Study on the Impact of Green Finance on Regional Total Factor

Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity

Based on Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River

Delta Regions

Xiangran Cheng

a

, Zhu Kai

b

, Nie Yan

c

, Yao Rui

d

, Yidong Liu

e

and Yanan Zheng

*

College of Economics, North China University of Technology, Tangshan, Hebei, China

*

1135233112@qq.com

Keywords: Green Finance, Green Total Factor, Carbon Productivity, Group Regression, SBM-DDL, GML Index.

Abstract: Looking at his Beijing-Tianjin-Hebei, Yangtze River Delta to Pearl River Delta type regarding teacup as every

prey. The total factor carbon productivity and the effect of green finance are measured using the GML index

model with SBM directional distance function from 2011 to 2020 is analyzed by constructing indicators

regarding the level of advancement in green financing and using group regression model. As a result of the

total regression results, the results are displayed, green securities have a strong contribution to TFCP, and

green securities and carbon finance have the strongest significant effect on TFCP in the region; green

insurance has a more significant effect on TFCP in the Pearl River Delta region; green insurance and carbon

finance have a stronger significant effect in the Yangtze River Delta region.

1 INTRODUCTION

The stage of China's economic development is

shifting from one of rapid expansion to one of high-

quality development. Promote China's economy to

green, low-carbon, environmentally friendly direction

to achieve benign development, to enhance the scale

of economic growth efficiency has been the general

trend. In the process of forming a strategic shift in the

economic development model, green finance can

build a bridge and link between economic

development and environmental regulation; green

finance promotes the allocation of financial resources

toward environmental protection and enhances the

ability of society to resist risks, while enhancing

economic vitality for green industries. The total factor

carbon productivity (TFCP) index includes carbon

emissions as an input variable, which can reveal the

impact of a country's (region's) resource endowment

on carbon productivity. Under the current national

goal of "carbon neutrality" and "carbon peaking", it is

a

https://orcid.org/0000-0002-9177-177X

b

https://orcid.org/0000-0003-3864-148X

c

https://orcid.org/0000-0002-8039-5019

significant to investigate the TFCP. As a result,

researching the interactions between green finance

and TFCP is critical to the high-quality development

of the green economy. As the three major urban

agglomerations in China, Beijing-Tianjin-Hebei

region (Region I), Yangtze River Delta (Region II),

and Pearl River Delta (Region III), it is of exemplary

significance to investigate the effect of green finance

on TFCP and the spatial variability over time.

Considering how green finance is developing at

the moment, five products are selected as explanatory

variables, and relevant data are collected for 10 years

from 2011 to 2020 for three regions with intensive

economic development for measurement and

evaluation; meanwhile, the non-radial and non-angle

SBM-DDL model is used to measure and analyze the

TFCP of the three regions. Finally, a group regression

model is constructed using the measured TFCP to

examine spatial and temporal heterogeneity of green

financial development on TFCP among the three

regions.

d

https://orcid.org/0000-0002-3582-7652

e

https://orcid.org/0000-0002-0524-5635

140

Cheng, X., Kai, Z., Yan, N., Rui, Y., Liu, Y. and Zheng, Y.

Study on the Impact of Green Finance on Regional Total Factor Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity Based on Beijing-Tianjin-Hebei, Yangtze River Delta and

Pearl River Delta Regions.

DOI: 10.5220/0012027000003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 140-148

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2 LITERATURE REVIEW

2.1 Research on Green Finance on

Total Factor Productivity

At present, academics mainly study the drivers of

TFCP. Different scholars have derived the influence

of various factors on TFCP from environmental

regulation (Chen Dongjing, Liu Kun 2022; Guo

Weixiang, Sun Hui 2020), industrial structure (Hu

Biqing 2019), foreign direct investment (Jin

Shucheng 2022), and Internet development (Bai

Xuejie; Sun Xianzhen 2021).

