Dynamic Early-Warning of Enterprise Financial Distress

Based on Gradient Boosting Algorithm

Ying Peng

*

, Ziyi Chen and Jingyi Wang

Business School, Jianghan University, No.8, Sanjiaohu Road, Wuhan Economic and Technological Development Zone,

China

Keywords: Enterprise Financial Distress, Gradient Boosting Algorithm, Dynamic Early-Warning.

Abstract: One of the biggest problems of users of financial statements is whether the enterprise will face financial

distress. In this study, an early-warning system model based on gradient boosting algorithm for enterprise

dynamic early-warning is presented. Sometimes special treatment (ST) is the warning of abnormal financial

or occurring other conditions in China stock exchange. We construct enterprise dynamic early-warning

model based on gradient boosting algorithm using the data of ST companies and their matching companies

before special treatment 3 years. Our model calculates the relative variable importance (RVI) of each

financial distress indicators, and get the average results of models. Through comparing with logit model, the

results show that model based on gradient boosting algorithm can get better warning results. Our paper

provides a more accurate method for enterprise dynamic early-warning, which can provide reference for

users of financial statements improve financial situation, change investment strategy and so on.

1 INTRODUCTION

An enterprise encounter financial distress is a

gradual process, not sudden. Before facing financial

distress, financial or non-financial indicators of

enterprise may appear abnormal. That is to say, we

can find indicators and use method to alert for the

probability of financial distress. Therefore, the key

to early-warning of enterprise financial distress is to

establish early-warning indicator system and find

out applicability algorithm.

About the early-warning indicator system, it has

experienced two stages. The first stage, indicators

are instructed based on financial statements; the

second stage, indicators are selected based on other

information that is also important for enterprises,

such as marketing indicators, corporate governance

indicators, and so on.

Enterprise financial distress early-warning

models can be divided into statistical methods and

machine learning methods (Alaka, Oyedele, .et al,

2018). Statistical methods have been introduced into

financial early-warning about 60 years ago. They

include z-score model, single and multiple

discriminant model, logit and probit models, and so

on (Altman, 1968; Deakin, 1972; Jones, 1987).

Machine learning methods first come into financial

distress early-warning in 1990s, and there are some

breakthroughs have been made in the financial

distress application research area. Such as genetic

algorithm, BP neural network, rand forest algorithm,

and so on (Brockeet and Cooper, 1995; Sharda and

Steiger, 1990; Breiman, 2001; Franco, 2002).

Through machine learning methods can improve

accuracy of financial distress early-warning, in spite

of the process of early warning seems in a “black

box” (Barboza and Kimura, 2017). Therefore, they

cannot provide suggestions on how to improve

performance of enterprises. However, gradient

boosting algorithm as an improved machine learning

models, which can overcome the defect of the “black

box” problem. It can not only output specific alert

results, but also output relative variable importance

of indicators, which can help users of financial

statements make decisions. In this study, we

introduce gradient boosting algorithm into the field

of financial early-warning field, which can further

expand the application scope of the method.

Peng, Y., Chen, Z. and Wang, J.

Dynamic Early-Warning of Enterprise Financial Distress Based on Gradient Boosting Algorithm.

DOI: 10.5220/0012022800003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 17-23

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

17

2 CONSTRUCTION OF

FINANCIAL DISTRESS

EARLY-WARNING

INDICATORS SYSTEM

Gradient boosting algorithm is not affected by

collinearity and missing value of indicators, and

with the effect of alert is not monotone decreasing.

Therefore, we construct financial distress early-

warning indicators system including both financial

indicators and non-financial indicators.

2.1 Construction of Financial

Indicators System

There is no doubt that traditional financial indicators

still play an important role in the field of early-

warning of enterprise financial distress. They usually

include solvency indicators, profitability indicators,

operating capacity indicators and development

capacity indicators. We can use solvency indicators

to reflect mismatch of assets and debt, as the

mismatch will cause such as non-effective

investment, much bigger operational risk, which

influence negatively. The decline of profitability is

one of the important manifestations of financial

distress. Operating capacity can reflect cash that are

occupied by suppliers and customers. If there are too

much cash are occupied, that will cause companies

lack of cash for their expanded. Development

capacity can reflect the growth rate of one company,

but the growth rate too fast or too late all influences

the happening of financial distress. However, cash

flow and the degree of earnings management also

occupy a key position in determine whether one

enterprise will go bankrupt or not. Therefore, we add

cash-flow indicators and earnings management

indicators in traditional financial indicators to

improve early-warning effect.

