Using Neural Network Architectures for Intraday

Trading in the Gold Market

Srinivas Devarajula, Vitaliy Milke

a

and Cristina Luca

b

Computing and Information Science, Anglia Ruskin University, East Road, Cambridge, U.K.

Keywords:

Machine Learning in Finance, Intraday Trading, Neural Network Computing, Artificial Intelligence,

Algorithmic Trading, Forex.

Abstract:

Financial market forecasting is used to assess the future value of financial instruments in various exchange

and over-the-counter markets. Investors have a high interest in the most accurate prediction of the financial

instruments’ prices. Inaccurate forecasting might result in a significant financial loss in certain circumstances.

This research aims to determine the most probabilistic deep learning model that can improve price forecasting

in the financial markets. In this research, Convolutional Neural Networks and Long Short-Term Memory are

used for the experiments to forecast the Gold price movements on the Forex market. The Gold(XAU/USD)

dataset is used in this research to predict the prices for the next minute. The models proposed have been

evaluated using Mean squared error, Mean absolute error, and Mean absolute percentage error metrics. The

results show that the Convolutional Neural Network has performed better than the Long Short-Term Memory

network and has the potential to predict the price for next minute with a low error rate.

1 INTRODUCTION

In financial markets, there are several ways to in-

vest based on the length of time one investor (natu-

ral or legal person) holds financial instruments such

as stocks, bonds, futures, options, commodities or

Forex. In long-term investment, the investors hold the

financial assets for months or years, whilst intraday

trading refers to the investment done in financial in-

struments for minutes or hours per day. While both

strategies have benefits and drawbacks, intraday trad-

ing is regarded as riskier due to the volatility of mar-

ket changes (Bhat and Kamath, 2013), (Demirer et al.,

2021).

Futures and Forex markets prediction is one of the

most challenging problems due to the data volatility

and high level of noise in the data. Adding unbal-

anced data makes predicting the accurate price move-

ment for the next few minutes even harder. As the

market behaviour is constantly changing, the patterns

identified could be altered too. There are studies

on time series prediction using the minute-to-minute

dataset for currencies ((Evans, 2018), (Raimundo and

Okamoto Jr, 2018), (Weeraddana et al., 2018), (Chen

a

https://orcid.org/0000-0001-7283-2867

b

https://orcid.org/0000-0002-4706-324X

et al., 2019), (Rundo et al., 2019), (Islam and Hos-

sain, 2020), (Liao et al., 2021)), Standard Poor’s

500 (S&P 500) index-based financial instruments,

such as SPY Exchange-Traded Fund (ETF) and E-

Mini futures ((Ferreira and Medeiros, 2021), (Kinyua

et al., 2021)), and studies of commodities and pre-

cious metal markets using classical statistical meth-

ods ((Huang et al., 2021), (Semeyutin et al., 2021),

(Zeng and Lu, 2022) or simple machine learning

methods (Gil, 2022)). So far, no research has been

found to analyse a one-minute time-term dataset on

Gold using Neural Networks. According to (Weng

et al., 2020) the annual growth rates of gold is 7.69%

which is more than 6.79% of S&P 500 from 2014 to

2019, and their paper stated that gold data could be

utilised for training models.

In the last decade, Neural Network (NN) technolo-

gies gained popularity in financial markets’ price pre-

diction. They have been extensively employed in the

financial sector in areas such as portfolio optimisa-

tion, High-Frequency Trading (HFT), risk manage-

ment and equity portfolio management. One of the

primary aims of researchers is to use Machine Learn-

ing (ML) models, which can produce results close to

the price in the financial market within a relatively

short certain period of the chosen time frame or de-

termine the moment before the most probable signifi-

Devarajula, S., Milke, V. and Luca, C.

Using Neural Network Architectures for Intraday Trading in the Gold Market.

DOI: 10.5220/0011794400003393

In Proceedings of the 15th International Conference on Agents and Artificial Intelligence (ICAART 2023) - Volume 3, pages 885-892

ISBN: 978-989-758-623-1; ISSN: 2184-433X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

885

cant price movement. The current trend in using ML

models is to create auto-trading bots to produce pre-

dictions close to the abstract capabilities of the human

brain but with more accurate computational predic-

tions.

Most of the research papers reviewed use Recur-

rent Neural Networks (RNNs) (Vargas et al., 2017),

(dos Santos Pinheiro and Dras, 2017), which are

specifically designed for next-hour to next-day price

prediction based on sequence data.

