Pricing Decision of Dual-Channel Supply Chain Based on Carbon

Emission Reduction Input Under Carbon Tax Policy

Hong Huo, Dan Luo

*a

and Zhanghua Yan

School of Management, Harbin University of Commerce, Harbin, China

Keywords: Tax Policy, Dual-Channel Supply Chain, Carbon Emission Reduction Input, Pricing Decision.

Abstract: This paper constructs the consumer demand function based on the low carbon preference of consumers.

Considering the manufacturer's carbon emission reduction investment, the pricing models of decentralized

supply chain and centralized supply chain based on consumer preference are constructed. This paper also

explores the effect of consumer low carbon sensitivity coefficient on wholesale prices, retail prices, demand

and profits of members. The results show that the profits and carbon emission reduction level of supply

chain members under centralized decision-making are greater than those of decentralized decision-making;

supply chain members' profits are positively correlated with consumer carbon emission reduction sensitivity

coefficient.

a

https://orcid.org/0000-0002-0466-8257

1 INTRODUCTION

The international community and governments pay

more attention to carbon emissions, put forward the

carbon tax policy, and achieved good environmental

benefits. The EU aims to reduce carbon emissions

by 40 percent from 1990 levels by 2030 (Liu, 2021).

On April 1, 2019, Canada introduced a nationwide

carbon tax pricing, imposing a carbon tax on units

(China Petrochemical News, 2019).

The formation of low carbon consumption

consciousness is transformed from the concept of

sustainable development in the era of low carbon

economy. Consumers usually consider the price of

products and services and low carbon factors when

making purchase behavior. It will also become an

important part of enterprises to judge customer

needs. Therefore, it can effectively promote the low

carbon process of supply chain incorporating

consumers' preferences into product decision and

network optimization of supply chain.

Companies in various fields such as IBM and

Apple have begun to use third-party platform

network sales channels. As a new marketing

channel, online sales channel is a kind of

competition or even suppression for the traditional

retail channel, and the living space of offline market

is getting smaller and smaller. Therefore, it is

particularly important for the retail industry what

joint online and offline sales channels.

In summary, this paper explores the decision-

making of an online direct Dual-channel supply

chain which is composed of a manufacturer and an

offline retailer considering the impact of low carbon

preference on channel sales prices. This paper

assumes that the manufacturer invests in carbon

emission reduction costs, and constructs two supply

chain pricing models based on consumer preferences

and carbon emission reduction investment under the

carbon tax policy.

2 LITERATURE REVIEW

This article is mainly related to the following four

aspects of literature: (1) Carbon tax policy, (2)

Consumer preference, (3) Carbon emission

reduction investment and (4) Dual-channel supply

chain pricing decision.

2.1 Carbon Tax Policy

Liu et al. (2022) discuss the impact of rising energy

prices caused by carbon tax policies on the welfare

of Chinese residents. Xu et al. (2022) take the green

marketing cost coefficient as the private information

Huo, H., Luo, D. and Yan, Z.

Pricing Decision of Dual-Channel Supply Chain Based on Carbon Emission Reduction Input Under Carbon Tax Policy.

DOI: 10.5220/0012026800003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 127-133

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

127

of retailers, and discuss the impact of information

asymmetry on the optimal decision-making. Most of

the current research focuses on the impact of carbon

tax policy on supply chain pricing decisions.

2.2 Consumer Preference

Yalabik (2011) finds that consumers' green

consumption behaviors will directly determine

enterprises' willingness to produce green products

and increase low carbon technology R&D.

Yenipazarli et al. (2015) consider how consumers'

willingness to pay affects enterprises' choice of

product greenness. Hu et al. (2021) show that

consumers' low carbon preferences have a

significant impact on manufacturers' decisions.

Some scholars explore the impact of consumer

preferences on pricing decisions of products.

2.3 Carbon Emission Reduction

Investment

Chen et al.(2022) build a duopoly model that

considers technology R&D and technology sharing

in carbon emission reduction. Liu et al.(2022) show

that the R&D investment in precooling technology

and carbon emission reduction reach the highest

level in the centralized supply chain model. Few

scholars explore the pricing decisions

comprehensively considering the manufacturers'

carbon emission reduction input and consumers'

preferences.

2.4 Dual-Channel Supply Chain

Pricing Decision

Some scholars also introduced manufacturers'

carbon emission reduction input into the pricing

decision of Dual-channel supply chain. Zhang et al.

