Impact of Macroeconomic Variables on Performance of Pension

Funds: An Econometric Analysis

Neha Mangla

1

and Kavita Indapurkar

2

1

Vivekananda Institute of Professional Studies – TC, Delhi, India

2

Amity School of Economics, Amity University Noida, India

Keywords: Retirement Planning, Macroeconomic Variables, Time Series Analysis, Successful Ageing.

Abstract: Retirement is a natural phase of life when after a certain age individual’s cease to work or reduce their work

hours. Retiring successfully can be ensured if one attains self-sufficiency in terms of wealth by the time of

retirement. Retirement planning is the process of making your money work for you in order to help you

achieve your goals and maintain your quality of life in later years. Like many other developing countries,

there is no social security system in India to protect the elderly from financial deprivation. The pension system

in India relies on employer and employee participation and contribution. Investing in Pension plans provide

financial support and stability to retirees when they cease to have a steady source of income. The returns on

pension funds are thus a key determinant of who enrolls in these schemes and how much money is generated

for retirement. This study investigates the impact of select macroeconomic variables, Gross Domestic Product

(GDP), exchange rate, money supply, inflation and unemployment on pension fund returns in India using time

series analysis. The study shows that changes in GDP significantly impact returns on pension funds especially

post the COVID-19 lockdown. While changes in exchange rate significantly impact returns on state

government pension funds, changes in inflation is a significant factor impacting returns on equity driven

pension funds.

1 INTRODUCTION

With rising life expectancy and increasing proportion

of elderly in the age structure, there is growing

concern about ensuring adequacy of retirement

resources. Appropriate retirement planning during the

working age can be one of the most effective tools for

easy transitioning to retirement and ensuring

wellbeing during the retirement years.

In 2004, India switched to a defined contributory

scheme under the National Pension System, shifting

the burden of financial well-being during retirement

to individuals. Since 2009, NPS is provided to all

citizens of the country on a voluntary. Retirement

benefits in defined-contribution plans are dependent

on the performance of the pension fund scheme, and

the risk of investment in the pension plan is

completely borne by the pension plan member.

During the Pandemic, there have been significant

changes in the macroeconomy that have an impact on

the returns of these pension funds.

Pension plans provide financial security and stability

to retirees who cease to have a steady income flow.

Retirement planning enables people to maintain their

standard of living even as they transition into

retirement. These funds are managed by professional

investment managers and comprise of contributions

from both the employees and employers. The money

in these funds is invested in a diversified portfolio of

assets such as government securities, equity, bonds,

and real estate, in order to grow the fund over time.

When any pension plan member retires, the fund

provides them with a regular stream of income that is

based on the value of their pension plan account. The

stream of income depends on the fund accumulation

till retirement, that in turn depends on the returns

generated on the pension fund.

Globally, countries are working hard to reform their

pension systems. Given the increased burden on

government funds, rising life expectancy, and

changing age structure, the focus has shifted to

privately funded pension programmes managed by

the private sector. Across the globe, there has been

substantial increase in assets under retirement savings

plans. However, when compared to GDP, the amount

of assets remain low in some large and rapidly

Mangla, N. and Indapurkar, K.

Impact of Macroeconomic Variables on Performance of Pension Funds: An Econometric Analysis.

DOI: 10.5220/0012502800003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 739-748

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

739

developing countries like India and China. Pension

funds are expected to become more important in the

future as people around the world become

increasingly concerned about saving for their

retirement years (OECD, 2021).

The interlinkage between the equity returns, mutual

fund returns, and macroeconomic variables has been

in focus of academicians. However, even though

there is an increased focus on retirement saving plans

and pension fund investments, an analysis of the

dynamics of returns on these funds has not been

studied particularly.

Pension funds have a long-term horizon and very

stringent rules regarding premature withdrawal,

which distinguishes them from other types of funds.

This gives pension funds a lot of leeway in selecting

investments, but it also means that subscribers expect

much better returns from their pension fund

managers. The present study studies the dynamics of

pension fund returns by analyzing the impact of

macroeconomic variables on pension fund returns in

India.

2 REVIEW OF LITERATURE

According to the World Population Prospects (2022),

global life expectancy increased to 72.8 years in 2019

and is projected to increase to an average of around

77.2 years in 2050. In India too, better health and

sanitation conditions have resulted in increased life

expectancy, and thus the number of post-retirement

years. Retirement planning has become essential in

today’s time given the increasing cost of living,

inflation and the rising life expectancy. The National

Pension System (henceforth NPS) was implemented

in India on January 1, 2004. On May 1, 2009, NPS

was made available to all Indian citizens on a

voluntary basis, as a step towards India’s endeavor to

develop an efficient and a sustainable pension system.

The contributions made by government employees

are invested in schemes of three public sector Pension

Fund Managers (PFMs). Each PFM invests majority

of the contributions in fixed income securities (85

percent) and the remaining 15 percent in stocks (Sane

& Thomas, 2014). The non-government employees

have a choice between three asset classes: G-

government bonds, C-fixed income instruments, and

E-equity market instruments for investment of their

voluntary NPS contributions.