The aim of this research is to predict the price

movement of the next minute using neural networks

on the one-minute Gold prices (XAU/USD) Forex

dataset. The experiments were done using Convo-

lutional Neural Networks (CNNs) and Long Short-

Term Memory (LSTM). The results obtained have

been compared against the state-of-the-art algorithms

that predict gold prices on more extended time frame

data. This research demonstrates how neural network

models can handle massive datasets and extract infor-

mation from transaction signals to determine the opti-

mal market entry points based on predicted significant

movements in the next minute in order to minimise

overall transaction costs, which is vital for intraday

trading. A comparison of algorithm performance on

error metrics with regard to the reduction in these er-

ror rates attained during prediction is also performed.

The models are fine-tuned and evaluated with better

training parameters for improving to reach a price pre-

diction close to the actual values.

The remaining sections of this study are structured

as follows: section 2 investigates the literature review

and state-of-the-art studies on the topic of intraday

financial trading; the proposed method is presented

in section 3; section 4 outlines the results and com-

parison of models; section 5 discusses the validation

based on the numerical analysis; finally the conclu-

sions are drawn in section 6.

2 LITERATURE REVIEW

During the unstable, volatility time, investors are

more interested in the gold market. Consequently,

the liquidity of different financial instruments based

on gold spot prices is increasing. For intraday trad-

ing, liquidity is crucially important, and it is possible

to apply intraday trading methods used for currency

and stock markets on the gold markets. As a result,

the same methods used for predicting prices in the fi-

nancial instruments in liquid markets, such as Forex

exchange rates, liquid ’Blue chip’ stocks (Big-tech,

mining companies or global banks), and integral stock

indices (Dow Jones, S&P 500, NASDAQ-100, FTSE

100) are employed for the gold markets.

Researchers have used a range of methodologies

to examine the volatility of the gold price and its rela-

tionship to the variables assumed to impact it. (Man-

jula and Karthikeyan, 2019), (Chandrabai and Suresh,

2020), (Makala and Li, 2021), (Chen, 2022) used

popular regression algorithms, such as support vector

machine, ARIMA, linear and Lasso regressions, ran-

dom forest, and gradient boosting, for gold datasets

based on hourly and daily prediction. (Milke et al.,

2020) used CNNs to predict the most probable signif-

icant price movements by analysing Forex tick data

and measuring the performance metrics of the model.

(Manjula and Karthikeyan, 2019) validated differ-

ent periods of data on a monthly basis to predict prices

using three regression models: Linear Regression

(LR), Random Forest (RF) and Gradient Boosting

Regression (GBR) algorithms. To assess the quality

of the prediction models implemented, they used the

Mean squared error (MSE), Root mean squared error

(RMSE) and Mean absolute error (MAE). Another

research by (Chandrabai and Suresh, 2020) studied

gold price prediction using Linear Regression, Ran-

dom forest and Support Vector Machine (SVM) with

R-Square and RMSE scores for evaluating the results.

The same dataset on gold was used by (Makala and

Li, 2021) in their research that studied ARIMA and

SVM models on daily data from World Gold Coun-

cil between 1979 and 2019 and measured the per-

formance of the proposed models using RMSE and

MAPE. The research results indicate that the SVM

outperforms ARIMA in terms of MAPE and RMSE,

with RMSE of 0.028, MAPE of 2.5 for SVM ver-

sus 36.18 and 2.897 for ARIMA. Due to SVM’s high

accuracy, the findings imply that it should be em-

ployed for commodity price prediction. With the

help of price components that possibly affect gold

prices, (Chen, 2022) created an ensemble technique

that combines SVM and LSTM models with quotient

space theory.

The key purpose of the intraday trading is to gain

instant profits from volatile prices of stocks, futures

contracts and other financial instruments. Intraday

trading can be defined simply as buying and selling

of the same security during one day within one trad-

ing session (U.S. Securities and Exchange Commis-

sion, 2022). All positions should be sold before the

end of the trading session, and no securities (including

short positions) should be held overnight in order to

avoid significant risks of getting losses from overnight

gaps triggered by economic or political events (Shen,

2021).

