Big Data Financial Analysis of BYD Company Profitability Based on

Power BI Software

Tieping Wang

Department of Economics and Management, Taishan University Tai’an, China

Keywords: Big Data, Profitability, Financial Analysis.

Abstract: Big data financial analysis comprehensively considers all the information of the company and can

comprehensively reflect the financial status of the company. This paper uses Power BI software to present

the results of big data financial analysis on BYD's profitability; using industry analysis and trend analysis, it

analyzes BYD's profitability from three aspects: capital profitability, asset profitability and commodity

profitability. The industry analysis method can be used to observe the current level of BYD in the industry,

compare the company's five-year average, judge the company's development status, and study the strengths

and weaknesses of the target company's capabilities; the trend diagram method can be used to observe BYD

in different time periods. Changes in indicators, find out the hidden problems in the company's operation

process, analyze the reasons for changes and put forward optimization suggestions.

1 INTRODUCTION

Big data financial analysis is the fusion of big data

technology and financial analysis. Different from

traditional financial analysis, it adopts big data

technology, comprehensively analyzes the financial

information and non-financial information of the

enterprise, and reflects the financial status of the

enterprise more comprehensively (George, 2014).

Big data financial analysis through PowerBI

software can connect relevant data sources and

generate multi-dimensional financial statements in

real time, which is convenient for accounting

information users to view the company's trend

changes over the years, compare trends with

industry competitors, find the company's

shortcomings and improve them to improve

company achievements (Kaufmann, 2001). The use

of PowerBI software greatly improves the work

efficiency of financial personnel (Fan, 2014).

This paper uses PowerBI software to conduct big

data financial analysis on BYD, which can build

multi-dimensional analysis models and make instant

financial statements. BYD's 2020 operating income

is 156,597,691,000yuan, an increase of

28,859,167,900 yuan compared with the previous

year's operating income, and the operating income

growth rate is 22.59%. The net profit in 2022 will be

6,013,963,000yuan, an increase of 3,895,106,000

yuan compared with the previous year's net profit.

The growth rate was 183.83%. BYD's revenue and

profits have grown, and its overall performance has

been on the rise. In 2020, the operating income

growth rate of BYD's automobile manufacturing

industry is 3.52%, and the net profit growth rate is

22.23%. At present, the overall performance of the

industry is on the rise. This paper takes BYD as the

research object, and analyzes BYD's profitability

from three aspects: capital profitability, asset

profitability and commodity profitability.

2 CAPITAL PROFITABILITY

ANALYSIS

Profitability of capital operation refers to the ability

of the company to obtain profit by investing in

capital operation (Revsine, 2012). ROE is a core

indicator reflecting profitability.

Wang, T.

Big Data Financial Analysis of BYD Company Profitability Based on Power BI Software.

DOI: 10.5220/0012023300003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 49-54

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

49

Table 1: Profitability Indicators.

