Detecting Anomalies on Cryptocurrency Markets Using Graph

Algorithms

Agata Skorupka

Collegium of Economic Analysis, Warsaw School of Economics, Warsaw, Poland

Keywords: Graph Embeddings, Anomaly, Anomaly Detection, Cryptocurrency.

Abstract: The low level regulation of cryptocurrency market as well as crucial role of trust and digital market specificity

makes it a good environment for anonymous transactions without identity verification, therefore fraudulent

activities. Examples of such anomalies may be failing to fulfil transaction, as well as different forms of market

manipulation. As cryptocurrencies are incorporated in more and more investment portfolios, including big

companies accepting payment by this means, anomalies on cryptocurrency may pose significant systemic

risk. Therefore there is a need to detect fraudulent users in a computationally efficient way. This paper presents

usage of graph algorithms for that purpose. While most of the literature is focused on using structural and

classical embeddings, this research proposes utilizing nodes statistics to build an accurate model with less

engineering overhead as well as computational time involved.

1 INTRODUCTION

In 2019 global economic cost associated with

fraudulent activities was estimated around $5.12

trillion (Gee, 2019). The emergence of unregulated

markets, such as cryptocurrency exchanges, often

perceived as a “lawless territory”, where one can

perform activities which will be illegal anywhere else

(Félez-Viñas, 2022), has elevated that number even

higher (to the extent which is not always possible to

determine due to the diffused nature of

cryptocurrencies). Examples of such activities may

include black-market trading (Foley, 2019), money

laundering and terrorist financing (Fletcher, 2021),

insider trading (Fratrič, 2022), market manipulations

such as wash trading (Cong, 2020) and pump-and-

dump schemes (Kamps, 2018) or just improper

performance of obligations stemming from the sales

contract (Kumar, 2018).

According to Félez-Viñas (2022), insider trading

is estimated to occur in even 25% of listings at the

largest cryptocurrency exchange in the US -

Coinbase. Despite general lack of regulation of the

cryptocurrency market, US Securities and Exchange

Commission (SEC) already commenced the first

prosecution regarding insider trading on that market,

estimating the value of illegal profits for more than

$1.1 million in that case (Fratrič, 2022). Apart from

insider trading, one can also enumerate other types of

fraudulent activities contributing to the global

economic cost, such as market manipulation -

especially wash sales (Victor & Weintraud, 2021) and

pump and dump (Chen, 2019) are common practices

on cryptocurrencies market. Both are coordinated

actions to artificially increase the market price (or

mislead investors in a different manner) in the short

run, but in wash sales, both seller and buyer is the

same market actor (Hamrick, 2019; Li, 2018).

Besides monetary cost, there also exists significant

systemic risk to the financial sector and to the entire

economy associated with cryptocurrency volatility

(Fratrič, 2022). Initially serving as a medium of

exchange or a niche asset for a relatively small

number of market actors, now cryptocurrencies are

incorporated in more and more investment portfolios,

including big companies accepting payment by this

means (Robleh, 2014). Naturally, this kind of cost is

more difficult to measure directly and even estimate.

Risk modeling in portfolios has been approached in

recent studies by methods such as multi-objective

feature selection (Kou, 2021), clustering (Li, 2021)

and network analysis (Anagnostou, 2018).

Taking the above mentioned into account, there

exists a need to detect fraudulent activities in both

computationally effective and relatively fast way.

Traditionally, fraudulent activities on financial

markets were examined by the regulatory organ

504

Skorupka, A.

Detecting Anomalies on Cryptocurrency Markets Using Graph Algorithms.

DOI: 10.5220/0012133900003541

In Proceedings of the 12th International Conference on Data Science, Technology and Applications (DATA 2023), pages 504-509

ISBN: 978-989-758-664-4; ISSN: 2184-285X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

manually in an individual (case by case) manner. This

approach requires gathering official documents,

transaction reports, interviewing witnesses and

therefore is time consuming (Dhanalakshmi, 2019).

As an example here may serve SEC investigation

guidelines.