Prediction of the next day’s price with some prob-

ability has become possible by searching for patterns

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

886

of behaviour of market participants in historical data

using complex neural networks and machine learning

algorithms such as RNNs, CNNs and Gradient Boost-

ing algorithms in regression models in conjunction

with some Natural Language Processing (NLP) tech-

nologies. Some models use hybrid joint analysis ap-

proaches on input market data (prices and some tech-

nical indicators) together with news. The papers pre-

sented based on daily (dos Santos Pinheiro and Dras,

2017), (Vargas et al., 2017) and hourly price predic-

tion (Madan et al., 2015) show that better accuracy

is achieved on intraday data in conjunction with the

news of the respective day, as previous days’ news

had minimal impact and became noise. In their pa-

per, (Vargas et al., 2017) employ Deep Learning (DL)

algorithms to predict S&P 500 index intraday prices,

using a headline technical indicators set and financial

news as input. When using DL algorithms, it is possi-

ble to recognize and analyze complex non-trivial pat-

terns and interactions of data, which are used to in-

crease capital returns and automatically accelerate the

trading process. (Vargas et al., 2017) focused on de-

signs like CNN and RNN, and achieved significant

results in typical natural language processing proce-

dures for financial information. The results show that

CNN performed better than the RNN for capturing se-

mantics from text, and RNN is recommended to pre-

dict the stock market by modelling contextual infor-

mation and complex temporal characteristics.

Using NLP techniques, (dos Santos Pinheiro and

Dras, 2017) explored character-level language model

pre-training with RNN for both interday and intraday

forecasts of the S&P 500 index. This method outper-

forms other recent approaches in predicting the direc-

tion of the S&P 500 index for both individual shares

and the index as a whole, demonstrating the high im-

pact of current news on stock price movements in re-

cent years.

Based on the hourly time-term dataset, the pre-

diction method proposed by (Madan et al., 2015)

uses minutes and seconds data of bitcoin to predict

prices for the next 10-minute prices. Properties to

predict the signs of future changes are modelled as

bionomic classifications that are experimented with

random forests and linear models. Their results were

50 to 55% accurate in predicting signals of future

price movements using a time frame of 10 minutes.

Because there are many microscopic fluctuations and

perturbations in the bitcoin price, as well as inside the

prices of other financial instruments, 10-second inter-

vals of data are used for a deeper understanding.

In their paper, (Zhang et al., 2021) applied hybrid

LSTM models to predict the EUR/USD price move-

ment. The classifier determines the direction of price

movement as no action, increase or decrease in price.

The model predictions included periods of one day,

three days, and five days ahead. Results show that hy-

brid models outperform individual models for daily

data.

In recent years, LSTM has been the most popular

method employed for price prediction using time se-

ries data. (Lim et al., 2019) used enhanced deep neu-

ral network LSTM to estimate the price value above

or below in the next time step. (Siami-Namini and

Namin, 2018) also used LSTM to forecast time series

data for 12 stocks. The empirical findings in this pa-

per show that DL-based algorithms, such as LSTM,

outperform classic algorithms, such as ARIMA mod-

els. Similar results were published by (McNally,

2016).

Most research papers reviewed used daily close

prices data as inputs for Neural Networks, Regression

methods or a combination of networks. The authors

identified a lack of research on intraday data, such as

1-minute and 5-minute time frames. Given the higher

predictive performance of neural networks compared

to classical machine learning methods and statistical

time series analysis, this research focuses on mod-

elling with neural networks, such as one-dimensional

CNN and LSTM, which are also very popular for

time-series data. The main contribution of this re-

search consists of comparing and analysing predic-

tions of two neural network models based on the one-

minute gold Forex dataset for intraday trading to close

the existing research gap.

3 PROPOSED METHOD

The expediency of short predictions of financial in-

strument’s price for the next second or minute can be

explained by a simple logical statement that follows

from the concept of causal determinism in economics

(Chen et al., 2018) and is vividly described by the

conception of Laplace’s demon (Johnson, 2017): if

it is possible to predict the next second or minute, it is

possible to predict the future any time ahead.

The prediction of the gold price for the next

minute can show a potential acceleration of price

change during the longer period inside the trading

session. In other words, it shows the starting point

of a possible momentum of future significant price

change. Thus, from a practical point of view, a trading

system based on this minute-by-minute neural net-

work prediction only pays attention to the prediction

of relatively big price changes in the next minute and

does not react to a casual flat.

For this research the one-dimension CNNs has

Using Neural Network Architectures for Intraday Trading in the Gold Market

887

been chosen because they are effective at time-series

analysis (Chollet, 2016) and for pattern recognition

in images. According to the literature review, LSTMs

are widely used for time-series analysis as a bench-

mark. Therefore, it has been chosen as a second ar-

chitecture for this paper.

