Big Data Financial Analysis of Vanke's Solvency Based on Power BI

Software

Tieping Wang

Department of Economics and Management, Taishan University Tai’an, China

Keywords: Big Data, Solvency, Power BI.

Abstract: Big data financial analysis is the specific application of big data information technology in financial analysis.

Power BI software can be used for visualization of the company's big data financial analysis. Solvency

analysis allows firm managers, investors, creditors to understand the financial status and financial risk of the

firm. The paper uses Power BI software to conduct big data financial analysis on Vanke’s solvency. The

paper adopts the industry analysis method and trend analysis method, and takes the real estate industry and

the industry's leading Greenfields as the reference objects, and conducts an in-depth analysis of Vanke.

From 2016 to 2020, Vanke's short-term solvency index was lower than the industry average and empirical

value, and the short-term financial risk was relatively large; the long-term solvency gradually improved, but

it was still lower than the overall level of the industry.

1 INTRODUCTION

Big data financial analysis is the application of big

data information technology in financial analysis.

Big data technology enables the availability of data

and enables real-time financial reporting (George,

2014). Big data financial analysis comprehensively

analyzes relevant data information available,

including non-financial information that is not

available in traditional financial analysis. Big data

financial analysis can make a more comprehensive

evaluation of corporate finance than traditional

financial analysis. It is a combination of accounting

and information engineering (Koop, 2006). Through

specialized techniques and methods, it collects,

prepares and analyzes financial and non-financial

data inside and outside the company to better meet

the needs of accounting information users.

Power BI software can be used for visualization

of the company's big data financial analysis

(McAfee, 2012). It can easily realize horizontal

analysis, structural analysis and trend analysis of

enterprise balance sheet and income statement;

provide powerful multi-dimensional analysis of

accounting projects; budget analysis; DuPont

analysis and other functions. Through the mouse,

you can drill down to the sub-ledgers and vouchers

at will, and you do not need to master the

complicated operations of financial software. It

breaks through many defects such as cumbersome,

rigid, and no charts in the setting of fixed report

forms, and helps enterprises transform from

book-keeping financial management to analytical

financial management.

This paper uses Power BI software to conduct

big data financial analysis on Vanke's solvency. It

uses the industry analysis method and the trend

diagram method to analyze the short-term solvency

of Vanke's ability to pay current liabilities and the

long-term solvency of non-current liabilities.

Solvency analysis can not only allow firm operators,

investors, creditors, etc. to understand the firm's

financial status and the level of financial risks that

the firm takes, but also predict the firm's prospects

and provide an important reference for the firm to

carry out various financial activities.

2 SHORT-TERM SOLVENCY

The indicators that reflect the short-term solvency of

the firm are based on the analysis of the relationship

between the firm's current assets and current

liabilities. Short-term solvency is analyzed by the

current ratio, quick ratio and cash ratio. Vanke

belongs to the real estate industry, and the industry

Wang, T.

Big Data Financial Analysis of Vanke’s Solvency Based on Power BI Software.

DOI: 10.5220/0012023600003620

In Proceedings of the 4th Inter national Conference on Economic Management and Model Engineering (ICEMME 2022), pages 61-66

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

61

leader is Greenland Firm. This article uses

Greenland as the benchmark to conduct industry

analysis by comparing Vanke with the real estate

industry and Greenland Firm, and conduct trend

analysis by comparing the firm's data from 2016 to

2020.

Table 1: Short-term solvency indicators.

