Research on Stock Price Prediction Based on Autoregressive Model of

Maximum Corentropy Criterion

Shenghan Gao

1a

, Mengyang Liu

1b

, Lina Wang

2c

, Xiaoyan Qiao

3d

and Feng Zhao

2,* e

1

School of Statistics, Shandong Technology and Business University, 191 Binhai Middle Road, Yantai, China

2

School of Computer Science and Technology, Shandong Technology and Business University, 191 Binhai Middle Road,

Yantai, China

3

School of Mathematics and Information Science, Shandong Technology and Business University, 191 Binhai Middle Road,

Yantai, China

Keywords: Stock Forecast, Relative Entropy, Clustering, Open Set Identification.

Abstract: As a barometer of the financial market, the stock market is closely related to national economic development,

corporate financing and investors' interests. However, there are many and complex factors affecting stock

price volatility, which makes accurate prediction of stock price volatility still a challenging problem. In order

to predict the stock price more accurately, the maximum correlation entropy autoregression model is proposed

in this paper. Specifically, the maximum entropy criterion is used to replace the minimum mean square error

criterion in the autoregressive model to eliminate the influence of singular values. Then a new clustering

method is used to cluster the segmented stock price curves, and a regression model is built for each class,

which reduces the influence of the order of the regression model on the prediction accuracy. In addition, the

open set identification method is adopted in this paper to add boundary constraints to each curve after

clustering, which is used to enhance the pertinence of the regression model and effectively improve the

prediction accuracy. The experimental results show that the proposed method has high prediction accuracy.

1 INTRODUCTION

As an important part of the national economy, the

stock market plays an irreplaceable role in the

economic development, and its changing trend is

considered as the barometer of the economic market.

The development of the stock market is of great

significance to the national macro economy,

enterprises and individual investors (Zeqiraj 2020). At

the national level, the changing trend of the stock

market can accurately reflect the development trend

of the national economy, which is conducive to the

country's macro-market regulation (Zhou 2021).

From the perspective of enterprises, the stock market

can help enterprises to make strategic adjustment and

enhance the liquidity and flexibility of investment

(Wu 2021). From the perspective of individuals,

a

https://orcid.org/0000-0002-3671-8036

b

https://orcid.org/0000-0001-9879-562X

c

https://orcid.org/0000-0003-1676-6230

accurate prediction of stock prices can improve

investment returns and reduce investment risks for

individual investors (Chen 2022). Therefore, stock

price prediction has very important research

significance, and has become a research hotspot of

many scholars at home and abroad.

At present, domestic and foreign scholars have

studied stock price prediction methods from different

angles, and have achieved relatively good results.

Generally speaking, the commonly used stock price

prediction methods at present mainly include

investment analysis method (Li 2022, Nti 2020,

Jordan 2018), statistical model (Khoojine 2020, Ji

2021, Wang 2020) and machine learning (Zhang

2021, Zhang 2018, Xiao 2020). Among them,

autoregressive (AR) model is regarded as a crucial

forecasting method in time series analysis, which is a

process of using itself as a regression variable as well

as adopting the minimum mean square error criterion

d

https://orcid.org/0000-0002-2011-9717

e

https://orcid.org/0000-0003-3954-4307

Gao, S., Liu, M., Wang, L., Qiao, X. and Zhao, F.

Research on Stock Price Prediction Based on Autoregressive Model of Maximum Corentropy Criterion.

DOI: 10.5220/0012023700003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 67-75

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

67

to estimate the model. Further, AR model and its

variant versions have been extensively used in field of

economics and finance (Ye 2017, Santosa 2022, Tash

2011). For example, Ye proposed an ARIMA-SVR

stock prediction model based on wavelet analysis,

which improved the forecasting accuracy but did not

overcome the influence of singularities in the time

series (Ye 2017). ARIMA model was employed to

predict the prices of 45 stocks with different

characteristics, and the stock sequence suitable for the

model was procured by classification (Santosa 2022).

Tash and Modarres applied the AR/GARCH model to

Tehran stocks, and the prediction results show ed that

their method could improve the prediction accuracy

(Tash 2011).

However, the method based on autoregressive

model still has two deficiencies, which may lead to

prediction bias in the model.

(1) The mean square error criterion used in the

autoregressive model will lead to errors in prediction.