3.1 Dataset

For the models to produce good results, it is crucial to

choose a dataset that is error-free and detailed enough

to reflect real short-term liquidity. Liquidity, in its

most basic definition, is the quantity of cash and read-

ily convertible assets a company has in order to meet

its short-term debt obligations. In terms of trading,

liquidity means the ability to sell a position in stocks,

futures contracts, or other financial instruments with-

out significantly affecting the current prices of these

assets. According to the World Gold Council (WGC)

(Das et al., 2022), gold is the second most liquid as-

set. Figure 1 demonstrates the changes of the gold

prices from 1974 to 2022 (Dukascopy Swiss Banking

Group, 2022).

Figure 1: Gold prices from 1974 to 2022 (Dukascopy Swiss

Banking Group, 2022).

Gold is one of the most liquid financial assets be-

cause it is traded with large volumes on the spot, fu-

tures, and Forex markets(Hundal et al., 2013). There-

fore, evaluating and comparing various models using

gold datasets is a promising resource for future re-

search conducted on minute-to-minute datasets.

This research uses the gold market financial in-

strument (XAU/USD) in the Forex market. This

one-minute interval dataset is publicly available on

the Dukascopy Bank official website

1

. Data from

2020 has been chosen because it has been extremely

volatile due to the start of COVID-19 pandemic. The

features include the trading volume and the Ask and

Bid Values prices with date and time. There are

355,590 rows and 11 columns — Open, High, Low,

Close, Volume values for both Ask and Bid, and local

time for each minute.

The volumes of each transaction in the Forex mar-

ket, including gold instruments, contain only some

1

https://www.dukascopy.com/swiss/english/home/

volumes bought and sold at current prices in the world

since the Forex market is not centralised. However,

the volumes of transactions indicated in this data

repository sufficiently reflect the activity of market

participants and increase when the market is acti-

vated. Thus, transaction volumes are an additional

linearly independent parameter that has to be analysed

(Milke et al., 2017).

