Research and Analysis on Stock Investment of Liaoning Chemical

Industry Based on Geometric Brownian Motion

Yanling Li

*

a

, Yuhan Song

b

, Yuting Ha

c

, Ruotong Sun

d

, Yuzhe Zhang

e

, Yue Chen

f

and Dandan Chen

g

Dalian University of Finance and Economics, China

Keywords: Geometric Brownian Motion Model, Simulation Analysis, Stock Investment.

Abstract: This paper examines the feasibility of using Geometric Brownian motion models to simulate prices and how

to use Geometric Brownian motion models to invest in stocks. Based on the historical closing prices of stocks

from September 1, 2019, to September 1, 2022, the Geometric Brownian motion model is built using Python,

based on Geometric Brownian motion 2023 prices from September 1 to October 1, future trends in Liaoning

chemical industry stocks were analyzed. To verify the accuracy of the model, we used historical prices from

January to February 2022 to simulate prices from February to March 2022 using a Geometric Brownian

motion model. Comparing the predicted value with the real value, the error rate is less than 20%, which

indicates that the model is feasible. The visualization results and data from the Geometric Brownian motion

simulation data show that under the assumptions of the Geometric Brownian motion model, the future

development of the Liaoning chemical industry’s stock is relatively stable, the share price of Fengguang

shares is on an upward trend, so investment may be considered.

1 INTRODUCTION

Chemical industry plays an important role in the

national economy of many countries and is the basic

industry and pillar industry of many countries. With

the rapid development of science and technology,

Liaoning 's chemical industry has made a qualitative

leap, which also makes today 's chemical enterprises

in full swing (Zhang, 1999). At the same time, some

enterprises also stand out. This paper selects several

enterprise stocks for analysis and prediction.

Some scholars predict the future development of

the real estate industry through the simulation of the

real estate stock price, which provides a certain

direction for our research (Liu, 2018).This paper

introduces the Geometric Brownian motion model

into the research and analysis of stock investment in

Liaoning chemical industry, and selects the stock data

of representative companies of Liaoning chemical

industry from 2019 to 2022 for simulation

analysis.The results show that the stock investment

a

https://orcid.org/0000-0002-7787-3104

b

https://orcid.org/0000-0002-1581-7756

c

https://orcid.org/0000-0002-5652-4685

d

https://orcid.org/0000-0002-6147-853X

behavior of the chemical enterprises in Liaoning

province conforms to the characteristics of the

geometric Brownian motion, and the proposed model

can be used to simulate the development direction of

the stock investment.

This paper provides data support for investors on

how to investment goals such as maximizing returns

under established risks or maximizing cumulative

returns. According to this data analysis, we can

effectively allocate existing funds, so as to avoid the

huge risks in the financial market, maximize the

benefits, and allow investors to have a clear vane

when buying stocks, so as to optimize investment and

make proper trade-offs.

e

https://orcid.org/0000-0001-5327-6025

f

https://orcid.org/0000-0003-4671-0780

g

https://orcid.org/0000-0002-0096-733X

522

Li, Y., Song, Y., Ha, Y., Sun, R., Zhang, Y., Chen, Y. and Chen, D.

Research and Analysis on Stock Investment of Liaoning Chemical Industry Based on Geometric Brownian Motion.

DOI: 10.5220/0012036000003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 522-528

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2 RESEARCH AND ANALYSIS OF

GEOMETRIC BROWNIAN

MOTION MODELS

In order to simulate the stock price and analyze the

future development trend of Liaoning chemical

industry stock, we chose the geometric Brownian

motion model for numerical simulation. We collected

the stock closing price data from 2019 to 2022, and

then we built a geometric Brownian motion model

using Python. A method to simulate the exponential

evolution of the stock market in 2020 with geometric

Brownian motion is proposed in the literature, where

the drift and diffusion are determined by taking into

account two economic connection states (economic

states), namely, the non-crisis state and the financial

crisis. Based on this result, we find that the GBM

model can very well describe the future evolution

process of the stock index, and it is a suitable model

for the prediction of the stock index value(Brătian,

2022). After evaluating the model, we simulated the

stock price using the historical data from 2019 to

2022.

