Dynamo Effects of Digital Marketing: Catalysing Dual Impact on

Post – Covid Tourism and Banking Sales

Khalisah Visiana

Faculty of Economics Business and Social Sciences, Universitas 17 Agustus 1945 Jakarta, Indonesia

Keywords: Digital Transformation, Sales, Digital Marketing, COVID-19, Tourism, Banking.

Abstract: During the COVID-19 pandemic in 2020, Indonesia experienced a contraction in economic growth which

caused deflation. In the third quarter of 2022, the rate of COVID-19 pandemic cases will be under control,

and this will encourage improvements in the national economic condition. The potential for tourism in

Indonesia makes the tourism industry an important economic sector, especially during the transition period

for economic recovery from the COVID-19 pandemic. The way tourism products are presented and promoted,

as well as the way consumers think, act and seek information, have changed radically. Technology has also

revolutionised the way people book their travel, using a variety of devices and channels. This can increase

sales of tourism companies, but it cannot be separated from the involvement of banking through its

intermediation role in financial transactions, so there is a reciprocal effect. This research aims to examine the

dynamo effect that arises from the use of digital marketing to increase income from sales and the double

impact or reciprocal relationship that occurs on income from sales of tourism companies and banking

companies post-COVID-19. To fulfil these objectives, research was conducted on tourism and banking

companies to provide answers to the research. The potential for tourism and the role of banking

intermediation, complemented by digital marketing, will drive national economic recovery.

1 INTRODUCTION

In 2020, Indonesia experienced economic contraction

and deflation due to the Covid-19 pandemic. The

government implemented regulations on Large-Scale

Social Restrictions to limit the spread of COVID-19

and restrict economic activity in society. A disruption

in the market's supply and demand can lead to

decreased productivity and consumption, ultimately

resulting in the disruption of a company's production

cycle and potential bankruptcy. The Central Bureau

of Statistics reports a decline in economic growth

from 5.02 percent in 2019 to 2.97 percent in 2020.

In the third quarter of 2022, the rate of COVID-19

cases has been under control, which has encouraged

improvements in the national economic conditions.

The domestic economy's growth has been on the rise

due to an increase in consumption, investment, and

exports. This is evidenced by the State Budget deficit

being maintained at 2.38 percent, inflation at 5.51

percent (YOY), and a decrease in unemployment to

5.86 percent. (Coordinating Ministry for Economic

Affairs Republic of Indonesia, n.d.; Wely Putri Melati

- Ministry of Finance of the Republic of Indonesia,

n.d.).

In 2023, the Public Health Emergency of

International Concern (PHEIC) status or public health

emergency for COVID-19 cases has been revoked

because it no longer meets three main criteria,

namely: unusual/extraordinary events, risk to

international health, and requiring cross-country

coordination.(Public Relations of the Cabinet

Secretariat of the Republic of Indonesia, n.d.) The

government has also stopped the implementation of

restrictions on community activities so that economic

activity has begun to increase.(Ministry of Finance of

the Republic of Indonesia, n.d.)

Indonesia is a country rich in natural beauty,

diverse ethnicities, culture, and ancestral heritage.

This is something to be proud of. This is an added

value to tourism potential in Indonesia, where this

potential can be maximized as best as possible to

improve the economy which leads to people's welfare

so that tourism becomes one of the important

economic sectors in Indonesia, especially during the

transition period of economic recovery from the

COVID-19 pandemic.(Ministry of Communication

Visiana, K.

Dynamo Effects of Digital Marketing: Catalysing Dual Impact on Post – Covid Tourism and Banking Sales.

DOI: 10.5220/0012581800003821

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Seminar and Call for Paper (ISCP UTA ’45 JAKARTA 2023), pages 331-338

ISBN: 978-989-758-691-0; ISSN: 2828-853X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

331

and Information, n.d.) However, the tourism industry

in Indonesia has been negatively impacted by the

COVID-19 pandemic so that the performance of the

tourism industry has decreased. The influx of foreign

tourists to Indonesia has significantly decreased,

resulting in a negative impact on the country's tourism

revenue. The implementation of strict social

distancing measures and travel restrictions has caused

a reduction in state income from the tourism sector by

IDR 20.7 billion (Ministry of Tourism and Creative

Economy of the Republic of Indonesia, n.d.).

