Determination of Amazon Stock Price Using Novel LASSO Algorithm

Comparing with Accuracy of Linear Regression Algorithm

P. H. Bhargav

*

and F. Mary Harin Fernandez

†

Department of Computer Science and Engineering, Saveetha School of Engineering, Saveetha Institute of Medical and

Technical Sciences, Saveetha University, Chennai, Tamil Nadu, India

Keywords: Amazon Stock Price, Novel LASSO, Linear Regression, Machine Learning, Price Prediction, Stock Market.

Abstract: This research sought to compare the efficacy of the Novel LASSO algorithm (Group 1) and the Linear

Regression algorithm (Group 2) in predicting Amazon's stock price, aiming to identify which technique offers

superior accuracy. The study was bifurcated into two groups, each comprising 10 samples, wherein each

group applied either the Novel LASSO technique or the Linear Regression algorithm to an extensive dataset

of Amazon's all-time stock prices. Sample sizes were calculated using ClinCalc software, setting α at 0.05

and a pretest power at 0.8. The results demonstrated that the Novel LASSO technique achieved a higher mean

accuracy of 85.31% compared to Linear Regression's 77.44%, a difference found to be statistically significant

(p=0.046). In summary, the Novel LASSO method outperformed the Linear Regression algorithm in

predicting stock prices.

1 INTRODUCTION

Stock price prediction involves using historical stock

price data to construct a model capable of forecasting

future prices (Ji, Wang, and Yan 2021). It requires the

analysis of various financial and economic indicators,

such as earnings per share, the price-to-earnings ratio,

and market trends, to discern patterns that might

indicate future stock prices. Such predictions are

valuable for multiple reasons (Schöneburg 1990). For

investors, predicting future stock prices accurately

can guide investment decisions. Companies also

value these predictions as indicators of their financial

health and performance. A myriad of factors, ranging

from financial performance and market conditions to

investor sentiment, can sway a company's stock price

(Hu, Zhao, and Khushi 2021). Numerous studies have

explored stock price prediction at the finance level,

with some harnessing ML and artificial intelligence

for forecasting, whilst others lean on traditional

statistical finance methods. Both investors, to guide

their investments, and companies, to gauge factors

affecting their stock value, use stock price predictions

(Obthong et al. 2020).

Research on predicting Amazon's stock price

currently sees an average of 50 articles published

*

Research Scholar

†

Research Guide, Corresponding Author

annually on IEEE Xplore and 800 on Science Direct

(Bayu Distiawan Trisedya.2015). One study utilised

neural networks' learning functions to process

financial data from the internet and then conduct

relevant stock data research (Yu and Yan 2020)

(Palanivelu et al. 2022). Another employed the

machine learning Linear Regression approach for

Amazon stock price prediction (J. A. Cook. 2018)

(Ramkumar G. et al. 2021). The significance of

machine learning in forecasting stock prices was

underscored by another study (Obthong et al. 2020).

A holistic method, inclusive of stock market dataset

pre-processing, diverse feature engineering

techniques, and a specialised deep learning algorithm

for stock market trend prediction, was proposed in

another study (Cakra, Yahya Eru 2015) (Vickram AS.

et al. 2021). The author's comprehensive evaluations

revealed their suggested solution's superiority,

attributed to their meticulous feature engineering

(Soni 2020).

Predicting stock closing prices presents

challenges and limitations (Matloob Khushi 2021).

Its objective is to leverage historical data and other

variables to anticipate a stock's future closing value,

which serves various purposes, from investment

decisions to strategy formulation. Given the stock

Bhargav, P. and Fernandez, F.

Determination of Amazon Stock Price Using Novel LASSO Algorithm Comparing with Accuracy of Linear Regression Algorithm.

DOI: 10.5220/0012518000003739

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Artificial Intelligence for Internet of Things: Accelerating Innovation in Industry and Consumer Electronics (AI4IoT 2023), pages 467-473

ISBN: 978-989-758-661-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

467

market's complexity and dynamism, influenced by

numerous factors, predicting future prices accurately

is arduous. Its inherent volatility further complicates

short-term predictions. This research aims to predict

Amazon's stock price using Novel LASSO and Linear

Regression techniques, comparing the data to

ascertain the most accurate method.

2 MATERIALS AND METHOD

The experiment was conducted at the Artificial

Intelligence Laboratory within the Saveetha School

of Engineering, Department of CSE, SIMATS. The

dataset titled "Amazon Stock Price (All Time)

Updated Microsoft Stock Price" was sourced from

[Kaggle](https://www.kaggle.com/datasets/kannan1

31/amazon-stock-price-all-time/code) and stored as a

`.csv` file comprising 10,486 data tuples, with the

intent of using the Novel LASSO technique for value

predictions.

