A Review on Adoptability of Digital Transactions Among Women

Entrepreneurs During and Post COVID - 19

Pooja Chaturvedi and Vijay Singh

Rabindranath Tagore University, India

Keywords: Entrepreneurship, Digital Transaction, COVID 19, Technology, Women.

Abstract: Women entrepreneurs are researched and analyzed quite a number of times since long. Women is known to

dilute herself in any circumstances and situation. The way of handling a situation let, it be a women or a

women entrepreneur needs no explanation. Women entrepreneurs are doing a great job in this modern era.

The problems faced by all of us during the nationwide lockdown due to COVID 19 are lot many. However, it

was during this pandemic that there was a major shift in the mode financial transactions. We all know that

technology driven work has become the need of the hour. Modern entrepreneurs have adopted this change

enthusiastically. Increase in digital transactions have been a boon to women entrepreneurs because of its

convenience and security factors as compared to traditional form of transactions. This paper will study the

adoptability of digital transactions among women entrepreneurs during and post COVID -19.

1 INTRODUCTION

Women is known to be the backbone of an every

family. She gives stability and sustainability to her

family. Likewise, when a woman becomes an

entrepreneur, she adds to the economic growth and

stability of the entire country. Entrepreneurship is a

field, which is full of risk and goes through

continuous changes. The power of entrepreneurship

increases as the word Women is added to it. Women

entrepreneurship is the new happening in this

modern scenario. Entrepreneur is an individual who

initiates the business, takes risks, gives new ideas to

the business and faces the difficulties. An

entrepreneur is called women entrepreneur when she

involves herself all these activities.

As we, all know that the whole world is facing the

mammoth pandemic known as Covid 19. This

pandemic has changed the lifestyle of the whole

humankind. We all have left many old practices and

adopted the new ones. In this digital era, this shift

has become the need of the hour and so is the case

with women entrepreneurship and digitalization.

Women is known to adjust herself in the most

difficult situations. The lockdown due to Covid 19

made the movement people very difficult. The

business came to a standstill. However, during the

lockdown and after the lockdown the situation

became very tough. Risk and uncertainty brings the

danger of business shutdown. We do not know when

this pandemic is going to be over. However, we need

to adjust and adopt the new needs of the business. The

crowd of consumers may slow down their demands.

This situation will need more working to grab control

over the consumers. Although the new age women

entrepreneur is efficient, enough to take decisions but

when it comes to technology there are mixed reactions.

A study done by Agrawal (2021), states that women

who belong to strong entrepreneurial background

possess an optimistic temperament. It was also found

that the influence of online trading has an assorted

relation with the temperament and internet feasibility

of businesswomen.

2 OBJECTIVE

● To understand the need of digital transactions.

● To understand the adoptability of digital

transaction among women entrepreneurs.

Chaturvedi, P. and Singh, V.

A Review on Adoptability of Digital Transactions Among Women Entrepreneurs During and Post COVID – 19.

DOI: 10.5220/0012499100003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 599-602

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

599

3 METHODOLOGY

This paper is the outcome based on reviewing the

various secondary data viz, websites, newspapers,

journals magazines and books.

4 REVIEW OF LITERATURE

Galhotra, B., & Puniya, M. (2020, March) in a study

said that profit maximization is the prime motive of

any form of business. In this changing scenario

electronic commerce has proved to be a boon. This

electronic technology has been of great help for the

women entrepreneurs in growing their business both

nationwide and worldwide.

Smitha, M., & Kumari, B. A. (2019) in their study

mentioned that the contribution of women is very

wide in the growth and progress of a nation. Women

are known to handle and manage challenges with

ease by proper need identification. They have also

become financially self-dependent. Their study was

done to know the guidance and assistance provided

by various financial institutions to the female

business leaders.

Rosca, E., Agarwal, N., & Brem, A. (2020) stated

that in the current scenario communal and women

entrepreneurship have emerged as pioneer in the

field of research related to entrepreneurship. In the

study it was observed that women business leaders

are a better leader when it comes to run a communal

enterprise. It was so observed because the way a

women entrepreneur looks and deals to s matter of

business has a concern for prestige of the particular

occupation.

Mary, F. R. (2018) did a research based on primary

data and collected data from collected from 200

respondents through a structured questionnaire.

They investigated and observed that although e-

transactions is the need of the hour but its acceptance

is still a concern. The surety and seclusion is a

hindrance in the Indian reference. The use of internet

has increased but still many people hesitate to share

the information.

Shukla, A., Kushwah, P., Jain, E., & Sharma, S. K.

