Performance of Delta-Neutral Hedging Strategy on Moderna Inc

Stock

Beibei Liu

College of Literature, Science, and Arts, University of Michigan, Ann Arbor, State of Michigan, U.S.A.

Keywords: Hedging Strategy, Option Contract, Delta-Neutral Hedging Strategy, The Black-Scholes Model, Binomial

Tree Model, Historical Return Model.

Abstract: This paper investigates the effectiveness of delta-neutral hedging strategy. The goal of this paper is to hedge

an option contract on Moderna Inc stock. The result of this paper is useful for investors, especially beginners,

to use as a reference when building a portfolio. This study is divided into two parts. The first one is to calibrate

volatility of stock using three different models: the Black-Scholes model, binomial tree model, and historical

return model. With implied volatility in hand, a delta-neutral portfolio is built to hedge a put option on

Moderna Inc stock. The performance of the hedging strategy can be observed by comparing portfolio return

with the return of the option contract alone. The result of this study indicates that delta-neutral hedging

strategy does reduce loss in investment. Such result is beneficial for individual investors in formulating a

simple portfolio.

1 INTRODUCTION

Option pricing calculates implied value of option

contract with the aid of mathematical models. Two

commonly used derivative pricing models are the

binomial tree model and the Black-Scholes model.

The Black-Scholes model is a well-known derivative

pricing strategy. The significance of the Black-

Scholes model is it lays a foundation for a new field of

finance called the continent-claims analysis (Gilster,

1997), which is useful in pricing complex financial

securities. The binomial tree model values options at

a discrete set of nodes. Binomial tree model has more

applications than the Black-Scholes model because it

works for both American options, European options,

and options with dividend-paying underlying stock.

Hedging strategy is a risk management strategy,

and it generates value for investors by reducing loss of

portfolio. Investments like options, futures, and other

derivatives are most used by investors when

formulating a hedging strategy. Delta hedging is a

commonly used strategy, where delta measures the

fluctuation in portfolio value with respect to the

change in the underlying asset price (Ajay, 1997). The

goal of delta-neutral hedging strategy is that value of

portfolio does not vary much as stock price changes.

Such a goal can be achieved by building a portfolio

that has zero value for delta (Capinski, 2003). One

problem with delta-neutral hedging strategy is that it

requires constant rebalance to ensure delta is equal to

zero (Robins, 1994). However, in the real world,

market is not frictionless. Rebalance results in

transaction cost, which is not taken into consideration

by delta-neutral strategy. Even though delta hedging

might not be an optimal strategy, it’s still commonly

used due to its simplicity.

Within the field of financial engineering, much

research has been done on different hedging strategy

and option pricing strategy. For example, Hauser and

Eales analyzed option hedging strategies (Hauser,

1987); Schweizer researched on mean-variance

hedging (Schweizer, 1992); Wang, Wu, and Yang

studied hedging with futures (Wang, 2015); Schied

and Staje wrote about the robustness of delta hedging

(Schweizer, 1992). Moreover, for option pricing,

Merton analyzed the theory of rational option pricing

(Merton, 1973); Kremer and Roenfeldt compared

jump-diffusion pricing model with the Black-Scholes

model (Kremer, 1993); Schaefer investigated the

development of derivative pricing method (Schaefer,

1998) etc. As the topics are of interests in the financial

field, this paper also focuses on the issue.

This paper combines option pricing and risk

hedging and specifically looks into the implied

volatility by three different methods on the same stock

412

Liu, B.

Performance of Delta-Neutral Hedging Strategy on Moderna Inc Stock.

DOI: 10.5220/0012033900003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 412-416

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

during the same time period, and compares return with

and without hedging.

The paper is divided into four sections: section 2

organizes data and explains method used; section 3

displays results and discuss; section 4 concludes the

discussion.

