A Topic Modelling Method for Automated Text Analysis of the

Adoption of Enterprise Risk Management

Hao Lu, Xiaoyu Liu and Hai Wang

Sobey School of Business, Saint Mary’s University, Canada

Keywords: Topic Modelling, Natural Language Processing, Machine Learning, Artificial Intelligence, Enterprise Risk

Management, Business Analytics, COVID-19.

Abstract: This paper presents a topic modelling method for automated text analysis of the adoption of enterprise risk

management by publicly traded firms. The topic modelling method applies the Latent Dirichlet Allocation

algorithm on corporate annual financial disclosures to identify whether firms have adopted enterprise risk

management. The preliminary results indicate that the firms that have adopted enterprise risk management

have a smaller reduction in daily abnormal returns during the recession period of the COVID-19 financial

market shock in 2020 (the first quarter of 2020 when the stock market crashed) and a larger increase in daily

abnormal returns during the recovery period (the second and third quarters of 2020 when the stock market

recovered). Moreover, there is no evidence that the adoption of enterprise risk management reduces the

volatility of stock returns of publicly traded firms during the COVID-19 financial market shock in 2020.

1 INTRODUCTION

Enterprise Risk Management (ERM) is a holistic risk

management approach to managing all risks within an

organization as a portfolio, and it has been adopted by

a significant portion of publicly traded firms since the

1990s (Arena et al., 2011). ERM is believed to add

value to a firm from both the micro-level and the

macro-level by creating competitive advantages,

increasing risk awareness, creating synergies among

diversified business units, and reducing the cost of

risk (Ai et al., 2018; Clarke & Varma, 1999; Doherty,

2000; Nocco & Stulz, 2006). Many rating agencies,

professional associations, legislative bodies,

regulators, and international standards organizations

endorse and promote ERM (Gatzert et al., 2016; Hoyt

& Liebenberg, 2011; Khurana et al., 2004; Nair et al.,

2014).

Despite the positive effects of ERM on risk

identification, risk mitigation, information sharing,

and the potential corresponding benefits to firm

performance and value, previous empirical research

indicated mixed results on the role of ERM during

and after a systematic crisis. Some research showed

that firms with sophisticated risk management

experienced a higher failure rate in turbulent

environments because of overconfidence in the

benefits of risk management (Baxter et al., 2013;

Bromiley et al., 2001). For example, insurance

companies such as Countrywide Mortgage faced

bankruptcy during the 2008 financial crisis, despite

having strong ERM (Bromiley et al., 2015).

Starting in 2019, the outbreak and spread of the

COVID-19 virus severely impacted global economics

and organizational performance. COVID-19 has

negatively impacted the financial performance of

many industries, such as transportation, mining and

real estate (He et al., 2020; Mazur et al., 2020). This

has resulted in a decline in gross domestic product

and international trade globally (Iyke, 2020). The

COVID-19 financial market shock in 2020 is of great

interest to the risk management research community

because it has created tremendous challenges and

difficulties for risk management.

In this paper, we propose a topic modelling

method for automated text analysis of the adoption of

ERM of publicly traded firms, and examine the

impact of COVID-19 on ERM. The proposed topic

modelling method applies the Latent Dirichlet

Allocation algorithm on corporate annual financial

disclosures to identify whether publicly traded firms

have adopted ERM. The output of the proposed topic

modelling method is then combined with the financial

market data for further analysis of the impact of ERM

456

Lu, H., Liu, X. and Wang, H.

A Topic Modelling Method for Automated Text Analysis of the Adoption of Enterprise Risk Management.

DOI: 10.5220/0012118500003538

In Proceedings of the 18th International Conference on Software Technologies (ICSOFT 2023), pages 456-462

ISBN: 978-989-758-665-1; ISSN: 2184-2833

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

during the COVID-19 financial market shock in

2020.

The remainder of the paper is organized as

follows. Section 2 formulates the research problem.

Section 3 describes the topic modelling method.

Section 4 presents the results of the topic modelling

method to examine the impact of ERM during the

COVID-19 pandemic. Section 5 presents the

conclusions.

