itself. Therefore, the use of such an indica-

tor allows for predicting a crisis and having time to

take measures that can mitigate the consequences of

the crisis. In addition, the wavelet transform provides

a time-frequency representation of the signal, which

allows you to obtain additional information that is not

reflected in the time representation of the signal.

In figures 3–10 shows the results of wavelet en-

tropy calculation for the gas, oil, and gasoline mar-

kets.

Analysis of the energy surface of the wavelet coef-

ficients (figure 3) allows us to draw conclusions about

the crisis situation in the gas market. On a small scale,

there is a manifestation of disturbance. In wavelet

analysis, small scales correspond to high frequencies.

Figure 3: Wavelet coefficient energy for gas index.

Figure 4 shows the dynamics of wavelet entropy.

We observe the formation of three waves in a neigh-

borhood of 1750-2000 points, which is an indicator of

the crisis. This crisis is the market’s reaction to Rus-

sia’s refusal to supply natural gas to Europe and the

introduction of sanctions.

Figure 4: Wavelet entropy and dynamics of the gas index.

In figures 5, 6 shows the results of calculations for

Brent oil, and figures 7, 8 – for WTI oil.

The energy of the wavelet coefficients shows a dif-

ferent situation for these two oil brands. This can be

explained by the fact that Brent oil is traded on the

markets of Europe and Asia, while WTI oil is traded

on the US markets. But for the current time, the sit-

uation for these two brands of oil is similar. We see

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

180

Figure 5: Wavelet coefficient energy for oil Brent index.

Figure 6: Wavelet entropy and dynamics of the oil Brent

index.

Figure 7: Wavelet coefficient energy for oil WTI index.

the formation of stable three waves, which indicates

a crisis. What is happening in the oil market? It can

be seen that the price of Brent and WTI oil bench-

marks continue to fall. In our opinion, this is related

to the war in Ukraine and the risk of recession. The

Figure 8: Wavelet entropy and dynamics of the oil WTI

index.

European Union in the eighth package of anti-Russian

sanctions “included a ceiling” on oil prices. In addi-

tion, the EU plans to ban sea imports of crude and

refined oil from Russia. In response to the EU sanc-

tions, Russia decided to reduce oil production by 3

million barrels per day, arguing that this is a lever to

increase oil prices on the market. For Russia, the im-

position of sanctions is a blow, as this is a budget-

forming article (about 40% of budget revenues are in

the form of taxes on hydrocarbon exports, and direct

and indirect revenues related to this export make up to

60%). That is, the consequence of the introduction of

sanctions will be a reduction in revenues from oil and

gas. That is, it is precisely in this sector that Russia’s

“Achilles’ heel” is, but the refusal of Saudi Arabia and

other large Middle Eastern players to replace the Rus-

sian share of the oil market leads to fluctuations in its

price, which in some way neutralizes the measures of

the EU and the US countries regarding the oil em-

bargo against Russia. They are trying to regulate the

oil market. Thus, OPEC+’s decision is to reduce oil

production by 2 million barrels per day, which should

lead to an increase in oil prices. However, such a de-

cision by OPEC+ has a reverse side. In particular, the

United States began selling oil from reserves.

So, according to the results of the calculations, it

can be stated that the oil and gas market is in a state

of crisis, which was formed as a result of the war in

Ukraine and the efforts of the main players to carry

out its transformation, blocking Russia and reducing

its influence on the world market. One such move

by the global anti-Putin coalition (producing coun-

tries account for 60% of global GDP) is the declared

creation of a buyers’ cartel that has set a “price ceil-

ing” for Russian oil and oil products. Even if India

and China do not join the “price ceiling”, the path

of Russian oil to the world market will be difficult

in December 2022, as the EU, Switzerland and Great

Analysis and Modeling of Globalization Processes in the Period of Crisis: The Impact of Military Actions in Ukraine on World Financial

Markets

181

Britain will not only ban their factories and traders

from buying it, but will also introduce sanctions on

insurance, financing and ship freight, which will lead

to the need for Russia not only to look for new sales

markets, but also to build alternative supply chains to

the world market from scratch.

In figures 9, 10 shows calculations for the gasoline

market. Gasoline is a derivative of oil. Therefore, the

behavior of the gasoline market should be similar to

the behavior of the oil market. If oil becomes cheaper,

then the price of gasoline should also fall.

Figure 9: Wavelet coefficient energy for gasoline index.