In the proposed methodology, the data was both

trained and tested employing a Jupyter notebook. The

SPSS software was utilised to visualise forecasting

graphs, while G Power was employed to compute the

pretest for the algorithms, determining their likely

performance (Cleophas & Zwinderman, 2011).

The algorithm ran on a machine equipped with a

50 GB hard drive and 8 GB RAM, operating on a 64-

bit Windows OS.

2.1 Novel LASSO

The Novel LASSO is an advancement of the

regularisation technique applied in Linear Regression

(LR). This method acts to curtail the model's

complexity by penalising it for excessive feature

usage (Ranstam and Cook 2018). Within the Novel

LASSO, the LR model's objective function is

augmented to incorporate a penalty term, which is

directly proportional to the absolute values of the

model coefficients. This can cause certain

coefficients to be nullified, effectively excluding the

associated features from the model.

This yields a streamlined and more

comprehensible model with fewer features. For stock

price prediction, LASSO can be integrated into a

linear regression framework (Bhattacharjee and

Bhattacharja 2019). In such an application, it's

imperative to collate and preprocess data prior to

model training. This data encompasses financial

metrics like stock prices and volumes, supplemented

by pertinent indicators like economic trends and

corporate news.

Using the Novel LASSO, the most salient features

from this data pool can be identified, forming the

foundation for the linear regression model. Once

trained, the model is then poised to forecast future

stock prices.

2.2 Linear Regression

Linear regression statistically models the relationship

between a dependent variable and one or more

independent variables (Montgomery, Peck, and

Geoffrey Vining 2021). This method is termed 'linear'

based on the underlying assumption that the variables

share a linear correlation. Essentially, this means a

change in the dependent variable is associated with a

proportional change in the independent variables.

Linear regression serves several purposes, from

forecasting future values, delineating relationships

between variables, to pinpointing key variables

influencing specific outcomes. It's applicable for

stock price prediction by constructing a linear

regression model that projects stock prices based on

historical data (Cakra and Distiawan Trisedya 2015).

The initial step involves data collection and

preprocessing. Post-preprocessing, the relevant

predictor variables are selected. Once the model is set

up, it becomes instrumental in anticipating future

stock prices.

Procedure

Step 1: Take note of both dependent and independent

factors when collecting data.

Step 2: Clean, normalize, and divide data into

training and testing sets as part of the preprocessing

step.

Step 3: Select a model: Based on the variables, decide

between basic and multiple linear regression.

Step 4: Use Mean Squared Error (MSE) as the loss

function to define loss.

Step 5: Apply Gradient Descent to reduce MSE in

order to optimize coefficients.

Step 6: Train the model by utilizing training data to

iteratively change the coefficients.

Step 7: Evaluation: Model performance is evaluated

using testing data (MSE, R-squared, etc.).

Step 8: Interpret Coefficients: Examine coefficients

for correlations between variables.