According to the Ministry of Tourism and

Creative Economy/Tourism and Creative Economy

Agency, there are three phases for restoring tourism

companies: Emergency Response, Recovery, and

Normalization. Currently, Indonesia is in the

recovery phase and is moving towards normalization.

Therefore, it is crucial to utilize technological

innovation to enhance the performance of tourism

companies after the pandemic. To achieve this,

tourism companies must attract both domestic and

foreign tourists. Marketing activities are a significant

contributor to a company's financial performance.

This is because marketing serves as a competitive tool

for businesses to persuade potential customers to

choose their products and services.

The COVID-19 pandemic has altered

environmental conditions, specifically the shift from

traditional to digital, resulting in a significant increase

in demand for telecommunications services and

devices. Tourism companies must be able to adapt,

innovate and collaborate well to keep up with the

changing community actors and tourism trends. The

tourism sector has seen an increase in internet

penetration and smartphone usage, as well as the

impact of the COVID-19 pandemic, which has led to

a more effective and efficient flow of information in

the tourism circuit (Velentza & Metaxas, 2023).

The presentation and promotion of tourism

products, as well as consumer behaviour and

information-seeking habits, have undergone

significant changes. Technology has revolutionised

the booking process, with travellers using various

devices and channels to make their arrangements

(Sinclaire & Vogus, 2011). Digital marketing enables

businesses to reach a broader audience, measure

campaign results more accurately, and respond more

quickly to changing trends and consumer preferences.

This is crucial in today's digitally connected business

environment (Chandy et al., 2021).

From all the conditions that have been explained,

digital marketing is a marketing technique that is

suitable for marketing products and services today in

tourism companies to increase revenue from sales.

Digital marketing is not only suitable for tourism

companies but also other companies considering

changes in people's habits or the transition from

traditional to digital.

Digital marketing can be effectively applied to

banking companies, given their intermediation role,

which has a strategic impact on the economy and can

stimulate a country's economic growth. This strategic

impact is due to the fact that banks act as financial

intermediaries, supporting transactions between

countries, collecting funds from the public, and

allocating them effectively and efficiently to

productive sources (Schilling, 2023).

Tourism companies in Indonesia are facing

significant challenges and opportunities due to the

COVID-19 pandemic. To adapt quickly to the

transition from traditional to digital and attract more

consumers, digital marketing is a useful technique for

tourism businesses, leading to increased income. This

concept is also applicable to banking companies, and

the two industries have a unique reciprocal

relationship due to the banking intermediation role.

This research aims to examine the dynamo effect

that arises from the use of digital marketing to

increase income from sales and the reciprocal

relationship that occurs between income from sales of

tourism companies and banking companies post

COVID-19.

2 LITERATURE REVIEW

Digital marketing is the practice of using digital

strategies and tools to promote products, services, or

brands to target audiences through online platforms.

It involves leveraging digital technology, the internet,

and mobile devices to achieve marketing goals.

(Miquel Vidal & Castellano-Tejedor, 2022).

To achieve their goals, companies select their own

marketing tactics using digital tools and

communication channels. Each tactic has a different

function and achieves different objectives. Digital

marketing encompasses marketing via social media,

video, mobile devices, search engines, email, affiliate

networks, online advertising, word of mouth, SEO,

websites, Google Analytics, and text and multimedia

content creation. The effectiveness of online

promotion is contingent upon the strategy selected by

the tourism enterprise. (Yasmin et al., 2015).

Technology plays a significant role in enhancing

the quality of services provided by business units.

According to Khan and Mahapatra (2009), the shift

from traditional marketing to digital marketing is a

decade-long process. Therefore, digital marketing

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

332

cannot entirely replace traditional marketing.

However, digital media, including social media, has

challenged traditional one-way communication and is

considered the future of marketing. The future of

marketing lies in the convergence of traditional and

digital methods. Philip Kotler et al. (2017) suggest

that a new era of digital marketing has emerged.

The COVID-19 pandemic prompted a shift

towards digitalization in almost every aspect of daily

life. As a result, traditional marketing has given way

to massive digital marketing.

Digital marketing can optimise planning

strategies and tactics using various techniques and

tools throughout the customer journey. According to

Guven (2020), digitalisation and e-marketing are now

considered essential for the sustainable development

of small and medium tourism businesses, ensuring

their activities continue to generate economic value.

