Deep Learning Models for Stock Price Prediction of Companies

Associated with Indian Natural Gas Value Chain Underpinning Their

ESG Commitments

Pratyush Prasad

Data Science and Engineering Department, Manipal University, Jaipur, Rajasthan, India

Keywords: ESG, Natural Gas, Deep Learning, Long Short-Term Memory, Multi-Layer Perceptron Model Recurrent

Neural Network.

Abstract: Globally, stockholders are investing in companies strategizing to create a tangible, practical strategy for

quantifying ESG value for investors, in tandem with decarbonization, to enhance sustainability and combat

climate change. Natural Gas (NG), recognized as the preferred transitional fuel, accounts for 24.2% of the

world's primary energy(PE) consumption mix. India seeks to increase the proportion of NG in the country's

PE mix from 6% to 15% by 2030 to sustain decarbonized economic growth with NG transition. In this context,

this article aims to forecast and compare the stock prices of eight Indian companies associated with the NG

value chain, contributing to India's transition to a gas-based economy. These companies with a robust ESG

framework are associated with activities like NG exploration, Liquified NG import, transmission, distribution,

and retailing. The researcher applied deep learning techniques like CNN, LSTM, the RNN model, and MLP

to forecast stock prices and evaluate performance using historical data with seven attributes imported from

yahoo-finance get data module. LSTM model prediction is the best with the lowest RMSE value. The research

novelty lies in integrating ESG commitments into the prediction framework, acknowledging the growing

importance of sustainability factors in the financial market while the end consumers enhance NG consumption

for a gas-based economy transition.

1 INTRODUCTION

Climate Change is a global debate, with different

counties setting aspirational targets for "Net Zero"

emissions to decarbonize their energy ecosystems. As

a result, global investors have switched their

investment decisions to companies manifesting

progressive and responsible Environmental, Social,

and Governance (ESG) commitments(Sarangi, 2021).

India aims to achieve its Net Zero target by

2070(MoEFCC, 2022), with stiff diverse energy

domain intermittent milestones for 2030. One such

target is to enhance the share of Natural Gas (NG) in

India's primary energy consumption mix from 6 % to

15 % by 2030 (MoPNG, 2023) to support economic

growth, and decarbonization plans concurrently. NG

is the cleanest fossil fuel, with 24.2 % share in the

global primary energy consumption mix, while only

6.3 % in India (BP, 2022). India companies associated

with the NG Value Chain strive to increase NG

availability and access to the natural gas supply chain

(NGSC) to enhance consumption. Oil and Natural

Gas Corporation (ONGC) and Reliance Industries

Limited (RIL) are upstream companies associated

with domestic NG production. ONGC aims to

maximize shareholder's value by enhancing domestic

gas availability promising sustainable growth. RIL

aims at building trust with stakeholders, consistently

achieving high productivity and growth. Midstream

and downstream companies like GAIL (India)

Limited, operating 15,413 km of NG pipelines, intend

to create stakeholder's value through affordable NG

access by enhancing its spread to pipelines and

penetration through City Gas Distribution (CGD)

Network for gas retailing. The Petronet LNG Limited

(PLL), operating India's largest Liquified NG(LNG)

terminal of 17.5 MMTPA capacity at Dahej, Gujarat,

builds stakeholder's trust by ensuring uninterrupted

LNG re-gasification service for the continuous supply

of degasified LNG(RLNG) for downstream

customers. Hindustan Petroleum Company Limited

(HPCL) and Bharat Petroleum Corporation Limited

(BPCL), are new entrants in establishing the CGD

454

Prasad, P.

Deep Learning Models for Stock Price Prediction of Companies Associated with Indian Natural Gas Value Chain Underpinning Their ESG Commitments.

DOI: 10.5220/0012517300003739

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Artificial Intelligence for Internet of Things: Accelerating Innovation in Industry and Consumer Electronics (AI4IoT 2023), pages 454-460

ISBN: 978-989-758-661-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

projects independently. They aim to fulfill its social

commitment through customer care, environmental

protection, continuous improvement, and innovation.

Indraprastha Gas Limited (IGL), the pioneer in India's

gas retailing, adopts a customer-centric approach to

improve quality of life and shareholder's value.

National Thermal Power Corporation (NTPC), the

largest electricity producer in India, creates

shareholder's value by providing a reliable power

supply in an environmentally friendly, economical,

and efficient way. These companies follow their

management-approved, universally accepted ESG

reporting guidelines, which attract socially conscious

prospective investors to invest in their companies.