Short-term solvency

2020 Average 2016-2020

Vanke Real estate Greenland Vanke Real estate Greenland

Current ratio 1.17 1.39 1.19 1.18 1.47 1.28

Quick ratio 0.41 0.48 0.49 0.45 0.50 0.43

Cash ratio 0.14 0.18 0.1 0.16 0.21 0.12

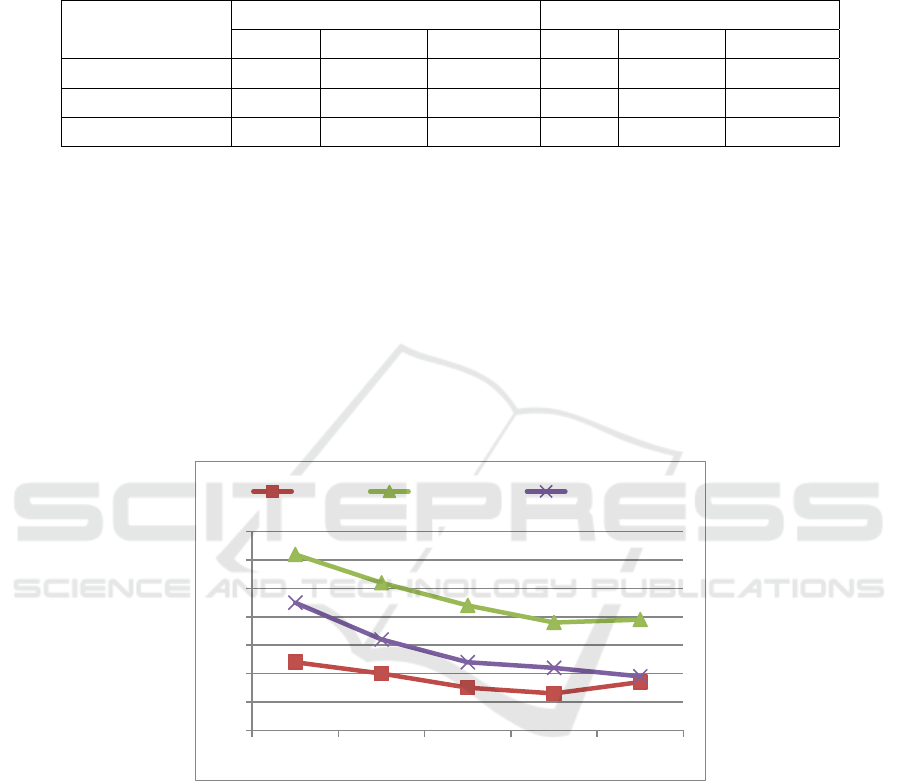

2.1 Current Ratio

Current ratio equals current assets divided by current

liabilities. It is generally believed that this indicator

should reach 2 or more (Koop, 2006). As shown in

Figure 1, the current ratios of Vanke, Real Estate

and Greenland are all lower than 2, indicating that

the overall short-term solvency of the real estate

industry is weak. Vanke's current ratio changed little

from 2016 to 2020. The firm's current ratio was 1.24

in 2016 and 1.13 in 2018. Vanke's current ratio

fluctuated between 1.13 and 1.24 over the years.

From 2019 to 2020, the current ratio was fine-tuned

from 1.13 to 1.17. The average current ratio of

Vanke over the years is less than the average current

ratio of the industry and benchmark Greenland

companies over the years. The industry to which

Vanke belongs is the real estate industry. The

change in the current ratio of the real estate industry

was relatively small from 2016 to 2020.The average

current ratio of the real estate industry over the years

is 1.28.

Figure 1: Current ratio from 2016 to 2019.