Digital marketing has a significant impact on

product promotion in tourism companies (Sakas et al.,

2022). It enables travel destinations to connect with

potential customers more effectively, expand their

global reach, and provide more immersive

experiences before, during, and after travel. This

impact can attract more consumers, thereby

increasing the income of tourism companies.

Banking companies also utilise the same concept

as tourism companies. Digital marketing plays a

significant role in promoting products for banking

companies. It helps banks reach customers in a more

efficient, personalised, and effective way, while

utilising digital technology to meet the growing needs

of today's digital era. This impact can increase

potential customers, resulting in increased sales

revenue. The study aims to investigate the impact of

digital marketing on company performance. The

research questions are:

Q1: How will digital marketing increase revenue

from sales of Tourism companies post COVID – 19?

Q2: How will digital marketing increase revenue

from Banking sales post COVID– 19?

Das (year not provided) reported that 72% of

consumers currently connect with businesses through

digital marketing channels. Businesses that use digital

marketing strategies can increase revenue by 2.8

times and ROI by up to 300% (Velentza & Metaxas,

2023). The financial performance of tourism

companies can improve by attracting more consumers

through digital marketing to promote their products

and services.

Banking service convenience programs offered

through digital marketing can support digital

marketing carried out by tourism companies, leading

to an increase in consumer or tourist attraction. This,

in turn, increases the income of tourism companies.

Similarly, banking income has increased due to the

growing number of customers using banking services

offered in digital marketing to facilitate financial

transactions before, during, and after their tourist

activities. The study aims to investigate the various

impacts of digital marketing implementation on

company sales revenue. The research questions are:

Q3: How can banking companies that use digital

marketing as their marketing strategy influence the

relationship between digital marketing and revenue

from sales of tourism companies?

Q4: How can Banking Companies that use digital

marketing as their marketing strategy influence the

relationship between increasing sales of Banking

Companies and revenue from sales of Tourism

Companies?

Q5: How can Tourism Companies that use digital

marketing as their marketing strategy influence the

relationship between digital marketing and sales

revenue from banking companies?

Q6: How can Tourism Companies that use digital

marketing as their marketing strategy influence the

relationship between increasing sales of Tourism

Companies and revenue from sales of Banking

Companies?

Q7: What is the reciprocal effect on income from

sales of Tourism companies and Banking

Companies?

3 METHODS

The research employed a quantitative approach

method, which draws conclusions based on statistical

hypothesis testing using empirical data collected

through measurement (Arikunto, 2002). The research

employed a quantitative approach method, which

draws conclusions based on statistical hypothesis

testing using empirical data collected through

measurement (Arikunto, 2002). The research

employed a quantitative approach method, which

draws conclusions based on statistical hypothesis

testing using empirical data collected through

measurement (Arikunto, 2002). The study was

conducted from July 2023 to August 2023.

This research focuses on tourism and banking

companies in Jakarta. Data was collected through an

electronic questionnaire, specifically a Google form

designed for research purposes. The questionnaire

was divided into two parts to collect data from two

random samples of the population. The study

population is comprised of tourism and banking

companies in Jakarta. There are 165 tour and travel

Dynamo Effects of Digital Marketing: Catalysing Dual Impact on Post – Covid Tourism and Banking Sales

333

companies operating in the tourism sector, while 61

conventional general banking companies represent

the banking sector.

The sample was determined using the purposive

sampling method. For tour and travel companies, the

sample was limited to those that use digital marketing

in their marketing strategy and offer both domestic

and international tourism trips. For banking

companies, the sample was limited to Foreign

Exchange Commercial Banks. Questionnaires were

distributed to managers in the company who handle

marketing and sales divisions. The reasons for the

respondents' answers were analysed using Ms. Excel.

The research hypothesis was proven using smart PLS-

SEM (Partial Least Square - Structural Equation

Modelling) software. The PLS-SEM analysis consists

of two sub-models: the measurement model (outer

model) and the structural model (inner model).

