Money Scripts and Financial Behaviour Among Millennials in India

Tushar Soubhari

1

, Sudhansu Sekhar Nanda

2

, Sreesha C. H.

1

and Sthitipragyan Biswal

3

1

University of Calicut, Kerala, India

2

Kirloskar Institute of Management, Harihar, Karnataka, India

3

ASTHA School of Management, Bhubaneswar, Odisha, India

Keywords: Money Scripts, Financial Behaviour, Millennials, Money Avoidance, Money Worship, Money Status, Money

Vigilance.

Abstract: The purpose of this paper is to understand the concept, of “Money Scripts” and evaluate the different types

of financial behaviour by measuring the relationship strength among the factors contributing to Money

Scripts/ Beliefs among Millennials in India. The primary data was collected based on the standardised

Klontz’s Money Script Inventory; based on a set of seventy-two questions categorised under four independent

factorial heads- Avoidance, Adoration, Status, and Constant Money Monitoring; obtained from two hundred

and thirty-five respondents approximately. The common space between the variables was examined based on

Multidimensional Scaling. Among the factors considered contributing to the Money Scripts of Millennials,

‘Money Scripts’ were highly and positively correlated with ‘Money Status’. There were no significant

associations identified between Money Scripts and the demographic variables (age, gender, income level and

occupation) of millennials in India. ‘Money Avoiders’ were found moving too far distances, experiencing

high levels of financial happiness and moderate frugality in savings. Both ‘Money Status’ and ‘Money

Vigilance’ type millennials were found very strange in their approach toward money actions. Persons with

high ‘status’ type behaviour were longing not to save more, but looking for comforting themselves in the

present moment. They were found deriving ‘financial happiness’ from their spending pattern and savings

made, which was much better than those of ‘Vigilant’ Millennials. Those with ‘Money Worship’ thoughts,

though good at saving high; were found the least to derive financial happiness.

1 INTRODUCTION

Financial decisions form an integral part of an

individual’s life, which is considered to be an

outcome of one’s own perceptions (belief system,

values, culture), attitudes, personality, readiness to

learn, and drive towards innovation. The Millennials

are those who were born between 1981 and 1996,

falling into the age group of 26-41 years at present.

“Money Scripts” are unconscious or unwritten rules

dictating our financial well-being. It demonstrates an

individual’s belief system about money;

illuminating

both good and bad financial habits nurtured in life.

Klontz (2011) classified the term, “Money Scripts”

into

four different belief systems, namely- (a) Money

Avoidance is a

fascinating paradox where someone

assumes that money is tainted, but can also solve their

problems. Clinging on to this script brings no thinking

about money, ignoring financial statements and

struggling to stick to their budget. Millennials with a

“Money Avoidance”- script type tends to give away

more money than they have (whether for family,

friends or charities); unconsciously decreasing their

worth. (b) The next category includes Money

Worship, in which people of such a mindset believe

that Money is the end goal. Questing to accumulate

wealth as rapidly as possible, they do find not enough

money to meet their ever-changing needs. Millennials

of this script type buy new things to bring a sense of

happiness, purpose and meaning to life. Sometimes,

this trait could prove fatal if unobserved because of

which millennials’ life could be indebted and turn

miserable. (c) Money Status means exactly the money

script epitomizing the “Keeping Up with the Joneses”

mentality. Millennials of such type lavishly

overspend; maintaining a lifestyle which they cannot

afford to impress others surrounding them. They face

situations of “Lifestyle-Inflation” crisis,

compromising their ability to save for their future.

People with the intention of ‘Money Status’ believe

to live a good life to impress others and make others

feel that they are good. (d) Money Vigilance refers to

thoughts where, Millennials with such scripts tend to

932

Soubhari, T., Nanda, S., C. H., S. and Biswal, S.

Money Scripts and Financial Behaviour Among Millennials in India.

DOI: 10.5220/0012530000003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 932-936

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Figure 1: Literature mapping.

approach their financial lives more practically,

logically and thoughtfully. Such people view money

as a by-product of their hard work, discipline and

frugality. Neil Howe and William Strauss coined the

word "Millennial" in their landmark book

"Generations" in 1991. The following hypotheses

were developed in light of the study's aims:

H

1

: Money Scripts of millennial investors are

dependent on their demographic variables.

H

2

: Factors contributing to Money Scripts are

significantly correlated.

1.1 Review of Literature

Conforming to the social learning hypothesis

(Bandura, 1977), people's attitudes towards money

are formed from childhood and persist into adulthood

(Furnham, 1996; Kirkcaldy &Furnham, 1994).