In addition, some researchers also focus on the

impact of developing green finance on TFCP and

GTFP: Shu Taiyi (2022) analysis of the impact of

green funding on TFP from 2011 to 2019 using a

fixed-effects model, and green finance had a

significant contribution to GTFP under the fixed-

effects model; Zhang Yuan(2022) empirically

analyzed by building a panel model and using the

level of economic development to determine how

green finance affects GTFP for heterogeneity

analysis, the mechanism of green finance on green

total factor productivity is examined. The findings

reveal that there is a significant regional

heterogeneity between green finance and GTFP.

Pengfei Ge (2018) et al found that there are different

non-linear relationships between financial scale,

structure, efficiency and deepening and GTFP; Ziju

Yin (2021) et al discovered that the geographical

structure of green finance and GTFP development in

China was "high in the east," "flat in the center," and

"poor in the west." "Cheng Gui et al (2022) found that

there is a significant non-linear relationship between

green financial development and GTFP. There are

differences in curve shape, inflection point and the

moment when different provinces cross the inflection

point between groups, and green finance cannot

effectively encourage the development of GTFP

enhancement early on, and the relationship curve

shows a significant U-shaped characteristic.

2.2 On the Measurement of TFCP

TFCP covers both desired and undesired outputs, and

its comprehensive consideration of economic and

environmental benefits seeks the organic

coordination of economy and ecology. In the face of

the increasingly serious environmental problems and

urgent economic development transformation in

recent years, how to accelerate the green

development is a hot topic of discussion in academic

circles.

Regarding the measurement of TFCP, most of the

domestic and international studies focus on the

optimization of measurement indicators and

improvement of measurement methods. In terms of

the selection of measurement indicators, energy,

labor, and capital inputs are mostly used as input

variables, while outputs are mostly expressed in

terms of gross national product. For carbon dioxide

emissions, some scholars include them as input

variables (Zhang Lifeng 2013; Li Yinrong 2020).

Some scholars include it in non-desired outputs into

the measurement system to reduce the bias of

production efficiency caused by undesirable outputs

(Li Bo et al.2016 ; Chen Dongjing, Liu Kun 2022)

include CO

2

emissions in non-desired indicators for

TFCP measurement; there are differences between

the two in the perspective of TFCP: the former will

emit a certain amount of CO

2

to produce a certain

amount of output and benefits on The former

analyzes carbon dioxide emissions to produce output

and benefits; the latter analyzes input factors to

produce carbon dioxide emissions; although the

research perspectives are different, there are

achievements in theoretical research. In terms of

TFCP measurement method, Zhang Lifeng (2013) for

the first time used the DEA method to measure the

Malmquist index. Subsequent scholars have

continuously improved and refined this method:

Dongjing Chen and Kun Liu (2022); Yifei Liu and

Kai Wang (2022) used the Super-SBM model with

non-expected output for measurement; Xuejie Bai

and Xianzhen Sun (2021); Wenjing Gao et al (2018)

used the Global Malmquist-Luenberger index method

based on the SBM directional distance function for

measurement.

3 MATERIALS AND METHODS

3.1 TFCP Measurement Method

For the measurement of TFCP, academics usually use

the DEA method to measure productivity change

using Malmquist index (Zhang Lifeng 2013), but this

method cannot include non-desired output into the

model; CHUNG Y, FÄRE R (1997) further extended

this method to form the Directional distance function

(DDF), which can include both desired and non-

desired output in a certain period.

Directional distance Function (DDF), which can

include both desired and non-desired outputs and be

widely used to measure total factor productivity for a

certain period of time, but this method has certain

shortcomings and cannot effectively overcome the

Study on the Impact of Green Finance on Regional Total Factor Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity Based

on Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta Regions

141

problem of linear programming nonsolutions and

measurement bias caused by the different selection of

radial or angular directions. The GML index was

introduced by OH (2010) to address this issue;

subsequent scholars further optimized the non-radial,

non-angle function model by combining the SBM

directional distance function with the GML index

(Fukuyama et al. 1997); some scholars in the

measurement of TFCP and GTFP also Some scholars

also followed this method in measuring TFCP and

GTFP (Xiang Yang 2015, Teng Zewei 2017, Liu

Zhang-sheng 2017). Therefore, in this paper, the

GML index is chosen to measure TFCP.