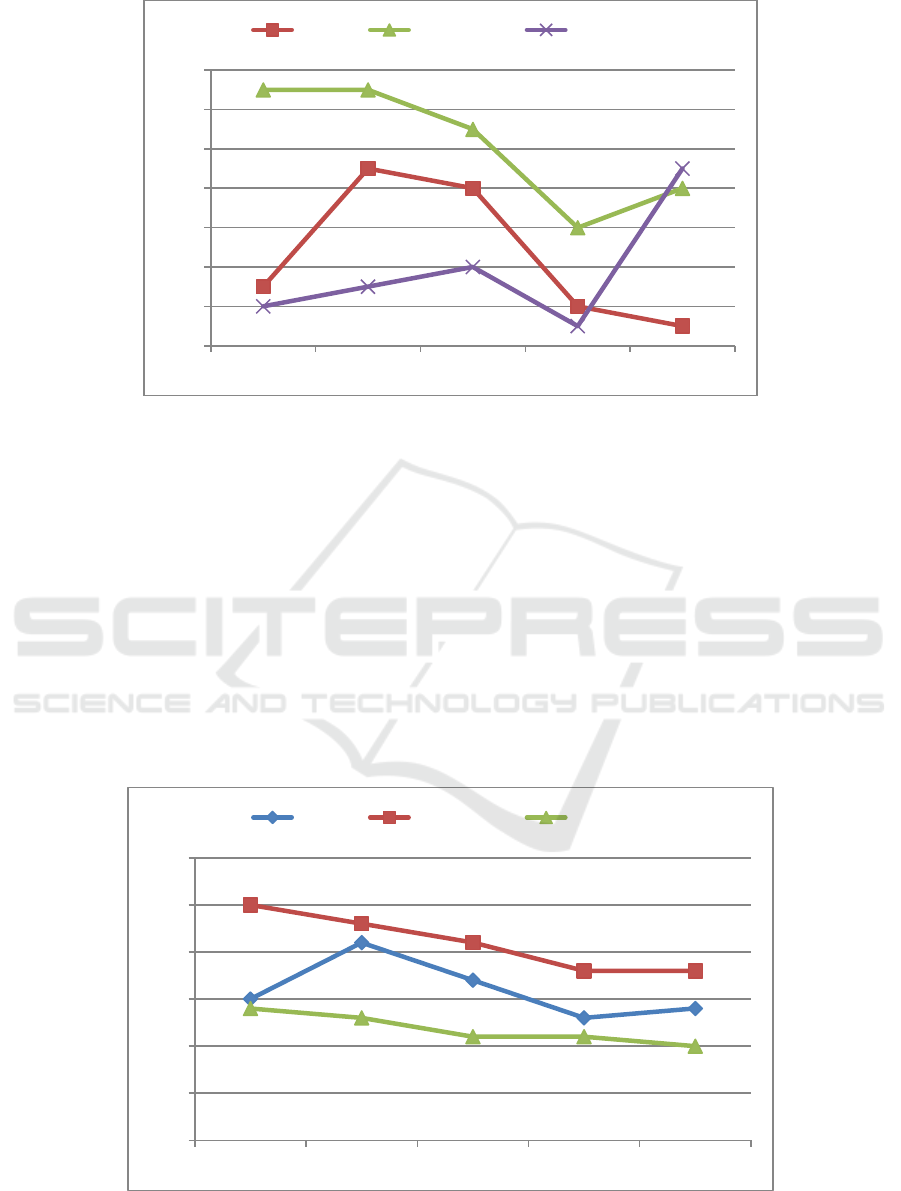

2.2 Quick Ratio

Quick ratio evaluates the short-term solvency of a

firm, eliminates the influence of inventory and other

current asset items with poor liquidity (Schroeder,

2019). The indicator should reach 1. If the quick

ratio is less than 1, it indicates that the solvency is

poor, but the analysis should be combined with other

factors to evaluate. As can be seen from Figure 2,

the quick ratios of the real estate industry, Vanke

and Greenland are all lower than 1, indicating that

the overall short-term solvency of the real estate

industry is weak and the financial risk is relatively

high. From 2017 to 2020, Vanke showed a

downward trend of change. The firm's quick ratio

value fluctuated between 0.41 and 0.49, and the

firm's average quick ratio over the years was 0.45.

In the real estate industry of Vanke, the quick ratio

of the real estate industry dropped from 0.53 to 0.46

from 2016 to 2019, and rose slightly to 0.48 in 2020,

with little change over the years. The five-year

average of the real estate quick ratio is 0.50.

