Innovation and CSR on Chinese SOEs: Adapting to COVID-19

Yan Wang

1

and Yunlang Xie

2

1

School of Accounting, Research Center for Accounting and Economic Development of Guangdong-Hong Kong-Macao

Greater Bay Area, Guangdong University of Foreign Studies, Guangzhou, China

2

School of Accounting, Guangdong University of Foreign Studies, Guangzhou, China

Keywords: Innovation, CSR, COVID-19, Corporate Competitiveness.

Abstract: In 2020, COVID-19 spread all over the world, seriously threatening human life and health and severely

impacting economic development. Chinese pharmaceutical state-owned enterprise (SOE) Da An Gene

quickly developed new products and helped meet huge demands for protective supplies. Its “R&D innovation

and corporate social responsibility (CSR)” interactive mechanism formed in the course of long-term

innovation and capital accumulation enabled it to seize opportunities brought by the epidemic. This study

explores the path of how innovative SOEs created value through interaction of R&D innovation and CSR

with case study against the background of COVID-19, and whether reform of state-owned capital regulatory

system to inject market vitality into SOEs can effectively transform the interaction mechanism of R&D

innovation and CSR into sustainable core corporate competitiveness.

1 INTRODUCTION

According to Organization for Economic Co-

operation and Development (OECD) in 2020, the

wide spread of COVID-19 is considered one of the

biggest public health security incidents in the

contemporary era. In addition to public health, it has

produced catastrophic impacts on the economy. Due

to their weak financial capabilities, micro and small

enterprises have halted production or closed down on

a large scale (

Bartik A et al., 2020). Enterprises need

to find a survival mechanism in crises (

Champion D,

1999

). In the context of sudden disasters such as

COVID-19, companies with the ability to innovate

and launch innovative products can more quickly

adapt to rapidly changing external environment

(

Amore M D, 2015). However, they need to undergo

a long technological R&D cycle and consume a lot of

human and financial resources, so most of them give

priority to reducing costs (

Bushee B J, 1998). On the

other hand, studies have shown that companies that

continue to focus on product innovation can

accumulate R&D skills and innovation resources,

who are more likely to survive crises than those

adopting a cost-cutting strategy (

Amore M D, 2015).

Therefore, companies need to lay stress on

accumulating innovation capital and cultivating

innovative talents in the boom times, so as to quickly

adapt to changes when major crises come and

withstand the impacts of huge external shocks. On the

other hand, COVID-19 has highlighted the

importance of CSR. CSR can not only reduce

companies’ production and labor cost (

Berman S L

et al., 1999

), affect the recruitment, retention and

motivation of employees (

Aguilera R V et al., 2007),

but also improve customer satisfaction and corporate

reputation, thereby affect customers’ loyalty and

purchase intention (

Lee S et al., 2020). During

economic crises, companies actively fulfill their

social responsibilities for the purpose of gaining the

trust of stakeholders and the public (

Popkova E et al.,

2021

), which helps them effectively coordinate the

relationship with stakeholders and thus survive

difficulties (

He H et al., 2020).

Under socialist market economy system, China’s

state sectors are the most important force for funding

and conducting innovative research, who provide

SOEs with stable talents, capital, knowledge, and

technical resources so that they can continue to work

on R&D and effectively commercialize patents and

R&D results (

Cao X et al., 2020). SOEs enjoy more

resources from government departments than private

enterprises, but should assume more CSR, especially

during difficult times such as economic crises or

natural accidents (

Zhu Q et al., 2016). However,

there are some problems in their development, such

Wang, Y. and Xie, Y.

Innovation and CSR on Chinese SOEs: Adapting to COVID-19.

DOI: 10.5220/0011954200003536

In Proceedings of the 3rd International Symposium on Water, Ecology and Environment (ISWEE 2022), pages 175-186

ISBN: 978-989-758-639-2; ISSN: 2975-9439

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

175

as imperfect supervision mechanism, which lead to

their limited development and insufficient vitality. In

respond, the state proposed to continue to deepen the

reform of the state-owned assets management system,

and impose more supervision on specialized state-

owned capital investment and operating companies,

so as to release the management power of SOEs,

stimulate their vitality, realize the maintenance and

appreciation of state-owned assets, and ensure their

role as main players in the market.

Da An Gene Co., Ltd. of Sun Yat-sen University

(hereinafter referred to as “Da An Gene”) is a state-

owned listed pharmaceutical company that draws

support from Sun Yat-sen University in terms of

scientific research. Since its establishment in 1991, it

has been focusing on R&D innovation. The company

has rich innovation resources and practical

experience, and adheres to fulfilling social

responsibilities based on product innovation. At the

outbreak of COVID-19 in early 2020, it quickly

seized market opportunities with its competitive

advantages in R&D innovation and CSR, and became

one of the first pharmaceutical companies to develop

and produce COVID-19 detection kits. In September

of the same year, its largest shareholder transferred its

equity to State-owned Assets Supervision and

Administration Commission of the State Council, and

the company began to receive assistance from

Guangzhou Finance Holdings for capital operations,

which put the company into more active market

competitions. Therefore, Da An Gene is a typical case

for studying the role of interaction between R&D

innovation and CSR in improving enterprises’ core

competitiveness, helping them resist the impacts of

COVID-19, increasing the value of state-owned

assets, and exploring potential development

opportunities brought by the reform of regulatory

model after transferring state-owned assets and the

path of corporate value creation after introducing

supervision of state-owned assets.

Although existing research points out the

importance of R&D innovation and CSR to the

development of enterprises, and that in most cases,

the fulfillment of CSR can promote R&D innovation,

there are few literatures on the mechanism of the

interaction and mutual promotion of R&D innovation

and CSR. This study focuses on the interaction

between “R&D innovation and CSR” among SOEs,

and adopts single case study with Da An Gene as a

typical case to discuss the path and mechanism for

innovative SOEs to create value through the

interaction between R&D innovation and CSR, and

explores whether competitive advantages of the

interaction mechanism can maintain and contribute to

the growth of corporate value in the market

environment of changed state-owned capital

operation and supervision model. Specifically, it

concludes “enterprises can accumulate R&D skills

and innovation resources if they continue to focus on

R&D and innovation”, that “enterprises can earn

social trust by fulfilling social responsibilities”, that

“R&D innovation and CSR interact and complement

with each other”, and that “reform of the state-owned

capital management system guarantees the long-term

and stable operation of interaction mechanism

between R&D innovation and CSR” based on case

study. By single case analysis, this study explores the

mutual promotion of R&D innovation and CSR in

innovative SOEs against the background of COVID-

19, enriches related theories, builds the path of

creating corporate value through an interaction

mechanism between R&D innovation and CSR, and

discusses whether Da An Gene’s interaction

mechanism can translate into its continuous core

competitiveness, which provides reference for the

development of other SOEs that implement a new

model of supervising state-owned assets.

