Performance of Delta-Hedging on Black-Scholes Model and Heston

Model

Weiyi Qian

Reading Academy, Nanjing University of Information Science and Technology, Nanjing, China

Keywords: Option Pricing, Black-Scholes Model, Heston Model, Delta Hedge.

Abstract: This paper mainly studies the Black-Scholes model, Heston model and their delta hedge, using the same data

about stock and option price of Ford Motor, which is useful for investors and company managers to build

their portfolios. In this study, unknow volatility is firstly assumed for the sake of simplicity. Then through

calculating, the theoretical volatility is estimated for establishing the model. Finally, after two models having

been established, the delta-hedging performances on them are compared in terms of the total gain or loss.

Relatively, the profit Heston model brings to the company is higher than the Black-Scholes model and the

error sum of squares of Heston model is lower than the Black-Scholes model. The results confirm that

choosing Heston model is more beneficial than BS model to investors for processing the data of Ford Motor

and gets a more accurate prediction.

1 INTRODUCTION

Black-Scholes model and Heston model are both the

most important achievements in modern economics

which mainly discuss the method of determining

option value (Wu, 2004). In addition, Venture capital

is a comprehensive investment system, closely related

to high-tech industry (Liu, 2022).

Hence, In the fierce stock and option market, the

study of establishing models and delta hedging is

significant. To illustrate, A large number of scholars

have done profound research in this aspect in these

years. Shiyu Wang studies and analyzes the pricing of

European option in risk averse market (Wang, 2022),

and Yanming Liu discusses the effect of option pricing

theory on venture capital (Liu, 2022). Meanwhile, On

the basis of option pricing model, some scholars have

extended their research to other fields. For example,

Wanshan Xie makes a task about the time fractional

Asian option pricing problem based on high precision

finite difference method and in another subfield (Xie,

2022), Yan Qing doed some numerical simulations

and empirical analysis on Pricing model of European

option based on radial function (Qing, 2022). What’s

more, Ziqi Lei and Qing Zhong provide an

explanation about the option pricing based on

uncertain fractional differential equation in the

floating rate case (Lei, 2022).

Nevertheless, the research of Specific

implementation of the company and reality to deal

with the problem is rare, most of them focusing on the

theoretical data construction. This paper based on the

stock data of Ford Motor, compare the earnings of

Black-Scholes model, and Heston model using delta

hedging. To begin with, based on the logical structure

and formulation of models, the parameters can be

calculated and adjusted which refers to the

establishment of models. After two models are both

founded, the theoretical and practical value are

compared to calculate the error sum of

squares.Finally,delta hedging is used to calculate the

gain or loss and analyze which model brings more

profit to the company. The result of the study proves

that the delta hedging strategy performs well on ford

motor’s stock options and Heston model relatively is

more accurate and profitable.

This paper contains the following: Section 2 shows

data and methods. Section 3 describes the results and

discussion, and Section 4 gives the conclusion.

2 DATA AND METHODS

2.1 Data

Ford Motor is an enterprise with a long history and

372

Qian, W.

Performance of Delta-Hedging on Black-Scholes Model and Heston Model.

DOI: 10.5220/0012033300003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 372-380

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

reputation. According to the 2021 annual financial

results released by Ford China, the development of

Ford in the past two years is quite good, with a total of

624,802 vehicles delivered in the whole year, with a

year-on-year growth of 3.7%. Hence, the future

growth trend of Ford stock is promising. Thus, in this

paper, the Fort Motor is selected as the research target.

The data selected is from wind

(https://www.wind.com.cn) and Yahoo Finance

(https://ca.finance.yahoo.com). The stock of Ford

motor is collected from June.22th, 2021 to

June.22th,2022 and five call options and five put

options on Ford motor are used to adjust parameters to

build models, namely to estimate an annual volatility

for two different option pricing models, which are

from June.1th, 2022 to June.22th, 2022.After

establishing models, a hedging strategy is constructed

for the Black-Scholes model and Heston model from

June.2th, 2022 to June.22th, 2022. In general, the

collected data is shown in the table below.