(2021) explore the impact of introducing online

channels on supply chain network equilibrium

decision-making, carbon emissions and profits. Che

et al. (2021) consider the impact of manufacturers'

participation in carbon trading and green financial

loans on participants' profits and emission reduction

decisions. Some scholars also explore the pricing

decision of Dual-channel supply chain considering

consumers' low carbon preferences. Xie et al. (2021)

show that the profits of producer, retailer and supply

chain have the same changes at different levels of

consumers' low carbon preference coefficient. This

paper comprehensively considers manufacturers'

carbon emission reduction input and consumers'

preferences under the carbon tax policy.

3 DUAL-CHANNEL SUPPLY

CHAIN PRICING MODEL

3.1 Problem Description and

Parameter Assumption

Under the background of carbon tax policy,

considering consumers' channel preference and low

carbon preference, the research objects of this paper

are a manufacturer and an offline retailer considering

the manufacturer's carbon emission reduction input.

Assume that the manufacturer establish an online

direct sale channel and an offline retail channel.

This paper assumes the supply and demand

balance in the supply chain market. Assume that the

manufacturer's carbon emission reduction input is

2

1

2

kg

. Assume that

represents the value of the

product purchased by consumers;

represents

consumer preference coefficient for online channels;

f

represents the cross price elasticity coefficient;

c

represents production cost;

1

w

represents wholesale

price;

i

P

represents retail prices of online direct sales

channels and offline retailers;

i

D

represents sales

volumes of online direct marketing channels and

offline retailers;

k

represents the carbon emission

reduction level coefficient of the manufacturer;

g

represents the carbon emission reduction level of the

manufacturer;

represents consumer carbon

emission reduction sensitivity coefficient;

e

represents the unit carbon emission of the product;

y

represents the tax price of unit carbon emissions;

E

represents carbon emission difference;

j

M

,

j

R

and

j

represent profits of manufacturers, retailers and

the whole supply chain respectively;

1, 2i

represent

online direct sales channels and offline retailers

respectively;

,

j

DC

represent decentralized supply

chain pricing models and centralized supply chain

pricing models respectively.

3.2 Pricing Model of Decentralized

Supply Chain

This section explores the pricing decision of online

direct sales Dual-channel supply chain under the

carbon tax policy considering the carbon emission

reduction investment which is to improve the carbon

emission reduction level of products through

technical means. At this time, the demand functions

of online direct sales channels and offline retailers

are as follows:

112

=

D

P

fP gD

(1)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

128

221

=1

D

P

fP gD

(2)

The profit functions are as follows:

2

111 2

1

2

DD DD DD D

M

pcD wcD kyE g

(3)

212

D

DDD

R

wDP

(4)

2

111 2

1

2

DD DD DD D

pcD p D kgcyE

(5)

Where

12

D

DD

egD DE

.

Proposition 3.1 There are optimal wholesale

price, retail prices, sales volumes and profits for the

manufacturer and offline retailer:

22

*

1

2

22

*

1

2

*22 2

2

2

22

11 1 11

21

1111

21

1

32311

41

23 1 1

D

D

D

w

p

p

ffyfgfcye

f

ff f yfgfcye

f

f

ff f fcye

f

ff f f yg

(6)

*

1

*

2

212 212

=

4

11+1

4

D

D

D

y

f

f ffcyef ff g

fcye fyg

D

(7)

*

2

22

22

2

2

2

*

*

212

1

21 2

1111

+1 1 + 1

11 1 11

11+1

16

21

1

8

1

2

2

1

81

1

=2

D

M

D

R

D

f f ffcye

f

fffyg

f

ffyfgfcye

fcye fyg

f

fcyef fyg

fcye fyg

ff ff

f

k

cye

f

g

2

2

2

22

2

12

1111

+1 1 + 1

11 1 11

11+1

16

11

2

ff yg

f

ffyfgfcye

fcye fyg

ffcyeff

k

yg

fcye y gfg

(8)

Proposition 3.2

(1) When

*

1

D

p

, there has

**

12

D

D

pp

; when

*

0

D

p

, there has

**

12

D

D

p

p

;

(2) When

*

1

D

d

, there has

**

12

D

D

DD

; when

*

0

D

d

, there has

**

12

D

D

DD

.