2 LITERATURE REVIEW

The literature review is as follows.

2.1 Influencing Factors and Mode of

Innovation

R&D innovation is an important driving force for

social and economic development, as well as an

important factor for the sustainable development of

enterprises. In the past two decades, more scholars at

home and abroad began to study its role in

enterprises. In related literature, influencing factors

on it are divided into external factors and internal

factors. External factors mainly include national

policy (

Gu Y and Zhang L, 2017), competitive

environment (

Lunn J, 1986), etc., while internal

factors mainly include enterprise scale (

Chen C T et

al., 2004

), equity incentive (Chang X et al., 2015),

employee compensation and benefits (

Li J et al.,

2020

), and managerial personality (Shen H et al.,

2020

), which either promote or inhibit enterprise

R&D innovation. However, the most important

determinant in corporate R&D is capital. Companies

raise capital mainly through equity financing (

Huang

Y et al., 2014

) and debt financing (Anderson et al.,

1999

). In China, government subsidy is also an

ISWEE 2022 - International Symposium on Water, Ecology and Environment

176

important source for companies to promote R&D

innovation (

Czarnitzki D and Licht G, 2006).

Main modes of R&D innovation are internal

R&D, external R&D and collaborative innovation

(

Arvanitis S, 2012). Enterprises would adopt

different modes in R&D innovation. Relevant studies

have shown that main determinants in the choice of

innovation modes are corporate size and dedicated

system (

Hull C E and Covin J G, 2009). From the

perspective of enterprise scale, small companies are

more likely to choose internal R&D or external R&D

alone, while large ones tend to choose both internal

R&D and external R&D (

Fritsch M et al., 2001 and

Veugelers R et al., 1999

). After controlling the

variable of scale effect, when dedicated system is

strong, companies tend to conduct independent

external R&D; when internal information is more

important for R&D, they tend to conduct both internal

and external R&D (

Veugelers R et al., 1999). When

companies develop to a certain extent, collaborative

innovation can also improve their innovation

performance (

Wang C and Hu Q, 2020). Each

innovation mode can promote the development of

enterprises to a certain extent, but enterprises should

appropriately balance R&D activities under multiple

modes (

Denicolai S et al., 2016).

2.2 Relationship Between Innovation

and CSR

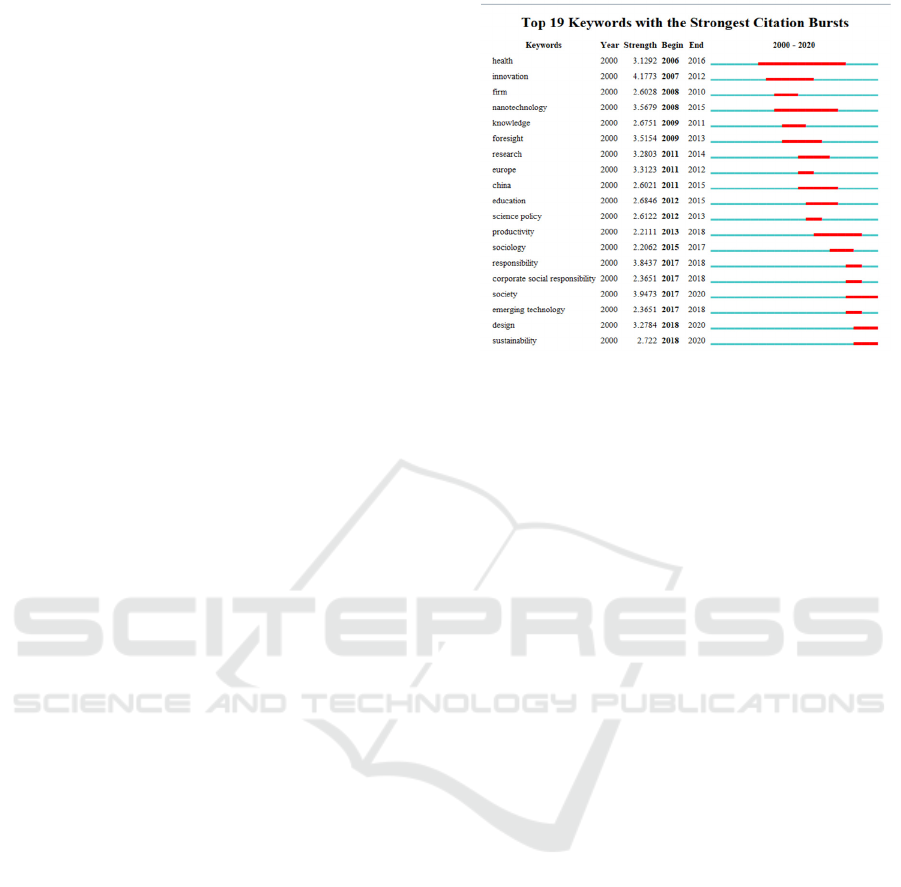

After analyzing 817 papers related to “research and

innovation” in the past 20 years (as shown in Figure

1.) with CiteSpace, we see that topics related to

corporate R&D and innovation and the fulfillment of

CSR have increasingly aroused the attention of

scholars in the last two years (

Luo X and Du S,

2015

). CSR mainly includes economic responsibility,

environmental responsibility and social responsibility

(

Yu W and Zheng Y, 2020), but no consensus has

been reached on the relationship between innovation

and the three kinds of CSR. Although some studies

point out companies will squeeze innovation

resources and inhibit innovation when fulfilling CSR

(

Mithani M A, 2017), that additional costs required

for performing CSR such as charity donations are

prone to cause agency conflicts (

Bethel J E et al.,

1993

), and that companies need to bear certain tax

risks in this regard (

Davis A K et al., 2015), but most

studies reveal the fulfillment of CSR exerts positive

effects on R&D innovation.