The guidelines underpin the requirements of the

Securities & Exchange Board of India and the

Ministry of Corporate Affairs, Government of

India(RIL, 2022).

Companies globally are giving high importance to

their ESG performance(Zumente & Bistrova, 2021).

Companies set their own targets to report

performance standards under various ESG criteria

(Edward & Evan, 1990), reflecting responsible

business growth. The environmental criteria reflect

company's policies, standards, and guidelines for

environmental protection, sustainability, energy

management, waste management, biodiversity, etc.

The social criteria manifest how the companies

handle their customers, employees, suppliers, and

communities within their operating domain. The

governance criteria relate to the company's leadership,

internal controls, audit systems, risk management,

shareholder rights protection, ethics etc. On scanning

the annual and sustainability report of a few of the

companies above, it is seen that apart from standard

financial performance parameters, economic, social,

and environmental parameters are also reported.

Some of these parameters are economic value

generated vs distributed, health safety and

environmental score, customer satisfaction index,

value added per employee, procurement from

government e-marketplace, energy consumption and

saving, GHG emission and saving, water

consumption and recycling, tree plantation,

environmental expenditure, audit para status, major

decisions in board meetings and AGM etc.(GAIL,

2022; RIL, 2022).

With growing concern for climate change and

enhanced awareness of corporate governance,

investors globally select their own set of criteria to

judge ESG performance before making investment

decisions for short-term and long-term profit

maximization. These may be related to the growth of

the top line, cost reductions, regulatory compliances,

productivity, and investment decisions(Henisz et al.,

2019). However, accurate prediction of future stock

prices is paramount for profit maximization and

shareholder value creation. In this context, this

exploratory quantitative research adopts data

analytics for predicting stock prices using Deep

learning techniques (Hu et al., 2021; Vijh et al., 2020).

The research has applied techniques such as CNN,

LSTM, RNN, and MLP to predict stock prices and

performance evaluation of the above-named Indian

companies associated with the NGSC.

2 DEEP LEARNING

TECHNIQUES

Machine learning's subfield, "Deep Learning" (DL),

utilizes multilayered neural networks. These artificial

neural networks aim to mimic the human brain so that

computers can learn from vast datasets like humans.

The following four models applied.

Artificial Neural Network (ANN) is a branch of

AI that takes its cues from the brain. Computational

networks inspired by the biological neural networks

used in brain development are the basis for most

artificial neural networks. Like the neurons in a

human brain, the neurons in an ANN are connected in

different layers. Nodes refer to these neurons.

A multi-layer perception (MLP) is a neural

network that has multiple layers. It's a deep layer with

many connections that can map one dimension to

another. Neural networks are constructed by linking

neurons together in such a way that the results of

certain neurons are used as inputs for other neurons.

Recurrent Neural Network (RNN) is a type of

neural network where the output from the previous

step is fed as input to the current step. The output from

the previous stage is used as input for the stage at

hand in RNN. The Hidden state, which retains some

data about a sequence, is RNN's primary and most

crucial characteristic. Since the state recalls the

Network's prior input, it is sometimes called the

Memory State. All inputs or hidden layers undergo

the same operation with the same parameters to

generate the output.

Long Short-Term Memory Networks (LSTM) are

DL, sequential neural networks that can retain

knowledge. It is a subset of RNNs that solves the

issue of vanishing gradients.

Deep Learning Models for Stock Price Prediction of Companies Associated with Indian Natural Gas Value Chain Underpinning Their ESG

Commitments

455

3 LITERATURE REVIEW

A comprehensive literature review was conducted to

understand the various concepts applied to the

research problem.

Hu et al., 2021 provide a detailed review from

2015 to the present on the prediction of stock price

value through DL methods. The models were

evaluated by analyzing the dataset through techniques

such as CNN, LSTM, DNN, RNN & reinforcement

learning. It also discusses the main performance

metrics of all models. In this paper, the hybrid

networks show promising signs for future research.

Islam & Nguyen, 2020 compares three models

ARIMA, ANN & geometric Brownian model. These

models could predict the stock price for the next day.

In this paper, the models ARIMA and geometric

Brownian model are better than the ANN model for

short-term next-day stock price prediction. ARIMA

model and Brownian model performed almost the

same. These models are good on time-series data, and

researchers and investors can examine some different

models to predict the prices of each stock to find the

best prediction model.

