The Correlation of ESG Ratings and Abnormal Returns:

An Event Study Using Machine Learning

Dominic Strube

1a

and Christian Daase

2b

1

Hochschule Wismar, University of Applied Sciences, Technology, Business and Design, Wismar, Germany

2

Institute of Technical and Business Information Systems, Otto-von-Guericke University, Magdeburg, Germany

Keywords: Environmental, Social and Governance (ESG), Impact Investing, Financial Performance, Sustainability,

Machine Learning.

Abstract: This short study uses machine learning (ML) to investigate whether the inclusion of sustainability ratings in

the training data can improve the estimated accuracy of the prediction of a company's abnormal returns. For

this purpose, we examined 72 companies that are listed in the indices EURO STOXX 50

®

or/and EURO

STOXX 50

®

ESG or/and EURO STOXX

®

ESG LEADERS 50. We found out that the mean-adjustment model

used to estimate returns produces more accurate results than with adding MSCI's sustainability ratings. The

preliminary results suggest that sustainability ratings are currently inappropriate for estimating expected or

abnormal returns and their inclusion in the training data interferes the algorithm behind the ML approach. By

extension, this leads to the assumption that the relation between ESG ratings and a business’ success are

suitably irregular to significantly decrease an ML models quality.

1 INTRODUCTION

In recent years, the importance of sustainability rating

agencies has steadily increased. These ratings are

more and more becoming tools for investors as well

as managers for strategic decision support and as

guideposts for capital investments amounting to

trillions of dollars. This assumption is also confirmed

by the inflow of funds (net of inflows and outflows)

into sustainable funds, which amounted to around

USD 650 billion worldwide in 2021. Global

sustainable fund assets reached a record level of

around USD three trillion at the end of 2021, with

Europe accounting for over 80% (Morningstar,

2022). Increasing investor demand for sustainable

investments thus calls for sustainability performance

ratings that are as objective as possible. Unlike credit

ratings, which focus on the probability of default of a

loan, environmental, social and governance (ESG)

ratings are directed at several different assessment

targets predominantly commissioned and paid for by

institutional investors such as investment funds, asset

managers, financial institutions (from the issuer's

perspective, so-called unsolicited rating)

a

https://orcid.org/0000-0003-3017-5189

b

https://orcid.org/0000-0003-4662-7055

(Christensen et al., 2022; Kögler, 2021) and influence

portfolio construction and trading (Serafeim and

Yoon, 2022). However, the relevance of ESG ratings

and their credibility are widely debated. Many studies

prove that ESG ratings have high inconsistency due

to low correlation with each other owing to diversity

of methodologies and ratings like type and number of

data, evaluation and weighting of data and rating

scales (Berg et al., 2019; Dimson et al., 2020).

Therefore, in academic research, studies

analyzing correlations between ESG aspects and

different performance indicators of a company have

become increasingly important. In particular, the

causality of ESG ratings by major sustainability

rating agencies on the future development of the

financial performance of rated companies is currently

a much-studied area of research. The findings

indicate that over a long-term span, roughly nine out

of ten studies exhibit a correlation between ESG and

financial performance that is not negative (Friede et

al., 2015; Whelan et al., 2020). Furthermore, ESG

portfolios yield better returns compared to

conventional investments, particularly for long-term

investors, and offer safeguards against losses during

76

Strube, D., Strube, D., Daase, C. and Daase, C.

The Correlation of ESG Ratings and Abnormal Returns: An Event Study Using Machine Learning.

DOI: 10.5220/0011841700003494

In Proceedings of the 5th International Conference on Finance, Economics, Management and IT Business (FEMIB 2023), pages 76-81

ISBN: 978-989-758-646-0; ISSN: 2184-5891

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

economic or societal turmoil (Whelan et al., 2020).

However, it is criticized that investors are led by the

assumption to use sustainability ratings for

investment decisions without knowing exactly their

measurement validity (Chatterji et al., 2016;

Dorfleitner et al., 2014).