Considering each province as a decision making

unit (DMU) separately, each province uses N inputs

x = (x

1

, ... , x

N

) ∈ R

N

to produce M desired outputs y

= (y

1

, ... , y

M

) ∈ R

+

M

and I non-desired outputs b =

(b

1

, ... , b

I

) ∈ R

M

at each period t = 1, ... , T the kth k

= 1, ... , T the kth k = 1, ... , the inputs and outputs of

the K provinces are (x

k, t

, y

k, t

, b

k, t

). Construct the set

of production possibilities containing desired and

undesired outputs.

() {( , ): , ;

1

,; , ; 1, 0, }

11 1

K

tttttt

Px yb zy y m

kkm km

k

KK K

ttt tttt t t

zbbi zxxxn z z k

k ki ki k kn kn kn k k

kk k

(1)

Where Zrepresents the weight of each cross-

sectional observation. In some cases,the production

of P(x) will regress. Based on this problem, Oh

(2010) created a list of potential worldwide

productions, which has improved the consistency and

comparability of the production frontier.

() {( , ): , ; ,

11 11

;,;1,0,}

11 11

TK TK

Gtt ttt ttt

Px yb zy y m zb b

k km km k ki ki

tk tk

TK TK

tt t t t

izxxnzzk

kkn kn k k

tk tk

(2)

Directional distance function for the SBM. based

on Fukuyama's et al (1997) construction of the SBM

directional distance function considering the resource

environment, the global SBM directional distance

function is obtained from the ideas of Yang Xiang

(2015) in carbon productivity measurement as

'''

'

''

11

,,,

,,

11 11

11

1

11

()

1

(, ,,,,)max

2

.. , ;

,; + ,;

0, ; 0, ; 0,

xyb

xb

NM

ni

x

y

nm

Gtk tk tk x y b

nm

V

sss

TK TK

tt x t t

kkn n k

k

tk tk

TK

tyt ttbt

km m k ki i

km ki

tk

K

txy

knm

k

ss

NgM g

Sx y b ggg

St z x s x n z

ysy m zbsbi

zksns

;0,

b

i

ms i

(3)

where (x

t, k′

, y

t, k

, b

t, k′

) denotes the input and output

vectors for province k′ and (s

x

, s

y

, s

b

) denotes the

vectors of input and output slack. (g

x

, g

y

, g

b

) denotes

the directional vectors of desired output expansion,

undesired output and input compression taking

positive values.

The GML index, since the Malmquist⁃Luenberger

index is often not cyclic and there is an unsolvable

linear programming nonsolution problem, constructs

the GML index built with SBM directional distance

function according to Oh (2010) and Yang Xiang

(2015)

with the following equation.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

142

1(,,;,,)

1

111

1(, ,;,,)

yGttt x b

Sxybggg

t

V

GML

t

yGt t t x b

Sx y b ggg

V

(4)

The change is represented by the GML index. in

period t + 1 relative to period t. Whenever the index

exceeds 1, it means that TFCP has an upward trend;

conversely, if it is less than 1, it means that TFCP has

a downward state; if it is equal to 1, it means that

TFCP is in a largely steady condition. The GML

index, however, is not similar because it measures

how time t + 1 changed from period t, therefore,

before the analysis, it is converted into a cumulative

index by drawing on the methods of Qiu Bin et al

(2008) and Li Bin (2013), if the TFCP in period 1 is

1, then the TFCP in period t + 1 is:

1

1

t

ttt

GTFP GML GTFP

(5)

3.2 Input and Output Indicators

Selection and Data Description

(1) Input indicators: labor input, fixed asset input and

energy input are selected as input indicators. For

labor input, most of the existing studies use the year-

end employment number of each province to

characterize, and this paper also continues this idea.

For fixed asset inputs, the permanent inventory

method (PIM) proposed by Goldsmith. The following

formula is used to calculate each province's

productive capital stock:

1

(1 )

tt t t

KK I

-

(6)

(2) Output indicators: for desired output, the

nominal GDP of each province is used to

characterize; for non-desired output, carbon dioxide

emissions are used to characterize, and carbon

emissions are measured using the IPCC method with

the following model equation.