Nikou et al., 2019 used four data mining

techniques to predict the close price of iShares MSCI

UK. The results showed that the RNN method with

an LSTM block was better than the other methods,

and the SVR method had higher precision than neural

networks and random forests. Recommendations

were made to use the DL method, investigate

different types of LSTM models, and consider the

role of other influential factors in future studies.

Vijh et al., 2020 argued that predicting stock

market returns is challenging due to constantly

changing stock values. They created new variables to

obtain higher accuracy. ANN is used for predicting

the next-day closing price of the stock, and RF is for

comparative analysis. Results show that ANN gives

better prediction of stock prices than RF. DL models

could be developed considering financial news

articles and financial parameters such as closing price,

traded volume, profit, and loss statements.

Kumbure et al., 2022 systematically reviewed and

analyzed machine-learning literature for stock market

prediction. It found that indices and stocks in the USA

were the most investigated, while stocks linked to

health care, information technology, and consumer

discretionary were most frequently found. 2173

unique variables were used in the selected literature,

with the largest type being Technical Indicator with

1348 variables. Our review found that machine

learning-based prediction models for stock market

forecasting were based on the ANN, SVM, and fuzzy

theory. DL techniques have received much attention

in the last three years, with GAs, PCA, and wavelet

transforms being the most popular methods. All DL-

based papers have applied improved LSTM models to

predict stock market variables.

This paragraph summarizes the findings of the

literature review focused on predicting stock price

values using various DL and traditional models. The

first paper(Hu et al., 2021) comprehensively

evaluates DL models such as CNN, LSTM, DNN,

RNN, and reinforcement learning. Hybrid networks

show promise for future research. The second

paper(Islam & Nguyen, 2020) compares three models

(ARIMA, ANN, and geometric Brownian model) and

concludes that ARIMA and geometric Brownian

model outperform ANN for short-term next-day stock

price prediction. The third paper (Nikou et al., 2019)

explores four data mining techniques and finds that

RNN with LSTM performs best, while SVR has

higher precision than neural networks and random

forest. The fourth paper (Vijh et al., 2020) focuses on

predicting stock prices using ANN and RF,

suggesting including financial news articles and

parameters for improved accuracy. The fifth paper

(Vijh et al., 2020) systematically reviews machine

learning literature, highlighting the use of ANN,

SVM, fuzzy theory, and DL techniques, such as

improved LSTM models for stock market prediction.

Overall, DL methods, especially LSTM models,

demonstrate potential for accurate stock market

forecasting, while traditional models like ARIMA

and the geometric Brownian model also yield good

results in short-term predictions.

