Precise Portfolio Optimization Based on Novel Modern Portfolio

Theory Using Time Series Model Compared with LASSO Regression

K. Sravan

*

and P. Sriramya

†

Department of Computer Science and Engineering, Saveetha School of Engineering, Saveetha Institute of Medical and

Technical Sciences, Chennai, Tamil Nadu, 602105, India

Keywords: Global Trade, Time Series Model, Novel Modern, Novel Modern Portfolio, LASSO Regression, Stock

Market.

Abstract: This study aims to augment the accuracy of stock market prediction by amalgamating Time Series Model

algorithms with LASSO Regression. Historical financial data for various assets is amassed to generate optimal

portfolios employing MPT 2.0 and LASSO Regression. Performance metrics such as the Sharpe ratio and

portfolio variance are harnessed to appraise these portfolios. The aim is to juxtapose the predictive precision

of the two methodologies and ascertain which one affords more precise portfolio optimisation results.

Materials and Methods: The prediction process involves Time Series Model (N=10) coupled with LASSO

Regression (N=10). Determining sample size utilises Gpower, with pretest power set at an alpha value of 0.8

and a beta value of 0.2. The accumulated financial data is employed to construct optimal portfolios through

MPT 2.0 and LASSO Regression. Evaluation criteria encompass the Sharpe ratio for risk-adjusted

performance and portfolio variance for risk assessment. Result: The Time Series Model showcases a lofty

accuracy rate of 90.1252%, whereas the LASSO Regression method attains an accuracy of 80.1423%. The

significance of accuracy and loss is underscored by the p-value being less than 0.05 (p=0.000), signifying the

marked significance of the Time Series Model in contrast to LASSO Regression. Conclusion: Within the

realm of portfolio optimisation, the Time Series Model approach manifests a marginally elevated predictive

rate when compared to the LASSO Regression method. This infers that the Time Series Model algorithm

endows advanced predictive capabilities for stock market performance.

1 INTRODUCTION

Portfolio optimisation constitutes a crucial facet of

global trade within investment management, aiming

to forge a collection of assets that maximises returns

while mitigating risk. Conventional portfolio theory,

rooted in mean-variance analysis, has long served as

the cornerstone for portfolio optimisation.

Nevertheless, it has faced criticism for its

oversimplification of market dynamics, presumption

of static correlations between assets, and neglect of

non-normal return distributions. This prompted the

development of Modern Portfolio Theory (MPT) to

address some of these limitations ('Predicting

portfolio returns using the distributions of efficient set

portfolios', 2003a) (Parzen, 1983).

Recently, a novel approach to portfolio

optimisation, termed Modern Portfolio Theory using

*

Research Scholar

†

Project Guide, Corresponding Author

Time Series Models (MPT-TSM), has emerged. This

method integrates time series techniques to model

asset returns and correlations (Md. Ehsanes Saleh,

Arashi and Golam Kibria, 2019). MPT-TSM

accounts for the dynamic nature of asset prices,

incorporating long-term trends, seasonality, and other

elements influencing asset prices over time. This

approach offers potential advantages over traditional

MPT, including enhanced risk-adjusted returns and

improved out-of-sample performance.

Another prominent global trade strategy for

portfolio optimisation is LASSO (Least Absolute

Shrinkage and Selection Operator) regression. This

statistical technique serves to select variables and

apply regularisation (Prendergast, no date; Parzen,

1981; Uğurlu and Brzeczek, 2022). LASSO

regression has demonstrated its capacity to bolster the

accuracy of portfolio optimisation models by

Sravan, K. and Sriramya, P.

Precise Portfolio Optimization Based on Novel Modern Portfolio Theory Using Time Series Model Compared with LASSO Regression.

DOI: 10.5220/0012602600003739

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Artificial Intelligence for Internet of Things: Accelerating Innovation in Industry and Consumer Electronics (AI4IoT 2023), pages 133-140

ISBN: 978-989-758-661-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

133

identifying pertinent predictors while mitigating

overfitting (Madsen, 2007).

Within this portfolio optimisation study, we

conduct a comparative analysis of MPT-TSM and

LASSO regression in their capacity to construct

efficient portfolios (G.R et al 2014). Through the

examination of historical stock data, we delve into the

risk-return tradeoff underpinning each approach and

assess the precision of their predictions. The

outcomes of this inquiry may yield valuable insights

for investors seeking to optimise their portfolios using

contemporary techniques that duly account for the

dynamic nature characterising financial markets

(Hyndman and Athanasopoulos, 2018).

