Tax Consultant Competency in the Digital Era

Sihar Tambun, Kiko Armenita Julito, Robiur Rahmat Putra and Agnes Do Parago

Universitas 17 Agustus 1945 Jakarta, Jl. Sunter Permai Raya, North Jakarta, Indonesia

Keywords: Digital Era, Tax Competency, Tax Consultant, NVivo.

Abstract:

This research aims to obtain concepts and information about what competencies are needed by a tax consultant

if he wants to become a tax consultant in the era of digitalization. The research data sources are online news,

YouTube, and research articles for 3 years, specifically from 2021 to 2023. Data sources are selected based

on credibility and suitability of the data to the problem being studied. Data processing uses NVivo 12 Plus

software. There are four stages of data processing, the data input process, coding process, visualization

process, and conclusion determination process. Coding validity was evaluated using a triangulation approach.

The research results obtained five competency points needed by tax consultants in the era of digitalization.

First, understand the tax rules well. Second, being able to provide education on tax digitalization to clients.

Third, it can improve the quality of human resources in the taxation sector. Fourth, be able to adapt to tax

digitalization. Fifth, being able to implement tax regulations in various organizations and companies. The

implications of the research results can be used by tax consultants or prospective tax consultants in the future.

If you want to work as a tax consultant, it is recommended that you master these five competencies. For

prospective tax consultant students, these five competencies can be equipped and prepared now. With these

five competencies, it is hoped that they can become capital to become superior tax consultants in the era of

digitalization in the future.

1

INTRODUCTION

The tax consultant profession has a very important

role in every country, including in Indonesia. Until

now, the tax role in Indonesia is used to fund more

than 70% of the state budget. This fact proves how

important the competence of a tax consultant is, to

help individual and corporate tax governance. As of

March 2023, the Indonesian Tax Consultants

Association has 6,685 certified members, consisting

of 5,301 who already have a practice license and

1,384 who are in the process of applying for a practice

license (IKPI, 2022). The number of tax consultants

is relatively small compared to Indonesia's population

of around 270 million. Japan with a population of 120

million, has 80,000 tax consultants (Srinadi, 2023).

Moreover, we have entered the era of digitalization,

where the transaction process will be faster and in

large quantities. Of course, qualified competence is

needed and able to solve tax problems related to

digital transactions. These facts and phenomena raise

one research question in this study, what

competencies are needed by tax consultants in today's

digital era.

Previous research achievements related to this

research include Diller et al. (2020) which states that

tax professionals must always update competencies in

accordance with business developments and the

development of government regulations related to

taxation. And if the level of compliance of taxpayers

can be known quantitatively, then it is not the case

with the level of public trust and integrity of the tax

apparatus which is also the target of achieving tax

administration modernization which shows the

success of tax reform.

This can be seen from the statement of the

Ministry of Finance of the Republic of Indonesia

(Kemenkeu) which uses public sector achievement

indicators released by the Organization for Economic

Cooperation and Development (OECD) to determine

the level of public confidence in government

performance. This achievement is far above other

developed OECD member countries such as the

United States which has a public trust value of 30%,

the United Kingdom at 31%, Germany at 55%, and

France at 28%; and above developing countries that

are not members of the OECD such as India which

has a public trust value of 78%, Brazil at 26%, and

Tambun, S., Julito, K., Putra, R. and Parago, A.

Tax Consultant Competency in the Digital Era.

DOI: 10.5220/0012581700003821

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Seminar and Call for Paper (ISCP UTA ’45 JAKARTA 2023), pages 325-330

ISBN: 978-989-758-691-0; ISSN: 2828-853X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

325

South Africa at 48% (Ministry of Finance of the

Republic of Indonesia, 2018) (Narsa I Made &, n.d.).

The difference between this research and previous

research lies in the problem studied and the resulting

research output. No studies have yet examined this

topic. The research output is in the form of coding

visualization images that are used as a basis for

determining conclusions or answers to research

questions. The uniqueness of this study uses data

processed from various sources on the internet. The

coding created comes from various sources, such as

online news, YouTube, and research articles, where

there are no research topics that use this data source.