Despite the government’s efforts to make NPS

attractive, it has been criticized on many grounds.

According to an online survey conducted by ET

Wealth (Zaidi, 2018), no assured returns, lower

returns on the annuity, availability of better

investment plans such as mutual funds, Public

Provident Fund, Equity linked saving schemes, etc.

are some reasons for criticizing the NPS investment

for retirement planning. The NPS has seen a

lukewarm response so far, with majority of

subscribers being central and state government

employees, for whom the scheme is mandatory

(Sanyal et al., 2011a). Investments in NPS till

retirement do not even guarantee a minimum pension

after retirement, thus defeating its ‘welfare’

orientation (Sanyal et al., 2011b).

In this backdrop, it is important to analyze the

performance of pension fund schemes and the factors

that impact their performance. Therefore, this study

shall broadly examine how the macroeconomic

factors, exchange rates, unemployment rate, money

supply, GDP and inflation impact the returns on

pension funds.

While attempting to find out the determinants of stock

returns and mutual fund returns, macroeconomic

variables have been paid special attention to (Nguyen

et al., 2020; Qureshi et al., 2019; Verma & Bansal,

2021; El Abed & Zardoub, 2019). Rahman et al.

(2009) used the Vector Autoregressive Model (VAR)

and the Vector Error Correction Model (VECM) to

analyze the interaction between selected

macroeconomic variables and stock prices in

Malaysia and concluded that Malaysian stock market

index does have a cointegrating relationship with

changes in interest rates, exchange rate and money

supply. Yu Hsing (2014) studied the interaction

between the stock market and macroeconomic factors

in Estonia and concluded that while gross domestic

product impacts the index positively, the exchange

rate and the expected rate of inflation affect the index

negatively. Nguyen et al. (2020) used the Auto

Regressive Distributed Lag (ARDL) model to

conclude that money supply, exchange rate and

inflation rate significantly influence stock market

returns in the long run in Vietnam. In a study on stock

market returns in Germany, El Abed and Zardoub

(2019) using the ARDL model conclude that

exchange rate and money supply have a positive but

no significant impact on stock return, while CPI has a

positive and a significant impact on the stock returns.

In the study on Asian developing economies, Qureshi

et al. 2019 conclude that there is a boom in stock

market returns when the economy is thriving whereas

the opposite holds true for bond returns. Khan (2019)

conclude that exchange rate has a negative and

significant influence on the stock returns of Shenzhen

stock exchange. In another study using Panel data

analysis Purwaningsih (2019) in their study on

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

740

Indonesia conclude that interest rates, exchange rates,

GDP and inflation significantly impact the returns of

equity mutual fund. Unemployment is related to the

business cycle and to fluctuations in the stock market,

and thus it may also have an impact on mutual fund

flows and returns (Geske & Roll,1983; Flannery &

Protopapadakis, 2002; Bali et al., 2014).

The objective of this paper is to model the dynamic

relation between pension fund returns and

macroeconomic variables in India using time series

analysis. A study of pension fund returns can help to

identify the driving factors in determining the

performance of pension funds, and can provide

insights into how changes in these factors may impact

pension returns in the future.

The rest of the paper is organized as, Section 3

explains the data and variables; Section 4 summarizes

the methodology; Section 5 discusses the empirical

results and interpretation, and Section 6 presents the

conclusions.

3 DATA AND VARIABLES

There are many kinds of pensions schemes

offered under the National Pension System. Based on

targeted individuals there are schemes specifically for

government sector employees (like Central

Government and State Government Schemes) and

other schemes open to all citizens of India (Tier 1 and

Tier 2 schemes). Basis asset allocation there are

schemes that invest the funds primarily in fixed

income securities (like Central and State Government

Schemes and Scheme G in Tier 1 and Tier 2), and

others that invest heavily in equity markets (like

Scheme E in tier 1 and tier 2).

As a representation of the different kinds of schemes,

the study analysis the performance of two specific

pension fund schemes; the State Government Scheme

and the Scheme E in Tier 1. The State Government

Scheme has the highest asset allocation under the

schemes open for public sector employees and it

invests majority of the funds in fixed income

securities. On the other hand, the Tier 1 Scheme E

with Fund Manager HDFC is open to all citizens of

India and has the highest asset allocation. It invests

majority of funds in equity markets. HDFC Pension

Fund offered the highest average return of 16.84% in

Tier I and is identified as the best pension fund

manager with the highest ratios as per all the three

risk-adjusted performance measures, i.e., the

Treynor, Sharpe and Jensen alpha (Murari, 2020).