With the advent of digitalisation and big data, as

well as developments in software and computing

power, machine learning techniques gained more

popularity for the purpose of detecting fraudulent

activities on financial markets (Kou, 2004; Nagi,

2011). In particular, neural networks and SVM

algorithms for outlier detection were used (Ogut,

2009), hidden Markov chains (Song, 2012), analysis

and Bayesian techniques regarding updating beliefs

(Holton, 2009). What is worth bearing in mind, not

all types of digital markets have text data just as

information markets, hence such methods will not be

always appropriate for analysis. Dhanalakshmi and

Subramanian (2014) proposed usage of the clustering

method, while Golmohammadi (2014) conducted an

in-depth survey using methods such as decision trees,

k-nearest neighbors analysis and Bayesian methods.

Nevertheless, usage of classical machine learning

techniques has been recently criticized in the

literature for not taking into account the complexity

of the structure of the financial market and

conducting analyses (Liu, 2019). For that purpose,

graph methods were proposed (Tamersoy, 2016;

Rayes and Mani, 2019). Although recent literature on

anomaly detection using graphs is developing at a fast

pace, it focuses mostly on anomalies in citation

networks, product networks (fake reviews), not

financial markets or social networks (Zhao, 2019;

Liu, 2021; Zhang, 2022; Wang, 2021).

On the other hand, fraud detection is a relatively

new topic in cryptocurrency research (Victor &

Weintraud, 2021; Chen, 2019) and most of research

focuses on simulating effects of fraudulent activities

using agent-based modeling (Luther, 2013; Bornhold,

2014; Cocco; 2017 and 2019, Pyromallis, 2018;

Zhou, 2017; Shibano, 2020; Bartolucci, 2020; Fratrič,

2022) or classical machine learning methods, as

Random Forests (Baek, 2019) or Support Vector

Machines (Sayadi, 2019).

2 RESEARCH MOTIVATION AND

GOALS

The following paper aims to cover this gap focusing

on graph anomaly detection methods, as well as

mitigate another challenge often raised when

detecting anomalies using graph data: lack of

extensive dataset with included labels (ground truth).

For that reason, mostly unsupervised techniques were

developed (Zhao, 2019; Liu, 2021; Zhang, 2022;

Wang, 2021). These have significant drawbacks, i.e.

injecting synthetic fraudulent users according to the

definition of developed algorithm, as in Liu (2021).

In that way, authors ensure that their algorithm will

outperform others, as it was designed specifically for

that problem.

Classical anomaly detection algorithms were

based on the network characteristics, however

training models can be as good as data provided.

Cryptocurrencies networks do not gather as much

data about users as e.g. social networks. On the other

hand, graph data is relatively easy to obtain even in

case of sparsity of users’ characteristics, as long as the

network can be represented as a graph, which is the

case with cryptocurrency market: users are

represented by nodes, whereas transactions by edges.

First category of graph features relatively easy to

obtain is to compute nodes’ statistics, such as number

of neighbors (centrality) as well as a variety of

importance measures (centralities). These features

will be further referred to also as “graph features”. On

the other hand, state of the art in the literature is to use

embedding algorithms, which, using deep learning

techniques map nodes to the vector space. The idea

behind it is to keep similar nodes close to each other

in vector space. There are two ways of interpreting

similarity: being neighbors of each other (node or

classical embedding) and having an equivalent type

of neighborhood (structural embedding). It is a

common consensus in the literature that this type of

sophisticated, deep learning based algorithms is a

better predictor than simple node statistics. On the

other hand, graph embeddings are not always

computationally efficient, which is of a special

importance with the constant increase of users in

underlying graph networks representing markets and

social networks. Furthermore, embeddings require

careful choice of type of embedding as well as

embedding dimension.

The aim of this paper is to contribute to the

literature on anomaly detection on the cryptocurrency

market in order to detect fraudulent transactions in an

accurate and computationally efficient way.

Especially the latter is of a particular importance

given the ever-growing number of market actors and

transactions performed. The following research aims

to propose a computationally efficient graph

algorithm for anomaly detection based on node

statistics and to test hypotheses if the proposed

Detecting Anomalies on Cryptocurrency Markets Using Graph Algorithms

505

algorithm can outperform state-of-the-art approaches

based on graph embeddings.