2 RESEARCH PROBLEM

A significant portion of publicly traded firms has

adopted ERM since the 1990s (Arena et al., 2011). As

previous empirical research indicated mixed results

on the role of ERM during and after a systematic

crisis (Baxter et al., 2013; Bromiley et al., 2001), the

impact of ERM during the COVID-19 financial

market shock in 2020 remains unclear. Pagach and

Wieczorek-Kosmala (2020) conceptually examined

the impact of COVID-19 on ERM and provided

important yet unanswered research questions on the

role of ERM in response to the COVID-19 pandemic:

1. Does the financial market recognize the benefits

of ERM during the COVID-19 financial market

shock in 2020?

2. Does ERM help reduce the volatility of firm

stock market returns during the COVID-19

financial market shock in 2020?

Based on the previous research literature (Alexander,

2008; Azar, 2014; Arena et al., 2011; Beasley et al.,

2008; Carpenter & Guariglia, 2008; Eckles et al.,

2014; Farrell & Gallagher, 2015; Gatzert & Martin,

2015; Hentschel & Hall, 1991; Hoyt & Liebenberg,

2011; Liebenberg & Hoyt, 2003; (Farrell &

Gallagher, 2015; Lu et al., 2020; Nocco & Stulz,

2006; Olowe, 2009; Pagach & Warr, 2010; Stulz,

1996; Traub, 2019; Wang, et al., 2009), we examine

the following two hypotheses.

H1: During the COVID-19 financial market shock in

2020, the firms that have already adopted ERM

experienced higher abnormal returns compared with

firms that do not adopt ERM.

H2: During the COVID-19 financial market shock in

2020, the firms that have already adopted ERM

experienced lower stock return volatility compared

with firms that do not adopt ERM.

We collected the stock market data for the first three

quarters of 2020 from the Capital IQ Security Daily

database, as well as all corporate annual financial

disclosures since 1985 of all publicly traded firms in

the US. The first confirmed COVID-19 case in the

US was recorded on January 20, 2020 (Taylor, 2020).

During February, the spread of the coronavirus in the

US was relatively slower compared with other

regions, such as Asia and Europe. The month of

March marked the sign of a full outbreak in the US.

On March 6, 2020, the US government announced the

COVID-19 Emergency Relief Aid Program. The US

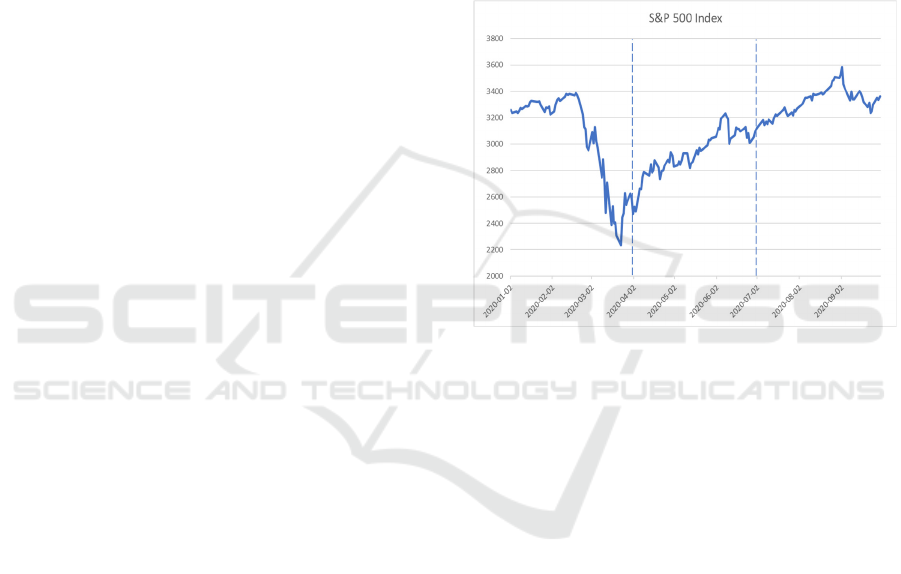

S&P 500 Index Prices in the first 3 quarters of 2020

are shown in Figure 1. For the COVID-19 financial

market shock in 2020, we define the first quarter of

2020 as the recession stage, and the second and third

quarters of 2020 as the recovery stage.

Figure 1: The US S&P 500 Index Prices in the first three

quarters of 2020.

We are interested in how ERM impacts both firm

stock performance and volatility of returns.

Therefore, we have two sets of dependent variables.