Figure 1. Keywords for innovation with strongest citation

bursts.

Bereskin believe that by setting up incentives for

employees and fulfilling economic responsibilities

related to employees, companies can improve

employee stability and innovation efficiency, and

inject vitality into R&D innovation (

Bereskin F L et

al., 2016 and Liu B et al., 2020

). Investing in

stakeholders such as shareholders and creditors

contributes to the sustainability of corporate profits

and financial support for continuous innovation

(

Choi J and Wang H, 2009). Miles and Covin point

out that environmental awareness enables enterprises

to carry out product innovation, solve social

problems, and improve business performance through

cost savings and market benefits (

Dionisio M et al.,

2020

). Voluntary charity activities and other social

activities can help enterprises not only solve social

problems and gain reputation, but also obtain more

external information to accumulate capital for future

innovation (

Holmes S and Smart P, 2009). In short,

companies that continue to perform CSR can win

social recognition, form a good industrial

responsibility atmosphere, and improve innovation

performance (

Bereskin F L et al., 2016 and Ko K-C

et al., 2020

).

Existing research points out R&D innovation and

CSR are important to the development of enterprises,

and that most activities for fulfilling CSR can

promote corporate R&D innovation, but there is no

study on whether the transfer of corporate holdings of

SOEs under the background of state-owned capital

reform can inject vitality into enterprise development,

and the mechanism of interaction and mutual

promotion of R&D innovation and CSR. This article

explores the role of R&D innovation activities and

CSR fulfillment in the development of SOEs against

Innovation and CSR on Chinese SOEs: Adapting to COVID-19

177

COVID-19 and China’s deepened SOE system

reform.

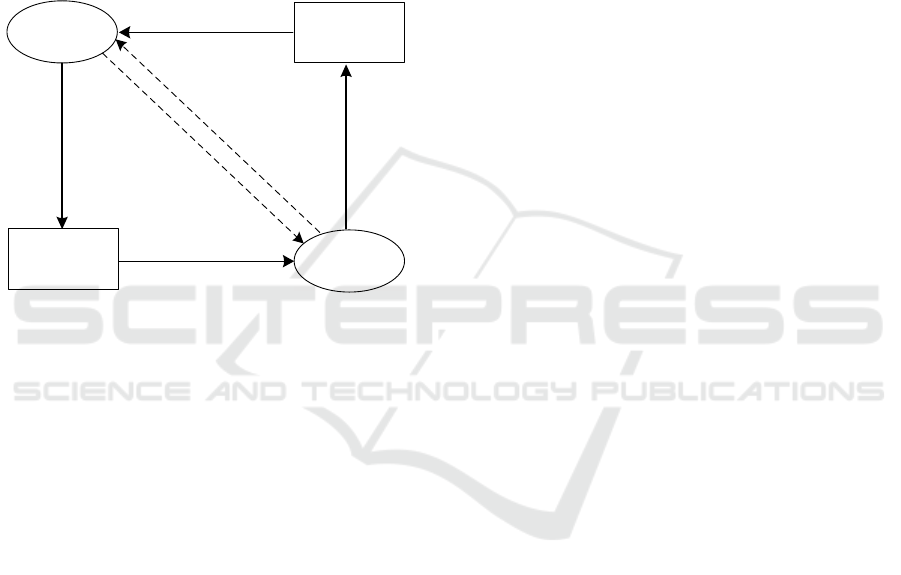

Figure 2. Framework of interaction between innovation and

CSR.

Based on review and summary of existing

research, this study builds an analytical framework

for interaction between R&D innovation and CSR in

promoting the sustainable development of SOEs in

the context of state-owned capital reform and

COVID-19, as shown in Figure 2. Enterprises gain

economic and product benefits through R&D

innovation, which is conducive for them to perform

CSR (in a broad sense). In turn, by performing CSR,

they win social trust and obtain more innovative

resources for R&D innovation. Under the background

of reform of state-owned capital management system

and COVID-19, the interaction between R&D

innovation and CSR facilitates the value creation of

SOEs, increases the value of state-owned assets, and

improves the core competitiveness of SOEs. This

study focuses on the process of R&D innovation of

SOEs, explores the mutual interaction and influence

of CSR performance and R&D innovation in the

context of COVID-19, and predicts that the reform of

state-owned assets supervision system will promote

this interaction mechanism to create value for SOEs.

3 EMPIRICAL METHODOLOGY

This part includes the empirical methodology as

follows.

3.1 Sample

This article follows the principle of typicality in case

selection and sets out the criteria for selecting case

company as follows (

Patton M Q, 1987). (1) The

company should have been focusing on R&D

innovation for a long time, embrace matured

innovation practice, and actively fulfill CSR, which is

the basis for exploring the path of mutual interaction

between R&D innovation and CSR. (2) It should be a

leader in the industry and perform well in COVID-19,

which make it a representative typical case. (3) It

should be east to obtain data about the company,

including public information to guarantees

availability and comprehensiveness, which is

conducive to the smooth progress of this study.

Following the above criteria, this study identified

Da An Gene as the sample enterprise. First of all, Da

An Gene is one of the state-owned university-run

enterprises that was founded early, has relatively

complete managerial mechanism, and embraces

excellent performance. It is also the first listed high-

tech enterprise run by

a university in Guangdong. As

a pharmaceutical company relying on the strong

scientific research strength of Sun Yat-sen

University, it has been emphasizing scientific and

technological R&D since its establishment, and has

achieved excellent results in vitro molecular

diagnostics. The company adopts diverse innovation

modes, including independent R&D, collaborative

innovation and technology introduction. As a state-

holding company, Da An Gene comprehensively

fulfills CSR. Secondly, the company performed

outstandingly in the fight against COVID-19. When

COVID-19 broke out in China, it quickly developed

nucleic acid detection kit (based on fluorescence

PCR) with ensured quality and producing capacity,

and earned a large number of domestic and foreign

orders, which brought it surging profits and better

development. In the meanwhile, Da An Gene has

accelerated its pace of market-oriented reform.

