Women Teachers and Their Long-Term Savings Approach on

Cryptocurrency Investment

A. Ruban Christopher

1

*

and A. R. Nithya

2

1

School of Management, Hindustan Institute of Technology and Science, Chennai, India

Keywords: Cryptocurrency, Women Teachers, Long-Term Savings.

Abstract: Enabling women empowered on cryptocurrency leverages them with greater control over their financial assets

with financial independence. Recently published research data shows that only 20+ percentage of crypto

investors in India are women. This gender gap in the cryptocurrency market may be due to a variety of factors;

This research identifies the variables that has a significant relationship on the cryptocurrency investment by

women, particularly the women teachers. An empirical study is conducted via a questionnaire, administered

online. The data is analysed in Python, a machine learning software, executed in ‘feature importance’ method

using decision tree analysis and output results are validated by ‘catboost’ algorithm. The interpretations

highlight the six independent variables that show significant relationship on cryptocurrency investment by

women teachers are namely; monthly income, long-term investment behaviour, educational stream, perceived

profit in crypto investment, percentage of long-term savings in cryptocurrency and their willingness to

participate in training.

1 INTRODUCTION

India stood fifth in the world on the number of crypto

owners as a percentage of the total population with

19.30% and third in terms of volume with 27.45 crore

accounts as of Nov 2022 report by Finder’s

Cryptocurrency Adoption Index. The total value of

the cryptocurrency market capital as of early 2023 is

around Rs.100 lakh crores. Considering the quantum

of money getting invested, having women involved in

cryptocurrency can help address the gender gap in the

technology industry and can also help to promote

inclusivity in the cryptocurrency space. Moreover,

having women made aware of cryptocurrency can

empower them by providing the knowledge and tools

to participate in the growing digital economy.

Additionally, understanding cryptocurrency can help

women to make informed decisions about the

technology and its potential uses and risks.

Furthermore, it can help to break down barriers and

to increase the participation of women in the

cryptocurrency industry, which can lead to a more

diverse and equitable ecosystem. In this study we

1

https://orcid.org/0009-0003-5081-3640

2

https://orcid.org/0000-0002-9051-4317

* Corresponding Author

shall discuss on the long-term savings approach of the

Women Teachers on Cryptocurrency.

2 REVIEW OF LITERATURE

2.1 Risk Factor

(Prasetyo, T.G. and Kurniasari, F., 2023) (Prasetyo

and Kurniasari, 2023) study affirms that Women are

more likely than men to invest in crypto assets due to

the blockchain system's security, transparency, and

ease of use. (Prapatchon Jariyapan et al, 2022)

(Prapatchon Jariyapan et al., 2022) This study

concluded that, the cryptocurrency asset ownership

was based on the perceived usefulness of it and not

on its risk consideration.

2.2 Financial Literacy or Awareness

(Samaira Tomer, 2022) (International Journal of

Advanced Research, n.d.) As per primary data

collected, around 85% do not invest in

Christopher, A. and Nithya, A.

Women Teachers and Their Long-Term Savings Approach on Cryptocurrency Investment.

DOI: 10.5220/0012492900003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundar y Conference for Sustainable Societies (PAMIR 2023), pages 533-537

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

533

cryptocurrency due to the widespread mis-

information and their risk-aversive behavior. (Kim,

Kyoung Tae, 2022) (Kim et al., 2022) study shown

that objective investment literacy was negatively

associated while subjective literacy was positively

associated with holding cryptocurrency.

2.3 Prior Investment Experience

(Chrančoková, Martina et al ,2022) (Chrančoková et

al., 2022) study states that, People who actively

invested in cryptocurrencies cite that the possibility

of quick earnings as the main reason for investing in

cryptocurrencies, whereas the respondents who did

not invest commented that it is very high risk. Most

investors are from the city, men and with inverse

relationship on age.

2.4 Government Regulations

(Anu Bala, 2022) (Researchers, n.d.) Discussed that

currently there is no legislation that bans

cryptocurrency as illegal and it sends a positive signal

and encourages investment in cryptocurrency.

(Shukla, S., &Akshay, A. 2019) (Anu Bala, 2022)

found that, the majority of the people would like to

invest in the same if only if the Government of India

regulates its use and control.

2.5 As a Payment Tool

(Zühal Yurtsizoğlu & Kerim Ali Akgül, 2022)

(Swathy Shukla and Akshay A, 2019) this study noted

that the crypto currency system became an investment

tool and was even adopted as a national currency in

many nations. (Samiullah Jahan Shaikh, 2021)

(Yurtsızoğlu and Akgül, 2022) It observed that the

willingness to adapt cryptocurrencies as an

alternative payment option increased especially when

Tesla accepted Bitcoins, in Urban areas.