2 DATA

In this paper, Moderna stock is chosen because

Moderna is a dominant player in the field of mRNA

vaccine (Dolgin, 2021). During the Covid-19

pandemic, it was the second pharmaceutical company

to develop a mRNA vaccine for Covid-19. Moderna’s

vaccine reduces the chance of getting infected by

Covid-19, and many countries around the globe have

adopted Moderna’s mRNA vaccine during the

pandemic. For example, British had ordered around 17

million doses of Moderna before January 2021 (BBC,

2021).

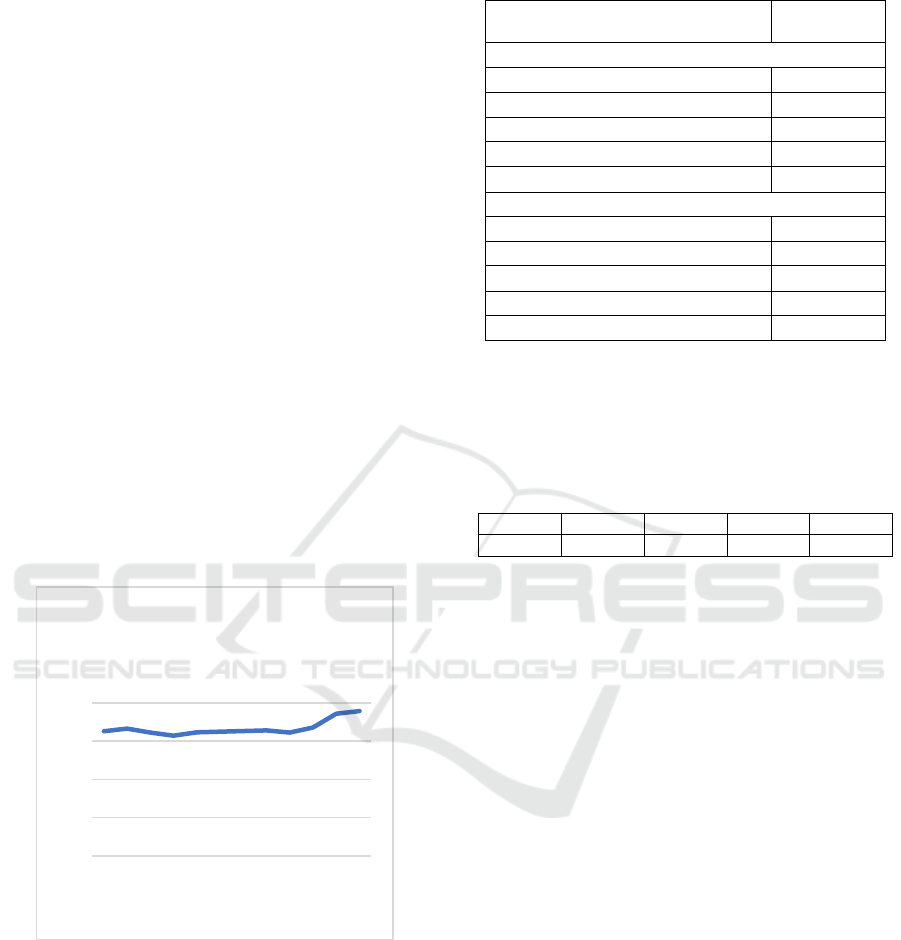

Stock open price and option contract price is

collected from Yahoo Finance

(www.yahoo.com/finance). Open price of Moderna

Inc stock from July 25th, 2022, to Aug 5th, 2022, is

recorded and shown in the graph below.

Figure 1. The stock price trend

In order to calibrate volatility, price of 5 call

options and 5 put options on July 25th, 2022, is

recorded. Each option has Moderna Inc stock as the

underlying asset. Option contracts chosen are shown

in the table below.

Table 1: 10 Options chosen.

