QR Cross: Border in Increasing Financial Integration in ASEAN

Endyastuti Pravitasari, Virgo Simamora and Indah Novitasari

Department of Business Administration, Faculty of Economics Business and Social Sciences,

Universitas 17 Agustus 1945 Jakarta, Indonesia

Keywords: Cross Border Qr, Financial Integration, NVivo.

Abstract: QRIS Cross border is a cross-border payment solution using QR Code as a payment method. The use of

QRIS Cross border is strengthened by "ASEAN-led Cross-Border Payment Connectivity, from ASEAN

to Global as an economic pathway which aims to strengthen and improve cross-border payment

connectivity in the region and encourage economic recovery, in line with the global attention of the G20.

The aim of this research is to find out Benefits of using QRIS Cross Border? And what are the factors

that support the success of QRIS Cross Border? In this research, the qualitative method and type of

Systematic Literature Review (SLR) requires a regional payment system with cross-border and multi-

currency capabilities to support regional growth with the ability cross-border and multi-currency to

support the growth of economic activity in the ASEAN region. By emphasizing opportunities for

regional payment system convergence in South Asia, which can speed up settlements, reduce transaction

costs, and expand facilities. Overall, it shows that the implementation of the ASEAN cross-border

payment system can improve trade facilities and economic integration in the region. Factors supporting

the success of ASEAN cross-border payments. Found that the existence of GDP and the real exchange

rate has an impact on e-commerce trade across countries in the ASEAN region. that it is important to

develop market infrastructure and create incentives for investors to encourage cross-border investment

in the ASEAN region. The overall factors show that the implementation of the ASEAN cross-border

payment system can improve trade facilities and economic integration in the ASEAN region.

1

INTRODUCTION

The increasingly rapid digitalization of financial

transactions has enabled faster and more precise

payment systems. Because of this, QR Codes have

become very popular all over the world. Their

convenience and speed for simpler digital payments,

QR Code Indonesia has released by Indonesia QRIS

the national standard for QR code money payments.

With international standards, namely cross-border or

known as Cross – Border QR overseas payment

system.

Cross Border QR is a digital payment system that

speeds up cross-border transactions in the ASEAN

region. Cross border QR is a cross-border payment

solution using QR Code as a payment method

(Lingkungan et al., n.d.). The use of Cross border QR

is strengthened by "ASEAN-led Cross-Border

Payment Connectivity, from ASEAN to Global as a

pathway economy which aims to strengthen and

improve cross-border payment connectivity in the

region and encourage economic recovery, in line with

the global attention of the G20 (Haryono, 2023). With

Cross Border QR, transactions no longer need to

exchange currency if you want to shop in the country

you are visiting by scanning a QR code. The QR

code-based cooperative payment system is a concrete

manifestation of the implementation of the G20

(Roadmap for Enhancing Cross-border Payments)

(Indonesia, 2023) QRIS often provides various

attractive benefits, such as exclusive offers,

discounts, or cashbacks that push consumers to

make more purchases to get additional benefits.

This is confirmed also by (Salim & Fermayani, 2021)

influence consumers to make impluse purchases

(Pravitasari & Fauziyah, 2023).

When customers or the public feel comfortable

with a service, they will try to buy again. People enjoy

the convenience of shopping via digital platforms and

enjoy safe, easy and fast payment features such as QR

code. The use of financial technology that provides

additional benefits such as discounts and cashback

also increases customer satisfaction. This is supported

364

Pravitasari, E., Simamora, V. and Novitasari, I.

QR Cross: Border in Increasing Financial Integration in ASEAN.

DOI: 10.5220/0012582300003821

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Seminar and Call for Paper (ISCP UTA ’45 JAKARTA 2023), pages 364-369

ISBN: 978-989-758-691-0; ISSN: 2828-853X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

by (Astria & Wadiniwaty, 2021) who states that

perceived convenience influences repeat purchases in

e-commerce. (Pravitasari & Fauziyah, 2023)

Cross Border QR is the brainchild of Bank

Indonesia and the Indonesian Payment System

Association (ASPI). The International Standard EMV

Co (European Master Card Visa) is used to

standardize the basis for preparing the QR code. This

standard is to support interconnection and

interperability between providers, between

instruments and between countries so that it can be

open source (Carera et al., 2022). With a commitment

to the payment system industry towards QR code

strategic development of cross-border transactions,

which has started with the implementation of Cross-

Border QR for Thailand on 19 August 2022 (Haryono

et al., 2023).