1,24

1,2

1,15

1,13

1,17

1,62

1,52

1,44

1,38

1,39

1,45

1,32

1,24

1,22

1,19

1

1,1

1,2

1,3

1,4

1,5

1,6

1,7

2016 2017 2018 2019 2020

Vanke Real estate Greenland

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

62

Figure 2: The change trend of quick ratio.

2.3 Cash Ratio

When the firm is faced with the need for a large

amount of cash on the day of paying wages or the

day of bulk purchase, the cash ratio can show its

important role, because the cash ratio does not take

into account the inventory and demand in the current

assets of the firm. Therefore, this indicator is

particularly important for companies that have

problems with receivables and inventory realization.

Due to the low profitability of the firm's cash assets,

it is impossible and unnecessary for the firm to keep

too many cash assets. High, indicating that the

liquidity raised by the firm through debt has not

been fully utilized, so the firm is not encouraged to

retain more cash assets. This ratio should be around

20%. As shown in Figure 3, the change in Vanke's

cash ratio from 2016 to 2020 showed a slight

increase at first, then a decrease, and a slight upward

trend. The cash ratios have fluctuated between 0.13

and 0.21 over the years. The average annual cash

ratio of Vanke was 0.16. In the real estate industry

to which Vanke belongs, the cash ratio of the real

estate industry has shown a downward trend over

the years, ranging from 0.25 to 0.18. The industry

average cash ratio over the years is 0.21.

Figure 3: The change trend of cash ratio.

0,43

0,49

0,48

0,42

0,41

0,53 0,53

0,51

0,46

0,48

0,42

0,43

0,44

0,41

0,49

0,4

0,42

0,44

0,46

0,48

0,5

0,52

0,54

2016 2017 2018 2019 2020

Vanke Real estate Greenland

0,15

0,21

0,17

0,13

0,14

0,25

0,23

0,21

0,18 0,18

0,14

0,13

0,11 0,11

0,1

0

0,05

0,1

0,15

0,2

0,25

0,3

2016 2017 2018 2019 2020

Vanke Real estate Greenland

Big Data Financial Analysis of Vanke’s Solvency Based on Power BI Software

63

Vanke's short-term solvency indicators all

showed a downward trend from 2017 to 2020, and

the three trends changed in the same direction, and

they were all lower than industry values and

experience values. Vanke's short-term solvency is

weak.

3 LONG-TERM SOLVENCY

The long-term solvency is analyzed in terms of

asset-liability ratio, equity ratio, shareholders' equity

ratio.