4 METHODOLOGIES

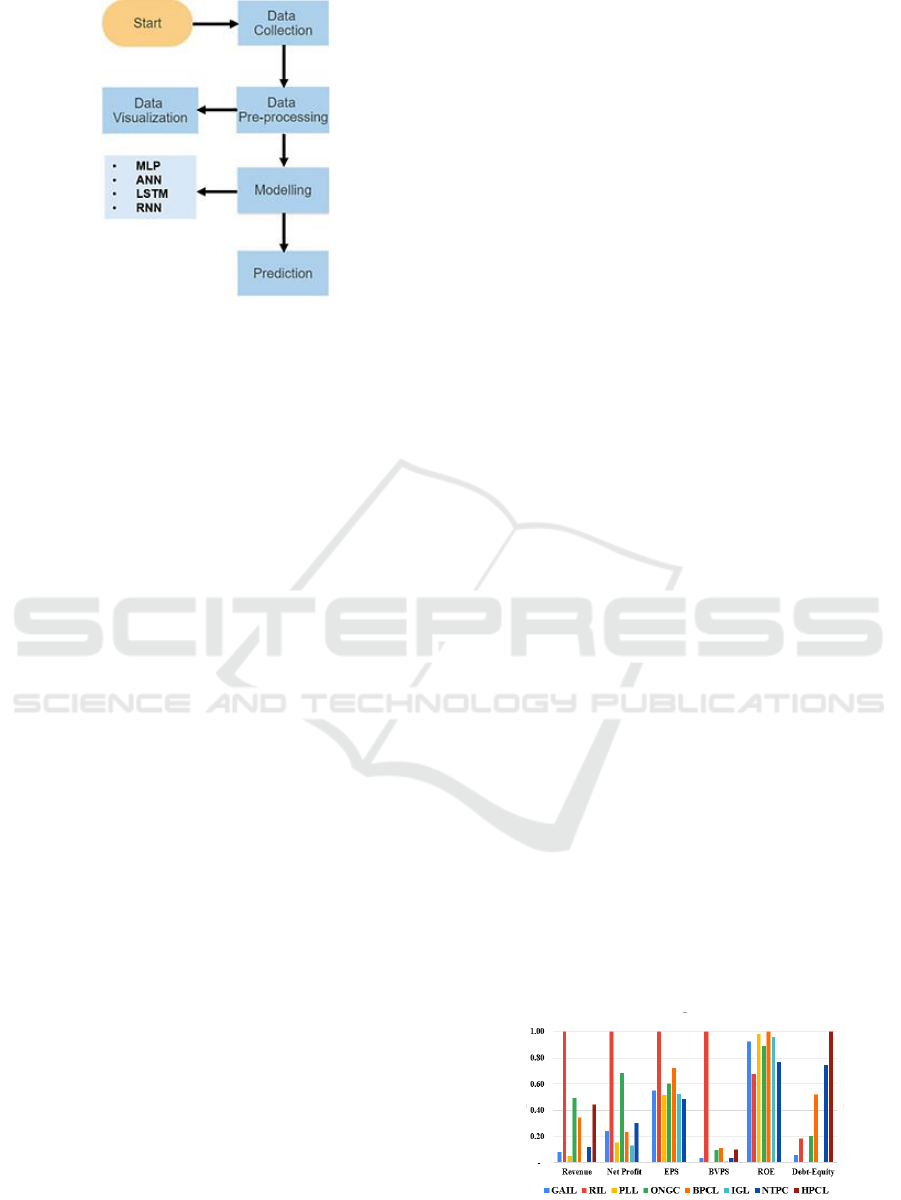

The researcher adopted an exploratory approach with

a comprehensive literature review to understand the

applicability of existing models like LSTM, ANN,

MLP, RNN, etc., to the research problem. The

following seven steps were applied to predict the

stock prices of the eight companies associated with

the NG value chain. Further, from these companies'

annual reports, the financial parameters like revenue,

net profit, EPS, BVPS, ROE, and Debt Equity ratio

were compared to plot the graphical trend for

visualizing their financial performance. The

methodology flow chart is in Figure 1.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

456

Figure 1: Methodology Flow Chart.

The seven steps are as under:

Step 1: Import the twelve Python libraries from

Google Colab applied to predict stock prices.

(i) Yahoo Finance gets

data

(ii) SweetViz

(iii) Matplotlib inline

(iv) NumPy

(v) Pandas

(vi) Seaborn

(vii) Matplotlib.pyplot

(viii) Plotly graph objects

(ix) TensorFlow

(x) Keras.models –

sequential, Model

(xi) Keras layers -

dense, LSTM,

SimpleRnn, Dense,

Dropout, Flatten,

Conc2D,

MaxPooling2D,

LeakyReLU

(xii) MLP Regressor

Step 2 Data Import: The data for the eight

companies were imported using the yahoo-finance

get data module with dates starting 1st Jan 2005 unto

14th May 2023 having one day time interval. The

Data consisted of seven attributes: Date, Open, High,

Low, Close, AdjClose (adjusted close), and

Volume(traded). The size of each company dataset

was 4546.

Step 3 Overview of the Data: SweetViz module was

used for obtaining statistical information about the

data.

Step 4 Data Cleaning: The data were cleaned by

removing null-valued entries/rows.

Step 5 Data Visualization: This section is divided

into two parts. Part one is the relation between all the

attributes, and Part two is the relation between

companies' stock values. Data Visualization was done

to display the relationship among attributes for a

company and the relationship between stocks of

different companies.

Step 6 Modelling: The modeling was done through

four techniques, namely ANN, LSTM, RNN, MLP,

by taking sixty data points at a time to predict the

sixty-first datapoint.

The ANN consists of one input layer and eleven

hidden layers. The number of neurons in each layer

was 1024, 512, 256, 128, 64, 32, 16, 8, 4, 2, and the

output layer had one neuron. The activation function

on each layer was LeakyRelu. The loss function was

mean squared error, and the optimizer Adam had a

learning rate of .01. The Number of epochs was fifty.

The Multi-Layer Perceptron model had an

activation function as Relu with 10x100 hidden layers.

The Recurrent Neural Network had one input

layer and three hidden layers. Activation for the first

three was LeakyRelu and the output layer's activation

was linear. The neurons in each layer were 1, 16, 4,

and 1. Optimizer used was Adam with a learning

rate .01 and loss function mean squared error. The

number of epochs was fifty.