This article explores the assumption whether

providing knowledge about the current rating of a

major ESG provider could improve the quality of

abnormal return predictions, meaning the difference

between actual and expected returns based on a long-

term average. The idea behind this assumption is that

responsible companies (assuming that ESG ratings

validly measure sustainability levels) may

outperform or underperform investors' expectations,

or that (institutional) investors may invest in

companies with a positive rating, thereby increasing

the stock price, while selling lower-rated stocks. In

this study, a machine learning (ML) approach with

two stages is applied. First, an ML model is trained

with a set of key performance indicators (KPIs) of

different companies that have received ESG ratings in

the past. However, this ML model is unaware of these

ratings. In addition, a second model is trained with the

exact same KPIs, but with the complementary

knowledge of ESG ratings. Thus, both models can be

viewed as imitating stock market experts, and it is

investigated whether the model with the additional

knowledge of ESG ratings outperforms the first

model. This research aims on answering the

following research question (RQ):

RQ: What impact does the addition of knowledge

about ESG ratings have on the accuracy of abnormal

return predictions with a trained ML model?

As mentioned earlier, research on ESG and financial

performance is often inconsistent in how

sustainability factors are measured and defined. For

this reason, we will also examine our ESG data using

descriptive analysis in a previous step.

2 METHODOLOGY AND DATA

The study focuses on the use of machine learning to

better explain abnormal returns through sustainability

ratings. The analysis and prediction of certain

financial values such as prices of resources and

valuable goods (Mahato and Attar, 2014; Tapia

Cortez et al., 2018; Zounemat-Kermani et al., 2020),

risk determinations (Wang et al., 2022), and stock

share prices and unforeseen disruptions (Sun et al.,

2019; Zhong and Enke, 2019) already has a history in

economics.

For the purpose of evaluating ESG impacts, we

use the price data of the companies from the EURO

STOXX 50

®

, the EURO STOXX 50

®

ESG and the

EURO STOXX

®

ESG LEADERS 50 for the study

period from 01.01.2018 to 22.11.2022. The EURO

STOXX 50® is a stock index consisting of 50 large,

listed eurozone companies and is regarded as one of

the leading stock market barometers in Europe. The

EURO STOXX 50 ESG® Index reflects the EURO

STOXX 50® Index with a standardized set of ESG

exclusion criteria and minimum sustainability rating

criteria by the ESG rating provider Sustainalytics.

The STOXX Europe ESG Leaders 50 Index offers

exposure to global leaders in environmental, social

and governance criteria, based on ESG indicators

supplied by Sustainalytics (STOXX® Index

Methodology Guide).

Estimated returns are calculated using simple

mean adjustment. The mean adjustment assumes that

the average returns and systematic risks associated

with the securities remain constant. Historical or

expected returns from the Τ-estimation period (with

Τ-element from {T0; ...; T1}) are used to estimate

returns (Brown and Warner, 1980). Current market

events are not taken into account. Since the ML

models used in this study are intended to imitate

experts for abnormal return predictions, the time

frame for available data must be previous to the date

to be predicted. The abnormal return of a security is

calculated for week τ in the event period, where τ is

defined as the last weekly event in the observation

period S={T

0

; T

1

; ... ; τ}.

𝐴𝑅

,

= 𝑅

,

−

1

𝑛(𝑆)−1

𝑅

,

AR

n,τ

= abnormal return of the stock n in one-week τ

in the event period

R

n,τ

= Return of the share on one-week τ in the event

period

T

0

= first week of the estimation period

n(S) = Number of weeks in the estimation period

The share price data used to calculate the returns was

downloaded from the following online databases:

Ariva, finanzen.net and finance.yahoo. The share

price data are the weekly closing prices in euros. In

the case that price data were only available from a

later date, the period from the first trading day was

considered.

The data basis for the ESG ratings comes from the

MSCI database. In particular, the MSCI ESG rating

is cited as an inclusion requirement for MSCI indices;

The Correlation of ESG Ratings and Abnormal Returns: An Event Study Using Machine Learning

77

for example, the requirement for inclusion in the

MSCI World ESG Leaders is an MSCI ESG rating of

"BB" or higher. In addition, MSCI is considered by

many to be one of the leading providers of data to the

investment community. MSCI also offers ESG scores

to institutional investors and utilizes ESG information

to generate additional stock market indices.

(Christensen et al., 2022).