2.1 Data Preparation

In order to analyze the stocks of Liaoning Chemical

Industry, we selected five representative stocks for

research. We refer to the literature and choose to use

Python to collect data through the tushare data

interface and then we process the data because the

closing price is the standard of the current market and

the basis of the next trading day's invoicing price (Si,

2020). The closing price can predict the future stock

market, so we choose the closing price of the stock as

the data of the model.

The ticker codes are as follows: '301100',

'300758', '300082', '000818', '000881'. We obtained

the data of five stocks from September 1, 2019 to

September 1, 2022. Finally, after importing the data

into an excel sheet, the original data collection is

complete.

2.2 Establishment of Geometric

Brownian Motion Model

2.2.1 The Introduction of GBM

GBM is a continuous-time stochastic process in

which the logarithm of a random variable follows

English surname’s Geometric Brownian motion. This

Geometric Brownian motion has applications in

financial mathematics. The purpose of our research is

to study the future trend of the stock investment of

Liaoning chemical industry. Considering the

simulation of the future stock price, we choose to use

Python to realize the future trend of the stock price

based on the Geometric Brownian motion model, and

through the final presentation of the results to the

stock investment.

2.2.2 The Equation of GBM

In Python, to simulate that the stock price obeys

geometric Brownian motion, it is necessary to use the

stock price expression that obeys geometric

Brownian motion after transformation by the Euler

discrete method, as follows:

S_t=S_(t-∆t) e^((μ-1/2 σ^2 )∆t+σε_t

√

∆t)

(1)

Where, “S_ T” and “S_ (t - ∆ t)” represents the

stock price at time “t” and time “t - ∆ t” respectively,

“μ” Is the expected value of stock return (annualized),

“σ” Is the stock return volatility (annualized), “∆t”

represents the unit time length, “ε_T” is a random

number with standard normal distribution at time “t”.

2.2.3 The Establishment of GBM

·Assumptions of the model

The assumption of the model is that in time t, the

change of stock price will not be affected by the joint

action of various external factors, such as economy

and policy. At the same time, the superposition of

various influencing factors on the stock price makes

the stock price a random variable and follows a

normal distribution.

·Establishment process of the model

Through the obtained data, first obtain the annual

average return and annual return volatility of each

stock, and then establish an initial array of stock

prices simulating geometric Brownian motion. Set the

simulation starting point as the stock closing price on

September 1, 2022, and generate 100 random

numbers at each time point. Use the difference

formula of geometric Brownian motion to simulate

and calculate the maximum, minimum and median of

the daily closing rate of the stock.

·Range selection of analog values

By reading the literature and looking for information,

we know that the accuracy of the Geometric

Brownian motion model is related to the length of the

set time (Agustini, 2018), and the shorter the time, the

more accurate the price prediction. It is also known

from the literature that the accuracy of the one-month

forecast is higher than that of the one-year and one-

week forecasts. We chose to forecast 2023 prices for

Research and Analysis on Stock Investment of Liaoning Chemical Industry Based on Geometric Brownian Motion

523

September to October in order to model future

movements.

2.2.4 Program Code

In the following section, we use the code for the

Geometric Brownian motion of scenic shares:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pylab import mpl

mpl.rcParams['font.sans serif']=['SimHei']

mpl.rcParams['axes.unicode_minus']=False

#Import Fengguang share price data

price_fengguang=pd.read_excel('FENGGUANG

.xlsx',sheet_name="Sheet1",header=0,index_col=0)

#Calculate the daily rate of return of scenic shares

R_fengguang=np.log(price_fengguang/price_fen

gguang.shift(1))

#Deletes rows with missing values

R_fengguang=R_fengguang.dropna()

R_fengguang.describe()

#Get the annualized average yield of scenic shares

and convert it into an array format

mu_fengguang=(R_fengguang.describe()).loc['m

ean']*252

mu_fengguang=np.array(mu_fengguang)