=

ii

i

i

EC

CE

EE

(7)

3.3 Analysis of TFCP Measurement

Results

The results of TFCP measurement in three regions

from 2011 to 2020 are obtained by using MATLAB

software and expressed by GML cumulative index, as

shown in Figure 1. In the long term, the TFCP of the

three largest urban areas in China is steadily

increasing and the growth rate has been increasing,

which indicates that the green economic development

of the three regions in China has achieved significant

results. However, the GML index decreased in the

period of 2012-2015 compared with that of 2011 and

2012. The reason for this phenomenon may be that

the control on the use of fossil energy such as coal

and the supervision and management of heavy

industrial industries were effective at the early stage

of policy promulgation, but there were problems of

lax supervision and lack of systematic and effective

management in the subsequent development.

Therefore, in the subsequent development the

government and other business sectors should

increase the supervision of environmental protection

to achieve a balance between the improvement of

production and living standards and carbon

emissions.

From the comparison of the three regions, the

GML accumulation index of the three major urban

clusters shows a pattern of "Region III > Region II >

Region I". The GML accumulation index of Beijing-

Tianjin-Hebei region is fluctuating in the past ten

years and has been declining since 2017, while the

GML index of Tianjin is the smallest in most years,

contributing the least to the GML accumulation index

and lagging behind in relative terms; the GML

accumulation index of Yangtze River Delta and Pearl

River Delta region are both on a stable upward trend,

and the development speed of Pearl River Delta is

faster than that of Yangtze River Delta. It may be due

to the rapid development of high-tech in Guangdong

Province, especially in Shenzhen and Guangzhou,

which provides technical support and financial

guarantee for industrial green development, coupled

with the inclined support of national policies, so the

PRD region has been in the front line of green

economic development.

4 EMPIRICAL ANALYSIS OF

THE IMPACT OF GREEN

FINANCE ON REGIONAL

TOTAL FACTOR CARBON

PRODUCTIVITY

4.1 Model Setting and Variable

Selection

In order to investigate how regional TFCP is affected

by green funding, a mixed OLS model (8) is used as

the benchmark regression equation for establishing

panel data.

11

it it it

TFCP digitfin

(8)

Study on the Impact of Green Finance on Regional Total Factor Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity Based

on Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta Regions

143

In this model, the explanatory variable TFCP

it

is

the regional TFCP, the core explanatory variable

digitfin

it

is the degree of regional green finance

development, and εit is a random disturbance term.

To investigate the spatial differences of green

finance on TFCP, i.e., the effects of green finance in

three regions on TFCP among the three regions,

models (9), (10), and (11) are developed to conduct

heterogeneity analysis of the structure of the core

explanatory variables, respectively.

22

it it it

TFCP digitfin

(9)

33

it it it

TFCP digitfin

(10)

44

it it it

TFCP digitfin

(11)