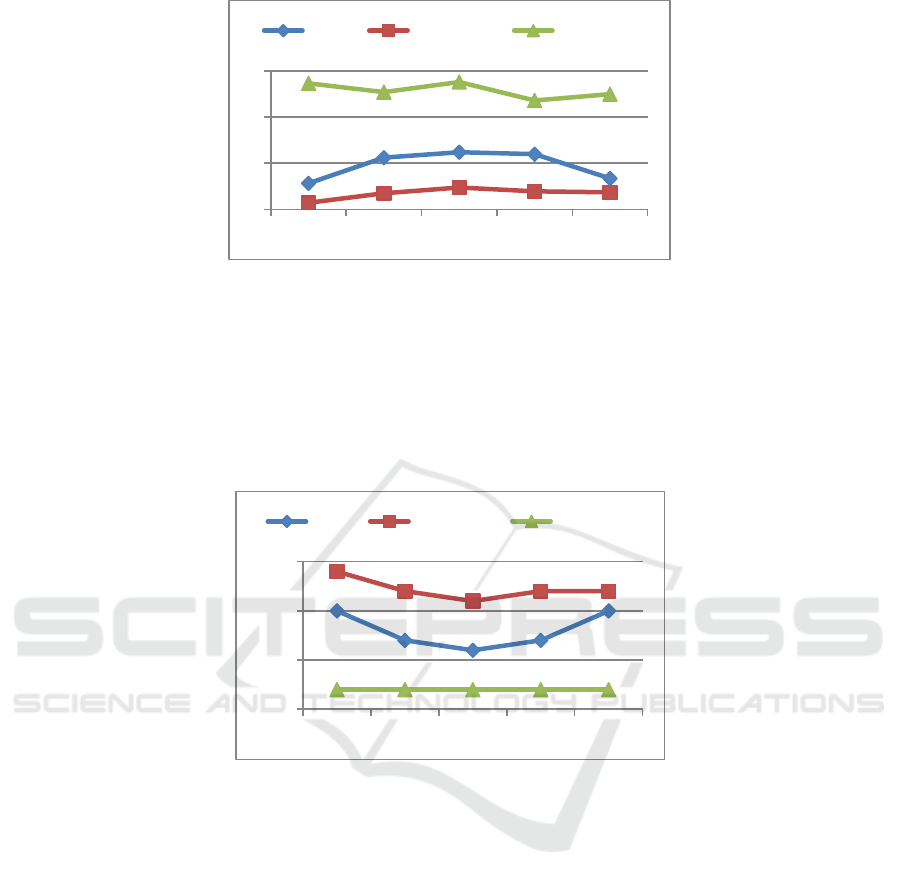

3.1 Asset-Liability Ratio

Asset liability ratio is an indicator reflecting the debt

burden of an firm. The appropriate level of asset

liability ratio is 40% - 60%. As shown in Figure 4,

Vanke's asset liability ratio changed significantly

from 2016 to 2020. Vanke's asset liability ratio

ranges from 81% to 85%, with a five-year average

of 83%. Vanke's asset liability ratio in 2020 is lower

than that in 2018, indicating that the debt burden in

2020 is slightly lower than that in 2018. According

to the empirical value, Vanke's total asset liability

ratio is too large, and the risk of long-term solvency

is large. The average ratio of Vanke over the years is

83%, and the average asset liability ratio of real

estate industry and benchmark Greenland over the

years are 79% and 89% respectively. The long-term

financial risk of Vanke is less than Greenland firm

and higher than the industry average.

Table 2: Long-term solvency indicators.

Long-term solvency

2020 Average 2016-2020

Vanke Real estate Greenland Vanke Real estate Greenland

Asset-liability ratio 0.81 0.79 0.89 0.83 0.79 0.89

Equity ratio 4.34 3.74 7.99 4.92 3.68 8.16

Shareholders' equity ratio 0.19 0.21 0.11 0.17 0.21 0.11

Figure 4: The change trend of asset liability ratio.

3.2 Equity Ratio

Vanke's equity ratio changed significantly from

2016 to 2020. Vanke's equity ratio varies between

4.13 and 5.48. Vanke's ownership ratio over the

years is 4.92. The equity ratio of the real estate

industry changes gently, and the equity ratio

changes from 3.29 to 3.95 over the years. Vanke's

average equity ratio is higher than the industry

average. Vanke and the industry's ownership ratio

over the years are lower than that of Greenland firm.

3.3 Shareholder Equity Ratio

The shareholders equity ratio is an indicator

reflecting the guarantee degree of solvency, which

indicates how many of the total assets of the firm are

formed by the investment of investors. Vanke's

shareholder equity ratio changed significantly over

the years from 2016 to 2020.

81,00%

84,00%

85,00%

84,00%

81,00%

76,00%

78,00%

79,00% 79,00%79,00%

89,00% 89,00% 89,00%

88,00%

89,00%

75,00%

80,00%

85,00%

90,00%

2016 2017 2018 2019 2020

Vanke Real estate Greenland

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

64

Figure 5: The change trend of equity ratio.

The shareholder equity ratio varied between 0.15

and 0.19, and the average shareholder equity ratio of

Vanke industry over the years was 0.1. The smaller

the equity ratio index of Vanke shareholders, the

smaller the proportion of equity capital, and the

greater the risk of debt repayment. The shareholder

equity ratio of Vanke's real estate industry fluctuated

slightly from 2016 to 2020, ranging from 0.2 to 0.23.