Incorporating Dynamic Market Conditions: The

utilisation of time series models within the proposed

modern portfolio theory enables the inclusion of

dynamic market conditions. This stands as a notable

improvement over traditional portfolio optimisation

models that frequently rely on static assumptions

regarding market behaviour.

Enhanced Risk Management: The proposed

modern portfolio theory is crafted to enhance risk

management by adopting a more realistic and

dynamic approach to modelling asset returns.

Augmented Accuracy: The integration of machine

learning techniques in the proposed modern portfolio

theory can yield heightened accuracy in portfolio

optimisation. This is achieved by accounting for more

intricate relationships amongst asset returns.

Complexity Considerations: The amalgamation of

time series models and machine learning techniques

can heighten the complexity of the innovative modern

portfolio optimisation model. This heightened

complexity might potentially render the model more

intricate to interpret and implement.

Data and Computational Requirements: The

proposed modern portfolio theory may necessitate

larger datasets and computational resources

compared to traditional portfolio optimisation

models. This aspect could pose a limitation for

smaller investors or those constrained in terms of data

accessibility.

Limitations of LASSO Regression: LASSO

regression might not offer as comprehensive a risk

management strategy as modern portfolio theory. The

latter has the capacity to accommodate more intricate

relationships between asset returns.

Assumption of Normality: LASSO regression

assumes normal distribution of asset returns,

potentially straying from real-world market

behaviour and consequently leading to less precise

portfolio optimisation outcomes (Dey, 2020). Neglect

of Dynamic Market Conditions: Traditional portfolio

optimisation models tend to disregard dynamic

market conditions. Limited Use of Advanced

Techniques: Time series analysis and machine

learning techniques are often underutilised in

traditional portfolio optimisation models.

Study Objective: The study aims to construct and

compare two portfolio optimisation models: an

innovative modern portfolio theory integrating time

series models and machine learning techniques, and

the traditional LASSO regression approach.

Research Gap: Limited research exists that

directly compares time series models, novel portfolio

theories, and SVM for portfolio optimisation.

Nevertheless, certain studies have contrasted these

approaches with conventional models, demonstrating

potential accuracy enhancements. For instance,

Zhang et al. (2021) compared a GARCH model, a

Bayesian network model, and an SVM model with a

traditional mean-variance model. They found that all

the alternative models surpassed the traditional model

in terms of risk-adjusted returns. Notably, the

Bayesian network model displayed the highest

Sharpe ratio among all models assessed.

Advantages of Time Series Models:

Time series models excel in capturing intricate

relationships and patterns in data over time,

enhancing the accuracy of asset return and correlation

modelling.

Incorporating time series models within modern

portfolio theory allows for more realistic assumptions

about market behaviour, accommodating non-normal

distributions, varying volatility, and dynamic

correlations. Time series models are equipped to

consider time-dependent factors like seasonality, a

crucial aspect for optimising portfolios in specific

industries.

Investors gain a better grasp of risk by using time

series models to simulate the impact of various

scenarios and events on portfolio performance.

Disadvantages of Time Series Models:

Time series models can be computationally

demanding, necessitating significant data and

computing power, presenting challenges for certain

investors.

Sensitivity to outliers and missing data can lead to

inaccurate predictions and suboptimal portfolio

allocations. Relying on historical data might not

always provide accurate predictions for future market

conditions, particularly in rapidly changing markets

or times of economic instability.

Advantages of LASSO Regression:

LASSO regression adeptly handles a multitude of

variables and pinpoints essential predictors of asset

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

134

returns. Computationally efficient, LASSO

regression is suitable for relatively modest datasets.

LASSO regression effectively deals with missing

data and outliers by constraining coefficients of less

significant variables towards zero.

Disadvantages of LASSO Regression:

LASSO regression assumes a linear relationship

between variables, which may not be appropriate for

modelling asset returns.

Static assumption of variable relationships over

time might not hold in swiftly changing market

conditions.

LASSO regression may fall short of capturing the

entire complexity of asset returns, particularly when

nonlinear relationships and variable interactions are

present.