The explanatory variables and control variables of

models (9)-(11) are the same as the model, and the

subscripts i and t of the variables in the above model

denote province and time

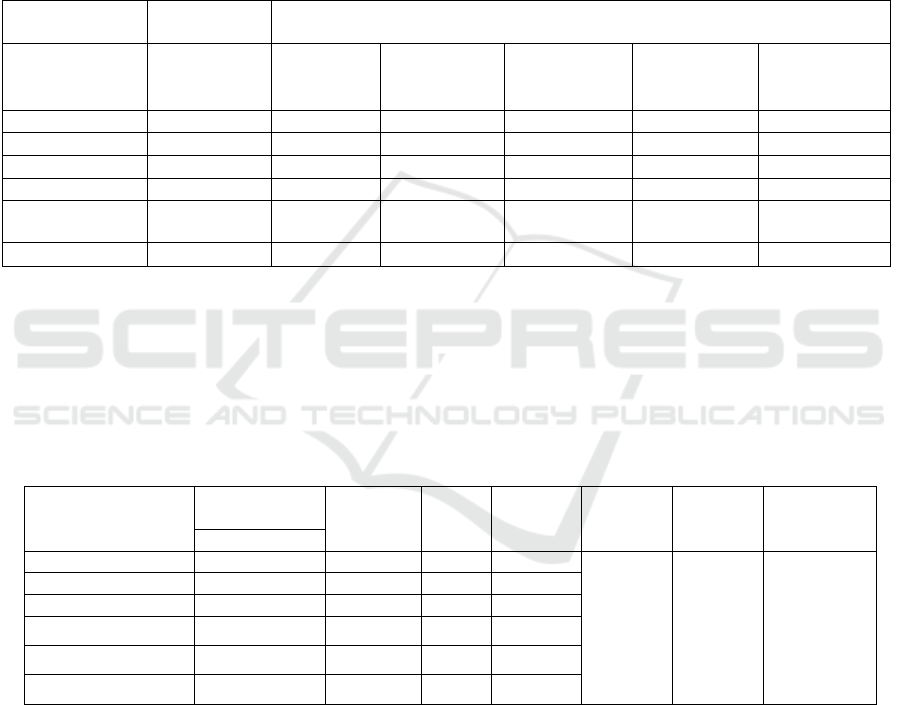

Table 1: Descriptive statistics for variables.

Var ia ble t yp e

Explained

variable

Explanatory variable

Variable name

Total Factor

Carbon

Productivity

Green

credit

Green

securities

Green

investment

Green

insurance

Carbon

finance

Sample size 70 70 70 70 70 70

Maximum value 1.448 0.615 0.3 0.003 9.171 0.003

Minimum value 0.758 0.192 0.012 0 0.067 0.002

Mean 1.03 0.392 0.088 0.001 1.841 0.009

Standard

deviation

0.153 0.111 0.057 0.001 2.111 0.006

Median 1.007 0.348 0.084 0.001 0.665 0.008

4.2 Data Sources

In this paper, the panel data of region I,region II,

region III from 2011 to 2020 are selected as the

research samples. The relevant data are mainly

obtained from the statistical yearbooks of each

province. Missing data are supplemented by

interpolation method for completeness. respectively,

and εit is a random disturbance term.

Baseline regression

The regression results of model (8) are shown in

Table 2

Table 2: Linear regression analysis results.

Standardized

coefficient

t P VIF R²

Adjustment

R²

F

Beta

Constants - 20.527 0.000*** -

0.488 0.448

F=12.186

P=0.000***

Green credit -0.111 -0.899 0.372 1.904

Green securities 0.384 3.042 0.003*** 1.996

Green investment -0.257 -2.415 0.019** 1.418

Green insurance -0.715 -6.736 0.000*** 1.408

Carbon finance -0.502 -2.769 0.007*** 4.106

The analysis of the results of the F-test can be

obtained that the significance P-value is 0.000***,

Therefore, the model basically meets the

requirements. The t-statistics of four indicators,

namely, green securities, green investment, green

insurance and carbon finance, are significant,

indicating that their effects on TFCP are more

significant.

The standardized coefficient of green securities is

0.384, which indicates that green securities have a

positive effect on TFCP; meanwhile, the standardized

coefficients of green investment, green insurance and

carbon finance are all negative, which indicates that

these three green financial products have a negative

effect on TFCP.

2. Heterogeneity analysis

The grouped regression results of models (9) to

(11) are shown in Table 3.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

144

Table 3: Regression results for subgroups.

Overall

Re

g

ion I Re

g

ion II Re

g

ion III

Constants

1.267***

(20.527)

1.013***

(15.998)

0.772

(1.474)

1.488***

(3.953)

Green

Credit

-0.153

(

-0.899

)

-0.079

(

-0.791

)

-0.744

(

-0.318

)

0.783

(

1.073

)

Green

Securit

y

1.035***

(

3.042

)

0.809***

(

5.003

)

3.568

(

0.672

)

-0.122

(

-0.062

)

Green

Investment

-67.556**

(-2.415)

-7.923

(-0.509)

-242.515

(-1.108)

-67.649

(-1.286)

Green

Insurance

-0.052***

(

-6.736

)

-0.007

(

-0.925

)

1.043*

(

2.652

)

-0.108***

(

-5.769

)

Carbon

Finance

-12.377***

(

-2.769

)

-4.695**

(

-2.089

)

33.121

(

0.538

)

-55.301***

(

-3.884

)

Sample size 70 30 10 30

R

2

0.488 0.548 0.940 0.687

Adjustment R

2

0.448 0.454 0.866 0.621

F

F

(

5,64

)

=12.186,

p

=0.000

F (5,24)=5.816,p=0.001 F (5,4)=12.644,p=0.015 F (5,24)=10.514,p=0.000

The p-values of the three regions were compared

by F-test and were significant at the degree of

confidence of 95%, indicating that green finance has

a significant contribution to TFCP in three regions.

