Analysis on the Financial Performance of OFDI Based on Principal

Component Analysis: The Case of Sinomine Resource Group

Company

Qian Yang and Gang Fang

*

Business school, Beijing Institute of Fashion Technology, Beijing, China

Keywords: SINOMINE, Outward Foreign Direct Investment, Principal Component Analysis, Financial Performance.

Abstract: Sinomine Resource Group Co., Ltd (SINOMINE) is taken as the case object in order to better measure the

influence of OFDI of resource-based enterprises on corporate performance. With the help of SPSS software

and principal component analysis method, this paper tests the financial performance of its OFDI. The study

shows that the overall financial performance of the company is good, but its profitability needs to be improved.

In addition, this article summarises the characteristics of SINOMINE's overseas expansion in two phases by

looking at its OFDI activities since its listing. The first phase of the company's location selection mainly

focused on Asian and African countries, while the second phase of overseas expansion focused on the

European and American markets.

1 INTRODUCTION

At the beginning of the 21st century, Chinese

resource-based enterprises began to gradually move

towards the international market and actively

participate in the competition and resource

redistribution in the world resource market. SONG

(2013) points out that Chinese resource-based

enterprises' outward direct investment is mainly

resource-oriented, and Sinomine Resource Group

Co., Ltd (SINOMINE) is one of the important

enterprises in China's "going out" solid mineral

exploration technology service industry. The

company has established a dominant position in the

international market for integrated geological

services, and has strengthened its control over global

mineral resources through direct investments in

foreign mining companies, mainly through greenfield

investments and cross-border mergers and

acquisitions.

In this paper, to explore the financial performance

of SINOMINE's outward foreign direct investment

(OFDI), the principal component analysis in SPSS

(Statistical Product and Service Solutions) was used

to further reduce the number of financial indicators to

a smaller number of comprehensive evaluation

*

Corresponding author

indicators. HUANG (2010) points out that the idea of

dimensionality reduction can be used to transform

multidimensional parameter indicators into several

low-dimensional principal component indicators.

Principal component analysis provides a visual and

comprehensive picture of the performance of

SINOMINE as a result of its continued overseas

expansion.

2 INTRODUCTION OF

SINOMINE

Founded in 1999, SINOMINE's main businesses

include solid mineral exploration technology services

and mineral rights development, rare metals

development and utilization, and lithium new energy,

etc. In 2014, SINOMINE was listed on the Shenzhen

Stock Exchange, becoming the first A-share listed

company in China's geological exploration services.

Since its establishment, SINOMINE has been

actively responding to China's "the belt and road"

policy and vigorously exploring overseas markets.

The company has more than 20 subsidiaries at home

and abroad and owns a total of 95 mining rights

worldwide, mainly in Canada, Zambia and Zimbabwe.

276

Yang, Q. and Fang, G.

Analysis on the Financial Performance of OFDI Based on Principal Component Analysis: The Case of Sinomine Resource Group Company.

DOI: 10.5220/0012029300003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 276-281

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

With a global presence in more than 40 countries and

regions in Asia, Africa, Europe, America and Oceania,

SINOMINE has developed a good market reputation

and a bright future with its rich experience in the field

of overseas solid mineral exploration.

3 ANALYSIS OF THE CURRENT

SITUATION OF SINOMINE

OFDI

The overseas expansion of resource-based enterprises

is characterised by geographical selection. The

current reserves of major metals and non-metallic

minerals are mainly located in four countries and

regions, namely the United States, Canada, Australia

and South Africa, which has a great influence on the

layout of SINOMINE's overseas expansion. From

SINOMINE's overseas expansion steps since its

listing in 2014, this paper divides its overseas

expansion into two main phases, with 2014 to 2017

being the first phase and 2018 to date being the

second phase. The division is mainly based on the

first statistics of rare light metals business such as

lithium salts and caesium rubidium salts under the

main business of SINOMINE's annual report in 2018,

which accounted for 23.61% of the total operating

revenue, gradually equal to the share of businesses

such as solid mineral exploration (23.94%). further

overseas expansion in 2019 made the rare light metals

business account for 42.55% of the total operating

revenue The business will become a major revenue

generator.