4 RESULTS AND DISCUSSION

During the initial stage of data analysis, reliability and

validity are measured. This is done using Cronbach's

alpha and Composite Reliability, which indicate the

correlation between the questions included in the

measurement scale. The coefficient should fall within

acceptable limits (-1 to +1); if it falls outside these

limits, it means that some questions overlap and

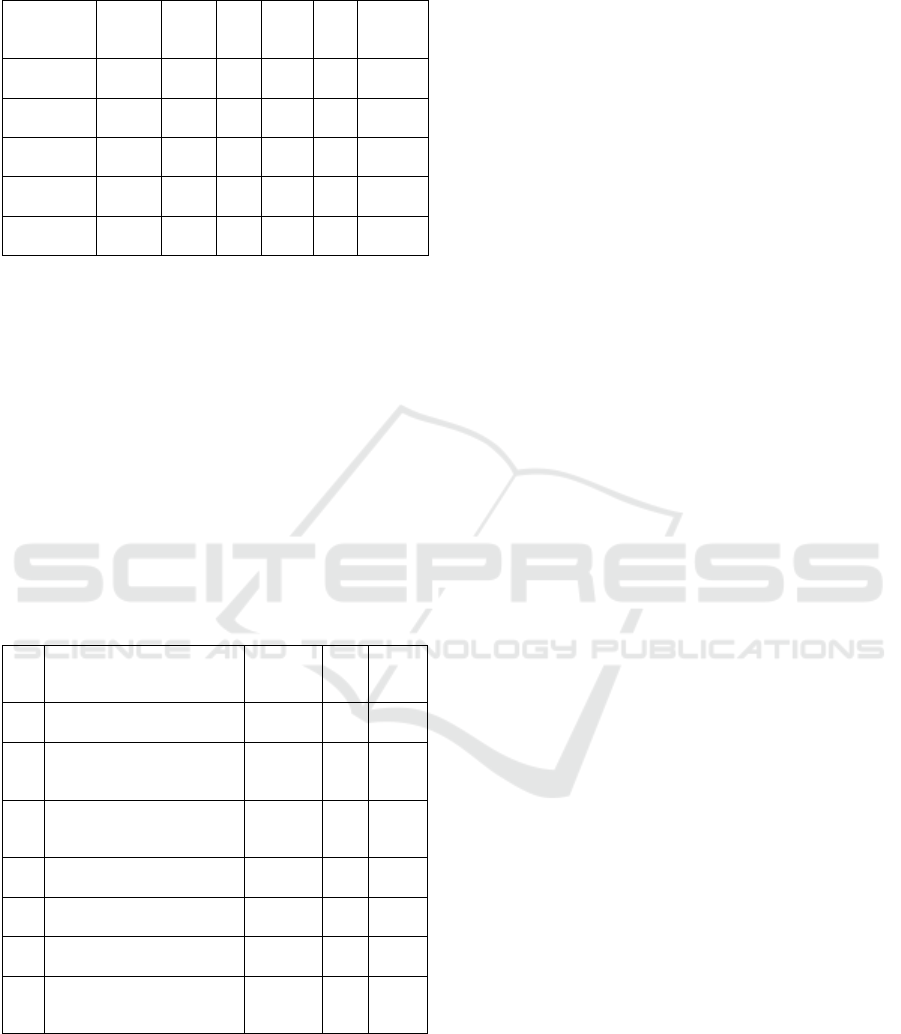

should be removed. Table 1 and Table 2 below

describe the results of the evaluation of the

measurement model or outer model.

Table 1: Outer Evaluation Results of the Tourism Business

Model.

Latent

variables

Cronbach's

alpha

rho_a

Composite

reliability

AVE Decision

Digital

Marketing

(X1)

0,897 0,944 0,928 0,746 Accepted

Banking

Company

Sales (X2)

0,816 0,835 0,890 0,730 Accepted

Tourism

Company

Sales (Y)

1,000 1,000 1,000 1,000 Accepted

Banking

Companies

that use

digital

marketing

(Z)

0,924 0,940 0,963 0,929 Accepted

Table 2: Outer Evaluation Results of Banking Business

Models.

Latent

variables

Cronbach's

alpha

rho_a

Composite

reliability

AVE Decision

Digital

Marketing

(X1)

0,898 0,909 0,922 0,665 Accepted

Banking

Company

Sales (X2)

0,808 0,879 0,866 0,619 Accepted

Tourism

Company

Sales (Y)

1,000 1,000 1,000 1,000 Accepted

Banking

Companies

that use

digital

marketing

(Z)

0,730 0,709 0,865 0,762 Accepted

The evaluation results indicate that the

questionnaire used in both Tourism and Banking

Companies is highly reliable, with Cronbach's values

ranging from a = 1.00 to a = 0.730. All variables

obtained Composite Reliability > 0.7, suggesting that

the indicators used in this research are valid and have

met convergent validity.