#Get the annualized return volatility of the

landscape stock and convert it into an array format

sigma_fengguang=(R_fengguang.describe()).loc[

'std']*np.sqrt(252)

sigma_fengguang=np.array(sigma_fengguang)

#Import the statistics submodule stats for the

SciPy module

import scipy.stats as st

#predict 23-09-10

date_fengguang=pd.date_range(start='2023-09-

01',end='2023-10-01',freq='B')

N_fengguang=len(date_fengguang)

I_fengguang=100

dt=1.0/252

fengguang_GBM=np.zeros((N_fengguang,I_fen

gguang))

fengguang_GBM[0]=22.77

for t in range(1,N_fengguang):

e=st.norm.rvs(size=I_fengguang)

fengguang_GBM[t]=fengguang_GBM[t-

1]*np.exp((mu_fengguang-

0.5*sigma_fengguang**2)*dt+sigma_fengguang*e*

np.sqrt(dt))

fengguang_GBM=pd.DataFrame(fengguang_GB

M,index=date_fengguang) #Converts the simulated

value into a data box with a time index

plt.figure(figsize=(9,6))

plt.plot(fengguang_GBM)

plt.xlabel(u'date',fontsize=13)

plt.ylabel(u'price',fontsize=13,rotation=90)

plt.xticks(fontsize=13,rotation=30)

plt.yticks(fontsize=13)

plt.title(u'FengGuang:The GBM simulate the full

path (September to October 2023) ',fontsize=13)

plt.show()

#Simulation of the scenery of the stock maximum

max_fengguang=np.max(np.max(fengguang_GB

M))

#Simulation of the scenery of the stock minimum

min_fengguang=np.min(np.min(fengguang_GB

M))

#Simulation of the scenery of the stock

medianmum

median_fengguang=np.median(fengguang_GBM

)

print(' Maximum simulated

price:',round(max_fengguang,4))

print(' Minimum simulated price:',round

(min_fengguang,4))

print(' Median simulated

price:',round(median_fengguang,4))egin

Writeln('Hello World!!');

2.3 Results of Model Run

After the establishment of the model, we first need to

evaluate the model. Then analyze the operation effect

of the model and visualize the data, and finally

summarize according to the analysis results.

2.3.1 Model Evaluation

To evaluate the model, we used data from January to

February 2022 to predict stock prices from February

to March 2022. Because the model generates 100 sets

of data at random, we choose to extract one set of data

from the predicted values by random sampling.

Compare the real values from February to March

2022 and calculate the error rate between the

predicted values and the real values. The visible error

value from the data is less than 20%, so we consider

the model to be valid.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

524

Table 1: Error rate between simulated value and real value of five stocks.