Contrast Name Option

Price

Call Option

MRNA220729C00160000 5.15

MRNA220729C00157500 7.87

MRNA220729C00155000 8.76

MRNA220729C00152500 11.75

MRNA220729C00150000 11.50

Put Option

MRNA220729P00160000 3.70

MRNA220729P00162500 5.00

MRNA220729P00165000 8.00

MRNA220729P00167500 10.04

MRNA220729P00170000 11.69

After acquiring calibrated volatility, a delta

hedging strategy is formulated to hedge a new put

option, MRNA220805P00170000, from Aug 1st,

2022, to Aug 5th, 2022. Market put option price, from

Aug 1st to Aug 5th, is shown in the table below.

Table 2: Put option price.

08/01 08/02 08/03 08/04 08/05

10.07 10.20 3.21 0.36 0.07

3 METHOD

In this paper, the hedging strategy is made up of two

parts. The first one is to calibrate volatility using three

different models: Black-Scholes model, binomial

model, and historical return model. The reasons are

shown below. First, the Black-Scholes model is shown

to be a highly accurate prediction of future volatility;

Second, the binomial tree model suits the discrete-

time case. Next, this paper builds a delta-neutral

portfolio to hedge a new option using delta hedging

strategy.

3.1 The Black-Scholes Model

The Black-Scholes model, a derivative pricing model,

measures the price of European put and call option.

The Black-Sholes model assumes that price of

European option is a function of strike price, time to

maturity, underlying stock price, volatility, and

interest rate of the return of the underlying stock. First

developed by Fischer Black, Robert Merton, and

Myron Scholes in 1973 (Manaster, 1982), the Black-

Scholes model is still widely used today to price

option contract. Although Black-Scholes model is an

easy method to calculate option price, this method has

0

50

100

150

200

7/25/22

7/26/22

7/27/22

7/28/22

7/29/22

7/30/22

7/31/22

8/1/22

8/2/22

8/3/22

8/4/22

8/5/22

Moderna Inc Open

Stock Price

Performance of Delta-Neutral Hedging Strategy on Moderna Inc Stock

413

some limitations. First, the Black-Scholes model only

works for European options since one assumption is

options can only be exercised at their maturity date.

Second, this model assumes that stocks do not pay

dividends and no interest is paid. Third, it assumes a

frictionless market, which means this model does not

take various transaction cost, like commissions and

taxes, into consideration. Fourth, it assumes that the

risk-free interest rate remains constant. However,

above assumptions are hardly ever the case in reality.

Details of the Black-Scholes model is shown below.

Time to maturity (t), strike price (K), interest rate

(r), and stock spot price (S(t)), are all known for each

of the ten options. The only unknown variable is

volatility ( σ). To calculate option price using the

Black-Scholes model, first assume that volatility

equals to 0.3. With above information, implied prices

of ten options are calculated using the below

equations. For clarification, 𝐶(𝑡) and 𝑃(𝑡) denote

price of European call and put option, and 𝑁

(

𝑑

)

represents the cumulative standard normal probability

of the value 𝑑

.

c𝑑

=

√()

ln

(

)

+

𝑟+

𝑡

(1)

𝑑

=

1

σ

√

(t)

ln

𝑆

(

𝑡

)

𝐾

+𝑟−

σ

2

𝑡

(2)

𝐶

(

𝑡

)

=𝑆

(

𝑡

)

𝑁

(

𝑑

)

−𝐾𝑒

𝑁(𝑑

)

(3)

𝑃

(

𝑡

)

=𝐾𝑒

𝑁

(

−𝑑

)

−𝑆

(

𝑡

)

𝑁

(

−𝑑

)

(4)

Then, the sum of squared errors (SSE) is used to

measure the discrepancy between the implied prices

and the market option prices. Equation (5) is the

formula for calculating SSE. In equation (5), 𝑃

stands for actual option price in the market. 𝑃

stands

for the theoretical option price. Lastly, minimize SSE

by plugging in different values for volatility, and mark

the value that yields minimum SSE.