2 MATERIALS AND METHODS

The study was conducted at the Data Analytics Lab

within the Department of Information Technology at

Saveetha School of Engineering. For each iteration of

the project, a sample size of 10 was employed (Group

1 = 10, Group 2 = 10). In 2022, Urlu and Brzeczek

conducted research in this field. The study was

carried out at the Data Analytics Laboratory in the

Department of Information Technology at the

Saveetha School of Engineering, Saveetha Institute of

Medical and Technical Science. The research

included two sample groups: Group 1 utilised the

Time Series Model, while Group 2 employed LASSO

Regression. Training data were collected from stock

market analyses, sourced from a data science website

and the Yahoo search engine.

All experimentation in this study was performed

on a computer equipped with an NVIDIA GeForce

GTX 1050 TI processor operating at 4.0 GHz,

NVIDIA graphics, and 8 GB of Random Access

Memory (RAM) for algorithm execution. The system

configuration employed a 64-bit edition of Microsoft

Windows 11. The models proposed and compared

were crafted using machine learning tools from the

Matlab library, OpenCv, and other Matlab libraries.

The development environment and all necessary

applications are required to be installed on a hard

drive with a capacity of 1 TB.

LASSO Regressions

An alternative loss system widely used is known as

Lasso, standing for "Least Absolute Shrinkage and

Selection Operator" (Hyndman, R.J. and

Athanasopoulos, G., 2018). Similar to ridge

regression, the objective in Lasso is to minimise the

term encompassing the least sum of residuals along

with a penalty term (Kassambara, 2018). In contrast

to ridge regression, a distinctive feature of Lasso is

that it shrinks certain predictor coefficients precisely

to zero, leading to the exclusion of those predictors

from the model (Md. Ehsanes Saleh, Arashi and

Golam Kibria, 2019). This distinctive characteristic

results in a lasso-like elegant subset, which

effectively performs variable selection.

Lasso regression represents a form of

regularization technique. It is favoured over

regression methods for more precise modelling. This

technique utilises loss, where data values contract

towards the mean. This process is known as

shrinkage. The lasso approach promotes models with

fewer parameters, as they are simpler and more

sparse. When seeking to automate specific model

selection stages like variable selection or parameter

removal, or when dealing with substantial

multicollinearity within the model, employing this

particular type of regression is recommended. Lasso

Regression employs L1 regularization, a concept that

will be elaborated on further in this composition. It is

particularly useful when dealing with additional

features, as indicated in Equation 1.

(1)

The performance of the LASSO Linear

Regression System was assessed by evaluating the

Root Mean Square Error (RMSE) and Mean Absolute

Percentage Error (MAPE). These performance

metrics have been employed in various studies as a

dependable means to gauge the reliability of the daily

forecasting model. Equation 2 can be utilised to

illustrate this evaluation.

(2)

When pi is the predicted stock price on day i and

yi is the actual stock price on the same day, n is the

total number of trading days. The absolute value of

the difference between the actual stock price and the

projected stock price is first determined in order to set

up the Mean Absolute Chance Error (MAPE)

statistic.

LASSO Regression Algorithm

Load the data: Start by loading the training and testing

datasets into the program.

Precise Portfolio Optimization Based on Novel Modern Portfolio Theory Using Time Series Model Compared with LASSO Regression

135

Pre-process the data: Clean and pre-process the data

to ensure it is in the correct format for analysis.

Split the data into training and testing sets: Split

the pre-processed data into training and testing sets in

order to train the model and evaluate its performance.

Initialise the LASSO model: Create an instance of

the LASSO regression model and initialise its

hyperparameters such as the regularisation parameter

and the number of iterations.

Train the LASSO model: Train the LASSO model

using the training data. The LASSO model will use a

linear regression algorithm with the added constraint

of a L1 regularisation term, which encourages the

model to have sparse coefficients.

Predict using the LASSO model: Use the trained

LASSO model to make predictions on the testing

data.

Evaluate the performance: Evaluate the

performance of the LASSO model using a metric

such as mean squared error or R-squared.

Fine-tune the hyperparameters: If the

performance is not satisfactory, adjust the

hyperparameters such as the regularisation parameter

and repeat steps 5-7 until an acceptable performance

is achieved.

Use the final model: Once an acceptable

performance has been achieved, use the final model

to make predictions on new, unseen data.