The average shareholder equity ratio of the real

estate industry over the years is 0.21. Vanke's

shareholders' equity ratio over the years is slightly

lower than that of the industry, but higher than the

average equity ratio of Greenland firm over the

years of 0.11.

Figure 6: The change trend of shareholders' equity ratio.

The asset liability ratio is an indicator reflecting

the debt burden of the firm, and the shareholder

equity ratio is an indicator reflecting the degree of

debt repayment guarantee. Equity ratio has the same

economic significance as asset liability ratio and

shareholder equity ratio, but among the three, the

equity interest rate index more intuitively shows the

degree of protection of liabilities from shareholder

equity. Generally speaking, the equity ratio shows

the degree of firm loan operation. Vanke's asset

liability ratio, shareholder's equity ratio and equity

ratio changed little from 2016 to 2020. From 2018 to

2020, Vanke's asset liability ratio and equity ratio

showed a downward trend, and the shareholder's

equity ratio showed an upward trend. The asset

liability ratio and equity ratio show the same change

trend, and the shareholder's equity ratio and asset

liability ratio show the opposite change trend. From

2016 to 2020, Vanke's asset liability ratio has always

been higher than that of the real estate industry. The

greater the asset liability ratio, the higher the degree

of debt; Vanke's equity ratio has always been higher

than that of the real estate industry, and Vanke's

liabilities receive less protection from shareholders'

equity; Vanke's shareholders' equity ratio has always

been lower than that of the real estate industry,

indicating that Vanke's guarantee of debt repayment

is not great. From 2016 to 2020, Vanke's asset

liability ratio has been lower than that of Greenland,

and Vanke's debt degree is lower than that of

Greenland; Vanke's equity ratio has always been

lower than that of Greenland, and Vanke's liabilities

have received greater protection from shareholders'

equity; Vanke's shareholder equity ratio has always

been higher than Greenland, indicating that Vanke's

guarantee of debt repayment is relatively large.

4,13

5,24

5,48

5,39

4,34

3,29

3,7

3,95

3,78

3,74

8,46

8,08

8,52

7,72

7,99

3

5

7

9

2016 2017 2018 2019 2020

Vanke Real estate Greenland

0,19

0,16

0,15

0,16

0,19

0,23

0,21

0,2

0,21 0,21

0,11 0,11 0,11 0,11 0,11

0,09

0,14

0,19

0,24

2016 2017 2018 2019 2020

Vanke Real estate Greenland

Big Data Financial Analysis of Vanke’s Solvency Based on Power BI Software

65

4 CONCLUSIONS

This paper makes a big data financial analysis of

Vanke's solvency through Power BI software. The

conclusion is as follows. Using the industry analysis

method and trend analysis method, taking the real

estate industry and industry leading green space as

the reference object, this paper makes an in-depth

analysis of Vanke from the two aspects of short-term

solvency and long-term solvency. From 2016 to

2020, Vanke's short-term solvency index is lower

than the industry average and empirical value, and

the short-term financial risk is large. The long-term

solvency has gradually improved, but it is still lower

than the overall level of the industry. Compared with

the industry leader Greenland, Vanke has stronger

short-term and long-term solvency, higher debt

degree and greater financial risk.

ACKNOWLEDGEMENT

The thesis is the result of the Taishan University

Introduced Talents Scientific Research Start-up

Fund Project.

REFERENCES

George, G., M.R. Haas and A. Pentland, Big data and

management. 2014, Academy of Management

Briarcliff Manor, NY. p. 321-326.

Koop, G., Analysis of financial data. 2006: John Wiley &

Sons Oxford.

Koop, G., Analysis of financial data. 2006: John Wiley &

Sons Oxford.

McAfee, A., et al., Big data: the management revolution.

Harvard business review, 2012. 90(10): p. 60-68.

Schroeder, R.G., M.W. Clark and J.M. Cathey, Financial

accounting theory and analysis: text and cases. 2019:

John Wiley & Sons.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

66