Guangzhou Finance Holdings will soon become its

state-owned asset investment and operation company,

thus realize modern governance of Da An Gene and

promote its sustainable development. Last but not

least, Da An Gene has been listed, so it is easier to

collect data in an all-round manner. Therefore, the

company is a very representative research case.

3.2 Data

To ensure the rigor of case study and improve the

reliability and validity of this study, we collected data

with triangulation. The data are mainly primary and

secondary data. Primary data include materials

collected from semi-structured interviews,

questionnaire, and field surveys, while secondary

data mainly consist of public information such as

assembly materials, minutes and reports of meetings,

publicity materials, and public information retrieved

via the Internet. They help us gain an in-depth

understanding of the entire process of Da An Gene’s

technological innovation, CSR fulfillment and state-

ISWEE 2022 - International Symposium on Water, Ecology and Environment

178

owned asset regulatory reform. Diversified sources of

data ensure the integrity and richness of information.

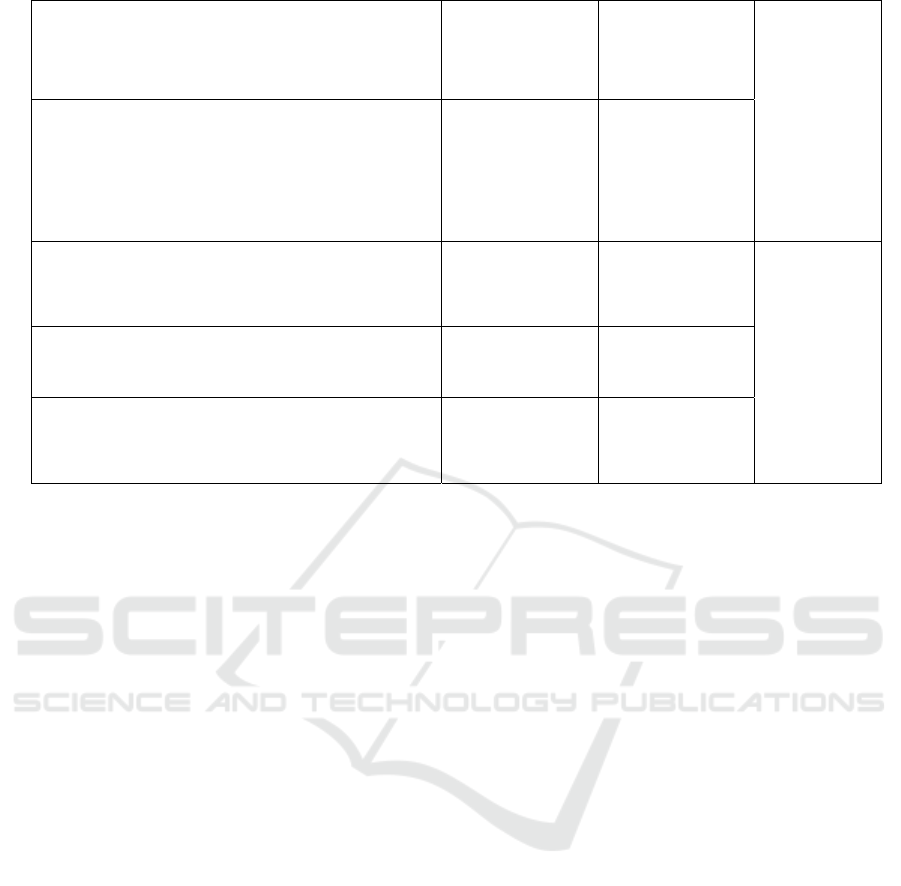

Table 1 shows details of sources of data about the case

company.

Table 1. Access to data about case company.

Type Sources Access

Primary

data

Financial manager

of Da An Gene

Semi-structured

interviews (sound

recorded)

Department head of

Guangzhou Finance

Holdings

Semi-structured

interviews (sound

recorded)

Secondar

y data

Assembly materials

Assembly materials,

product information,

annual reports

Publicity materials

Brochures, press

releases

Other public

information

Company website,

public information

retrieved via Internet

tools such as

browsers and

databases

Field investigation and interview of case company

were conducted by 7 team members. Before that, we

prepared the outline for survey of case company and

its controlling shareholder Guangzhou Finance

Holdings, trained team members, and divided work

among members to ensure smooth interview. During

interviews, 2 people asked and answered questions, 3

made notes, and 2 recorded to ensure data accuracy.

After that, recorded interviews were transcribed in a

timely manner to avoid memory deviation.

3.3 Measures

This paper adopts single case study to discuss mutual

promotion of R&D innovation and CSR by

longitudinal case analysis. In addition, it hopes to

build a mechanism and path for the interaction

between R&D innovation and CSR. Grounded

Theory is a method of establishing a substantive

theory from the bottom up, which generalizes original

data to form theoretical system (

Jantunen S and

Gause D C, 2014

), being suitable for constructing a

deductive path and consistent with expectations of

this paper.

Grounded Theory mainly includes three

processes: open coding, axial coding and selective

coding, as shown in Figure 3. Open coding refers to

the process of decomposing, refining, and

categorizing data acquired. We decomposed original

data item by item, labeled and conceptualized them,

refined them into initial categories (subcategories),

and completed open coding based on expert opinions;

then conducted axial coding, namely to further

generalize subcategories, analyze the nature of each

subcategory and the connection relationship among

them, and summarize interconnected independent

subcategories into fundamental categories; and

finally integrated main category codes into core

categories through selective coding. Throughout the

process, we interpreted data as objectively as

possible, and repeatedly compared coding results

with materials to ensure that the obtained categories

are saturated.

Figure 3. Grounded theory coding process.

4 RESULTS AND DISCUSSION

In this part, the results and discussions will be

presented.

4.1 Framework of Innovation-CSR

interaction

The framework of innovation-CSR interaction.