The scoring system is divided from 0 to 10 into

seven equal parts, each corresponding to a letter grade

from AAA to CCC. These scores should not be

viewed as absolute, but rather in comparison to other

companies in the same industry. The ESG rating for

the company is determined based on the enterprise

value after taking industry-specific adjustments into

account. For the description of the exact methodology

for the determination of the rating see the ESG

methodology documents (ESG Ratings Methodology

- MSCI, 2022). Since MSCI does not publish the

Company Score, we assign a score of 1 (AAA) bus 7

(CCC) to each letter for further calculation.

Table 1: MSCI-ESG-Rating-Scale and Weighting (MSCI

ESG Research LLC).

LETTER LEADER/

LAGGARD

ADJUSTED

COMPANY SCORE

AAA Leader 8.571 - 10.0

AA Leader 7.143 – 8.571

A Average 5.714 – 7.143

BBB Average 4.286 – 5.714

BB Average 2.857 – 4.286

B Laggard 1.429 – 2.857

CCC Laggard 0.0 – 1.429

For the comparative analysis, we use the latest ratings

from Sustainalitics and Renfintiv. The data

availability for the ESG data is consistently above 90

percent over the entire study period through 2021, as

shown in Table 2. For 2022, data availability is likely

to be as solid as in previous years, although ESG data

for that year had not yet been fully published at the

time of the assessment and therefore may lead to bias

in the results. This limitation applies to all subsequent

analyses.

Table 2: Data availability of the MSCI ESG data for the

observation period [in %].

2018 2019 2020 2021 2022

MSCI

94.4 97.2 97.2 97.2 63.9

SST

98.6*

REF.

97.2*

* According to the last available rating

From the technical side, the influence of ESG

ratings on abnormal return prediction accuracy is

estimated using machine learning algorithms. Since

predicting daily price values is a complex, probably

unsolvable problem, relying on a comparison of mean

absolute errors between the two ML models is an

abstract yet more feasible approach. The ML model

for this purpose is therefore simplistically based on a

linear regression, using as independent variables the

data of previous weeks. If the ML model with the

additional integration of ESG ratings as features

performs significantly better than the model without

this knowledge, this can be understood as an indicator

that ESG ratings have an impact on how returns

develop and how certain effects influence the

behavior of a stock. To train the models, the data on

weekly returns and associated values from the

companies listed in the indices EURO STOXX 50

®

,

EURO STOXX 50

®

ESG and EURO STOXX

®

ESG

LEADERS 50 from 2018 until 2022 were used. After

a preprocessing stage, 17736 rows of data served as a

training and evaluation data set. The ML models were

trained by using BigQuery ML in Google Cloud, as it

is a powerful platform for data storage and analysis,

especially useful for analyst teams collaboratively

working in a cloud environment.

3 DESCRIPTIVE ANALYSIS

First, a descriptive analysis of the sustainability rating

data is conducted to critically evaluate the validity of

the rating.