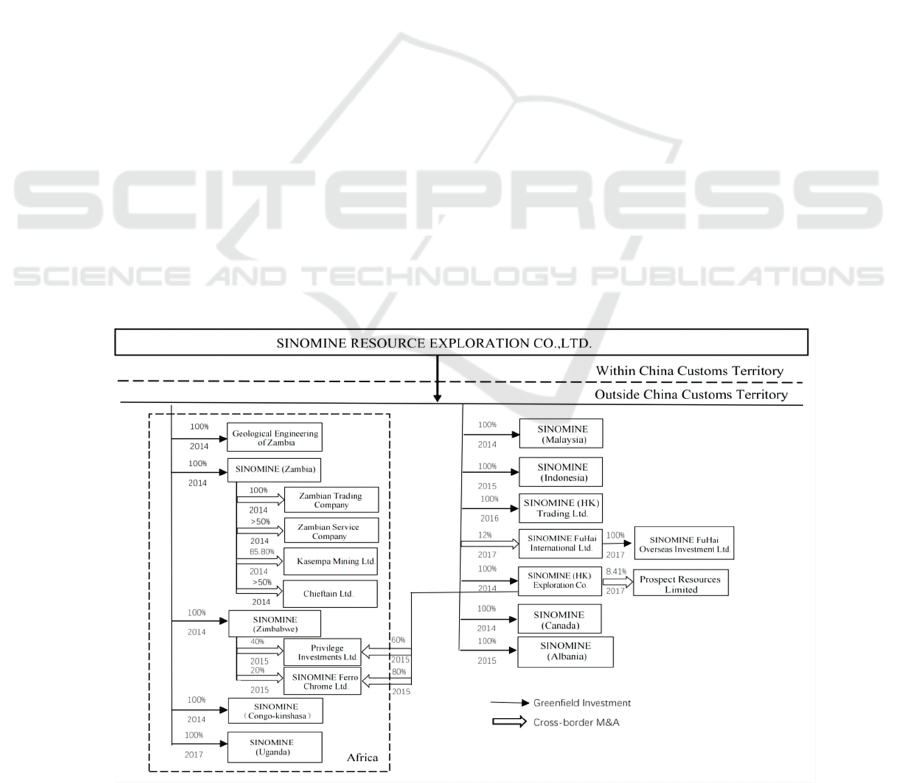

3.1 First Phase of Expansion 2014-2017

From 2014 to 2017, SINOMINE's choice of location

for overseas expansion was mainly focused on Asia

and Africa. The first phase of expansion was

concentrated in Africa, particularly in Zambia (as

shown in Figure 1).SINOMINE has been working

with Zambia for a long time, mainly with the

Zambian ministry of education, the army and

hospitals, and has undertaken some of the country's

major international projects while helping to repair

local schools and some infrastructure, contributing to

the development of the local economy.

The Zambian business has been the main source

of revenue generation for SINOMINE's overseas

operations for the last four years, accounting for an

average of 48.6% of total revenue over the four years.

However, as SINOMINE expanded into other African

countries such as Zimbabwe, Congo and Uganda, the

share of the Zambian business in the overall overseas

business trended downwards. Albania, which has rich

mineral resources in Europe and is an important

country along the "belt and road" route, has also

become an important step in SINOMINE's overseas

expansion.

The highest proportion of SINOMINE's major

operating revenue was from solid mining exploration

and technical services. In 2015, the company's

revenue

declined significantly, mainly due to the

Figure 1: 2014-2017 SINOMINE Overseas Subsidiaries and Holding Companies.

Analysis on the Financial Performance of OFDI Based on Principal Component Analysis: The Case of Sinomine Resource Group Company

277

continued downturn in the global mining market and

the devaluation of the Zambian currency, which is the

main source of overseas revenue generation, resulting

in a reduction in consolidated revenue due to

translation differences in foreign currency financial

statements. In 2016, SINOMINE established a

dedicated international trading company and the

proportion of international trade revenue has

increased year on year since then.