We use daily abnormal return (AR) to measure a

firm’s stock market performance (Albuquerque,

Koskinen, Yang, & Zhan, 2020). To calculate AR, we

first calculated the three-year average beta between

2017 and 2019 using the capital asset pricing model.

AR is calculated as the residual returns after the

market-induced return is removed. We first run the

regression based on the market model as follows.

R

it

=α

i

+ β

i

*R

mt

(1)

where i, t, m represents the publicly traded firm i, date

t, and industry m; R

it

is the risk-adjusted daily return;

α

i

is the constant; β

i

is the three-year average beta; and

R

mt

is the risk-adjusted market daily return. We then

calculate AR as the difference between the risk-

adjusted return and the risk-adjusted market return as

follows.

AR

it

=R

it

–(α

i

+ β

i

*R

mt

) (2)

A Topic Modelling Method for Automated Text Analysis of the Adoption of Enterprise Risk Management

457

We use the standard deviation of a firm’s risk-

adjusted daily return to measure a firm’s stock return

risk.

We then use the difference-in-difference (diff-in-

diff) regression method to test the hypothesis H1. We

regress AR on the diff-in-diff estimator and all other

control variables at the firm-day level as follows.

AR

it

= α + β

1

* (ERM

i

* COVID

t

) + β

2

* ERM

i

+ β

3

* COVID

t

+ X’δ + λ

m

+ ε

it

(3)

where i, t, m represents the publicly traded firm i, date

t, and industry m; ERM

i

=1 represents the adoption of

ERM by the publicly traded firm i before 2020, and 0

otherwise; COVID

t

=1 if the date is March 6, 2020 or

after, and 0 otherwise, because the US government

announced the COVID-19 Emergency Relief Aid

Programs on March 6, 2020; X’ is the vector of

control variables; λ

m

is the industry fixed effects; and

ε

it

is the error term. As expressed in the hypothesis

H1, we expect the coefficient β

1

to be positive. This

diff-in-diff estimation has an advantage in estimating

the marginal effects of the treatment group versus the

control group in different periods. In order to further

control for time-invariant factors that may bias the

diff-in-diff coefficient, we also run a firm-day fixed

effect regression with the same diff-in-diff estimator

as follows.

AR

it

= α + γ

1

*(ERM

i

*COVID

t

) + γ

2

K

it

+ μ

i

+ θ

t

+ ε

it

(4)

where K

it

is the daily price range; μ

i

is the firm fixed-

effects and θ

t

is the day fixed-effects. Please note that

the independent variable ERM

i

and all firm-year level

control variables are absorbed in the firm fixed-

effects.

The hypothesis H2 investigates ERM’s impact on

stock return volatility. We use the cross-sectional

estimation by regressing the standard deviation of

daily abnormal returns on the independent variable

ERM

i

and the vector of firm-year level control

variables. Stock volatility is calculated based on the

stock returns in the first quarter, the first two quarters,

and the first three quarters, respectively. We include

industry fixed-effects for all stock volatility risk

regressions as follows.

Volatility

i

= α + β*ERM

i

+ X’δ + λ

m

+ ε

i

(5)

where Volatitity

i

is the stock return volatility of the

publicly traded firm i.

The independent variable ERM

i

in the regressions

(3), (4) and (5) is the adoption of ERM by the publicly

traded firm i. The adoption of ERM by a publicly

traded firm in the US can be found in one of corporate

annual financial disclosures such as the 10-K, DEF-

14A and PRE-14A filings. Because there are a large

number of publicly traded firms in the US in our

dataset, each with multiple financial disclosure filings

every year, it is impossible to manually identify the

adoption of ERM in the corporate annual financial

disclosures. We propose a topic modelling method

for automatically identifying the adoption of ERM by

a publicly traded firm.

3 AUTOMATED TEXT

ANALYSIS OF THE ADOPTION

OF ERM

3.1 The Proposed Topic Modelling

Method

In machine learning, topic modelling refers to a

variety of algorithms for discovering the abstract

“topics” in a collection of text documents. The Latent

Dirichlet Allocation (LDA) algorithm is the most

popular topic modelling algorithm that has been

extensively studied (Blei, Ng, & Jordan, 2003). It is

capable of generating a probabilistic model of a

mixture of hidden topics, each of which is defined as

a probability distribution over the vocabulary.