According to Tigor M. Siahaan, Deputy General

Chairman of PERBANAS, cooperation and

innovation will be very important to build a stronger

and more efficient payment system in ASEAN. By

supporting the integration of payment systems in

ASEAN through fast payment system connectors, and

will continue to work together with stakeholders or

MSME companies to ensure that payment systems

such as real-time transfers and QR codes can be

accessed by all ASEAN communities thereby

improving the ASEAN economy (Haryono et al.,

2023). Erwin Haryono in a press release stated that

Cross – Border QR which was founded by Indonesia

allows ASEAN member countries to work together to

integrate their digital currencies. This payment

system has the potential to place ASEAN at the

forefront globally in efficient digital MSME payment

connectivity for economic stability (Haryono, 2023).

The use of Cross Border QR in ASEAN has great

potential. The potential for Indonesia's digital

economy is very large and the momentum of

Indonesia's Chairmanship in ASEAN in 2023 makes

the digital economy a main topic. This is supported

by ASEAN's economic potential which is estimated

to increase to US$ 330 billion in (2025) and then

increase to US$ 1 trillion in (2030), with a third of it

coming from Indonesia. This figure will even

increase with the Framework for Digital Economic

Agreements (DEFA) (Kementerian Koordinator

Bidang Perekonomian Republik Indonesia, 2023).

The growing development of financial integration

in the international world has created large amounts

of cross-border capital flows between developed and

developing countries. As foreign financial institutions

grow throughout the world and bind international

financial markets.

ASEAN or The Association of Southeast Asian

Nations is a regional organization in a global region

with the majority of developing countries

implementing financial integration within the region.

In the planning of ASEAN financial integration talks

since the first ASEAN Finance Minister and Central

Bank Governors Meeting or AFMGM in Kuala

Lumpur, Malaysia in March (2015) and the second

meeting held in Jakarta, Indonesia in August (2023)

these discussions will realize work efforts

Collaboration between the Indonesian Ministry of

Finance and Bank Indonesia in maintaining economic

stability in the ASEAN region fosters a sense of trust

and encourages regional economic integration

cooperation to strengthen the financial system and

ASEAN economic vulnerability (Sentral et al., 2023).

Source: https://databoks.katadata.co.id/

Figure 1: ASEAN Digital Economy by sector (2025).

According to e-Conomy SEA themed report (Blog

& Sea, 2002) it shows that the digital economy in

Southeast Asia will be achieved by the e-commerce

sector which is targeted to reach US$ 330 billion in

2025. With an estimated GMV value of US$211

billion, or 6.93% of the total value of the ASEAN

digital economy. In addition, the digital economy

sector adds online travel ticket booking services or

booking temporary accommodation during tourist

trips to places you want to visit, estimated to

contribute a GMV value of $44 billion (1.33%), food

delivery orders of $39 billion (11.81%) and online

media at $36 billion (10.9%) (Network, 2023)

The QR code payment system is a follow-up to the

commitment of 5 ASEAN countries to collaborate on

cross-border transaction systems or cross-border

payments. These countries are Indonesia, Thailand,

Malaysia, Singapore and the Philippines. With the

interconnection cooperation agreement, this

0

100

200

300

400

E- Commerce

Online Travel

Online transport / food

Online media

Total

123 4

Digital Economy in the ASEAN

Region

Value / US$ Billion

QR Cross: Border in Increasing Financial Integration in ASEAN

365

transaction system will be officially implemented at

the G20 leaders meeting in November (2022). With

this, people visiting the Land of the White Elephant

or Thailand can make transaction payments by

scanning the QR code. At the end of the year (2022),

Bank Indonesia (BI) recorded QR codes transactions

of Indonesians in Thailand reaching 14,555 times or

around IDR 8.54 billion or the reverse of QR

transactions of Thai people in Indonesia were only

492 times or around IDR 114 million (Mesra, 2022).

Source: https://www.cnbcindonesia.com

Figure 2: Cross Border QR Transactions in Indonesia and

Thailand.

Based on the data above, it appears that there is a

very imbalance in transactions in Indonesia and

Thailand. There are several things where the influence

of Thai tourists in Indonesia has decreased or there are

still minimal transactions using QRIS merchant

MSME transactions by tourists in Indonesia. The post-

revocation of PPKM will encourage community

movement and QR transactions at several MSME

merchants (Mesra, 2022).