Specifically, if some data points of random variables

are far away from each other in the coordinate system

of the same name, the error will expand in the form of

square, which makes a huge gap between the two

random variables.

(2) The autoregressive model uses the same order

to predict different fluctuations, which will lead to

prediction errors. Specifically, because of the

complexity of the stock price curve, a regression

model is used to predict the change of the price curve

of all stocks, resulting in low prediction accuracy.

In order to accurately predict the stock price trend,

this paper proposes a stock price trend prediction

method based on the maximum correlation entropy

autoregressive model. Specifically, firstly, the stock

price curve is segmented and correlational entropy is

used as the similarity measure to cluster the price

curve segments. Then, for each class of clustered data,

a regression model is constructed using the maximum

corentropy criterion as the constraint function, which

is used to predict the change trend of the stock price

curve. In summary, this paper mainly does the

following four aspects :(1) based on the maximum

correlationentropy criterion, a new regression

prediction model is constructed. Traditional

autoregressive models are sensitive to singularities

because of the minimum mean square error criterion.

In this paper, the maximum corentropy criterion is

used as the constraint function, and the Gaussian

corentropy is used to limit the infinite expansion of

the error, which effectively weakens the influence of

the singularity on the curve similarity measurement.

(2) Based on the clustering strategy, a well-targeted

regression prediction model is constructed for each

type of price curve. The prediction accuracy of

regression model is greatly affected by model order.

Because of the complexity of using the stock price

curve, using one regression model to predict the

change of the price curve of all stocks leads to low

prediction accuracy. Using the clustering strategy, the

price curves with similar change trends are grouped

into a group, and a regression model is constructed

for price prediction, which can effectively improve

the accuracy of prediction. (3) Based on correlational

entropy, a new similarity measure of price curve is

proposed. The existing clustering methods are

generally based on Euclidean distance and the

clustering results are particularly sensitive to the

singularity of the stock price curve. Correlational

entropy is used to measure the similarity of any two

curves. Essentially, two curves are taken as random

variables to measure the similarity based on the

difference of their probability distribution, which can

better overcome the influence of singularities. (4)