Recently, the LDA algorithms have been studied for

analyzing corporate annual financial disclosures of

publicly traded firms (Bao & Datta, 2014; Dyer et al.,

2017; Toubia et al., 2019).

The objective of using the LDA algorithm in our

study is to automatically identify the adoption of

ERM by publicly traded firms in their annual

financial disclosures, including the 10-K, DEF-14A

and PRE-14A filings.

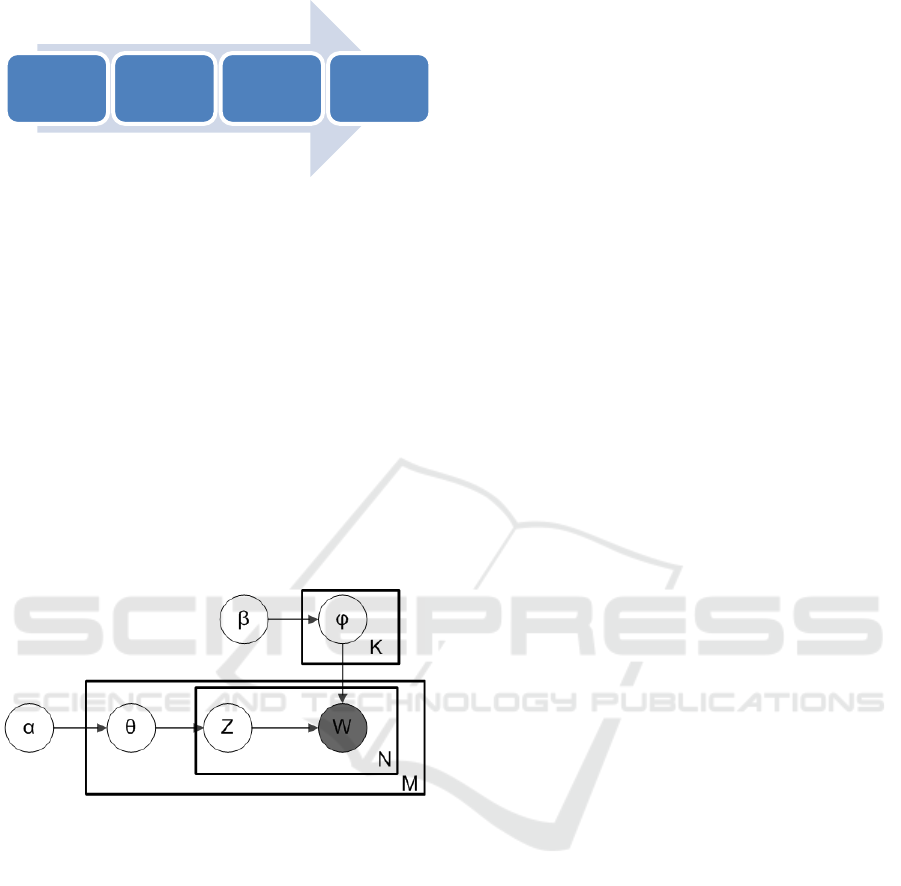

Our method for automated text analysis of

corporate annual financial disclosures of publicly

traded firms is summarized in Figure 2. First, we

apply several data preprocessing steps to transform all

original corporate annual financial disclosures into

text documents that are suitable for the input of the

LDA algorithm. Second, we apply the LDA algorithm

to extract different topics of the text documents. If the

topics related to the adoption of ERM are among the

top topics identified by the LDA algorithm and more

important than other irrelevant topics, then we

conclude the corresponding corporate annual

financial disclosure contains the information of such

an ERM adoption by the firm. Third, we perform a

data-driven validation procedure to validate the

results of the LDA algorithm. Finally, we perform an

event analysis to identify the starting year of the

adoption of ERM.

ICSOFT 2023 - 18th International Conference on Software Technologies

458

Figure 2: The method for automated text analysis of

corporate annual financial disclosures of publicly traded

firms.

3.2 The LDA Algorithm

The Latent Dirichlet Allocation (LDA) algorithm is

the most popular topic modelling algorithm that has

been extensively studied (Blei, Ng, & Jordan, 2003).

It is a generative machine learning model that

explains a set of observed words through unobserved

topic groups. A text document is associated with a

small number of topics, and each word’s presence in

the document is attributable to one of the document’s

topics. Figure 3 illustrates the probabilistic graphical

representation of the LDA model (Blei, Ng, & Jordan,

2003).