The LSTM had seven layers, one input and six

hidden layers. The six hidden layers had three LSTM

layers and three dense layers. The loss function was a

mean squared error, and optimizer Adam with a

learning rate of .01 and number of epochs considered

was ten.

Step 7 Prediction: The model was tested with the

dataset of size 490. The results were plotted to make

the predictions against each model. Comparison

among the model was made based on the root mean

squared model.

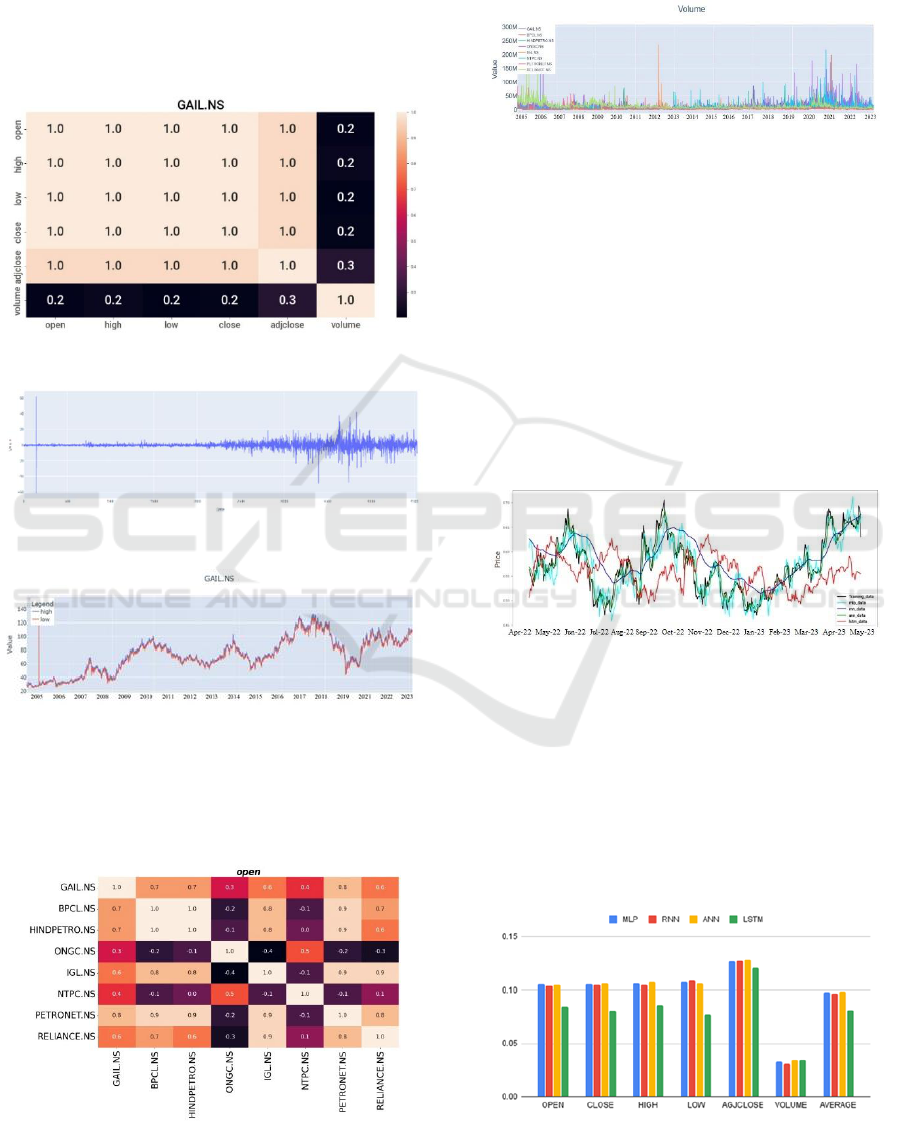

5 RESULTS

The researcher has discussed the various results

obtained through applying the four different models,

which interest prospective investors in assisting in

their decision-making during investment in any of

these companies' stock suiting their short or long-

term investment objectives. The financial

performance for FY 2021-22 plotted on a min-max

scale is shown in Figure 2. The relative comparison

reveals that the revenue, net profit, EPS and BVPS

are highest for RIL. The ROE and Debt-Equity are the

highest for BPCL and HPCL, respectively. The debt-

equity is negligible for PLL.