4.1.1 Innovation

Innovation is an important cornerstone in enterprises’

long-term development. In the 1990s, traditional PCR

technology could not meet the needs of clinical

diagnosis. Based on access to a large amount of

foreign information, Da An Gene’s scientific and

technical personnel decisively worked on

fluorescence PCR technology in developing next

generation PCR products, which won support from

the Ministry of Health and the National Science and

Technology Commission, and was included as a key

research project for “Ninth Five-Year Plan” on

biotechnology. Da An Gene still focuses on the R&D

of PCR genetic testing kits now. It has played an

important role in several major epidemic disease

outbreaks in China, which mainly owes to its

emphasis on R&D innovation for more than 20 years.

The important events in its innovation and

development are shown in Table 2.

Innovation and CSR on Chinese SOEs: Adapting to COVID-19

179

Table 2. Important innovation events in the development of Da An Gene.

Events

Innovation

capital

accumulation

(Fundamental

category)

1996

Independently developed fluorescence quantitative PCR detection technology,

achieving technical breakthrough in this regard in China.

Intellectual

capital

1999

Completed property rights restructuring with the new mechanism and funds of the

People’s Government of Guangzhou Municipality, realized equity diversification,

introduced capitals, and thus commercialized its innovative products.

Financial capital

2004

Got listed on the SME board of the Shenzhen Stock Exchange, became the first

listed university-run company in Guangdong, and realized the combination of

intellectual capital and financial capital.

Financial capital

2005

Applied for testing and calibration laboratory with China National Accreditation

Board for Laboratories (CNAL) and was accredited.

Intellectual

capital

2007

Acquired Zhongshan Biotech and obtained multiple immune diagnostic reagents,

which were powerful supplements to its existing nucleic acid products and

enriched its product lines.

Intellectual

capital

2008

Purchased land and prepared to build Foshan Medical Devices Company as its

equipment production base to strengthen its R&D ability, which will specialize in

the research, development and production of life science analytical instruments.

Intellectual

capital

2009

Passed the Dn An Gene’s Incentive Plan for the First Batch of Stock Option

(Draft), which injected vitality into its continuous innovation and development.

Intellectual

capital

2011

till now

Established a professional big health incubator to focus on creating a “no wall”

resource sharing platform for the big health industry and promote collaborative

innovation amon

g

enter

p

rises.

Intellectual

capital

In the early days of its establishment, Da An Gene

achieved independent innovation and breakthrough in

fluorescence quantitative PCR detection technology

relying on government subsidies and intellectual

capital, embraced growth to some extent, but did not

have the strength for industrial development. It

launched capital increase and restructuring in 1999,

successfully got listed in 2004, and established a

perfect capital entry and exit mechanism, which

brought it external financing and helped it further

enhance R&D and innovation. In the meanwhile, the

company strengthened its innovation capabilities and

improved market competitiveness through

technology introduction, mergers and acquisitions. In

2011, it began to create a big health ecosystem,

aiming to help entrepreneurs and SMEs, raise the

success rate of entrepreneurship, and promote the

collaborative innovation and development of

enterprises.

Accumulation of innovation capital over the past

two decades has enabled Da An Gene to quickly adapt

to crises brought by the outbreak of COVID-19 in

2020 and seize development opportunities. The

epidemic resulted in surging demands for test kits in

ISWEE 2022 - International Symposium on Water, Ecology and Environment

180

China, to which Da An Gene quickly responded and

developed 2019-nCoV nucleic acid test kit on January

20. On January 28, the test kit was approved by the

National Medical Products Administration and

available on the market in large quantities.

Based on above case analysis, we put forward the

following research propositions:

Proposition 1: Enterprises that continue to focus

on R&D innovation can accumulate R&D skills and

innovation resources, and quickly adapt to changes

when sudden crises such as COVID-19 come, when

R&D skills and innovation resources will become

their core competitiveness.

CSR

R&D

Innovation

Product

innovation

Social trust

innovative capital

promote

Figure 4. Framework of innovation-CSR interaction.

4.1.2 Corporate Social Responsibility

As a high-tech biomedical company, Da An Gene

actively fulfills its social responsibilities in a

professional spirit. The process of its R&D and

innovative development mentioned above shows that

its innovative products in each stage have been

promoting the development of fluorescence PCR

gene detection in China. At first, it invented

fluorescence PCR technology, which solved false

positives and non-quantitative detection caused by

the contamination of gene amplification products in

traditional PCR technology. During the SARS

epidemic in 2003, the H1N1 influenza in 2009 and the

COVID-19 epidemic in 2020, it quickly launched test

kits, made important contributions to preventing the

further spread of diseases, and protected the health of

the public.

Adhering to the mission of “reach the source of

life and secure the foundation of health”, Da An Gene

fully fulfills its CSR to ensure people’s health. During

the Spring Festival of 2020, its R&D team still

worked in the laboratory and finally developed test

kits, thereby seizing the huge market opportunity of

domestic and foreign demand for protective medical

products. During the critical period of COVID-19, the

R&D team developed in vitro testing reagents and

related instruments, ensured production capacity, and

secured product quality. This shows that Da An Gene

responded to problems occurred in the course of

social development through innovative ways, has

achieved profitability and sustainable development,

and won social trust and respect.

On the basis of above analysis, we propose the

following proposition:

Proposition 2: By fulfilling CSR, enterprises can

win trust from the society, effectively coordinate the

relationship with various stakeholders, obtain more

external resources, and better survive crises.

4.1.3 Innovation and CSR

Above-mentioned analyses reveal that continuous

R&D innovation can help companies accumulate

innovation resources, and that actively fulfilling CSR

can help them win social trust and obtain social

resources, but is there an interaction between them

and how does it work if there is? Exploring the issue

will help us better understand the mechanism of

interaction between R&D innovation and CSR.

After summarizing original data about Da An

Gene during the epidemic, we refined 18 concepts,

further compared and analyzed them, and finally

divided them into 8 subcategories and 5 core

categories, as shown in Table 3.

Innovation and CSR on Chinese SOEs: Adapting to COVID-19

181

Table 3. Coding of Da An Gene during the fight against COVID-19.

Primary data Conceptualization Subcategory

Fundamental

category

In the face of sudden outbreak of COVID-19 across

the country, almost all designated hospitals were in

short supply of nucleic acid detection kits.