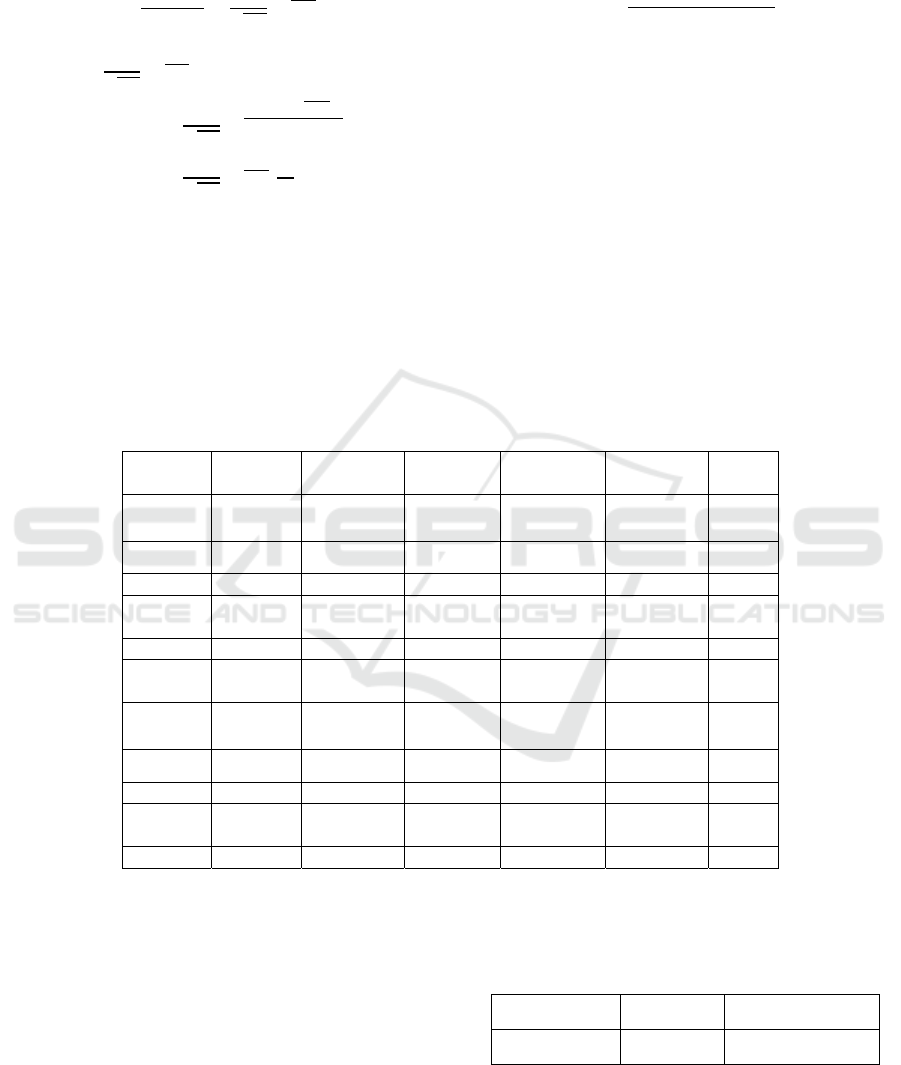

Table 1: Partial screenshot of stock data of Ford Motor.

Date Open High Low Close Adj Close Volume

2022/6/1 13.88 13.97 13.4 13.55 13.55 50726200

2022/6/2 13.64 13.96 13.6 13.89 13.89 42979700

2022/6/3 13.63 13.78 13.36 13.5 13.5 43574400

2022/6/6 13.74 13.74 13.38 13.46 13.46 37711100

2022/6/7 13.26 13.77 13.19 13.74 13.74 38940300

2022/6/8 13.63 13.85 13.44 13.53 13.53 39441900

2022/6/9 13.51 13.59 13.28 13.28 13.28 30468000

2022/6/10 13 13.21 12.63 12.75 12.75 55644400

2022/6/13 12.3 12.38 11.74 11.81 11.81 80676300

2022/6/14 11.99 12.42 11.91 12.2 12.2 82369300

2022/6/15 12.22 12.42 12 12.27 12.27 70393200

2022/6/16 11.8 11.91 11.12 11.25 11.25 80380100

2022/6/17 11.24 11.44 10.9 11.23 11.23 80166800

2022/6/21 11.55 11.66 11.35 11.46 11.46 65671600

2022/6/22 11.55 11.42 11.21 11.375 11.375 3182685

This a partial screenshot of stock data of Ford

Motor from June.1st,2022 to June.22nd, 2022. As

shown above, the stock price fluctuated between 10

and 14 during this period and the overall trend is

downward. And to calculate the parameters of Black-

Scholes model and Heston model, making sure the

error is minimal, the data of options on June.1th,2022

is chosen for numerical modeling. The following table

shows the options collected for calculating volatility.