Source: https://www.rri.go.id/keuangan/

Figure 3: Number of Cross Border QR MSME Merchants

in ASEAN Region.

Based on June (2023), the number of MSME

merchant transactions using QR codes has reached

26.7 million or 91.4%, while the number of

transactions using QR codes in (2022) has reached

1.03 billion or growing 86% on an annual basis (Bank

Indonesia, 2023).

1.1 Formulation of the Problem

Based on the following background, the research

questions outlined are:

1. What are the benefits of using Cross Border QR?

2. What are the factors that support the success of

Cross Border QR?

2

LITERATUR REVIEW

2.1 Cross Border QR

Cross Border QR is a QR code-based cross-border

payment system that can be used for cross-border

transactions and does not exchange currency when

shopping in the country visited (Wahyudi et al., n.d.).

According to Sunarto in (Santhika Parwitasari, 2022)

QR codes are products that have three advantages,

namely price differences, an effective system, and the

ability to accommodate hundreds of MSME

merchants in one QR code to carry out payment

transactions.

2.2 Financial Integration

According to Yu (2013) in (Cahyanti, 2017)

financial integration helps the state obtain more

resources efficiently and increases the income

received by the state and with minimal risk of a

stronger market framework. (Cahyanti, 2017) states

that financial integration has a strong policy for

measuring financial stability which is used as an

overall indicator. There are several factors for

financial market integration in ASEAN, namely the

lack of liquidity in small financial markets, which

causes investors to prefer major financial markets in

developed countries. Strict policies on some cross-

border financial transactions also hinder financial

integration throughout ASEAN (Rillo, 2018). Price

indicators and volume indicators, with price

indicators used to measure integration in financial

markets in relation to movements in financial asset

returns. Meanwhile, volume indicators show

increased financial integration. Cross border asset

holdings of countries in ASEAN grew by 27% to

(US$14.5) trillion in 2015, from (US$11.4) trillion in

0 500

Number of

Transactions

(Times)

Transaction

Amount (Rupiah

Million)

Cross Border QR transactions in

Indonesia and Thailand

Thai people in Indonesia

Indonesian people in Thailand

0

10

20

30

Number of

MSMEs

Number of Cross

Border QR

Merchants

Number of Cross Border QR MSME

Merchants in the ASEAN Region

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

366

2010. Most of these assets were bank claims (US$4.1

trillion) followed by portfolio debt assets (US$3.5

trillion), foreign direct investment stock (US$3.6

trillion) and portfolio equity assets (US$3.2 trillion).

Increasing the share of intra-regional cross-border

assets over the years, which shows gradual financial

integration, some asset ownership in the ASEAN

region. Cross-border liabilities of countries in the

ASEAN region increased by 31% to (US$15.1

trillion) in 2015. There was a gradual increase in the

intra-regional portion of total cross-border liabilities

which shows an increase in the level of regional

financial integration. With financial relations in the

ASEAN region in terms of obligations with other

countries in the world, it is stronger than in the region

(Rillo, 2018)