Step 9: Predict: Use a trained model to provide

predictions.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

468

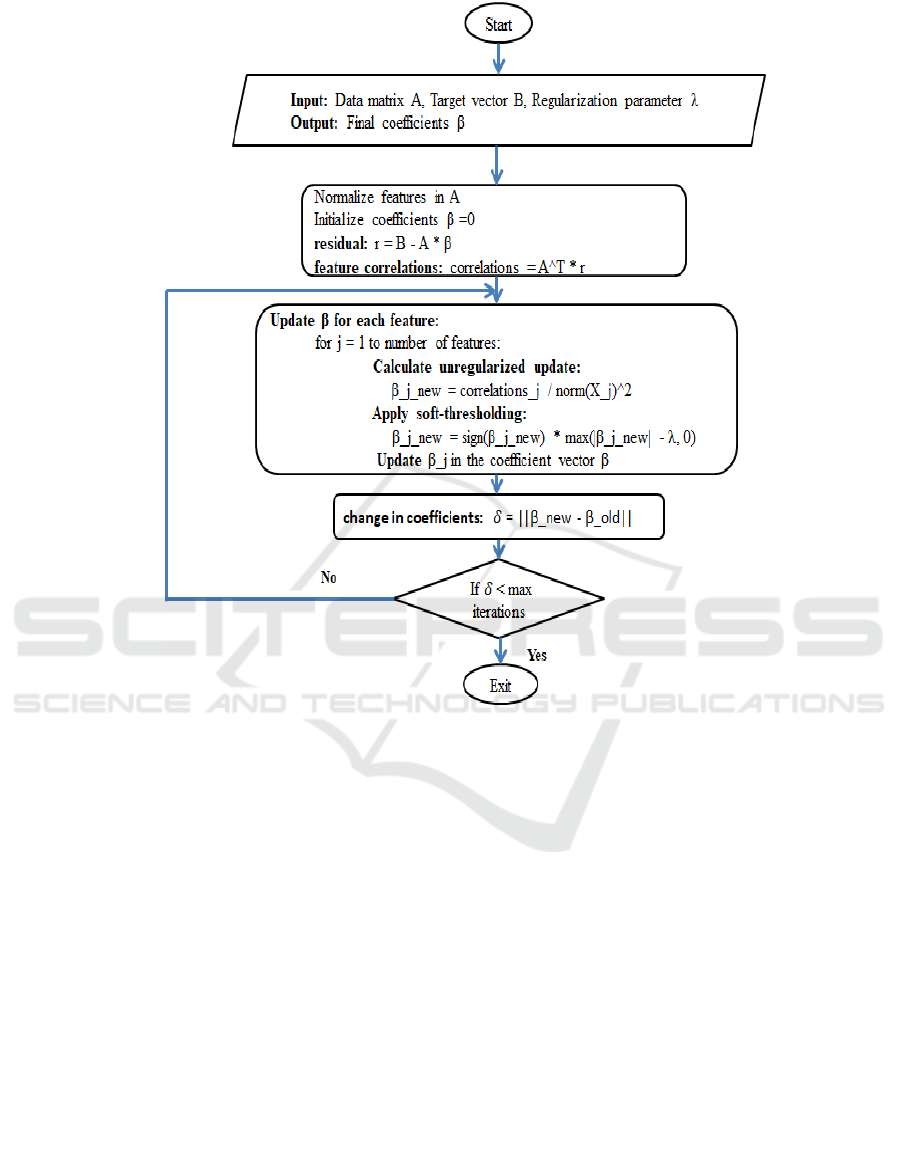

Figure 1: Flowchart.