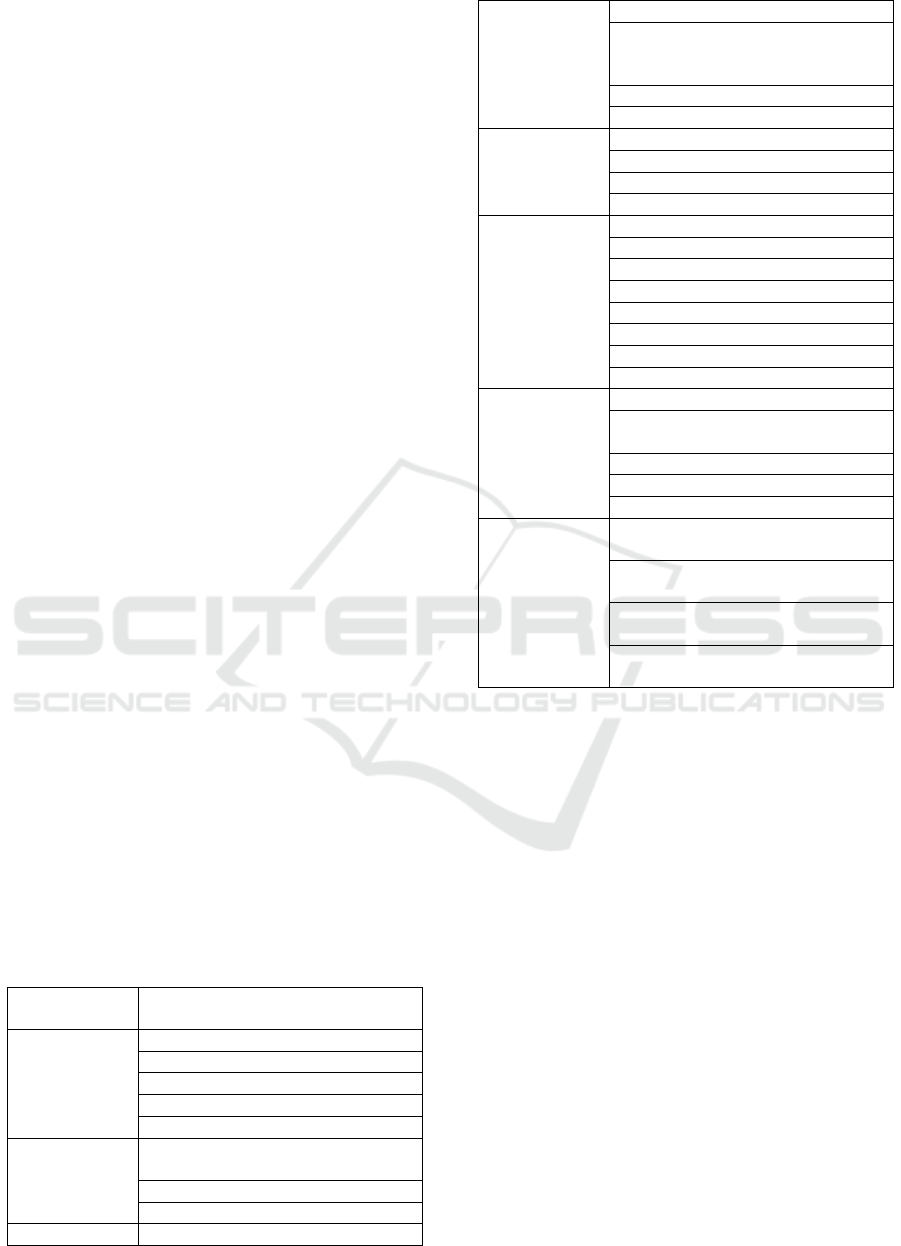

Table 1: Financial indicators system.

