Exploring the Viability of Digital-Only Banking: An Empirical

Investigation Using the Push-Pull Model

Avus Hou

a

Asia Eastern University of Science and Technology, No.58, Sec.2, Sihchuan Rd. Banciao District 220, Taiwan

Keywords: Digital-Only Bank, Alternative, Push-Pull Model.

Abstract: Fintech has the potential to revolutionize the banking industry through various digital channels. Digital-only

banking is one such channel emerging as a potential disruptor of traditional banking business models. This

study applies the push-pull model as a theoretical framework to examine digital-only banks as an alternative.

Our sample consists of 214 respondents assessed using component-based structural equation modeling. The

results show that low service quality and inconvenience more than customers’ perceived advantage affect

digital-only banks as an alternative. This study’s findings provide valuable insights into the design of digital-

only banking services.

1 INTRODUCTION

The adoption of Internet-based banking services in

Taiwan has significantly increased recently.

According to the Financial Supervisory Commission

of Taiwan (FSC), the number of online banking users

in Taiwan reached 16.3 million in 2023 (FSC, 2023).

This represents a significant increase from the

previous year and is a result of the COVID-19

pandemic, which has accelerated the adoption of

online banking services. Taiwanese consumers have

turned to online banking and mobile banking apps to

manage their finances during the pandemic, resulting

in a surge in online banking accounts. The growth in

online bank accounts in Taiwan can be attributed to

the increasing popularity of digital banking services

and the convenience they offer customers.

Most online banks are dependent on the

traditional banking system. Specifically, online banks

are associated with their parent banks, such as brands,

physical branches, and technology infrastructure.

However, digital-only banks, also known as Internet-

only or virtual banks, operate exclusively through

digital channels such as websites, mobile apps, and

other online platforms. All banking services are done

on the Internet (Windasari et al., 2022).

As Taiwan’s most popular mobile instant

messaging, LINE has opened a digital-only bank to

a

https://orcid.org/0000-0003-2549-4118

extend its business boundaries. However, in a well-

developed financial infrastructure island, a fresh

Digital-only bank could be an alternative for people

still unclear. It is a big challenge for people to accept

Digital-only banks as alternative banking services.

Therefore, we discuss the following research question

(RQ).

RQ1: What factors affect digital-only banks as an

alternative for users?

The Push-Pull migration model has been effective

in various switching contexts in previous studies

(Hou et al., 2011; Hou & Shiau, 2020; Liao et al.,

2021; Sun et al., 2017). The model explains how

customers switch from one service provider to

another, where one provider “pushes” customers to

switch while the other “pulls” customers toward its

service. This model can also be applied to adopting

digital-only banks as an alternative. We aim to

address the following RQ.

RQ2: How to categorize these factors into the

Push-Pull migration model?

The remainder of this paper proceeds as follows.

The next section describes the theoretical

background; section three shows the hypotheses;

section four presents the methodology; sections five

and six show results and discussions.

26

Hou, A.

Exploring the Viability of Digital-Only Banking: An Empirical Investigation Using the Push-Pull Model.

DOI: 10.5220/0012053000003552

In Proceedings of the 20th International Conference on Smart Business Technologies (ICSBT 2023), pages 26-31

ISBN: 978-989-758-667-5; ISSN: 2184-772X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2 LITERATURE REVIEW

2.1 Alternative Service

Alternative refers to an option or choice distinct from

the mainstream or standard. Alternative service and

service switching intention are related constructs in

relationship marketing (Hou & Lu, 2023). Alternative

service refers to consumers considering and possibly

switching to other service providers instead of using

their current service provider but could come back to

their current preference (Reiter & Matthes, 2021).

This can happen when the consumer is dissatisfied

with the quality of service or perceives that the

alternative service provider offers better values. On

the other hand, service switching intention refers to a

consumer’s intention to switch to an alternative

service provider (Hou & Shiau, 2020).