Among them,

*22

2

1

31 11 1

45

D

p

f

ff ffyg

ff

2

11

f

fcye

,

22

*

111 1

3

D

d

f

ffygfcye

f

,

**

0

DD

pd

.

Proposition 3.2 shows that when

*

0

D

p

, that

is, when consumer's preference for online channels

is at a small value, the retail prices of online direct

selling channels will be lower than that of offline

retailers, and the manufacturer's online direct selling

channels can obtain greater price advantages in the

Dual-channel supply chain of online direct selling.

When

*

1

D

d

is greater, the demands for online

direct selling channels is higher than that of offline

retailers; otherwise, the opposite is true.

Proposition 3.3

When

*

D

g

kk

, the manufacturer

has optimal carbon emission reduction level

*

D

g

, and

*

0

D

g

. It makes manufacturer's profit achieve

Pareto optimal.

Among them,

2

*

323

4

D

g

yf f f y

k

,

2

*

2

11 +23

4+233

D

yf f f f cye

g

kyf f y f

.

Proposition 3.3 when

2

323

4

y

fffy

k

,

the manufacturer obtain the optimal carbon emission

reduction level and maximize its profit. In addition,

manufacturer's carbon emission reduction level

increases with the increase of the consumer's carbon

emission reduction sensitivity coefficient

, which

indicates that increasing the consumer's carbon

emission reduction sensitivity coefficient can enable

manufacturer to increase the carbon emission

reduction level.

3.3 Pricing Model of Centralized

Supply Chain

In the centralized supply chain pricing model,

manufacturers and offline retailers regard the entire

supply chain system as an enterprise, they strive to

the win-win situation.

The profit function of centralized supply chain

system is:

Pricing Decision of Dual-Channel Supply Chain Based on Carbon Emission Reduction Input Under Carbon Tax Policy

129

1

1112 212

2

1

2

+

CC CC CCCCC C

C

yDEDPpc wcD w kg

2

112 2

1

2

CCCCC C

pcD Pc kyEDg

(9)

Proposition 3.4 There are optimal retail prices,

sales volumes and profits for the manufacturer and

offline retailer:

22

*

1

2

22

*

2

2

1111

=

21

11 1 11

=

21

C

C

p

f

ffyfgfcye

f

f

fyfgfcye

f

p

(10)

*

1

*

2

11

=

2

111

=

2

C

C

D

yfgf cye

yg

D

f

fcye

(11)

2

2

2

*

22

2

11+1

41

+1c +1 1

1

1

+1 1 + 1 + 1c

11

2

1+

1

C

C

ff f yfg

f

fye yfgfcye

f

fyfgf ye

yyggf e kfc

(12)

Proposition 3.5

(1) When

*

1

C

p

, there has

**

12

CC

p

p

; when

*

0

C

p

, there has

**

12

CC

p

p

;

(2) When

*

1

C

d

, there has

**

12

CC

DD

; when

*

0

C

d

, there has

**

12

CC

D

D

.

Among them,

*

1

=

2

C

p

,

*

1

=

2

C

d

.

Proposition 3.6

When

*C

g

kk

, manufacturer has

optimal carbon emission reduction level

*C

g

. It makes

the profit of manufacturer achieve Pareto optimal,

and

*

0

C

g

.

Among them,

*

1

C

g

kfy

,

*

21

21

C

y

fcye

g

ky fy

.

The proof process of Propositions 3.5 and 3.6 is

similar to Propositions 3.2 and 3.3.

Proposition 3.7

The profit and carbon emission

reduction level of centralized decision are higher than

that of decentralized decision.

**CD

gg g

2

1

214 233

yf

ky fy kyf f y f

21 2 1k y fy k y fy

22

274 23 43 0fkffy f ycye

When

**

D

C

g

g

, there is

***

11

16

1

CDD

CMR

f

cye

2

+1 0fyg

.

Proposition 3.7 shows that when manufacturer

invests the same carbon emission reduction level, the

manufacturer and retailer jointly set the wholesale

price and retail prices under centralized decision-

making, aiming at making the profit of the entire

system to maximize and pursue a win-win situation.

The sales prices of retailers increase, which leads to

the decrease of profits under the decentralized

decision.