Table 2: The 10 options used for calculating volatility.

Call option

2022/6/1 strike price option price

12 1.96

13 1.49

13.5 0.86

14 0.58

14.5 0.47

Put option

2022/6/1 strike price option price

11.5 0.1

12 0.13

13 0.32

13.5 0.49

14 0.67

As shown above, the strike prices set for two

different options respectively are 12-14.5, decreasing

by 0.5 for call option and 11.5-14 increasing by 0.5 for

put option. Moreover, according to the model built on

data on June.1st,2022, the delta hedge of two options

is calculated for the profit and loss. The parameters in

hedging strategy are shown below.

Table 3: Parameters in hedging strategy.

date strike price(K) option price type

2022/6/2 12.5 1.48 call

2022/6/3 12.5 1.32 call

2022/6/6 12.5 1.34 call

2022/6/7 12.5 0.97 call

2022/6/8 12.5 1.19 call

Performance of Delta-Hedging on Black-Scholes Model and Heston Model

373

2022/6/9 12.5 1.17 call

2022/6/13 12.5 0.41 call

2022/6/14 12.5 0.28 call

2022/6/15 12.5 0.34 call

2022/6/16 12.5 0.17 call

2022/6/17 12.5 0.08 call

2022/6/21 12.5 0.03 call

2022/6/22 12.5 0.02 call

date strike price(K) option price type

2022/6/2 12.5 0.19 put

2022/6/3 12.5 0.24 put

2022/6/6 12.5 0.23 put

2022/6/7 12.5 0.25 put

2022/6/8 12.5 0.13 put

2022/6/9 12.5 0.16 put

2022/6/10 12.5 0.26 put

2022/6/13 12.5 0.57 put

2022/6/14 12.5 0.71 put

2022/6/15 12.5 0.5 put

2022/6/16 12.5 0.9 put

2022/6/17 12.5 1.33 put

2022/6/21 12.5 0.9 put

2022/6/22 12.5 1.09 put

As shown above, strike price is set to 12.5 and

option data is form June.2nd,2022 to June.22nd,2022.

2.2 Methods

To begin with, Black-Scholes model and Heston

model are both one of the most popular mathematical

models which are used for the option pricing in

contracts. (MacBeth, 1979; Backus, 2004; Bohner,

2009).

In this study, to compare the advantages and

disadvantages of the two models, the profit and loss

by delta hedging of these two models are calculated

and analyzed. There are three steps which are essential

process the study needs.

Firstly, the Black-Scholes model is established

according to the data of option price on June.1st,

2022.It was proposed by Black and Scholes in the

1970s. According to this model, only the current value

of the stock price is related to the future forecast. The

past history and evolution of variables are not

correlated with future predictions. And there are a

couple of assumptions if the model is set up. It

assumes no arbitrage pricing and the volatility of the

stock is constant and follows normal distribution.

Using Black-Scholes model to price an option has to

do with five parameters--current price, strike price,

volatility, risk-free return and time to maturity.

Volatility means the annualized standard deviation of

stock prices. Risk-free return means the rate of return

you can get from investing money in a risk-free

investment. The formulas of call and put option are

here.

𝐶all:S(t)N(d

)−𝐾𝑒^(−r(T

− t) ) 𝑁(𝑑

)

(1)

𝑃𝑢𝑡:−𝑆𝑒^(−D(T − t) ) 𝑁(−d

)

+𝐾𝑒^(−𝑟(𝑇

−𝑡)) N(𝑑

)

(2)

d

=1/(𝜎

√

(T − t))[log (𝑆(𝑡)/𝑘) +(𝑟

+ 1/2 𝜎^2 )(T − t)

(3)

𝑑

=1/(𝜎

√

(𝑇− 𝑡))[log (𝑆(𝑡)/𝑘) + (𝑟

− 𝜎^2/2 (𝑇 − 𝑡)]]

=d

−𝜎

√

(𝑇− 𝑡)

(4)

As the formulas shown above, S means current

price of the stock, K refers to the strike price assumed,

r means risk-free return, σ refers to the volatility.

After plugging in the data and recalculating the

theoretical price, the sum of squares due to error can

be got by using formulas below.

𝜎(𝑠𝑖𝑔𝑚𝑎) =(𝑃𝑖(𝑎)

−

〖

𝑃𝑖

〗

^𝑚 )^2

/

〖

𝑃𝑖

〗

^𝑚

(5)

Pi(a) means the theoretical price, and Pi(m) means

the actual price. The steps above is all the process for

establishing the Black-Scholes model.