The evaluation of the structural model or inner

model is used to measure the research hypothesis. In

this study, data quality testing was conducted using

PLS-SEM analysis with an approach based on variant

or component-based structural equation models. The

software used was Smart-PLS. The validity test

explains the relationship between the variables in the

research. The output contained in the path

coefficients output is used to test the hypothesis

directly. To test for significant loading factors, the t

statistic or p value can be used. A validity is

considered significant if the p value is less than 0.05

and the T statistic value is greater than 1.960. Tables

3 and 4 below show the results of the evaluation of

the structural model or inner model for Tourism

Companies.

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

334

Table 3: Evaluation of the Structural Model or Inner

Tourism Business Model.

Hypothesis Sample Sample

Mean

σ T-Test p Decision

(X1)--> (Y) 0,379 0,378 0,052 7,267 0,000 Accepted

(X2)--> (Y) 0,006 0,006 0,024 0,241 0,809 Rejected

(Z)--> (Y) 0,607 0,607 0,052 11,763 0,000 Accepted

Z x X1 -> Y 0,005 0,004 0,013 0,375 0,708 Rejected

Z x X2 -> Y 0,005 0,006 0,012 0,396 0,692 Rejected

The following explanation is based on the test

results and the relationships between constructs found

in the evaluation of the structural or inner model in

tourism companies:

How digital marketing can increase revenue

from tourism company sales post COVID-19

The test results for the Digital Marketing variable

yielded a p-value of 0.000, which is less than 0.05,

and a t-statistic of 7.267, which is greater than 1.960.

Therefore, it can be concluded that digital marketing

can increase revenue from sales of tourism companies

after COVID-19. Table 4 below illustrates the role of

digital marketing.

Table 4: The Role of Digital Marketing in Increasing

Revenue from Sales.

No

The Role of Digital

Marketing

Number of

Answers

N %

1 Attract New Customers 150 165 91%

2

Receive Feedback from

Customers 80 165 48%

3

Providing Information to

Customers

165 165 100%

4 Improving Company Image 70 165 42%

5 Interaction/Communication 165 165 100%

6 Increasing Customer Trust 50 165 30%

7

Building Strong

Relationships 90 165 55%

Table 4 shows that the top three roles of digital

marketing, as identified by respondents, are attracting

new customers, providing information to customers,

and facilitating interaction and communication.

Digital marketing can increase the income of tourism

companies by expanding their customer reach,

conveying information digitally for easy access, and

facilitating active two-way communication. This

enables customers to make informed purchasing

decisions and ultimately increases the company's

sales revenue.

Increased banking company sales can boost

revenue for tourism companies.

The test results for the variable of increasing sales

in banking companies yielded a p-value of 0.809,

which is greater than 0.05, and a t-statistic of 0.241,

which is less than 1.960. Therefore, it can be

concluded that increasing sales in banking companies

cannot increase income from sales of tourism

companies post COVID-19. The increase in

customers at banking companies does not necessarily

lead to an increase in sales at tourism companies. This

is because banking customers often carry out

transactions that are not related to purchasing tourism

products.

Digital marketing can be an effective strategy for

banking companies to increase sales to tourism

companies.

The test results for the variable of banking

companies that use digital marketing as their

marketing strategy yielded a p-value of 0.000, which

is less than 0.05, and a t-statistic of 11.763, which is

greater than 1.960. Therefore, it can be concluded that

banking companies that use digital marketing as their

marketing strategy can increase revenue from sales of

tourism companies after the COVID-19 pandemic.

Banks offer a variety of products and services to

facilitate customers' financial transactions.

Customers can take advantage of these services to

facilitate the purchase of tourism products and

transactions during their trips.

Digital marketing can influence the relationship

between digital marketing and revenue from sales of

tourism companies. Banking companies that adopt

this strategy may benefit from increased revenue.

The study tested the impact of digital marketing

on the income from sales of tourism companies post

COVID-19 for banking companies. The results

showed that there was no significant influence of

digital marketing on the income from sales of tourism

companies (p value = 0.708 > 0.05, t-statistic = 0.375

< 1.960).

Banking companies that utilise digital marketing

as a marketing strategy can influence the relationship

between the increasing sales of banking companies

and the income from sales of tourism companies.