3.2 Experiments

3.2.1 Convolutional Neural Networks

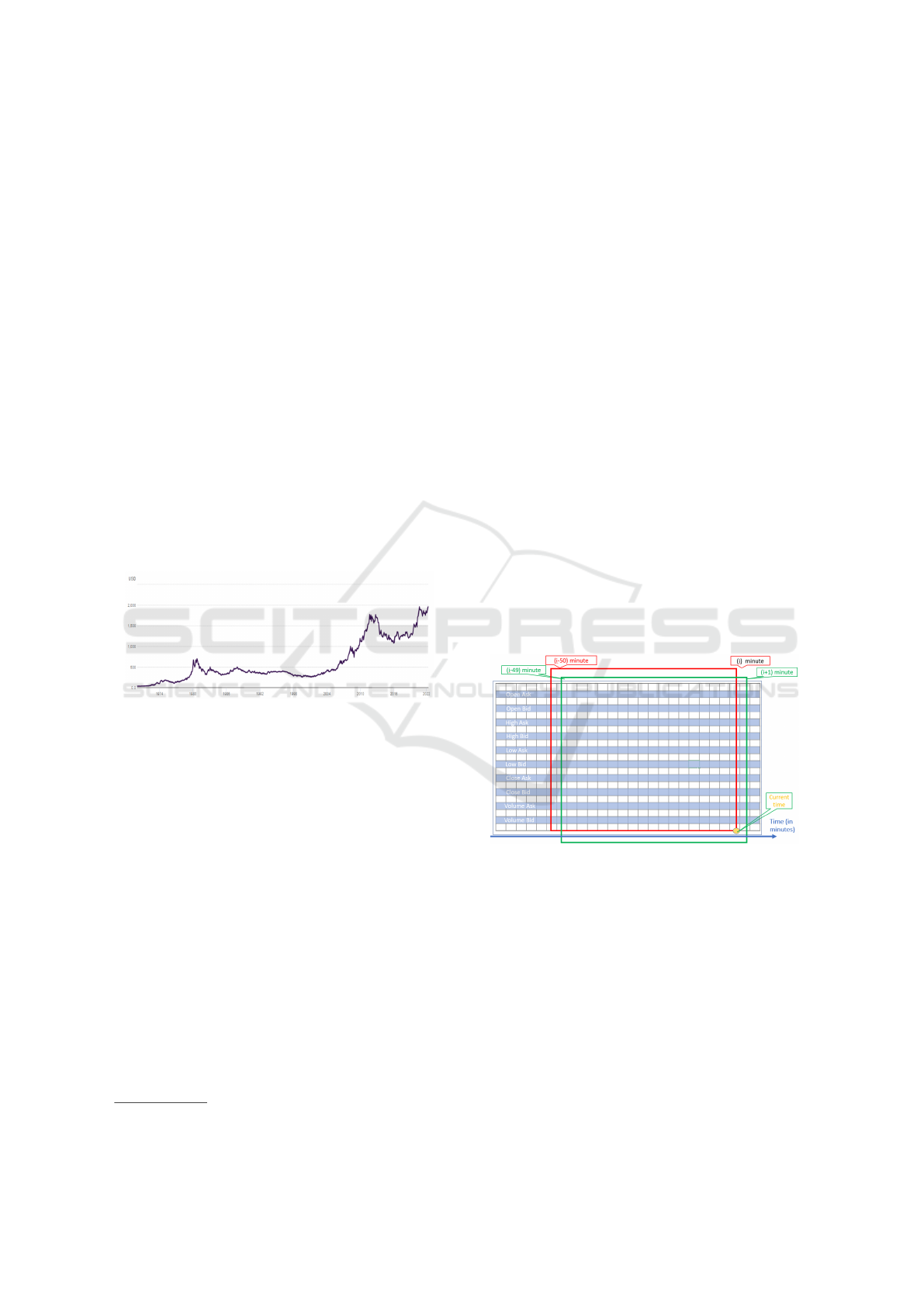

The essential step in the data preprocessing for time-

series data is setting the rolling window size before

training the neural network models. The 50-minute

wide rolling window was used to generate mock im-

ages as inputs to the CNN. This window contains

minute prices and volumes vs time, advancing in min-

utes left-to-right (increasing time) increments. Each

minute generates a new chart for the previous 50 min-

utes, which then adds up to a 3D input tensor. Further,

to reduce the size occupied in RAM and improve the

metrics of correlation recognition, this 3D tensor was

transformed from pictures into a 3D tensor of time se-

ries slices. The process described above is shown in

Figure 2.

Figure 2: The 50-minute rolling window for generating 3D

tensor of inputs.

The 50-minute wide rolling window was chosen

as the maximum possible based on the performance

of the available GPU processors. For example, a 200-

minute wide rolling window increases the number of

input data by four times, and the number of calcula-

tions for training the neural network is proportional to

16 times.

As a consequence of this conversion, 2D arrays

of prices and volumes are converted into a 3D tensor.

The MinMaxScaler technique is used to normalize the

data that is then fed into a CNN for training and pat-

tern recognition. The sliced 2D windows in the 3D

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

888

tensor may be associated with the previously known

financial practice of analysing Japanese candlestick

patterns, but on a newer technological platform (Ni-

son, 2011).

After preprocessing, the data is divided into

training (including 20 % for validation) and testing

datasets in a ratio of about 1:10; approximately 230

days for training and 30 days for testing.

The 2-convolutional layers CNNs, with 50 and

100 neurons each, are trained. Then max-pooling

layer is added to shrink the dimension with the aim

of reducing the redundant characteristics. After the

2-layer CNN network, a dense layer with 25 neurons,

with ReLU activation, was added to allow for addi-

tional customisation. Then the sequence proceeded to

the fully connected layer with the softmax activation

function to forecast expected outcomes; a dense layer

of four neurons was chosen as the last layer for cat-

egorising samples into Open, High, Low, and Close

values. Overall, 40,500 total weight parameters were

optimised during training.

The above conventional neural network architec-

ture was chosen to receive preliminary training out-

comes to assess the approach’s perspective. In further

research, the authors intend to use AutoML tools to

determine the optimal wide of the rolling window and

the best hyperparameters of the neural network used.

3.2.2 Long Short-Term Memory

The data preprocessing for the LSTM consists in re-

shaping the data to a one-dimensional array from the

CNN model’s close price data. This analysis can be

considered a regression task. Similarly, the train vali-

dation and test split of data are kept the same.

The first experiment used a single-layered LSTM

network where the 64-neuron layer is followed by a

25-neuron dense layer and a 4-neuron output dense

layer.