Money scripts, which Klontz and Klontz (2009)

define as people's beliefs about money, (a) are formed

during early development, (b) are commonly

transmitted within families, (c) are typically

unconscious, (d) are bound to specific contexts, and

(e) are a major motivator of various financial

behaviours. Children's attempts to understand the role

that money plays in their own lives, the lives of their

families, and the lives of their communities and the

world at large may be dramatically impacted by

emotionally charged "financial flashpoint" events, as

proposed by the authors. Money difficulties, as we've

seen, often have their roots in money scripts, and

when those scripts are tied to emotionally charged or

traumatic events, they can be very difficult to change

(Klontz & Klontz). Using Research Rabbit software,

the literature discussed above was mapped in the form

of a network diagram with nodes representing the

related cited and co-cited works of different authors.

The nodes separated aside with no nodes represent the

research gap being depicted for this study. This is

shown below figure.

2 METHODOLOGY OF THE

STUDY

Population: According to the news article written by

Sharms (2021) in the Times of India, Millennials

account for nearly thirty-four per cent of the total

Indian population (nearly 460 million). The study

population included Millennials from North, South,

East and Western parts of India.

Sample and Sample Unit: Samples selected for the

study included only 235 respondents; who were in the

Money Scripts and Financial Behaviour Among Millennials in India

933

age group between 21-40 years (called Millennials).

Sample selection was made on the basis of Multi-

stage random sampling; wherein the top 7 metro and

smart cities (Delhi, Bengaluru, Kolkata, Chennai,

Hyderabad, Mysuru and Kochi) were identified on

the basis of employment prospects, cost of living and

quality of life of the Millennials.

Scope of the Study. This study focuses on Indian

members of the Millennial age. All money belief

items were coded on a six-point Likert-type scale, and

in this study, we analyse Millennials' money scripts

by examining their responses to the Money Script

items from the standardised Klontz-Money Script

Inventory. The statements were organised into four

categories based on the 72 money ideas that were

identified for the study: Avoidance (a), Adoration (b),

Status (c), and Suspicion (d) all pertain to one's

relationship with money.

Tools for Data Collection. The study was conducted

by Klontz, Britt, Mentzer, and Klontz (2011) on the

basis of seventy-two statements framed in the

standardised questionnaire developed by Klontz’s

Money Script Inventory (KMSI); which was further

revised by Taylor, Klontz and Britt (2015) and the

scale was renamed as “KMSI-Revised”.

The data in this study was analysed and

interpreted by using a number of different SPSS

statistical analysis methods. The sample data was

analysed using mean value, variance, standard

deviation, and reliability analysis, and several tables

were created to display the results. Analysing the

factors that contribute to the consistency of a

measurement scale is the focus of reliability analysis.