Based on the open set identification, the singularity

problem in the clustering process is optimized. In this

paper, the open set recognition strategy is adopted to

add boundary constraints to the clustering results,

which makes the clustering results more accurate and

can better deal with the problem of singular point

classification in the clustering process. In order to

visually illustrate the advantages of open set

recognition, this paper clustering the data containing

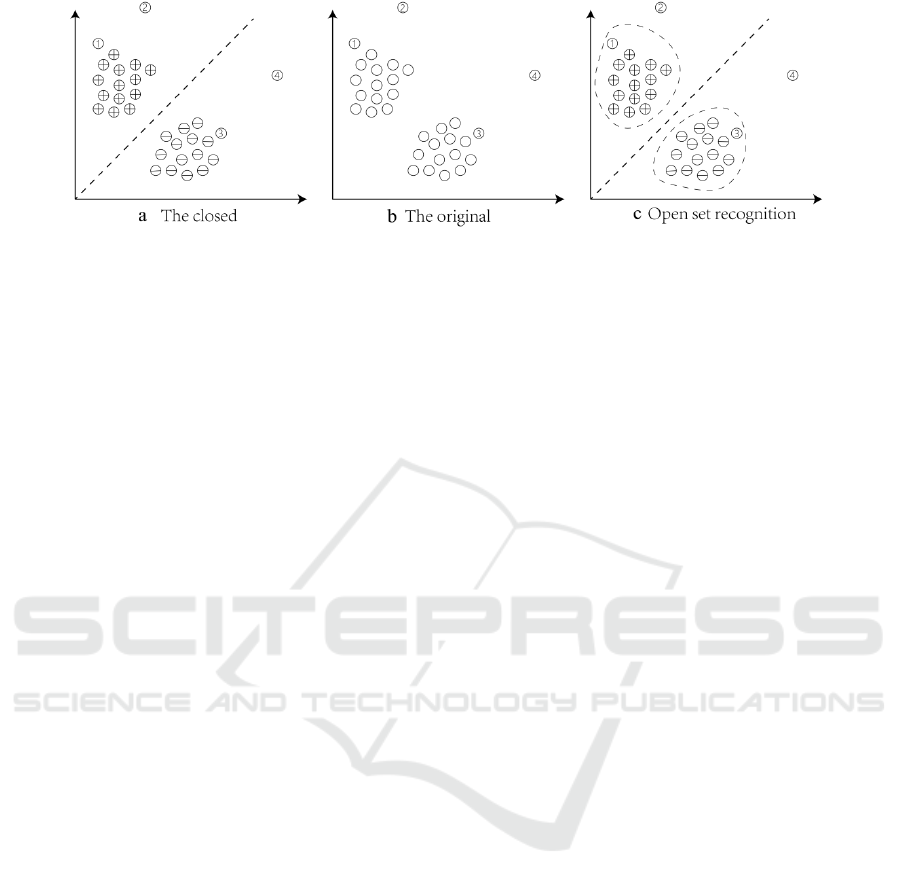

singularities. As shown in Figure 1, Figure 1 (b)

represents the original data, where sample points

①~④ represent the data to be classified. Figure 1

(a) shows the result obtained by using closed sets,

and symbols "⊕" and "

○

,— " represent different

categories. It is obvious that singularities ② and ④

do not fit into any category. If open set identification

is adopted, the result is shown in FIG. 1 (c). It can be

seen that singularities ② and ④ are outside the

boundary constraints and can eliminate this problem.

2 RELATED METHODS

This section mainly introduces the methods related to

this paper, including similarity measures and

autoregressive models. This paper uses uppercase

letters (e.g. X,Y ) to represent time series data,

lowercase letters with subscripts (e.g. x

,y

) to

represent individual data, uppercase bold letters

(e.g.𝑿,𝒀)to represent matrices, and superscript letter

d to represent distances (e.g.d

, Euclidean distances).

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

68

Figure 1: Comparison of classification results.

2.1 Autoregressive Model

For the multidimensional regression model, the N-

order regression process of data series {𝛸

} is :

𝛸

=𝛽

𝛸

+𝛽

𝛸

-2

+⋯𝛽

𝛸

+𝐸

(1)

According to the linear theory, the p-dimensional

regression model is expressed as:

𝛸

(

𝑖

)

=𝛽

(

𝑖

)

𝛸

+⋯+𝛽

(

𝑖

)

𝛸

+𝐸

(

𝑖

)

(2)

Among them 𝑖=1,2, ···

,

𝑃

The least square algorithm is used to minimize the

sum of squares of errors, so that 𝛽=[𝛽

,𝛽

,…𝛽

]

and 𝑌

=[𝛸

,𝛸

,···

,

𝛸

] ,get the target

function:

min

(𝛸

−β𝑌

)

(3)

The final regression coefficient is : β =

(𝑌

𝑌

)

𝑌

Χ

.

However, the use of the minimum mean square

error criterion in the autoregressive model and the use

of the same order to predict different stock volatility

will lead to the model being more sensitive to singular

points. Specifically, if some data points of a random

variable are far away from each other in the

coordinate system with the same name, the error will

be expanded by the square situation, thus making a

huge gap between the two random variables. As stock

prices are affected by abnormal and unexpected

events, there are many singular points in stock price

data, so autoregressive model can not accurately

predict stock prices. Aiming at this problem, this

paper adopts an improved prediction method to

establish a robust regression prediction model based

on the maximum correlationentropy criterion.