Classification Index

2020 Average 2016-2020

BYD

Automotive

Manufacturing

SAIC BYD

Automotive

Manufacturing

SAIC

Capital

profitability

ROE 9.47% 6.56% 9.55% 7.86% 10.18% 15.46%

Asset

profitability

ROA 3.47% 3.11% 4.06% 4.45% 5.39% 6.92%

Commodity

profitability

Net

sales

margin

3.84% 3.35% 4.04% 3.63% 4.68% 5.03%

Cash to

sales

ratio

88.55% 91.79% 88.19% 85.19% 98.03% 103.03%

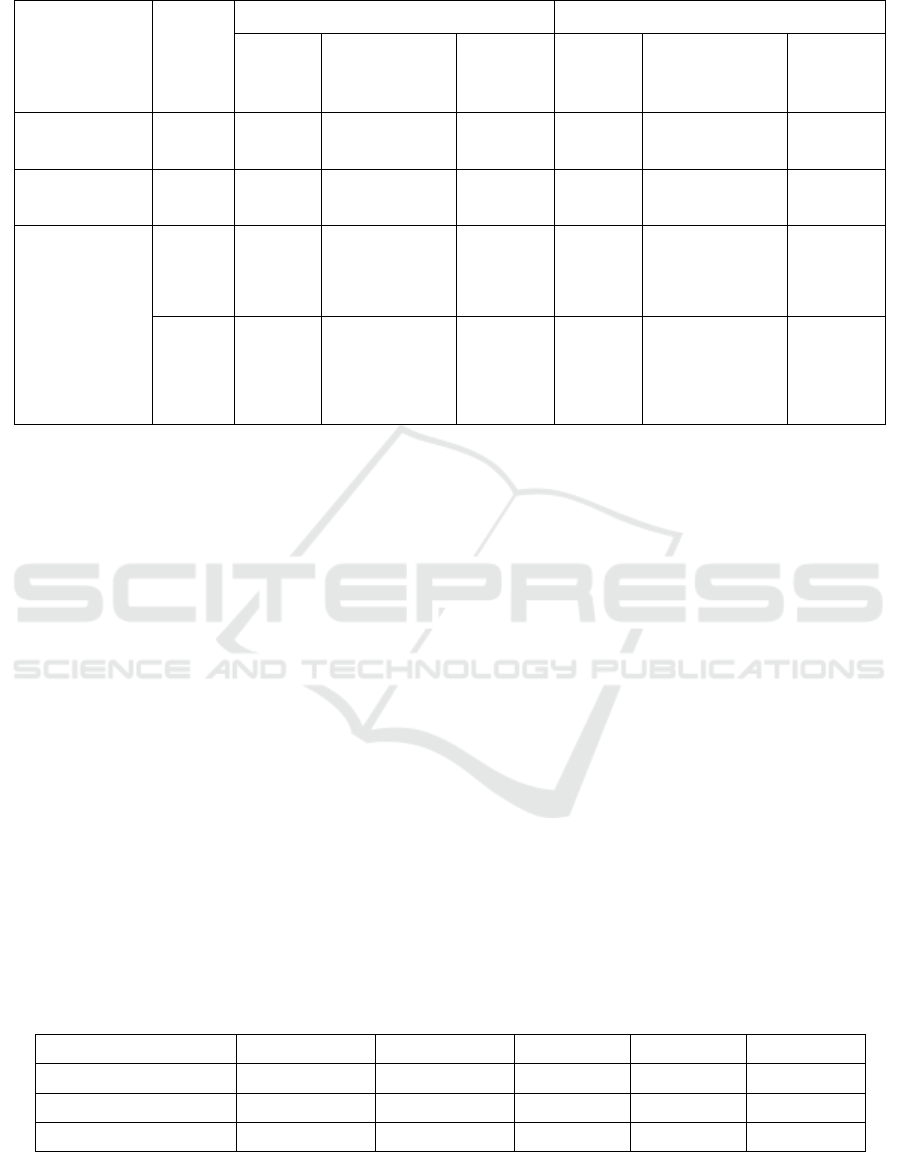

2.1 Change Trend of ROE

As shown in Figure 1, BYD's ROE generally

showed a downward trend from 2016 to 2019, from

11.98% to 3.43%. From 2019 to 2020, there was a

substantial growth trend, from 3.43% to 9.46%.

BYD's five-year average is only 7.86%. From 2016

to 2019, the ROE of BYD, the automobile

manufacturing industry and the benchmarking

company SAIC all showed a downward trend. The

average ROE of BYD over the years is 4 percentage

points lower than the average ROE of the industry

over the years, and the average ROE of the

automobile manufacturing industry is nearly 4

percentage points lower than that of the benchmark

company SAIC. In 2020, after BYD's ROE rose, it

was on par with the benchmark company SAIC. The

ROE of the automobile manufacturing industry is in

line with the downward trend of the benchmark

company SAIC, and the profitability of capital is

declining year by year. SAIC's ROE has shown a

downward trend over the years. Its five-year average

ROE is still as high as 15.46%, and the industry's

five-year average ROE is 10.18%.

2.2 BYD's Capital Profitability

ROE is equal to net profit divided by average net

assets, also known as net interest rate on equity

(Gibson, 2013). ROE, as an indicator of capital

profitability, reflects the profitability of all invested

funds. The higher the ROE, the stronger the

profitability of BYD, and vice versa. The ROE

indicator is the core indicator reflecting profitability.