Date

300082 300758 000818 301100 000881

2/7

-2.5% -2.4% -1.5% -2.4% -1.9%

2/8

1.4% 0.4% -7.8% 2.8% -3.1%

2/9

1.9% -7.9% -7.7% 3.4% -4.4%

2/10

2.9% -1.7% -6.1% 0.2% 2.4%

2/11

5.8% -1.8% -2.8% 5.6% 5.7%

2/14

8.4% -0.1% -0.6% 3.4% 8.3%

2/15

1.2% 2.6% 1.3% 1.8% 7.1%

2/16

6.5% 5.7% -1.9% 5.9% 3.9%

2/17

4.6% 8.1% 0.1% 5.1% 3.0%

2/18

5.1% 7.8% 0.9% 7.6% 5.7%

2/21

9.9% 8.8% 4.3% 7.9% 7.4%

2/22

10.5% 17.3% 10.0% 6.0% 10.2%

2/23

7.3% 5.5% 10.4% 6.3% 12.6%

2/24

11.1% 5.4% 8.3% 6.2% 18.8%

2/25

12.8% 7.6% 7.9% 8.2% 14.3%

2/28

14.6% 8.9% 8.0% 10.5% 16.4%

3/1

18.6% 12.6% 9.9% 7.3% 13.8%

2.3.2 Liaoning Chemical Industry Stock 2023

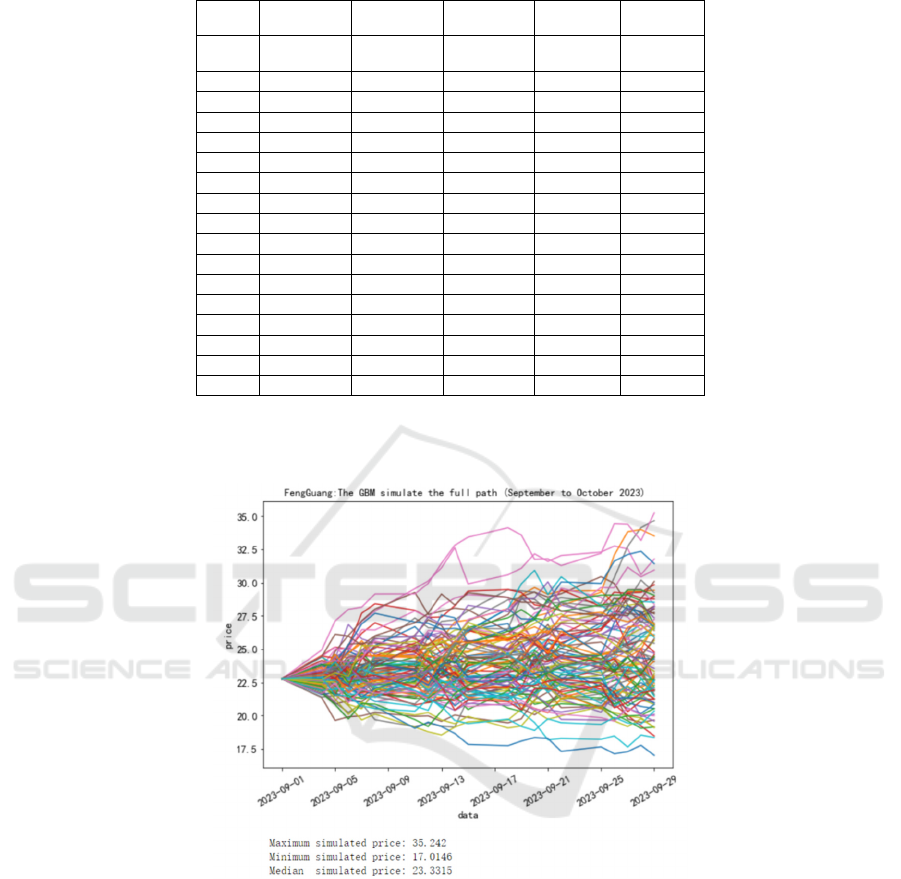

Figure 1: FengGuang: The GBM simulate the full path (September to October 2023).

Fengguang shares (301100) is a global polymer

materials to provide core additives and high-tech

support suppliers. The company is mainly engaged in

the production and r & D of high-efficiency rubber

and plastic additives, and provides one-stop solution

of polymer additives for customers. Group is a state-

level high-tech Enterprises, with a special research

laboratory. Fengguang is a high-tech enterprise

specializing in the research, development, production

and sales of chemical additives for polymer materials.

It belongs to the chemical additives sub-industry in

the fine chemical industry, and in principle belongs to

the chemical materials cycle stock, the market share

of products is relatively high

From the simulation results of Fengguang shares,

we can see that the maximum value of Fengguang

shares is 35.242 yuan, and the minimum value is only

17.0146 yuan. The difference between the two is

nearly two times, the median price was 23.3315 yuan,

up from the initial 22.77 yuan (closing price on Sept.

1, 2022). As a result, when the shares follow the

Geometric Brownian motion, there is an overall

upward trend in the simulated share price.