3 CONSTRUCTION OF

AUTOREGRESSIVE MODEL

BASED ON

CORRELATIONENTROPY

In order to eliminate the singularity sensitivity

problem of stock price data, the correlational entropy

autoregressive model is adopted in this paper, and its

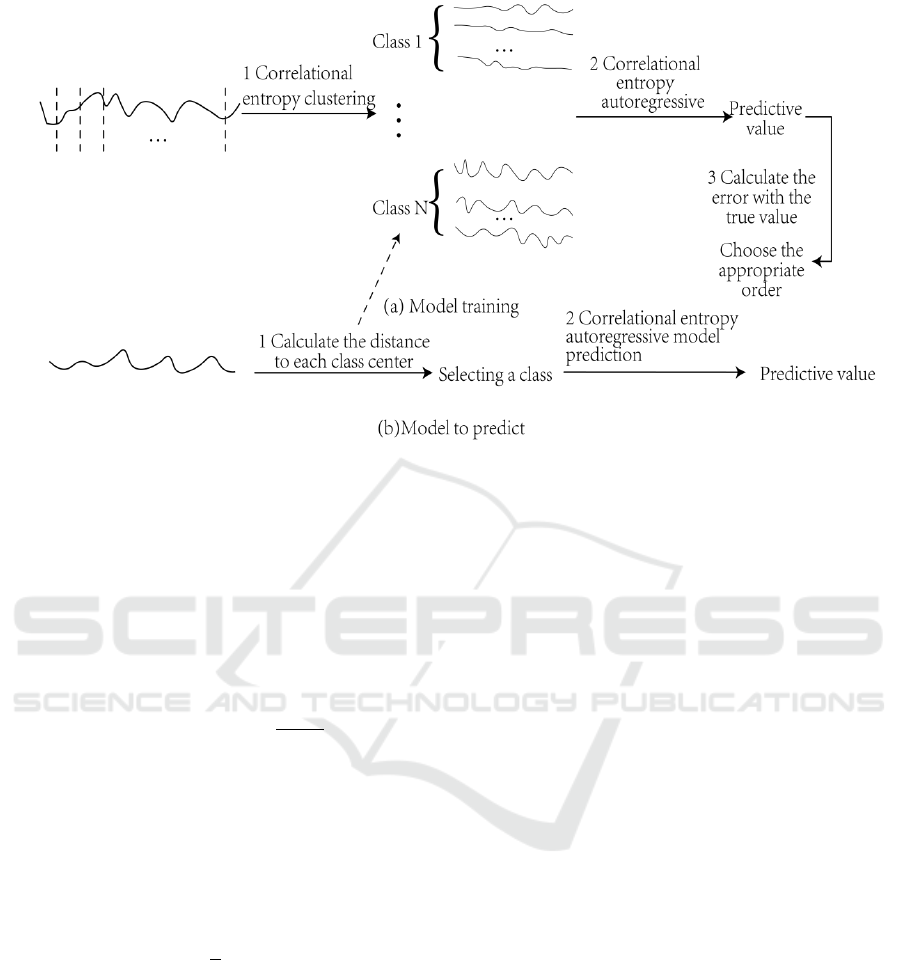

flow chart is shown in FIG. 2, where (a) represents

the training stage process of the model, and (b)

represents the prediction stage process of the model.

In the model training stage, the segmented stock

price curves are firstly clustered, corentropy is used

as the similarity measure in the clustering process,

and the open-set recognition method is integrated to

improve the accuracy of clustering results, as shown

in step 1 in FIG. 2 (a). Secondly, after the completion

of clustering, a regression model is constructed for

each class, and the prediction value is obtained by

using the constructed model, as shown in step 2 in

FIG. 2 (a). Finally, Step 1 and step 2 are repeated with

different orders and the error with the real value is

calculated to select the optimal order. In the model

prediction stage, firstly, the distance between the data

to be predicted and each class center is calculated,

and the class with the smallest distance is selected as

its category, as shown in step 1 in FIG. 2 (b).

Secondly, the correlational entropy autoregressive

model is used for prediction, and the final predicted

value is obtained, as shown in step 2 in FIG. 2 (b).

3.1 Construction of Curve Similarity

Measure Based on

Correlationentropy

Aiming at the sensitivity of Euclidean distance to

singularity, correlational entropy is chosen as the

similarity measure of curves in this paper. When the

statistical distributions of the two random variables

Research on Stock Price Prediction Based on Autoregressive Model of Maximum Corentropy Criterion

69

Figure 2: Flowchart of correlational entropy autoregressive model.

are closest, the objective function of Equation (8) is

the smallest. Correlational entropy is a measure of

similarity between two random variables, which can

be expressed as:

𝑑

(

𝑋,𝑌

)

=𝐸[𝑘

(𝑋,𝑌)] (4)

Among them, 𝐸[∙] Said expectations, 𝑘

(X,Y)

denote Gaussian kernel:

𝑘

(𝑋,𝑌) = 𝑒𝑥𝑝( −

()

)

(5)

𝜎 represents the kernel width, selected using

density estimation.

In actual calculation, because only some finite

samples can be obtained, the joint probability density

cannot be calculated, so the correlational entropy of

finite samples is estimated by the Parzen window

method:

𝑑

(

𝑋,𝑌

)

=

∑

𝑘

(𝑦

−x

)

(6)

The main advantages of the method adopted in

this paper are as follows: 1. Considering the

influence of abnormal data, correlational entropy

adopts kernel width to control the adjustable

window, which can effectively reduce the adverse

influence of outliers. 2. Considering the algorithm

complexity, the sample estimation method is simpler

than the traditional moment expansion method. 3.