Time Series Model

In general, portfolio optimization employing NMPT

through time series models can furnish investors with

portfolios that are not only accurate but also

diversified, capable of accommodating evolving

market dynamics and incorporating diverse data

sources. Nevertheless, it is crucial to meticulously

scrutinize the assumptions and constraints of such

models. Consistently monitoring and adjusting

portfolio allocation in response to changing market

conditions and investor preferences is equally essential

(Lohmeyer and Lohmeyer, no date; Madsen, 2007).

Time Series Model Algorithm

First, the required libraries must be imported.

The financial data should then be loaded into a

pandas dataframe.

The data should be cleaned and prepared for

modelling.

The dependent and independent variables should

be defined.

The time series model should be fitted.

The model summary should be printed.

The target variable can be predicted using new,

unseen data.

Finally, the performance of the time series model

should be evaluated.

3 STATISTICAL ANALYSIS

The analysis was conducted using ibm spss version

2.1. In spss, datasets were created, each consisting of

a sample size of 10 for both the lasso regression and

long short term returns algorithms. The grouping

variable is designated as "group id," with accuracy

being used as the testing variable. "grouped" is

assigned a value of 1 for long short term returns and

2 for lasso regression. The properties include date,

symbol, open, high, close, volume btc, volume usd,

and trade count. The dependent variables encompass

date, close, high, open, and dollar volume usd. Both

precision and accuracy are considered independent

variables. The study employs an independently

conducted t-test.

4 RESULTS

The total sample size employed in the statistical

analysis is 10. This dataset is used for examining both

time series models and LASSO regression. Both the

specified algorithms, namely LASSO Regression and

the Videlicet Time Series Model, involve processing

statistical data. The computation of group and

delicacy values is carried out to forecast stock

demand. Additionally, statistical values for

comparison purposes are computed using the 10 data

samples for each algorithm along with their

corresponding losses.

Following experiments on a historical financial

dataset, it was determined that the Time Series Model

outperformed the LASSO Regression algorithm in

the context of portfolio optimization. The accuracy of

the Time Series Model (90.1252%) was notably

higher than that of LASSO Regression (80.1423%).

