Option Pricing and Delta Hedging for Moderna Inc. on Different

Models

Wuyu Wei

Department of Statistical Sciences University of Toronto, Toronto, Canada

Keywords: Delta Hedging, Black-Scholes Model, Binomial Model, Calibration, Option Pricing.

Abstract: The aim of this paper is to compare the performance of the same delta hedging strategies using three different

models in the process of pricing options for Moderna Inc., which has reference value for investors to compare

such models and build their hedging portfolios. Historical volatility is estimated from past open prices and

two implied volatilities are calibrated utilizing the selected 10 options on the Moderna Inc.’s stock. Then the

delta hedging strategy using three different models with volatilities above, containing one unit of a specific

option with different maturity and delta shares of the stock, is applied to obtain daily profit/loss. Finally, the

trends of daily gain/loss for such three models are visualized compared with the trends without hedging. To

conclude, the hedging strategy performs all well for the three models. This results in this study benefits

investors and researchers in choosing the relatively suitable option pricing model and the best-fit hedging

strategy for specific companies or sectors.

1 INTRODUCTION

Option pricing has been a focus of mathematical

research in finance since the publication of the Black-

Scholes formula in 1973 (Davis, 1993). Basically, it

provides an evaluation of an option’s value, which

would be involved into investors’ strategies. Options

are used for hedging and speculation (Amir, 2018).

Hedging is a term used nowadays primarily in

conjunction with financial markets (Rata, 2009),

which refers to the entrepreneur’s financial strategy of

mitigating market price risks through selling or

buying futures contracts for the commodity that is the

object of his activity (Rata, 2009). Hedging strategies

limit the losses to a great extent and meanwhile,

provide a flexible price mechanism. In recent years,

hedging with options, no matter what kind of options,

has been a crucial part in mathematical finance and

widely used. The related topics have been

continuously studied.

To demonstrate, on the one hand, researchers have

improved classical model and hedging strategy to fit

them better in realistic situations. First, based on the

exist theory under the model without considering

liquidity, Gueant, Olivier, and J. Pu modeled a new

framework which considers stochastic optimal control

to price and hedge a call option with execution costs

and market impact (Gueant, 2017). Also, to improve

delta hedging for options, Hull, J., and A. White

determined empirically a model for minimizing the

variance of changes in the value of a trader’s position

(Hull, 2017). Moreover, Ye, M., et al. improved

Black-Scholes model for crop price insurance

premium (Ye, 2017). Also, Imaki et al. proposed a

new neural network to facilitate fast training and

accurate optimal hedging strategies. In addition, Kim

et al. extended binomial model in two ways,

developed the one with time-dependent parameters

and derived a hedging strategy for a trinomial model

(Kim, 2017).

On the other hand, there are also some scholars

who try to test the performance of different models for

specific companies or fields, or for different kind of

options. Lassance, Nathan and Vrins, Frederic

compared the hedging ability of several popular

models on the Apple stock (Lassance, 2017). Also,

Doffou tested three parametric models in pricing and

hedging higher-order moment swaps (Doffou, 2019).

Besides, Bollin and Lepaczuk explored the

performance of several option pricing models in

hedging the exotic options (Bollin, 2020)

To sum up, this topic is of interest to the

researchers in the financial field. This paper also

focuses on this topic and two main parts are included

in the entire study. First, the three volatilities are

Wei, W.

Option Pricing and Delta Hedging for Moderna Inc. on Different Models.

DOI: 10.5220/0012033700003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 401-406

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

401

calibrated. In detail, one historical volatility is

estimated by historical stock open prices, and the

Black-Scholes model as well as Binomial model are

applied to calibrate the other two implied volatilities

by minimizing the SSE. Then, the same delta hedging

strategy using Black-Scholes model and Binomial

model is applied to a specific option. Moreover, the

replicate processes display the daily profits/losses

with hedging and without hedging in three different

models, which are visualized to compare. As a result,

the hedging strategies are successful utilized on the

three calibrated models and all perform well, while the

gain/loss gap between BSM and Binomial model is

quite large.