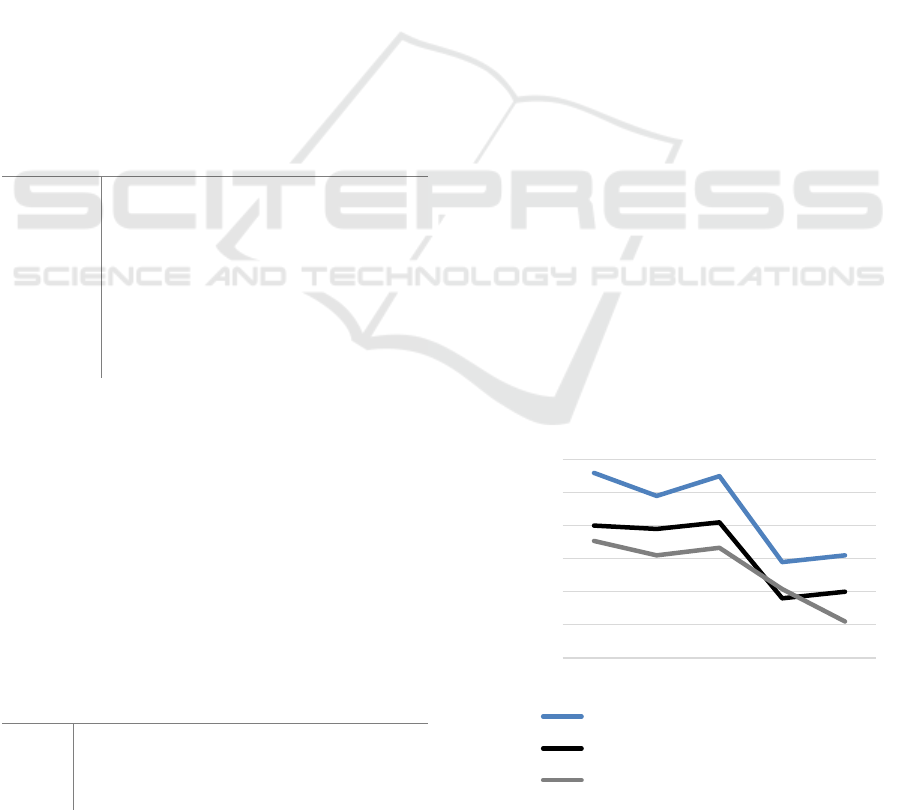

Figure 1 shows the average ESG scores of the

companies analyzed over time. Overall, a significant

improvement in the ESG scores from 2011 to 2022

can be seen for all the indices studied. In addition, the

Figure 1: Ø MSCI-ESG-rating development over time.

2

2,1

2,2

2,3

2,4

2,5

2,6

2018 2019 2020 2021 2022

Ø ESG-Rating

EURO STOXX 50®

EURO STOXX 50® ESG

EURO STOXX® ESG Leaders 50

FEMIB 2023 - 5th International Conference on Finance, Economics, Management and IT Business

78

overall rating of the ESG indices is consistently better

compared to the base index, with the EURO STOXX

®

ESG LEADERS 50 achieving even slightly better

rating results.

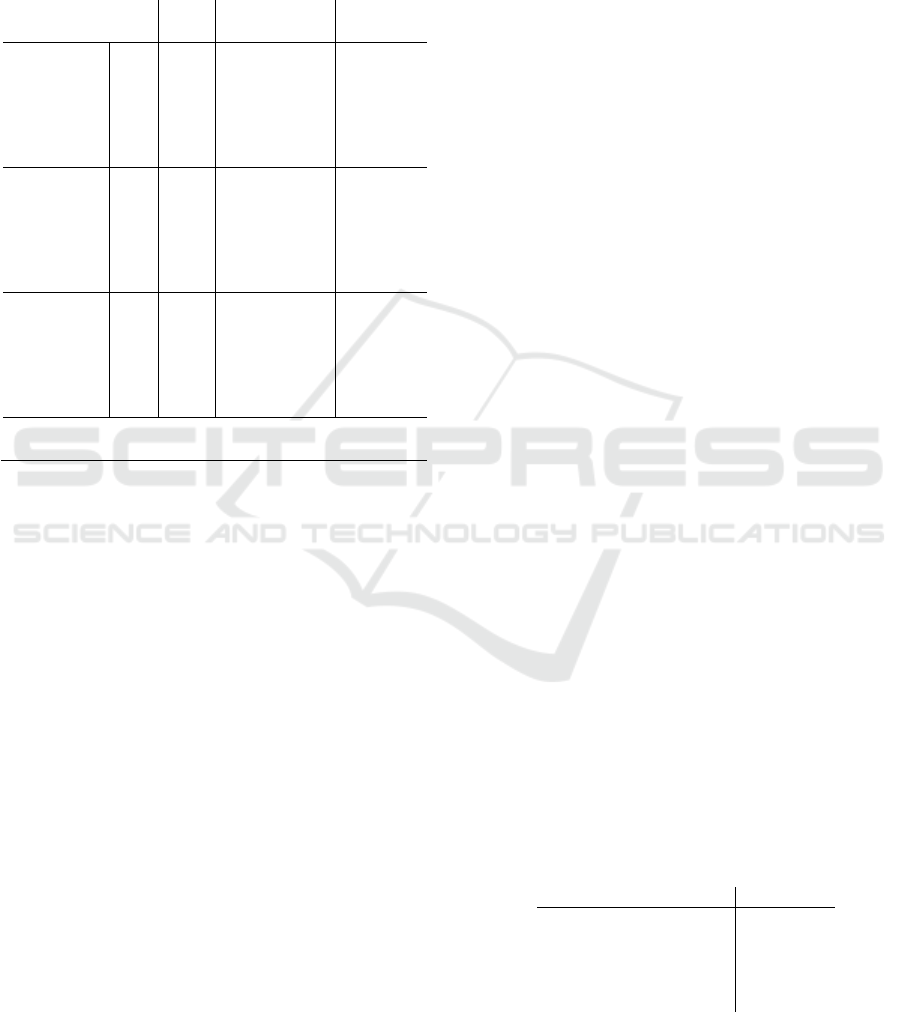

Table 3: Pearson rank correlation coefficients of the ESG

ratings and market cap.