The significance of the accuracy and loss values was

0.000 (p<0.05). The Time Series Model exhibited a

lower Mean Squared Error (MSE) compared to

LASSO Regression, indicating more accurate

predictions for the target variable, as demonstrated in

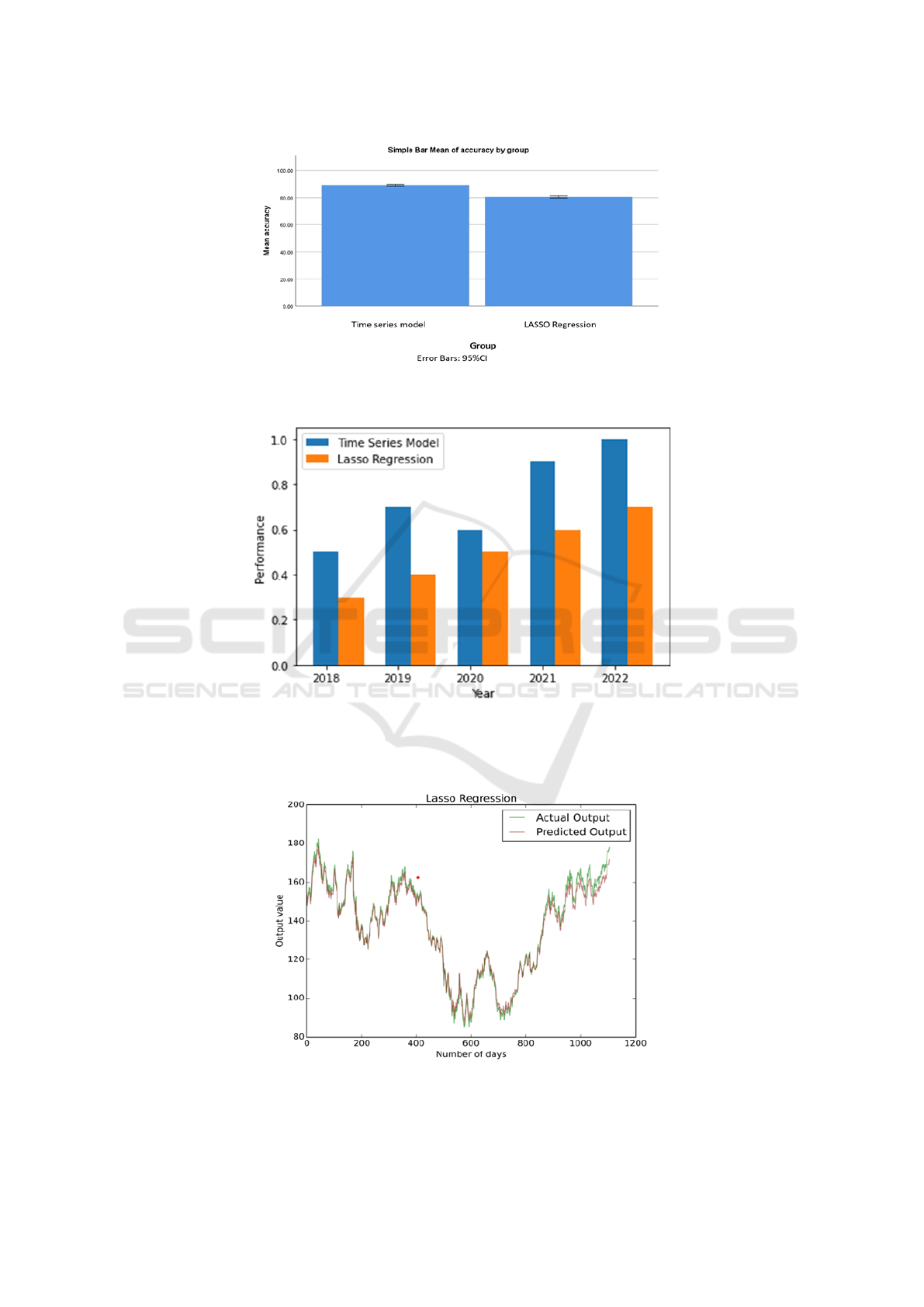

Table 2. The comparative analysis graph illustrating

both algorithms is depicted in Figure 3.

Furthermore, the Time Series Model offered more

comprehensive and informative statistical summaries,

allowing for a deeper comprehension of the underlying

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

136

relationships among variables. It's important to

acknowledge that the selection of the optimal model

hinges on various factors, including the data's nature,

hyperparameter choices, and the specific portfolio

optimization problem in question. In this particular

case, the Time Series Model was better suited for the

given problem. However, diverse datasets might yield

differing outcomes, as illustrated in Figure 3.

5 DISCUSSION

As per the data, the accuracy of the LASSO

Regression Algorithm is 80.1423%, while the Time

Series Model demonstrates a higher accuracy of

90.1252%. This significant difference in accuracy is

supported by a p-value of 0.5, indicating that the Time

Series Model is superior (Chatfield, 2013). Modern

Portfolio Theory (MPT) enhanced by time series

models is widely acknowledged as a more realistic

approach to portfolio optimization, as it considers

dynamic market conditions. This stands in contrast to

traditional models that rely on static assumptions

about market behaviour. An important advantage of

incorporating time series models into MPT is the

improved risk management through a dynamic

approach to modelling asset returns, accounting for

changing market conditions (Parzen, E., 1981).

Furthermore, the integration of machine learning

techniques within modern portfolio theory can

enhance the accuracy of portfolio optimization by

capturing complex relationships among asset returns,

as demonstrated in Figure 1. This represents a

significant advantage over traditional models that rely

on simpler statistical methods.

LASSO regression's risk management capabilities

are limited and may not offer the robustness provided

by modern portfolio theory, which can account for

intricate relationships among asset returns. This

limitation could be a drawback for investors seeking

a more comprehensive risk management strategy

(Parzen, E., 1983).

Table 1: Group, Accuracy and Loss value uses 8 columns with 8 width data for the time series model of improving prediction.

Name

Type

Width

Decimal

Columns

Measure

Role

1

Group

Numeric

8

2

8

Nominal

Datasets

2

Accuracy

Numeric

8

2

8

Scale

Improve

prediciton

3

Loss

Numeric

8

2

8

Scale

Prediction

Table 2: Group Statistical analysis for Time Series Model Algorithm and LASSO regression Algorithm, Standard Deviation

and standard error mean is determined.