The results of the variable testing indicate that the

p-value is 0.692, which is greater than 0.05, and the t-

statistic is 0.396, which is less than 1.960. Therefore,

it can be concluded that the use of digital marketing

as a marketing strategy by banking companies does

Dynamo Effects of Digital Marketing: Catalysing Dual Impact on Post – Covid Tourism and Banking Sales

335

not affect the relationship between the increase in

banking company sales and the revenue from tourism

company sales post COVID-19.

Tables 5 and 6 below present the results of the

evaluation of the structural model or inner model for

Banking Companies.

Table 5: Evaluation of the Structural Model or Inner

Banking Business Model.

Hypothesis Sample

Sample

Mean

σ T Statistic p Decision

(X1)--> (Y) 0,173 0,174 0,081 2,151 0,032 Accepted

(X2)--> (Y) 0,282 0,283 0,056 5,075 0,000 Accepted

(Z)--> (Y) 0,406 0,406 0,055 7,421 0,000 Accepted

Z x X1 -> Y 0,170 0,173 0,025 3,740 0,000 Accepted

Z x X2 -> Y 0,181 0,006 0,035 5,170 0,000 Accepted

The following explanation is based on the test

results and the relationships between constructs found

in the evaluation of structural or inner models in

banking companies:

Digital Marketing's Role in Boosting Banking

Company Sales Post COVID-19.

The test results for the Digital Marketing variable

yielded a p-value of 0.032, which is less than 0.05,

and a t-statistic of 2.151, which is greater than 1.960.

Therefore, it can be concluded that digital marketing

can increase revenue from sales of banking

companies after COVID-19. The role of digital

marketing is illustrated in Table 6.

Table 6: The Role of Digital Marketing in Increasing

Revenue from Sales.

No

The Role of Digital

Marketing

Number of

Answers

N %

1 Attract New Customers

55 61 90%

2

Receive Feedback from

Customers

46 61 75%

3

Providing Information to

Customers

61 61 100%

4 Improving Company Image

42 61 69%

5 Interaction/Communication

61 61 100%

6 Increasing Customer Trust

48 61 79%

7

Building Strong

Relationships

45 61 74%

Table 6 shows that based on the three highest

responses from respondents regarding the role of

digital marketing, namely informing customers,

interacting or communicating and attracting new

customers. Digital marketing can increase the

revenue from sales of banking companies by

informing customers and interacting or

communicating with customers, because customers

will know the latest information and customer

transactions will become easier because customers

will receive intensive service in financial transactions

using banking services. Information that is easily

accessible to the public expands the customer base

and creates potential new customers.

Increased revenues from tourism companies can

increase revenues for banking companies.

The results of the test of the increasing sales

variable for tourism companies obtained a p-value of

0.000 < 0.05 and a t-statistic of 5.075 > 1.960, so it

can be concluded that increasing sales of tourism

companies can increase the income from sales of

banking companies according to COVID-19. This

means that an increase in the number of customers

buying tourism products can increase the sales of

banking companies, because customers use banking

services in transactions to buy tourism products and

also in transactions during tourism trips.

Tourism companies that use digital marketing as

a marketing strategy can increase sales at banking

companies.

The results of testing the variable for banking

companies that use digital marketing as a marketing

strategy obtained a p-value of 0.000 < 0.05 and a t-

statistic of 7.421 > 1.960, so it can be concluded that

tourism companies that use digital marketing as a

marketing strategy can increase the sales revenue of

banking companies after COVID-19. Tourism

products marketed digitally will reach new customers

from anywhere at any time, as information is easily

available to potential customers. To facilitate

transactions, customers use banking services, and if

banking companies also use digital marketing, the

dynamo effect of digital marketing can be felt.

Tourism companies that use digital marketing as

part of their marketing strategy can influence the

relationship between digital marketing and sales

revenue for banking companies.

The results of testing the variable for tourism

companies that use digital marketing as their

marketing strategy, obtained a p-value of 0.00 < 0.05

and a t-statistic of 3.740 > 1.960, so it can be

concluded that tourism companies that use digital

marketing as their marketing strategy can influence

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

336

marketing relationships digital on revenue from sales

of banking companies after COVID-19.

Tourism companies that use digital marketing as

their marketing strategy can influence the relationship

between increasing sales of tourism companies and

income from sales of banking companies.

The results of the variable test show that the p-

value is 0.000 < 0.05 and the t-statistic is 5.170 >

1.960, so it can be concluded that tourism companies

that use digital marketing as a marketing strategy can

influence the relationship between increasing sales of

tourism companies and income from sales of banking

companies according to COVID-19.