Further analysis shows that green securities and

carbon finance have the strongest significant effect on

TFCP in Beijing-Tianjin-Hebei region; green

insurance has a more significant effect on TFCP in the

Pearl River Delta region; green insurance and carbon

finance have a stronger significant effect in the

Yangtze River Delta region. and the standardized

coefficients of each indicator in Beijing-Tianjin-

Hebei and Yangtze River Delta regions are consistent

with the overall model, while the standardized

coefficients in the PRD region differ slightly, which

may be due to too little data.

Table 4: Regression coefficient variance test.

Name Item 1 Item 2

b

1

b

2 Difference t

p

Green

Credit

Re

g

ion I

Region III

-0.079 -0.744 0.665 2.117 0.041**

Region I Region II

-0.079 0.783 -0.862 -2.289 0.028**

Region III Region II

-0.744 0.783 -1.527 1.857 0.072*

Green

Security

Region I Region III

0.809 3.568 -2.759 -11.588 0.000***

Region I Region II

0.809 -0.122 0.931 -3.896 0.000**

Region III Region II

3.568 -0.122 3.690 -1.953 0.056

Green

Investment

Region I Region III

-7.923 -242.515 234.592 1.089 0.281

Region I Region II

-7.923 -67.649 59.726 1.460 0.150

Region III Region II

-242.515 -67.649 -174.866 10.268 0.000***

Green

Insurance

Region I Region III

-0.007 1.043 -1.050 7.692 0.000***

Region I Region II

-0.007 -0.108 0.101 -1.742 0.090

Region III Region III

1.043 -0.108 1.151 1.241 0.222

Study on the Impact of Green Finance on Regional Total Factor Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity Based

on Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta Regions

145

Name Item 1 Item 2

b

1

b

2 Difference t

p

Carbon

Finance

Region I Region III

-4.695 33.121 -37.816 -0.589 0.560

Region I Region II

-4.695 -55.301 50.605 5.439 0.000***

Region III Region II

33.121 -55.301 88.421 3.721 0.001***

Table 5: Results of robustness test.

Name

Re

g

ion I Re

g

ion II Re

g

ion III

Constants 0.958**(12.563) 1.368**(3.217) 0.889(1.645)

Credit

-0.059

(-0.587)

1.055(1.396) -3.402(-1.646)

Security 0.651**(3.086) 0.030(0.014) 6.899(1.382)

Investment 0.803(1.082) -0.516(-0.094) -3.289(-0.844)

Insurance -0.004(-0.590) -0.111**(-4.553) 1.371*(2.850)

Carbon Finance -3.446(-1.349) -58.136**(-3.651) 115.943(1.515)

Sample size 30 30 10

R

2

0.564 0.665 0.934

Adjustment R

2

0.473 0.595 0.852

F

F (5,24)=6.215,

p=0.001

F (5,24)=9.532,

p=0.000

F (5,4)=11.322,

p=0.018

By comparing the differences in regression

coefficients among the three regions, the regions and

variables that are significant in each region are

bolded, as shown in Table 4. According to the chart,

It is possible to draw the following conclusions: the

effect of green credit and green investment on the

TFCP of the three regions is not significant; green

securities bring a greater impact effect in Region I,

and their p-values are more significant compared with

the Region II and Region III, with greater spatial

heterogeneity; green insurance has a strong

significance in the Region III and theRegion II; the p-

values of the Region III compared with the Region I

are heterogeneous at the p-value in the PRD region is

heterogeneous at 90% confidence level compared to

the Region I, while the heterogeneity is not

significant compared to the Region II, indicating that

the effect level of green insurance scale on TFCP is

not much different between the two regions. Carbon

finance has a strong heterogeneity in Region I,Region

II, Region III.