Overall, positive macroeconomic developments are

expected to boost market returns and flow of funds in

the economy, and vice versa. The GDP growth rate is

the primary indicator of macroeconomic conditions

(Jank, 2012; Chatziantoniou et al., 2013; Bali et al.,

2014). Apart from GDP other macroeconomic

indicators used in this study are: change in inflation

rate; money supply growth rate; change in Rs./$

exchange rate; and unemployment rate. Data from

June 2017 to August 2022 was compiled for all the

variables under study. Table 1 gives the details of the

variables used; definition, source and summary

statistics.

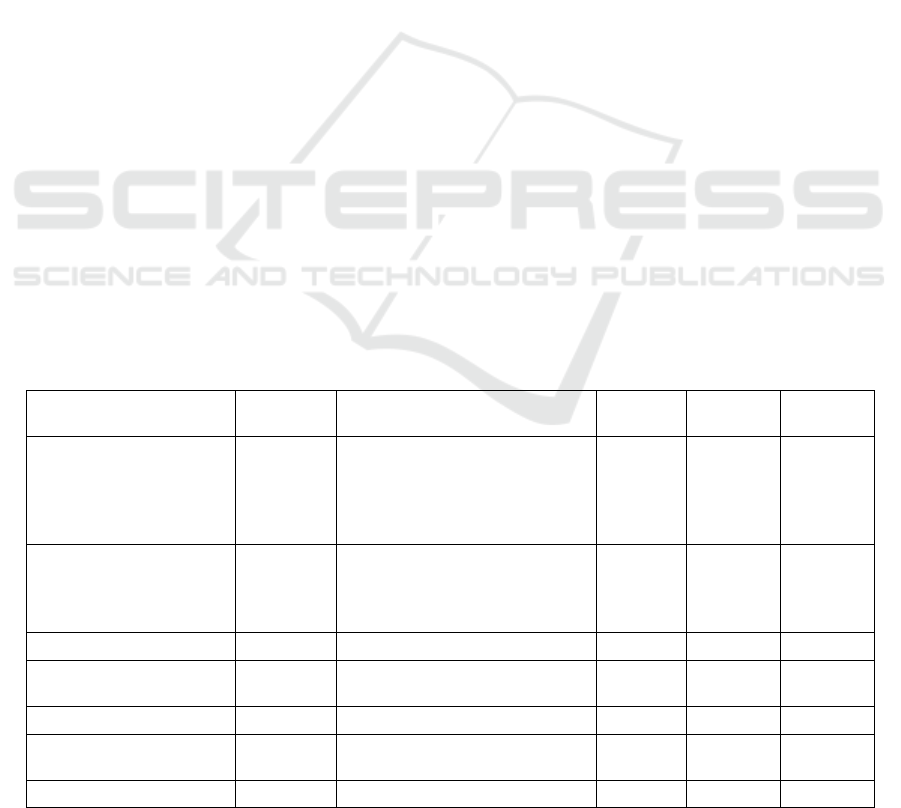

Table 1: Description of Variables.

Variable

Variable

Name

Definition Source Mean Std. Dev.

Returns on State

Government Pension

Scheme

Ret_sgs

3-month returns calculated on a

monthly basis. Average returns

for the three fund managers

(SBI, HDFC and UTI) were

calculate

d

National

Pension

System

Trust

0.019 0.020

Returns on Tier 1

Scheme E (HDFC PF)

Ret_Sche

3-month returns calculated on a

monthly basis.

National

Pension

System

Trust

0.034 0.086

Inflation CPI Consumer Price Index RBI 0.004 0.006

Exchange Rate Exrt

Rate of change in exchange rate

(

Rs./U.S Dollar

)

; monthl

y

FRED 0.003 0.014

GDP GDP Change in monthly GDP index FRED 0.001 0.019

Money Supply (M3) Ms

Rate of change in money supply

(

M3

)

; monthl

y

FRED 0.008 0.008

Unemployment Rate Un Monthly Unemployment Rate CMIE 0.075 0.031

Source: Author’s own compilation using Eviews 12 SV

Impact of Macroeconomic Variables on Performance of Pension Funds: An Econometric Analysis

741

4 METHODOLOGY

Choosing the appropriate method for time series

analysis is crucial as any misspecification or using the

wrong method gives biased and unreliable estimates.

The choice of methodology primarily depends on the

stationarity of the series by checking the unit root. If

all the series of interest are stationary, ordinary least

square (OLS) or VAR models can provide unbiased

estimates (Shrestha & Bhatta, 2018).

The times series for all variables were tested for

stationarity using the Augmented Dickey Fuller

(ADF) test, the Kwiatkowski-Phillips-Schmidt-Shin

(KPSS) test and the Phillips-Perron (PP) test.

Contrary to the other unit root tests, the presence of a

unit root is the alternative hypothesis in the KPSS

test. Sometimes, data tends to reject the null

hypothesis, so testing for stationarity using all the

tests helps to test if the null is rejected in all the tests

despite different null hypothesis. In our data, all the

tests showed that all the series are stationary at level.