3

METHODS

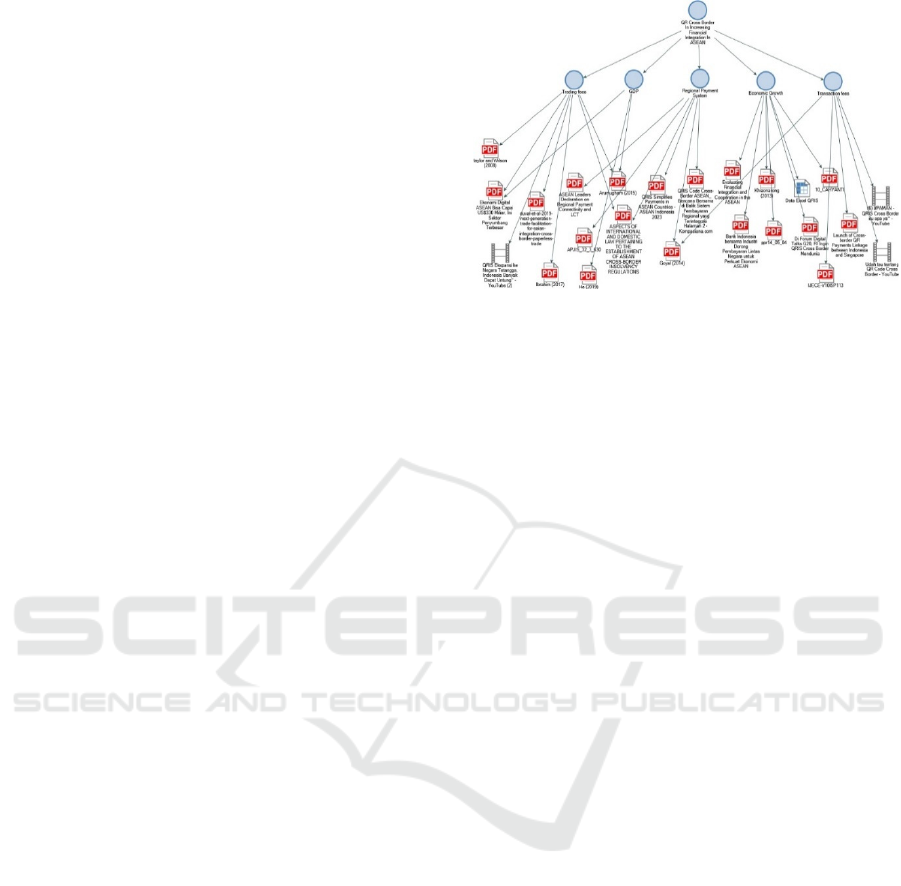

The definition of qualitative methods is scientific

research that aims to understand a phenomenon and

solve problems (Penelitian & Pengertian, 2023). This

research is a type of Systematic Literature Review

(SLR). The SLR method is a research method used to

identify, analyze, evaluate and interpret all previous

research results that the researcher obtained (Kamus

Besar Bahasa Indonesia, 1994) The aim of using the

systematic literature review (SLR) method is to find

strategies that will help overcome the problems faced

as well as identify perspectives that are different from

the problem being researched and show relevant

theories in the research. study. In carrying out the

SLR method the author needs secondary data in the

form of videos, press release documents and website

news (Iii & Penelitian, 2015). The author uses the

NVIVO 12 plus application to analyze a problem

formulation question. In carrying out the SLR method

the author needs secondary data in the form of

journals, videos, press release documents and website

news (Iii & Penelitian, 2015). The author uses the

NVIVO 12 plus application to analyze a problem

formulation. This software was chosen because it is

able to produce coding visualization images and how

to use the software is very user friendly (Tambun et

al., 2023)

Figure 4: Visualization of Coding Results.

4

RESULTS AND DISCUSSION

Based on the problem formulation question, the

researcher explains Cross Border QR.

4.1 Benefits of Cross Border QR

These papers collectively show that there are

potential benefits from using ASEAN cross-border

payment systems. Cross Border QR payment linkage

between Indonesia and Thailand will promote faster,

cheaper, more transparant, and more inclusive cross

border payments, particularly for the benefits of

micro, small, and medium enterprises (Launch &

Linkage, 2023). (Khiaonarong, 2013) highlights the

need for a regional payment system with cross-border

and multi-currency capabilities to support the growth

of economic activity in the ASEAN region.

According to (Goyal, 2015) emphasizes the

opportunity for convergence of regional payment

systems in South Asia, which can speed up

settlement, reduce transaction costs, and expand

facilities. (Bank, 2008) discusses the importance of

addressing time and document requirements for

ASEAN cross-border transactions, as reforms in this

area could significantly improve trade. Kiseleva

(2012) focuses on the need to develop market

infrastructure and create incentives to support cross-

border investment in ASEAN+3 countries. Overall,

these papers show that the implementation of the

ASEAN cross-border payment system can increase

trade facilitation and economic integration in the

region.

4.2 Factors That Support Cross Border

QR

Factors that support the success of ASEAN cross-

QR Cross: Border in Increasing Financial Integration in ASEAN

367

border payments. The implementation of the QR

Cross Border system among ASEAN countries has a

positive impact in strengthening economic integration

in the region. with the ease of cross border payments,

Cross Border QR trading will become more efficient,

transparent and easy. This will encourage sustainable

economic growth and increase the competitiveness of

ASEAN countries in the era of the global digital

economy (Alexander, 2023). (Khiaonarong, 2013)

highlights the need for a regional paymenst system

with cross-border and multi-currency capabilities to

facilitate economic activities. (He & Wang, 2019)

found that GDP and real money exchange rates have

an impact on cross-border e-commerce trade in

ASEAN countries. (Hsia et al., 2015) identified

variables such as GDP, trade costs, financial

development indicators, and real money exchange

rates as influential factors in determining cross-

border mergers and acquisitions in ASEAN countries.