From the geometric perspective, in the sample space,

the mean square error (MSE) in the least squares is

expressed as the 2-norm of the distance. In

correlational entropy theory, when the distance

between two points is close, it is equivalent to the

distance measured as 2 norm. With the increase of

the distance between two points, it is similar to 1

norm, and even tends to 0 norm eventually.

Therefore, correlational entropy has the

characteristic of suppressing abnormal data, and

introducing correlational entropy can enhance the

robustness of the training model.

3.2 Correlational Entropy

Autoregressive Model Construction

In the autoregressive model, the least mean square

error criterion is used to make the model more

sensitive to the singularity. Specifically, if there are

singular values in the data, the error will also be

expanded in a quadratic way, making the influence of

these samples far greater than that of other samples,

resulting in a huge gap between the two random

variables. Aiming at this problem, this paper

establishes a new regression model by transforming

the constraint function. For the convenience of

calculation, the equality constraint is

introduced 𝛷

𝛷=1, then the constraint problem is:

max

𝑘

x

−ΦY

𝑠.𝑡.Φ

Φ=1 (7)

Equation (11) is a nonlinear non-convex

constrained optimization problem, which cannot be

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

70

solved directly. In this paper, we use the properties

of conjugate convex functions to solve the semi-

quadratic technique, define the matrix 𝑅=

𝑑𝑖𝑎𝑔(ω

) ,among them, ω

=

[−𝜔

,−𝜔

,⋯,𝜔

],Based on this equation (11), it

can be written as:

min

R

‖

X−ΦY

‖

s.t.Φ

Φ=1 (8)

The variable 𝑡is introduced to solve the non-

convex quadratic programming problem shown in

Equation (12), when the initial conditions 𝑅(0) =

𝑑𝑖𝑎𝑔(1) and t

=1,The above equation can be

transformed into a homogeneous constrained

programming problem:

min

‖

𝑡𝑋 − ΦY

‖

𝑠.𝑡.t

=1,Φ

Φ=1 (9)

And then:

min

[

𝛷

𝑡

]

Y

Y−Y

X

−X

Y

‖

Y

‖

Φ

𝑡

𝑠.𝑡.t

=1,Φ

Φ=1 (10)

Make 𝜉=[𝛷

𝑡]

,𝐵=

𝐼

×

0

00

, 𝐶=

Y

Y−Y

X

−X

Y

‖

Y

‖

,Equation (14) can be written as:

min

𝜉

𝐶𝜉

𝑠.𝑡.𝜉

𝐵𝜉 = 1 (11)

Using the semidefinite relaxation (SDR) method,

the objective function and constraints in Equation

(15) are respectively equivalent to:

𝜉

𝐶𝜉 = 𝑇𝑟{𝜉

𝐶𝜉} = 𝑇𝑟{𝐶𝜉𝜉

}

𝜉

𝐵𝜉 = 𝑇𝑟{𝜉

𝐵𝜉} = 𝑇𝑟{𝐵𝜉𝜉

} (12)

Where Tr denotes the trace of the matrix and

defines the matrix:

𝛺=𝜉𝜉

. (13)

Ω is a symmetric positive semidefinite (PSD)

matrix with rank 1, and the final semidefinite

relaxation optimization constraint is obtained:

min

𝑇𝑟{𝐶𝛺}

s.t.𝑇𝑟

{

𝐵𝛺

}

=1,𝛺≥0 . (14)

The eigendecomposition of matrix Ω can be

expressed as:

𝛺=𝑉R𝑉

. (15)

Among them, 𝑉=[𝑣

,𝑣

,⋯,𝑣

] the

Ω eigenvector of lambda, 𝑅=𝑑𝑖𝑎𝑔(𝑟

,𝑟

,⋯,𝑟

)

represents the corresponding eigenvalue, Because

when rank is one, 𝛺(1) = 𝑟

𝑣

𝑣

the closest Ω,

Therefore, the following equation is used to

estimate ξ.

𝜉=

√

𝑟

𝑣

. (16)

The solution of the final regression prediction

parameter Φ is the first Ν values of ξ. Finally,

the coefficient value optimized by MCC model is

obtained, and the predicted value at the future

moment is obtained by the weighted sum of

historical data.