Customers choose an alternative for various

reasons, such as dissatisfaction with the current

service provider, better offerings by the other

provider or technology, or changes in personal

circumstances (Bansal et al., 2005). In the context of

online game switching, Hou et al. (2011) posited that

online game service providers can attract new

customers by providing attractive alternative online

games. The alternative games need to offer better

value propositions, such as more entertainment, better

customer services, and lower price or free-to-play. At

the same time, incumbent service providers can also

try to retain their customers by identifying the factors

that drive service alternatives and addressing them to

improve customer satisfaction and loyalty.

2.2 Digital-Only Bank

The term Digital-only banks do not have the same

meaning as online banks. Online banks mean

traditional banks provide their part services by

Internet-based system. Digital-only banks are similar

to online banks in delivering customer services via

the Internet but without physical branches. That is,

customers of digital-only banks use all banking

services that operate solely online without assistance

from any physical branches and staff. Thus, trust and

usage habit becomes a big issue for customers (Nel &

Boshoff, 2021).

Digital-only banks provide all services through

mobile platforms, which include opening accounts,

depositing and withdrawing funds, loan, and

conducting transactions 24/7 from anywhere. It

provides customers with a fast, convenient, and cost-

effective alternative to traditional brick-and-mortar

banks. Digital-only banks expect many changes to the

banking industry and financial markets (Windasari et

al., 2022).

However, concerns have been raised about the

lack of physical branches and face-to-face customer

service. Some countries are still working on creating

legal and regulatory frameworks to oversee digital-

only banks (Nel & Boshoff, 2021). Despite these

challenges, the digital-only banks are growing

globaly, and some traditional banks are even creating

their own digital-only banking brands. This trend

highlights the growing importance of digital

transformation and innovation in the banking industry

and suggests that digital-only banks will continue to

be a viable option for customers seeking a more

streamlined banking experience.

2.3 Push-Pull Model

The Push-Pull (PP) model was initially developed to

study human migration patterns. Its application has

since extended to various analyzing switching

behavior intentions (Bansal et al., 2005; Jung et al.,

2017; Sun et al., 2017). The PP model proposes that

both push and pull effects influence individuals’

decisions to switch from one provider to another.

Push factors, such as dissatisfaction with the current

provider, poor quality of service, and inconvenience,

create negative perceptions and drive customers away

from their current provider. In contrast, pull effects,

such as attractive service offerings, perceived

advantages of the alternative provider, and

convenience, create positive perceptions and attract

customers toward alternative providers (Hou et al.,

2011; Hou & Shiau, 2020).

In analyzing switching behavioral intentions, the

PP model provides a comprehensive framework for

identifying and analyzing the underlying factors that

drive customer behavior (Hou & Shiau, 2020; Jung et

al., 2017). The model recognizes that switching

behavior intentions are influenced by push and pull

effects, providing a holistic view of the customer’s

decision-making process. Therefore, the PP model

can be helpful for traditional banks to identify the

factors that drive customers away from their services

and develop strategies to attract and retain customers.

On the other hand, PP model also helpful digital-only

banks attract new customers by their technology

innovation or mobile Apps design.

Exploring the Viability of Digital-Only Banking: An Empirical Investigation Using the Push-Pull Model

27

3 HYPOTHESIS

3.1 Push Effects

Inconvenience. Inconvenience is a critical factor

influencing customers’ perceptions of service and

intention to switch to an alternative provider.

Inconvenience can be defined as the waste of time and

efforcustomers experience while using banking

services (Ferreira et al., 2014). The effort

minimization aspect of convenience is essential for

service providers as it covers saving customers’

cognitive, emotional, and physical activities while

purchasing and using a service.

Studies have shown convenience is a significant

variable in service-switching contexts (Jebarajakirthy

& Shankar, 2021; Keaveney, 1995). Customers are

likely to switch to alternative service providers if they

perceive that the current provider is inconvenient or

does not meet their convenience requirements.