In the second experiment, a two-layered LSTM

network was built. It has 64 neurons on the first

LSTM-layer, followed by 128 neurons in the second

LSTM-layer, and the rest is the baseline of the dense

layers described above. Though the computational

time for two-layered networks is slightly higher than

for one-layered networks, the loss is 100 times less.

Finally, a third LSTM-layer with 256 neurons was

added to the two-layered LSTM network, which has

performed better both in specific computational speed

as well as with test loss. During training, a total of

516,400 total weight parameters were tuned.

4 RESULTS AND COMPARISON

Experiments with CNNs are carried out with dif-

ferent convolutional layers, optimisation algorithms,

loss functions, and metrics. 2-layer ReLu CNN net-

works were compared with 4- and 6-layer networks.

Keras Model Checkpoint callback function was

utilised to remember training results for every epoch,

with the epoch with the best error metrics being cho-

sen as the subsequent choice. Tests were conducted

with data batch sizes ranging from 10 to 100 and

epoch counts ranging from 5 to 100 for this research.

During the analysed period, 20 data batches and 10 to

50 epochs which were determined by the above call-

back function, produced the best results.

The CNN with the parameters showed in table 1

demonstrates a good performance.

Table 1: Hyper parameters settings of Final Model.

Parameter Parameter

Settings

Loss Function MSE

Optimizer Adam

Batch Size 20

Number of neurons in each layer 50

Epochs 50

Table 2 presents the results of both CNN and

LSTM for the error metrics MSE, MAE and MAPE,

used to evaluate model efficiency on each epoch. The

decrease in the error values shows that the model per-

forms well on the training and validation dataset.

Table 2: Table comparing error metrics of models for the

year 2020.

Model MSE MAE MAPE

CNN 0.000001017 0.001208 11.55

LSTM 0.000013088 0.002531 60.33

The predicted prices produced by the CNN on the

test data from 2020 are shown in Figure 3, alongside

the actual values of Open, High, Low and Close.

The visualisation for the LSTM training process

is shown in Figure 4 with Training and validation

losses. Figure 5 demonstrates the LSTM model re-

sults of Train, Test, Valid and Prediction prices.

Following the outcome of the models developed,

the CNN was chosen for further experiments as its

performance is greater than the one of LSTM for

the dataset used. After changing and comparing the

NN architectures and hyper-parameters, the CNN was

trained with parameters that are performing better to

produce fewer error rates.

Using Neural Network Architectures for Intraday Trading in the Gold Market

889

Figure 3: CNN model results for year 2020.

Figure 4: Training and Validation Loss for LSTM for year

2020.

5 DISCUSSION AND CRITICAL

ANALYSIS

The ability to recognise financial market patterns has

clear benefits for investors.

For this paper we employed the CNN and three-

layered LSTM models to forecast the future move-

ment of intraday financial market transactions utiliz-

ing non-standard approaches for preprocessing raw

data. The normalisation of nonlinear data as well as

the conversion of 2D data into a 3D tensor via the pro-

duction of consecutive data are both essential compo-

nents of the approach’s design. As a consequence, the

size of the incoming data grows substantially and im-

pacts the available resources. In this research, the data

was normalised using the min-max approach that is

one of the most often used data normalisation strate-

gies.

In transactions involving very high volume lots,

significant price fluctuations and probable delays in

the execution of market orders often occur, decreas-

ing the prediction’s quality. Therefore, deep learning

techniques, such as CNN and LSTM were chosen as

they are more accurate than basic neural networks.

Preliminary findings indicated a reasonably high

accuracy and error rate, which should yet be thor-

oughly confirmed in calculations, taking into consid-

eration the constraints imposed by the time-series data

set utilized in the calculations. The data was separated

into training and validation datasets in a 9:1 ratio, with

90% of the dataset utilized for training and 10% for

results validation. The results found that baseline 2-

layered CNN with the parameters shown in table 1

had the best performance in terms of MSE, MAE,

MAPE. The decrease in the error values shows that

the model has performed well on the training and val-

idation dataset.

After changing and comparing the hyper-

parameters, the model was trained againand it

produced fewer error rates.

6 CONCLUSION

In this research, two neural network architectures

were applied to gold Forex market data based on gold

spot market prices, using various deep learning ap-

proaches and non-linear data preprocessing. These

approaches were utilised to predict the intensity and

volatility of price movements in a short-term period.