BYD's ROE generally showed a downward trend

from 2016 to 2019, and increased from 2019 to

2020. From 2016 to 2019, ROE dropped

significantly to 3.43%, and BYD's capital

profitability was relatively weak. In 2020, BYD's

capital profitability has been greatly improved, and

the utilization efficiency of shareholders' invested

capital has been significantly improved.

Table 2: Change trend of ROE.

ROE 2016 2017 2018 2019 2020

BYD 11.98% 8.52% 5.89% 3.43% 9.46%

Industry 15.18% 13.72% 9.79% 5.64% 6.56%

SAIC 19.71% 18.57% 17.38% 12.05% 9.55%

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

50

Figure 1: Change trend of ROE.

3 ASSET PROFITABILITY

ANALYSIS

Asset management capability refers to the ability of

the company to operate assets and generate profits.

ROA reflects the profitability of asset management.

3.1 The Changing Trend of ROA

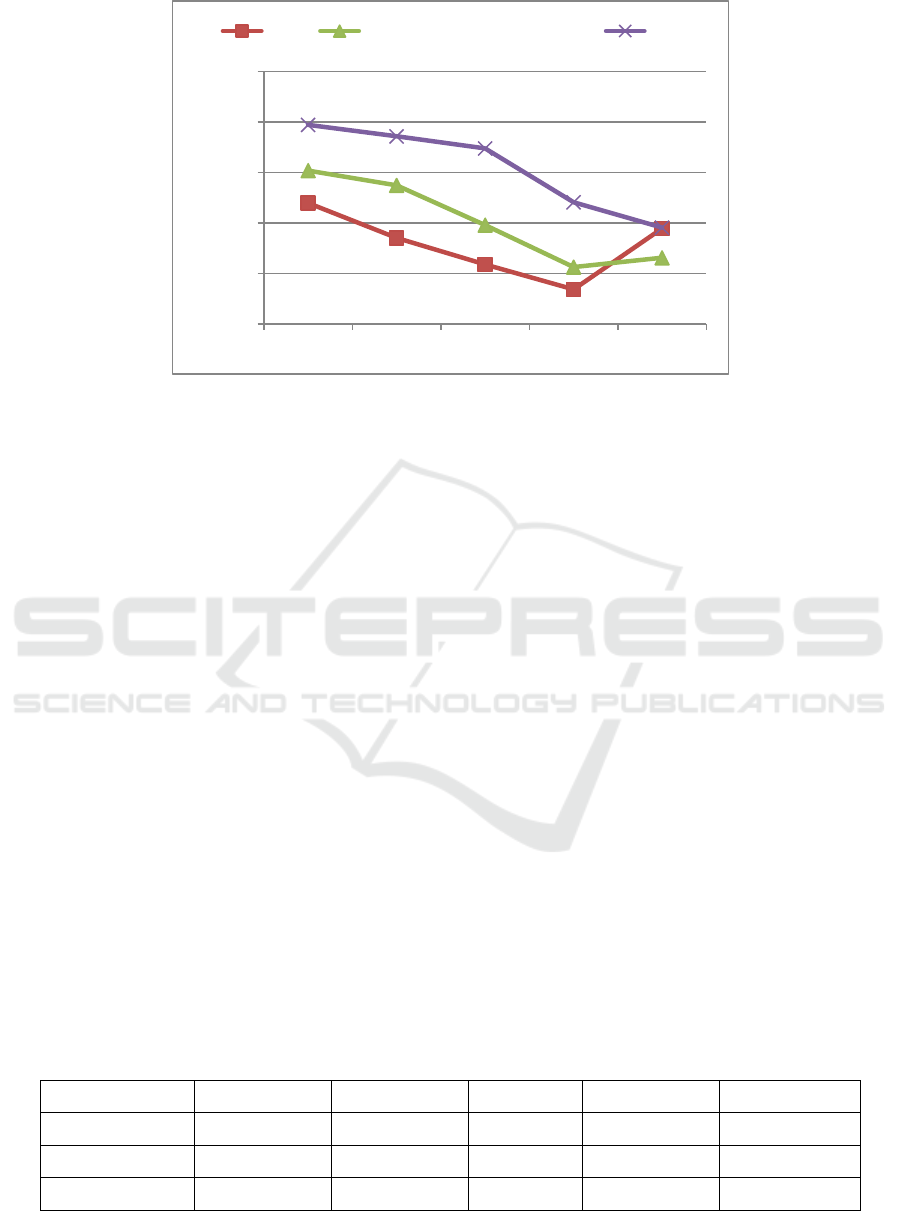

As shown in Figure 2, BYD's ROA generally

showed a downward trend from 2016 to 2019, and

the decline in five years was relatively obvious,

from 6.52% in 2016 to 3.13% in 2019, and ROA

increased slightly from 2019 to 2020, rising to

3.47 %. BYD's five-year average ROA is 4.45%.

From 2016 to 2020, the industry ROA of BYD's

auto manufacturing industry showed a downward

trend, from 7.90% in 2016 to 3.11% in 2020. The

five-year average ROA of the automobile

manufacturing industry is 5.39%. The change trend

of ROA of the benchmark enterprise SAIC is in line

with the industry, from 9.29% in 2016 to 4.06% in

2020. The five-year average ROA of SAIC is

6.92%.

3.2 BYD's Asset Profitability

ROA is equal to EBIT divided by average total