This research produces details of competencies

needed by a tax consultant in the digital era, where

these competencies are confirmed from various

sources and their validity is tested using a

triangulation approach.

The purpose of this study is to get answers to

research questions. To get the concept of

competencies needed by tax consultants in the digital

era. The concept of competence of a tax consultant is

detailed and structured. Concepts are formed from

various sources, which are then carried out coding

processes and form detailed and systematic concepts.

This research will produce the concept of competence

and can be used by professionals in the tax field to

improve their competence. Until the research is

completed, there are no competency standards

standardized by professional organizations in the

field of tax consultants, related to competency

standards in the field of taxation in the digital era.

The benefits of this research can help practitioners

in the field of taxation as a reference source for

competencies that need to be improved. Professional

organizations can also use the information from this

research as a basis for organizing training needed in

the era of digitalization. Including compiling

standardized or required competency standards if you

want to practice in the field of taxation in the digital

era. Another benefit is for universities that organize

tax accounting study programs. The results of research

are very useful to assist the preparation of curriculum

or learning materials, so that the competencies

produced by are in accordance with current

developments. Especially mastery of taxation aspects

and their application in the era of business

digitalization and digitalization of transaction records.

2

LITERATUR REVIEW

Competency is the work ability of each individual

which includes aspects of knowledge, skills, and

work attitudes that are in accordance with the

expected standardization (Li et al., 2022). Another

definition states that competence is something related

to an individual's ability and skills to achieve the

expected results (Basilotta et al., 2022). According to

Spencer & Spencer (2008), competence consists of

five characteristics. First, skills are the ability to plan,

accuracy, the ability to lead, the ability to work

together in groups accompanied by the ability in

accordance with intellectual, emotional, and social

intelligence in planning, leading with accuracy, the

ability to cooperate in groups. Second, purpose or

motivation is something in which a person

consistently thinks that he acts. adding that motives

are drive, direct, and select behavior toward certain

actions or goals and away from others. For example,

a person who has achievement motivation

consistently develops goals that challenge himself

and takes full responsibility for achieving those goals

and expects feedback to improve himself. Third, traits

are dispositions that make people behave or how

someone responds to something in a certain way. For

example, confidence, self-control, fortitude, or

endurance. Fourth, attitude is the attitude and values

that a person has. Attitudes and values are measured

through tests to respondents to find out the value a

person has and what attracts someone to do

something. Fifth, knowledge is the information that a

person has for a particular field. Knowledge is a

complex competency. Knowledge tests measure a

participant's ability to choose the most correct answer

but cannot see if someone can do the job based on the

knowledge they have.

Tax consultant is a person who provides tax

consulting services to taxpayers in order to exercise

their rights and fulfill their tax obligations in

accordance with tax laws and regulations (Apostol &;

Pop, 2019). Tax consultant competencies are the

skills possessed, which are used to carry out the

profession. The competencies possessed by

professionals in the field of taxation must always be

improved and adjusted to the needs in the world of

practice in various types of organizations or

companies (Diller et al., 2020).

(Hermina, 2022)

3

METHODS

This study used qualitative research methods using a

systematic literature review approach. The literature

studied does not only come from research articles, but

from several sources obtained online. The processed

data sources come from YouTube, online news,

research articles, and from other social media. Data

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

326

sources must come from credible sources, both

YouTube channels, online news, and other sources.

Data is searched using keywords that match the

research question. The consideration of using these

data is due to the availability of adequate data on the

internet and can be accessed easily (Hafidhah &;

Yandari, 2021). The selected data samples are data

published for the last three years, specifically from

2021 to 2023. The data processing process uses

NVivo 12 Plus software. This software was chosen

because it is able to produce coding visualization

images and how to use the software is very user

friendly (Tambun &; Sitorus, 2023).