This research presents a CNN model for pre-

dicting future intraday financial market price accel-

erations utilising non-standard data processing ap-

proaches. Based on the test results, it can be con-

cluded that the primary contribution of this research

is a statistical confirmation of the high probability

of the ability of traders (natural or legal persons)

to make profits through intraday forecasting of gold

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

890

Figure 5: Prediction Result for LSTM for year 2020.

price movements.

On the basis of various hyper parameter values,

we compared the performance of the CNN and LSTM

neural networks in forecasting the prices of the gold

market index in intraday time periods . To evaluate

the resilience and performance of these models, we

compared the error metrics of the two neural networks

and concluded that CNN performs better based on low

error rates.

Future research should focus on including Au-

toML to optimise Hyper-parameters with hyper-

parameter optimization (HPO), Reinforcement Learn-

ing by normalising raw data. HPO eliminates the need

for a human expert to perform the time-consuming

task of hyper-parameter tuning. It is possible to create

self-learning agent using reinforcement learning (RL)

with the recognises not only market entry points with

the highest probability of profit but also market exit

points. Such a system will be evaluated in terms of

maximising the Sharpe ratio with RL algorithms like

Proximal Policy Optimization (PPO), Q-learning and,

Deep Q Neural Network.

REFERENCES

Bhat, A. A. and Kamath, S. S. (2013). Automated stock

price prediction and trading framework for nifty in-

traday trading. In 2013 Fourth International Confer-

ence on Computing, Communications and Networking

Technologies (ICCCNT), pages 1–6. IEEE.

Chandrabai, D. and Suresh, D. (2020). Assessment of ma-

chine learning techniques for gold price predictions.

Chen, D., Harimoto, K., Bao, R., Su, Q., Sun, X., et al.

(2019). Group, extract and aggregate: Summarizing

a large amount of finance news for forex movement

prediction. arXiv preprint arXiv:1910.05032.

Chen, S.-H., Kaboudan, M., and Du, Y.-R. (2018). The

Oxford handbook of computational economics and fi-

nance. Oxford University Press.

Chen, W. (2022). Estimation of international gold price by

fusing deep/shallow machine learning. Journal of Ad-

vanced Transportation, 2022.

Chollet, F. (2016). Building autoencoders in keras. The

Keras Blog, 14.

Das, S., Nayak, J., Kamesh Rao, B., Vakula, K., and Ran-

jan Routray, A. (2022). Gold price forecasting us-

ing machine learning techniques: Review of a decade.

Computational Intelligence in Pattern Recognition,

pages 679–695.

Demirer, R., Gupta, R., Pierdzioch, C., and Hus-

sain Shahzad, S. J. (2021). A note on oil price shocks

and the forecastability of gold realized volatility. Ap-

plied Economics Letters, 28(21):1889–1897.

dos Santos Pinheiro, L. and Dras, M. (2017). Stock mar-

ket prediction with deep learning: A character-based

neural language model for event-based trading. In

Proceedings of the Australasian Language Technol-

ogy Association Workshop 2017, pages 6–15.

Dukascopy Swiss Banking Group (2022). Historical

data feed. https://www.dukascopy.com/swiss/english/

marketwatch/historical/. Accessed: 2022-11-15.

Evans, M. D. (2018). Forex trading and the wmr fix. Jour-

nal of Banking & Finance, 87:233–247.

Ferreira, I. H. and Medeiros, M. C. (2021). Modeling and

forecasting intraday market returns: a machine learn-

ing approach. arXiv preprint arXiv:2112.15108.

Gil, C. (2022). Intraday trading of precious metals futures

Using Neural Network Architectures for Intraday Trading in the Gold Market

891

using algorithmic systems. Chaos, Solitons & Frac-

tals, 154:111676.

Huang, J., Li, Y., Suleman, M. T., and Zhang, H. (2021).

Effects of geopolitical risks on gold market return dy-

namics: Evidence from a nonparametric causality-in-

quantiles approach. Defence and Peace Economics,

pages 1–15.

Hundal, B., Grover, S., and Bhatia, J. K. (2013). Herd be-

haviour and gold investment: A perpetual study of re-

tail investors. IOSR Journal of Business and Manage-

ment, 15(4):63–69.

Islam, M. S. and Hossain, E. (2020). Foreign exchange cur-

rency rate prediction using a gru-lstm hybrid network.

Soft Computing Letters, page 100009.

Johnson, T. (2017). The ascendancy of financial economics.

In Ethics in Quantitative Finance, pages 195–220.

Springer.

Kinyua, J. D., Mutigwe, C., Cushing, D. J., and Poggi, M.