Several studies have highlighted the importance of

convenience in service-switching contexts,

emphasizing the need for service providers to

prioritize convenience in their service offerings (Nel

& Boshoff, 2020; Vyas & Raitani, 2014). Therefore,

it is essential for service providers to understand the

factors that contribute to inconvenience and to take

steps to minimize inconvenience for their customers

(Kim et al., 2020).

Low Service Quality. Scholars define service quality

as the degree to which an institution meets customer

expectations consistently (Lebdaoui & Chetioui,

2020). Service quality is a critical determinant of

customer loyalty, as customers are more likely to

remain loyal to a bank if they perceive that it provides

high-quality services. In the traditional banks, service

quality includes face-to-face and other service

channels such as ATMs, online banking, and mobile

apps (Windasari et al., 2022). All above factors

could affect customers’ perceptions of the quality of

services provided. A customer may choose digital-

only banks as an alternative due to perceived low

service quality from tranditional banks.

Service quality plays a crucial role in customers’

switching behavior intentions. Customers are more

likely to switch to alternative service providers if they

perceive that the current provider does not meet their

expectations in terms of service quality (Vyas &

Raitani, 2014). Therefore, service providers need to

focus on meeting customer expectations consistently

and providing high-quality services across all

channels to retain customers and prevent them from

switching to alternative providers (Hou & Shiau,

2020). Thus, we hypothesize as follows:

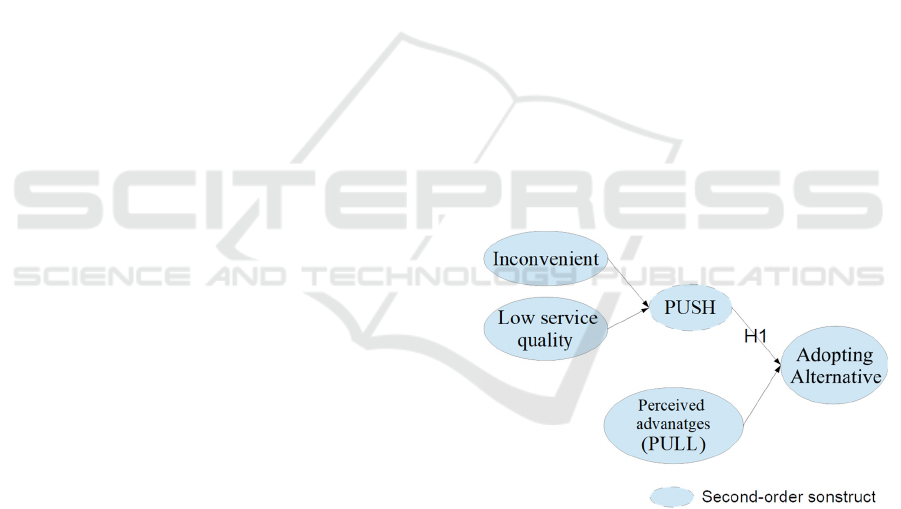

H1: Push effects (inconvenience and low service

quality) positively associate with digital-only banks

as an alternative.

3.2 Pull Effects

Perceived Advantages. Perceived advantages refer

to the efforts, cost, and time savings customers

perceive when using digital-only banking services.

Hou (2015) perceived advantages are essential factors

that attract customers to adopt a new technology or

service. In the context of digital-only banks as an

alternative, when customers perceive that using a

digital-only bank will provide them with costs and

time savings, they are more likely to be driven

towards adopting the service (Hou & Lu, 2023).

More, suppose customers perceive advantages such

as ease of use of Apps, higher interest rate, online

quick loan, and cost-effectiveness (Windasari et al.,

2022). In that case, they are more likely to choose a

digital-only bank as an alternative . This is why

perceived advantages are associated with a high pull

effect. Thus, we hypothesize that:

H2: The pull effect (perceived advantages)

positively associated with digital-only banks as an

alternative.

Figure 1: Research model.

4 METHODOLOGY

We developed a survey instrument for our study on

Digital-only banks, drawing on prior research. To

ensure contextual relevance, we made slight

modifications to all questionnaires. The survey

comprises four constructs with a total of 15 items.