There are four stages carried out in the data

processing process with NVivo, the data input stage,

coding stage, visualization stage and conclusion stage

(Sitorus &; Tambun, 2023). The first stage, data input

uses two methods, internal data input and external

data. Internal data is data that is inputted to NVivo

without using an internet connection. This data is

usually data that is already available on a laptop, such

as a research article. While external data is data that

the input process to NVivo uses an internet

connection, the data input process uses the Ncapture

for NVivo facility. Examples of external data from

the internet such as YouTube, online news, and

various social media. The second stage is coding data

in accordance with the answers to the research

questions. Coding is a simple word or sentence that is

the answer to a research question. At this stage,

content analysis is carried out, which is the stage of

understanding words or sentences in the research data

(Tambun, 2021). Especially for the coding process

for YouTube data sources or social media sources in

the form of videos, coding is done after there is a

transcript of YouTube content or video. The analysis

was carried out by making transcripts, then the coding

process was carried out (Salahudin et al., 2020). The

third stage, create a coding visualization image.

Visualization coding is a collection of coding that

makes up an image. Coding images are interrelated

with various data sources. This coding image is

analyzed in the process of making research

conclusions. The fourth stage is the determination of

research conclusions. The conclusion of the study is

the answer to the research question. The answer is

seen from the existing coding. Coding is considered

to have strong validity if coding is confirmed from

various data sources. Coding validity is strong if

confirmed at least three times from various data

sources. This principle is a measurement of coding

validity using the triangulation method (Natow,

2020). Furthermore, coding is sorted by most

confirmations to the least confirmed coding. These

codes are used as answers to research questions, as

well as research conclusions.

4

RESULTS AND DISCUSSION

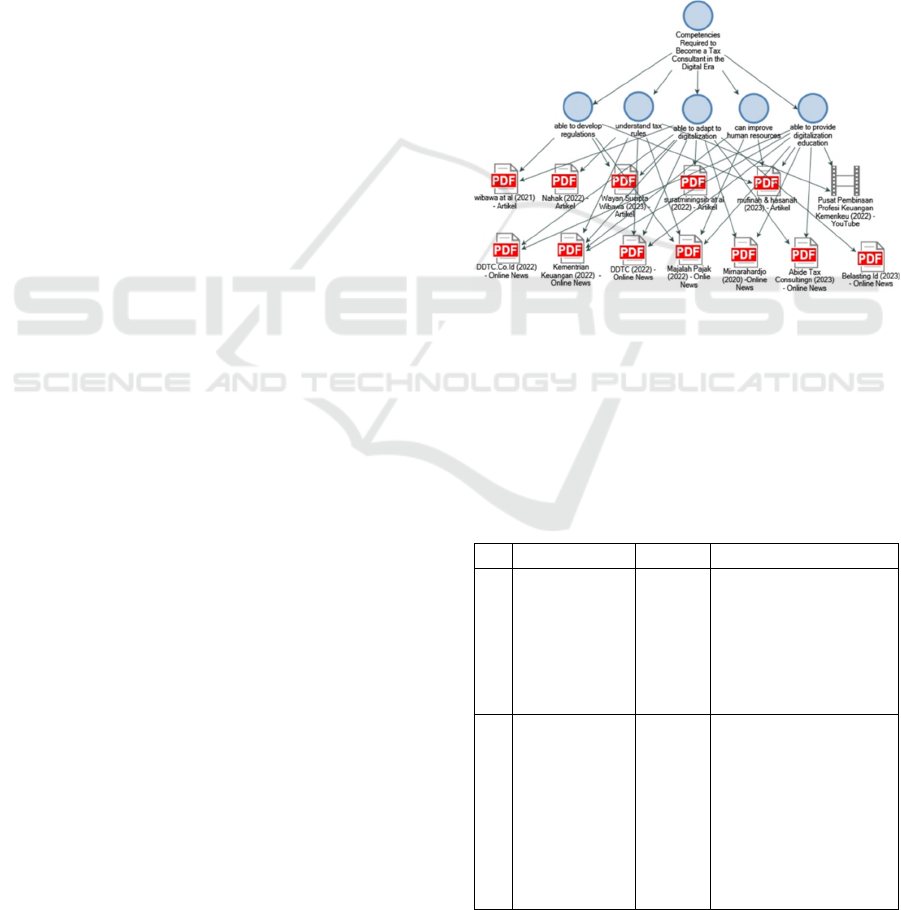

This research produced several references consisting

of 1 YouTube, 6 Online News, and 5 research articles.