2.6 Other Factors

(Aleksander Berentsen and Fabian Schär, 2018)

(Samiullahjahan Shaikh, 2021) concludes that, in the

world of cryptocurrencies,eliminating the

intermediary results in lower costs and lesser

additional fees. This encourages people to invest and

use cryptocurrency more often.

2.7 Research Gap

Many of the existing research literatures on the

cryptocurrency investment are focusing on diverse

aspects like, Risk Factor, Financial Literacy or

awareness, Prior investment Experience, Government

Regulations, as a Payment tool and other factors like

age, gender etc... and recommend that such of these

research studies can be studied on other target

samples or by different other variables.

3 OBJECTIVE

To analyze the relationship between long- term

savings approach of the women teachers against their

cryptocurrency Ownership.

Figure 1: Research Framework.

Hypotheses

H1: There is a significant relationship between the

Long-Term savings approach of the women teachers

and with the cryptocurrency ownership.

4 RESEARCH METHODOLOGY

This Research design is based on the Descriptive

Research method. The primary data with convenient

sampling was sourced with the help of a structured

survey questionnaire distributed via internet online to

women teachers either from school or college

including both government and private educational

institutions limiting only to the city of Chennai. The

total responses received were 272. The questionnaire

was tested for intercorrelations reliability among its

test items with Cronbach’s Alpha α = 0.72

(acceptable standard). Secondary Data were also

collected from the various research papers and web-

based articles and existing research studies

4.1 Analysis and Results

The exploratory data analysis of the surveyed data is

done using Python Programming Language to find

the insights. Python software version-3.11.1-amd64

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

534

is used with Anaconda (Jupyter Notebook) as a

Platform. Some graphical analysis of the data from

the dataset is shown in the output by using different

libraries of Python like NumPy, Pandas, Seaborn,

Matplotlib and Sklearn with inbuilt statistics API

functions. Here, a dataset named

'Cryptocurrency_file.csv' is used to analyse and

extract various information in both numerical as well

as in pictorial form. First, Running the Chi-Square

analysis to evaluate the relationship between all the

available independent variables against the dependent

variable of cryptocurrency ownership in Python using

the machine language function ‘chi2_contigency’. we

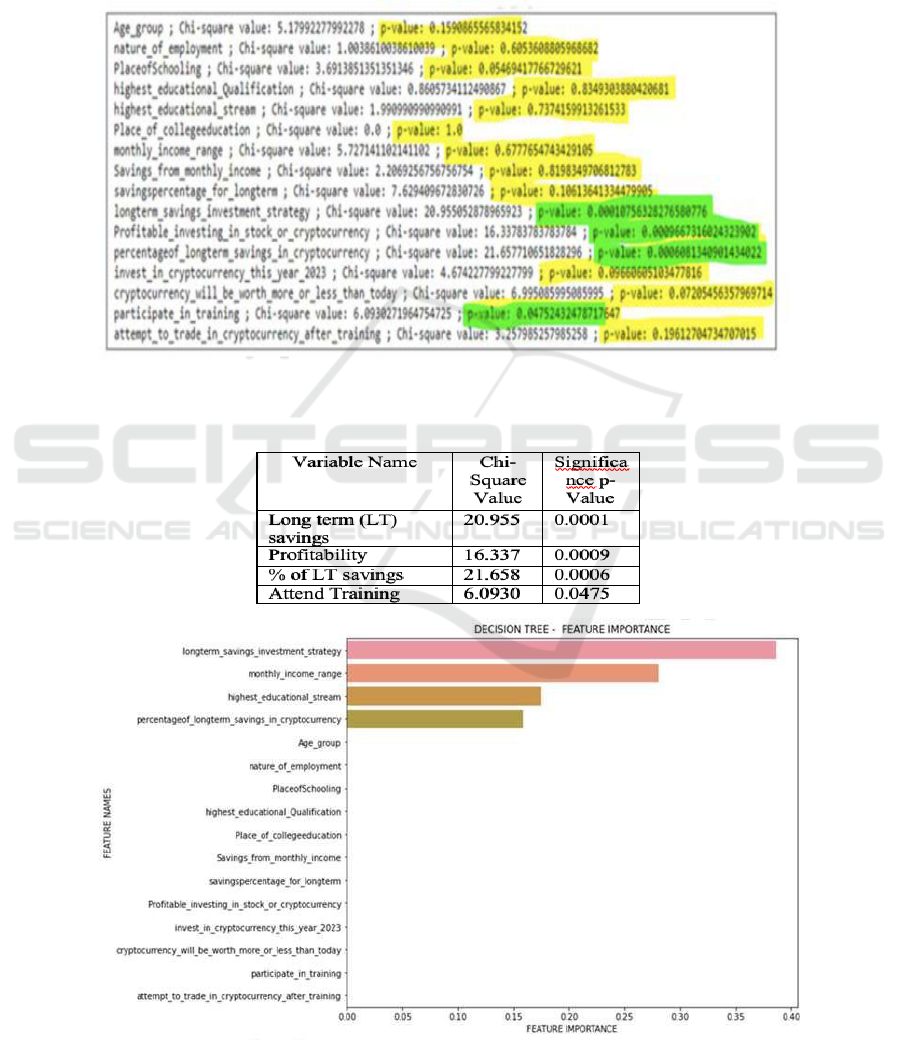

get the below result in [Fig 2].