Figure 2: Financial Performance Trend.

Deep Learning Models for Stock Price Prediction of Companies Associated with Indian Natural Gas Value Chain Underpinning Their ESG

Commitments

457

Relation Between Attributes: The relationship

between attributes for each company was obtained

from seaborn and matplotlib modules. A few sample

figures are shown. Figure 3 is the correlation heat map

with all attributes for GAIL. Figure 4 is the residual

AdjClose value for BPCL. Figure 5 is the stock price

variability for GAIL. These plots help investors make

an informed decision by viewing the visual images.

Figure 3: Correlation heat map for GAIL.

Figure 4: Residual Adj-Close for BPCL.

Figure 5: Stock price variability for GAIL.

The relationship between company’s stocks is

represented using matplotlib.pyplot. Each attribute

has one image. Figure 6 shows the correlation of

opening stock prices between companies.

Figure 6: Correlation of opening stock prices.

Volume of stock traded for all companies from 1st

Jan 2005 till 14th May 2023 is plotted using the

Matplotlib.pyplot library in Figure 7. This provides

real-time stock price comparison to the investors.

Figure 7: Volume of Stock Traded.

The stock price prediction is shown in Figure 8,

plotted using Matplotlib. The pyplot model represents

the predicted opening stock price for GAIL from 10th

April 2022 to 14th May 2023. The Black line in the

image represents the actual opening stock price, the

Cyan line represents predicted values using MLP

model, the Dark blue line represents the predicted

values of the RNN model, the green line represents

the predictions of the ANN model, and the red

represents predicted values of the LSTM model. It is

seen that the LSTM model predicts the stock prices

with the least error since the predictions are very close

to the actual values.

Figure 8: Predicted opening stock prices for GAIL all

models.

The average RMSE of stock prices based on six

attributes is in Figure 9. The RMSE obtained from

MLP, RNN, and ANN models is very close and

higher compared to the LSTM model, where the value

is comparatively smaller. So, the application of the

LSTM model by prospective investors may provide

better results, positively impacting their decisions for

investment.

Figure 9: Average RMSE for all models on all attributes.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

458

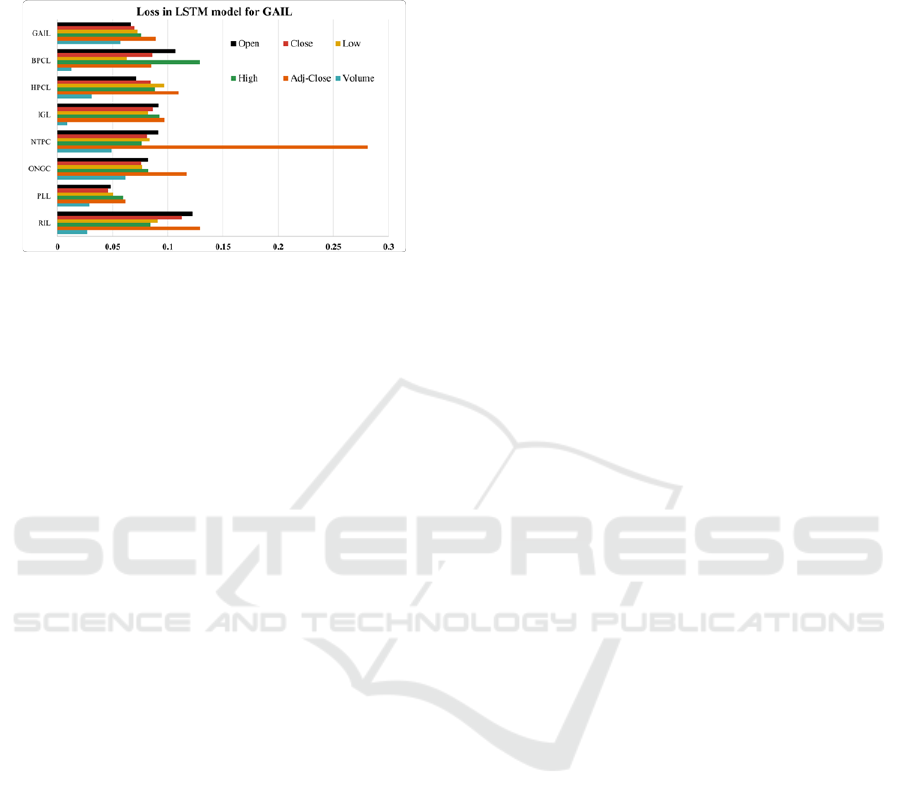

The Average of RMSE for LSTM model, which

provides the best prediction among all models, for all

companies is in Figure 10.