Secondly, Heston model need to be established

using the same data calculated. Due to the deficiency

of the Balck-Scholes model in assumptions,

subsequent scholars have continuously modified and

improved the Balck-Scholes model. Heston model is

an extension of Black-Scholes model.

Heston model is a model that introduces stochastic

volatility on the traditional BS model. It assumes that

the fluctuation of underlying is not a constant, but a

random process of reverting to the mean. This process

involves a long-run average of volatility and a rate of

recurrence of this volatility. If the previous volatility

is below the long-run average, then the model can

adjust upward at a certain rate.

In general, Heston model assumes that the

underlying asset price follows a Brownian motion, and

the volatility is regarded as a stochastic process.

Assume that the price and variance of the underlying

asset follow the following diffusion process formula:

𝑑𝑆 = 𝜇𝑆𝑑𝑡+

√

(𝑣𝑆𝑑𝑊

_

𝑡^(1 ) )

(6)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

374

𝑑𝑣_𝑡 = 𝑘(𝜃− 𝑣_(𝑡)) 𝑑𝑡

+𝛿

√

𝑣_𝑡 𝑑𝑊_𝑡^2

(7)

As the formulas shown above, S means current

price of the stock, K refers to the adjusting speed,

θmeans a long-run mean level, σ refers to the

fluctuations in volatility.

And according to ITO's lemma, the variance of the

option value at time t is C(S,v,t) as the formula below:

𝑣𝑆

𝜕

𝐶

2𝜕𝑆

+

𝜌𝛿𝑣𝑆𝜕

𝐶

𝜕𝑆𝜕𝑣

+

𝛿

𝑣𝜕

2𝜕𝑣

+

𝑟𝑆𝜕𝑐

𝜕𝑆

−𝑟𝐶

+

[

𝑘

(

𝜃−𝑣

)

−λ

]

∂C

∂

v

+

𝜕𝐶

𝜕𝑡

=0

(8)

Analyzing this formula above, the model satisfy

some other formulas below:

λ

=

λ

(

S,

v

,t

)

=k

√

v

(9)

𝐶

(

𝑆,∞,𝑡

)

=𝑆

(10)

𝑟𝑆𝜕𝑐

𝜕𝑠

(

𝑆,0,𝑡

)

+

𝑘𝜃𝜕𝑐

𝜕𝑣

(

𝑆,0,𝑡

)

−𝑟𝐶

(

𝑆,0,𝑡

)

+ 𝐶

(

𝑆,0,𝑡

)

=0

(11)

Considering that volatility risk is only related to

volatility, the option price calculated in the risk-

neutral case can be applied in practice, that is, ρ= 0,

where:

𝑑𝑣

=𝑘

∗

(

𝜃

∗

− 𝑣

)

𝑑𝑡

+𝛿

𝑣

𝑑𝑊

(12)

𝐶𝑜𝑣

(

𝑊

,𝑊

)

=𝜌𝑑𝑡

(13)

As the formulas shown above, k*= k + λ,

θ*=kθ/k+1, ρ means the correlation between Wt1 and

Wt2.

So, the partial differential equation solution of

Heston model and part of the relationship between

variables are got, then it’s time to adjust the

parameters. According to the partial differential

equation of Heston's model, calculating the European

option price needs to know the rate of adjustment, the

mean of the long run level, fluctuations in volatility,

variance, correlation, volatility risk, but due to the

assumption that it is a risk-neutral world ,the volatility

risk namely ρ is equal to 0.Hence,only five parameters

are required.

Table 4: Stock data in past 14 day.

Date Open High Low Close Adj Close Volume

2022/5/17 13.34 13.53 13.16 13.53 13.53 50891400

2022/5/18 13.25 13.36 12.71 12.78 12.78 68362500

2022/5/19 12.64 13.12 12.63 12.85 12.85 58459600

2022/5/20 13.05 13.12 12.07 12.5 12.5 78183400

2022/5/23 12.64 12.95 12.5 12.83 12.83 51929600

2022/5/24 12.6 12.68 12.27 12.42 12.42 51082800

2022/5/25 12.33 12.81 12.32 12.71 12.71 41193100

2022/5/26 12.8 13.2 12.79 13.12 13.12 45709200

2022/5/27 13.26 13.63 13.24 13.63 13.63 54195700

2022/5/31 13.68 13.82 13.35 13.68 13.68 79689900

As the table shown above, the variance of open

price in past 14 days calculated equals to 19.3%.