assets. The higher the ROA, the stronger the asset

profitability of the company, and vice versa. When

only operating conditions are considered, ROA

reflects the benefits of management's management

of all assets, that is, management's ability to create

value from the company's existing resources.

Although the ROA trend of BYD, the automobile

manufacturing industry and SAIC is in the same

downward trend, the decline rate of BYD is

significantly slower than that of the other two

parties. At the same time, BYD achieved a slight

increase in ROA in 2020 (3.47%), which is higher

than the industry ROA of 3.11%, and the gap with

SAIC is also small (4.06%). The asset profitability

of the auto manufacturing industry is generally low.

The profitability of BYD's assets in the last five

years is not strong, although there will be a slight

rebound in 2020, which needs the attention of

BYD's management.

Table 3: Change trend of ROA.

ROA 2016 2017 2018 2019 2020

BYD 6.52% 4.97% 4.15% 3.13% 3.47%

Industry 7.90% 7.15% 5.43% 3.41% 3.11%

SAIC 9.29% 8.47% 7.47% 5.27% 4.06%

0,00%

5,00%

10,00%

15,00%

20,00%

25,00%

2016 2017 2018 2019 2020

BYD Automotive Manufacturing SAIC

Big Data Financial Analysis of BYD Company Profitability Based on Power BI Software

51

Figure 2: Change trend of ROA.

4 PRODUCT PROFITABILITY

The profitability of commodity operation does not

consider the financing or investment of the

enterprise, and only studies the ratio between profit

and income or cost. In this paper, the net profit ratio

of sales and the ratio of cash sales are used to reflect

the profitability of commodities.