This paper is structured as follows. Section 2

shows the data and methods. In Section 3, the results

are displayed, and Section 4 refers to the conclusion

of this paper.

2 DATA AND METHODS

2.1 Data

Moderna Inc. are chosen to be the target company

because it delivered a strong first quarter performance

and had a tremendous financial performance

throughout the past years. Besides, the Moderna

vaccines has been broadly used by many countries to

prevent Covid-19, and recently, the Moderna Covid-

19 vaccine was authorized by FDA for children down

to 6 months of age, which makes the Moderna stock

trending higher. Thus, the company’s stock and

underlying options are worth studying.

The data used is all extracted from the Yahoo

Finance (https://ca.finance.yahoo.com). Five call

options and five put options on Moderna Inc. are

chosen with a same maturity date, July 15th, but

different strike prices to calibrate two implied

volatilities for the stock using two different models.

The data is around the current price at the day when

the data was selected to prevent the edge cases of

volatility smile from the calibrated results. Besides,

the historical stock open prices are collected from

March 21st, 2022, to June 22nd, 2022, to estimate a

historical volatility. Then, a Delta hedging strategy is

constructed for another new option, whose maturity is

July 29th, 2022, from June 23rd, 2022, to July 7th,

2022, using the three different volatilities and

corresponding models. In details, options contracts

that are selected to calibrate the implied volatility for

Moderna Inc., followed by their strike prices, are

shown below in the table 1 below.

Table 1: The 10 options selected for the calibration.

Call options chosen for

calibration

Strick

p

rices

MRNA220715C00165000 165

MRNA220715C00170000 170

MRNA220715C00175000 175

MRNA220715C00180000 180

MRNA220715C00185000 185

Put options chosen for

calibration

Strick

p

rices

MRNA220715P00160000 160

MRNA220715P00165000 165

MRNA220715P00170000 170

MRNA220715P00175000 175

MRNA220715P00180000 180

And the option contract which is used in the

hedging section is shown in the table 2 below.

Table 2. The option chosen for hedging

O

p

tion chosen for hed

g

in

g

Moderna Inc. MRNA220729P00135000

Furthermore, the historical stock open price trends

for Moderna Inc. ‘s are shown in the figure below.

Figure 1: The stock price trend for Moderna Inc.

As shown above, Moderna Inc. ‘s stock open price

has increased dramatically from June 30th to July 7th

from $143.4 to $159.5, while prior to that, the prices

fluctuated around $143. It is interesting to find that the

slopes during the increasing prior are almost same.

2.2 Method

To begin with, the Black-Scholes model and Binomial

model are two of the most important concepts which

are widely applied in modern finance to solve the

option pricing problems, and each has its own pros

and cons. Thus, they have been compared to judge

which one is better. On the one hand, the 5 inputs: the

strike price, the current stock price, the time to

maturity, the risk-free rate and the volatility are taken

into account by the Black-Scholes model, and it will

return the numerical result based on these arguments,

140

150

160

170

180

6/23/22 6/28/22 7/3/22 7/8/22 7/13/22

Moderna Inc.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

402

while the multiple-stage Binomial model can show a

binomial tree structure with options and their

possibilities. On the other hand, the Black-Scholes

model can be only applied to European options but not

American options, but the Binomial model is able to

utilize multiple periods to value American options.

Besides, the assumption of the Black-Scholes model

is that the returns of the underlying asset are normal

distributed.

In this study, the process can be divided into two

parts. First one historical and two implied volatilities

of the stock are calibrated using three different

methods. In details, the historical volatility is

approximated by the standard deviation of the natural

log of the ratio of consecutive past stock open prices

from the assumption that the stock follows the Black-

Scholes model.