𝐹

(

𝑥

)

=

1

2

−(

1

𝛱

)

𝑅𝑒[

𝑒

(

)

𝜑

(

𝑢

)

𝑖𝑢

]𝑑𝑢

(14)

𝑘𝜃 >

1

2

𝜎

(15)

Plugging in the data, the parameters rho, sigma,

theta, kappa, and v can be estimated through formulas

(8), (11), (12), (14), (15).

Thirdly, after establishing Black-Scholes model

and Heston model, delta hedge is carried out on the

basis of the two models, and based on the data of stock

and option, the returns of the two models are estimated

respectively. Delta hedging is the operation of keeping

the Delta value of an asset portfolio close to zero. The

value of delta is equal to the ratio of the change in the

option price to the change in the underlying asset

price, which aims to reduce the impact of the change

in the underlying asset price on the asset portfolio.

𝑑𝑒𝑙𝑡𝑎

(

∆

)

=

𝜕𝛱

𝜕𝑆

(16)

As the formulas shown above, Π means the option

price, S means the stock price.

To start with, for the delta hedge of Black-Scholes

model: Through the establishment of Black-Scholes

Performance of Delta-Hedging on Black-Scholes Model and Heston Model

375

model, the formulas (1), (2) of call and put options are

got. Hence, N’(d1) and N’(d2) can be got by

calculating.

𝑁

(

𝑑

)

=

𝜕𝑁

(

𝑑

)

𝜕𝑑

=

1

√

2𝜋

𝑒

(17)

𝑁

(

𝑑

)

=

1

√

2𝜋

𝑒

=

1

√

2𝜋

𝑒

(

√

)

=

1

√

2𝜋

𝑒

.

𝑆

𝑋

𝑒

()

(18)

As a result, the delta formula for non-dividend

stock options can be derived based on the Black-

Scholes model: Δ (call option)= N(d1), Δ (put

option)= N(d1) - 1.

Since in the establishment of Black-Scholes

model, σ has been got which is equal to 43.5%, setting

k is 12.5 and r is 0.0325, the gain or loss in Black-

Scholes model based on the Ford Motor data can be

calculated. Then do the delta hedge of Heston model,

using definition of differential to estimate the delta.

The formulas are as follows:

𝐷𝑒𝑙𝑡𝑎

=

𝐶

(

𝑠+∆𝑠

)

−𝐶

(

𝑠

)

∆

𝑠

(19)

Plugging in the data, the gain or loss of Heston

model can be calculated.

After getting the profit of the stock and option data

of Ford Motor through two different models, the data

obtained from the two groups can be compared to

analyze the advantages and disadvantages of the two

models.

3 RESULTS AND DISCUSSION

3.1 Results

Based on the logical structure and formulation of the

model, Black-Scholes model can be established by

excel like the table below.