3 DATASETS

The following research examines anomaly detection

algorithms on two datasets representing Bitcoin

transaction markets: Bitcoin OTC

1

and Bitcoin

Alpha

2

. These networks can be represented as

directed graphs, with nodes denoting users and edges

denoting transactions between them. Weights of

edges are representing rating by a particular user,

which can happen only after a transaction and can

take values from -10 (full distrust) to 10 (full trust).

The ratings were rescaled between -1 and 1. Benign

users were determined in the following way: platform

founders, as well as users rated positively (at least 0.5

after rescaling) by them. Fraudulent users, also

referred to as anomalies, were considered as those

who were rated negatively (at most -0.5 after

rescaling) by a benign user group. Table 1 represents

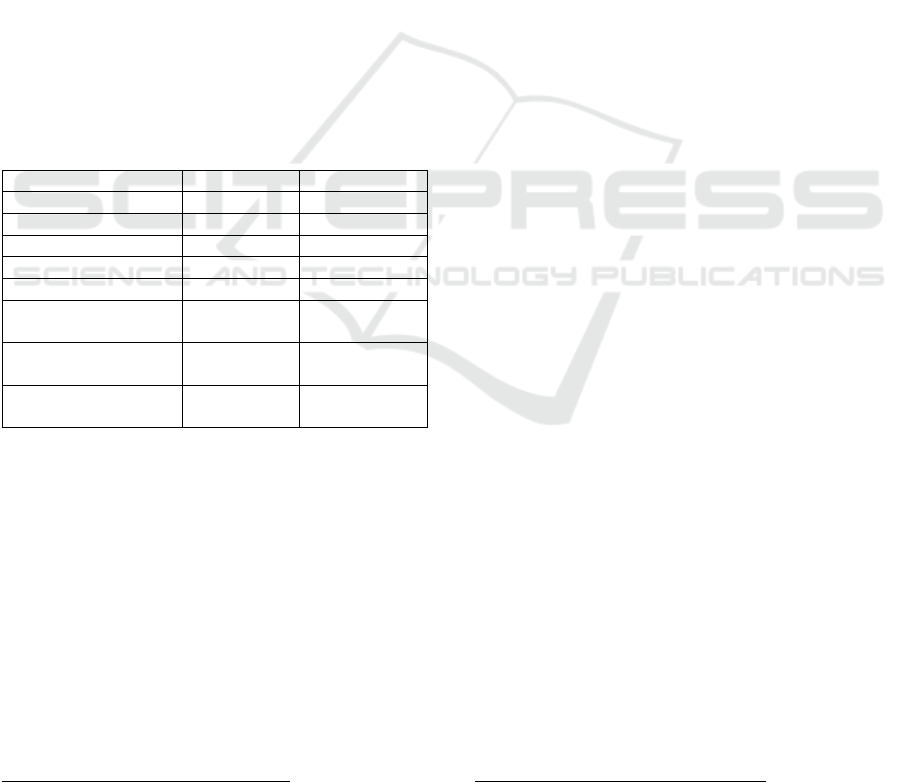

statistics of both datasets.

Table 1: Statistics of Bitcoin datasets.

Bitcoin OTC Bitcoin Alpha

Number of nodes 5881 3783

Number of ed

g

es 35592 2418

Avera

g

e de

g

ree 12 13

Minimum de

g

ree 1 1

Maximum degree 1298 888

Number of

com

p

onents

4 5

Size of the largest

component

5875 3775

Number of isolated

nodes

0 0

One advantage of these datasets is that the graph

represents the whole network, as sometimes it may be

hard to obtain one and therefore graph sampling

methods are used (Stella, 2019; Feng, 2021;

Dehghan, 2022). This procedure can negatively

influence accuracy of results. Another value Bitcoin

datasets are providing is the existence of dataset

labels based on objective criterion, rather than manual

annotation by human using expert knowledge (Stella,

2019; Feng, 2021), which is also a significant factor

able to influence model performance and possibility

of generalizations.

1

https://snap.stanford.edu/data/soc-sign-bitcoin-otc.html

4 METHODS AND RESULTS

On the basis of two Bitcoin datasets the following

models detecting fraudulent users were built: one

group using embeddings and second one using node

statistics such as degree centrality, harmonic

centrality, pagerank, closeness and betweenness

centrality, as well as local clustering coefficient. For

the first group of models, following embeddings were

used - each with its own model: two classical

(node2vec and DeepWalk) and two structural (RolX

and Struc2vec). Following dimensions of

embeddings were used: 4, 8, 16, 32, 64, 128 in order

to determine the best performing dimension.