The coding process is done using NVivo 12 Plus

Software. There are five valid and confirmed codings

at least three times to the data source studied. The

following is presented a visualization image of the

resulting coding.

Figure 1: Coding Visualization Image.

All coding in Figure 1 is an answer to the research

question. Coding comes from content analysis of the

various data studied. The coding process uses the

facilities available in the NVivo 12 Plus software. The

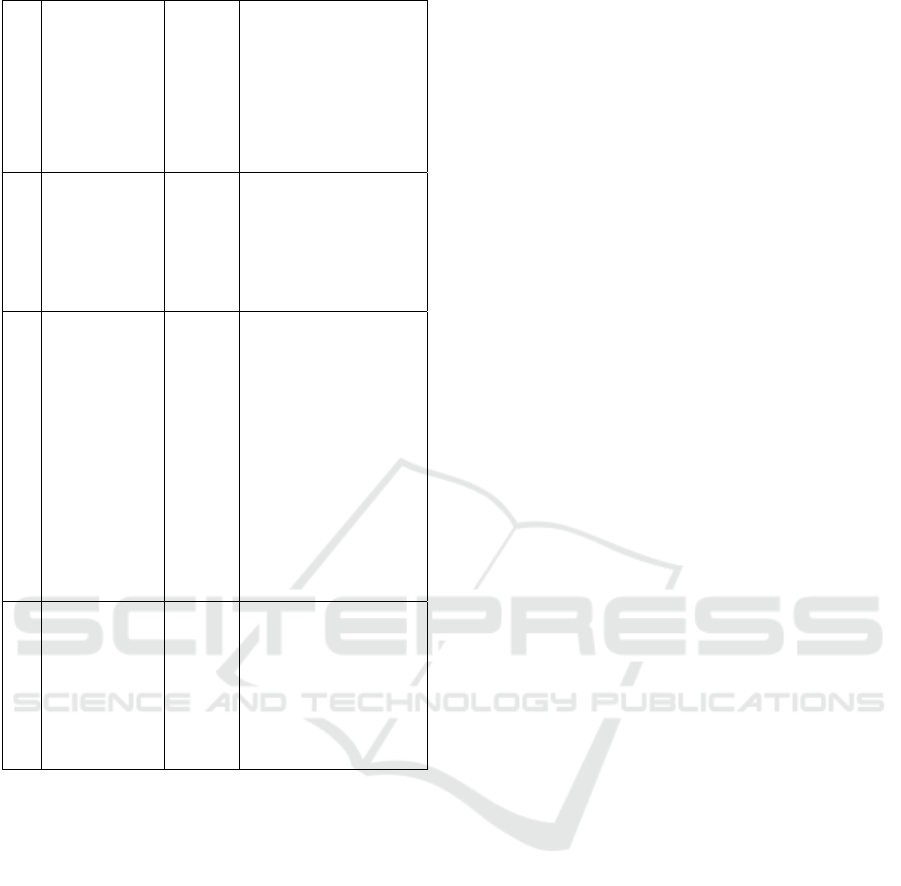

following is a summary table and intensity of each

coding created.

Table 1: Recapitulation of Coding.

No. Coding Intensity Reference

1 Understand

tax rules

5

• (Nahak, 2022)

• (Dian, 2022)

• (Sutopo, 2022)

• (Yulianto, 2022)

• (Ministry of

Finance, 2022)

2 Able to

provide

digitalization

education in

the field of

taxation

8

• (Mufidah &;

Anisaul, 2022)

• (Group, 2008)

• (Dian, 2022)

• (Aurora, 2022)

• (Sutopo, 2022)

• (Yulianto, 2022)

• (Mirna, 2021)

Tax Consultant Competency in the Digital Era

327

• (Ministry of

Finance, 2022)

3 Can improve

human

resources,

especially in

the field of

taxation.

3

• (Mufidah &;

Anisaul, 2022)

• (Sutopo, 2022)

• (Yulianto, 2022)

4 Able to adapt

to tax

digitalization.