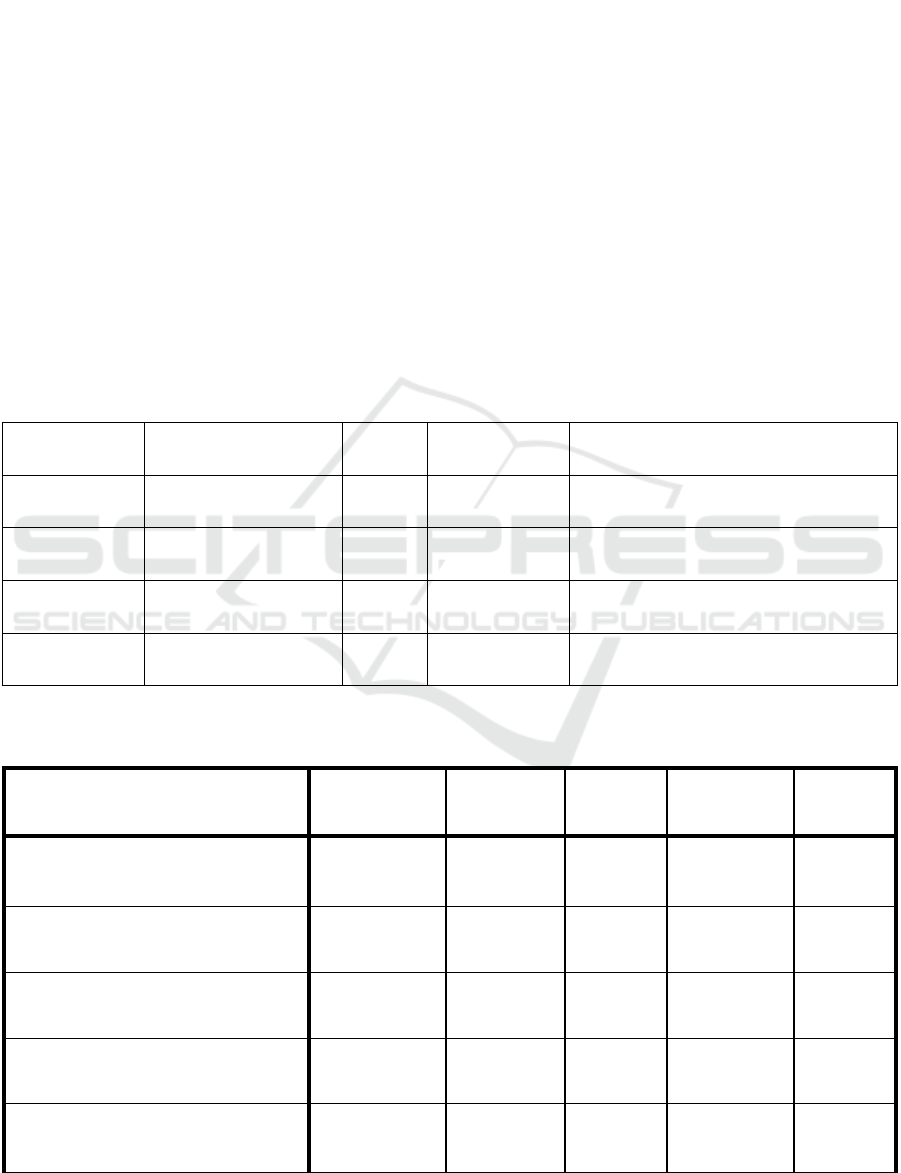

Table 1 shows Chi-Square test summary results for the Association between Demographic Variables and Money Scripts of

Millennials.

Chi-Square Tests

Demographic

Variables

Pearson Chi-Square

Value

df Asymp. Sig.

(2-sided)

Result

Age 103.187 97 .315

Not Significant (more than 5% level

of si

g

nificance)

Gender 191.639 194 .534

Not Significant (more than 5% level

of si

g

nificance)

Income 332.058 388 .982

Not Significant (more than 5% level

of si

g

nificance)

Occupation 276.808 291 .716

Not Significant (more than 5% level

of si

g

nificance)

Test of Correlation between factors contributing to Money Scripts among Millennials

Table 2 shows Correlation Matrix studying the Relationship Strength of factors contributing to Money Scripts

Money

Avoidance

Money

Worship

Money

Status

Money

Vi

g

ilance

Money

Scripts

Money

Avoidance

Pearson Correlation

Si

g

. (2-tailed)

Money

Worship

Pearson Correlation .387

Si

g

. (2-tailed) .000**

Money

Status

Pearson Correlation .553 .832

Si

g

. (2-tailed) .000** .000**

Money

Vi

g

ilance

Pearson Correlation .511 .782 .946

Si

g

. (2-tailed) .000** .000** .000**

Money

Scripts

Pearson Correlation .687 .864 .969 .945

Si

g

. (2-tailed) .000** .000** .000** .000**

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

934

2.1 Data Analysis and Interpretation-

Reliability of the Scale

Cronbach's alpha revealed an impressively high level

of reliability and internal consistency for the

approximated test, with a total value of 0.890. If the

value is greater than 0.70, then the latent variables

being measured by the selected items are indeed

being measured by those items. (Nunally, 1978).

3 FINDINGS FROM THE STUDY

Based on the four demographic variables, none of

them stand to be significantly associated with the

money scripts of the respondents since, their p-values

are respectively more than 5% level of significance.

Among the four Money Scripts being studied,

‘Money Avoidance’ is an independent factor

positively correlated with a higher score. The relative

higher scores in Money Status prioritize outward

displays of wealth. The Millennials’ tendencies

towards money for status, and prestige value are

directly proportional to their Money scripts/ beliefs.

There is a slight difference in the positive correlation

among the relationship between ‘Money Scripts and

Money Status’ and ‘Money Scripts and Money

Vigilance’. Not many millennials are looking forward

to sacrificing their benefits in mere future at the cost

of huge expenditures. They believe to be known for

their spending rather than savings or social services.

Perhaps, the persons opting for status may sometimes

avoid their unnecessary spending; rather focussing on

their uncertain future. The correlation between

‘Money Worship and Money Scripts’ is on par with

the relation between ‘Money Worship and Money

Status’. Millennials’ attitude towards ‘keeping money

sacred and for a worthy future’ decides their long-

term financial security. The strong relationship is

expressed between them since millennials value

‘becoming more mindful’ in their spending style;

which is in part to their thoughts on scaling life with

social status.