𝑉𝑎𝑟log𝑆

(

𝑡

)

−log𝑆

(

𝑡

)

=

(

𝑡

−𝑡

)

𝜎

(1)

Then the Black-Scholes model and Binomial

model are used to calculate theoretical prices of the

selected 5 call and 5 put options. The calculated prices

are compared with the real market prices to calibrate

the implied volatilities by minimizing the SSE. For

the Black-Scholes model, initially, the stock price, the

price, the strike price, the maturity date for 5 call and

5 put options on the stock are collected from June

27th, 2022, to July 6th, 2022. The Black-Scholes

option prices are calculated using Black-Scholes

model with the formula below, where 𝜎 represents to

the implied volatility, t represents time to maturity,

S(t) represents to the stock price at time t, K represents

to the strike prices of the option, r is the risk-free rate,

which is 2.8% in annual term obtained from the

Federal Reserve. The call option price and put option

price are calculated by equation (2) and (3)

respectively, where N represents the standard normal

distribution.

𝐶𝑡,𝑆

(

𝑡

)

=𝑆

(

𝑡

)

𝑁

(

𝑑

)

−𝐾𝑒

𝑁

(

𝑑

)

(2)

𝑃𝑡,𝑆

(

𝑡

)

=𝐾𝑒

𝑁

(

−𝑑

)

−𝑆

(

𝑡

)

𝑁(−𝑑

)

(3)

𝑑

=

1

σ

√

(𝑡)

ln

𝑆

(

𝑡

)

𝐾

+𝑟+

σ

2

𝑡

(4)

𝑑

=

1

σ

√

(t)

ln

𝑆

(

𝑡

)

𝐾

+𝑟−

σ

2

𝑡

=𝑑

−σ

√

t

(5)

Moreover, one-step Binomial model is

constructed to calculate the option price as well, and

the same calibration approach is applied in the

Binomial model by minimizing the SSE of calculated

option prices. For the Binomial model, up and down

factors, which are represented by u and d respectively,

are needed in the formula. The general Binomial

model formula is shown below, where T represents to

the time to maturity, p represents the possibility to

move up, n represents to the number of time steps of

binomial trees. The equation (7) calculate the option

price and it is interesting to notice that call and put

options use the same formula.

𝑆

=𝑒

[

𝑆

𝑢×𝑝+𝑆

𝑑×

(

1−𝑝

)

]

(6)

𝑐

=𝑒

[

𝑓

×𝑝+

𝑓

×

(

1−𝑝

)

]

(7)

𝑢=𝑒

√

∆

,𝑑=

1

𝑢

,𝑝=

𝑒

−𝑑

𝑢−𝑑

,∆𝑡

=𝑇/𝑛

(8)

After the theoretical option prices are calculated

from the two models. The sum of percentage squared

errors between the calculated option prices and real-

market prices is calculated for every option on every

day from June 27th, 2022, to July 6th, 2022, except

for some losing data, shown in the equation (9), where

𝑝

represents the calculated option and 𝑝

represents

the real-market prices. Then the SSE is minimized to

calibrate the final implied volatility. And this process

is repeated for both models.

SSE=

(𝑝

−𝑝

)

𝑝

(9)

At the end of the calibration section, the three

different volatilities and the corresponding methods

are compared. Since the similar amount of data for

calculated option price, SSE from two methods for

implied volatility can be compared as well.

After the calibration of the historical and implied

volatilities, a Delta hedging strategy is applied for a

new selected option on the same stock, which has a

further maturity on July 29th, 2022. Its strike price is

$135. The Black-Scholes models for both historical

volatility and implied volatility follow the same

strategy but with different sigma value. The price of

the option is calculated using the Black-Scholes

model with the parameters and calibrated volatility

provided above. The portfolio contains one unit of call

option contract, and ∆

shares of stock, where ∆

is

equal to 𝑁(𝑑

) for call option. Thus, the following

formula can be applied to calculate the portfolio value

at time t, the profit or loss with hedging as well as

profit/loss without hedging can be calculated every

day from June 23rd, 2022, to July 7th, 2022.