Classification

of Indicators

Financial Indicators

Solvency

Indicators

Current ratio

(

x

11

)

Quick ratio

(

x

12

)

Cash ratio (x

13

)

Equity to assets ratio (x

14

)

Working capital to debt (x

15

)

Long term liabilities

to total assets (x

16

)

Fixed assets to total assets (x

17

)

Intangible assets to total assets (x

18

)

Profitabilit

y

Net

p

rofit to total assets

(

x

21

)

Indicators Net

p

rofit to ca

p

ital

(

x

22

)

Profit before interest and tax to

profit before tax + financing

expenses (x

23

)

Gross profit to sales (x

24

)

O

p

eratin

g

p

rofit to sales

(

x

25

)

Operating

Capacity

Indicators

Receivables turnover

(

x

31

)

Inventor

y

turnover

(

x

32

)

Total assets turnover (x

33

)

Working capital turnover (x

34

)

Development

Capacity

Indicators

Cumulative capital ratio (x

41

)

Earnin

g

s

p

er share

g

rowth rate

(

x

42

)

Net

p

rofit

g

rowth rate

(

x

43

)

Self-sustainable growth rate (x

44

)

Income growth rate (x

45

)

Total asset growth rate (x

46

)

Fixed assets

g

rowth rate

(

x

47

)

Intan

g

ible assets

g

rowth rate

(

x

48

)

Cash-flow

Indicators

Free cash flow

(

x

51

)

Cash flow interest

covera

g

e ratio

(

x

52

)

Cash meet investment ratio

(

x

53

)

Cash to o

p

eratin

g

income

(

x

54

)

Cash to net profit (x

55

)

Earnings

Management

Indicators

Accrued earnings

mana

g

ement de

g

ree

(

x

61

)

Real earnings

mana

g

ement de

g

ree

(

x

62

)

Absolute value of

accrued earnings management (x

63

)

Absolute value of

real earnin

g

s mana

g

ement

(

x

64

)

2.2 Construction of Non-Financial

Indicators System

As the traditional financial indicators have many

defects, which can only reflect historical information

and exist hysteresis (Brochet, Loumioti, 2015; Kraft,

Vashishtha,2018). However, non-financial indicators

that have good forward-looking and value relevance

for users of financial statements. They effectively

make up the shortage of traditional financial

indicators. Therefore, we construct non-financial

indicators system, which include marketing

indicators, corporate governance indicators and

auditors’ behaviour indicators. According to signal

transmission theory, if one company suffer financial

distress, which transfer negative signal to market,

and then it will cause negative market response.

Corporate governance is the specific of enterprise’s

internal stable environment. Good corporate

governance will effectively decline agent cost, but

bad corporate governance may cause financial

distress. Sometimes auditors cannot directly decide

one company financial risk, whose behaviour can

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

18

tell us whether the corporate suffer financial distress,

such as raising audit fees, increasing audit delay,

issuing nonstandard audit opinion, and so on.