(2021) did a study, which aimed to identify the

significant factors essential for the growth of

Women Enterprising community (WEC). Their

study emphasises that when a female deal with the

business, she looks it with a varied perception. With

the enhancement of women enterprising skills there

has also been a development of self-entrepreneurial

habits, reliance, self-satisfaction and women being

more confident.

5 NEED OF DIGITAL

TRANSACTIONS

Digitalization has become the need of the hour. Digital

transactions have largely taken over the traditional

form of money transactions. Hence, the field of

entrepreneurship is also not untouched by this change.

Moreover, when it comes to women they also adopted

this change knowing the fact that this will increase

their business convenience. Although the fact cannot

be denied that Digital transactions have their own

lacunas also. However, despite this woman have

adopted it well as they are known to be diluted in any

kind of condition and situation. There are many

reasons for why there is a need of digital transaction in

the field of women entrepreneurship.

▪ The initiation of digital platforms has brought

a revolution in the form low cost digital

transfer of money.

▪ Digital transactions provide security as

compared to traditional money transactions.

▪ They provide proper authentication and

verification of each transaction done.

▪ Digital transaction is with great convenience

and ease.

▪ Entrepreneurs access to credit will improve

as digital transactions automatically provide

access to credit history.

▪ Women entrepreneurs are benefitted from

digital transaction as they more control over

their incomes potentially benefitting the

entire family specially their children.

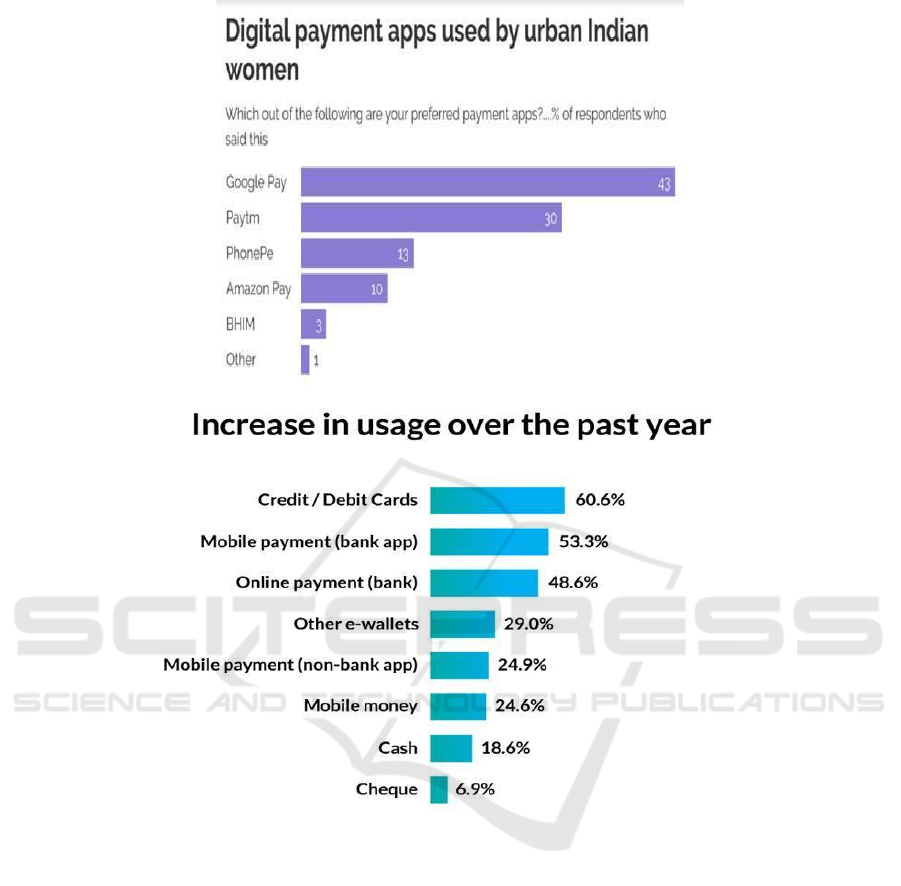

There has also been a steep rise in the use of digital

platform by Indian female citizens. Studies show that

women have very conveniently adopted the digital

platform in recent times.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

600

Source:https://www.google.com/search?q=adoptability+of+digital+transactions+among+indian+women&sourc

e=lnms&tbm=isch&sa=X&ved=2ahUKEwjIxNeV-

dDzAhXGfX0KHdCiBsUQ_AUoAnoECAEQBA&biw=1707&bih=837&dpr=1.13

6 ADOPTABILITY OF DIGITAL

TRANSACTION AMONG

WOMEN ENTREPRENEURS

Digital transaction has had its grip in Indian market

since post demonetization. People have widely

accepted the digital mode of payment. The pandemic

Covid-19 has accelerated the use of digital payment

not only in India but also across the globe. Almost all

the sectors and individuals have accepted the

digitalization of money with open arms.