Kiseleva (2012) emphasized the importance of

developing market infrastructure and creating

incentives for investors to stimulate cross-border

investment in the ASEAN+3 region. Overall, this

paper shows that factors such as regional payment

systems, economic growth, money exchange rates,

and financial development play an important role in

supporting success ASEAN cross-border payments.

5

CONCLUSION

This research is a qualitative study that aims to

describe the benefits and factors that support the

successful use of QR Cross Border payments in the

ASEAN region. QR Cross-Border (QR CB) has

emerged as a powerful tool for driving financial

integration within the ASEAN region. Its managerial

implication across various sectors are significant.

First, The use QR CB increased efficiency and

convenience for customers with simplified

transactions, faster settlement, reduced costs, and

enhanced customer experience. Second, The use of

QR CB boosted trade and investment. It eliminates

barriers, QR CB removes friction from cross-border

transactions, expands market reach for businesses

which can access a wider customer base and explore

new opportunities across the region. Promotes

regional economic integration to a more integrated

ASEAN economic space, facilitating collaboration

and economic growth. Third, for greater financial

inclusion, it promotes digital financial services,

empowers MSMEs. Small businesses can benefit

from increased access to digital payments, improving

their financial inclusion and competitiveness, and

contributes to financial stability.

REFERENCES

Alexander, R. F. (2023). QRIS Code Cross-Border

ASEAN : Bencana Bersama di Balik Sistem

Pembayaran Regional yang Terintegrasi. 1–7.

Astria, N., & Wadiniwaty, R. (2021). Intensitas Pembelian

Ulang Melalui E-Commerce. 1(1), 31–42.

Bank Indonesia. (2023). Atas Kontribusinya Akselerasi

Digitalisasi di Masyarakat, QRIS Raih Penghargaan

Internasional. 2022–2023.

https://www.bi.go.id/id/publikasi/ruang-media/news-

release/Pages/sp_2521123.aspx

Bank, W. (2008). Trade Issue Brief Deeper Integration in

ASEAN : Why Transport and Technology Matter for

Trade ii. World, July.

Blog, P. M., & Sea, C. (2022). Blog resmi Google di

Indonesia: Google Workspace untuk semua.

https://indonesia.googleblog.com/2021/06/google-

workspace-untuk-semua.html

Cahyanti, T. D. (2017). Mempengaruhi Pertumbuhan

Ekonomi : Studi Kasus Negara Asean. Skripsi, Fakultas

Ekonomika Dan Bisnis: Universitas Diponogoro :

Semarang, 1–58.

Carera, W. B., Gunawan, D. S., & Fauzi, P. (2022). Analisis

Perbedaan Omset Penjualan Umkm Sebelum Dan

Sesudah Menggunakan QRIS di Purwokerto. Jurnal

Ekonomi Dan Bisnis Akuntansi (JEBA), 24(1), 48–57.

Connectivity, P., Gubernur, D., Indonesia, B., & Hendarta,

F. (2023). BANK INDONESIA BERSAMA INDUSTRI

DORONG. 1–4.

Goyal, A. (2015). Payment Systems to Facilitate South

Asian Integration. South Asia Economic Journal,

16(September), 102S-118S.

https://doi.org/10.1177/1391561415594893

Haryono, E. (2023). Transaksi qr antar negara dukung

integrasi keuangan asean. Bank Indonesia, 15–16.

https://www.bi.go.id/id/publikasi/ruang-media/news-

release/Pages/sp_245022.aspx

He, Y., & Wang, J. (2019). A panel analysis on the cross

border e-commerce trade: Evidence from ASEAN

countries. Journal of Asian Finance, Economics and

Business, 6(2), 95–104.

https://doi.org/10.13106/jafeb.2019.vol6.no2.95

Hsia, K.-C. C., Stavropoulos, P., Blobel, G., Hoelz, A.,

Sudha, G., Nussinov, R., Srinivasan, N., Taylor, P.,

Sawhney, B., Chopra, K., Saito, S., Yokokawa, T.,

Iizuka, G., Cigdem, S., Belgareh, N., Rabut, G., Baï, S.

W., Van Overbeek, M., Beaudouin, J., … Gupta, M. R.