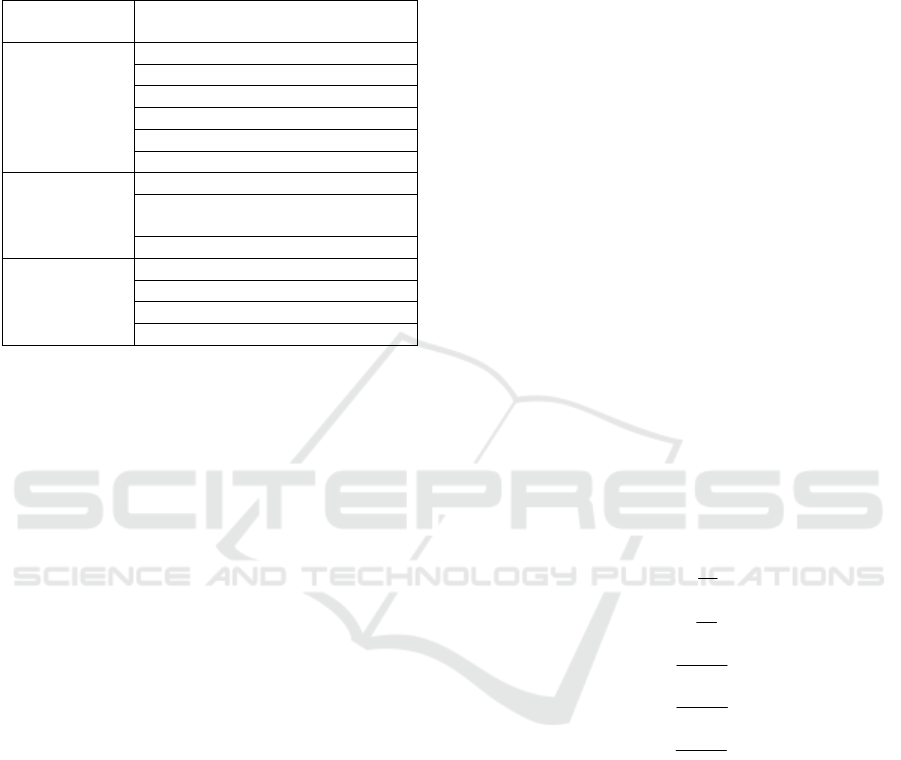

Table 2: Non-Financial indicators system.

Classification

of Indicators

Non-Financial Indicators

Marketing

Indicators

Price earnings ratio (x

71

)

Price to sales (x

72

)

Price to boo

k

(

x

73

)

Dividend declared ratio

(

x

74

)

Earnin

g

s

p

er share

(

x

75

)

Net asset per share (x

76

)

Corporate

Governance

Indicators

Director numbe

r

(x

81

)

Institutional investors

shareholding ratio (x

82

)

Equity concentration (x

83

)

Auditors’

Behaviour

Indicators

Abnormal audit fees (x

91

)

Audit dela

y

(

x

92

)

Nonstandard audit o

p

inion

(

x

93

)

Auditors chan

g

e

(

x

94

)

3 ESTABLISHMENT OF

EARL-WARNING MODEL AND

CALCULATION STEPS

3.1 Establishment of Enterprise

Financial Distress Model Based on

Gradient Boosting Algorithm

Gradient boosting algorithm is an ensemble learning

algorithm that can combine a series of weak

classifiers into a strong classifier. Traditional

machine learning can only establish one learning

model, but ensemble learning can establish a series

learning models and can combine all learning

models together format a committee-based learning

model. Therefore, weaker classifiers can become

strong classifier. We can use training data as

experience knowledge to establish learning model,

which can learn the relationship from input to

output. And then we can use the learning

relationship on test data.

As we all known, no matter financial indicators

or non-financial indicators can alert whether a listed

company happens financial distress or not. But

sometimes the effective of single indicator to do

early-warning is always bad, so we can define the

single indicator as a weak classifier. Therefore, we

design both financial indicators system and non-

financial indicators system, which can seem as a

strong classifier. We use the classifier to predict

whether a company facing financial distress.

Sometimes we cannot obtain the intuitiveness

and accuracy at the same time in one model.

Machine learning algorithm can enhance the

effective of early learning, but it cannot tell us how

to get the results. However, using gradient boosting

algorithm to do the dynamic prediction process

through calculating indicators relative variable

importance (RVI) and the effectiveness indicators of

early warning model. That is to say, gradient

boosting algorithm can get intuitiveness and

accuracy at the same time to some extent. The

calculations of RVI can be given in the form:

1

22

1

() [() ]

J

t

t

TiIVT

ϑ

τϑ

−

=

==

(1)

Where

2

()T

ϑ

τ

is the indicators relative variable

importance (RVI); J-1 is the number of nodes in the

decision tree;

2

[() ]

t

iIVT

ϑ

=

it the classification error

of indicators in i node. The bigger RVI, the better

early-warning effectivity of indicators.

We use true positive rate (TPR), false positive

rate (FPR), and accuracy rate (AR), recall rate (RR)

and precision rate (PR) to calculate the effectiveness

of early warning model. Accuracy rate can be used

to measure accuracy of the model; recall rate can be

used to calculate the probability of Type I error; and

precision rate can be used to estimate the probability

of Type II error. The formulas are shown as follow:

TP

TPR

N

=

(2)

FP

FPR

N

=

(3)

TP TN

AR

N

+

=

(4)

TP

RR

TP FN

=

+

(5)

TP

PR

TP FP

=

+

(6)

Where TP is the ST companies’ number which

is correctly classified by model; FN is the ST

companies’ number which is wrongly classified by

model; FP is the non-ST companies’ number which

is wrongly classified by model; TN is the non-ST

companies’ number which is correctly classified by

model; N is the number of the whole sample.