Research and Analysis on Stock Investment of Liaoning Chemical Industry Based on Geometric Brownian Motion

525

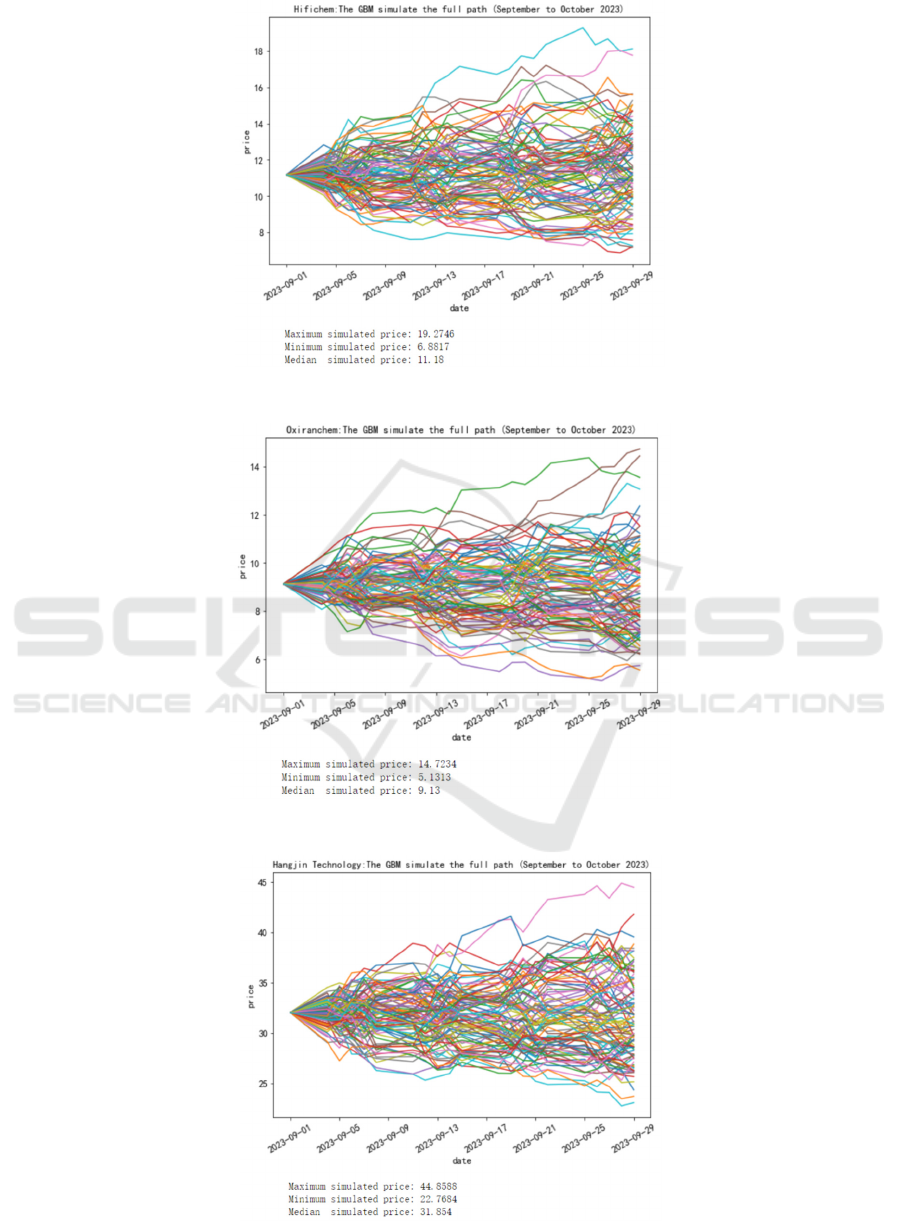

Figure 2: Hifichem: The GBM simulate the full path (September to October 2023).

Figure 3: Oxiranchem: The GBM simulate the full path (September to October 2023).

Figure 4: Hangjin Technology: The GBM simulate the full path (September to October 2023).