Accordingly, long run static model using ordinary

least squares method is estimated using the following

model specification for the two types of pension

funds:

𝑅𝑒𝑡_𝑠𝑔𝑠

=𝛼+ 𝛽

𝐶𝑃𝐼

+ 𝛽

𝐸𝑥𝑟𝑡

+

𝛽

𝐺𝐷𝑃

+𝛽

𝑀𝑠

+ 𝛽

𝑈𝑛

+ 𝜀

𝑅𝑒𝑡

=𝛼+ 𝛽

𝐶𝑃𝐼

+ 𝛽

𝐸𝑥𝑟𝑡

+𝛽

𝐺𝐷𝑃

+𝛽

𝑀𝑠

+ 𝛽

𝑈𝑛

+ 𝜀

5 EMPIRICAL RESULTS AND

INTERPRETATIONS

Table 2 reports the results of unit root tests applied to

determine the order of integration of the time series

data. ADF, PP and KPSS tests were employed to test

if the series has a unit root (series is not stationary).

Basis the ADF and PP test with the null hypothesis;

series has a unit root, the p-values for all the series

were significant at 5% level of confidence thus

rejecting the null. This indicates that all the series are

stationary at level or integrated at level. The KPSS

test, that tests the null; series is stationary, had the LM

stat value less than the critical value at 5%

confidence, for all the variables, thus accepting the

null. The KPSS test also indicates that all the series

are stationary or integrated at level.

Table 2: Unit Root Tests.

Variable ADF Test Statistic PP Test Statistic KPSS Test Statistic Final Decision

Ret_SGS

(3.006413)*

(3.320006)*

0.167919 I(0)

Ret_Sche

(2.982738)*

(3.358908)*

0.110098 I(0)

CPI

(5.963184)*

(5.608603)*

0.094482 I(0)

Exrt

(6.996219)*

(6.996219)*

0.055920 I(0)

GDP

(6.517648)*

(3.799529)*

0.054377 I(0)

Ms (8.688854)* (9.484461)* 0.087092 I(0)

Un (4.352836)* (3.484874)* 4.417547 I(0)

Source: Author’s own compilation using Eviews 12 SV

Note: * represent significant at 5% level of significance; () represent negative values.

Final decision has been made based on individual

stationarity tests

Since all the series are stationary at level, only the

long run static model (without lags) is estimated using

OLS.

Table 3 shows the results of the regression model with

returns on the state government pension scheme as

the dependent variable and all the macroeconomic

variables as the independent variables.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

742

Table 3: Regression results for returns on state government scheme.

Variable Coefficient Std. Error

CPI 0.226692 0.386329

Exrt -0.478893 0.180685

**

GDP 0.358255 0.162793

**

Ms -0.085375 0.317164

Un 0.192409 0.099132

*

C 0.00629 0.008072

Source: Author’s own compilation using Eviews 12 SV

*, **, *** indicates significance at the 90%, 95%, and 99% level, respectively.

The results indicate that in the long run changes in

exchange rate and GDP significantly impact the

returns on state government pension scheme at 5%

significance level. A one percent increase in the Rs./$

exchange rate decreases the pension returns on state

government scheme by .47 percent. Also, a one

percent increase in GDP increases the return

on state

government scheme by .35 percent. Changes in

unemployment rate impact returns on state

government scheme at a 10% significance level.

Changes in inflation and money supply do not have a

significant impact on the returns on state government

scheme. The model is significant as reflected in the

value of the F-statistic (3.384773) being significant at

5% significance level.