A1 domestic

demand (a1)

AA1 market

demand (A1, A2)

Impacts of

COVID-19

Beginning in late February, overseas markets showed

great demands for detection kits.

A2 international

demand (a2)

As the epidemic continued to spread globally,

formalities of applying for CE certification became

simpler and the threshold was continuously lowered.

A3 low

certification

threshold (a3)

AA2 industry

status (A3, A4)

On March 25, Spanish newspaper El Pais reported

that a batch of rapid detection kits purchased from

China were inaccurate.

A4 some

companies only

pursued profits

(

a4

)

Starting from March 29, Chinese companies must

obtain relevant qualifications from the National

Medical Products Administration while exporting

protective products against COVID-19.

A5 Chinese

policies tightened

(a5)

AA3 related

policies (A5, A6,

A7)

The threshold set by the country did not affect export

of medical supplies, as there is huge demand. This is

a good news for compliant manufacturers.

A6 favorable

policies (a6)

The State Council stipulated that in addition to

people, objects should be included for COVID-19

testing.

A7 expanded

detection range

(a7)

On January 24, President Xi Jinping clearly put

forward the requirement of scientific prevention and

targeted policy implementation, and emphasized

resolutely winning the battle against the epidemic.

A8 science and

technology-based

anti-epidemic

measures (a8)

AA4 response to

the epidemic in

China (A8, A9,

A10)

Fight against

COVID-19

Beginning on February 2, under the guidance of the

Central Steering Group, Wuhan launched dragnet

investigation, centralized treatment, and thorough

investigation.

A9 strengthened

COVID-19

screening (a9)

Rapid spread of the epidemic was contained. The

epidemic was generally stable across the country

except Hubei.

A10 China made

progress in

epidemic

prevention and

control

(

a10

)

China consolidated and deepened the results of

epidemic prevention and control, promptly deal with

outbreak in clusters, resumed work and production in

an orderly manner, and cared for overseas Chinese

citizens.

A11 Epidemic

prevention and

control abroad

(a11)

AA5 response to

the epidemic in

foreign countries

(A11)

After the outbreak of COVID-19, Da An Gene

quickly launched 2019-nCoV nucleic acid detection

kit (based on fluorescence PCR).

A12 independent

innovation (a12)

AA6 R&D

innovation (A12)

R&D

innovation

The company’s nucleic acid detection technology

enabled timely prevention, control, diagnosis and

treatment of the epidemic.

A13 product

function (a13)

AA7 products and

services (A13,

A14, A15)

CSR

ISWEE 2022 - International Symposium on Water, Ecology and Environment

182

After successfully developing the test kit, the

company quickly put it into production, providing a

large amount of “ammunition” support for the “fight”

against the epidemic.

A14 guaranteed

production

capacity (a14)

The company has its own fluorescence quantitative

PCR instrument, nucleic acid extraction instrument

and molecular hybridization instrument, but also sells

imported fluorescence quantitative PCR instrument

and nucleic acid extraction instrument to meet

demands in different scenarios.

A15 instrument

R&D (a15)

The company witnessed CNY 2.133 billion of

revenue in the first half of 2020, an increase of

313.63% year-on-year with a gross profit margin of

67.41%.

A16 profits

surged (a16)

AA8 capital

inflow (A16, A17,

A18)

Corporate

sustainable

development

From January 2 to July 31, the company’s stock price

rose from CNY 10.45/share to CNY 43.34/share, an

increase of 314.83%.

A17 stock price

rose (a17)

The joining of Guangzhou Finance Holdings brought

it government endorsements and enabled it to obtain

more social capitals, which promoted its R&D

innovation.

A18 new

milestone in

development

(a18)

Through data analysis, we found that there is a

story line at different stages of Da An Gene’s

development: internal factor (accumulated innovation

capital) and external factors (shock by COVID-19,

response to it) → action strategy (R&D innovation,

CSR) → result (sustainable development).

Under the impact of the epidemic (external

factor), market demand increased dramatically,

bringing opportunities to companies. Whether

companies can seize the opportunities depends

mainly on if they can produce normally and have

certain technical strength. As shown in the history of

its R&D innovation, Da An Gene laid the foundation

for subsequent R&D innovation (internal factor) by

accumulating innovation capital in the early days.

During the Spring Festival when COVID-19 broke

out, Da An Gene persisted in protecting people’s

health and safety. Its R&D personnel remained at

their post, actively responded China’s policy against

the epidemic, and soon developed nucleic acid

detection kits (R&D innovation), which were

produced in sufficient capacity with guaranteed

quality. In doing so, it not only contributed to the

prevention and control of the epidemic (CSR), bu also

made a lot of profits and embraced raised stock price

(corporate sustainable development).

While enjoying economic benefits brought about

by epidemic prevention and control, Da An Gene also

further promoted market-oriented reform. On

December 21, 2020, Sun Yat-sen University, the

shareholder of Guangzhou Zhongda Holding Co.,

Ltd., and Guangzhou Finance Holdings completed

changes in equity, which changed the status of Da An

Gene who did not have goals of strategic growth as a

university-run enterprise. Therefore, this equity

transfer was a new milestone in the development of

Da An Gene (corporate sustainable development).

The Figure 4 is a simple diagram of the mechanism

of interaction between R&D innovation and CSR.

By above analysis, we put forward another

proposition:

Proposition 3: R&D innovation promotes

pharmaceutical companies to solve social problems.

By actively performing CSR, companies win social

trust and embrace inflow of social capitals, which

further promote their innovation and development,

form a mechanism of interaction between R&D

innovation and CSR, and thus help them seize

opportunities and achieve rapid development in times

of crisis.

4.2 Innovation-CSR and Institutional

Background

Universities do not place goals of strategic growth

performance on their enterprises, which makes it

difficult for such enterprises to have long-term

development impetus. Therefore, the performance of

listed university-run companies is not ideal. In recent

years, China accelerated the reform of separation of

SOEs and state-owned assets, implemented separated

operation of SOEs and state-owned assets, and

transferred to capital management from assets

management. In 2020, Sun Yat-sen University, the

Innovation and CSR on Chinese SOEs: Adapting to COVID-19

183

actual controller of Da An Gene, signed the

Agreement on Transfer of State-owned Property

Rights with Guangzhou Finance Holdings,

transferring its 100% equity of Guangzhou Zhongda

Holding (including 16.63% of equity of Da An Gene)

to Guangzhou Finance Holdings for free, as shown in

Figure 5.