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

526

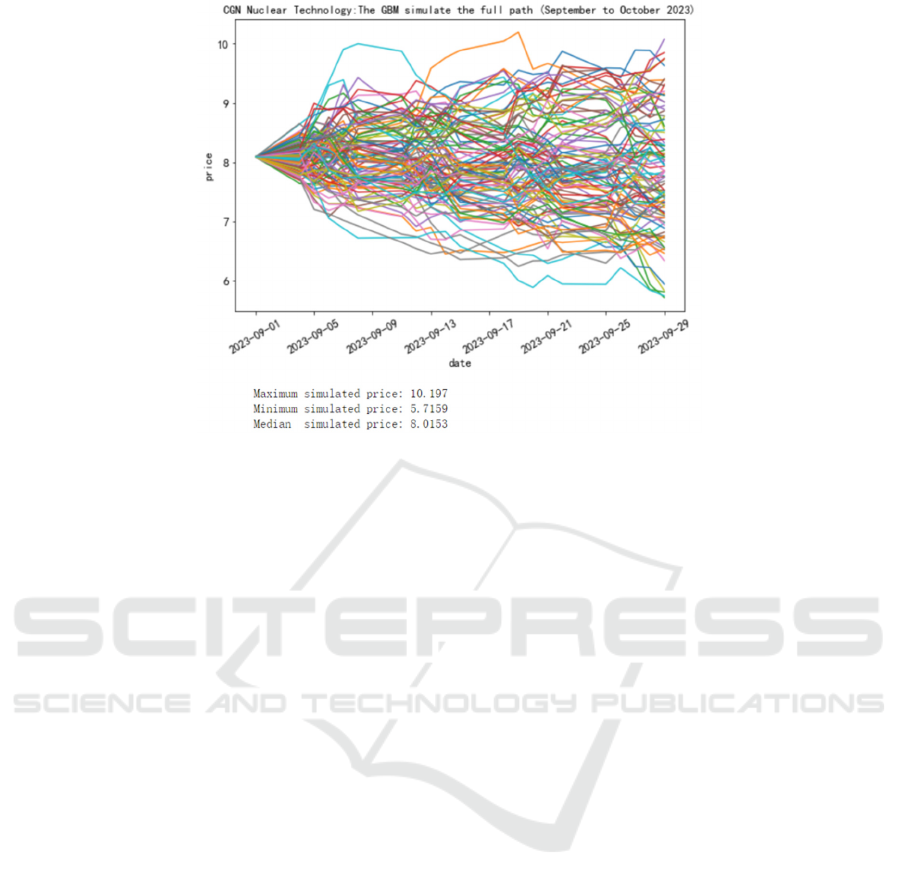

Figure 5: CGN Nuclear Technology: The GBM simulate the full path (September to October 2023).

Next to the other four companies of the simulation

chart analysis, can be seen in the simulation results of

Hangjin Science and technology, the median share

price is 32.03 yuan, equal to the initial 32.03 yuan

(September 1,2022 closing price), as a result, the

stock price of technology is unchanged. The median

price of Hifichem was 11.18 yuan, close to the initial

value of 11.18 yuan, which closed Sept. 1,2022. The

median price of Oxiranchem shares is 9.13 yuan,

close to the initial value of 9.13 yuan (the closing

price of 9.1 in 2022). The median share price of CGN

Nuclear Technology was 8.0153 yuan, close to the

initial value of 8.09 yuan (the closing price on

September 1, 2022).

From the forecast results, we can see that the

future development of Liaoning chemical industry

stock tends to be stable. The chemical industry has

been a big contributor to revenue and profits, take

Hangjin Technology for example. In the past, Aijin

Technology’s annual report was not very eye-

catching. However, in recent years, Aijin

Technology’s performance has continued to rise. On

the one hand, the price of chemical products is at a

high level, while on the other hand, military and civil

electronics have continued to contribute to the

performance, it can be said that the current aviation

brocade technology gradually entered a new round of

growth cycle. Therefore, in the analysis of stock

investment, but also with the development of the

industry to carry out a systematic analysis.

2.3.3 Research and Analysis on Stock

Investment of Chemical Industry in

Liaoning Province

In order to analyze the stock investment of Liaoning

chemical industry, we chose to use the same industry

analysis method in addition to the Geometric

Brownian motion model. We compare Liaoning

chemical industry’s stock with industry leader

Wanhua Chemical. We can see that the total market

value, net assets and net profit of Wanhua chemical

are much higher than those of Fengguang shares, but

the net interest rate of Fengguang shares is higher

than Wanhua Chemical. Therefore, we can introduce,

in the investment of stocks, to consider many aspects.