3 STATISTICAL ANALYSIS

IBM SPSS Version 21 was utilised for the data

analysis (Zhang 2022). In this analysis, accuracy

served as the dependent variable, while the

independent variables comprised price, objects, low,

modulation, medium, and high. Iterations, capped at

10 samples, were conducted for both the proposed

and existing algorithms. For every iteration, the

predicted accuracy was recorded to analyse

performance. The data gathered from these iterations

was then subjected to the Independent Sample T-test

4 RESULT

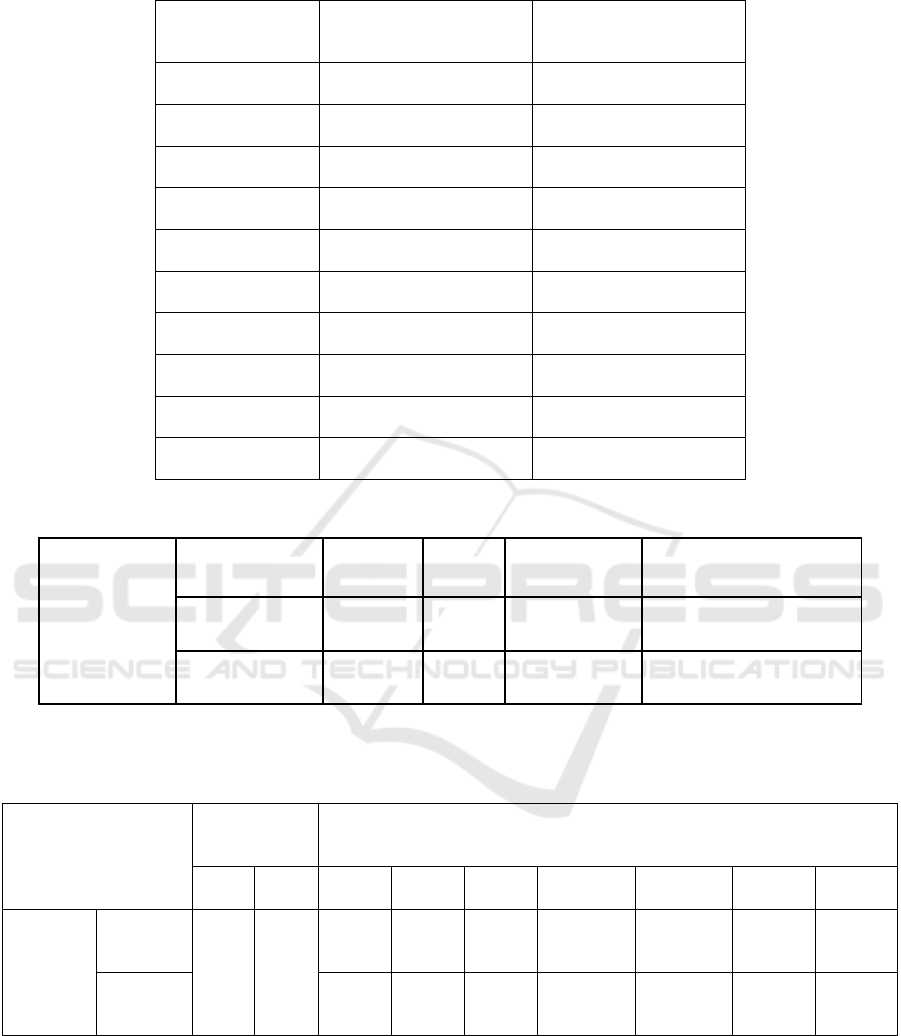

Table 1 details the accuracy analysis of features

extracted statistically from the data for training both

the Novel LASSO and Linear Regression algorithms.

The statistics extracted encompass the mean, standard

deviation, minimum, 25% quantile, 50% quantile,

75% quantile, and maximum.

As illustrated in Table 2, the LASSO technique

achieved an accuracy with a mean value of 85.31, a

standard deviation of 0.74162, and a mean standard

error of 0.23452. In contrast, the Linear Regression

method presented a mean of 77.44, standard deviation

of 0.73270, and a mean standard error of 0.23170.

Notably, the independent sample t-test from Table 3

produced a significance value below 0.046 (p<0.05),

affirming our hypothesis's validity.

Figure 2 displays the average accuracy in

forecasting Amazon's stock price via both the LASSO

and linear regression methods. The LASSO model's

mean accuracy stood at 85.31%, while the Linear

Regression's was 77.44%. Evidently, the LASSO

technique surpassed the Linear Regression in

performance.

Determination of Amazon Stock Price Using Novel LASSO Algorithm Comparing with Accuracy of Linear Regression Algorithm

469

Table 1: Accuracy Analysis of Novel LASSO and Linear Regression Algorithm.

Iterations

Novel LASSO Accuracy (%)

Linear Regression

Accuracy (%)

1

84.31

76.34

2

84.54

76.45

3

84.79

76.67

4

84.98

76.98

5

85.14

77.25

6

85.43

77.58

7

85.69

77.89

8

85.93

78.17

9

86.24

78.28

10

86.57

78.56

Table 2: Group Statistics Results for Novel LASSO and Linear Regression algorithms.

Accuracy

Group

N

Mean

Std. Deviation

Std. Error Mean

LASSO

10

85.3100

0.74162

0.23452

Linear Regression

10

77.4430

0.73270

0.23170

Table 3: Independent sample test for the determination of the standard error. Independent samples t-tests were used to obtain

the P-value, which was found to be 0.046, less than the 0.05 threshold for statistical significance. The 95% confidence

intervals were also calculated.

Levene’s test for

equality of

variances

T-test for equality means with 95% confidence interval

f

Sig.

t

df

Sig. (2-

tailed)

Mean

difference

Std.Error

difference

Lower

Upper

Accuracy

Equal

variances

Assumed

0.011

0.919

0.098

18

0.0461

0.13500

1.38137

-2.76714

3.03714

Equal

Variances

not Assumed

23.863

17.997

0.001

7.86700

0.32967

7.17437

8.55963

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

470

Figure 2: The mean accuracy of the LASSO method and linear regression are compared in a bar graph. A bar graph showing

the mean accuracy gain comparison between the LASSO method and Linear Regression. LASSO approach has a higher mean

precision than linear regression. Mean detection accuracy is +/- 2SD.

5 DISCUSSION

In the study under discussion, the LASSO algorithm

predicted Amazon's stock price with 85.31%

accuracy, whereas the linear regression method

achieved 77.44%. Using independent samples t-tests

for statistical analysis, a significant difference in the

accuracy of the two algorithms was identified, with a

value of 0.046 (p<0.05).