4.1 Change Trend of Net Sales Margin

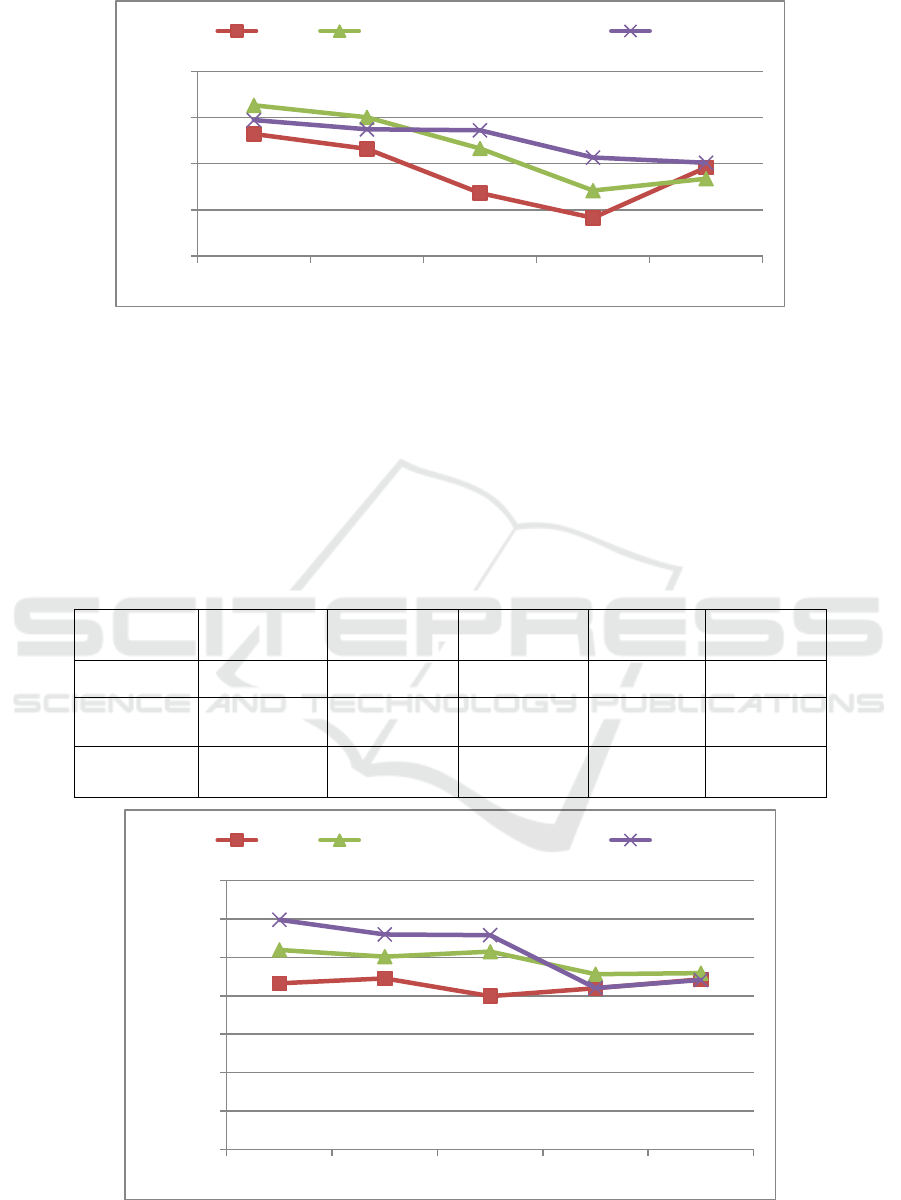

As shown in Figure 3, BYD's net sales margin from

2016 to 2019 generally showed a downward trend,

and the decline in the five years was relatively

obvious, from 5.29% in 2016 to 1.66% in 2019, and

the net sales margin from 2019 to 2020. It increased

slightly to 3.84%. The five-year average of BYD's

net sales margin is 3.63%. From 2016 to 2019, the

net sales margin of BYD's auto manufacturing

industry showed a downward trend, from 6.53% in

2016 to 2.84% in 2020. From 2019 to 2020, the net

sales margin in the automobile manufacturing

industry increased slightly to 3.35%. The average

five-year sales net sales margin of the automobile

manufacturing industry is 4.68%. The net sales

margin of benchmark company SAIC showed a

gradual downward trend, from 5.89% in 2016 to

4.04% in 2020. The five-year average of SAIC's net

sales margin is 5.03%.

Table 4: Change trend of Net sales margin.

Net sales margin 2016 2017 2018 2019 2020

BYD 5.29% 4.64% 2.73% 1.66% 3.84%

Industry 6.53% 6.01% 4.66% 2.84% 3.35%

SAIC 5.89% 5.49% 5.45% 4.27% 4.04%

0,00%

1,00%

2,00%

3,00%

4,00%

5,00%

6,00%

7,00%

8,00%

9,00%

10,00%

2016 2017 2018 2019 2020

BYD Automotive Manufacturing SAIC

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

52

Figure 3: Change trend of Net sales margin.

4.2 Change Trend of the Cash-to-Sales

Ratio

As shown in Figure 4, BYD's cash-to-sales ratio was

generally stable from 2016 to 2020, fluctuating

within the range of 79.82% to 88.55%. The five-year

average of BYD's cash-to-sales ratio is 85.19%.