The adoptability of digital transactions was also seen

among the females of India. Even the rural women

entrepreneurs have adopted it well. A study done by

Manrai, R., Goel, U., & Yadav, P. D. (2021) signifies

that companies providing digital platforms must

consider that it should be user friendly digital

platform so that rural women business women can

also use them with ease. Because adopting digital

platforms is also required by the rural women

entrepreneurs. When it comes to women

entrepreneur, they have adopted and accepted the

digital mode of business as it has its own significance

and convenience. Studies reveal that more than six in

A Review on Adoptability of Digital Transactions Among Women Entrepreneurs During and Post COVID – 19

601

every ten women use digital mode of transactions.

Convenience and secured modes stands as the

strongest reasons for this. According to Rosca, E.,

Agarwal, N., & Brem, A. (2020) the women

businessperson need to face challenges that are

specific in nature. But it was observed that they deal

with these situations by employing comprehensive

plan of action one of the strategies, which the modern

women entrepreneurs are incorporating in their

business plans, is more and more use of digital

sources of payments. This thought has not only made

the work convenient but has also helped in giving the

society a new dimension.

Digital platform has made commendable

encroachment among the Indian women business

world in the recent times. This is because the need and

usage requirements have changed drastically in

Indian society. The following figure shows the

changes in the past years.

Source:

https://www.google.com/search?q=adoptability%20of%20

digital%20transactions%20among%20indian%20women&

tbm=isch&tbs=rimg:CTQ-zxD0-Uo_1Ye-

HSdmj3wdZsgIGCgIIABAA&hl=en&sa=X&ved=0CBsQ

uIIBahcKEwjw3eGr-

dDzAhUAAAAAHQAAAAAQJQ&biw=1688&bih=837

7 CONCLUSION

India in the recent times have seen major

transformation among women entrepreneurs. Digital

platform and its adoptability among women

entrepreneurs needs no justification as to how well

these two have adopted each other. The above

discussion revels the existence of women

entrepreneurs, their growth and acceptability of

modern technologies in order to improve their own

business outcomes. They have very well understood

the need of digital transactions and have very well

incorporated the digital tools in their day-to-day

working. The above review reveals the strong need

and adoptability of digital transactions among women

entrepreneurs in India.

REFERENCES

Kamberidou, I. (2020). “Distinguished” women

entrepreneurs in the digital economy and the

multitasking whirlpool. Journal of Innovation and

Entrepreneurship, 9(1), 1-26.

Galhotra, B., & Puniya, M. (2020, March). Digital Media

& Technology-Fueling the Growth of E-Business for

Women Entrepreneurs. In Proceedings of the

International Conference on Innovative Computing &

Communications (ICICC).

Smitha, M., & Kumari, B. A. (2019). Role of banks in

empowering women entrepreneurs in small and micro

enterprises-with reference to Mangaluru City.

International Journal of Social and Economic Research,

9(3), 62-74.

Rosca, E., Agarwal, N., & Brem, A. (2020). Women

entrepreneurs as agents of change: A comparative

analysis of social entrepreneurship processes in

emerging markets. Technological Forecasting and

Social Change, 157, 120067.

Agarwal, S., Ramadani, V., Dana, L. P., Agrawal, V., &

Dixit, J. K. (2021). Assessment of the significance of

factors affecting the growth of women entrepreneurs:

study based on experience categorization. Journal of

Entrepreneurship in Emerging Economies.

Mary, F. R. (2018). Women Entrepreneurs Acceptance and

Satisfaction towards Online Banking. MASIVJ, Sep.

Agarwal, S., Ramadani, V., Dana, L. P., Agrawal, V., &

Dixit, J. K. (2021). Assessment of the significance of

factors affecting the growth of women entrepreneurs:

study based on experience categorization. Journal of

Entrepreneurship in Emerging Economies.

Manrai, R., Goel, U., & Yadav, P. D. (2021). Factors

affecting adoption of digital payments by semi-rural

Indian women: extension of UTAUT-2 with self-

determination theory and perceived credibility. Aslib

Journal of Information Management.

Shukla, A., Kushwah, P., Jain, E., & Sharma, S. K. (2021).

Role of ICT in emancipation of digital entrepreneurship

among new generation women. Journal of Enterprising

Communities: People and Places in the Global

Economy.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

602