5 CONCLUSIONS

When the COVID-19 pandemic ends, people will be

used to digitalisation in almost all aspects, so the

environment will become a new digital environment.

This requires all business sectors to keep up with

developments in the new digital environment.

Likewise, tourism and banking companies need to

follow the trends that are happening in the community

and find opportunities to improve their business.

The situation of tourism in Indonesia is currently

in the recovery phase and moving towards the

normalisation phase, so technological innovation

must be used as much as possible to improve the

performance of tourism companies after the

pandemic.(Deputy for Strategic Policy, 2021) Digital

marketing can increase the sales revenue of tourism

companies by attracting new customers, providing

information to customers and interacting with

customers. With digital marketing, customers will

also find it easier to find information through various

search engines to make purchasing decisions, so

digital marketing has a significant impact on product

promotion in tourism companies. This is in line with

the research conducted by Sakas DP, Reklitis DP,

Terzi MC, Vassilakis C.

The same mechanism occurs in banking

companies, digital marketing can increase the

revenue from sales of banking companies by

providing information to customers, interacting or

communicating with customers and attracting new

customers. Information that is easily communicated

to the public and the ease of digital transactions

increases customer reach and creates new potential

customers.

When banking enterprises use digital marketing as

a marketing strategy, this has no effect on the

relationship between the use of digital marketing in

tourism enterprises, which has an effect on the

increase in turnover of the tourism enterprise. Then,

if the turnover of banking enterprises increases due to

the use of digital marketing, this also has no effect on

the increase in turnover of tourism enterprises.

When income from sales of tourism companies

increases, sales at banking companies also increase.

Then, when tourism companies use digital marketing

as their marketing strategy, they can increase revenue

from sales for banking companies. Tourism

companies that use digital marketing and this

increases their sales can strengthen the relationship

between digital marketing and revenue from sales in

banking companies and can also increase revenue in

banking companies.

When banking companies implement digital

marketing, even though their sales revenue increases

as a result, it does not lead to an increase in sales

revenue for tourism companies. This is because

customers who use banking services are not focused

on transactions related to purchasing tourism

products. Banking customers tend to use banking

services for financial transactions that vary according

to their activities. However, on the contrary, when

tourism companies use digital marketing and this

increases their sales income, then sales income from

banking companies also increases. Tourism products

marketed digitally will reach new customers from

anywhere and at any time because information is

easily obtained by potential customers. Customers

and potential customers will use banking services to

make their transactions easier. Moreover, when

banking companies also use digital marketing,

customers who are clients of tourism companies shall

take advantage of the offers proposed by banking.

This way the dynamo effect of digital marketing can

be experienced.

The population in this study consists of two parts,

namely tourism companies and banking companies in

Jakarta. It is recommended to expand the regional

scope in future research. In this study, companies

operating in the tourism sector were represented by

165 tour and travel companies. It is advisable to

include other types of companies operating in the

tourism sector, such as hotels and transportation

companies, for future research. The banking

companies in this research are represented by 61

traditional high street banks, so it is recommended

that further research includes Sharia banking

considering the rapid development of Sharia banking

currently in Indonesia.

Dynamo Effects of Digital Marketing: Catalysing Dual Impact on Post – Covid Tourism and Banking Sales

337

REFERENCES

Arikunto, S. (2002). Prosedur penelitian : Suatu

pendekatan praktek. PT Rineka Cipta.

Chandy, R. K., Johar, G. V., Moorman, C., & Roberts, J. H.

(2021). Better Marketing for a Better World. Journal of

Marketing, 85(3), 1–9.

https://doi.org/10.1177/00222429211003690

Coordinating Ministry for Economic Affairs Republic of

Indonesia. (n.d.). Gelar Rakornas Transisi Penanganan

Covid-19 dan Pemulihan Ekonomi Nasional,

Pemerintah Rumuskan Berbagai Kebijakan Transisi

Pasca Pandemi. Retrieved September 15, 2023, from

https://www.ekon.go.id/publikasi/detail/4882/gelar-

rakornas-transisi-penanganan-covid-19-dan-

pemulihan-ekonomi-nasional-pemerintah-rumuskan-

berbagai-kebijakan-transisi-pasca-pandemi

Deputy for Strategic Policy. (2021). Tren Industri

Pariwisata. Kemenparekraf.