Although Fengguang shares listed for a short time,

but the overall company’s product gross profit and net

profit are relatively high, so there is a lot of room for

the development of Fengguang shares, the future

development prospects are also worth watching.

We used a Geometric Brownian motion model to

simulate the stock price. From the 2023 analysis of

the Liaoning chemical industry stock simulation data

visualization, we can see that the stock price of

Fengguang shares shows an upward trend, after

considering all the factors, we think we can give

priority to Fengguang shares when we invest in

Liaoning chemical industry

Research and Analysis on Stock Investment of Liaoning Chemical Industry Based on Geometric Brownian Motion

527

3 CONCLUSIONS

In the course of adopting Geometric Brownian

Motion to simulate stock prices, when Monte Carlo

method is used to simulate random numbers,if more

data samples are generated, the test effect will be

better. On the contrary, fewer simulation data samples

will result in poorer prediction effect.

The premise of adopting Geometric Brownian

Motion for modeling is that the stock prices conform

to normal distribution, but the real stock prices

usually do not conform to normal distribution. So

there exists certain deviation between the simulation

prediction results and the real prices.

Our conclusion is that Fengguang is preferred for

investment in the stock pool of Liaoning chemical

industry. If we use Brownian Motion to describe the

intraday high-frequency movement of stock price,

each sample trajectory has enough randomness. Stock

price is more likely to fluctuate around the opening

price, rather than stay above or below it; Moreover,

with the passage of trading time, the stock price at

time t will not deviate too far from the standard

deviation of the price movement (Nándori, 2022). In

this paper, we use the Geometric Brownian motion

model to simulate future trends and use the predicted

results as a reference for stock investing. The

limitation is that the Geometric Brownian motion

model results under certain assumptions, it is not a

complete reference, and that’s something we should

address in the future.

ACKNOWLEDGEMENTS

The writing idea and funding support of this paper

came from the Social Science Planning Fund of

Liaoning Province (Project No. L20BGL003).

REFERENCES

Agustini, W. F., Affianti, I. R., & Putri, E. R. (2018,

March). Stock price prediction using geometric

Brownian motion. In Journal of physics: conference

series (Vol. 974, No. 1, p. 012047). IOP Publishing.

Brătian Vasile, Acu AnaMaria, Mihaiu Diana Marieta , Ș

erban Radu Alexandru. (2022). Geometric Brownian

Motion (GBM) of Stock Indexes and Financial Market

Uncertainty in the Context of Non-Crisis and Financial

Crisis Scenarios.J.Mathematics.10(3).

Cardillo Giovanni, Bendinelli Ennio & Torluccio Giuseppe.

(2022). COVID-19, ESG investing, and the resilience

of more sustainable stocks: Evidence from European

firms. J. Business strategy and the environment.

Klibanov Michael V,Shananin Aleksander A,Golubnichiy

Kirill V, Kravchenko Sergey M(2022). Forecasting

stock options prices via the solution of an ill-posed

problem for the Black– Scholes equation.J. Inverse

Problems.38(11).

Liu Yang, Zhang Yue &Zhu Lifang. (2018). A Geometric

Brownian motion simulation of real estate prices.

J.Statistics and decision making.(09), 86-89.

Nándori Péter & Pirjol Dan.(2022). On the distribution of

the time-integral of the geometric Brownian motion.

J.Journal of Computational and Applied Mathematics.

Osei Antwi, Francis Tabi Oduro. (2018) Pricing Options on

Ghanaian Stocks Using Black-Scholes Model.J.

Science Journal of Applied Mathematics and

Statistics.6(1).

SiWen (2020). Hands-On Python for Finance.J.China Post

and Telecommunications Press(1).296-303.

Zhang Jiahe (1999). The great change of 50 years ---50

years since the founding of the People's Republic of

China and 20 years since the reform and opening-up

policy in Liaoning province. J.Liaoning chemical

industry(05), 247-252.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

528