In 2017, supported by the accelerated global

economic recovery and the phased stabilisation of the

Chinese economy, prices of most global metal

products continued to shake out higher, especially for

bulk commodities such as copper, aluminium, zinc

and lead, which all rose by more than 20% in

aggregate during the year, and prices of minor metal

varieties related to new energy and materials also

surged, as the global mining market started a new

development cycle.

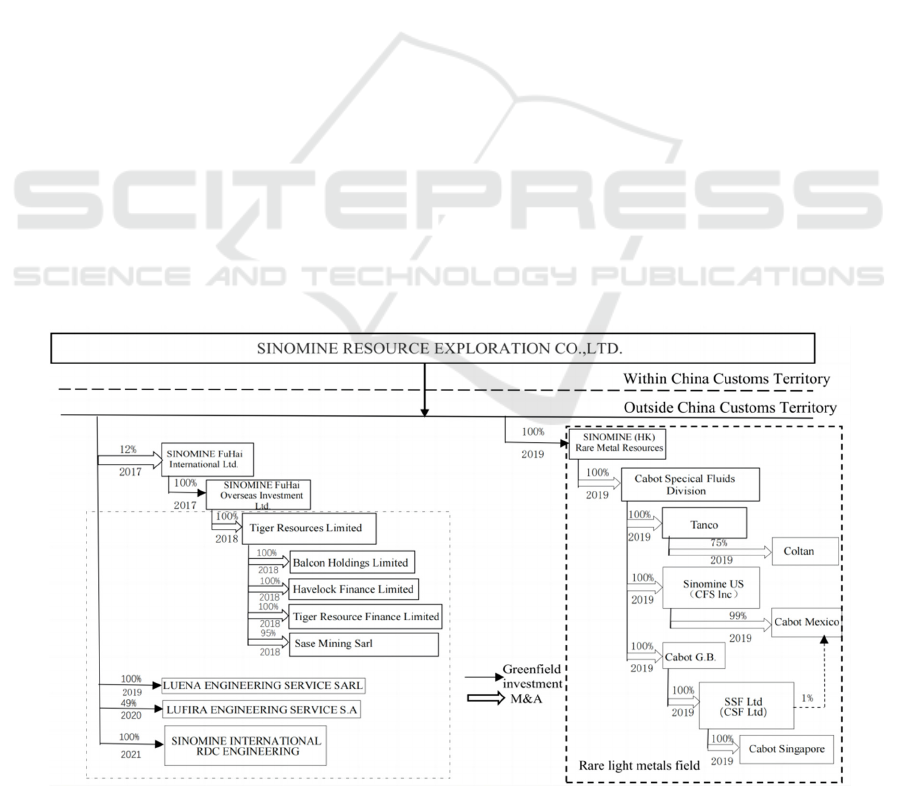

3.2 Second Phase of Expansion

2018-Present

With the accumulation of international experience,

SINOMINE has become more and more proficient in

expanding its business abroad and has gradually

started to enter some of the American countries.In

2017, SINOMINE acquired Dongpeng New

Materials Company in China, which marked the

gradual focus on rare and light metals, and in 2019,

SINOMINE established a wholly-owned subsidiary,

SINOMINE(Hong Kong, China). In the same year,

SINOMINE acquired Gabot Special Fluids Division,

and through its 100% holding in Gabot Special Fluids

Division, it ventured into the United States, the

United Kingdom, Mexico, Canada and other

countries. It is worth noting that the 2017 annual

report did not yet have the revenue amount of the

operating details of rare light metals, the following

year the enterprise began to specialise in the statistics

of the project accounted for as much as 23.61%,

second only to the share of solid mineral exploration

business. In 2020, the operating revenue of rare light

metals business has reached 54.85%, the share of

solid mineral exploration business began to decrease.