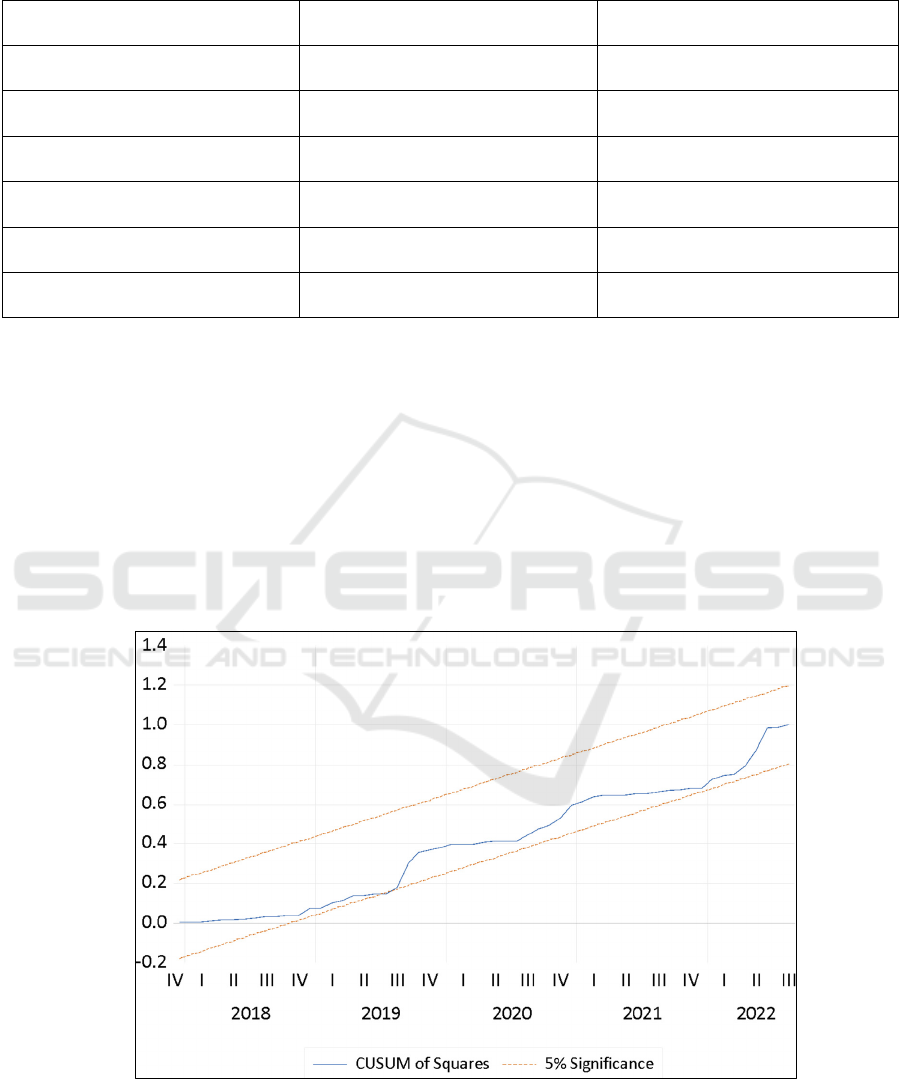

To check the stability of the coefficients and to

check for any structural breaks in the data, the

CUSUM square test is used. The test confirms that the

coefficients are stable (Figure 1).

Figure 1: CUSUM Square Test.

Next, we analyse the returns on Tier 1 Scheme E

(HDFC PF). Table 4 shows the results of the

regression model with returns on the Tier 1 Scheme

E (HDFC PF) as the dependent variable and all the

macroeconomic variables

as the independent

variables.

Impact of Macroeconomic Variables on Performance of Pension Funds: An Econometric Analysis

743

Table 4: Regression results for return on Tier 1 Scheme E (HDFC PF).

Variable Coefficient Std. Error

CPI 0.999576 1.446423

Exrt -1.549711 0.676487

**

GDP 2.293429 0.609502

***

Ms -0.942381 1.187468

Un 0.014875 0.371151

C 0.04116 0.030221

Source: Author’s own compilation using Eviews 12 SV

*, **, *** indicates significance at the 90%, 95%, and 99% level, respectively.

The results from the regression show that the changes

in exchange rate and GDP significantly impact the

returns on Tier 1 Scheme E (HDFC PF). While

increases in GDP positively impact the returns, an

increase in the exchange rate impacts the returns on

Tier 1 Scheme E negatively. The overall significance

of the model is reflected in the F-statistic (3.384773)