Proposition 3.8

In two decision-making models,

there are following conclusions

,jDC

:

(1)

*

1

0

D

w

e

,

*

1

0

j

p

e

,

*

2

0

j

p

e

,

*

1

0

j

D

e

,

*

2

0

j

D

e

,

*

0

D

M

e

,

*

0

D

R

e

,

*

0

C

C

e

;

(2)

*

1

0

D

w

g

,

*

1

0

j

p

g

,

*

2

0

j

p

g

,

*

1

0

j

D

g

,

*

2

0

j

D

g

,

*

0

D

M

g

,

*

0

D

R

g

,

*

0

C

C

g

;

(3)

*

1

0

D

w

,

*

1

0

j

p

,

*

2

0

j

p

,

*

1

0

j

D

,

*

2

0

j

D

,

*

0

D

M

,

*

0

D

R

,

*

0

C

C

;

(4)

*

1

0

D

w

y

,

*

1

0

j

p

y

,

*

2

0

j

p

y

,

*

1

0

j

D

y

,

*

2

0

j

D

y

,

*

0

D

M

y

,

*

0

D

R

y

,

*

0

C

C

y

.

Proposition 3.8 shows that (1) It will increase

wholesale price and retail prices with the increase of

unit carbon emissions of products, resulting in the

decrease of demands and profits; (2) When carbon

emission reduction level increases, manufacturer and

offline retailer have pricing initiative, which

ultimately increase their profit; (3) When consumer

carbon emission reduction sensitivity coefficient is

higher, the profit of the whole supply chain will be

higher; (4) When the tax price of unit carbon

emissions increases, the wholesale price and retail

price increases.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

130

4 DUAL-CHANNEL SUPPLY

CHAIN PRICING DECISION

ANALYSIS

This paper uses MATLAB to further analyze the

impact of relevant parameters on pricing and supply

chain members' profits. Refer to the parameter

assignment in the study of xie et al. (2021), the

parameter values used in this paper are:

=40, =0.6, =0.6, 0.8, 21, 3.5, 0.265,fcky

4.93.e

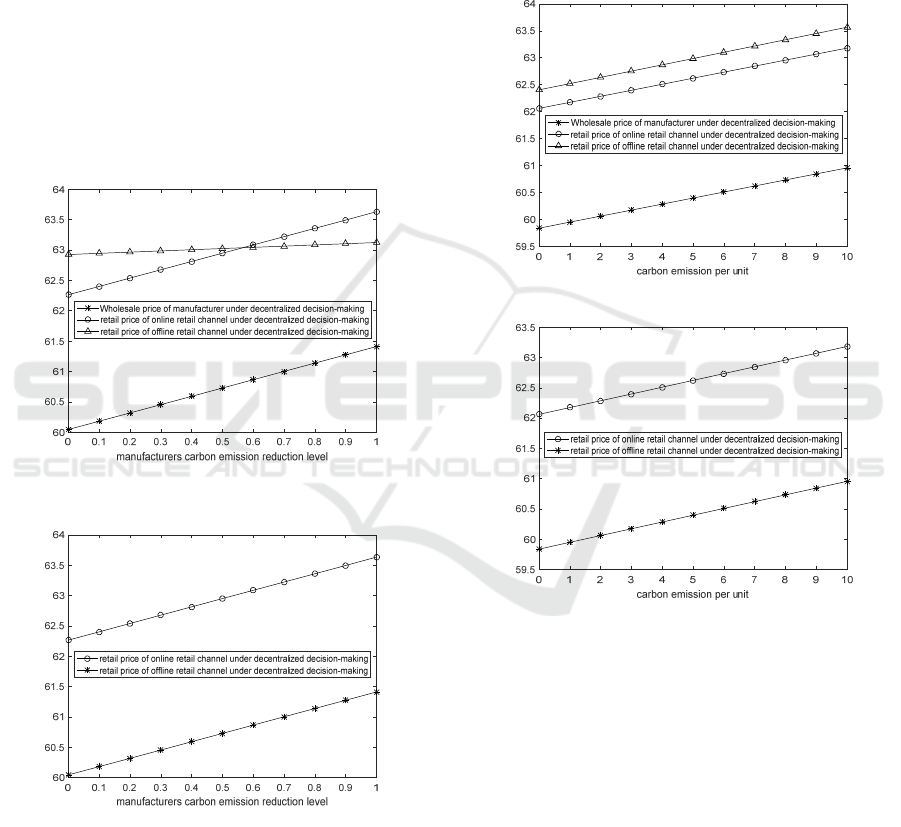

4.1 Impact of Manufacturers' Carbon

Emission Reduction Level on

Pricing Strategy

(1) Decentralized decision

(2) Centralized decision

Figure 1: Impact of manufacturers' carbon emission

reduction level on pricing strategy.