Figure 3: The LDA model.

The notations in Figure 2 are as follows.

M: the number documents

N: the number of words in a document m

K: the number of possible topics

α: the parameter of the Dirichlet prior on the per-

document topic distribution

β: the parameter of the Dirichlet prior on the per-

topic word distribution

θ: the topic distribution for a document m

ϕ: the word distribution for a topic k

Z: the topic for a word n in a document m

W: the specific word

The only observable variable of the LDA model is W,

and the other variables are latent variables. The input

variable of the LDA algorithm is a set of M text

documents, and the desired output of the LDA

algorithm is θ, the topic distribution of every

document. If the topics related to the adoption of

ERM are among the top topics identified by the LDA

algorithm and more important than other irrelevant

topics, then we conclude the corresponding corporate

annual financial disclosure indicates an ERM

adoption by the firm.

Using the LDA algorithm to identify the adoption

of ERM has at least two major advantages compared

to the traditional manual identification process used

in research literature (Berry-Stölzle & Xu, 2018;

Hoyt & Liebenberg, 2011). First, the LDA algorithm

is consistent and free from human errors. This makes

data replicability relatively easy compared with the

human judgment process. The process is objective in

the sense that it does not have a preference over, or

against, any specific firm. Human judgment, in

contrast, is sometimes biased due to personal

preferences, physical and psychological conditions,

and personal errors. Second, the LDA algorithm can

process a huge number of documents while the

human manual process cannot.

Moreover, for automatic text analysis of

identifying the adoption of ERM in the corporate

annual financial disclosures, the LDA algorithm is

capable of yielding much more accurate results than

the exact keyword matching, another alternative

automated process. For example, the sentence “This

combination of legal and management experiences

enables Mr. Carter to provide guidance to the

Company in the areas of legal risk oversight and

enterprise risk management, corporate governance,

financial management and corporate strategic

planning” in a corporate annual financial disclosure

could yield a positive adoption of ERM by the exact

keyword matching of “enterprise risk management”,

but a negative adoption by the LDA algorithm as the

topic “enterprise risk management” is not more

important (i.e., has a higher probability) than the

irrelevant topics “corporate governance” and

“financial management”.

3.3 Data-Driven Validation

The use of the LDA algorithm for identifying the

adoption of ERM by a firm in a corporate annual

financial disclosure is rule-based. In the algorithm, a

corporate annual financial disclosure indicates an

ERM adoption by the firm when the topics of the

financial disclosure related to the adoption of ERM

are more important and thus have higher probabilities

than other irrelevant topics.

As the LDA algorithm is an unsupervised learning

algorithm, it is difficult to assess the quality of its

Data

preprocessing

Topic

modeling

Data‐driven

validation

Eventanalysis

A Topic Modelling Method for Automated Text Analysis of the Adoption of Enterprise Risk Management

459

results. We perform a data-driven validation

procedure to establish the robustness of the results of

the LDA algorithm. First, we manually label a small

set of corporate financial disclosures on the adoption

of ERM. Second, we use this training data set to train

a supervised classification model using the logistic

regression algorithm on all topics identified by the

LDA algorithm. Third, we use this trained

classification model to predict each financial

disclosure whether it is about the adoption of ERM.

Finally, the prediction results are then compared with

the rule-based results from the LDA algorithm in

order to establish the robustness of the results of the

LDA algorithm.

3.4 Event Analysis

We identify the starting year of the adoption of ERM

by the firms in their corporate annual financial

disclosures. This can be achieved by a simple event

analysis, where a firm’s corporate annual financial

disclosures had a change of topics regarding ERM.

4 RESULTS

4.1 Description of the Data

We used the data of the U.S. publicly traded firms for

our study by combining the Compustat Capital IQ

database and the Compustat Security Daily databases.

Since we are interested in how ERM influences

financial market risk and returns during the COVID-

19 financial market shock in 2020, we can only

include firms that still exist at the beginning of 2020.

To construct the dataset, we first obtain financial

information for all firms that still exist in Compustat

Capital IQ by 2019. The stock market information for

these firms was then collected from the Compustat

Security Daily database between January 1st, 2020

and September 30th, 2020. To show the preliminary

results, we randomly selected 1500 firms for our

study. After removing firms with missing values in

key variables, we were able to retain 1468 firms. This

gives us a total of 274,520 firm-day observations.