The acquisition of Gabot's Specialty Fluids

Division in 2019 enabled SINOMINE to acquire the

mineral rights to Tanco in Canada, making it the

world's largest mining company to mine cesium

garnets. The world's available cesium garnet resources

are currently concentrated in three main mining areas,

including the Bikita mine in Zimbabwe, the Tanco

mine in Canada and the Sinclair mine in Australia. The

Bikita mine supplies raw materials to SINOMINE's

subsidiary, Dongpeng company, and to Arbor in the

USA. This acquisition not only gives SINOMINE 126

international patents for the deep processing and

application of cesium resources, but also gives it

control over 75% of the world's cesium resources.

This breaks the monopoly of foreign companies in the

energy industry and establishes SINOMINE's global

pricing power in the cesium resource chain. This has

greatly enhanced SINOMINE's industry position in

the world energy community.

Figure 2 2018-2021 SINOMINE Overseas Subsidiaries and Holding Companies

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

278

4 ANALYSIS OF SINOMINE'S

FINANCIAL PERFORMANCE

Resource-based companies cannot show very

significant financial performance as quickly as

consumer-based companies after an acquisition. In

order to study the long-term corporate development

of SINOMINE, this paper uses principal component

analysis to analyse the financial performance of

SINOMINE from 2014 to 2021.

4.1 Data Sources and Description of

Indicators

This article obtains data from sina finance and selects

SINOMINE quarterly financial indicators from 2014

to 2021 Due to some missing data in 2014, some

quarterly indicators with incomplete data were

excluded, and 28 sets of data samples were finally

retained. Based on WANG et al. (2014), this paper

focuses on three aspects of profitability, solvency and

operating capacity, and selects nine indicators to

analyse the financial performance of SINOMINE

after several outward direct investments in recent

years. In this paper, the indexes are appropriately

revised according to the positive treatment of the

moderate indexes of corporate financial indicators by

Xu et al. (2000). The index of gearing ratio is mainly

adjusted based on Equation X

=1/|X

|(i=1, 2, …,

n).