Figure 2: Chi-Square output Python Console.

Table 1: Chi-Square Result Summary.

Figure 3: Decision Tree - Feature Importance Classifier output from Python console.

Women Teachers and Their Long-Term Savings Approach on Cryptocurrency Investment

535

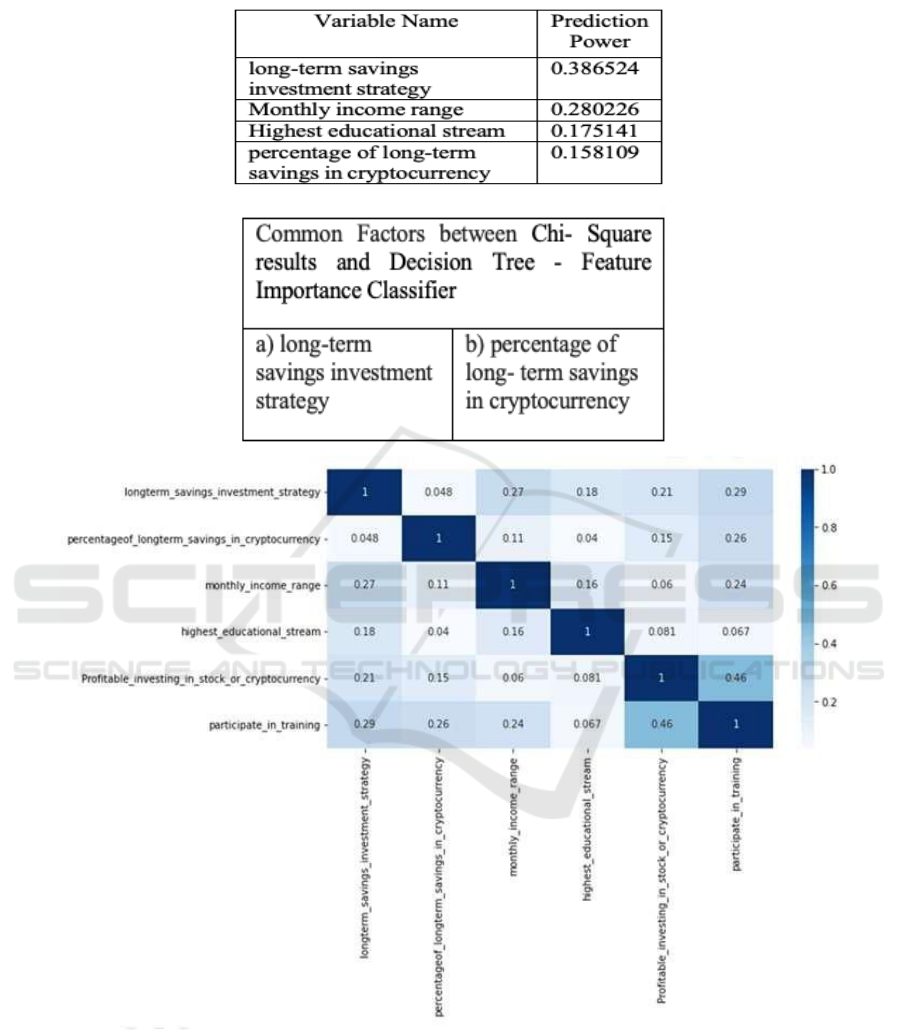

Table 2: Chi-Square result summary & Common Factors Details.

Figure 4: Correlation matrix output of the variables from Python console.

In order to interpret the results of a chi- squared

test, a significance level needs to be chosen. The

significance level is the probability threshold that is

used to determine whether the results of a test are

statistically significant or not. The widely accepted

and the most common significance level used in

practice is < 0.05, which means that if the p- value of

a test is less than 0.05, the results of the test are

considered statistically significant and the null

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

536

hypothesis is rejected and accepts the alternative

hypothesis.

From the above result, it shows that above 4

variables are significant as in [Table 1]. The larger the

chi-squared test statistic, the more likely it is that the

observed frequencies are different from the expected

frequencies. Now, we try another approach called

‘Feature importance using Decision tree classifier’ to

identify the variables responsible for crypto currency

ownership. The output is given in a visualisation from

as in [Fig 3] as well as in a tabular form [Table 2].