3.2 Establishment of Enterprise

Financial Distress Calculation

Steps

The aim of gradient boosting algorithm is to train a

strong classifier, which can improve the effect of

early-warning of enterprise financial distress. The

Dynamic Early-Warning of Enterprise Financial Distress Based on Gradient Boosting Algorithm

19

strong classifier is combine with many weak

classifiers. Therefore, how to train a strong classifier

is a problem. The steps are as follow:

Step 1: input training data set;

Step 2: assign the weight of sample point as 1/n;

Step 3: assume there are m financial distress

indicators in total:

Use the training set that was assigned

weight, and get the basic classifier:

{

}

(): 1,1

m

Gxx→−

(7)

Calculate the classification error rate

of G

m

(x) in the training set:

m

e(())

mii

PG x y=≠

(8)

Calculate the coefficient of G

m

:

1

1

log

2

m

m

m

e

a

e

−

=

(9)

Update the weight distribution of

training data set:

m1 1,1 1,2 1,

(, ,, )

mm mn

Dww w

+++ +

=

(10)

,

1,

exp( ( ))

mi

mi mim i

m

w

wayGx

Z

+

=−

(11)

m,

1

exp( ( ))

n

mi m i m i

i

Z

wayGx

=

=−

(12)

Where D

m+1

is the updated weight of training

data set.

Step 4: get a linear combination of weak

classifiers:

1

f( ) ( )

M

mm

m

x

aG x

=

=

(13)

Repeat the above process, finally we can get the

linear combination f(x) of weaker classifier, which is

our strong classifier trained by gradient boosting

algorithm. Using this strong classifier to judge

whether the listed company will have financial crisis

can greatly improve the warning effect.

4 AN ILLUSTRATIVE EXAMPLE

4.1 Data and Sample Selection

Our sample data includes all public listed companies

in the Chinese market between 2007 and 2017. 2007

is the start year because it is the year that newly

Chinese Accounting Standard issued. The relevant

financial data of sample firms are collected from the

China Stock Market and Accounting Research

(CSMAR) database. In order to test the indicators’

differences between ST companies and normal

companies, we select out 404 publicly listed

companies which are the first time to be ST. We

removed financial industry samples and with a large

number of missing data samples. Finally, it keeps

266 publicly listed companies that are the first time

to be ST.

We paired matching companies of the first time

to be ST companies at a ratio of 1:1. The principles

for selecting matching samples are as follows: first,

matching companies and ST companies are in the

same industry; second, the matching companies

always be listed throughout the sample range from

2007 to 2017; third, the matching companies have

never been ST in the entire sample range; fourth,

when it meet the above three conditions, selecting

the companies that closest to the total assets of the

ST company as the matching samples.

4.2 Descriptive Statistics

In order to analyse how to predict operational risks,

we start with the descriptive analysis on showing the

distribution characteristics of indicators, and the

results are presented in Table 3.