Guangzhou Municipal

Government

Guangzhou International

Holding Group Co., Ltd.

Guangzhou Zhongda

Holding Co., Ltd.

Da An Gene Co., Ltd. of

Sun Yat-Sen University

Guangzhou Zhongda

Holding Co., Ltd.

Sun Yat-sen University

Da An Gene Co., Ltd. of

Sun Yat-Sen University

100%

16.63%

16.63%

100%

100%

»

Figure 5. Changes in Da an Gene’s Actual Controller.

After the equity transfer, Da An Gene’s direct

controller is Guangzhou Zhongda Holding, actual

controller is changed to Guangzhou Finance

Holdings, and ultimate controller is Guangzhou

Municipal Government. This brings government

endorsements to the company and helps it gain more

social capitals. Stable flow of capitals is also

conducive to its continuous R&D innovation and

guarantees the interaction between R&D innovation

and CSR. In addition, Guangzhou Finance Holdings’

capital operation capabilities can help the company

maintain a leading position in the biomedical

industry, promote integration of resources in the

pharmaceutical industry, bring new milestones for its

development, and maintain its sustainable future

development.

There, we propose the following proposition:

Proposition 4: Under the institutional background

of reform of state-owned assets management system,

Da An Gene embraced stronger capital operation

ability, which guarantees its long-term and stable

interaction between R&D innovation and CSR.

Above analyses show that external environmental

impacts promote companies to adopt the strategy of

launching R&D innovation and fulfilling CSR at the

same time. Accumulation of innovation capital is an

important internal support for companies to quickly

complete R&D. “R&D innovation and CSR” can be

transformed into their core competitive advantages in

crises like COVID-19 and help them secure further

development, as shown in Figure 6. Da An Gene

completed equity transfer in 2020. In the future, its

actual controller Guangzhou Finance Holdings may

continue to maintain this core competitiveness

through capital operation and market value

management.

support

Outbreak

response

Epidemic

impact

Sustainable

development

promote

Results

External factors

Behavioral strategies

Internal factors

Innovation capital

accumulation

promote

CSR

Innovation

Reformation

Figure 6. Selective decoding graph.

5 CONCLUSIONS

This study explores the mechanism of interaction

between “R&D innovation and CSR” and the path of

how the reform of state-owned capital regulatory

system creates value for enterprises with Da An Gene

as a representative case.

First, enterprises should emphasize accumulating

innovative resources during boom times, and

maintain social trust by actively fulfilling their CSR.

Second, pharmaceutical companies solve social

problems through innovation. Actively performing

CSR is conducive for them to win the trust of the

public. Inflow of social capitals to companies further

promotes their innovation and development,

facilitates interaction between R&D innovation and

CSR, and helps them tide over crises. Third, in the

context of the transformation of state-owned assets

supervision mode, the mechanism of interaction

between R&D innovation and CSR and capital

operation help enterprises form core competitive

advantages.

6 LIMITATIONS

Although single case study has unique advantages for

constructing theories in this paper, the conclusions

drawn need to be treated with caution. A

representative company whose development was

promoted by interaction between R&D innovation

and CSR under the impact of COVID-19 was

analyzed, but due to limitations of the case, research

conclusions are not universally applicable. That is,

the promotive relationship between R&D innovation

and CSR shown in this study may not be the only

ISWEE 2022 - International Symposium on Water, Ecology and Environment

184

possibility. In the future, the validity of research

conclusions can be tested and expanded by empirical

research or other methods.

ACKNOWLEDGMENTS

First of all, the first author is grateful for being the

chief expert in the 2021 National Major Project

(ongoing) “Research on Mechanism Innovation and

Practice Path of Deepening Mixed Ownership

Reform (21ZDA039)” of the National Office of

Philosophy and Social Sciences and the authors

thanks for the support from this project. Secondly,

The authors thank the grant from the Chinese

National Social Science Fund Granted Project of

China (Grant: 20VSZ006); Thirdly, the authors

appreciate the support from the project of “The

Research on Comprehensively Promoting Urban

Digital Transformation in Guangzhou

(2022GZZK06)” of the 14th Five-Year Plan for the

Development of Guangzhou Philosophy and Social

Sciences in 2022, and thank to the support of the 2022

project "ESG (environment, social and governance)

Report on the impact of the Certified Public

Accountants industry". Moreover, the authors also

want to give the appreciation to the support of these

two projects: the 2022 Industry research project of the

Guangdong Institute of Certified Public Accountants

"Guangdong-Hong Kong-Macao Greater Bay Area

Accounting Firms to Promote ESG Information

Disclosure" and the 2023 Guangdong Institute of

Certified Public Accountants industry research

project (ongoing) "Comprehensive Evaluation of

Public Accountants".

REFERENCES

Bartik A, Bertrand M, Cullen Z, Glaeser E L, Luca M and

Stanton C (2020) How are small businesses adjusting

to covid-19? Early evidence from a survey HKS Faculty

Research Working Paper Series RWP 20-012

Champion D (1999) The asian crisis - the price of

undermanagement Harvard. Bus. Rev. 77 14-5

Amore M D (2015) Companies learning to innovate in

recessions Res. Policy. 44 1574-83; Archibugi D,

Filippetti A and Frenz M (2013) Economic crisis and

innovation: Is destruction prevailing over

accumulation Res. Policy. 42 303-14

Bushee B J (1998) The influence of institutional investors

on myopic R&D investment behavior Account. Rev. 73

305-33; Orsenigo L and Malerba F (2000) Knowledge,

innovative activities and industrial evolution Ind. Corp.

Change. 9 289-313

Berman S L, Wicks A C, Kotha S and Jones T M (1999)

Does stakeholder orientation matter? The relationship

between stakeholder management models and firm

financial performance Acad. Manage. J. 42 488-506

Aguilera R V, Rupp D E, Williams C A and Ganapathi J

(2007) Putting the s back in corporate social

responsibility: A multilevel theory of social change in

organizations Acad. Manage. Rev. 32 836-63

Lee S, Han H, Radic A and Tariq B (2020) Corporate social

responsibility (CSR) as a customer satisfaction and

retention strategy in the chain restaurant sector J.