Furthermore, all embeddings having dimension

above 64 were additionally compressed using PCA

and UMAP algorithms in order to examine if noise

reduction can help in model performance, or, in case

of UMAP, taking non-linearity into account. In the

case of UMAP, three versions were prepared with

three different seeds to ensure that the algorithm is

stable.

Models for two dataset features were chosen using

AUC metrics among Random Forest, XGBoost and

Generalized Linear Model as well as two ensemble

models: one built on the top of all models and second

built on the top of best models of their own class using

AUC metrics. AutoML parameter tuning with 5-fold

cross-validation on the test dataset was used. Then,

the best model built on the top of embeddings was

compared with the best model built using nodes’

statistics using F-1 metrics.

All models were built using h2o and xgboost

python libraries. Results were presented in Tables 2

and 3. For brevity purposes, only ten best models

were shown.

There are following conclusions from the

comparison of anomaly detection graph algorithms:

first of all, nodes’ statistics perform almost as good as

the best model based on embeddings. In the case of

the Bitcoin Alpha dataset, h2o model based on nodes’

statistics achieved a 0.83 F-1 score compared to 0.86

in the case of h2o model based on Struc2vec with 32

dimensions. In the case of Bitcoin OTC, h2o model

built on the top of nodes’ statistics achieved 0.91 F-1

score outperforming h2o RolX of dimension 128,

compressed to 16 using PCA. That means that similar

results can be achieved by far less computational and

engineering time. The latter refers to the choice of

type of embedding, as well as its dimension. Each

machine learning task requires a specific choice of

2

https://snap.stanford.edu/data/soc-sign-bitcoin-alpha.html

DATA 2023 - 12th International Conference on Data Science, Technology and Applications