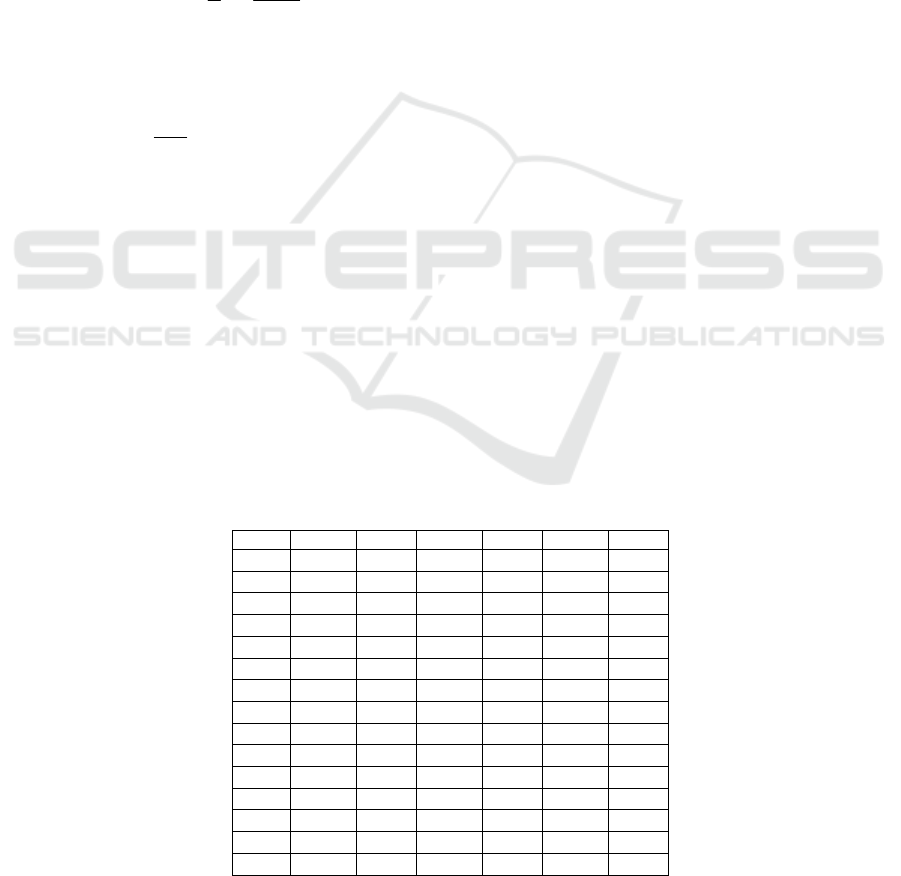

Table 3: Descriptive statistics.

Index Mean1 Med1 Mean2 Med2 Mean3 Med3

x11 1.06 0.78 1.22 0.93 1.42 1.10

x12 0.74 0.50 0.84 0.59 0.99 0.71

x13 0.26 0.13 0.28 0.14 0.38 0.16

x14 -3.61 1.96 2.31 1.60 1.68 1.30

x15 0.55 -0.37 0.71 -0.15 1.97 0.06

x16 0.08 0.02 0.08 0.03 0.07 0.03

x17 0.34 0.35 0.34 0.33 0.31 0.31

x18 0.06 0.04 0.05 0.03 0.05 0.03

x21 -0.13 -0.09 -0.07 -0.06 0.01 0.01

x22 -0.19 -0.10 -0.07 -0.05 0.03 0.03

x23 -0.66 -0.08 -0.25 -0.01 0.13 0.12

x24 0.08 0.07 0.95 1.00 0.67 0.78

x25 -0.86 -0.20 -0.40 -0.11 -0.02 0.01

x31

332.77 5.82 181.96 5.76 403.51 6.29

x32

103.17 3.73 10.71 3.83 26.37 4.13

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

20

x33 0.51 0.43 0.56 0.47 0.63 0.52

x34

0.91 -0.98 -13.76 -0.58 0.48 0.62

x41 -0.35 -0.25 -0.14 -0.12 -0.03 0.02

x42 0.21 0.40 -16.90 -7.31 -0.64 -0.76

x43 -0.12 0.32 -20.11 -6.35 -0.72 -0.65

x44 -0.34 -0.23 -0.16 -0.13 0.03 0.01

x45 -0.07 -0.07 0.13 -0.09 3.35 0.06

x46 -0.07 -0.07 0.00 -0.02 1.22 0.04

x47 -0.03 -0.06 0.26 -0.02 2.75 -0.01

x48 14.77 -0.03 0.74 -0.02 2.29 -0.02

Table 3: Descriptive statistics.