4.2 Robustness of the LDA Algorithm

Results

We randomly selected 50 corporate annual financial

disclosures from the1468 firms in our dataset, and

manually labelled them on the adoption of ERM. We

use this training data set to train a supervised

classification model using the logistic regression

algorithm on all topics identified by the LDA

algorithm. We use this trained classification model to

predict each financial disclosure whether it is about

the adoption of ERM. Finally, the prediction results

are then compared with the rule-based results from

the LDA algorithm.

For all 50 financial disclosures, we found that the

rule-based results from the LDA algorithm are all

identical to the classification results of the logistic

regression classifier. With 100% accuracy for the 50

randomly selected corporate annual financial

disclosures, the robustness of the LDA algorithm

results is established.

4.3 Impact of ERM on Abnormal

Returns

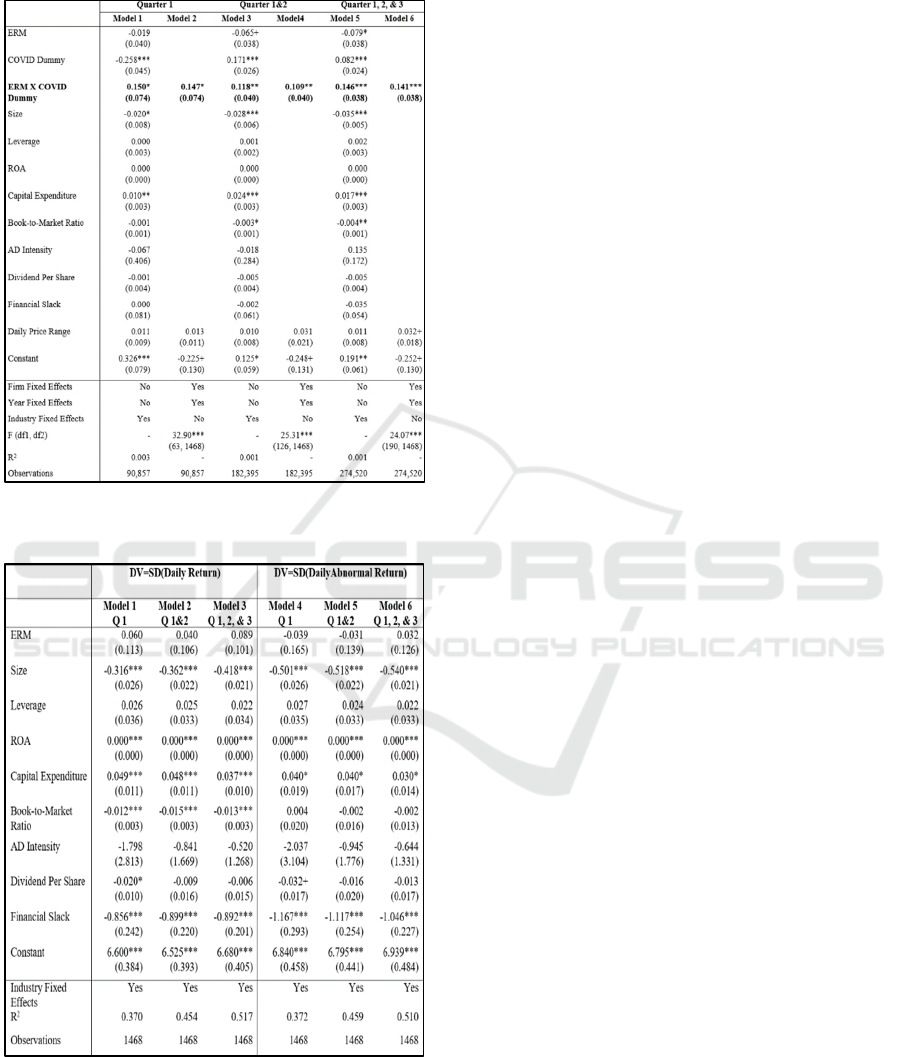

Table 1 shows the results for the AR regression for

the hypothesis H1. The coefficient for the diff-in-diff

estimator is positive and significant in all models.