Day 1:

𝑋(𝑡)=𝐶(0)

(10)

Option Pricing and Delta Hedging for Moderna Inc. on Different Models

403

Day 2-10:

𝑋

(

𝑡

)

=𝑋

(

𝑡−1

)

+∆

(𝑆

(

𝑡

)

−𝑆

(

𝑡−1

)

)

(11)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 ℎ𝑒𝑑𝑔𝑖𝑛𝑔(𝑡)

=𝑆

(

𝑡

)

−𝐾−𝐶(0)

(12)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ ℎ𝑒𝑑𝑔𝑖𝑛𝑔(𝑡)

= 𝑆

(

𝑡

)

−𝐾−𝑋(𝑡)

(13)

Besides, for the one-step Binomial model, the

strike price, stock price from June 23rd, 2022, to July

7th, 2022, upper factor, down factor, and the

possibility to move up are collected and computed.

The option prices are composed from the formula

below.

𝐻𝑒𝑑𝑔𝑒 𝑅𝑎𝑡𝑖𝑜=

𝐶

−𝐶

𝑢𝑆 − 𝑑𝑆

(14)

𝐶

=max

(

0,𝑢𝑆 −𝐾

)

,𝐶

=max

(

0,𝑑𝑆 − 𝐾

)

(15)

𝑃𝑎𝑦𝑜𝑓𝑓=𝐻𝑒𝑑𝑔𝑒 𝑅𝑎𝑡𝑖𝑜 ∗ 𝑢𝑆− 𝐶

=𝐻𝑒𝑑𝑔𝑒 𝑅𝑎𝑡𝑖𝑜∗𝑑𝑆

− 𝐶

(16)

𝐶=𝐻𝑒𝑑𝑔𝑒 𝑅𝑎𝑡𝑖𝑜∗𝑆−𝑃𝑎𝑦𝑜𝑓𝑓

∗ 𝑒

(17)

Then Loss/profit with hedging can be calculated

every day from June 23rd, 2022, to July 7th, 2022,

using the following formula.

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ 𝐻𝑒𝑑𝑔𝑖𝑛𝑔

=𝑆

(

𝑡

)

−𝐾

−[𝐻𝑒𝑑𝑔𝑒 𝑅𝑎𝑡𝑖𝑜

∗(𝑆

(

𝑡

)

−𝑆

(

0

)

)

+𝐶]

(18)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 𝐻𝑒𝑑𝑔𝑖𝑛𝑔

=𝑆

(

𝑡

)

−𝐾−𝐶

(19)

Thus, starting at different date, the gain/loss with

or without hedging can be composed every day from

June 23rd, 2022, to July 7th, 2022.

As the profit or loss of the portfolio with or

without hedging using two models and three

volatilities is calculated, the performance of the

hedging strategy can be compared among them.

3 RESULT

From the process of the calibration, one historical

volatility and two implied volatilities using Black-

Scholes model and Binomial model are shown in the

table below followed by their SSE.

Table 3. The calibrated volatilities

Method Calibrated

volatilit

y

SSE

Historical

volatilit

y

0.696

IV from BSM 0.652 31.903

IV from

Binomial model

0.549 61.713

Furthermore, to test the influence of number of

historical stock prices to the calibrated historical

volatility, the trends of historical volatility as the

amount of historical stock prices used increases are

shown in the figure below.

Figure 2: The historical volatility trend.

As shown in the figure, when the used historical

data reaches a certain amount, around 28 in this study,

the change of historical volatility becomes smaller,

and the values of historical volatility fluctuate within

a relative narrow range. But eventually, the chosen

historical volatility is obtained from around 64

historical prices, which is close to the number of

calculated terms in calibrating implied volatility to

make the results comparable.

As shown in the Table 3 above, historical volatility

is largest, followed by the implied volatility calibrated

from Black-Scholes model. They are similar, while

implied volatility using binomial model is relatively

small with much larger SSE, compared with the one

in Black-Scholes model.