Figure 10: Wavelet entropy and dynamics of the gasoline

index.

Comparing figure 9 from figure 5 and figure 7, we

see that the energy surface for the gasoline market dif-

fers from the energy surfaces for oil. As you can see,

the gasoline market is not stable. But starting from

around the point of 1800, which corresponds to the

year 2022 (figure 10), we observe the appearance of a

triad of growing waves. And from this period, the be-

havior of the gasoline market becomes similar to the

oil and gas market. And we state the crisis state of

the market. What is the impact of the war in Ukraine?

The world market of oil, oil products, and gas is being

reformatted, and connections are changing. Ukrainian

markets are also undergoing transformation, reorient-

ing themselves towards the EU. It is obvious that the

change of players in the market (both strong and not

so) leads to instability, problematic issues of redistri-

bution of resources.

The foreign exchange market is an important com-

ponent of the financial market. Modeling and analy-

sis of the currency market will allow an understanding

of the economic and organizational relations between

the participants.

In figure 11 shows the comparative dynamics of

currency pairs EUR/USD and GBP/USD. These cur-

rency pairs are the most traded, which influenced the

selection for the study.

Figure 11: Comparative dynamics of indices of currency

pairs EUR/USD and GBP/USD.

Figure 11 shows the sharp decline of currency pair

indices in 2020. As for 2022, there is a drop in in-

dices, but it is not of a rapid nature.