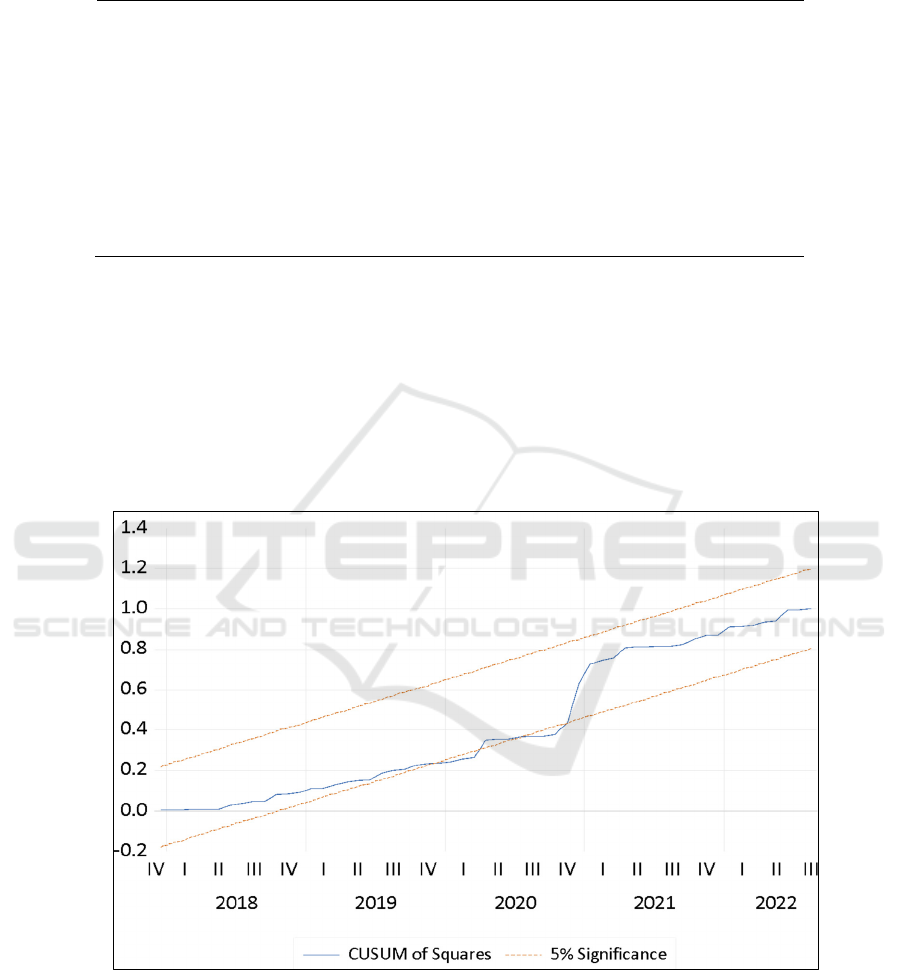

being significant at 5% significance level. The

CUSUM square test for stability of the model (Figure

2) shows that the results are not stable and there exists

a structural break in the series. The test shows that the

there is a digression outside the 5% significance level

boundary at 2020 month IV.

Figure 2: CUSUM Square Test.

To confirm the structural break, the Chow Break

point test for employed. The results from the Chow

Test (Table 5) confirm the presence of a structural

break at the fourth month of 2020. The F-statistic is

significant at 5% significance level, thus rejecting the

null; no breaks at specified break points. Structural

break occurs when an event distorts the movement in

a time series. April 2020 was the month when the

country was under a complete lockdown due to the

COVID-19 Pandemic and the economic activity came

to a standstill.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

744

Table 5: Chow Break Point Test.

F-statistic 3.114477 Probability 0.0112

Log likelihood ratio 19.66773 Probability 0.0032

Wald Statistic 18.68686 Probability 0.0047

Source: Author’s own compilation using Eviews 12 SV

To account for the structural break, a revised

regression for returns on Scheme E Tier 1 is done.

The data is divided in two parts; till April 2020 and

post April 2020. Separate regressions were run to

check if there is a change in the factors that impact

the returns on Scheme E pension funds pre and post

the structural break

1

.

Table 6 shows the results of the regression model with

returns on the Tier 1 Scheme E (HDFC PF) as the

dependent variable and all the macroeconomic

variables as the independent variables including the

data from June 2017 to April 2020.

Table 6: Regression results for return on Tier 1 Scheme E (HDFC PF) – June 2017 to April 2020.

Variable Coefficient Std. Error

CPI 4.296811 1.815105

**

EXRT -1.365153 0.685897

***

GDP 1.969318 1.616761

MS -1.737495 1.237123

UN -0.302359 0.853247

C 0.040569 0.056277

Source: Author’s own compilation using Eviews 12 SV

*, **, *** indicates significance at the 90%, 95%, and 99% level, respectively.

The model is overall significant reflected in the F-

statistic (6.687051) being significant at 5%

significance level. Changes in inflation rate

significantly impact the returns on the Scheme E

pension fund. Changes in exchange rate impact

returns on Scheme E funds but only at a 10%

significance level. GDP, which was one of the key

impact factors for the state government scheme does

not impact the returns on Scheme E significantly

during the pre-COVID times. The CUSUM square

test (Figure 3) confirms the stability of the model.

1

The results of difference-in-difference method was

also in line with the results from the two separate

regressions. Residual diagnostics have been

performed and found robust.

Impact of Macroeconomic Variables on Performance of Pension Funds: An Econometric Analysis

745

Figure 3: CUSUM Square Test.

Next, we analyse the returns post the structural break i.e., April 2020. Table 7 shows the results of the regression

model with returns on the Tier 1 Scheme E (HDFC PF) as the dependent variable and all the macroeconomic

variables as the independent variables including the data from April 2020 to August 2022.

Table 7: Regression results for return on Tier 1 Scheme E (HDFC PF) – May 2020 to August 2022.

Variable Coefficient Std. Error

CPI -2.966947 2.346576

EXRT -1.524814 1.416957

GDP 2.162815 0.833436**

MS 0.976743 2.183324

UN -0.513548 0.588774

C 0.107379 0.055316***

Source: Author’s own compilation using Eviews 12 SV

*, **, *** indicates significance at the 90%, 95%, and 99% level, respectively.

The model is overall significant with the F-statistic

(2.927130) significant at 5% significance level.