506

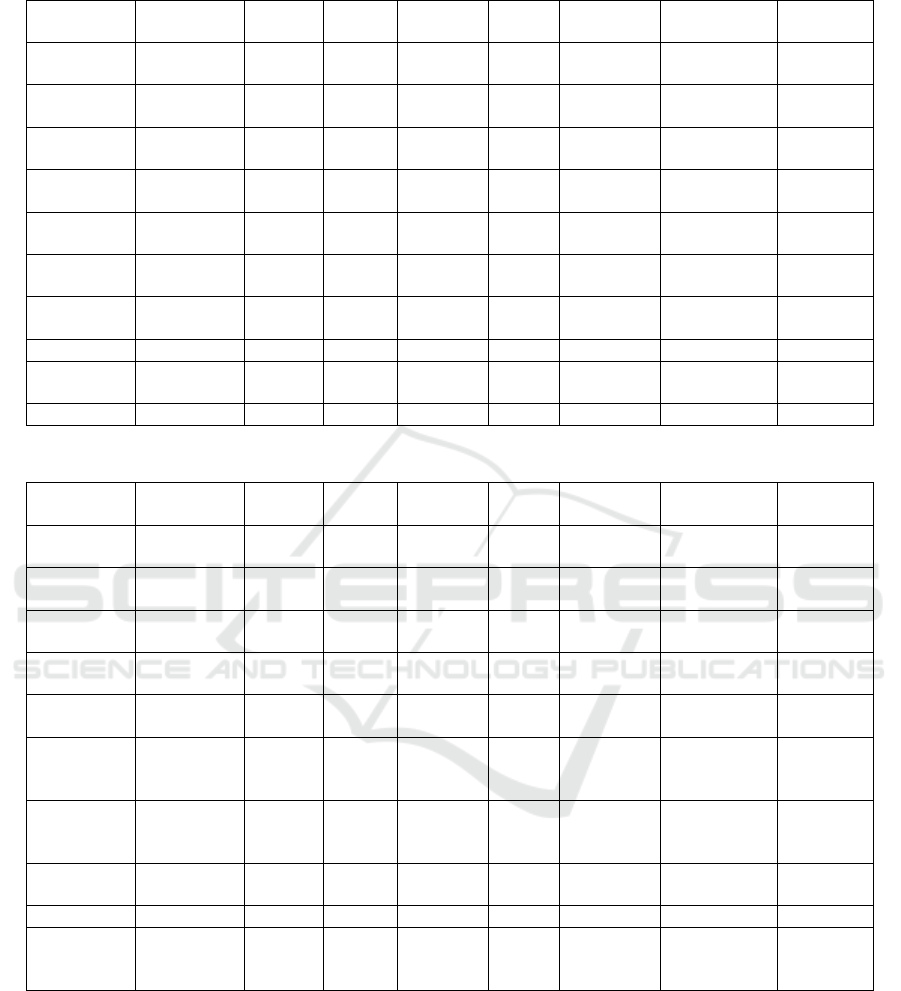

Table 2: Comparison of anomaly detection model performance on Bitcoin Alpha network.

Rank Embedding Library F1 Accuracy MCC Dimension Compression Original

dimension

1 struc2vec

(

32

)

h2o 0.857 0.833 0.679 32 no NA

2 nodes’

statistics

h2o 0.829 0.805 0.615 NA no NA

3 struc2vec

(16)

h2o 0.827 0.805 0.611 16 no NA

4 struc2vec

(

64

)

h2o 0.825 0.805 0.611 64 no NA

5 nodes’

statistics

xgboost 0.825 0.805 0.611 0 no NA

6 struc2vec

(128)

h2o 0.825 0.805 0.611 128 no NA

7 struc2vec

(

8

)

h2o 0.820 0.805 0.609 8 no NA

8 rolx (128) h2o 0.820 0.805 0.610 128 no NA

9 struc2vec

(

4

)

h2o 0.818 0.777 0.580 4 no NA

10 rolx

(

8

)

h2o 0.814 0.792 0.585 8 no NA

Table 3: Comparison of anomaly detection model performance on Bitcoin OTC network.

Rank Embedding Library F1 Accuracy MCC Dimension Compression Original

dimension

1

nodes’

statistics

h2o 0.913 0.916 0.832 NA no NA

2

rolx (128 to

16), PCA

h2o 0.886 0.894 0.789 16 PCA 128

3

struc2vec

(

128

)

h2o 0.878 0.873 0.759 128 no NA

4

struc2vec

(

32

)

h2o 0.872 0.873 0.750 32 no NA

5

struc2vec

(8)

h2o 0.869 0.873 0.747 8 no NA

6

rolx (128 to

16), UMAP

1

h2o 0.860 0.863 0.728 16 UMAP 128

7

rolx (128 to

16), UMAP

2

h2o 0.860 0.863 0.728 16 UMAP 128

8

rolx (32 to

16), PCA

h2o 0.860 0.863 0.728 16 PCA 32

9 rolx

(

128

)

h2o 0.857 0.852 0.717 128 no NA

10

rolx (128 to

16), UMAP

0

h2o 0.857 0.863 0.726 16 UMAP 128

embeddings. Nevertheless, there is no specific

principles or rule of thumb how to choose it, so either

engineer choose embedding arbitrarily with a low

chance of outperforming nodes’ statistics algorithm,

either will they build number of embedding types in

different dimensional variants, which is very time

consuming, especially when size of graph is

significant.