MSCI Sustainalytics Marketcap

MSCI

Corr. 1

Sig.

N 70

Sustainalytics

Corr. .305

*

1

Sig. .011

N 69 71

Marketcap

Corr. .046 -.153 1

Sig. .710 .204

N 69 71 71

*. Correlation is significant at the 0.05 level (2-tailed).

This observation is consistent with empirical results

from other samples (Christ et al., 2021). The question

of the extent to which a good ESG rating is associated

with a higher level of sustainability cannot be

answered conclusively. A study by Drempetic et. al.

shows that the amount of data availability alone has a

positive significance with the ESG rating, so there is

a possibility that even the lack of availability of

sustainability data leads to a more negative rating

(Drempetic et al., 2020). For example, the company

'Isra Vision' was given a worst rating of ‘D-‘ by

Institutional Shareholder Services (ISS) because it

refused to participate in the preparation of an

unsolicited assessment. Only after legal action did

Isra Vision force a ban on publication (Blume, 2020).

As noted earlier, there is uncertainty as to whether

ESG performance is adequately represented by the

ratings used. However, even beyond the lack of data

availability, there are limits to the operationalizability

of the ratings. It is conceivable that larger companies

with more resources could share ESG data with ESG

rating agencies. Some studies find this effect

(Drempetic et al., 2020; Gregory, 2022). Table 3

shows the correlation between market capitalization

and ESG ratings from Sustainalytics and MSCI,

among others, of the dataset studied, with no

significant correlation. There also appears to be

inconsistencies in the assessment of relevant

disclosures. For example, the approaches of the

individual ESG rating agencies differ in terms of the

selection of evaluation criteria and their weighting.

Table 3 also shows the rank correlation coefficients

of the ESG rating providers for the entire sample

studied. There is a slightly significant correlation

between the MSCI rating and that of Sustainalytics.

4 PRELIMINARY RESULTS

The first step to propose an answer to the RQ is to

contrast the two trained ML models from which one

solely comprises accessible data on past KPIs and the

other one additionally integrates current and past ESG

ratings from MSCI. As the so-called label, the target

variable to be predicted, the previously explained

abnormal return was used with a time frame for

averaging past returns of 20 weeks. The first objective

to acquire meaningful results was to apply feature

engineering to assemble a suitable set of input

parameters for the construction of an ML model that

already provides the capability to predict the

abnormal return approximately correctly to a certain

degree.

The features that were best suited for an initial

training phase are the respectively three last returns

and the averages of returns of the last 20, 10, and 5

weeks. Table 4 summarizes the evaluation parameters

of the first ML model that has been trained without

ESG knowledge. The mean absolute error of 3.273 in

consideration of the meaning of the input data

describes a usual deviation of about 3.3 percent of

predicted abnormal returns to actually realized

abnormal returns. The median absolute error of 2.36

percent indicates that the deviations are not equally

distributed but tend to be less accurate in absolute

numbers, while some predictions are in turn closer to

the actual outcome. The R

2

coefficient with almost 90

percent suggests that the model has quite a good

ability to approximate to the correct values.

Table 4: Evaluation of ML model without ESG ratings.