3.3 Open Set Identification Method

Traditional clustering uses Euclidean distance, which

treats the differences between different attributes of

samples equally, which will lead to the deviation of

its results. In this paper, the open set identification

method is integrated with the traditional clustering

method, which can effectively deal with the

singularity problem in clustering results.

Algorithm 1. Open set recognition algorithm that

makes stock price prediction more accurate.

Step 1: Randomly select K cluster centers, and

then calculate the correlational entropy distance

between each stock price index series and the

selected cluster centers.

Step 2: According to the principle of minimum

distance, each sample point is assigned to the

corresponding cluster center, and then a new cluster

center is obtained.

Step 3: For the new clustering results, this paper

calculates the correlational entropy distance from the

sample point to the cluster center, as well as the mean

and standard errors. Then we judge whether the

distance between each sample point and the cluster

center is within three standard deviations of the

cluster distance. After the judgment is completed, a

new cluster center is calculated for the sample points

in its range.

Step 4: Continue to perform steps 2)~3) until the

loop terminates. For sample points that are not within

the scope, this paper considers that they do not

belong to any category and are left for subsequent

processing.

The open set identification method used in this

paper can effectively identify outliers. The reason is

that the traditional clustering method does not add

boundary constraints to the clustering results, which

leads to more outliers. However, the proposed

method can solve this problem well.

Research on Stock Price Prediction Based on Autoregressive Model of Maximum Corentropy Criterion

71

4 EXPERIMENTAL RESULTS

AND ANALYSIS

4.1 Selection of Experimental Data and

Evaluation Index

The experimental data in this paper are the daily

closing price data of CSI 300 Index, Dow Jones

Index and Nikkei Index, and the data collection

parameters are shown in Table 1. In this paper, stock

price data are divided into groups of every 10 by

sliding window, and the data source is British

Finance and Economics.

Table 1: Experimental data.

Csi 300 Index Dow Jones Index Nikkei Index

Data

interval

2010.1.1 ~2020.12.30 2010.1.1~2020.12.31 2010.1.1~2020.12.32

The training set 2010.1.1~2019.12.31 2010.1.1~2019.12.32 2010.1.1~2019.12.33

The test set 2020.1.1~2020.12.31 2020.1.1~2020.12.32 2020.1.1~2020.12.33

The amount of data 2675 2769 2719

In this paper, mean absolute error (MAE) and

mean absolute percentage error (MAPE) are selected

as the evaluation indexes to measure the performance

of the model. The formula is shown in Table 2,Where

𝑋 =

(

𝑥

, 𝑥

,…, 𝑥

)

is the true value and 𝑋

=

(

𝑥

, 𝑥

,…, 𝑥

)

is the predicted value.

Table 2: Definition of evaluation indicators.

Measure Expression

MAE

1

𝑛

|𝑥

−𝑥

|

MAPE

100%

𝑛

𝑥

−𝑥

𝑥

4.2 The Effect of Order on the

Prediction Result

To explore order for predicting results, the influence

of this article by selecting different order number, for

different categories using maximal entropy regression

model to forecast, forecast range of the csi 300 index,

the dow Jones index, the nikkei 2010 January 1 to

December 31, 2019, the closing price data, including

Shanghai and shenzhen 300 index data for 2433, Data

volume for the Dow was 2,516 and for the Nikkei

2,476. The prediction results are shown in FIG. 3. In

FIG. 3 (A1), (B1) and (C1), the abscissa represents

the order, and the ordinate represents the MAE value.

In FIG. 3 (A2), (B2) and (C2), the abscissa represents

the data points, and the ordinate represents the index

data.

According to the above results, the following

conclusions can be drawn :(1) in FIG. 3, the

prediction errors of different orders (a1), (b1) and

(c1) are different, indicating that the order has a great

influence on the prediction results. (2) The minimum

points of curves in FIG. 3 (A1), (B1) and (C1) are

different, indicating that the optimal order of

different categories is different. (3) Gently

fluctuating curve order has little influence on the

prediction effect, such as C5 curve in FIG. 3 (A1) and

(A2), while sharply fluctuating curve order has great

influence on the prediction effect, such as C5 curve

in FIG. 3 (B1) and (B2).