This second approach of identifying independent

variables responsible for Crypto ownership using the

feature importance result using Decision Tree

classier, gives us following 4 variables are significant.

Comparing both the approaches [Chi-square and

Decision tree classifier] for identifying the

parameters which has an impactful relationship on

crypto asset ownership, below are 2 features

commonly showing Significance is given in [Table

3]. Finally, we wanted to confirm if there are any

correlations exist between these six significant

variables and we create the correlation matrix

heatmap using Pearson method to find out

connectedness amongst them in the below [Fig 4].

From the above matrix, it is obvious that none of

the independent features are correlated with one

another. Therefore, there is no biasedness. We also

performed ‘catboost’ algorithm, based on gradient

boosting decision trees to validate the factors

identified above and got the results with 97.87% of

accuracy. Hence our prediction model is more

accurate.

To summarise the findings, data analysis using

Python’s statistical tools 1) Chi-square test, 2)

Decision tree classifier 3) Correlation Matrix and 4)

catboost algorithm we conclude that, the following

six variables have more significance relationship that

has an influence on the cryptocurrency investment

are, 'long-term savings investment strategy', 'highest

educational stream', 'percentage of long-term savings

in cryptocurrency', 'monthly income range',

‘Profitable investing in stock or cryptocurrency' and

'participate in training'.

Conclusion: This research study has provided an

insight into the possible factors triaged to the

cryptocurrency investment amongst the women

teaching fraternity with their level of significant

relationship. Similarly, Python language is also

shown as a data analysis & visualization tool, further

it can also be used for Quantitative modeling and

Algorithmic trading in cryptocurrencies. This study is

also helpful to investors choosing cryptocurrency as

their long-term savings; especially women who are

more aggressive in savings as they tend to plan for

their long- term investment when it comes to

retirement, due to their longer life expectancy, breaks

in professional life, early retirement and most

importantly gender pay gap.

REFERENCES

(Prasetyo, T.G. and Kurniasari, F., 2023). The Influence of

Subjective Norms, Financial Literacy, Trust, and

Government Regulation on Behavioral Intention to

Invest in Crypto Assets. Preprints 2023, 2023010400

(doi: 10.20944/preprints202301.0400.v1)

(Prapatchon Jariyapan et al, 2022) Factors Influencing

theBehavioural Intention to Use Cryptocurrency in

Emerging Economies During the COVID-19

Pandemic: Based on Technology Acceptance

Model 3, Perceived Risk, and Financial Literacy.

Journal of Frontiers in Psychology. 10:475

International Journal of Advanced Research 10(09),1003-

1010. ISSN:2320-5407

(Kim, Kyoung Tae, 2022) Kim, Kyoung Tae and Hanna,

Sherman D. and Lee, Sunwoo, Investment Literacy,

Overconfidence and Cryptocurrency Investment

(March 2022). Forthcoming, Financial Services

Review,SSRN: ttps://ssrn.com/abstract=3953242 or

http://dx.doi.org/10.2139/ssrn.3953242

(Chrančoková, Martina et al, 2022) cryptocurrency as a

form of investment. in dokbat 2022 - 18th International

Bata Conference for Ph.D. Students and Young

Researchers (Vol. 18). Zlín: Tomas Bata University in Zlín,

Faculty of Management and Economics. DOI:

http://dokbat.utb.cz/conference- proceedings/

(Anu Bala, 2022) Cryptocurrency and its scope in India,

international journal of innovative research in

technology, january 2022| Volume 8 Issue 8 | ISSN:

2349-6002, Page 593 – 596.

Swathy Shukla & Akshay A (2019),“A Study on awareness

and perception of cryptocurrency in Bangalore”, Indian

Journal of Applies Research, Volume 9, Issue 4, pp 15-

25.

Yurtsızoğlu, Z., ve Akgül, K. A. (2022). Spor Bilimleri

Fakültesi Öğrencilerinin Kripto Para Algısı ve

Farkındalık Düzeyi. Akdeniz Spor Bilimleri Dergisi,

5(3), 383-397. DOI:

https://doi.org/10.38021asbid.1140495

(samiullahjahan Shaikh, 2021) a study on individuals

awareness and perception’s toward crypto-currencies

with special reference to mumbai city.

(Aleksander Berentsen and Fabian Schär, 2018), A Short

Introduction to the World of Cryptocurrencies, Federal

Reserve Bank of St. Louis Review, First Quarter 2018,

100(1), pp. 1-16. https://doi.org/10.20955/r.2018.1-16

Women Teachers and Their Long-Term Savings Approach on Cryptocurrency Investment

537