Moreover, the significance level of the diff-in-diff

estimator increases as we include longer post-COVID

period (β1=0.150, p=0.043 for Quarter 1; β1=0.118,

p=0.003 for Quarter 1 & 2; β1=0.146, p=0.000 for

Quarters 1, 2 & 3, respectively), indicating that

ERM’s impact on the abnormal return during the

COVID-19 pandemic is long-term. The coefficients

of the diff-in-diff estimator are similar in the firm

fixed-effects models (Models 2, 4, & 6). Therefore,

the hypothesis H1 is supported.

4.4 Impact of ERM on Stock Return

Volatility

Table 2 shows the regression results for the

hypothesis H2. The results show that ERM does not

have a significant impact on the stock return volatility

during both the recession period and the recovery

period. The results are consistent when we use other

measurements of stock return volatility, such as the

standard deviation of daily abnormal returns and the

standard deviation of the daily price range. Therefore,

the hypothesis H2 is not supported.

5 CONCLUSIONS

The proposed topic modelling method for automated

text analysis of the adoption of ERM by publicly

traded firms is superior to the traditional manual

process and alternative automated process. We have

demonstrated the effectiveness and robustness of the

ICSOFT 2023 - 18th International Conference on Software Technologies

460

Table 1: Difference in Difference Regression of Abnormal

Return on ERM.

Table 2: Cross-sectional Regression of Stock Market

Volatility on ERM.

results of the proposed method. Using the output of

the proposed method, we have validated the

hypothesis on the relationship between ERM and

abnormal returns of the firms. In particular, the firms

that have adopted ERM have a smaller reduction in

abnormal returns during the recession period of the

COVID-19 pandemic (the first quarter of 2020 when

the stock market crashed) and a larger increase in

abnormal returns during the recovery period (the

second and third quarters of 2020 when the stock

market recovered). Moreover, we have found no

evidence that ERM reduces the volatility of stock

returns of publicly traded firms. Based on these

findings, we would suggest that investors are more

confident about the financial outcome of the firms

with an ERM adoption during the COVID-19

pandemic.

REFERENCES

Ai, J., Bajtelsmit, V., & Wang, T. 2018. The Combined

Effect of Enterprise Risk Management and

Diversification on Property and Casualty Insurer

Performance. Journal of Risk and Insurance, 85(2):

513-543.

Arena, M., Arnaboldi, M., & Azzone, G. 2011. Is enterprise

risk management real? Journal of Risk Research, 14(7):

779-797.

Azar, S. A. 2014. The determinants of US stock market

returns. Open Economics and Management Journal,

1(1).

Bao, Y. & Datta, A. 2014. Simultaneously discovering and

quantifying risk types from textual risk disclosures.

Management Science, 60(6): 1371-1391.

Baxter, R., Bedard, J. C., Hoitash, R., & Yezegel, A. 2013.

Enterprise risk management program quality:

Determinants, value relevance, and the financial crisis.

Contemporary Accounting Research, 30(4): 1264-

1295.

Beasley, M., Pagach, D., & Warr, R. 2008. Information

conveyed in hiring announcements of senior executives

overseeing enterprise-wide risk management processes.

Journal of Accounting, Auditing & Finance, 23(3): 311-

332.

Beasley, M. S., Clune, R., & Hermanson, D. R. 2005.

Enterprise risk management: An empirical analysis of

factors associated with the extent of implementation.

Journal of accounting and public policy, 24(6): 521-

531.

Berry-Stölzle, T. R. & Xu, J. 2018. Enterprise risk

management and the cost of capital. Journal of Risk and

Insurance, 85(1): 159-201.

Blei, D. M., Ng, A. Y., & Jordan, M. I. 2003. Latent

dirichlet allocation. Journal of Machine Learning

Research, 3: 993-1022.

Bromiley, P., Miller, K. D., & Rau, D. 2001. Risk in

strategic management research. The Blackwell

handbook of strategic management: 259-288.

Bromiley, P., McShane, M., Nair, A., & Rustambekov, E.

2015. Enterprise risk management: Review, critique,

and research directions. Long Range Planning, 48(4):

265-276.

A Topic Modelling Method for Automated Text Analysis of the Adoption of Enterprise Risk Management

461

Carpenter, R. E. & Guariglia, A. 2008. Cash flow,

investment, and investment opportunities: New tests

using UK panel data. Journal of Banking & Finance,

32(9): 1894-1906.