4.3 Measure of Similarity

In order to verify the correlational entropy distance

performance used in this paper, the following

experiments were conducted to construct three

groups of fluctuation curves, calculate the distance

with different similarity measures, and compare the

performance of each similarity measure through the

results. Among them, the first set of volatility curves

contains singularities, the second set of volatility

curves contains time offset, and the third set of

volatility curves contains singularities and time

offset. The experimental results are shown in FIG. 4,

where the abscissa represents the data point and the

ordinate represents the value.In the figure d

(

X,Y

)

Euclidean

distance calculation is used,d

(

X,Y

)

is

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

72

Figure 3: Order selection and class mean line.

calculated using Rangelis distance, d

(

X,Y

)

indicates the use of dynamic bending distance

calculation, d

(

X,Y

)

is calculated using

correlational entropy.

From Fig.4, it is obvious that:(1) as can be seen

from FIG. 4 (a), for sequences containing

singularities. The correlational entropy measure

distance is 0.32, which is the smallest, indicating that

correlational entropy can obviously eliminate the

influence of singular points. (2) As can be seen from

FIG. 4 (b), for the time offset series. The correlational

entropy measure distance is 0.44, which is the

smallest, indicating that this method can better deal

with the problem of time offset. (3) As can be seen

from FIG. 4 (c), for the sequence containing time

offset and singular points, the correlational entropy

measure distance is 0.51, with the minimum distance,

indicating that the proposed method can effectively

deal with the problem of singular points and time

offset.

Figure 4: Results of different similarity measures.

4.4 Correlational Entropy

Autoregressive Model

In order to verify the model adopted by the

performance, this article USES the following scheme

to forecast experiments, using clustering to construct

a regression model, do not use the open set after build

regression model, clustering using open set after three

kinds of schemes to build regression model, and

compare forecast results, to validate the clustering

method and open set method for predicting effect for

ascension. The data used are the daily closing price

data of CSI 300 index from January 1 to December

31, 2020, with a volume of 243. Meanwhile, to verify

the performance of the proposed model, the results

are compared with the prediction results of statistical

models and machine learning models. The results are

shown in Table 3 and Table 4. The rows in the table

represent the prediction scheme used, the columns

represent the error indexes, and the optimal results

are represented in bold,In the table, A represents The

regression model was constructed without clustering

scheme, B represents Open set is not used to build

regression model after clustering scheme, and C

represents Open set was used to construct regression

model after clustering scheme.

Research on Stock Price Prediction Based on Autoregressive Model of Maximum Corentropy Criterion

73

Table 3: Comparison of errors.

Prediction method MAE MAPE

A 92.175 9.64

B 76.512 7.76

C 40.964 0.0474

From Table 3, it is obvious that:(1) the effect of

constructing regression model after clustering is

significantly better than that of constructing

regression model without clustering, indicating that

the addition of clustering method can effectively

improve the accuracy of prediction. The reason is that

the stock price fluctuation curve is different between

categories, so a single regression model is not applied.

(2) The effect of using open set method to construct

regression model after clustering is significantly

better than that of not using open set method. The

reason is that the traditional clustering method can not

deal with the outlier problem well. In this paper, the

accuracy of clustering results can be effectively

improved after the clustering results are constrained.

Table 4: Results compared with statistical models and

machine learning models.

Prediction metho

d

MAE MAPE

Machine

learning

Adaptive RNN 57.621 6.6

GRU 59.225 6.86

Statistical

models

AR 63.695 7.44

ARIMA 60.727 7.08

GARCH 61.03 7.13

Our proposed MCC-AR 40.964 4.74

From Table 4, it is obvious that :(1) the proposed

method is superior to the machine learning method.

The reason is that the maximum corentropy criterion

is used as the constraint function, and gaussian

corentropy is used to limit the infinite expansion of

errors, which effectively reduces the influence of

singularities. Moreover, the machine learning model

uses a large amount of data in training and testing, and

the method in this paper can get better prediction

results even when the sample size is small. (2) The

method in this paper is superior to the statistical

model method. The reason is that the statistical model

uses the same order to predict different fluctuations,

and does not consider the difference between curves.

5 CONCLUSION

In order to eliminate the influence of singularities on

stock price prediction, a maximum correlational

entropy criterion autoregressive model is proposed.