Index Mean1 Med1 Mean1 Med2 Mean3 Med3

x51

4.1E+07 3.6E+6 1.1E+8 1.8E+7 -9.2E+7 8.3E+6

x52 261.19 0.75 3.57 0.73 -1.25 1.48

x53 0.24 0.25 0.28 0.25 0.68 0.24

x54 1.35 1.03 1.06 1.03 1.05 1.03

x55 -1.49 -0.11 -0.05 -0.09 7.54 1.55

x61 -0.09 -0.08 -0.05 -0.04 0.00 0.00

x62 0.06 0.06 0.08 0.07 0.06 0.05

x63 0.11 0.09 0.07 0.06 0.06 0.04

x64 0.12 0.09 0.13 0.10 0.14 0.10

x71 -60.42 -11.72 -33.73 -14.90 174.14 106.03

x72 19.38 3.02 15.00 2.10 7.88 1.99

x73 1.81 4.25 5.51 2.82 3.32 2.30

x74 0.00 0.00 -0.01 0.00 0.18 0.00

x75 -0.78 -0.50 -0.43 -0.33 0.09 0.04

x76 1.67 1.53 2.56 2.22 3.17 2.62

x81 8.82 9.00 9.13 9.00 9.22 9.00

x82 3.40 1.70 3.46 1.97 3.51 2.09

x83 43.37 41.83 45.22 43.69 47.45 46.29

x91 0.01 0.00 -0.04 -0.07 -0.02 -0.03

x92 98.50 108.00 101.26 107.00 92.02 98.00

x93 0.30 0.00 0.18 0.00 0.08 0.00

x94 0.26 0.00 0.19 0.00 0.19 0.00

Where Mean1 is the mean value before one year

of companies’ special treated year; Med1 is the

median value before one year of companies’ special

treated year. From Table 3, it can be seen that the

mean value is smaller than its median value in major

development capacity indicators (x41, x42, …, x48).

That is to say, companies went through negative

growth. Accrued earnings management indicators

are negative, but real earnings management

indicators are positive. Because the cost of accrued

earnings management is lower than real earnings

management. At the beginning of enterprises suffer

financial deteriorate, they tend to pay low cost to do

earnings management. But they have to do the real

earnings management to manipulate the surplus,

which shows the two types of earnings management

methods have a certain substitution effect.

About the value of all non-financial indicators

are go bad from t-3 year to t-1 year. The increase

value of abnormal audit fees, audit delay and

nonstandard audit opinion with the time goes by,

which means that auditors have the demand of

reducing risk.

4.3 Analysis of Indicators Relative

Variable Importance (RVI)

Relative variable importance (RVI) can provide a

reference for executives to improve corporate

performance and avoid financial distress. As we all

known, financial distress is a gradual process, and

different early warning indicators play different

roles before companies’ special treated 3 years.

Therefore, we estimated average score of RVI

respectively, and compared the average score of RVI

in different years. The results of each classification

of indicators are presented in Table 4.

From Table 4, we can get the contribution of

each early-warning indicators through calculating

average score of RVI. Among all early-warning

indicators, profitability indicators contribute most in

gradient boosting algorithm, which also play an

important role in other financial early-warning

models. However, development capacity indicators

and marketing indicators have also made great

Dynamic Early-Warning of Enterprise Financial Distress Based on Gradient Boosting Algorithm

21

contributions in early-warning indicators system,

which usually ignored by a large number of studies.

Table 4: Average score of RVI.

Classification of Indicators t-1 t-2 t-3

Solvency Indicators 5.03 9.65 15.32

Profitabilit

y

Indicators 31.26 14.59 32.98

Operating Capacity

Indicators

11.50 12.27 18.43

Development Capacity

Indicators

23.14 22.22 31.65

Cash-flow Indicators 10.07 10.50 5.99

Earnings Management

Indicators

1.51 4.03 8.58

Marketing Indicators 20.34 21.75 37.09

Corporate Governance

Indicators

6.30 11.43 14.27

Auditors’ Behaviour

Indicators

3.05 4.85 4.85

Besides, the importance of indicators changes

with the time goes by. The importance of some

indicators reduced, such as solvency indicators,

operating capacity indicators, earnings management

indicators, marketing indicators and corporate

governance indicators; however, the importance of

other indicators enhanced, such as cash-flow

indicators.

4.4 Empirical Results

(1) Average results based on gradient boosting

algorithm

We get the results of early-warning from

indicators, such as true positive rate, false positive

rate, accuracy rate, recall rate and precision rate.

From Table 5, we can get the average effectiveness

of early warning model, which estimated by the

percentage of training samples and test samples as

7:3, 8:2 and 9:1. It can be seen accuracy rate

increased with the time near special treatment year.