Predicting stock prices is a complex endeavour,

given the myriad factors like market conditions,

economic shifts, corporate performance, and investor

sentiment, all potentially influencing a stock's value

(Obthong et al. 2020). Despite the plethora of data,

many scholars agree that no single prediction model

can consistently forecast stock prices with complete

accuracy, given the multifarious variables at play

(Sen and Chaudhuri 2018). With myriad variables

affecting stock prices, any decision based on

predictions must be made judiciously, considering a

spectrum of possible outcomes. While linear

regression is beneficial for discerning relationships

between variables, it might be constrained in

capturing intricate relationships (Vijh et al. 2020).

Thus, there may be a need to adopt advanced

approaches, such as machine learning algorithms, for

heightened predictive accuracy. Like other

companies, Amazon's stock predictions are not

immune to market vagaries, which can impinge on the

precision and dependability of stock price forecasts

(Bhimani 2019). However, Amazon's continued

growth, forays into new domains like cloud

computing and digital advertising, offer a promising

future for stock price predictions (Siahaan and

Sianipar 2022). If Amazon sustains its innovation and

market expansion, it might well uphold or augment its

stock value (Ta 2020).

In conclusion, while Amazon's stock price

predictions carry inherent uncertainties, the

company's potential for growth remains intact. It's

essential to be cognisant of these uncertainties when

considering investments and to treat stock price

predictions as one among many decision-making

tools. Furthermore, seeking advice from financial

experts prior to investment decisions is always

prudent.

6 CONCLUSION

Predicting stock prices has always been a challenge

for analysts and investors alike. The complexity

arises from the numerous variables that can influence

a stock's price, ranging from a company's financial

performance to broader economic trends and even

investor sentiment. This study attempted to decipher

some of this complexity, specifically targeting

Amazon's stock price using two prediction models:

LASSO and Linear Regression. A deeper dive into

the results and surrounding contexts reveals several

points of note.

1. Model Complexity and Interpretability: LASSO's

regularization property aids in simplifying the

model by selecting only the most crucial features,

Determination of Amazon Stock Price Using Novel LASSO Algorithm Comparing with Accuracy of Linear Regression Algorithm

471

making it more interpretable. This contrasts with

Linear Regression, which might consider all

variables, potentially overcomplicating the model.

2. Feature Selection: LASSO inherently performs

feature selection. By introducing a penalty to the

absolute values of model coefficients, it reduces

some of them to zero, effectively removing less

important features, which might be beneficial in

stock price predictions where numerous variables

can influence the outcome.

3. Robustness Against Overfitting: LASSO tends to

be more resilient against overfitting compared to

traditional Linear Regression, especially in

scenarios where there's a risk of fitting the model

too closely to the training data. This is crucial in

stock price predictions, given the volatile nature of

stock markets.

4. Statistical Significance: The p-value of 0.0461

from the independent sample t-test is crucial as it

indicates a statistically significant difference

between the results of the two algorithms. This

adds weight to the conclusion that one method

might be superior to the other.

5. Future Applications: The results suggest that

LASSO might be a more suitable technique for

other stock price predictions or in scenarios with

vast amounts of data and numerous features. The

adaptability of LASSO to other complex

predictive scenarios warrants further exploration.

6. External Influences: It's crucial to understand that

while the LASSO algorithm shows higher

accuracy in this study, stock price prediction is

influenced by numerous external factors. Market

conditions, economic shifts, and company

performance, among other variables, will always

introduce an element of unpredictability.

In conclusion, while the mean accuracy of the

LASSO algorithm stands at 85.31% in predicting

Amazon's stock price, the Linear Regression

approach lags slightly with 77.44%. It becomes

evident that, in this context, LASSO seems to offer a

more accurate prediction model. The independent

sample t-test, backed by a p-value of 0.0461, further

solidifies the significance of this difference. Given

the insights, it's compelling to lean towards models

like LASSO when faced with multifaceted prediction

tasks such as stock price forecasting.

REFERENCES

Bhattacharjee, Indronil, and Pryonti Bhattacharja. 2019.

“Stock Price Prediction: A Comparative Study between

Traditional Statistical Approach and Machine Learning

Approach.” 4th International Conference on Electrical

Information and Communication Technology 1–6.

Bhimani, Shabbir. 2019. Right Stock at Right Price for

Right Time. Independently Published.

Cakra, Yahya Eru, and Bayu Distiawan Trisedya. 2015.

“Stock Price Prediction Using Linear Regression Based

on Sentiment Analysis.” In 2015 International

Conference on Advanced Computer Science and

Information Systems (ICACSIS), 147–54.