Evaluation parameter Value

Mean absolute erro

r

3.273

Mean square

d

erro

r

22.5101

Mean s

q

uare

d

lo

g

erro

r

1.4438

Median absolute erro

r

2.3631

Rs

q

uare

d

0.8947

To estimate the impact that additional knowledge of

ESG ratings might have, ESG ratings from 2018 to

The Correlation of ESG Ratings and Abnormal Returns: An Event Study Using Machine Learning

79

2022 are added as features to the first model. Each

row of data is preprocessed to remove values from the

ESG cells if the date of the row is earlier than the year

in which the ESG rating was published. In this way,

the model mimics an expert who also has only the

currently available knowledge about a stock price and

related information. However, one limitation of this

model is that the ratings are usually not published at

the very beginning of a year, but rather during the

course of the year. Table 5 presents the evaluation

parameters of the model. In contrast to the mean

absolute error shown in Table 4, the value of 3.9577

is about 21 percent higher. Furthermore, considering

the higher median absolute error and the lower R2, it

can be observed that the integration of ESG ratings

significantly lowers the accuracy of the model. With

respect to the RQ, this result leads to the assumption

that ESG ratings not only do not improve the quality

of the model, but rather confuse the algorithm behind

it. One reason for this could be that the model learns

a false correlation based on some examples in the data

where successful companies have low ESG ratings

and less successful companies receive better ratings

in comparison. As it is then faced with predicting

abnormal returns of highly rated companies, it falls

back on knowledge based on uncorrelated data. Two

examples in the data used are the German company

Adidas, with AAA ratings over the entire period

observed, and the German company Volkswagen,

with CCC to B ratings. Although Adidas is better

rated at each point in time, its return over the last five

years is about -32 percent, while Volkswagen has a

slightly less negative performance of about -20

percent over the same period. The lower accuracy of

the model suggests that this contrasting relationship

between ratings and performance is not an exception,

but to a large extent the rule. In response to the RQ,

the inclusion of ESG ratings during the training of an

ML model with the specified features and labels has

a negative impact on accuracy, as it appears to disrupt

the training by suggesting a misinterpreted

correlation between ESG ratings and a company's

performance.

Table 5: Evaluation of ML model with ESG ratings.

Evaluation

p

arameter Value

Mean absolute erro

r

3.9577

Mean s

q

uare

d

erro

r

35.7671

Mean square

d

log erro

r

2.2909

Median absolute erro

r

2.7699

R square

d

0.8697

5 LIMITATIONS AND

CONCLUSION

A large number of studies have attempted to provide

evidence that sustainability ratings affect the return

performance of a stock, with many studies finding a

positive correlation (Friede et al., 2015; Whelan et al.,

2020). In this context, we investigate whether

machine learning can be used to better estimate a

company's returns by adding a sustainability rating

from MSCI. Our results show that adding the rating

degrades the model for prediction. This may be due

to the fact that no standardized metrics are currently

used to measure sustainability, leading to a diffusivity

between rating-providers that distorts our results.

Second, it is possible that there is no correlation

between ESG and financial performance currently. In

addition, it is possible that the population of our study

with predominantly positively rated companies leads

the model to incorrect assumptions. Also, the use of

mean value adjustment is a very simple procedure;

here, for example, the capital asset pricing model

(CAPM) or the Fama-French three-factor model

could lead to better predictions.

Further research should improve the study and the

model by using a larger population and other methods

to calculate expected returns and by adding more

financial parameters to the model. A shift to more

complex solution approaches such as deep neural

networks to address the complexity of the problem

domain of stock market predictions could also be a

reasonable extension.

REFERENCES

Berg, F., Kö, lbel, J., & Rigobon, R. (2019).

Aggregate Confusion: The Divergence of ESG Ratings.

SSRN Electronic Journal. Advance online publication.

Blume, J. (2020, March 10). Green Finance. Handelsblatt.

https://www.handelsblatt.com/finanzen/steuern-recht/

recht/green-finance-oekoratings-vor-gericht-isra-visio n-

erwirkt-verbot-gegen-agentur-iss-esg/25629486.html

Brown, S. J., & Warner, J. B. (1980). Measuring security

price performance. Journal of Financial Economics,

8(3), 205–258.

Chatterji, A. K., Durand, R., Levine, D. I., & Touboul, S.

(2016). Do ratings of firms converge? Implications for

managers, investors and strategy researchers. Strategic

Management Journal, 37(8), 1597–1614.

Christ, J., Koclan, J., & Lehmann, K. (2021). Der neue

DAX 50 ESG unter der Lupe: Mehr grün, weniger

Risiko? Corporate Finance, 1–8.

Christensen, D. M., Serafeim, G., & Sikochi, A. (2022).

Why is Corporate Virtue in the Eye of The Beholder?

FEMIB 2023 - 5th International Conference on Finance, Economics, Management and IT Business

80

The Case of ESG Ratings. The Accounting Review,

97(1), 147–175.