To measure digital-only banks as an alternative,

our dependent variable, we adapted a scale with three

items from (Hou & Lu, 2023). We assessed the push

ICSBT 2023 - 20th International Conference on Smart Business Technologies

28

effects of digital-only banks using two factors:

inconvenience and low service quality. To measure

inconvenience, we used a scale with four items

developed by (Ameen et al., 2021). We used a scale

with four items to measure low service quality (Vyas

& Raitani, 2014). A scale with three items that Hou

(2015) developed for perceived advantages,

representing the pull effect. All items were measured

using a 5-point Likert scale.

To ensure the validity of the questionnaires in the

alternative context of digital-only banks, we had two

experts from the banking industry review

questionnaires before initiating the survey process.

Additionally, we conducted a pilot test to evaluate the

wording used in the questionnaires before

administering them.

For data collection, we conducted an empirical

field survey with a subjective selection of

participants. Researchers placed messages on

Taiwan’s most popular online forum, specifically

PTT (https://term.ptt.cc/), and invited respondents to

participate in the study. As an incentive, we offered

each participant a gift certificate worth US$3 for

completing the questionnaire. In total, we collected

data from 214 respondents who completed the

questionnaire.

5 RESULTS

5.1 Measurement Model

To assess the reliability of the survey instrument, we

calculated Cronbach’s alpha coefficient to determine

the internal consistency of the constructs. Cronbach’s

alpha value of 0.6 or higher is acceptable (Nunnally,

1994). As shown in Table 1, our results indicate that

Cronbach’s alpha values for alternative,

inconvenience, low service quality, and perceived

advantages are 0.91, 0.87, 0.88, and 0.78,

respectively. Therefore, the reliability of all

constructs is acceptable.

Table 1: Reliability.

Constructs Cronbach

al

p

ha

Composite

Reliabilit

y

Alternative

0.91 0.87

Inconvenience

0.87 0.90

Low service quality

0.88 0.92

Perceived advantage

0.78 0.93

To evaluate the convergent validity of the

measurements, we adopted the criteria proposed by

scholars (Fornell & Larcker, 1981). Specifically, we

assessed the factor loading and the Average Variance

Extracted (AVE). A factor loading of 0.7 or higher

and an AVE exceeding 0.5 are considered appropriate

indicators of convergent validity. Table 2

demonstrates that all four constructs met these

criteria, with factor loadings exceeding 0.7 and AVE

values exceeding 0.5. Hence, the convergent validity

of our survey instrument is acceptable.

Table 2: Confirmatory factor Analysis.

Constructs items Factor loading AVE

Alternative 3 0.96; 0.97; 0.95 0.92

Inconvenience 4 0.83; 0.92; 0.82;

0.81

0.72

Low service

qualit

y

4 0.88; 0.92; 0.87;

0.89

0.71

Perceived

advanta

g

e

4 0.86; 0.88; 0.92;

0.87

0.67

5.2 Structural Model

Our analysis treated the push construct as a reflective-

formative format second-order construct with no

items. This means the construct was created based on

underlying latent variables rather than directly

measured using items (Hair et al., 2013).

The researchers utilized Partial Least Squares

(PLS) software to test their research hypotheses, as

recommended by prior research (Hou et al., 2019).

The results are presented in Figure 2, which shows the

relationships between the push effect, pull effect, and

alternative.

The results are presented in Figure 2. Our findings

indicate that the push effect, operationalized by

inconvenience and low service quality, had a

significant positive association with alternatives, thus

supporting H1 (β= 0.371, p<0.01). On the other hand,

the pull effect, formulated by perceived advantages,

had a significant positive association with

alternatives, thus supporting H2 (β= 0.286, p<0.01).

Figure 2: Results.

Exploring the Viability of Digital-Only Banking: An Empirical Investigation Using the Push-Pull Model

29

6 CONCLUSIONS

6.1 Discussion

The study applies the Push-Pull model to investigate

the constructs influencing users’ consideration of

digital-only banks as an alternative. Both push and

pull effects significantly affect users’ decisions.