Group

N

Mean

Std Deviation

Std.Error Mean

Accuracy

TSM

10

90.1252

1.90296

.60177

LASSO

regression

10

80.1423

2.33696

.73901

Loss

TSM

10

5.7180

1.90296

.60177

LASSO

regression

10

15.0430

2.33696

.73901

Table 3: Independent sample T-test t is performed on two groups for significance and standard error determination. The p-

value is lesser than 0.05 (0.000) and it is considered to be statistically significant with a 95% confidence interval.

Levene's

Test for

Equality of

variance

t

df

Sig(2 -

tailed)

Mean

differen

ce

Std.Erro

r

Differen

ce

95%

confiden

ce of

Differen

ce

F

Sig

Lower

Upper

Los

s

Equal

variances

assumed

304

.56

-9.78

18

.00

-9.31

.96

-11.12

-7.31

Accuracy

Equal

Variances

not assumed

-9.78

17.29

.00

-9.32

.95

-11.33

-7.21

Equal

Variances

not assumed

9.78

17.29

.00

9.21

.94

7.31

11.32

Precise Portfolio Optimization Based on Novel Modern Portfolio Theory Using Time Series Model Compared with LASSO Regression

137

Figure 1: Line chart showing the comparison of actual output and predicted output LASSO Regression algorithm in terms of

output value and the number of days.

Figure 2: Bar chart showing the comparison of Time series model (90.1252%) and LASSO Regression algorithm (80.1423%)

in terms of mean accuracy. The Mean accuracy of the Time series model is better and more efficient than the LASSO

Regression algorithm approach. And the Standard Deviation of X-Axis and Y-Axis shows time series model vs LASSO

Regression algorithm.

Figure 3: Comparison of Time series model and LASSO Regression in terms of mean accuracy. The mean accuracy of the

time series model is better than the LASSO Regression. The standard deviation of the TMS algorithm is better than the

LASSO Regression. X-axis: TMS and vs LASSO Regression Y-Axis: Mean Efficiency of detection is ±2 SE.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

138

An inherent assumption of LASSO regression is

that asset returns follow a normal distribution, which

might not accurately mirror real-world market

behaviour. Consequently, this assumption can lead to

less precise results in portfolio optimization, which

could be a drawback for investors aiming for higher

accuracy (Hyndman, R.J. and Athanasopoulos, G.,

2018).

On a positive note, LASSO regression is often

appreciated for its simplicity and ease of

comprehension. This aspect is advantageous for

investors who might not be well-versed in more

complex models, as indicated in Table 1.

Furthermore, LASSO regression is

computationally efficient and can perform well even

with smaller datasets. This efficiency could be an

advantage for investors with limited access to

extensive data or computational resources, as

highlighted in Table 3. The study's scope might be

limited due to data availability, as both modern

portfolio theory using time series models and LASSO

regression demand substantial data to yield accurate

outcomes. Both approaches also rest on specific

assumptions about market behaviour, which may not

always hold true in real-world scenarios.

Generalizing the study's findings to different markets

or time periods might be challenging, given the

substantial variations in market conditions, as

depicted in Figure 2.

A prospective avenue for LASSO Regression's

expansion is its application to other asset classes like

commodities or real estate. This extension could

assess the models' effectiveness in diverse markets.

Moreover, exploring the integration of alternative

machine learning techniques, such as neural networks

or different forms of LASSO Regressions, could

provide insights into their comparative performance.

Comparative evaluations of the proposed models

against other risk management strategies, like value

at risk or conditional value at risk, could offer insights

into the most efficient risk management approach.

While various predictive models have been

developed (Hyndman and Athanasopoulos, 2018),

not all of them accurately predict favourable stock

market movements. Despite their potential, many

time series models, like the one in "Predicting

portfolio returns using the distributions of efficient set

portfolios" (2003a), tend to be less user-friendly and

time-consuming. This suggests that while time series

models have the potential to enhance stock market

forecasts, their computational demands and

complexity might remain limiting factors (2003b,

"Predicting portfolio returns using efficient set

portfolio distributions").

6 CONCLUSION

The study's results revealed that Modern Portfolio

Theory using time series models exhibited superior

performance over LASSO regression in both risk

management and portfolio optimization accuracy.