Though changes in GDP did not affect returns on

Scheme E Tier 1 pension scheme before the

pandemic, post the pandemic changes in GDP

significantly impact the return on Scheme E pension

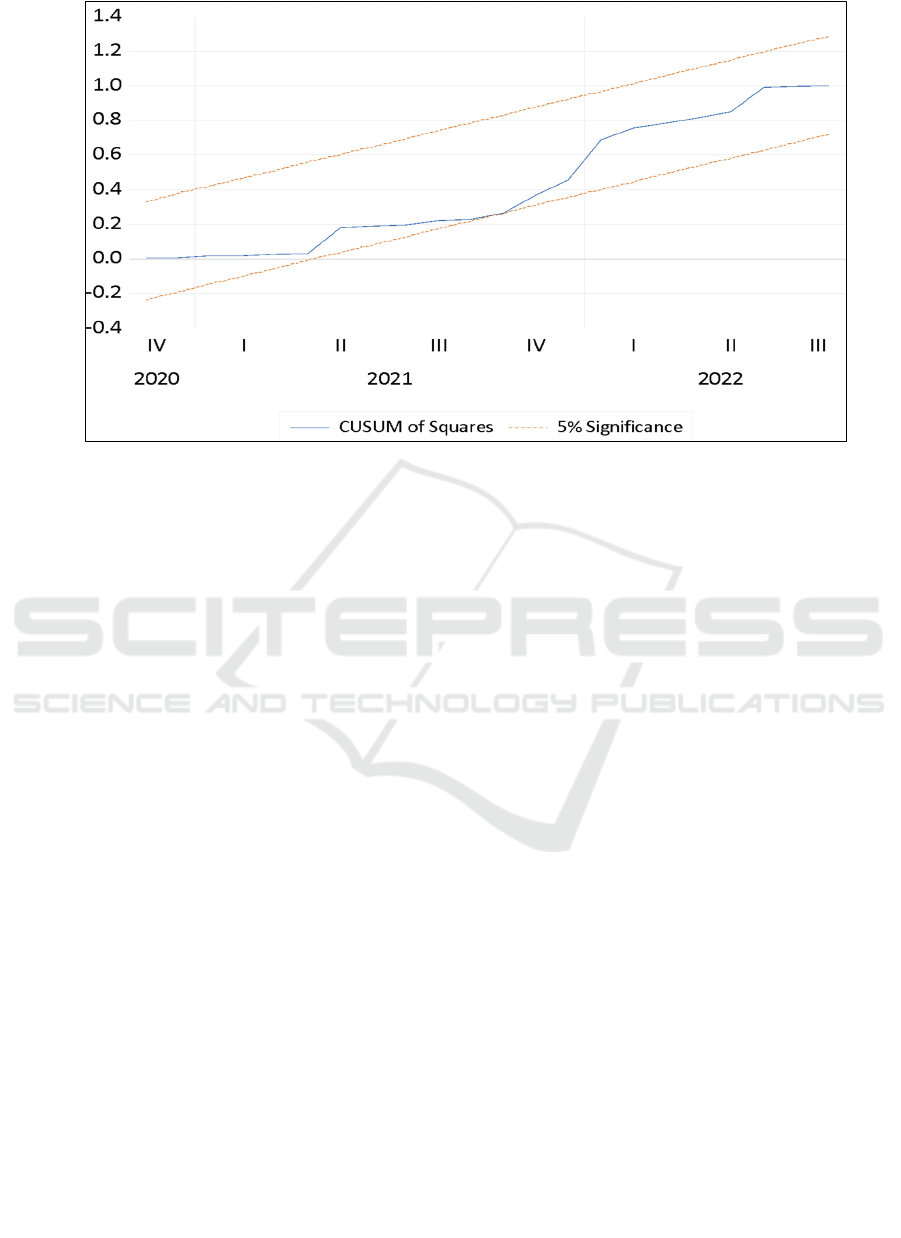

fund. The CUSUM square test (Figure 4) confirms the

stability of the model.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

746

Figure 4: CUSUM Square Test.

6 DISCUSSION AND

CONCLUSION

The present study is an attempt to examine the

dynamic interaction between macroeconomic

variables and pension fund returns in India using

monthly time series data for the period June 2017 to

August 2022. The period under consideration has

specific relevance because of the economic shock, the

COVID 19 pandemic. The entire analysis was done

with two broad objectives, first, to see how in general

macroeconomic variables impact the returns from

pension funds and second, to analyse if economic

shocks like to COVID 19 pandemic distort returns

from different pension funds.

For the first objective, out of the macroeconomic

indicators studied, changes in exchange rates and

changes in GDP significantly impact the returns on

state government scheme. While changes in exchange

rate have a negative impact, the GDP has a positive

impact on the returns. Many factors may corroborate

the observed results. An increase in exchange rate

implies depreciation of the rupee which negatively

impacts investor sentiments and increases the

exposure of the economy to exchange rate risks thus

impacting the returns negatively. GDP is a measure

of economic growth and is reflective of the overall

health of the economy. An increase in the GDP may

result in increased fund flows and positive investor

sentiments thus increasing the returns. Additionally,

though changes in inflation do not impact the returns

on the state government schemes, it does impact the

returns on Tier 1 Scheme E prior to the lockdown

period.