The experimental results show that: 1. Using the

clustering strategy, the price curves with similar

change trends are clustered into a group, and a

regression model is constructed for price prediction,

which effectively improves the prediction accuracy.

2. Correlational entropy is used to measure the

similarity of any two curves. Essentially, two curves

are taken as random variables to measure the

similarity based on the difference of their probability

distribution, which can better overcome the influence

of singularities. 3. In this paper, the open-set

recognition strategy is adopted to add boundary

constraints to the clustering results, which makes the

clustering results more accurate and can better deal

with the problem of singularity classification in the

clustering process. 4. In this paper, the maximum

corentropy criterion is used as the constraint

function, and the Gaussian corentropy is used to limit

the infinite expansion of the error, which effectively

weakens the influence of singularity points on the

curve similarity measurement.

To sum up, the correlational entropy measure

used in this paper can better deal with the singularity

problem in stock series. Correlational entropy

autoregressive model can deal with the singularity

problem in stock prediction. The open-set strategy

and the strategy of constructing a regression model

for each class can effectively improve the prediction

accuracy. The experimental results show that the

method proposed in this paper has a good prediction

effect.

ACKNOWLEDGEMENTS

This work is supported by National Natural Science

Foundation of China (62176140, 61972235)

REFERENCES

Chen Rongda, Yu Jingjing, Xu Min, Dang Chao, Huang

Jiahao. 2022. Research on the Influence of Investors'

Local Preference on the Information Efficiency of

Stock Market. J. Systems Engineering Theory and

Practice.

Jordan S J, Vivian A, Wohar M E. 2018. Stock returns

forecasting with metals: sentiment vs. Fundamentals. J.

The European Journal of Finance, 24(6).

Ji Jingyu,Li Deyuan. 2021. Application of autoregressive

tail-index model to China's stock market. J. Statistical

Theory and Related Fields,5(1).

Khoojine A S, Han D. 2020. Stock price network

autoregressive model with application to stock market

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

74

turbulence. J. The European Physical Journal B, 93(7).

Li X J, TANG P. 2022. Stock price forecasting based on

technical analysis, fundamental analysis and deep

learning . J. Journal of Statistics and Decision,38(02).

Nti I K, Adekoya A F, Weyori B A. 2020. A systematic

review of fundamental and technical analysis of stock

market predictions. J. Artificial Intelligence Review,

53(4).

SANTOSA,R. G., CHRISMANTO, A. R., & LUKITO, Y.

2022.STOCKS Forecasting exploration on LQ45 index

USING ARIMA (p, d, q) model. J. Journal of

Theoretical and Applied Information

Technology,100(13).

Tash, F.H., & Modarres, M. 2011.Modeling volatility of

financial markets using an AR/GARCH model in

Tehran stock exchange. C. In Mechanical, Industrial,

and Manufacturing Engineering Proceedings of 2011

International Conference on Mechanical, Industrial, and

Manufacturing Engineering.

Wu Fei, Hu Huizhi, Lin Huiyan, Ren Xiaoyi.

2021.Corporate Digital Transformation and Capital

Market Performance: Empirical evidence from Stock

liquidity. J. Managing the world,37(07).

Wang Y, Guo Y. 2020. Forecasting method of stock market

volatility in time series data based on mixed model of

ARIMA and XGBoost. J. China Communications,

17(3).

Xiao C, Xia W, Jiang J. 2020. Stock price forecast based on

combined model of ARI-MA-LS-SVM. J. Neural

Computing and Applications, ,32(10).

Ye, Tian. 2017. Stock forecasting method based on wavelet

analysis and ARIMA-SVR model. C. International

Conference on Information Management,102-106.

Zeqiraj V, Sohag K, Soytas U. 2020.Stock market

development and low-carbon economy: The role of

innovation and renewable energy. J. Energy Economics

91: 104908.

Zhou Jun. 2021. Policy adjustment and Abnormal volatility

of Stock market . J. Shanghai Finance.(08).

Zhang D, Lou S. 2021. The application research of neural

network and BP algorithm in stock price pattern

classification and prediction. J. Future Generation

Computer Systems, 115.

Zhang H. 2018.The forecasting model of stock price based

on PCA and BP neural network. J. Journal of Financial

Risk Management,7(4)

Research on Stock Price Prediction Based on Autoregressive Model of Maximum Corentropy Criterion

75