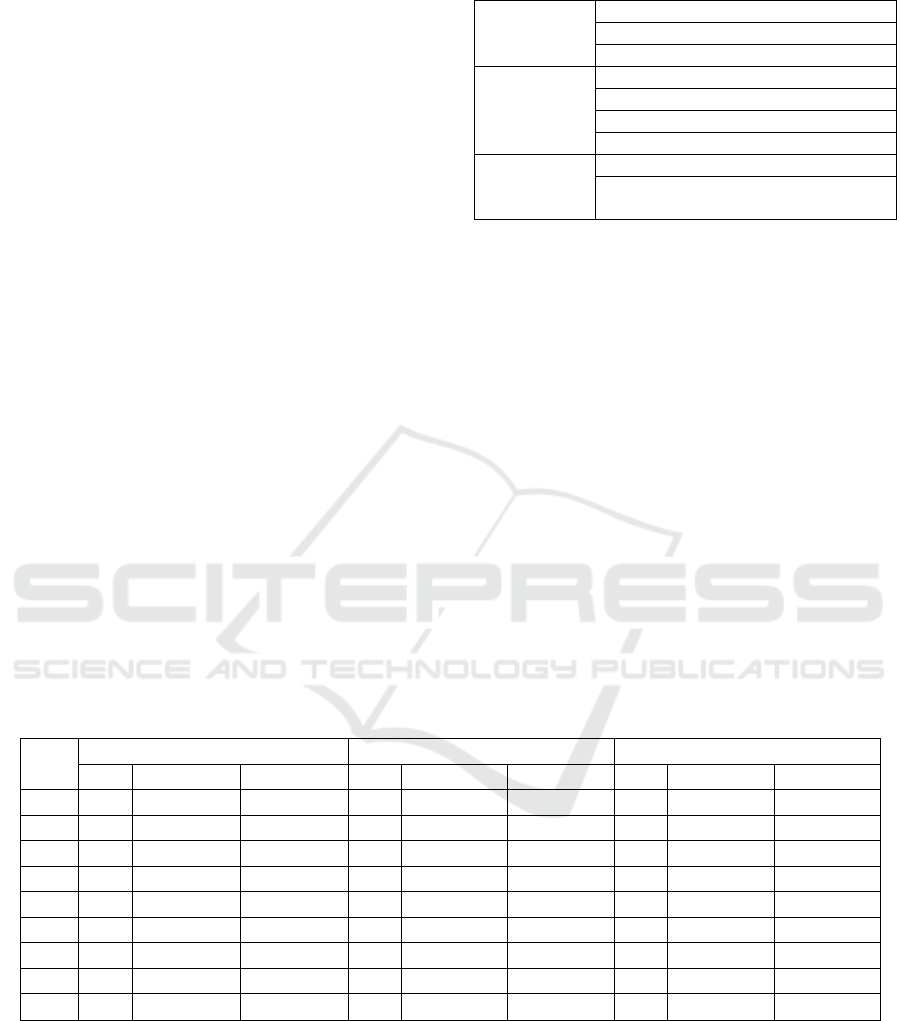

Table 1: Main financial indicators.

Profitability

Return on Equity (X

)

Rate of Return on Total Assets (X

)

Return on Assets (X

)

Solvency

Current Ratio (X

)

Aci

d

-test Ratio (X

)

Cash Ratio (X

)

Asset-liability Ratio (X

)

Operating

capacity

Total Assets Turnove

r

(X

)

Accounts Receivable Turnover Ratio

(X

)

4.2 Empirical Analysis

The 336 financial data were measured by SPSS.26

software. The test results from the KMO and Bartlett's

test showed that the value of KMO was 0.680. YANG

et al. (2020) concluded that a KMO value greater than

0.6 met the requirements for factor analysis. The

Bartlett sphericity test significance was 0.000, which

was less than the significance level of 0.05, so the data

could be continued for factor analysis.

In this paper, the three common factors with

eigenvalues greater than one were extracted using

principal component analysis, with variance

contribution rates of 40.423%, 35.451% and 15.005%

respectively, and the cumulative total variance

contribution rate was 90.879%. The three common

factors selected in this paper can cover the

information contained in the nine indicators and

basically meet the calculation criteria.

Table 2: Total Variance Explained.

Comp

onen

t

Initial Eigenvalues Extraction Sums of Squared Loadings Rotation Sums of Squared Loadings

Total % of Variance Cumulative % Total % of Variance Cumulative % Total % of Variance Cumulative %

1 3.827 42.524 42.524 3.827 42.524 42.524 3.638 40.423 40.423

2 3.191 35.453 77.977 3.191 35.453 77.977 3.191 35.451 75.874

3 1.161 12.902 90.879 1.161 12.902 90.879 1.350 15.005 90.879

4 0.456 5.065 95.944

-- -- -- -- -- --

5 0.199 2.209 98.152

-- -- -- -- -- --

6 0.080 0.890 99.043

-- -- -- -- -- --

7 0.066 0.739 99.781

-- -- -- -- -- --

8 0.014 0.150 99.932

-- -- -- -- -- --

9 0.006 0.068 100.000

-- -- -- -- -- --

As can be seen from Table 3, the two indicators

with the largest loadings in common factor F1 are

total assets margin and return on net assets, which

mainly reflect the profitability of the enterprise and

are therefore named profitability factor. The two

indicators that contribute the most to the loadings of

common factor F2 are the quick ratio, the current ratio

and the cash ratio, which mainly measure the

solvency of the enterprise and are therefore named the

debt service factor. The largest contributor to

common factor F3 is the accounts receivable turnover

ratio, and is therefore named the operating capacity

factor.

Analysis on the Financial Performance of OFDI Based on Principal Component Analysis: The Case of Sinomine Resource Group Company

279

Table 3: Component Score Coefficient Matrix.