Secondly, regarding types of embeddings,

structural embeddings are performing significantly

better than classical ones. There is not even one

classical embedding in top ten models in the case of

both Bitcoin Alpha and Bitcoin OTC. It is worth to

note that with the first dataset the advantage of

Struc2vec among others is prevalent, however it does

not happen with Bitcoin OTC, as we can see both

RolX and Struc2vec among top ten models. Another

Detecting Anomalies on Cryptocurrency Markets Using Graph Algorithms

507

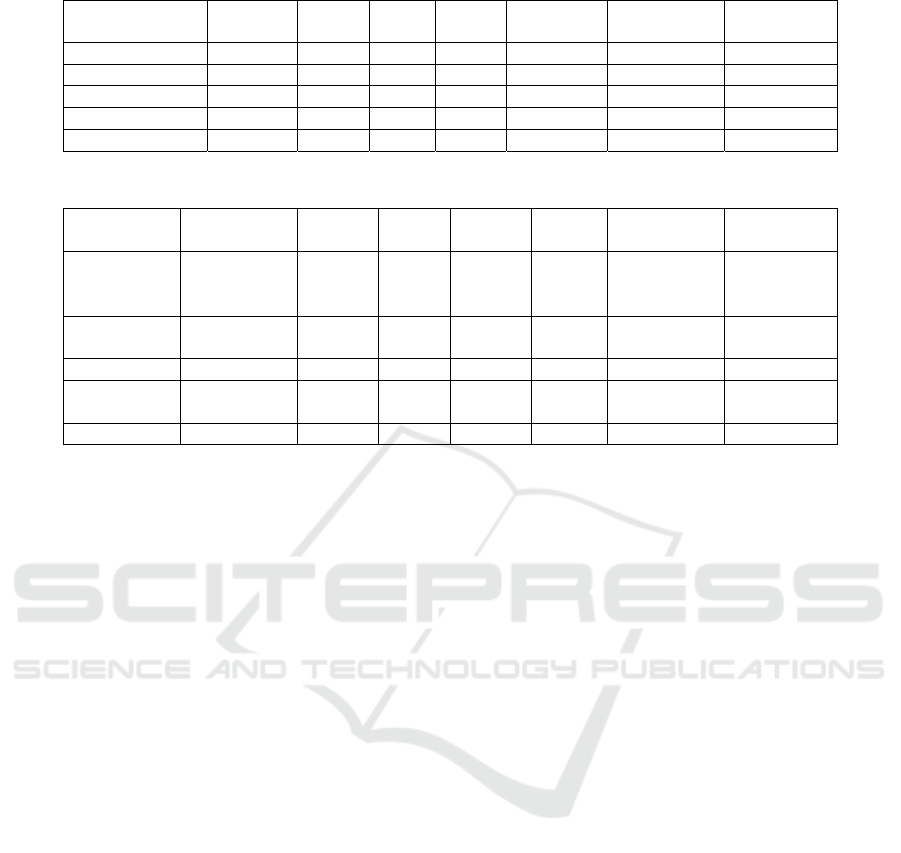

Table 4: Comparison of the model performance of the best model of the given class embedding on the Bitcoin Alpha market.

Embedding Dimensi

on

Librar

y

F1 Accur

ac

y

MCC Compression Original

dimension

struc2vec 32 h2o 0.857 0.833 0.679 no NA

nodes statistics NA h2o 0.829 0.806 0.615 no NA

rolx 128 h2o 0.821 0.806 0.610 no NA

node2vec 8 h2o 0.740 0.653 0.347 no NA

dee

p

wal

k

128 h2o 0.712 0.597 0.227 no NA

Table 5: Comparison of the model performance of the best model of the given class embedding on the Bitcoin OTC market.

Embedding Dimension Library F1 Accura

c

y

MCC Compression Original

dimension

nodes

statistics

NA h2o 0.913 0.916 0.832 no NA

rolx

16 from 128

(

PCA

)

h2o 0.886 0.895 0.789 PCA 128

struc2vec 128 h2o 0.878 0.874 0.760 no NA

node2vec

16 from 64

(UMAP)

h2o 0.804 0.780 0.613 UMAP 64

dee

p

wal

k

16 h2o 0.727 0.726 0.453 no NA

conclusion is that it is difficult to determine if

dimensionality reduction help, as in the case of

Bitcoin Alpha no compressed features found

themselves in the top ten models, whereas in the case

of Bitcoin OTC half of the best embedding models

were characterized by compression (both UMAP and

PCA). This means compression is task and dataset

specific and adds engineering overhead to the model

building. Tables 4 and 5 are presenting comparison of

the model performance of the best model in the case

of given class embedding, on the Bitcoin Alpha and

Bitcoin OTC markets respectively.

5 CONCLUSIONS

In this work, graph anomaly detection methods were

examined on the basis of cryptocurrency markets: two

over-the-counter Bitcoin markets, namely Bitcoin

OTC and Bitcoin Alpha. It was determined that

although state-of-the-art embeddings have strong

predictive power, they are often computationally

inefficient, especially in the case of large graphs.