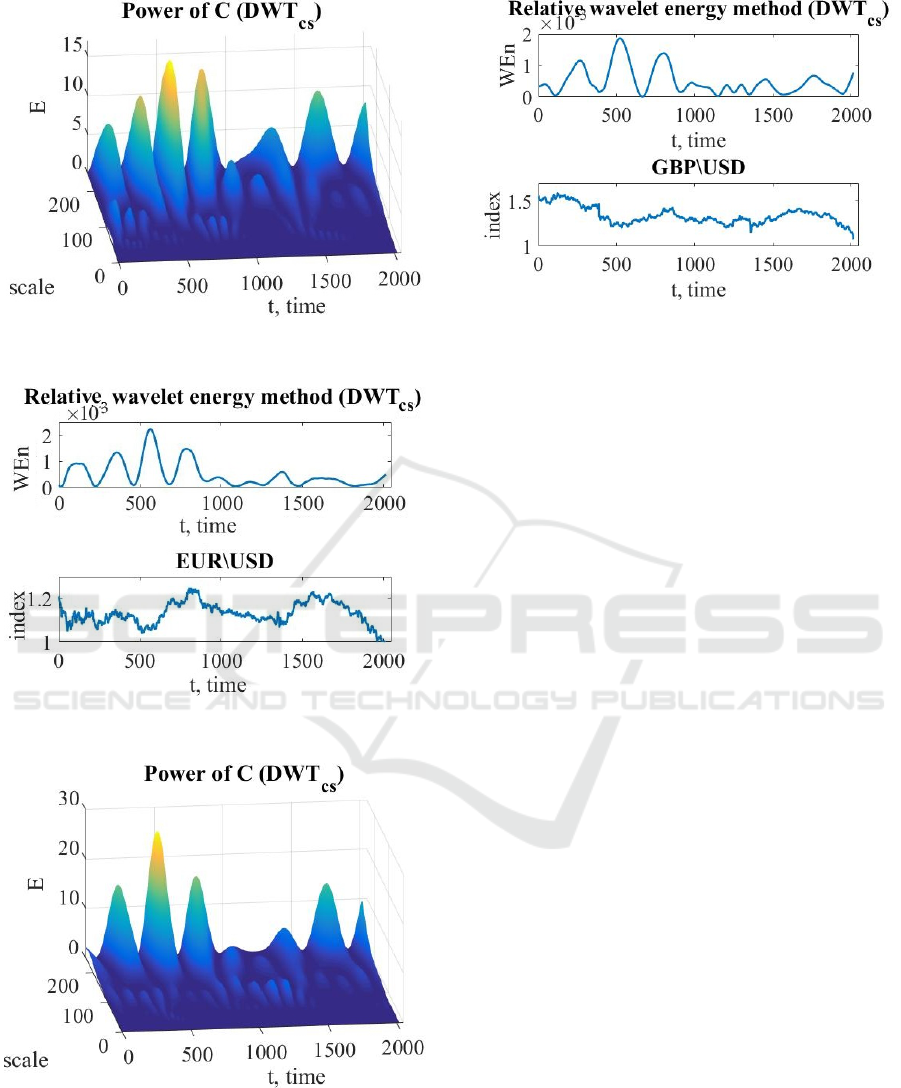

Applying the wavelet entropy method to the cur-

rency market allows you to get an answer to the ques-

tion of the existence of a crisis in it. For both cur-

rency pairs, the formation of three waves, which is an

indicator-precursor of the crisis phenomenon, was ob-

served during 2015-2017 (within points 50-520, see

figures 13, 15). The same situation is observed for the

currency pair GBP/USD during the pandemic period

(figure 15). The current situation for both currency

pairs is marked by a gradual drop in the index val-

ues. The reasons for the subsidence may be the war

in Ukraine, sanctions against Russia, the dependence

of European states on Russian gas supplies, the politi-

cal crisis in the EU regarding the support of sanctions

and aid to Ukraine. The euro is the base currency, but

it is also a tool for speculation.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

182

Figure 12: Wavelet coefficient energy for the currency pair

EUR/USD.

Figure 13: Wavelet entropy and dynamics of the currency

pair EUR/USD.

Figure 14: Wavelet coefficient energy for the currency pair

GBP/USD.

Therefore, the simulation results indicate the ab-

sence of a crisis state at the time of the study. This

market needs further monitoring, as the next wave is

still in the process of formation.

Figure 15: Wavelet entropy and dynamics of the currency

pair GBP/USD.

4 CONCLUSION

So, based on the results of modeling and analysis of

oil, gas, oil products and foreign exchange markets

using the wavelet entropy method, we can conclude

that the war in Ukraine can be considered an influ-

ential factor in the crisis phenomena that are already

present or are forming in these markets. Wavelet en-

tropy models demonstrated the existence of a crisis

in the oil, gas and gasoline market. In the currency

market, the main currency pairs show a gradual, but

rather long-term, decline. The currency market has

its own characteristics and requires constant monitor-

ing. Using the wavelet entropy method to model this

market will allow early identification of a crisis state.

The obtained results do not contradict the conclusions

that the oil market has a heterogeneous effect on all fi-

nancial assets, the peak of its influence falls precisely

during the war in Ukraine (Adekoya et al., 2022), and

globalized markets are more affected by the war in

Ukraine (Boubaker et al., 2022) and others. Global-

ization processes in the world economic space carry

with them, in addition to advantages, certain threats.

Today, these threats exist in the market of oil, gas and

other energy carriers. The war in Ukraine, unleashed

by Russia for its own self-assertion, a huge desire for

world domination and an overwhelming fear of los-

ing what it has, forced the international community

to review the structure, connections and processes of

globalization in world economic activity.

REFERENCES

Abdel-Latif, H. and El-Gamal, M. (2020). Financial liq-

uidity, geopolitics, and oil prices. Energy Economics,

87:104482.

Analysis and Modeling of Globalization Processes in the Period of Crisis: The Impact of Military Actions in Ukraine on World Financial

Markets

183

Adekoya, O. B., Oliyide, J. A., Yaya, O. S., and Al-Faryan,

M. A. S. (2022). Does oil connect differently with

prominent assets during war? analysis of intra-day

data during the russia-ukraine saga. Resources Policy,

77:102728.

Bentes, S. R. (2022). On the stylized facts of precious met-

als’ volatility: A comparative analysis of pre-and dur-

ing covid-19 crisis. Physica A: Statistical Mechanics

and its Applications, 600:127528.

Bielinskyi, A. O., Serdyuk, O. A., Semerikov, S. O., and

Soloviev, V. N. (2021). Econophysics of cryptocur-

rency crashes: a systematic review. In Kiv, A. E.,

Soloviev, V. N., and Semerikov, S. O., editors, Pro-

ceedings of the Selected and Revised Papers of 9th

International Conference on Monitoring, Modeling &

Management of Emergent Economy (M3E2-MLPEED

2021), Odessa, Ukraine, May 26-28, 2021, volume

3048 of CEUR Workshop Proceedings, pages 31–133.

CEUR-WS.org.

Boubaker, S., Goodell, J. W., Pandey, D. K., and Kumari, V.

(2022). Heterogeneous impacts of wars on global eq-

uity markets: Evidence from the invasion of ukraine.

Finance Research Letters, 48:102934.