Each recall rate is higher than accuracy rate and

precision rate, that is to say, the probability of Type

I error is smaller than Type II error in our model

based on gradient boosting algorithm. As we all

known, the cost of Type I error is higher than Type

II error (Lian, 2017). Therefore, the dynamic early-

warning model of enterprise financial distress can

better identify enterprises from all sample

companies, which can help investors, managers and

other enterprise stakeholders to make decisions.

Table 5: Average results based on gradient boosting

algorithm.

Indicators t-1 t-2 t-3 Average

True Positive Rate 0.507 0.510 0.484 0.500

False Positive Rate 0.026 0.049 0.089 0.055

Accuracy Rate 0.900 0.885 0.756 0.847

Recall Rate 0.952 0.913 0.847 0.904

Precision Rate 0.872 0.886 0.758 0.839

(2) Average results based on logit

For further verification early-warning effectivity

of gradient boosting algorithm, we construct a

comparing model based on logit. From Table 6, we

can see all the indicators results in logit model are

lower than gradient boosting algorithm. The result

shows that effectiveness of gradient boosting model

significantly better than logit model. But also the

RVI that reported by gradient boosting can provide

suggestions for improving management.

Table 6: Average results based on logit.

Indicators t-1 t-2 t-3 Average

True Positive Rate 0.431 0.427 0.433 0.430

False Positive Rate 0.154 0.176 0.189 0.173

Accuracy Rate 0.788 0.724 0.680 0.731

Recall Rate 0.797 0.741 0.691 0.743

Precision Rate 0.732 0.715 0.659 0.724

5 CONCLUSIONS

This paper constructs enterprise dynamic early-

warning model based on gradient boosting algorithm

using the data of ST companies and their matching

companies before special treatment 3 years. The

model calculates the relative variable importance

(RVI) of each financial distress indicators, and get

the average results of models. Through comparing

with logit model, the results show that model based

on gradient boosting algorithm can get better

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

22

warning results. This study provides a more accurate

method for enterprise dynamic early-warning, which

can provide reference for users of financial

statements improve financial situation, change

investment strategy and so on.

ACKNOWLEDGEMENTS

Supported by the Discipline Group of "Urban Circle

Economy and Industrial Integration Management" of

Jianghan University.

REFERENCES

Alaka, H. A., L. O. Oyedele, H. A. Owolabi, V. Kumar, S.

O. Ajayi, O. O. Akinade & M. Bilal (2018) Systematic

review of bankruptcy prediction models. Expert

Systems with Applications: An International Journal.

Altman, E. I. (1968) Financial ratios, discriminant analysis

and the prediction of corporate bankruptcy. The

journal of finance, 23, 589-609.

Barboza, F., H. Kimura & E. Altman (2017) Machine

learning models and bankruptcy prediction. Expert

Systems with Applications, 83, 405-417.

Breiman, L. (2001) Random forests. Machine learning, 45,

5-32.

Brochet, F., M. Loumioti & G. Serafeim (2015) Speaking

of the short-term: Disclosure horizon and managerial

myopia. Review of Accounting Studies, 20, 1122-

1163.

Brockett, P. L., A. Charnes, W. W. Cooper, D. Learner &

F. Y. Phillips (1995) Information theory as a unifying

statistical approach for use in marketing research.

European Journal of Operational Research, 84, 310-

329.

Deakin, E. B. (1972) A discriminant analysis of predictors

of business failure. Journal of accounting research,

167-179.

Desai, H., S. Rajgopal & J. J. Yu (2016) Were information

intermediaries sensitive to the financial

statement‐based leading indicators of bank distress

prior to the financial crisis? Contemporary Accounting

Research, 33, 576-606.

Kraft, A. G., R. Vashishtha & M. Venkatachalam (2018)

Frequent financial reporting and managerial myopia.

The Accounting Review, 93, 249-275.

Sharda, R. & D. M. Steiger (1995) Using artificial

intelligence to enhance model analysis., 263-279.:

Springer.

Dynamic Early-Warning of Enterprise Financial Distress Based on Gradient Boosting Algorithm

23