Furthermore, they require case-by-case choice of type

of embedding, as well as its dimension. Sometimes

there is a need to determine if to use dimensionality

reduction techniques, which adds engineering

overhead and can be even more time consuming, as

the choice of the embedding can either be random or

informed after building a number of embeddings. On

the other hand, anomaly detection models based on

nodes’ statistics turned out to be almost as good as the

best model among embedding-based, while providing

simplicity and computational efficiency. Presenting

results on the two datasets show that results can be

generalized, however, there is a need to extend the

research on other datasets for further check of results

stability. Another interesting research direction in the

future is to build specific algorithms using nodes’

statistics, e.g. involving dimensionality reduction or

statistics for node neighbors.

REFERENCES

Gee, J., & Button, M. (2019). The financial cost of fraud.

Retrieved from http://www.crowe.ie/wp-

content/uploads/2019/08/The-Financial-Cost-of-

Fraud-2019.pdf

Félez-Viñas, E., Johnson, L., & Putniņš, T. J. (2022).

Insider Trading in Cryptocurrency Markets. Available

at SSRN 4184367..

Fletcher E., Larkin C., Corbet S. (2021) Countering money

laundering and terrorist financing: a case for Bitcoin

regulation. Res Int Bus Finance 56(January):101387.

https://doi.org/10.1016/j.ribaf.2021.101387

Kamps J., Kleinberg B. (2018) To the moon: defining and

detecting cryptocurrency pump-and-dumps. Crime Sci

7(1):1–18. https://doi.org/10.1186/s40163-018-0093-5

Kumar, S., Hooi, B., Makhija, D., Kumar, M., Faloutsos,

C., & Subrahmanian, V. S. (2018, February). Rev2:

Fraudulent user prediction in rating platforms. In

Proceedings of the Eleventh ACM International

Conference on Web Search and Data Mining (pp. 333-

341).

DATA 2023 - 12th International Conference on Data Science, Technology and Applications

508

Fratrič, P., Sileno, G., Klous, S., & van Engers, T. (2022).

Manipulation of the Bitcoin market: an agent-based

study. Financial Innovation, 8(1), 1-29.

Hamrick J., Rouhi F., Mukherjee A., Feder A., Gandal N.,

Moore T., Vasek M. (2019) The economics of

cryptocurrency pump and dump schemes. SSRN

Electron J. https://doi.org/10.2139/ssrn.3303365

Chen W., Xu Y., Zheng Z., Zhou Y., Yang J. E., Bian J.

(2019) Detecting ‘Pump & dump schemes’ on

cryptocurrency market using an improved a priori

algorithm. In: Proceedings—13th IEEE international

conference on service-oriented system engineering,

SOSE 2019, 10th international workshop on joint cloud

computing, JCC 2019 and 2019 IEEE international

workshop on cloud computing in robotic systems,

CCRS 2019, pp 293–298. https://doi.org/10.1109/

SOSE.2019.00050

Victor F., Weintraud A. M. (2021) Detecting and

quantifying wash trading on decentralized

cryptocurrency exchanges. In:The web conference

2021—proceedings of the world wide web conference,

WWW 2021 2, pp 23–32. https://doi.org/10.1145/

3442381.3449824. arXiv:2102.07001

Hamrick J., Rouhi F., Mukherjee A., Feder A., Gandal N.,

Moore T., Vasek M. (2019) The economics of

cryptocurrency pump and dump schemes. SSRN

Electron J. https://doi.org/10.2139/ssrn.3303365

Li T., Shin D., Wang B. (2018) Cryptocurrency pump-and-

dump schemes. SSRN Electron J. https://doi.org/10.

2139/ssrn.3267041

Robleh A., Barrdear, J., Clews, R., Southgate, J. (2014) The

economics of digital currencies. Bank Engl Q Bull 2014

Q3(1):276–286.