Cleophas, Ton J., and Aeilko H. Zwinderman. 2011.

Statistical Analysis of Clinical Data on a Pocket

Calculator: Statistics on a Pocket Calculator. Springer

Science & Business Media.

Hu, Zexin, Yiqi Zhao, and Matloob Khushi. 2021. “A

Survey of Forex and Stock Price Prediction Using Deep

Learning.” Applied System Innovation 4 (1): 9.

Ji, Xuan, Jiachen Wang, and Zhijun Yan. 2021. “A Stock

Price Prediction Method Based on Deep Learning

Technology.” International Journal of Crowd Science 5

(1): 55–72.

Kishore Kumar, M. Aeri, A. Grover, J. Agarwal, P. Kumar,

and T. Raghu, “Secured supply chain management

system for fisheries through IoT,” Meas. Sensors, vol.

25, no. August 2022, p. 100632, 2023, doi:

10.1016/j.measen.2022.100632.

Montgomery, Douglas C., Elizabeth A. Peck, and G.

Geoffrey Vining. 2021. Introduction to Linear

Regression Analysis. John Wiley & Sons.

Obthong, Mehtabhorn, Nongnuch Tantisantiwong,

Watthanasak Jeamwatthanachai, and Gary Wills. 2020.

“A Survey on Machine Learning for Stock Price

Prediction: Algorithms and Techniques.” In , 9.

Palanivelu, J., Thanigaivel, S., Vickram, S., Dey, N.,

Mihaylova, D., & Desseva, I. (2022). Probiotics in

functional foods: survival assessment and approaches

for improved viability. Applied Sciences, 12(1), 455.

Ramkumar, G. et al. (2021). “An Unconventional Approach

for Analyzing the Mechanical Properties of Natural

Fiber Composite Using Convolutional Neural

Network” Advances in Materials Science and

Engineering vol. 2021, Article ID 5450935, 15 pages,

2021. https://doi.org/10.1155/2021/5450935

Ranstam, J., and J. A. Cook. 2018. “LASSO Regression.”

The British Journal of Surgery 105 (10): 1348–1348.

Schöneburg, E. 1990. “Stock Price Prediction Using Neural

Networks: A Project Report.” Neurocomputing 2 (1):

17–27.

Sen, J., and T. D. Chaudhuri. 2018. “Stock Price Prediction

Using Machine Learning and Deep Learning

Frameworks.” On Business Analytics and Intelligence.

https://www.academia.edu/download/57743652/ICBA

I_2018_Final_Paper.pdf.

Siahaan, Vivian, And Rismon Hasiholan Sianipar. 2022.

Amazon Stock Price: Visualization, Forecasting, And

Prediction Using Machine Learning with Python Gui.

Balige Publishing.

Soni, Vishal Dineshkumar. 2020. Prediction of Stock

Market Values Using Artificial Intelligence.

Ta, Ton Viet. 2020. Price-Forecasting Models for Amazon

Inc AMZN Stock.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

472

Vickram, A. S., Srikumar, P. S., Srinivasan, S., Jeyanthi, P.,

Anbarasu, K., Thanigaivel, S., ... & Rohini, K. (2021).

Seminal exosomes–an important biological marker for

various disorders and syndrome in human reproduction.

Saudi journal of biological sciences, 28(6), 3607-3615.

Vijh, Mehar, Deeksha Chandola, Vinay Anand Tikkiwal,

and Arun Kumar. 2020. “Stock Closing Price

Prediction Using Machine Learning Techniques.”

Procedia Computer Science 167 (January): 599–606.

V. P. Parandhaman, "An Automated Efficient and Robust

Scheme in Payment Protocol Using the Internet of

Things," 2023 Eighth International Conference on

Science Technology Engineering and Mathematics

(ICONSTEM), Chennai, India, 2023, pp. 1-5, doi:

10.1109/ICONSTEM56934.2023.10142797.

Yu, Pengfei, and Xuesong Yan. 2020. “Stock Price

Prediction Based on Deep Neural Networks.” Neural

Computing & Applications 32 (6): 1609–28.

Zhang, Haorui. 2022. “Stock Price Prediction Using Linear

Regression and LSTM Neural Network.” 2022

International Conference on Machine Learning and

Intelligent Systems Engineering (MLISE).

https://doi.org/10.1109/mlise57402.2022.00043.

Determination of Amazon Stock Price Using Novel LASSO Algorithm Comparing with Accuracy of Linear Regression Algorithm

473