In terms of hedging, the profits or losses of the

portfolio with and without hedging for the chosen

period from June 23rd, 2022, to July 7th, 2022, using

the historical volatility and the two implied volatility

are compared and shown in the following graphs and

0,6

0,7

0,8

0,9

1

1,1

1,2

1 6 111621 26 31364146 51 5661667176

amount of histrical stock prices used

Historical volatility

Historical volatility

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

404

table. It’s clear that the Delta hedging strategy on

Moderna Inc. has performed better than merely

holding the call option without hedging.

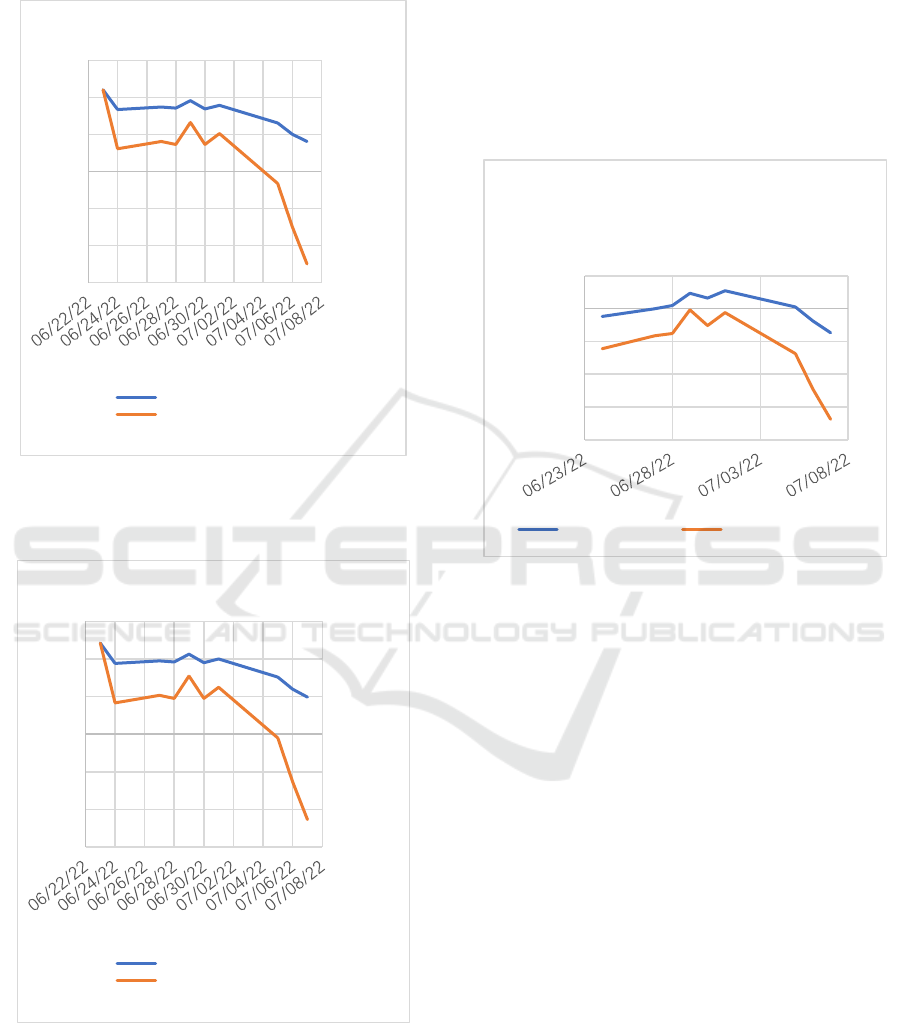

Figure 3: The Comparison of the Profit/Loss holding one

unit of option on Moderna Inc. with/without hedging using

Implied Volatility in BSM.

Figure 4: The Comparison of the Profit/Loss holding one

unit of option on Moderna Inc. with/without hedging using

Historical Volatility in BSM.