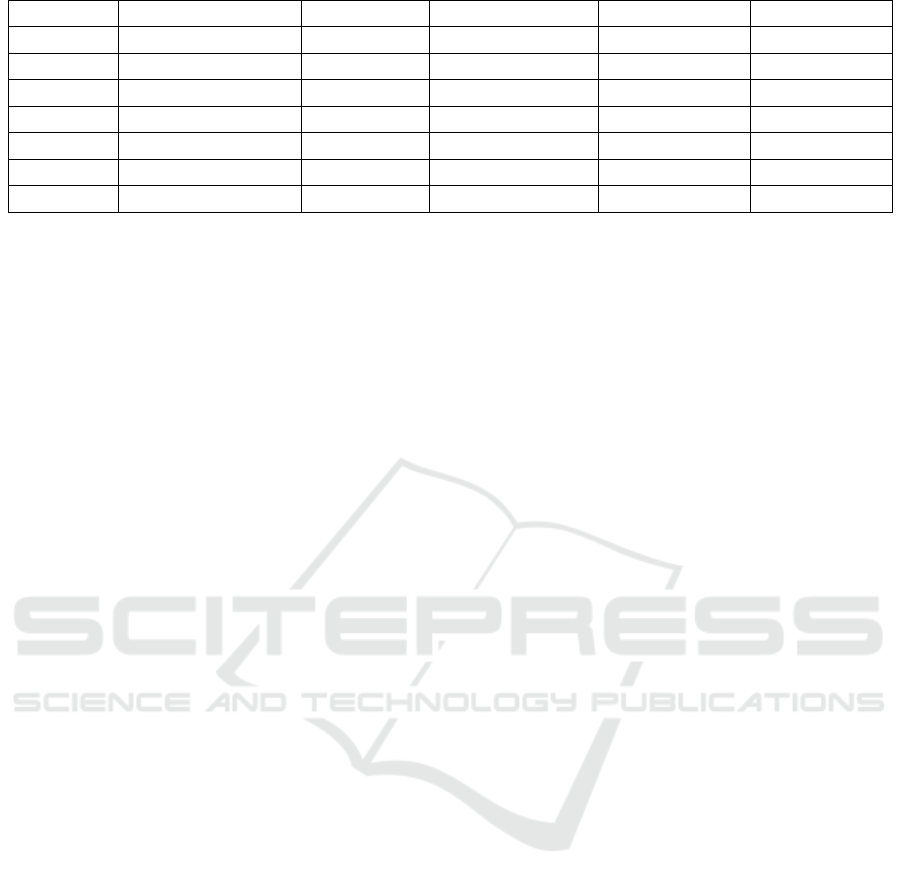

Table 5: Black-Scholes model (sigma assumed as 0.2).

Current

p

rice

Strike

p

rice

Risk-free

return

Time to

maturit

y

Volatility Dividend Type

13.88 14.00 3.25% 0.07 20.00% 0.00% Call

option

d1 d2 N(d1) N(d2) Exp (-r T) Exp (-q T)

-0.0909 -0.1443 0.4638 0.4426 0.9977 1.0000

Option

p

rice

0.26

Current

p

rice

Strike

p

rice

Risk-free

return

Time to

maturit

y

Volatility Dividend Type

13.88 14.00 3.25% 0.07 20.00% 0.00% Put

option

d1 d2 N(d1) N(d2) Exp (-r T) Exp (-q T)

0.0909 0.1443 0.5362 0.5574 0.9977 1.0000

Option

p

rice

0.34

As the table shown above, time to maturity is 0.07.

Due to the model and the research content of this

study, the dividend is set to 0, namely there does not

exist dividend. And the yield on the 10-year Treasury

note is chosen to be the risk-free return, which is

3.25%. Since the volatility is an indeterminate value,

it was set to 20% in the beginning. After Plugging the

option data into the model, the theoretical value of

options can be obtained when volatility is 20%. By

Analyzing and calculating the theoretical and actual

value of the option, the volatility namely sigma can be

fitted out which is 0.424. The unknown parameters of

Black-Scholes model are all calculated which are in

the table below:

Table 6: Parameters of Black-Scholes model.

σ T r

0.424 0.07 0.0325

According to the parameters estimated, the Black-

Scholes model is established resetting the volatility to

42.4.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

376

Table 7: Theoretical value (sigma is 0.424).

N(d1) N(d2) Theoretical value

Call 0.91 0.89 1.97

0.74 0.71 1.17

0.63 0.58 0.85

0.50 0.46 0.59

0.38 0.34 0.39

Put 0.62 0.66 0.03

0.09 0.11 0.07

0.26 0.29 0.26

0.37 0.42 0.43

0.50 0.54 0.67

As shown in the table above, the theoretical price

of option can be calculated from June.2,2022 to

June.22,2022 through Black-Scholes model.

Figure 1: Comparison between theoretical and practical

value.

Table 8: Error sum of squares of Black-Scholes model.

Black-Scholes model

6.1 sigma=0.424 Call K theoretical value practical value (P-Pm)^2/Pm

12 1.97 1.96 5.10204E-05

13 1.17 1.49 0.068724832

13.5 0.85 0.86 0.000116279

14 0.59 0.58 0.000172414

14.5 0.39 0.47 0.013617021

SSE 0.082681567

Put 11.5 0.03 0.1 0.049

12 0.07 0.13 0.027692308

13 0.26 0.32 0.01125

13.5 0.43 0.49 0.007346939

14 0.67 0.67 0

SSE 0.095289246

Total SSE 0.177970813

As shown in the figure above, for both call and put

options, the actual Ford Motor option prices are

generally higher than the theoretical values estimated

by the Black-Scholes model.

As shown in the table above, the sum of squares of

call option is 0.083 and put option is 0.095, the total

sum of squares of Black-Scholes model is 0.178. The

fitting result is valid. Based on the logical structure

and formulation of the model, the parameters of

Heston model can be calculated.

Table 9: Parameters of Heston model.