Push effects, such as inconvenience and low

service quality, make users dissatisfied with their

current bank services. Hence, they are more likely to

consider digital-only banks as an alternative. On the

other hand, pull effects, formulated by perceived

advantages, attract users to adopt digital-only banks

as an alternative. These factors could include a better

user interface to fit the smartphone, innovative

features, or a better interest rate (Windasari et al.,

2022). By addressing these pull effects, digital-only

banks can enhance their appeal to users and increase

the likelihood of users considering their services.

Based on the study’s findings, it can conclude that

the push effect has a more decisive influence than the

pull effect on users’ consideration of digital-only

banks as an alternative. The study found that push

factors, such as inconvenience and low service

quality, were positively associated with users’

consideration of digital-only banks. On the other

hand, while pull effects, such as perceived

advantages, were also positively associated with

users’ consideration of digital-only banks, their

influence was weaker than push factors. Our findings

differ from prior studies that apply the PP model as

the theoretical framework (Hou & Shiau, 2020). They

found pull effect is stronger than push effect in social

media switching context.

This suggests that when users experience push

factors, such as inconvenience or low service quality

in their current banking service, they are more likely

to consider digital-only banks as an alternative

option, regardless of the perceived advantages of

these digital-only banks. However, perceived

advantages still attract users to digital-only banks,

particularly when push factors are not present or are

not significant enough to prompt users to consider

alternative options.

6.2 Academic Implications

The present study’s proposal of service alternatives

instead of service switching is a novel academic

contribution as it extends the existing literature on the

Push-Pull (PP) model. The PP model has been widely

used to explain the factors influencing consumers’

decisions to switch from one service provider to

another. However, the focus has been mainly on

switching behavior rather than considering

alternatives.

By introducing the concept of service alternative,

the present study provides a more nuanced

understanding of consumers’ decision-making

processes in the context of service consumption. This

extension of the PP model is valuable as it

acknowledges that consumers may not necessarily

switch to an alternative service provider but may

consider doing so.

6.3 Practice Implications

The purpose of the present study is to apply the Push-

Pull model to explain users’ alternatives in the

context of digital-only banks, which is essential for

management policy. Digital-only banks can use these

findings to design their services to address users’

push factors and enhance their pull effects. For

example, traditional banks can improve their

services’ convenience and service quality to reduce

the likelihood of users considering alternatives.

Additionally, digital-only banks can highlight the

advantages of their services, such as higher interest

rates, quick loan services, and all services on Apps, to

increase the likelihood of users considering using

their services as an alternative.

7 LIMITATIONS

It is vital to acknowledge the limitations of this study.

Firstly, the sample size is relatively small and may not

be representative of the entire population.

Additionally, the study is limited to a specific

geographic region and may not be applicable to other

regions or countries. Finally, the study only considers

three constructs as dimensions and other constructs

may provide more insights into the viability of

digital-only banking.

REFERENCES

FSC of Tawian. (2023). The status of digital deposit

account services provided by domestic banks as of the

end of March in 2023. Available in:

https://www.fsc.gov.tw/ch/home.jsp?id=96&parentpat

h=0,2&mcustomize=news_view.jsp&dataserno=2023

05020002&dtable=News. Accessed at April, 2024.

Ferreira, F. A. F., Santos, S. P., Rodrigues, P. M. M., &

Spahr, R. W. (2014). Evaluating retail banking service

quality and convenience with MCDA techniques: A

ICSBT 2023 - 20th International Conference on Smart Business Technologies

30

case study at the bank branch level. Journal of Business

Economics and Management, 15(1), 1–21.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural

equation models with unobservable variables and

measurement error. Journal of Marketing Research,

18(1), 39–50.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial

least squares structural equation modeling: Rigorous

applications, better results and higher acceptance. Long

Range Planning, 46(1–2), 1–12.

Ameen, N., Tarhini, A., Reppel, A., & Anand, A. (2021).