Hosp. Tour. Manag. 45 348-58; Pivato S, Misani N and

Tencati A (2008) The impact of corporate social

responsibility on consumer trust: The case of organic

food Bus. Ethics. 17 3-12

Popkova E, DeLo P and Sergi B S (2021) Corporate social

responsibility amid social distancing during the

COVID-19 crisis: BRICS vs. OECD countries Res. Int.

Bus. Financ. 55 101315

He H and Harris L (2020) The impact of Covid-19 pandemic

on corporate social responsibility and marketing

philosophy J. Bus. Res. 116 176-182.

Cao X, Cumming D and Zhou S (2020) State ownership

and corporate innovative efficiency Emerg. Mark. Rev.

44 100699; Cumming D, Rui O and Wu Y (2016)

Political instability, access to private debt, and

innovation investment in China Emerg. Mark. Rev. 29

68-81

Zhu Q, Liu J and Lai K-h (2016) Corporate social

responsibility practices and performance improvement

among Chinese national state-owned enterprises Int. J.

Prod. Econ. 171 417-26

Gu Y and Zhang L (2017) The impact of the Sarbanes-

Oxley Act on corporate innovation J. Econ. Bus. 90 17-

30

Lunn J (1986) An empirical analysis of process and product

patenting: A simultaneous equation framework J. Ind.

Econ. 34 319–30

Chen C T, Chien C F, Lin M H and Wang J T (2004) Using

DEA to evaluate R&D performance of the computers

and peripherals firms in Taiwan Int. J. Bus. 9 261-288;

Scherer F M (1965) Firm size, market structure,

opportunity, and the output of patented inventions Am.

Econ. Rev. 55 1097-125

Chang X, Fu K, Low A and Zhang W (2015) Non-executive

employee stock options and corporate innovation J.

Financ. Econ. 115 168-88

Li J, Shan Y, Tian G and Hao X (2020) Labor cost,

government intervention, and corporate

innovation: Evidence from China J. Corp. Financ. 64

101668

Shen H, Lan F, Xiong H, Lv J and Jian J (2020) Does top

management team’s academic experience promote

corporate innovation? Evidence from China Econ.

Model. 89 464-75

Huang Y, Lam F Y and Wei K C (2014) The Q-Theory

explanation for the external financing effect: New

evidence J. Bank. Financ. 49 69–81

Anderson M H and Prezas A P (1999) Intangible

investment, debt financing and managerial incentives J.

Innovation and CSR on Chinese SOEs: Adapting to COVID-19

185

Econ. Bus. 51 3-19; Mann W (2018) Creditor rights

and innovation: Evidence from patent collateral J.

Financ. Econ. 130 25-47

Czarnitzki D and Licht G (2006) Additionality of public

R&D grants in a transition economy: The case of

Eastern Germany Econ. Transit. 14 101-31

Arvanitis S (2012) How do different motives for R&D

cooperation affect firm performance? - an analysis

based on Swiss micro data J. Evol. Econ. 22 981-1007

Hull C E and Covin J G (2009) Learning capability,

technological parity, and innovation mode use J. Prod.

Innovat. Manag. 27 97-114

Fritsch M and Lukas R (2001) Who cooperates on R&D?

Res. Policy. 30 297-312

Veugelers R and Cassiman B (1999) Make and buy in

innovation strategies: Evidence from Belgian

manufacturing firms Res. Policy. 28 63-80

Wang C and Hu Q (2020) Knowledge sharing in supply

chain networks: Effects of collaborative innovation

activities and capability on innovation performance

Technovation. 94-95 102010

Denicolai S, Ramirez M and Tidd J (2016) Overcoming the

false dichotomy between internal r&d and external

knowledge acquisition: Absorptive capacity dynamics

over time Technol. Forecast. Soc. 104 57-65

Luo X and Du S (2015) Exploring the relationship between

corporate social responsibility and firm innovation

Market. Lett. 26 703-14

Yu W and Zheng Y (2020) The disclosure of corporate

social responsibility reports and sales performance in

China Account. Financ. 60 1239-70

Mithani M A (2017) Innovation and CSR - do they go well

together Long. Range. Plann. 50 699-711

Bethel J E and Liebeskind J (1993) The effects of ownership

structure on corporate restructuring Strategic. Manage.

J. 14 15-31

Davis A K, Guenther D A, Krull L K and Williams B M

(2015) Do socially responsible firms pay more taxes

Account. Rev. 91 47-68

Bereskin F L, Campbell T L and Hsu P-H (2016) Corporate

philanthropy, research networks, and collaborative

innovation Financ. Manage. 45 175-206

Liu B, Sun P-Y and Zeng Y (2020) Employee-related

corporate social responsibilities and corporate

innovation: Evidence from China Int. Rev. Econ.

Financ. 70 357-72

Choi J and Wang H 2009 Stakeholder relations and the

persistence of corporate financial performance

Strategic. Manage. J. 30 895-907

Dionisio M and De Vargas E R (2020) Corporate social

innovation: A systematic literature review Int. Bus.

Rev. 29 101641; McWilliams A and Siegel D (2001)

Corporate social responsibility: A theory of the firm

perspective Acad. Manage. Rev. 26 117-27; Miles M P

and Covin J G (2000) Environmental marketing: A

source of reputational, competitive, and financial

advantage J. Bus. Ethics. 23 299-311

Holmes S and Smart P (2009) Exploring open innovation

practice in firm-nonprofit engagements: A corporate

social responsibility perspective R&D Manage. 39 394-

409

Ko K-C, Nie J, Ran R and Gu Y (2020) Corporate social

responsibility, social identity, and innovation

performance in China Pac-Basin. Financ. J. 63 101-415

Patton M Q (1987) How to use qualitative methods in

evaluation (California: Sage Publications)

Jantunen S and Gause D C (2014) Using a grounded theory

approach for exploring software product management

challenges J. Syst. Software. 95 32-51

ISWEE 2022 - International Symposium on Water, Ecology and Environment

186