Figure 10: Average RMSE for LSTM Model.

6 DISCUSSION AND

CONCLUSIONS

Increasing awareness of climate change has driven

companies in the NG value chain to prioritize cleaner

energy consumption and lower carbon footprints,

aligning with investor preferences. This research

applied DL techniques to predict the stock prices of

eight Indian natural gas companies while considering

their ESG commitments. The study revealed that GAIL,

responsible for promoting SDG-7, exhibits relatively

steady stock prices despite environmental changes.

Additionally, RIL demonstrates the highest earnings

per share (EPS) in 2022, while BPCL exhibits the

highest return on equity (ROE). The LSTM model

outperforms other models in accuracy. The findings

surpass previous studies, highlighting practical

applications for prospective investors. DL models for

stock price prediction specifically applied to

companies associated with the Indian NG value chain

and their ESG commitments, hold significant practical

implications for real-world investors.

Individuals traditionally rely on various methods

to predict stock market movements, including

fundamental, technical, and sentiment analysis.

However, these conventional approaches often

struggle to capture financial markets' complex and

non-linear relationships. On the other hand, DL

models offer a more sophisticated and effective

solution for predicting stock market trends. These

models leverage the power of neural networks and

large-scale data processing capabilities to identify

intricate patterns and correlations that might not be

apparent to human analysts. These models utilize

large amounts of historical stock price data and

relevant ESG metrics to generate predictions about

future price movements. This information enables

investors to identify potential investment

opportunities aligned with their ESG commitment, as

it provides insights into companies' financial

performance and their adherence to ESG practices.

This provides a significant advantage to investors

seeking to anticipate market movements, enabling

them to make timely and informed investment

decisions, ultimately maximizing their potential

returns while minimizing risks associated with

uncertainty in the stock market. By leveraging these

models, investors gain access to advanced analytics

that can aid in making informed investment decisions.

Consequently, real-world investors can allocate their

capital in a manner that supports sustainable and

responsible business practices, aligning with their

values and contributing to a more socially and

environmentally conscious investment landscape.

The researcher found that the results obtained by

applying the ANN model provided an average RMSE

of 0.125, which is better than Vijh et al.,2020, which

showed an average RMSE of 1.528. Further, the

researcher used the 3-layer model with seven attributes

for input, including hidden and an output layer which

Vijh et al., 2020 did not use. The performance of

models in this research are better than Islam & Nguyen,

2020 that used ARIMA(0,2,1)0 model with an RMSE

of 0.14553. The researcher's model is also better than

Nikou et al., 2019 due to lower RMSE value of LSTM

model. Further comparing the results with Nikou et al.,

2019 where the RMSE value for LSTM was 0.3065, it

is seen that the current result RMSE value for LSTM is

0.090, which is better. Overall the current results are

better than previous findings offering higher reliability

and accuracy to prospective investors. The findings of

the research suggest that ESG-integrated companies

have outperformed their counterparts, indicating the

financial benefits related to ROE as also recommended

by Naeem et al., 2022. Further, results suggest that

ESG offers long-term value creation for the

shareholders, as also recommended by Zumente &

Bistrova, 2021. Since investors provide capital to

companies to expand and grow, resulting in surplus

funds to manage environmental concerns, companies

must give high importance to ESG performance to

attract global shareholders(Cornell & Shapiro, 2021).

This research paper addressed the need for accurate

stock price prediction in the context of companies

operating in the Indian NG sector. By incorporating

DL models, which have shown great promise in other

domains, the research provided enhanced predictive

capabilities for stock prices. Moreover, by

underpinning the analysis with ESG commitments, the

paper took a comprehensive approach to consider both

Deep Learning Models for Stock Price Prediction of Companies Associated with Indian Natural Gas Value Chain Underpinning Their ESG

Commitments

459

financial performance and sustainability factors, which

are increasingly influential in investment decision-

making while reducing investment risk(Hoepner et al.,

2017).

7 FUTURE WORK

Several researchers have recently applied different

models for predicting global companies' financial

performance and stock prices in diverse sectors. The

domain being contemporary, new applications with

accurate forecasting is the demand of end users.

Considering these, the researcher suggests future

work involving the following.

• Feature Engineering: Explore new techniques to

identify and extract relevant features the data. This

can provide additional insights and improve models'

performance.