ρσ θ

k

v0

rho si

g

ma theta ka

pp

a v0

value 0 0.4326 0.6454 0.7376 0.193

As the table above shows, the volatility risk is 0,

the fluctuation in volatility is 0.4326, the mean of the

long run level is 0.6454, the rate of adjustment is

0.7376, and the variance of open price is 0.193. Hence,

after adjusting parameters, the Heston model can be

established.

Performance of Delta-Hedging on Black-Scholes Model and Heston Model

377

Figure 2: Comparisons between theoretical and practical value.

As shown in the figure above, this is a statistical

processing about the option price of Heston model.

For put option (in the right), most conditions practical

value is higher than theoretical value. While for call

option (in the left), both theoretical and practical value

have higher points.

Table 10: Error sum of squares of Heston model.

Heston model

6.1 sigma=0.433 Call K theoretical value practical value (P-Pm)^2/Pm

12 1.99 1.96 0.000459184

13 1.2 1.49 0.056442953

13.5 0.88 0.86 0.000465116

14 0.63 0.58 0.004310345

14.5 0.43 0.47 0.003404255

SSE 0.065081853

Put 11.5 0.03 0.1 0.049

12 0.08 0.13 0.019230769

13 0.29 0.32 0.0028125

13.5 0.47 0.49 0.000816327

14 0.72 0.67 0.003731343

SSE 0.075590939

Total SSE 0.140672792

As shown in the table above, the sum of squares of

call option is 0.065 and put option is 0.049, the total

sum of squares of Heston model is 0.141. The fitting

result is valid.

After establishing Black-Scholes model and

Heston model, do delta hedging based on the two

models and calculate the gain or loss from June.2,2022

to June.22,2022.

Table 11: Delta hedge of call option in Black-Scholes model.

date stock price(open) d1 N(d1) actual call price gain/loss total gain/loss

2022/6/2 13.64 2.05 0.98 1.48

0

-1.50

2022/6/3 13.63 2.12 0.98 1.32

-0.009796422

2022/6/6 13.74 2.64 1.00 1.34

0.108126984

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

378

2022/6/7 13.26 1.88 0.97 0.97

-0.477996657

2022/6/8 13.63 2.74 1.00 1.19

0.358942818

2022/6/9 13.51 2.66 1.00 1.17

-0.119632467

2022/6/10 13 1.63 0.95 0.89

-0.508023709

2022/6/13 12.3 -0.31 0.38 0.41

-0.6637545

2022/6/14 11.99 -1.61 0.05 0.28

-0.117774181

2022/6/15 12.22 -0.86 0.20 0.34

0.012339877

2022/6/16 11.8 -3.29 0.00 0.17

-0.082143867

2022/6/17 11.24 -7.74 0.00 0.08

-0.000279742

2022/6/21 11.55 -29.82 0.00 0.03

0

2022/6/22

As the table above shows, the total loss of call

option in Black-Scholes model is 1.5, basically most

days in the red. On June.13,2022, it losses the most

which reaches 0.66 and on June,8,2022, it gains the

most which reaches 0.36.

Table 12: Delta hedge of put option in Black-Scholes model.

date stock price (open) d1 N(d1) actual put price gain/loss total gain/loss

2022/6/2 13.64 2.05 -0.02 0.19 0 0.59

2022/6/3 13.63 2.12 -0.02 0.24 0.000203578

2022/6/6 13.74 2.64 0.00 0.23 -0.001873016

2022/6/7 13.26 1.88 -0.03 0.25 0.002003343

2022/6/8 13.63 2.74 0.00 0.13 -0.011057182

2022/6/9 13.51 2.66 0.00 0.16 0.000367533

2022/6/10 13 1.63 -0.05 0.26 0.001976291

2022/6/13 12.3 -0.31 -0.62 0.57 0.0362455

2022/6/14 11.99 -1.61 -0.95 0.71 0.192225819

2022/6/15 12.22 -0.86 -0.80 0.5 -0.217660123

2022/6/16 11.8 -3.29 -1.00 0.9 0.337856133

2022/6/17 11.24 -7.74 -1.00 1.33 0.559720258

2022/6/21 11.55 -29.82 -1.00 0.9 -0.31

2022/6/22 1.09

As the table above shows, the total gain of put

option in Black-Scholes model is 0.59, basically most

days are profitable. On June.21,2022, it losses the

most which reaches 0.31 and on June,17,2022, it gains

the most which reaches 0.56.