Name F1 F2 F3

𝑋

0.250 0.018 0.057

𝑋

0.248 0.007 0.061

𝑋

0.282 -0.022 -0.291

𝑋

-0.008 0.307 -0.033

𝑋

0.014 0.306 -0.091

𝑋

-0.074 0.284 0.319

𝑋

0.130 0.186 -0.559

𝑋

0.276 -0.036 -0.089

𝑋

0.039 0.092 0.543

The formula for calculating the principal

component factor is 𝐹

=𝑏

𝑋

+𝑏

𝑋

+…+𝑏

𝑋

.The

formula for scoring the overall financial performance

evaluation indicators is 𝐹 = 𝑊

× 𝐹

+ 𝑊

× 𝐹

+

𝑊

× 𝐹

.Where is 𝑊

, 𝑊

, 𝑊

determines the

weighting of each composite indicator based on the

cumulative variance contribution.

In terms of profitability indicator F1, there was

little overall volatility (as shown in Table

5).SINOMINE's larger profitability indicator in 2015

was

mainly due to the continued downturn in the

Table 4: Principal component factor scores and composite scores.

Date of report F1 F2 F3 F

2014-12-31 -0.0263 0.4479 0.4170 0.2319

2015-03-31 -0.1099 0.4801 0.4689 0.2158

2015-06-30 -0.0161 0.3206 0.2549 0.1600

2015-09-30 -0.0914 0.5382 0.5170 0.2547

2015-12-31 0.0394 0.2112 0.1596 0.1263

2016-03-31 -0.0467 0.2150 0.1919 0.0948

2016-06-30 0.0240 0.1441 0.0806 0.0802

2016-09-30 0.0017 0.1539 0.1250 0.0814

2016-12-31 0.0487 0.1681 0.1126 0.1059

2017-03-31 -0.0251 0.1370 0.1092 0.0603

2017-06-30 0.0350 0.0966 0.0381 0.0595

2017-09-30 0.0122 0.0979 0.0713 0.0554

2017-12-31 0.0642 0.1232 0.0583 0.0863

2018-03-31 -0.0206 0.1161 0.0913 0.0512

2018-06-30 0.0119 0.1573 0.1211 0.0866

2018-09-30 0.0081 0.0787 0.0568 0.0437

2018-12-31 0.0090 0.1957 0.1741 0.1091

2019-03-31 -0.0296 0.1755 0.1623 0.0821

2019-06-30 0.0194 0.1041 0.0703 0.0608

2019-09-30 0.0041 0.1299 0.1142 0.0714

2019-12-31 0.0124 0.1740 0.1501 0.0982

2020-03-31 -0.0337 0.1824 0.1682 0.0839

2020-06-30 -0.1067 0.5549 0.5702 0.2631

2020-09-30 -0.1205 0.5878 0.6165 0.2775

2020-12-31 -0.0871 0.5606 0.5776 0.2753

2021-03-31 -0.1210 0.5656 0.5853 0.2634

2021-06-30 -0.1310 0.7309 0.7525 0.3511

2021-09-30 -0.0482 0.4243 0.4395 0.2166

global mining market and the contraction of the

geological exploration business. During this period,

the main overseas revenue came from the Zambian

region, where the devaluation of the Zambian

currency led to a reduction in consolidated earnings

due to translation differences in foreign currency

financial statements. 2019 saw the acquisition of

Canadian cesium metal mineral rights, helping the

company to gain control of the global cesium

resource chain. In 2020, however, SINOMINE's

business is impacted by the global outbreak of the

New Crown epidemic and profitability does not

improve effectively and tends to decline. 2021, when

the epidemic is effectively controlled, SINOMINE's

profitability increases. Foreign direct investment by

resource-based companies does not tend to improve

performance significantly in a short period of time, as

mineral exploration takes a long time, so the overall

profitability effect is not good in the short term.

In terms of solvency indicator F2, SINOMINE's

solvency was low for a long time due to the high

OFDI activity after the IPO. The company's revenue

from the rare metals business increased significantly

in 2019, which led to higher solvency, and the

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

280

company's debt maturity in 2021, which led to lower

solvency, so there were large fluctuations. It is worth

mentioning that frequent overseas expansions have

led to a rise in the company's operating income and a

strengthening of debt servicing capacity. In terms of

operating capacity indicator F3, the successive

overseas expansions since SINOMINE's IPO have

increased the pressure on the company's operations.