(2021). An analysis of the impact of president trump’s

tweets on the djia and s&p 500 using machine learn-

ing and sentiment analysis. Journal of behavioral and

experimental finance, 29:100447.

Liao, S., Chen, J., and Ni, H. (2021). Forex trading volatil-

ity prediction using neuralnetwork models. arXiv

preprint arXiv:2112.01166.

Lim, B., Zohren, S., and Roberts, S. (2019). Population-

based global optimisation methods for learning long-

term dependencies with rnns. arXiv preprint

arXiv:1905.09691.

Madan, I., Saluja, S., and Zhao, A. (2015). Automated

bitcoin trading via machine learning algorithms.

URL: http://cs229. stanford. edu/proj2014/Isaac%

20Madan, 20.

Makala, D. and Li, Z. (2021). Prediction of gold price with

arima and svm. In Journal of Physics: Conference

Series, volume 1767, page 012022. IOP Publishing.

Manjula, K. and Karthikeyan, P. (2019). Gold price pre-

diction using ensemble based machine learning tech-

niques. In 2019 3rd International Conference on

Trends in Electronics and Informatics (ICOEI), pages

1360–1364. IEEE.

McNally, S. (2016). Predicting the price of Bitcoin using

Machine Learning. PhD thesis, Dublin, National Col-

lege of Ireland.

Milke, V., Luca, C., and Wilson, G. (2017). Minimisation

of parameters for optimisation of algorithmic trad-

ing systems. In 2017 International Conference on

Optimization of Electrical and Electronic Equipment

(OPTIM) & 2017 Intl Aegean Conference on Electri-

cal Machines and Power Electronics (ACEMP), pages

1114–1119. IEEE.

Milke, V., Luca, C., Wilson, G., and Fatima, A. (2020).

Using convolutional neural networks and raw data to

model intraday trading market behaviour. In ICAART

(2), pages 224–231.

Nison, S. (2011). Strategies for Profiting with Japanese

Candlestick Charts, volume 132. John Wiley & Sons.

Raimundo, M. S. and Okamoto Jr, J. (2018). Application

of hurst exponent (h) and the r/s analysis in the clas-

sification of forex securities. International Journal of

Modeling and Optimization, 8(2):116–124.

Rundo, F., Trenta, F., di Stallo, A. L., and Battiato, S.

(2019). Grid trading system robot (gtsbot): A novel

mathematical algorithm for trading fx market. Applied

Sciences, 9(9):1796.

Semeyutin, A., Gozgor, G., Lau, C. K. M., and Xu, B.

(2021). Effects of idiosyncratic jumps and co-jumps

on oil, gold, and copper markets. Energy Economics,

104:105660.

Shen, J. (2021). Nine challenges in modern al-

gorithmic trading and controls. arXiv preprint

arXiv:2101.08813.

Siami-Namini, S. and Namin, A. S. (2018). Forecasting

economics and financial time series: Arima vs. lstm.

arXiv preprint arXiv:1803.06386.

U.S. Securities and Exchange Commission (2022).

Day trading. Online: https://www.investor.gov/

introduction-investing/investing-basics/glossary/

day-trading. Accessed: 2022-11-20.

Vargas, M. R., De Lima, B. S., and Evsukoff, A. G. (2017).

Deep learning for stock market prediction from finan-

cial news articles. In 2017 IEEE international con-

ference on computational intelligence and virtual en-

vironments for measurement systems and applications

(CIVEMSA), pages 60–65. IEEE.

Weeraddana, N., Silva, A., and Jayathilake, P. (2018). De-

tection of black regions in the forex market by analyz-

ing high-frequency intraday data. In 2018 18th Inter-

national Conference on Advances in ICT for Emerging

Regions (ICTer), pages 384–391. IEEE.

Weng, F., Chen, Y., Wang, Z., Hou, M., Luo, J., and Tian,

Z. (2020). Gold price forecasting research based on an

improved online extreme learning machine algorithm.

Journal of Ambient Intelligence and Humanized Com-

puting, 11(10):4101–4111.

Zeng, H. and Lu, R. (2022). High-frequency volatility

connectedness and time-frequency correlation among

chinese stock and major commodity markets around

covid-19. Investment Management and Financial In-

novations, 19(2):260–273.

Zhang, W., Yan, K., and Shen, D. (2021). Can the baidu

index predict realized volatility in the chinese stock

market? Financial Innovation, 7(1):1–31.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

892