From 2016 to 2018, the cash-to-sales ratio of BYD's

auto manufacturing industry was relatively stable,

fluctuating between 100.34% and 103.84%. The

average five-year cash-to-sales ratio of the

automobile manufacturing industry is 98.03%. The

cash-to-sales ratio of the benchmark company SAIC

has shown a downward trend, from 119.48% in

2016 to 88.19% in 2020. The five-year average of

SAIC's cash-to-sales ratio is 103.03%.

Table 5: Trends in Cash to Sales Ratio.

2016 2017 2018 2019 2020

BYD 86.44% 89.07% 79.82% 83.89% 88.55%

Industry 103.84% 100.34% 102.92% 91.27% 91.79%

SAIC 119.48% 111.89% 111.50% 84.07% 88.19%

Figure 4: Trend of Cash to Sales Ratio.

0,00%

2,00%

4,00%

6,00%

8,00%

2016 2017 2018 2019 2020

BYD Automotive Manufacturing SAIC

0,00%

20,00%

40,00%

60,00%

80,00%

100,00%

120,00%

140,00%

2016 2017 2018 2019 2020

BYD Automotive Manufacturing SAIC

Big Data Financial Analysis of BYD Company Profitability Based on Power BI Software

53

4.3 BYD's Commodity Profitability

The net profit rate of sales is equal to the ratio of net

profit to operating income. From 2016 to 2019, the

sales net profit margin of BYD and the automobile

manufacturing industry showed a similar downward

trend. BYD's sales net profit margin was always 1%

lower than the industry average, and SAIC's sales

net profit margin was generally better than the

industry average. In 2019, the inflection point of

BYD's sales net profit margin appeared, rising to

3.84% in 2020, basically the same as SAIC's 4.04%,

and higher than the industry average of 3.35%.

Although BYD is comparable to benchmark

companies, BYD's sales net profit margin is still

low, and the overall profitability of goods in the auto

manufacturing industry has declined.

The cash-to-sales ratio is equal to the cash

received from the sale of goods and services,

divided by the operating income. The higher the

cash-to-sales ratio, the stronger the company's

ability to obtain cash through sales, the good sales

situation of the company's products, the reasonable

credit policy, the timely recovery of payment for

goods, and the effective collection of payments.

From 2016 to 2020, BYD's cash-to-sales ratio has a

relatively stable change trend, and the fluctuation

range is also relatively flat, which is generally lower

than the industry average and SAIC. BYD's

commodity profitability indicator was little changed.

5 CONCLUSIONS

The paper uses Power BI software to carry out big

data financial analysis of Vanke's solvency. The

conclusions are as below. This paper uses industry

analysis and trend analysis to analyze BYD's

profitability. Compared with SAIC, a benchmark

company in the automobile manufacturing industry,

BYD's performance in 2020 is very good, and its

profitability has risen sharply, which is basically the

same as SAIC and higher than the industry average.

But at the same time, it should be noted that the

overall profitability of the automobile manufacturing

industry is on a downward trend, and even the

profitability of SAIC, the leading enterprise, is not

high. The increase in the cost of automobile

manufacturing has led to a decline in profits. It is

necessary to strengthen cost management, reduce

expenses, and increase corporate profits.

ACKNOWLEDGEMENT

The thesis is the result of the Taishan University

Introduced Talents Scientific Research Start-up

Fund Project.

REFERENCES

Fan, J., F. Han and H. Liu, Challenges of big data

analysis. National science review, 2014. 1(2): p.

293-314.

George, G., M.R. Haas and A. Pentland, Big data and

management. 2014, Academy of Management

Briarcliff Manor, NY. p. 321-326.

Gibson, C.H. and P.A. Boyer, Financial statement

analysis. 2013.

Kaufmann, R., A. Gadmer and R. Klett, Introduction to

dynamic financial analysis. ASTIN Bulletin: The

Journal of the IAA, 2001. 31(1): p. 213-249.

Revsine, L., et al., Financial reporting and analysis. 2012:

McGraw Hill.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

54