9

• (Suratminingsih

et al., 2022)

• (Wibawa et al.,

2023)

• (Zunaidi et al.,

2021)

• (Group, 2008)

• (Aurora, 2022)

• (Dian, 2022)

• (Yulianto, 2022)

• (Sutopo, 2022)

• (Mirna, 2021)

5 Able to

develop or

implement

tax

regulations.

4

• (Mufidah &;

Anisaul, 2022)

• (Wibawa et al.,

2023)

• (Zunaidi et al.,

2021)

• (Yulianto, 2022)

4.1 Understand Tax Rules Well

Understanding tax rules, tax consultants are expected

to have the ability to understand and follow the legal

provisions applicable in a country's tax system. In the

era of digitalization, the tax consultant profession is

also required to innovate in connection with the

development of knowledge, including the statement

of financial accounting standards (PSAK), applicable

laws and regulations, and transfer pricing guidelines

as released by the OECD (Dian, 2022). Other sources

argue that tax consultants should have a good

understanding of tax regulations that apply in

Indonesia, this includes a deep understanding of tax

laws, tax regulations, fiscal policies, and recent

changes in tax regulations (Group, 2008). The

purpose of making tax rules is to collect revenue for

the government, which will later be used for financing

various state development programs and projects. In

line with that, he believes that tax consultants play a

major role in accelerating taxpayer compliance with

various rules that have been initiated by the authority

(Aurora, 2022).

4.2 Able to Provide Tax Digitalization

Education

The Directorate General of Taxes (DGT) stated that

the tax consultant profession as a strategic partner of

the government plays a role in educating taxpayers

according to the times (Aurora, 2022). Therefore, the

consulting profession needs to continue to develop in

order to understand the development of the tax

landscape, open your eyes to technology, and have a

multidisciplinary perspective such as

macroeconomics, law, and business (Dian, 2022). In

today's digital era, tax consultants also play an

important role in the implementation of tax

technology and software solutions (Group, 2008). and

Can provide digital education in an effort to improve

the quality of consulting business (Wibawa et al.,

2023). As well as utilizing digital era services by

following technological developments can facilitate

the service process (Mufidah &; Anisaul, 2022).

It will always be expected that there will be an

educational program, so it will also directly be able to

provide an understanding related to the tax payment

system. (Nahak, 2022). Various tax system

innovations continue to be carried out, such as

Monitoring Tax Reporting and Payment or known as

the MP3 system, e registration (e-reg), Geographic

Information System (GIS), online tax return reporting

(e-filling), DGT Information System (SIP

Replacement).

4.3 Can Improve Human Resources in

the Field of Taxation

It is expected that tax consultants will be able to

improve human resources in taxes which refers to

efforts to improve Human Resources (HR) working

in the field of taxation. It covers various aspects, such

as increasing the knowledge, skills, and competencies

of employees involved in tax administration, tax law

enforcement, and tax planning and policy. This is

important in efforts to increase tax revenue collection,

which is an important source for financing

government programs and projects. To maximize the

use of technology, and improve the quality of Human

Resources (Mufidah &; Anisaul, 2022). Meanwhile,

according to Darussalam, to be able to survive in the

digital era, the tax consultant profession must be a

human resource who understands the development of

the tax landscape due to digitalization, has a

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

328

multidisciplinary perspective, is sensitive to

technology, has high integrity, and increases

education and literacy about modern taxes (Sutopo,

2022).

4.4 Able to Adapt to Tax Digitalization

Bonarsius Sipayung said that in the current era of

digitalization, the role of tax consultants has

penetrated into the realm of digital transactions

carried out by taxpayers (Aurora, 2022). Lani

believes that the tax consultant profession must

understand all technical tax processes that have been

digitized, both payments, reporting and various

applications have been directed to the digitization

system. (Sutopo, 2022). This is to respond to the

evolving tax dynamics (Mufidah &; Anisaul, 2022).