Table 13: Delta hedge of put option in Heston model.

date stock price(open) delta actual put price gain/loss total gain/loss

2022/6/2 13.64 -0.20451 0.19 0 0.71153653

2022/6/3 13.63 -0.200254 0.24 0.0020451

2022/6/6 13.74 -0.1742165 0.23 -0.02202794

2022/6/7 13.26 -0.264333 0.25 0.08362392

2022/6/8 13.63 -0.178801 0.13 -0.09780321

2022/6/9 13.51 -0.194189 0.16 0.02145612

Performance of Delta-Hedging on Black-Scholes Model and Heston Model

379

2022/6/10 13 -0.3144005 0.26 0.09903639

2022/6/13 12.3 -0.5489845 0.57 0.22008035

2022/6/14 11.99 -0.670097 0.71 0.170185195

2022/6/15 12.22 -0.592458 0.5 -0.15412231

2022/6/16 11.8 -0.767487 0.9 0.24883236

2022/6/17 11.24 -0.9340715 1.33 0.42979272

2022/6/21 11.55 -0.91652 0.9 -0.289562165

2022/6/22 -0.94613 1.09

As the table above shows, the total gain of put

option in Heston model is 0.71, basically most days

are profitable. On June.21,2022, it losses the most

which reaches 0.29 and on June,17,2022, it gains the

most which reaches 0.43.

3.2 Discussion

As calculated and discussed above in the section about

result, the total sum of squares of Black-Scholes

model is 0.178 and the total sum of squares of Heston

model is 0.141. And the total gain of put option in

Heston model is 0.71 and the total gain of put option

in Black-Scholes model is 0.59. Therefore, the quasi

value of Heston's model is relatively more accurate

and profitable. The reason is that The Black-Scholes

model is an idealized model that does not perform so

well in practice since it has some flaws in its

assumptions. To illustrate, the model assumes that

stock prices follow a continuous geometric Brownian

motion, whereas in reality stock prices may jump like

the stock data from June.14.2022 to June.16,2022.

Moreover, if the stock price volatility specified by the

Black-Scholes model is constant, then the implied

volatility surface should be smooth which is

impossible. Nevertheless, relatively speaking, the

Heston model ensures the randomness of volatility. As

a result, the Heston model performs better than the

Black-Scholes model for the stock data of Ford Motor.

4 CONCLUSION

This paper mainly studies the effect of the same delta

hedging on Black-Scholes model and Heston model

using the same data about stock and option price of

Ford Motor. Although there are some researchers have

studied the difference and the pros and cons of the two

models, the topic which discuss the option price model

about Ford Motor has not been studied before. In this

paper, Black-Scholes model and Heston model are

established and be compared in terms of error sum of

squares and the total gain or loss. Firstly, an assumed

value of sigma is set and based on the logical structure

and formulation of the model, the theoretical value of

sigma is calculated. Then according to the model

established, the theoretical price of options are

calculated, Finally, using delta hedging, the total gain

or loss of the two models can be worked out and be

compared to analyses which model is more profitable

and suitable for Ford Motor.

However, since the status of dividends is not taken

into account, and the Black-Scholes model ignores the

transaction costs in real market, The results can be

significantly biased. In addition, apart from these two

models, there are many other famous option pricing

models like Cox-Ross-Rubinstein model, which

deserve more investigation in the future.

REFERENCES

D.K. Backus, S. Foresi, L. Wu. Accounting for biases in

Black-Scholes, 2004. Available at SSRN 585623.

J.D. MacBeth, L.J. Merville. An empirical examination of

the Black-Scholes call option pricing model. The

journal of finance, 1979, 34(5), 1173-1186.

J. Wu. Application of option pricing Theory in investment

decision of real estate development, 2004.

M. Bohner, Y. Zheng. On analytical solutions of the Black–

Scholes equation. Applied Mathematics Letters, 2009,

22(3), 309-313.

S.Y. Wang. Pricing European options in risk averse

markets, 2022.

W. S. Xie. Research on time fractional Asian option pricing

problem based on high precision finite difference

method, 2022.

Y.M. Liu. Application of option pricing theory in venture

capital, 2022.

Y.M. Liu. Application of option pricing theory in venture

capital, 2022.

Y. Qing. Numerical simulation and empirical analysis of

European option pricing model based on radial

function, 2022.

Z. Q. Lei, Q Zhong. Research on option pricing based on

uncertain fractional differential equation under floating

rate, 2022.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

380