𝑆𝑆𝑅=

(

)

+

(

)

+⋯+

(

)

(5)

3.2 Binomial Tree Model

Binomial tree model is a simple discrete-time model

used to determine value of option. Under the binomial

tree model, the lifetime of one option contract is

divided into discrete many intervals (Breen, 1991).

During each interval, the value of underlying asset

either goes up or goes down. The multiplicative

parameters of the movements are denoted by u and d,

and p denotes the probability of price of underlying

asset going up. Mechanism of binomial tree model is

that the value of option at certain node relies on the

possibility of stock price moving up or down. One

advantage of binomial tree model is that it works for

both American and European options. Also, it is

appliable for dividend paying options. However, one

fundamental assumption of binomial tree model is that

the underlying asset can only take one of the two

suggested values, which is more than idealized.

Binomial tree model is similar to the Black-

Scholes model when time interval is small enough

(Cvitanić, 2004). Use below equations to find

theoretical option price. Similarly, calculate SSE and

mark the volatility that yields minimum SSE. Detailed

model specifications are shown by the follow

equations.

𝑢=𝑒

√

∆

(6)

𝑑=

1

𝑢

(7)

𝑝=

𝑒

−𝑑

𝑢

−

𝑑

(8)

3.3 Historical Return Model

The historical return model utilizes historical stock

returns to predict sigma. Among the three models,

volatility calibrated by the historical return model, in

theory, deviates most from the actual volatility.

Because stock price is highly volatile and follows no

discernible trend. Past return is not a good indicator of

return in the future.

For the historical return model, plug stock prices

from July 25th to July 29th into equation (9).

𝜎=

251𝑉𝑎𝑟[ln

(

𝑆

)

−ln

(

𝑆

)

]

(9)

3.4 Delta-neutral Hedging Strategy

Delta-neutral hedging strategy is a commonly used

risk managing option trading strategy. Delta measures

the fluctuation in the value of portfolio as the

underlying asset price moves. Mathematically, delta

can be expressed as the partial derivative of the

portfolio value with respect to the underlying asset

price. The purpose of the hedging strategy is to build

a portfolio that reaches a delta neutral position, which

means the delta of the portfolio is zero. Following

equations shows how to calculate the overall profit or

loss of a delta neutral portfolio. Lastly, calculate loss

without using hedging and compare the loss with

hedging and loss without hedging. This step verifies

that delta hedging strategy reduce the loss in option

trading.

The goal of the paper is to hedge one share of put

option, MRNA220805P00170000, with some shares

of stock. Equation (10) gives the delta of option, ΔP.

The delta-neutral portfolio consists of one share of put

option and -ΔP shares of stock. In addition, equation

(11) and equation (12) calculate the loss with and

without hedging strategy at maturity (T).

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

414

∆𝑃=−𝑁

(

−𝑑

)

(10)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ ℎ𝑒𝑑𝑔𝑖𝑛𝑔

=𝑀𝑎𝑥

0,𝐾− 𝑆(𝑇)

−ΔP

[

S

(

𝑇

)

−S

(

0

)

]

−P(t)

(11)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 ℎ𝑒𝑑𝑔𝑖𝑛𝑔

=𝑀𝑎𝑥

0,𝐾− 𝑆(𝑇)

−𝑃(𝑡)

(12)

4 RESULT

The below chart shows three parameters of the Black-

Scholes model. Interest rate, 0.028, is collected from

Federal Reserve website. Because there is 251 trading

days in 2022, time to maturity (t) is

.

Table 3: Parameters of black-scholes model.