Boungou, W. and Yati

´

e, A. (2022). The impact of the

ukraine–russia war on world stock market returns.

Economics Letters, 215:110516.

Campos-Martins, S. and Amado, C. (2022). Financial mar-

ket linkages and the sovereign debt crisis. Journal of

International Money and Finance, 123:102596.

Chang, C.-L., McAleer, M., and Wang, Y.-A. (2020).

Herding behaviour in energy stock markets during

the global financial crisis, sars, and ongoing covid-

19. Renewable and Sustainable Energy Reviews,

134:110349.

Choi, S.-Y. (2022). Evidence from a multiple and partial

wavelet analysis on the impact of geopolitical con-

cerns on stock markets in north-east asian countries.

Finance Research Letters, 46:102465.

Danylchuk, H., Chebanova, N., Reznik, N., and Vitkovskyi,

Y. (2019). Modeling of investment attractiveness

of countries using entropy analysis of regional stock

markets. Global J. Environ. Sci. Manage, 5:227–235.

Danylchuk, H., Kibalnyk, L., Kovtun, O., Kiv, A., Pursky,

O., and Berezhna, G. (2020). Modelling of cryp-

tocurrency market using fractal and entropy analy-

sis in COVID-19. In Kiv, A., editor, Proceedings

of the Selected Papers of the Special Edition of In-

ternational Conference on Monitoring, Modeling &

Management of Emergent Economy (M3E2-MLPEED

2020), Odessa, Ukraine, July 13-18, 2020, volume

2713 of CEUR Workshop Proceedings, pages 352–

371. CEUR-WS.org.

Foster, G. (1996). Wavelets for period analysis of un-

evenly sampled time series. The Astronomical Jour-

nal, 112:1709–1729.

Isik, I. and Uygur, O. (2021). Financial crises, bank effi-

ciency and survival: Theory, literature and emerging

market evidence. International Review of Economics

& Finance, 76:952–987.

Kuzu, E., S

¨

usay, A., and Tanrı

¨

oven, C. (2022). A model

study for calculation of the temperatures of major

stock markets in the world with the quantum simu-

lation and determination of the crisis periods. Phys-

ica A: Statistical Mechanics and its Applications,

585:126417.

Labidi, C., Rahman, M. L., Hedstr

¨

om, A., Uddin, G. S., and

Bekiros, S. (2018). Quantile dependence between de-

veloped and emerging stock markets aftermath of the

global financial crisis. International review of finan-

cial analysis, 59:179–211.

Liu, B.-Y., Fan, Y., Ji, Q., and Hussain, N. (2022). High-

dimensional covar network connectedness for measur-

ing conditional financial contagion and risk spillovers

from oil markets to the g20 stock system. Energy Eco-

nomics, 105:105749.

Lo, G.-D., Marcelin, I., Bass

`

ene, T., and S

`

ene, B. (2022).

The russo-ukrainian war and financial markets: The

role of dependence on russian commodities. Finance

Research Letters, 50:103194.

Quiroga, R. Q., Rosso, O. A., and Bas¸ar, E. (1999).

Wavelet entropy: a measure of order in evoked po-

tentials. Electroencephalography and clinical neuro-

physiology. Supplement, 49:299–303.

Sello, S. (2003). Wavelet entropy and the multi-

peaked structure of solar cycle maximum. New

Astronomy, 8(2):105–117. https://doi.org/10.1016/

S1384-1076(02)00192-6.

Soloviev, V., Serdyuk, A., and Chabanenko, D. (2010).

Wavelet entropy as a critical phenomena precursor. In

Information Technologies, Management and Society,

pages 48–49, Riga, Latvia. Information System Insti-

tute.

Vedernikova, S. V. (2017). Modern trends of globaliza-

tion. Problemy systemnoho pidkhodu v ekonomitsi–

Problems of a systemic approach in economics,

5(61):16–22.

Xu, Y., Taylor, N., and Lu, W. (2018). Illiquidity and

volatility spillover effects in equity markets during

and after the global financial crisis: An mem ap-

proach. International Review of Financial Analysis,

56:208–220.

Yahoo Finance (2022). https://finance.yahoo.com/.

Zunino, L., P

´

erez, D. G., Garavaglia, M., and Rosso,

O. A. (2007). Wavelet entropy of stochastic processes.

Physica A: Statistical Mechanics and its Applications,

379(2):503–512.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

184