3.Robustness test

By referring to the test method of grouped

regression by Chang-Rong Wu et al (2022), this paper

performs robustness test by replacing the indicators

of explanatory variables.

The amount of money invested in reducing

environmental pollution and the amount of money

spent on energy efficiency and environmental

protection are some of the development indicators of

green investment; the development indicators of

green credit include the proportion of agricultural

insurance scale and agricultural insurance payout

rate

. And the indicators of agricultural insurance

payout rate were removed from the stepwise

regression after the strong covariance problem of the

variables. Therefore, the core explanatory variables

in the baseline regression models (9) to (11) were

replaced with the share of fiscal spending on

environmental preservation, energy efficiency, and a

new regression with three regional groupings was

conducted, and the obtained results are shown in

Table 5. The F-test shows that the overall regression

effect of each region is still significant, and a

comparison with Table 2 reveals that this is generally

agreeable to the outcomes of the benchmark

regression model (9) in terms of the core explanatory

variables; indicating that the econometric model and

regression results of this study have high reliability

and robustness.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

146

5 RESEARCH CONCLUSIONS

AND COUNTERMEASURE

SUGGESTIONS

5.1 Research Conclusions

First, at the overall level, the four indicators of green

securities, green investment, green insurance and

carbon finance have a significant effect on TFCP in

the three regions, and green credit has no significant

effect on its impact. Among them, green securities

have a positive promoting effect on TFCP, while the

other three indicators have a negative hindering effect

on TFCP. It may be because green finance, in

promoting the flow of capital in the market, both

increases carbon emissions in the production process

and generates economic benefits at the production

end. The economic benefits generated by green

securities are the strongest in the capital flow, and the

capital flows more to the high-end production end,

and the economic benefits generated are greater than

the impact brought by carbon emissions; while the

production end to which the capital flows such as

green insurance, green investment and carbon finance

are more to the primary production end, and the

reasons for the capital flows are mostly policy-driven

factors, and the economic benefits brought are less

than the impact of carbon emissions.

Second, at the regional level, the positive

contribution of green securities to TFCP in Beijing-

Tianjin-Hebei region is more obvious than other two

regions, probably because in recent years, Beijing-

Tianjin-Hebei region has been promoting green

transformation in various industries, increasing green

financial expenditures, and taking a number of

practical actions to implement the national energy

conservation and emission reduction policies, in

addition to the joint hosting of the 2022 Winter

Olympics. In addition, the joint hosting of the 2022

Winter Olympics by Beijing and Zhangjiakou has

also contributed to the green transformation and

upgrading of the region's industries. Green insurance

has a more obvious and significant effect on TFCP in

both the PRD and the Yangtze River Delta, while the

impact of carbon finance on TFCP varies greatly

among the three regions, and the possible reason for

the variability is the imbalance of economic strength

and technological innovation capacity.

5.2 Suggestions for Countermeasures

The following recommendations are provided for the

growth of green finance and the enhancement of

TFCP based on the research findings mentioned

above.

First, the three major city clusters, especially the

Yangtze River Delta, should take the initiative and

fully utilize the benefits of industrial agglomeration

to take the lead in achieving a sustainable and steady

growth of total factor carbon productivity, and at the

same time, they can also play a radiating effect to

drive other regions to make a rapid change to high-

quality economic development, while paying

attention to the balance between the speed of

economic development and the utilization of

environmental resources.

Secondly, strengthen top-level design, enhance

regional synergy and linkage across provinces and

cities, strengthen information sharing between

regions, promote the construction of green financial

standard system, increase the scale share of

agricultural insurance, improve the innovation

capacity of financial industry, and promote TFCP.

Finally, improve and perfect the relevant rules and

regulations, strengthen the supervision and

management of high energy consumption, high

pollution, low value-added industries, and promote

the green transformation and modernization of

industry; can further encourage collaboration

between educational institutions and businesses.,

increase the financial and policy support for research

institutes and universities as well as the

environmental research enterprise sector, train

innovative and complex talents, and promote

technological innovation to help the development of

green economy.