Dimson, E., Marsh, P., & Staunton, M. (2020). Divergent

ESG Ratings. The Journal of Portfolio Management,

47(1), 75–87.

Dorfleitner, G., Halbritter, G., & Nguyen, M. (2014).

Measuring the Level and Risk of Corporate

Responsibility - An Empirical Comparison of Different

ESG Rating Approaches. SSRN Electronic Journal.

Advance online publication.

Drempetic, S., Klein, C., & Zwergel, B. (2020). The

Influence of Firm Size on the ESG Score: Corporate

Sustainability Ratings Under Review. Journal of

Business Ethics, 167(2), 333–360.

ESG Ratings Methodology - MSCI. (2022, November 29).

https://www.msci.com/esg-and-climate-methodologies

Friede, G., Busch, T., & Bassen, A. (2015). ESG and

financial performance: aggregated evidence from more

than 2000 empirical studies. Journal of Sustainable

Finance & Investment, 5(4), 210–233.

Gregory, R. P. (2022). The influence of firm size on ESG

score controlling for ratings agency and industrial

sector. Journal of Sustainable Finance & Investment,

1–14.

Kögler, A. (2021, May 4). Worauf Sustainalytics beim

ESG-Rating achtet. FINANCE. https://www.finance-

magazin.de/finanzabteilung/investor-relations/worauf-

sustainalytics-beim-esg-rating-achtet-43642/

Mahato, P. K., & Attar, V. (2014). Prediction of gold and

silver stock price using ensemble models. In 2014

International Conference on Advances in Engineering

& Technology Research (ICAETR - 2014) (pp. 1–4).

IEEE.

Morningstar (2022). Global Sustainable Fund Flows: Q3

2022 in Review: Flows fell further but held up better

than the broader market, 1–35. https://assets.content

stack.io/v3/assets/blt4eb669caa7dc65b2/blt77ddb1651

bd21f15/635c12de55e3125597604f2e/Global_ESG_Q

3_2022_Flow_Report_12pm_27_Oct_2022_FRES_E

DIT.pdf

MSCI ESG Research LLC. ESG Ratings Methodology.

https://www.msci.com/documents/1296102/34424357/

MSCI+ESG+Ratings+Methodology.pdf/390b55a3-

031f-e32f-a22e-7f5c8cab9250?t=1666182604205

Serafeim, G., & Yoon, A. (2022). Which Corporate ESG

News Does the Market React To? Financial Analysts

Journal, 78(1), 59–78.

STOXX® Index Methodology Guide. https://www.stoxx.

com/document/Indices/Common/Indexguide/stoxx_in

dex_guide.pdf

Sun, J., Xiao, K., Liu, C., Zhou, W., & Xiong, H. (2019).

Exploiting intra-day patterns for market shock

prediction: A machine learning approach. Expert

Systems with Applications, 127, 272–281.

Tapia Cortez, C. A., Saydam, S., Coulton, J., & Sammut, C.

(2018). Alternative techniques for forecasting mineral

commodity prices. International Journal of Mining

Science and Technology, 28(2), 309–322.

Wang, L., Jia, F., Chen, L., & Xu, Q. (2022). Forecasting

SMEs’ credit risk in supply chain finance with a

sampling strategy based on machine learning

techniques. Annals of Operations Research. Advance

online publication.

Whelan, T., Atz, U., & Clark, C. (2020). ESG and Financial

Perfomance: Uncovering the Relationship by

Aggregating Evidence from 1,000 Plus Studies

Published between 2015 – 2020, 1–19. https://sri360.

com/wp-content/uploads/2022/10/NYU-RAM_ESG-

Paper_2021-2.pdf

Zhong, X., & Enke, D. (2019). Predicting the daily return

direction of the stock market using hybrid machine

learning algorithms. Financial Innovation, 5(1).

Zounemat-Kermani, M., Ramezani-Charmahineh, A.,

Razavi, R., Alizamir, M., & Ouarda, T. B. (2020).

Machine Learning and Water Economy: a New

Approach to Predicting Dams Water Sales Revenue.

Water Resources Management, 34(6), 1893–1911.

The Correlation of ESG Ratings and Abnormal Returns: An Event Study Using Machine Learning

81