Kou G., Xu Y., Peng Y., Shen F., Chen Y., Chang K., Kou

S. (2021) Bankruptcy prediction for SMEs using

transactional data and two-stage multiobjective feature

selection. Decis Supp Syst 140:113429. https://doi.org/

10.1016/j.dss.2020.113429

Anagnostou I., Sourabh S., Kandhai D. (2018)

Incorporating contagion in portfolio credit risk models

using network theory. Complexity 2018:6076173.

https://doi.org/10.1155/2018/6076173

Li T., Kou G., Peng Y., Yu P. S. (2021) An integrated

cluster detection, optimization, and interpretation

approach for financial data. IEEE Trans Cybern. https://

doi.org/10.1109/TCYB.2021.3109066

Dhanalakshmi, S., & Subramanian, C. (2014). An analysis

of data mining applications for fraud detection in

securities market. International Journal of Data Mining

Techniques and Applications, 3(1), 9–1.

doi:10.20894/IJDMTA.102.003.001.003

Öğüt, H., Doganay, M., & Aktas, R. (2009). Detecting

stock-price manipulation in an emerging market: The

case of Turkey. Expert Systems with Applications,

36(9), 11944–11949. doi:10.1016/j.eswa.2009.03.065

Tamersoy, A. (2016). Graph-based algorithms and models

for security, healthcare, and finance [Unpublished

Doctoral dissertation]. Georgia Institute of Technology.

Rayes, J., & Mani, P. (2019). Exploring Insider Trading

Within Hypernetworks. In P. Haber, T.

Lampoltshammer, & M. Mayr (Eds.), Data Science –

Analytics and Applications. Springer. doi:10.1007/978-

3-658-27495-5_1

Zhao, S., Grasmuck, S., & Martin, J. (2008). Identity

construction on Facebook: Digital empowerment in

anchored relationships. Computers in human behavior,

24(5), 1816-1836.

Zhao, Y., Nasrullah, Z., & Li, Z. (2019). Pyod: A python

toolbox for scalable outlier detection. arXiv preprint

arXiv:1901.01588.

Liu, Y., Li, Z., Pan, S., Gong, C., Zhou, C., & Karypis, G.

(2021). Anomaly detection on attributed networks via

contrastive self-supervised learning. IEEE transactions

on neural networks and learning systems, 33(6), 2378-

2392.

Dehghan, A., Siuta, K., Skorupka, A., Dubey, A., Betlen,

A., Miller, D., Xu, W., Kaminski, B., and Pralat, P.

Detecting Bots in Social-Networks Using Node and

Structural Embeddings, Unpublished, 2022.

Zhang, F., Fan, H., Wang, R., Li, Z., & Liang, T. (2022).

Deep Dual Support Vector Data description for

anomaly detection on attributed networks.

International Journal of Intelligent Systems, 37(2),

1509-1528.

Wang, G., Xie, S., Liu, B., and Philip, S. Y.. Review graph

based online store review spammer detection. In IEEE

International Conference on Data Mining series, 2011.

Luther W. J. (2013) Crypto-currencies, network effects, and

switching costs. SSRN Electron J. https://doi.org/10.

2139/ssrn.2295134

Cocco L., Concas G., Marchesi M. (2017) Using an

artificial financial market for studying a cryptocurrency

market. J Econ Interact Coord 12(2):345–365. https://

doi.org/10.1007/s11403-015-0168-2. arXiv:1406.6496

Pyromallis C., Szabo C. (2019) Modelling and analysis of

adaptability and emergent behavior in a cryptocurrency

market. In: 2019 IEEE Symposium series on

computational intelligence, SSCI 2019, pp 284–292.

https://doi.org/10.1109/SSCI44817.2019.9002829

Shibano K, Lin R, Mogi G (2020) Volatility reducing effect

by introducing a price stabilization agent on

cryptocurrencies trading. In: ACM International

conference proceeding series, pp 85–89. https://doi.org/

10.1145/3390566.3391679

Bartolucci S, Caccioli F, Vivo P (2020) A percolation

model for the emergence of the Bitcoin Lightning

Network. Sci Rep 10(1):1–14. https://doi.org/10.1038/

s41598-020-61137-5

Kumar, S., Spezzano, F., Subrahmanian, V. S., &

Faloutsos, C. (2016, December). Edge weight

prediction in weighted signed networks. In 2016 IEEE

16th International Conference on Data Mining

(ICDM) (pp. 221-230). IEEE.

Kumar, S., Hooi, B., Makhija, D., Kumar, M., Faloutsos,

C., & Subrahmanian, V. S. (2018, February). Rev2:

Fraudulent user prediction in rating platforms.

In Proceedings of the Eleventh ACM International

Conference on Web Search and Data Mining (pp. 333-

341).

Detecting Anomalies on Cryptocurrency Markets Using Graph Algorithms

509