For the second objective, the results of the Chow Test

confirm that the lockdown during COVID-19

distorted the returns of the Tier 1 Scheme E. In terms

of the impact of the macroeconomic variables as well,

though GDP was not a significant factor impacting

the returns during the pre lockdown period, it does

become a significant factor impacting Scheme E

returns post the lockdown. Some of the reasons

explaining the same can be stated as increased market

volatility, economic lockdown and loss of businesses

and changed investor behaviour post the economic

shock. Since Scheme E specifically invests in stocks,

its returns were distorted because of the economic

shock. On the other hand, the results show that the

economic lockdown did not have an impact on the

returns of state government pension scheme.

The importance of the macroeconomic variables

studied in this research can be useful for pension fund

managers and policymakers, as it can help them to

make more informed investment and policy

decisions.

REFERENCES

Bali, T. G., Brown, S. J., & Caglayan, M. O. (2014).

Macroeconomic risk and hedge fund returns. Journal of

Financial Economics, 114(1), 1-19.

Impact of Macroeconomic Variables on Performance of Pension Funds: An Econometric Analysis

747

Chatziantoniou, I., Duffy, D., & Filis, G. (2013). Stock

market response to monetary and fiscal policy shocks:

Multi-country evidence. Economic modelling, 30, 754-

769.

El ABED, R., & Zardoub, A. (2019). Exploring the nexus

between macroeconomic variables and stock market

returns in Germany: An ARDL Co-integration

approach. Theoretical & Applied Economics, 2(2).

Qureshi, F., Kutan, A. M., Ghafoor, A., Khan, H. H., &

Qureshi, Z. (2019). Dynamics of mutual funds and

stock markets in Asian developing economies. Journal

of Asian Economics, 65, 101135.

Flannery, M. J., & Protopapadakis, A. A. (2002).

Macroeconomic factors do influence aggregate stock

returns. The review of financial studies, 15(3), 751-782.

Geske, R., & Roll, R. (1983). The fiscal and monetary

linkage between stock returns and inflation. The journal

of Finance, 38(1), 1-33.

Jank, S. (2012). Mutual fund flows, expected returns, and

the real economy. Journal of Banking & Finance,

36(11), 3060-3070.

Khan, M. K. (2019). Impact of exchange rate on stock

returns in Shenzhen stock exchange: Analysis through

ARDL approach. International Journal of economics

and management, 1(2), 15-26.

Murari, K. (2022). Risk-adjusted performance evaluation of

pension fund managers under social security schemes

(National Pension System) of India. Journal of

Sustainable Finance & Investment, 12(4), 1217-1231.

Nguyen, T. T., Mai, H. T., & Tran, T. T. M. (2020).

Monetary Policy and Stock Market Returns: Evidence

from ARDL Bounds Testing Approach for the Case of

Vietnam. Asian Economic and Financial Review, 10(7),

758-777.

OECD (2021), Pension Markets in Focus

2021,www.oecd.org/finance/pensionmarketsinfocus.ht

m

Purwaningsih, S. S. (2019, October). An Analysis of

Influence of Interest Rates, Rupiah Exchange Rates,

Gross Domestic Product (GDP), Inflation, and

Indonesia Composite Index (ICI) on the Performance of

Mutual Funds Using Panel Data Methods. In

International Conference On Applied Science and

Technology 2019-Social Sciences Track (iCASTSS

2019) (pp. 105-108). Atlantis Press.

Rahman, A. A., Sidek, N. Z. M., & Tafri, F. H. (2009).

Macroeconomic determinants of Malaysian stock

market. African Journal of Business Management, 3(3),

95.

Sane, R., & Thomas, S. (2014). The way forward for India’s

National Pension System. Indira Gandhi Institute of

Development Research.(Available online at:

http://www. igidr. ac. in/pdf/publication/WP-2014-022.

pdf).

Sanyal, A., Gayithri, K., & Erappa, S. (2011). National

pension scheme: For whose benefit?. Economic and

Political Weekly, 17-19.

Sanyal, A., Gayithri, K., & Erappa, S. (2011). Indian Civil

Servants Pension Liability Projections: An Alternative

Framework. The IUP Journal of Public Finance, 9(2),

7-29.

Shrestha, M. B., & Bhatta, G. R. (2018). Selecting

appropriate methodological framework for time series

data analysis. The Journal of Finance and Data

Science, 4(2), 71-89.

United Nations Department of Economic and Social

Affairs, Population Division (2022). World Population

Prospects 2022: Summary of Results. UN

DESA/POP/2022/TR/NO. 3.

Verma, R. K., & Bansal, R. (2021). Impact of

macroeconomic variables on the performance of stock

exchange: a systematic review. International Journal of

Emerging Markets, 16(7), 1291-1329.

Hsing, Y. (2014). Impacts of macroeconomic factors on the

stock market in Estonia. Journal of Economics and

Development Studies, 2(2), 23-31.

Zaidi, B. (2018, Dec 27). 5 Reasons Why Investors Stay

away from NPS. But should you?. The Economics

Times.

https://economictimes.indiatimes.com/wealth/invest/5-

reasons-why-investors-stay-away-from-nps-but-

should-you/articleshow/61890679.cms?from=mdr

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

748