Guven, H. (2020). Industry 4.0 and Marketing 4.0: In

perspective of Digitalization and e-commerce. In Agile

Business Leadership Methods for Industry 4.0. Emerald

Publishing Limited.

Public Relations of the Cabinet Secretariat of the Republic

of Indonesia. (n.d.). Merajut Kebijakan Transisi

Penanganan COVID-19. Retrieved September 15,

2023, from https://setkab.go.id/merajut-kebijakan-

transisi-penanganan-covid-19/

Ministry of Finance of the Republic of Indonesia. (n.d.).

Pengaruh Covid-19 Atas Kondisi Sosial Ekonomi di

Indonesia. Retrieved September 20, 2023, from

https://pen.kemenkeu.go.id/in/page/pengaruhcovid

Ministry of Communication and Information, R. of I. (n.d.).

Di Masa Transisi Menuju Endemi COVID-19

Perekonomian Indonesia Tumbuh. Retrieved

September 23, 2023, from

https://covid19.go.id/artikel/2022/06/05/di-masa-

transisi-menuju-endemi-covid-19-perekonomian-

indonesia-tumbuh

Ministry of Tourism and Creative Economy of the Republic

of Indonesia. (n.d.). Tren Pariwisata Indonesia di

Tengah Pandemi. Retrieved September 10, 2023, from

https://kemenparekraf.go.id/ragam-pariwisata/Tren-

Pariwisata-Indonesia-di-Tengah-Pandemi

Miquel Vidal, M., & Castellano-Tejedor, C. (2022).

Identification of Marketing Strategies Influencing

Consumers’ Perception of Healthy Food Products and

Triggering Purchasing Decisions. Businesses, 2(4),

410–422. https://doi.org/10.3390/businesses2040026

M.S.Khan, & S. S. Mahapatra. (2009). Service quality

evaluation in internet banking: an empirical study

in India. . Int. J. Indian Culture and Business

Management, 2(1), 30–26.

Philip Kotler, Hermawan Kartajaya, & Iwan Setiawan.

(2017). Marketing 4.0 : moving from traditional to

digital.

Sakas, D. P., Reklitis, D. P., Terzi, M. C., & Vassilakis, C.

(2022). Multichannel Digital Marketing Optimizations

through Big Data Analytics in the Tourism and

Hospitality Industry. Journal of Theoretical and

Applied Electronic Commerce Research, 17(4), 1383–

1408. https://doi.org/10.3390/jtaer17040070

SCHILLING, L. M. (2023). Optimal Forbearance of Bank

Resolution. The Journal of Finance.

https://doi.org/10.1111/jofi.13273

Sinclaire, J. K., & Vogus, C. E. (2011). Adoption of social

networking sites: an exploratory adaptive structuration

perspective for global organizations. Information

Technology and Management, 12(4), 293–314.

https://doi.org/10.1007/s10799-011-0086-5

Velentza, A., & Metaxas, T. (2023). The Role of Digital

Marketing in Tourism Businesses: An Empirical

Investigation in Greece. Businesses, 3(2), 272–292.

https://doi.org/10.3390/businesses3020018

Wely Putri Melati - Ministry of Finance of the Republic of

Indonesia. (n.d.). Pandemi Covid-19 Dan Menurunnya

Perekonomian Indonesia.

Https://Www.Djkn.Kemenkeu.Go.Id/Artikel/Baca/160

64/Pandemi-Covid-19-Dan-Menurunnya-

Perekonomian-Indonesia.Html. Retrieved September

10, 2023, from

https://www.djkn.kemenkeu.go.id/artikel/baca/16064/

Pandemi-Covid-19-Dan-Menurunnya-Perekonomian-

Indonesia.html

Yasmin, A., Tasneem, S., & Fatema, K. (2015).

Effectiveness of Digital Marketing in the Challenging

Age: An Empirical Study. The International Journal of

Management Science and Business Administration,

1(5), 69–80. https://doi.org/10.18775/ijmsba.1849-

5664-5419.2014.15.1006

Yusuf- Ministry of Communication and Information. (n.d.).

Pandemi Covid-19 Pacu Adaptasi Gunakan Teknologi

Digital. Retrieved September 10, 2023, from

https://www.kominfo.go.id/content/detail/32602/pande

mi-covid-19-pacu-adaptasi-gunakan-

teknologi%20digital/0/berita_satker

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

338