The Time Series Model demonstrated a notably

higher accuracy rate of 90.1252% compared to the

LASSO Regression algorithm's accuracy of

80.1423%. The statistical significance of these

accuracy values, coupled with the associated p-value

of 0.000 (p<0.05), underscores the substantial

advantage of the Time Series Model in terms of

accuracy and predictive capability.

REFERENCES

Chatfield, C. (2013) The Analysis of Time Series: Theory

and Practice. Springer.

Dey, N., Vickram, S., Thanigaivel, S., Subbaiya, R., Kim,

W., Karmegam, N., & Govarthanan, M. (2022).

Nanomaterials for transforming barrier properties of

lignocellulosic biomass towards potential applications–

A review. Fuel, 316, 123444.

G. R et al, "Uncompressed digital video watermarking

using stationary wavelet transform," (2014) IEEE

International Conference on Advanced

Communications, Control and Computing

Technologies, Ramanathapuram, India, 2014, pp. 1252-

1258, doi: 10.1109/ICACCCT.2014.7019299.

Hyndman, R. J. and Athanasopoulos, G. (2018)

Forecasting: principles and practice. OTexts.

Kassambara, A. (2018) Machine Learning Essentials:

Practical Guide in R. STHDA.

Lohmeyer and Lohmeyer (no date) ‘Time series analysis

under model uncertainty’. Available at:

https://doi.org/10.26481/dis.20190524jl.

Madsen, H. (2007) Time Series Analysis. CRC Press.

Md. Ehsanes Saleh, A., Arashi, M. and Golam Kibria, B.M.

(2019) Theory of Ridge Regression Estimation with

Applications. John Wiley & Sons.

Parzen, E. (1981) ‘Time Series Model Identification and

Prediction Variance Horizon’, Applied Time Series

Analysis II, pp. 415–447. Available at:

https://doi.org/10.1016/b978-0-12-256420-8.50019-8.

Parzen, E. (1983) ‘Time Series Model Identification By

Estimating Information’, Studies in Econometrics, Time

Series, and Multivariate Statistics, pp. 279–298.

Available at: https://doi.org/10.1016/b978-0-12-

398750-1.50019-x.

‘Predicting portfolio returns using the distributions of

efficient set portfolios’ (2003a) Advances in Portfolio

Construction and Implementation, pp. 342–355.

Available at: https://doi.org/10.1016/b978-075065448-

7.50018-5.

Precise Portfolio Optimization Based on Novel Modern Portfolio Theory Using Time Series Model Compared with LASSO Regression

139

‘Predicting portfolio returns using the distributions of

efficient set portfolios’ (2003b) Advances in Portfolio

Construction and Implementation, pp. 342–355.

Available at: https://doi.org/10.1016/b978-075065448-

7.50018-5.

Prendergast, M. (no date) ‘Mutual Fund Allocations that

Maximize Safe Portfolio Returns’. Available at:

https://doi.org/10.31219/osf.io/dypw6.

Ramalakshmi, M., & Vidhyalakshmi, S. (2021). GRS

bridge abutments under cyclic lateral push. Materials

Today: Proceedings, 43, 1089-1092.

S. K. Sarangi, Pallamravi, N. R. Das, N. B. Madhavi, P.

Naveen, and A. T. A. K. Kumar, (2022) “Disease

Prediction Using Novel Deep Learning Mechanisms,”

J. Pharm. Negat. Results, vol. 13, no. 9, pp. 4267–4275,

, doi: 10.47750/pnr.2022.13.S09.530

Thanigaivel, S., Vickram, S., Dey, N., Gulothungan, G.,

Subbaiya, R., Govarthanan, M., ... & Kim, W. (2022).

The urge of algal biomass-based fuels for

environmental sustainability against a steady tide of

biofuel conflict analysis: Is third-generation algal

biorefinery a boon?. Fuel, 317, 123494.

Uğurlu, K. and Brzeczek, T. (2022) ‘Distorted probability

operator for dynamic portfolio optimization in times of

socio-economic crisis’, Central European Journal of

Operations Research , pp. 1–18.

V. P. Parandhaman, (2023)"A Secured Mobile Payment

Transaction Handling System using Internet of Things

with Novel Cipher Policies," International Conference

on Advances in Computing, Communication and

Applied Informatics (ACCAI), Chennai, India, 2023,

pp. 1-8, doi: 10.1109/ACCAI58221.2023.10200255.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

140