Parameter r t S(t)

Value 0.028 0.020 162.75

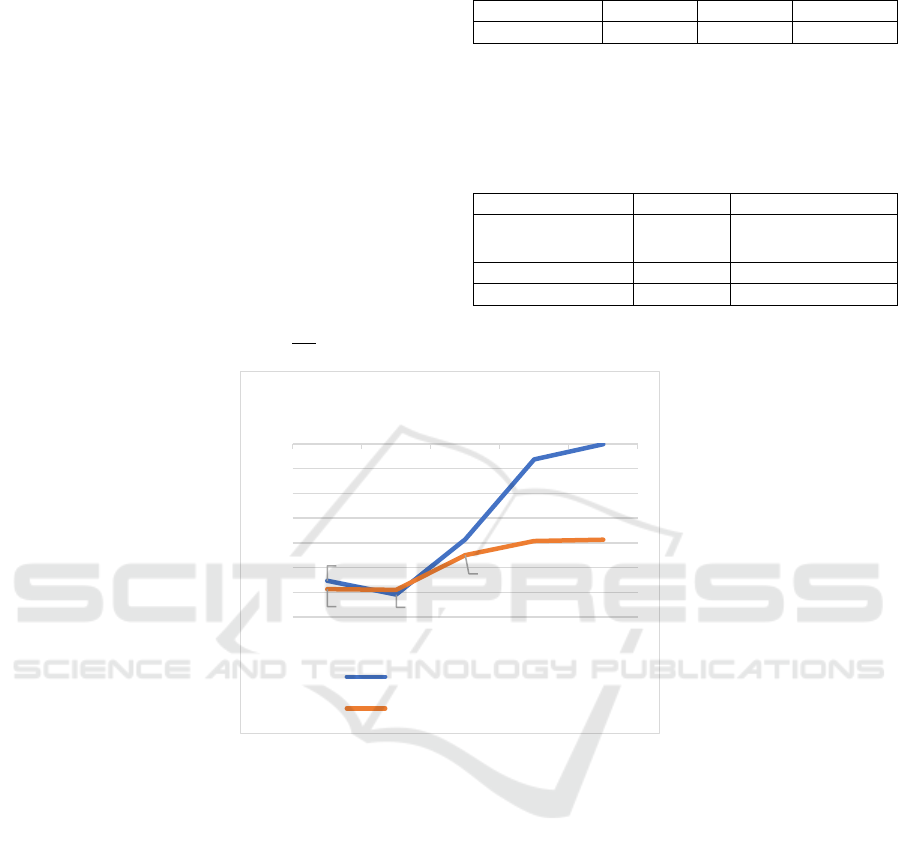

The volatility calibrated, and the return from three

different methods are shown in the table III. The return

of delta-neutral hedging is calculated using three

different volatilities.

Table 4: Result using three different models.

Method SSE volatility

Black-Scholes 8.162 0.389

Binomial 1.706 0.481

Historical Return - 0.493

Figure 2: Trends of return with and without heding.

5 DISCUSSION

As shown in the previous section, the volatilities

calibrated ranges from 0.389 to 0.493, which means

Moderna stock is volatile. Price of security is closely

related to the value of the firm. Modern belongs to the

healthcare sector, and its firm value is closely related

to the change in sales, and the launch of new product.

Moderna specializes in developing mRNA vaccine.

Because, before a vaccine got approved by the FDA,

its research process is highly costly. Currently, mRNA

vaccine for COVID-19 is the only type of mRNA

vaccine in the market, and Pfizer is a strong

competitor in the Covid-19 mRNA vaccine market.

Due to these factors, it’s reasonable that Moderna

stock is highly volatile.

In figure (2), there is only one curve showing the

return with hedging. Because the difference between

the returns calculated using three different volatility is

too small that it’s reasonable to ignore the difference.