Clarke, C. J. & Varma, S. 1999. Strategic risk management:

the new competitive edge. Long Range Planning, 32(4):

414-424.

Doherty, N. 2000. Integrated risk management: Techniques

and strategies for managing corporate risk. New York,

NY: McGraw Hill Companies.

Dyer, T., Lang, M., & Stice-Lawrence, L. 2017. The

evolution of 10-K textual disclosure: Evidence from

Latent Dirichlet Allocation. Journal of Accounting and

Economics, 64(2-3): 221-245.

Eckles, D. L., Hoyt, R. E., & Miller, S. M. 2014. The impact

of enterprise risk management on the marginal cost of

reducing risk: Evidence from the insurance industry.

Journal of Banking & Finance, 43: 247.

Farrell, M. & Gallagher, R. 2015. The valuation

implications of enterprise risk management maturity.

Journal of Risk and Insurance, 82(3): 625-657.

Gatzert, N. & Martin, M. 2015. Determinants and value of

enterprise risk management: Empirical evidence from

the literature. Risk Management and Insurance Review,

18(1): 29-53.

Gatzert, N., Schmit, J. T., & Kolb, A. 2016. Assessing the

risks of insuring reputation risk. Journal of Risk and

Insurance, 83(3): 641-679.

Gordon, L. A., Loeb, M. P., & Tseng, C.-Y. 2009.

Enterprise risk management and firm performance: A

contingency perspective. Journal of Accounting and

Public Policy, 28(4): 301-327.

Grace, M. F., Leverty, J. T., Phillips, R. D., & Shimpi, P.

2015. The Value of Investing in Enterprise Risk

Management. Journal of Risk and Insurance, 82(2):

289-316.

He, P., Sun, Y., Zhang, Y., & Li, T. 2020. COVID–19’s

impact on stock prices across different sectors—An

event study based on the Chinese stock market.

Emerging Markets Finance and Trade, 56(10): 2198-

2212.

Hoyt, R. E. & Liebenberg, A. P. 2011. The value of

enterprise risk management. Journal of Risk and

Insurance, 78(4): 795-822.

Iyke, B. N. 2020. COVID-19: The reaction of US oil and

gas producers to the pandemic. Energy Research

Letters, 1(2): 13912.

Liebenberg, A. P. & Hoyt, R. E. 2003. The determinants of

enterprise risk management: Evidence from the

appointment of chief risk officers. Risk Management

and Insurance Review, 6(1): 37-52.

Mazur, M., Dang, M., & Vega, M. 2020. COVID-19 and

the march 2020 stock market crash. Evidence from

S&P1500. Finance Research Letters: 101690.

Nair, A., Rustambekov, E., McShane, M., & Fainshmidt, S.

2014. Enterprise risk management as a dynamic

capability: A test of its effectiveness during a crisis.

Managerial and Decision Economics, 35(8): 555-566.

Nocco, B. W. & Stulz, R. M. 2006. Enterprise risk

management: Theory and practice. Journal of Applied

Corporate Finance, 18(4): 8-20.

Olowe, R. A. 2009. Stock return, volatility and the global

financial crisis in an emerging market: The Nigerian

case. International Review of Business Research

Papers, 5(4): 426-447.

Pagach, D. & Wieczorek-Kosmala, M. 2020. The

Challenges and Opportunities for ERM Post-COVID-

19: Agendas for Future Research. Journal of Risk and

Financial Management, 13(12): 323.

Pagach, D. P. & Warr, R. S. 2010. The effects of enterprise

risk management on firm performance. Available at

SSRN 1155218.

Stulz, R. M. 1996. Rethinking risk management. Journal of

Applied Corporate Finance, 9(3): 8-25.

Toubia, O., Iyengar, G., Bunnell, R., & Lemaire, A. 2019.

Extracting features of entertainment products: A guided

latent dirichlet allocation approach informed by the

psychology of media consumption. Journal of

Marketing Research, 56(1): 18-36.

Wang, J., Meric, G., Liu, Z., & Meric, I. 2009. Stock market

crashes, firm characteristics, and stock returns. Journal

of Banking & Finance, 33(9): 1563-1574.

ICSOFT 2023 - 18th International Conference on Software Technologies

462