(2015). No 主観的健康感を中心とした在宅高齢者

における 健康関連指標に関する共分散構造分析

Title. Proceedings of the National Academy of

Sciences, 3(1), 1–10.

http://scholar.google.com/scholar?hl=en&btnG=Searc

h&q=intitle:EM+Demystified:+An+Expectation-

Maximization+Tutorial#0%0Ahttps://www2.ee.washi

ngton.edu/techsite/papers/documents/UWEETR-2010-

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

368

0002.pdf%0Ahttp://dx.doi.org/10.1038/srep22311%0

Ahttp://www.life.um

Iii, B. A. B., & Penelitian, M. (2015). Contoh Bab 3 SLR.

1–15.

Indonesia, B. (2023). QRIS antarnegara : Jajan di Luar

Negeri bisa Pake Rupiah! Www.Bi.Go.Id, 3–5.

https://www.bi.go.id/id/publikasi/ruang-media/cerita-

bi/Pages/QRIS-antar-negara.aspx

Kamus Besar Bahasa Indonesia. (1994). Kamus Besar

Bahasa Indonesia. Balai Pustaka, 1–1277.

https://www.worldcat.org/title/222001867

Kementerian Koordinator Bidang Perekonomian Republik

Indonesia. (2023). Ekonomi Digital Mesin

Pertumbuhan Ekonomi Nasional Ke Depan. Siaran

Pers HM.4.6/302/SET.M.EKON.3/08/2023, 10–12.

www.ekon.go.id

Khiaonarong, T. (2013). Creating an Association of

Southeast Asian Nations Payment System: Policy and

Regulatory Issues. SSRN Electronic Journal, 422.

https://doi.org/10.2139/ssrn.2267281

Launch, P. M., & Linkage, C. Q. R. P. (2023). LAUNCH

OF CROSS-BORDER QR PAYMENTS LINKAGE

BETWEEN INDONESIA AND Press Releases. August

2022, 2–5.

Lingkungan, P. A., Pinjol, T. P., & Brastara, V. (n.d.).

Melampaui Batas dengan QRIS Cros- Border :

Meningkatkan Kerja Sama Ekonomi ASEAN dengan

Pembayaran Digital. 1–7.

Mesra, H. I. (2022). Perbedaan Transaksi QRIS Indonesia-

Thailand. 29–32.

Network, K. M. (2023). Ekonomi Digital ASEAN Bisa

Capai US $ 330 Miliar , Ini Sektor Penyumbang

Terbesar. 1–9.

Penelitian, M., & Pengertian, K. (2023). Metode Penelitian

Kualitatif : Pengertian , Tujuan , Ciri , Jenis & Contoh.

1–9.

Pravitasari, E., & Fauziyah, A. (2023). The Influence of

Lifestyle, Perceived Convenience, And Promotion on

The Decision to Use Quick Response Code Indonesian

Standard (QRIS). In Return : Study of Management,

Economic and Bussines (Vol. 2, Issue 8, pp. 784–794).

https://doi.org/10.57096/return.v2i8.131

Rillo, A. D. (2018). Asean Financial Integration:

Opportunities, Risks,and Challenges. Public Policy

Review, 14(5), 901–924.

Salim, A., & Fermayani, R. (2021). Konsumen Matahari

Departement Store Padang. Jurnal Menara Ekonomi,

VII(3), 1–14.

Santhika Parwitasari, E. (2022). Di Forum Digital Talks

G20, RI Ingin QRIS Cross Border Mendunia. 15

Februari 2022, 1–6.

https://www.cnnindonesia.com/ekonomi/20220215141

722-78-759416/di-forum-digital-talks-g20-ri-ingin-

qris-cross-border-mendunia

Sentral, B., Kembali, A., & Pers, S. (2023).

PERTEMUAN

MENTERI KEUANGAN DAN GUBERNUR. 22–24.

Tambun, S., Sitorus, R. R., Putra, R. R., & Julito, K. A.

(2023). Pemanfaatan aplikasi NVivo 12 Plus untuk riset

kualitatif di bidang akuntansi. Jurnal Inovasi Hasil

Pengabdian Masyarakat (JIPEMAS), 6(2), 359–372.

https://doi.org/10.33474/jipemas.v6i2.19401

Wahyudi, U., Bukti, P., Sebagai, A., & Baku, B. (n.d.). Tak

Perlu Resah , dengan QRIS Cross Border Belanja di

Luar Negeri Bisa Pakai Rupiah. 1–7.

QR Cross: Border in Increasing Financial Integration in ASEAN

369