However, with the accumulation of international

experience, SINOMINE's overall operating position

is good.

In terms of the composite indicator F, there was

an overall downward trend in the indicator from 2014

to 2016. From 2017 to 2019, the overall score is

stable, with SINOMINE consolidating its solid

exploration while starting to strategically target

lithium and rare metals in the context of an

accelerating global economic recovery. In 2020,

SINOMINE's overall financial performance will be

significantly higher as it takes control of most of the

world's metallic cesium claims. In 2021, the

company's significant decline is mainly due to the

maturity of its debt, which will need to be repaid.

Overall, SINOMINE's OFDI in recent years has

improved the company's long-term financial

performance.

5 CONCLUSIONS

This paper examines the status of SINOMINE's OFDI

since its IPO. The analysis shows that SINOMINE's

early OFDI was mainly in mineral-rich regions in

Africa, while its later OFDI was mainly in rare

metals, with a shift from Africa to Canada, Australia

and the United States. In terms of long-term financial

performance, SINOMINE's profitability has not been

satisfactory since its IPO, but the numerous OFDIs

have increased the company's international

experience and improved its operating and debt

servicing capacity. The global impact of the new

crown epidemic in 2020 has caused a significant

decline in the overall performance of resource-based

companies. According to the study, overall

profitability will show an upward trend in 2021 and

financial performance is expected to improve in the

future.

SINOMINE's overseas subsidiaries and holding

companies are located in many countries and regions

such as Africa, Southeast Asia, Central Asia and

Southern Europe, and are exposed to risks such as

exchange rate changes, political unrest and

institutional issues that may affect the revenue of

overseas operations. Therefore, it is important to

improve the risk warning mechanism to prepare for

possible risks in advance and to reduce the series of

negative impacts caused by risks. Secondly, from the

perspective of financial consolidation, SINOMINE's

foreign investment activities are relatively frequent.

In particular, there are several acquisitions taking

place at the same time in the same year, making it

more difficult for the company to integrate its

finances. The company can introduce a digital

management system to improve its ability to manage

and analyse its assets through the digital

transformation of its finances. From the perspective

of resource integration, enterprises should optimise

the allocation of resources, including natural

resources, human resources and resources with

unique advantages, etc. SINOMINE can strengthen

the integration efforts of the upstream and

downstream industrial chains and can integrate the

logistics system to improve operational efficiency.

ACKNOWLEDGEMENTS

Support by: “Beijing Higher Education

Undergraduate Teaching Reform Innovation Project”

project (Project No.: 202110012004); “The first batch

of new liberal arts research and reform practice

projects of the Ministry of Education” project (Project

No.: 2021140009); Beijing Education Science "14th

Five-Year Plan" Project for 2021” project (Project

No.: 3067-0001).

REFERENCES

HUANG Y. L.(2010).Statistical Analysis of Data - SPSS

Principles and Applications[M].Higher Education

Press, 26-27.

SONG Y. C.(2013).Examining the effectiveness of China's

OFDI purpose: A resource-seeking OFDI as a

perspective [J].Inquiry into Economic Issues, 8, 123-

129.

WANG D., CHEN R.(2014).Evaluation of financial

performance of mineral resource-based listed

companies: Based on a sustainable development

perspective [J].Friends of Accounting, 26, 25-30.

XU G. X., SHAN X. Q., HU H. H.(2000). Comprehensive

evaluation of business performance of listed companies

and its empirical study [J].Statistics, 09, 44-51.

YANG L. H., YUAN H. C.(2021).A study on the impact of

institutional distance on firms' overseas M&A

performance: Based on the moderating effect of

overseas M&A experience, bilateral investment

cooperation relationship[J].Communication of Finance

and Accounting, 8,67-70.

Analysis on the Financial Performance of OFDI Based on Principal Component Analysis: The Case of Sinomine Resource Group Company

281