According to Bonarius, tax consultants need to adapt

and then improve their abilities, aka upgrading skills

to educate taxpayers who need direction (Aurora,

2022; Wibawa et al., 2023). So in the digital era, data

processing technology is needed that can help the

performance of tax consultant services such as ERP

system software and ever systems that have account

tax service system products (Mirna, 2021). It can also

help in improved services to taxpayers and better tax

collection. Because the current Digitalization Era

forces and requires millennials to be technologically

literate in making and presenting technology-based

financial reports (Mufidah &; Anisaul, 2022;

Suratminingsih et al., 2022).

4.5 Able to Develop or Implement Tax

Regulations

Able to develop regulations in taxation, it is expected

that tax consultants refer to the ability of government

institutions or bodies responsible for regulating tax

rules and regulations to create, update, or compile

new regulations related to taxation. The challenge of

digitizing the tax system, particularly developing

feasible and appropriate regulations, maximizing the

use of technology (Mufidah & Anisaul, 2022). There

are several processes of developing regulations in

taxation, First, identification of needs. Second, Draft

Regulation, Third, consultation and participation.

Fourth, impact evaluation. Fifth, publication and

implementation. Sixth, monitoring and change.

Finally, it is to develop good and effective tax

regulations.

5

CONCLUSIONS

This research has produced conclusions that are

answers to research questions that have been written

in the introduction. There are five coding

competencies needed by tax consultants in the digital

era. First, understand tax regulations well. Second,

able to provide digitalization education in the field of

taxation. Third, it can improve the quality of human

resources, especially in the field of taxation. Fourth,

able to adapt to the digitization of taxation. Fifth, able

to develop or implement tax regulations. Information

on the results of this research can be used by tax

consultants to improve their competence, so that they

can compete with tax consultants at the national and

international levels. The results of this research can

also be recommended to educational institutions,

especially in the field of tax accounting. This

information can be used by higher education

institutions to compile tax accounting curricula, in

accordance with the needs of tax competencies

needed in this digital era. The implication of this

research is that prospective tax consultants and tax

consultants need to study the 5 competencies

provided by the results of this research. Apart from

that, further research needs to examine these 5

competencies quantitatively to determine which

competencies have a greater influence on the

performance of tax consultants in the digital era.

REFERENCES

Apostol, O., & Pop, A. (2019). ‘Paying taxes is losing

money’: A qualitative study on institutional logics in

the tax consultancy field in Romania. Critical

Perspectives on Accounting, 58, 1–23.

Aurora, S. (2022). Digitalization of tax administration

makes the role of consultants more strategic. 79639.

https://www.belasting.id/pajak/79639/Digitalisasi-

Administrasi-Pajak-Buat-Peran-Konsultan-Makin-

Strategis/

Basilotta, V. G. P., Matarranz, M., Casado, L.-A. A., &

Otto, A. (2022). Teachers’ digital competencies in

higher education: a systematic literature review.

International Journal of Educational Technology in

Higher Education, 19(1), 1–16.

Dian, K. (2022). Supported by digital technology, tax

consultant professional opportunities are getting wider.

https://news.ddtc.co.id/didukung-teknologi-digital-

peluang-profesi-konsultan-pajak-makin-luas-43042

Diller, M., Asen, M., & Späth, T. (2020). The effects of

personality traits on digital transformation: Evidence

from German tax consulting. International Journal of

Accounting Information Systems, 37, 100455.

Tax Consultant Competency in the Digital Era

329

Group, P. M. S. (2008). Tax Consultant PT. 282.

https://abidetaxconsulting.com/konsultan-pajak-pt-2/

Hafidhah, H., & Yandari, A. D. (2021). Training Penulisan

Systematic Literature Review dengan Nvivo 12 Plus.

Madaniya, 2(1), 60–69.

IKPI. (2022). IKPI's Attitude on the Alleged Role of Tax

Consultants Behind the RAT Case. Indonesian Tax

Consultants Association.

Li, C., Khan, A., Ahmad, H., & Shahzad, M. (2022).