3.1 Implications and Scope for Future

Research

This study highlights the money beliefs and script

patterns of Millennials in India. If anyone has been

identified with one financial archetype, it does not

mean that such a personality could not be changed.

Rather, efforts when taken to keep track of one’s

thoughts could help to rewrite their script and

establish a healthy relationship with money. In the

future, the research gap lies in chunking these four

main independent variables with new concepts and

decluttering unnecessary statements in the

questionnaire and improvising in the Indian present

context. Besides this, the research gap paving way for

future research in this area lies in understanding the

fact that such money scripts when once understood

and efforts taken to correct them; could lead to

financial well-being. Such an ‘Alpha’ framework

needs to be modelled for behavioural changes that

could practically help financial advisors sort out the

financial problems of their investor clients. This is the

need of the next hour.

4 CONCLUSION

Individuals' spending and saving habits are often

guided by "Money Scripts," which are often

unconscious and passed down from previous

generations. Millennials' wealth, income, occupation,

gender, and revolving credit balances are all linked to

these script patterns. Financial adultery, compulsive

buying and hoarding, excessive gambling, and so on

are only some of the money disorders that can be

predicted with theirguidance. Once the script is

identified, then it can be challenged and changed to

interrupt their destructive financial patterns by

promoting financial soundness and thereby, financial

well-being. When Money Scripts are camouflaged by

intense emotions, then it leads to resistance towards

change. Being able to diagnose one’s own cognitive

or emotional biases is the key to identifying the

money scripts; helping financial advisors to schedule

a financial plan for review and developing treatments

and financial interventions leading to the well-being

of Millennials.

REFERENCES

Bandura, A. (1977), Social Learning Theory. General

Learning Press, New York, NY.

http://www.asecib.ase.ro/mps/Bandura_SocialLearnin

gTheory.pdf

Cronbach, L. J. (1951), Coefficient alpha and the internal

structure of tests, Psychometrika, Vol. 16, No. 3, pp.

297-334.https://doi.org/10.1007/BF02310555

Furnham, A, Kirckaldy, B.D. & Lynn, R (1994), National

Attitudes to Competitiveness, Money, and Work

Among Young People: First, Second, and Third World

Differences, Human Relations, SAGE Publications,

Vol. 47, No.1, pp. 119-132.

Money Scripts and Financial Behaviour Among Millennials in India

935

Goldberg, H., & Lewis, R. T. (1978), Money madness: The

psychology of saving, spending, loving, and hating

money, William Morrow and Company, Inc., New

York, NY. https://doi.org/10.1177/2167696812466842

Kessel, Brent (2016), ‘Summary of Brent Kessel’s Eight

Money Archetypes’, available at https://bristol-

buddhist-centre.org/wp-

content/uploads/2016/06/Money-Archetypes-

overviewPDF-1.pdf (accessed 15 August 2020).

Kessel, Brent & Sherman, Spencer. D. (2008), Financial

Archetypes, Sounds True, Louisville, LOU.

Klontz, B, Brit, S.L., Mentzer, J., Klontz, T., (2011), Money

Beliefs and Financial Behaviors: Development of the

Klontz Money Script Inventory, Journal of Financial

Therapy, Financial Therapy Association, Vol. 2, No.1,

pp. 1-22. ISSN: 1945-7774. Also available at

DOI:10.4148/jft.v2i1.451

Klontz, B., Klontz, T., &Kahler, R. (2008), Wired for

wealth: Change the money mindsets that keep you

trapped and unleash your wealth potential, Health

Communications, Inc., Deerfield Beach, FL.

Nunnally, J. C. (1978), Psychometric theory (2nd ed.),

McGraw-Hill, New York, NY.

Prensky, Marc (2001), The Death of Command and

Control? Strategic News Service LLC, USA. ISSN

1093-8494. https://marcprensky.com/writing/Prensky-

SNS-01-20-04.pdf

Strauss, William & Howe, Neil (2009), The Fourth

Turning: What the Cycles of History Tell Us About

America's Next Rendezvous with Destiny, Crown,

USA.

Tang,T.L. (1992), The meaning of money revisited, Journal

of Organizational Behavior, Vol. 13, No. 2, pp. 197-

202.

Taylor, Klontz and Lutter (2016), Reliability and

Convergent Validity of the Klontz Money Script

Inventory-Revised, Journal of Financial Therapy, New

Prairie Press, Vol.6, No.2, pp. 1-13.

DOI:10.4148/1944-9771.1100

Yamauchi, K.T., & Templer, D.J. (1982), The development

of a money attitude scale, Journal of Personality

Assessment, Vol. 46, No. 5, pp. 522-528.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

936