Customer experiences in the age of artificial

intelligence. In Computers in Human Behavior (114),

106548.

Bansal, H. S., Taylor, S. F., & James, Y. S. (2005).

“Migrating” to new service providers: Toward a

unifying framework of consumers’ switching

behaviors. In Journal of the Academy of Marketing

Science (33), 96-115.

Hou, A., Chern, C.-C., Chen, H.-G., & Chen, Y.-C. (2011).

‘Migrating to a new virtual world’: Exploring

MMORPG switching through human migration theory.

In (27), 1892-1903.

Hou, A., & Lu, Y. Z. (2023). The obstacles of Internet-only

bank as an alternative banking service. Procedia

Computer Science, 219, 642-646.

Hou, A., & Shiau, W.-L. (2020). Understanding Facebook

to Instagram migration: a push-pull migration model

perspective. In Information Technology & People,

(33)1, 272-295.

Hou, A. C. Y. (2015). Switching motivations on instant

messaging: A study based on two factor theory,

Springer.

Hou, A. C. Y., & Shiau, W.-L. (2020). Understanding

Facebook to Instagram migration: a push-pull

migration model perspective. Information Technology

& People, 33(1), 272-295.

Jebarajakirthy, C., & Shankar, A. (2021). Impact of online

convenience on mobile banking adoption intention: A

moderated mediation approach. Journal of Retailing

and Consumer Services, 58, 102323.

Han, H., & Oh, M. (2017). Travelers' switching behavior in

the airline industry from the perspective of the push-

pull-mooring framework. In Tourism Management

(59), 139-153.

Keaveney, S. M. (1995). Customer Switching Behavior in

Service Industries: An Exploratory Study. In Journal of

Marketing (59)2, 71-82.

Kim, S., Chang, Y., Wong, S. F., & Park, M. C. (2020).

Customer resistance to churn in a mature mobile

telecommunications market. International Journal of

Mobile Communications, 18(1), 41-66.

Lebdaoui, H., & Chetioui, Y. (2020). CRM, service quality

and organizational performance in the banking

industry: a comparative study of conventional and

Islamic banks. In International Journal of Bank

Marketing (38), 1081-1106).

Liao, J., Li, M., Wei, H., & Tong, Z. (2021). Antecedents

of smartphone brand switching: a push–pull–mooring

framework. In Asia Pacific Journal of Marketing and

Logistics (33), 1596-1614.

Nel, J., & Boshoff, C. (2020). Traditional-bank customers'

digital-only bank resistance: evidence from South

Africa. In International Journal of Bank Marketing (39),

429-454.

Nel, J., & Boshoff, C. (2021). “I just don't like digital-only

banks, and you should not use them either”:

Traditional-bank customers' opposition to using digital-

only banks. Journal of Retailing and Consumer

Services, (59), 102368.

Nunnally, J. C. (1994). Psychometric theory 3E. In: Tata

McGraw-hill education.

Reiter, F., & Matthes, J. (2021). Correctives of the

Mainstream Media? A Panel Study on Mainstream

Media Use, Alternative Digital Media Use, and the

Erosion of Political Interest as Well as Political

Knowledge. Digital Journalism, 1-20.

Sun, Y., Liu, D., Chen, S., Wu, X., Shen, X.-L., & Zhang,

X. (2017). Understanding users' switching behavior of

mobile instant messaging applications: An empirical

study from the perspective of push-pull-mooring

framework. In Computers in Human Behavior (75),

727-738.

Vyas, V., & Raitani, S. (2014). Drivers of customers’

switching behaviour in Indian banking industry. In

International Journal of Bank Marketing (32), 321-342.

Windasari, N. A., Kusumawati, N., Larasati, N., & Amelia,

R. P. (2022). Digital-only banking experience: Insights

from gen Y and gen Z. Journal of Innovation &

Knowledge, 7(2), 100170.

Exploring the Viability of Digital-Only Banking: An Empirical Investigation Using the Push-Pull Model

31