REFERENCES

Bai Xuejie, Sun Xianzhen.(2021).Internet development

affects TFCP: cost, innovation or demand induced[J].

China Population-Resources and Environment, 31(10):

105-117.

Chen, Dongjing, Liu, Kun. (2022).A study on the impact of

heterogeneous environmental regulations on total

factor carbon productivity[J]. Forestry Economics,

44(06): 35-49.DOI:10.13843/j.cnki.lyjj.20220725.001.

Chen Jingquan, Lian Xinyan, Ma Xiaojun, Mi Jun. (2022).

Total factor energy efficiency measurement and its

driving factors in China [J]. China Environmental

Science, 42(05):2453-2463.

DOI:10.19674/j.cnki.issn1000-6923.0120.

Cheng Gui,Zeng Lesong.(2022).Heterogeneous impact of

regional green financial development on green total

factor productivity[J]. Gansu Finance, (03):4-14.

CHUNG Y, FÄRE R.(1997).Productivity and undesirable

outputs: a directional distance function approach [J].

Journal of environmental management, 51(3):229-240.

Study on the Impact of Green Finance on Regional Total Factor Carbon Productivity: Analysis of Spatial and Temporal Heterogeneity Based

on Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta Regions

147

FUKUYAMA H, WEBER W L.(2009).A directional

slacks-based measure of technical inefficiency [J].

Socioeconomic planning sciences, 43(4) : 274 - 287.

Gao WJ, Ren Xuedi, Kang XH, Zhao GH.(2018).Analysis

of resource optimization allocation path for industrial

carbon productivity improvement[J]. Macroeconomic

Research,2018(05):166-175.DOI:10.16304/j.cnki.11-

3952/f.2018.05.016.

Hu Biqing. (2019).Research on the impact of industrial

structure on carbon productivity in China's service

industry [D]. Zhongnan University of Economics and

Law.

Jin Shucheng.(2022).Research on the impact of foreign

direct investment on carbon productivity in China[D].

Liaoning University.

DOI:10.27209/d.cnki.glniu.2022.000467.

Li B, Zhang WZ, Yu JH.(2016).Service industry

development, informationization level and TFCP

growth-an empirical study based on threshold effect[J].

Geography Research,35(05):953-965.

Liu Yifei, Wang Kai. (2022).TFCP of tourism in Yangtze

River Economic Zone and its interactive response with

industrial agglomeration[J]. Journal of Hubei Academy

of Arts and Sciences,43(08):48-56.

Liu Huiqun, Peng Chuanli. (2022)OFDI, reverse

technological spillover and total factor energy

efficiency--analysis based on PVAR model[J].

Ecological Economics,38(04):68-76.

Liu Zhangsheng, Song Deyong, Gong Yuanyuan.(2017).A

study on the spatio-temporal divergence and

convergence of green innovation capability in China

[J]. Journal of Management, 14(10) : 1475 - 1483.

Qiu B, Yang SH, Xin Pei J.(2008).A study on FDI

technology spillover channel and manufacturing

productivity growth in China: an analysis based on

panel data [J]. World Economy, 31 (08) :20 - 31.

Shu, Taiyi, Zhao, Tiantian, Zhang, Xiaolei. (2022).

Research on the impact of green finance on GTFP--an

empirical test based on fixed effects model [J]. Green

Technology,24(15):255-258.

DOI:10.16663/j.cnki.lskj.2022.15.035.

Wu C. R., Chen C.Meng X. W., Dong J. Yuan. (2022).

Differential analysis of the impact of digital inclusive

finance on residents' consumption in the South and

North--empirical evidence based on provincial panel

data [J]. Times Business and Economics, 19(05):22-30.

DOI:10.19463/j.cnki.sdjm.2022.05.036.

Zhang Yuan. (2022).Research on the impact of green

finance on GTFP[D]. Shanxi University of Finance and

Economics, DOI:10.27283/d.cnki.gsxcc.2022.000044.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

148