It can be seen from Figure 1 that whether it is

decentralized decision-making or centralized

decision-making, the retail prices of offline retail

channels are greater than those

of online direct

selling channels. When the manufacturers' carbon

emission reduction level improve, the wholesale

prices, retail prices and the sales volumes

increase, ultimately increasing profits of

manufacturers and the offline retailers.

4.2 Impact of Carbon Emission per

Unit Product on Pricing Strategy

(1) Decentralized decision

(2) Centralized decision

Figure 2: Impact of carbon emission per unit product on

pricing strategy.

It can be seen from Figure 2 that whether it is

decentralized decision-making or centralized

decision-making, the increase of carbon emission

per unit product will increase the wholesale price

of manufacturers and retail price of online direct

sales channels and offline retailers. Due to the

existence of

consumer carbon emission reduction

sensitivity coefficient, the demands for online

direct sales channels and offline retailers will

decrease, and profits of manufacturers and offline

retailers will decrease.

priceprice

priceprice

Pricing Decision of Dual-Channel Supply Chain Based on Carbon Emission Reduction Input Under Carbon Tax Policy

131

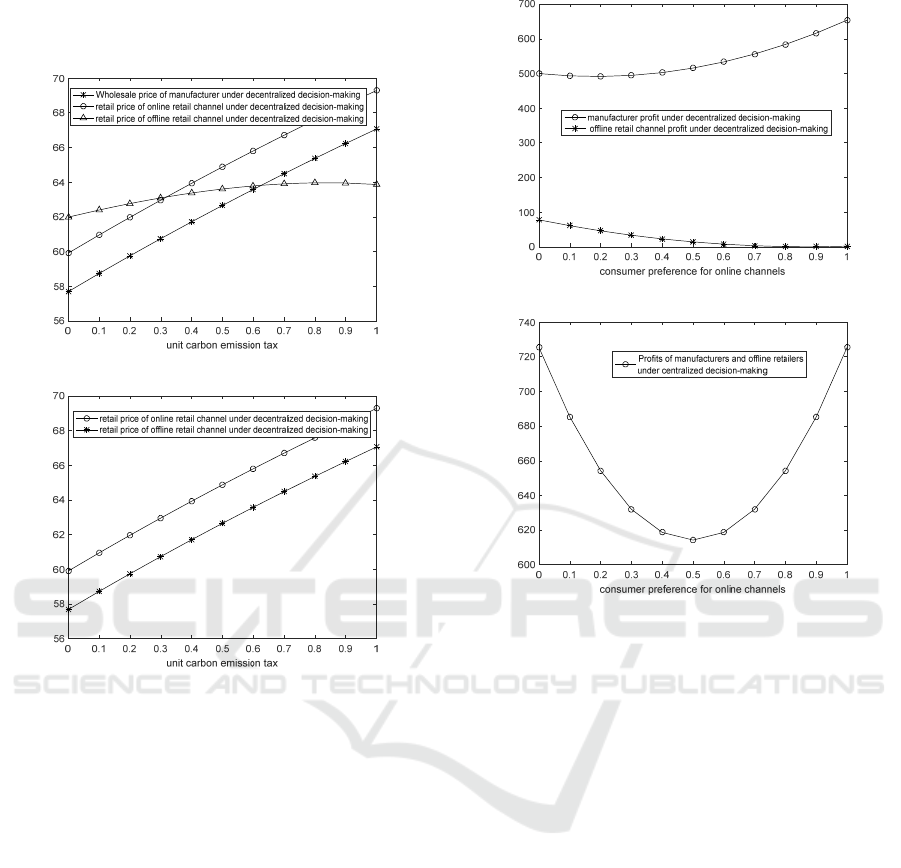

4.3 Impact of Unit Carbon Emission

Tax on Pricing Strategy

(1) Decentralized decision

(2) Centralized decision

Figure 3. Impact of unit carbon emission tax on pricing

strategy.