The Result section also shows that the loss with

hedging is lower than the loss without hedging on

every day except for Aug 2nd. The most significance

difference between the two approach is 19.27. In this

case, the hedging strategy indeed reduces the overall

risk of the portfolio. On Aug 2nd, the loss without

hedging is lower than the loss with hedging, because

the goal of delta-neutral hedging strategy is to reduce

the fluctuation in overall portfolio value with respect

to variation in stock price. But in some cases, change

in stock price leads to a larger increase in option return

than increase in overall portfolio return. To avoid

having lower return with hedging strategy, when

-27,65

-30,41

-19,31

-3,17

-0,07

-29,34

-29,47

-22,48

-19,63

-19,34

-35

-30

-25

-20

-15

-10

-5

0

8/1/22 8/2/22 8/3/22 8/4/22 8/5/22

Return

Return with hedging

Return without hedging

Performance of Delta-Neutral Hedging Strategy on Moderna Inc Stock

415

trading with delta-neutral strategy, it’s necessary for

traders to closely monitor and constantly rebalance the

portfolio.

6 CONCLUSION

This paper examines the performance of delta-neutral

hedging strategy using three different implied

volatility. Because the limitations of each model the

implied volatility might deviate from the actual

volatility of the stock. No transaction cost is taken into

consideration, and very option studied in paper is

treated as European option. Moreover, despite the

actual interest rate futurates daily, for simplicity of this

paper, 0.028 is chosen to be the interest rate.

Therefore, the implied volatility might deviate from

the actual volatility of the stock, and the results shown

in this paper might not be perfectly accurate. Another

potential problem is that calibration using the Black-

Scholes model and binomial tree model only uses 10

options; calibration using the historical return method

only collects historical open price for five consecutive

trading days. For improvement, more data should be

used in the process of calibration. Further study is

needed for a more accurate result.

REFRENCES

BBC. Covid-19: England gets third jab as Moderna rollout

begins, 2021

E. Dolgin. The tangled history of mRNA vaccines. Nature

News, 2021

J. Cvitanić, F. Zapatero. Introduction to the Economics and

Mathematics of Financial Markets. The MIT Press,

2004

J.E. Gilster. Option Pricing Theory: Is “Risk-Free” Hedging

Feasible Financial Management, 1997, 26(1), 91–105.

J. W. Kremer, R. L.Roenfeldt. Warrant Pricing: Jump-

Diffusion vs. Black-Scholes. The Journal of Financial

and Quantitative Analysis, 1993, 28(2), 255–272.

M. Capinski, T. Zastawniak. (2003). Mathematics for

Finance: An Introduction to Financial Engineering.

Springer, 2003.

M. Schweizer. Mean-Variance Hedging for General

Claims. The Annals of Applied Probability, 1992, 2(1),

171–179.

M. Schweizer. Mean-Variance Hedging for General

Claims. The Annals of Applied Probability, 1992, 2(1),

171–179.

R. Breen. The Accelerated Binomial Option Pricing Model.

The Journal of Financial and Quantitative Analysis,

1991, 26(2), 153–164.

R.P. Robins, B. Schachter. An Analysis of the Risk in

Discretely Rebalanced Option Hedges and Delta-

Based Techniques. Management Science, 1994, 40(6),

798–808.

R.J. Hauser, J. S. Eales. Option Hedging Strategies. North

Central Journal of Agricultural Economics,1987, 9(1),

123–134.

R.C. Merton. Theory of Rational Option Pricing. The Bell

Journal of Economics and Management Science, 1973,

4(1), 141–183.

S. Ajay. Black, Merton and Scholes: Their Work and Its

Consequences. Economic and Political Weekly, 1997,

32(52), 3337–3342.

S. M. Schaefer. Robert Merton, Myron Scholes and the

Development of Derivative Pricing. The Scandinavian

Journal of Economics, 1998, 100(2), 425–445.

S. Manaster, G. Koehler. The Calculation of Implied

Variances from the Black-Scholes Model: A Note. The

Journal of Finance, 1982, 37(1), 227–230.

Y. Wang, C. Wu, L. Yang. Hedging with Futures: Does

Anything Beat the Naïve Hedging Strategy?

Management Science, 2015, 61(12), 2870–2889.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

416