As shown in the two figures above, the hedging

strategy works very well on the option on Moderna

Inc. using both historical and implied volatility in

Black-Scholes model. Besides it shows that the two

figures follow the similar trends no matter with or

without hedging. Overall, the profit with hedging for

each trading day is comparatively stable, while

without hedging, it remains profitable during the early

days in the period, but the loss appears at the end of

the period. Besides, two methods indicates that the

difference between profit/loss with and without

hedging becomes larger gradually.

Figure 5: The Comparison of the Profit/Loss holding one

unit of option on Moderna Inc. with/without hedging using

Implied Volatility in Binomial Model.

As shown in the figure, the line corresponding to

the strategy with hedging is always above the other

line which displays the gain/loss without hedging,

which is same as the previous results. Besides, the

same conclusion can be presented that the profit/loss

with hedging is relatively more resisting than the loss

by only holding the option. However, the overall

profit or loss is less than the profit/loss using Black-

Scholes model. During the period, the hedging strange

only guarantee that the profit or loss is around 0.

4 CONCLUSION

This paper studies the difference between two kinds

of models: Black-Scholes model and Binomial model,

as well as the disparities between historical and

implied volatilities. In this study, first, the one

historical volatility and two implied volatilities in the

two model are calibrated by utilizing the data on past

stock prices and ten options respectively. Then, a delta

hedging strategy is constructed, including one unit of

-15,00

-10,00

-5,00

0,00

5,00

10,00

15,00

With Hedging

Without Hedging

-15,00

-10,00

-5,00

0,00

5,00

10,00

15,00

Historical volatility BSM

Hedging

With Hedging

Without Hedging

-20

-15

-10

-5

0

5

profit(loss) $

Implied volatility Binomial

model Hedging

With Hedging Without Hedging

Option Pricing and Delta Hedging for Moderna Inc. on Different Models

405

the new selected option and delta shares of the stock

to make delta neutral. Finally, the hedging

performances for three different volatilities in two

models are compared. The hedging strategy on all the

three situations performs well, while the results show

the different amount of profit or loss, especially the

two in BSM with the one in Binomial model.

Nevertheless, there is a limit in the paper, for

example the simple one-step binomial model is

considered merely, but not a higher steps model. The

one-step model makes the calculation much easier

when dealing with long-time period in a replicated

process, while the more steps may make the results

more accurate. Besides, since the interest rate used in

this study is fixed, the transaction costs are ignored

and the options chosen are assumed to be European,

these deficiencies need to be researched

comprehensively in the future.

REFERENCES

A. D. Amir, N. Anuradha. Comparison: Binomial model

and Black Scholes model. Quantitative Finance and

Economics, 2018, 2(1): 230-245.

A. Doffou. Testing derivatives pricing models under

higher-order moment swaps. Studies in Economics and

Finance, 2019, 36(2):154-167.

B. Bollin, R. Lepaczuk. Variance Gamma Model in

Hedging Vanilla and Exotic Options. Working Papers,

2020.

D.A. Rata, L. O. Cinade. HEDGING: AN IMPORTANT

TOOL IN AGRICULTURE RISK MANAGEMENT.

lucrări ştiinţifice management agricol, 2009.

Gueant, Olivier, J. Pu. OPTION PRICING AND

HEDGING WITH EXECUTION COSTS AND

MARKET IMPACT. Mathematical finance, 2017,

27(3):803-831.

J. Hull, A. White. Optimal Delta Hedging for Options.

Social Science Electronic Publishing. 2017, 82: 180-

190.

M. V. G. P. Davis, T. Zariphopoulou. European Option

Pricing with Transaction Costs. IEEE Conference on

Decision & Control IEEE, 1993.

M. Ye, et al. Crop price insurance in China: pricing and

hedging using futures market. China Agricultural

Economic Review, 2017

N. Lassance, V. Frédéric. A comparison of pricing and

hedging performances of equity derivatives

models. Applied Economics, 2017, 50: 1122 - 1137.

Y.S. Kim, et al. Enhancing Binomial and Trinomial Equity

Option Pricing Models." Finance Research Letters,

2017:185-190.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

406