As can be seen from Figure 3, the wholesale

prices of

manufacturers, the retail prices will

increase with the increase of unit carbon emission

tax prices. This shows that the collection of

carbon tax

makes manufacturers raise wholesale

prices and retailers raise retail prices to reduce the

cost of carbon tax policy.

4.4 Profit Comparison Analysis

It can be seen from Figure 4 that the profits of

manufacturers and offline retailers under centralized

decision-making are greater than those of

decentralized decision-making. When making

centralized decisions, it can narrow the profits gap

between manufacturers and offline retailers.

(1) Decentralized decision

(2) Centralized decision

Figure 4. Profit comparison between decentralized

decision and centralized decision.

5 CONCLUSIONS

The main conclusions of our paper are as follows:

(1) The profits and carbon emission reduction level

under centralized decision making are higher than

those under decentralized decision making. (2)

When the consumer carbon emission reduction

sensitivity coefficient is higher, the profit of the

whole supply chain will be higher. (3) Supply chain

members' profits are positively correlated with the

tax price of unit carbon emissions and unit carbon

emission of the product; they are negatively

correlated with consumer carbon emission reduction

sensitivity coefficient.

Manufacturers should increase the cost of carbon

emission reduction and reduce the unit carbon

emissions of products. The government can

encourage manufacturers to invest in carbon

emission reduction through carbon tax discounts and

other ways.

Future research can explore the pricing strategies

from the perspective of government subsidies. The

priceprice

profitprofit

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

132

asymmetric carbon information also should be

considered in the future. The pricing decisions and

channel selection problems for these complex

channel structures also can be further studied.

ACKNOWLEDGEMENTS

This article is supported by the reform and develop

high-level talent projects in local universities

supported by the central government (2020GSP13),

National Social Science Foundation of Heilongjiang

Province (No.20GLB114), Social Science

Foundation Think Tank Project of Heilongjiang

Province (No.21ZK032).

REFERENCES

China Petrochemical News.(2019). Canada: The rise of oil

price and carbon tax "carry the pot"? [EB/OL].(2019-

08-05)[2020-07-23].

Che C, Chen Y, Zhang X, et al.(2021). Study on Emission

Reduction Strategies of Dual-channel Supply Chain

Considering Green Finance[J]. Frontiers in

Environmental Science.9.

Chen J, Sun C, Shi J, et al. (2022). Technology R&D and

sharing in carbon emission reduction in a duopoly[J].

Technological Forecasting & Social Change.183.

https://oil.in-en.com/html/oil-2876651.shtml.

Hu Z, Wang S.(2021). An Evolutionary Game Model

Between Governments and Manufacturers Considering

Carbon Taxes, Subsidies, and Consumers’ Low-

Carbon Preference[J]. Dynamic Games and

Applications(prepublish).

Liu J, Gong N, Qin J.(2022). How would the carbon tax

on energy commodities affect consumer welfare?

Evidence from China's household energy consumption

system[J]. Journal of Environmental Management.317.

Liu Z, Deng Z, He G et al.(2021). Challenges and

opportunities for carbon neutrality in China[J]. Nature

Reviews Earth & Environment.3,2.

Liu Z, Huang Y, Shang W, et al.(2022). Precooling energy

and carbon emission reduction technology investment

model in a fresh food cold chain based on a

differential game[J]. Applied Energy.326.

Xie J, Liu J, Huo X, et al.(2021). Fresh Food Dual-channel

Supply Chain Considering Consumers’ Low carbon

and Freshness Preferences [J]. Sustainability.13,11,1-

29.

Xu J, Wang P, Xu Q.(2022). Impact of Information

Asymmetry on the Operation of Green Closed-Loop

Supply Chain under Government Regulation[J].

Sustainability.14,13.

Yakita A, Yamauchi H. (2011). Environmental awareness

and environ-mental r & d spillovers in differentiated

duopoly [J]. Research in Economics.65,3,13-143.

Yenipazarli A, Vakharia A. (2015). Pricing, market

coverage and capacity: Can green and brown products

co-exist? [J]. European Journal of Operational

Research.242,1,304-315.

Zhang G, Cheng P, Sun H, et al. (2021). Carbon reduction

decisions under progressive carbon tax regulations: A

new Dual-channel supply chain network equilibrium

model[J]. Sustainable Production and

Consumption.27.

Pricing Decision of Dual-Channel Supply Chain Based on Carbon Emission Reduction Input Under Carbon Tax Policy

133