• Applying Alternative Data Sources: An

Investigation to integrate alternate data sources to

capture second-period data. The Analysis will

provide unique perspectives to enhance model

prediction capabilities.

• Real-time Prediction: The Scope to develop models

conducting real-time prediction exists by streaming

real-time data using a fast interface algorithm.

• Interpretable and Explainable Models: Focus on

developing interpretable and explainable models that

can provide insights into the factors driving share

price predictions. This is particularly important for

regulatory compliance, risk management, and

gaining trust from investors and stakeholders.

• Robustness and Generalization: Enhance the

robustness and generalization capabilities of share

prediction models to handle various market

conditions, including market crashes, economic

downturns, or abnormal events. Investigate

techniques for model recalibration and adaptation to

changing market dynamics.

• Real-world Evaluation: Validate share prediction

models in real-world scenarios and compare their

performance against benchmarks and industry

standards. Conduct rigorous evaluation using

historical data and consider factors like transaction

costs, slippage, and trading volume impact.

REFERENCES

BP. (2022). BP Statistical Review of World Energy.

Cornell, B., & Shapiro, A. C. (2021). Corporate

stakeholders, corporate valuation and ESG. European

Financial Management, 27(2), 196–207.

https://doi.org/10.1111/eufm.12299

Edward, R., & Evan, M. (1990). Corporate governance: A

stakeholder interpretation. The Journal of Behavioral

Economics, 19(4), 337–359.

GAIL. (2022). GAIL (India) Limited, Sustainability Reports.

GAIL. https://www.gailonline.com/SBReports.html

Henisz, W., Koller, T., & Nuttall, R. (2019). Five ways that

ESG creates value. McKinsey Quarterly, November, 1–

12.

Hoepner, A. G. F., Oikonomou, I., Sautner, Z., Starks, L.

T., & Zhou, X. (2017). ESG Shareholder Engagement

and Downside Risk. SSRN Electronic Journal,

November. https://doi.org/10.2139/ssrn.2874252

Hu, Z., Zhao, Y., & Khushi, M. (2021). A survey of forex

and stock price prediction using deep learning. Applied

System Innovation, 4(1), 1–30.

https://doi.org/10.3390/ASI4010009

Islam, M. R., & Nguyen, N. (2020). Comparison of

Financial Models for Stock Price Prediction. Dmouj

2006. https://doi.org/10.3390/jrfm13080181

Kumbure, M. M., Lohrmann, C., Luukka, P., & Porras, J.

(2022). Machine learning techniques and data for stock

market forecasting: A literature review. Expert Systems

with Applications, 197(February), 116659.

https://doi.org/10.1016/j.eswa.2022.116659

MoEFCC. (2022). India’s Stand at COP-26. PIB, 1–2.

https://pib.gov.in/PressReleasePage.aspx?PRID=17950

71

MoPNG. (2023). Government has set target to increase share

of gas in energy mix up to 15 per cent by 2030. PIB.

Naeem, N., Cankaya, S., & Bildik, R. (2022). Does ESG

performance affect the financial performance of

environmentally sensitive industries? A comparison

between emerging and developed markets. Borsa

Istanbul Review, 22, S128–S140.

https://doi.org/10.1016/j.bir.2022.11.014

Nikou, M., Mansourfar, G., & Bagherzadeh, J. (2019). Stock

price prediction using DEEP learning algorithm and its

comparison with machine learning algorithms.

Intelligent Systems in Accounting, Finance and

Management, 26(4), 164–174.

https://doi.org/10.1002/isaf.1459

RIL. (2022). Business Responsibility Report. RIL.

http://www.ril.com/DownloadFiles/IRStatutory/Code-

of-Conduct.pdf

Sarangi, G. K. (2021). Resurgence of ESG Investments in

India: Towards a Sustainable Economy (No. 1284;

ADB Working Paper Series, Issue 1284).

www.adbi.org

Vijh, M., Chandola, D., Tikkiwal, V. A., & Kumar, A.

(2020). Stock Closing Price Prediction using Machine

Learning Techniques. Procedia Computer Science,

167(2019), 599–606.

https://doi.org/10.1016/j.procs.2020.03.326

Zumente, I., & Bistrova, J. (2021). Esg importance for long-

term shareholder value creation: Literature vs. practice.

Journal of Open Innovation: Technology, Market, and

Complexity, 7(2).

https://doi.org/10.3390/joitmc7020127

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

460