Business analytics competencies in stabilizing firms’

agility and digital innovation amid COVID-19. Journal

of Innovation & Knowledge, 7(4), 100246.

https://doi.org/https://doi.org/10.1016/j.jik.2022.10024

6

Ministry of Finance, P. P. P. finance. (2022). PKE Webinar

2022: Application of the Digital Economy:

Strengthening and Role of Tax Consultants in the

Practice of the Ministry of Finance Professional

Development Center.

https://www.youtube.com/watch?v=Qf3PwfBOdGc&t

=2161s

Mirna. (2021). The Best Tax and Accounting Consultant

Services in the Digital Era.

https://mirnarahardjo.com/2021/03/jasa-konsultan-

pajak-dan-akutansi-terbaik-di-era-digital/

Mufidah, I. F., &; Anisaul, H. (2022). Thoroughly Peel the

Role of Tax Digitalization. 05, 36–46.

file:///C:/Users/ASUS/Downloads/artikel+5 (1).pdf

Nahak, S. A. (2022). Analysis of tax reform strategies in

welcoming digital. 8.5.2017, 2003–2005.

http://103.164.117.216/bitstream/handle/071061/1699/

17 Salvatrix Nahak.pdf?sequence=1&isAllowed=y

Narsa I Made &, M. R. (n.d.). A study of tax reform in the

digital age. 414–427.

https://repository.unair.ac.id/119519/

Natow, R. S. (2020). The use of triangulation in qualitative

studies employing elite interviews. Qualitative

Research, 20(2), 160–173.

Salahudin, S., Nurmandi, A., & Loilatu, M. J. (2020). How

to Design Qualitative Research with NVivo 12 Plus for

Local Government Corruption Issue in Indonesia?

Jurnal Studi Pemerintahan, 369–398.

Sitorus, R. R., &; Tambun, S. (2023). Qualitative research

training in accounting with NVivo software at the

master of accounting study program at Ganesha

University of Education. Scholar Room: Journal of

Community Service, 2(1), 13–21.

Spencer, L. M., & Spencer, P. S. M. (2008). Competence at

Work models for superior performance. John Wiley &

Sons.

Srinadi, N. P. D. (2023). Want a Career in Taxation? Find

out here! Pajakku.Com.

Suratminingsih, Hidayat, T., Purwanto, &; Vera. (2022).

Soft Skills and Hard Skills Training (Accounting and

Taxation) for Students at SMK Bina Mandiri

Multimedia. Journal of Civil Service (JPMM

), 2(1),

102–107. https://doi.org/10.51805/jpmm.v2i1.76

Sutopo, S. D. (2022). Refer! Discussion of Public

Accountants and Tax Consultants on Digital and

Sustainable Economy Responses.

https://pppk.kemenkeu.go.id/in/post/simak!-diskusi-

akuntan-publik-dan-konsultan-pajak-respons-

ekonomi-digital-dan-berkelanjutan-

Tambun, S. (2021). Improving the Ability to Conduct

Qualitative Research Using NVivo 12 PLus Software at

LAN Training and Development Center and Study of

Decentralization and Regional Autonomy in

Samarinda. Journal of Nusantara Empowerment, 1(2).

Tambun, S., &; Sitorus, R. R. (2023). NVivo Application

Training for Qualitative Research in Accounting to

Researchers at Dhyana Pura University. Joong-ki:

Journal of Community Service, 2(1), 129–138.

Wibawa, I. W. S., Suryandari, N. N. A., JS, I. P. W. D., &

Satya, K. T. E. (2023). Increased knowledge about the

importance of client data collection and promotion in

the digital era in an effort to improve business quality

at MI Consulting. 2, 551–556. https://e-

journal.unmas.ac.id/index.php/seminarfeb/article/view

/6531

Yulianto, H. (2022). Reviewing the Application of the

Digital Economy and the Role of Tax Consultants. Tax

Magazine. https://majalahpajak.net/menelaah-

penerapan-ekonomi-digital-dan-peran-serta-konsultan-

pajak/

Zunaidi, A., Natalina, S. A., &; Laksana, M. A. (2021).

Introducing Types of Accountant Professions and

Services to New Students in an Effort to Strengthen

Interest in Sharia Accounting Studies and Welcome the

Era of Society 5.0. Mathematics: Journal of Community

Service, 1(2), 29–34.

https://doi.org/10.34148/komatika.v1i2.409

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

330