Sales Prediction Through Time Series Analysis with Machine

Learning

Kamal Kumar

1,*

, Reena Devi

1,†

and Pardeep Goel

2,*

1

Department of Mathematics, Baba Mastnath University Asthal Bohar, Rohtak, Haryana, India

2

Department of Mathematics, Himalayan Garhwal University, Uttarakhand, India

Keywords: Time Series, Sales, Machine Learning, Regression.

Abstract: In this article, we examine how machine learning models are used in sales predictive analytics. This paper's

primary goal is to investigate the key methods and research methods of applying machine learning to sales

forecasting. It has been thought about how machine learning (ML) generalization would affect things. Such

result may be used to forecast sales whenever there is just a little quantity of past records for a certain sales

time series, such as after the opening of a new store or product. Researchers have researched to create

regression groups by overlaying individual models. The results suggest that stack tactics can enhance the

prognostic accuracy of predictive methods aimed at selling period series forecasts.

1 INTRODUCTION

Modern business intelligence heavily includes sales

forecasting (Mentzer et al. 2004). A dearth of

information, incomplete information, and the

existence of extremes can make this a challenging

challenge. It is likely to contemplate about sales as a

data series. Various time series representations must

be released as of late-night, counting those through

Holt-Winters, SARIMAX, ARIMA, GARCH, etc. In

(Taieb et al. 2012), various methods of various levels

forward time series forecasting are taken into account

or contrasted. (Graefe et al. 2014) investigates a

variety of forecasting techniques. It is demonstrated

that there may be a significant improvement in

reliability when several models are derived from

various data and methods. In situations where there is

a lot of ambiguity, reliability improvement is crucial.

Numerous ensemble-based approaches for

classification issues are taken into consideration in

(Gomes et al. 2017). Various factors for efficient

prediction merging were taken into consideration in

the work. There are substantial disadvantages to using

time-series approaches for predictive analysis. The

following are: When detecting periodicity,

researchers require historical data that spans a

*

Professor

†

Research Scholar

significant amount of time. Moreover, frequently,

such as when a new model is introduced, we lack past

information for an attribute value. We can predict that

the sales trend of their product will be equivalent

because we already obtain sales time series about a

similar item. There could be numerous thrilling

values and absolute statistics facts in the sales

statistics. When smearing a period series practice,

they first eliminate outliers and try to interpret the

data. There are several external elements that affect

sales that we must consider. As practice has shown,

regression procedures can frequently outperform time

series approaches in positions of returns. Machine

learning approaches can be second-hand to search

aimed at trend in period series. With the use of

controlled machine learning techniques, we may

identify complicated trends in marketing behavior.

Regression algorithms are built on the fundamental

assumption that designs in past statistics will reoccur

in fresh datasets. We examined probabilistic, ML, and

linear methods for time series modeling in

(Pavlyshenko 2016). We investigated the custom of

copulas too Bayesian inference methods in

probabilistic modeling. We looked at logistic

deterioration in the context of the difficulty of

identifying production issues (Pavlyshenko 2016)

and (Ensafi et al. 2020).

Kumar, K., Devi, R. and Goel, P.

Sales Prediction Through Time Series Analysis with Machine Learning.

DOI: 10.5220/0012608500003739

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Artificial Intelligence for Internet of Things: Accelerating Innovation in Industry and Consumer Electronics (AI4IoT 2023), pages 163-169

ISBN: 978-989-758-661-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

163

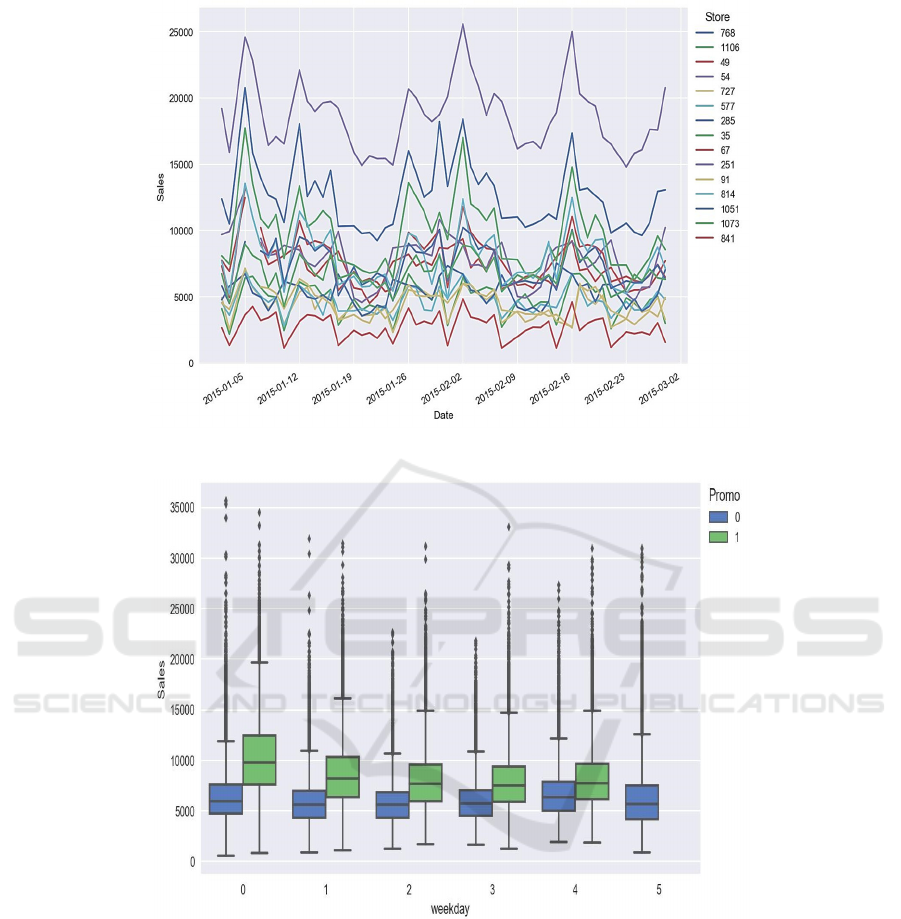

Figure 1: Typical sales time series.

Figure 2: Boxplots showing day of the week vs sales distribution.

We looked at extended linear models, and Bayesian

models aimed at logistic deterioration. (Shafali et al.

2021) his paper explores a combined inventory model

(IM) when the collapse rate shadows histrionic

movement under conversation acclaim. (Kumar et al.

2020) studied on the Inventory Control Policy aimed at

Imperfect Manufacture Procedure on Numerous

Demand. In (Pavlyshenko 2018), we looked at stacking

methods for logistic regression and time-series

forecasting with severely skewed data. We can spot a

variety of trends and impacts in the sales figures. They

are: themes, periodicity, covariance, and structures

generated by the influence of outside variables like

promotions, prices, and rivals' actions. Additionally, we

notice sales turbulence. The elements we don't take into

consideration contribute to noise. We could also find

outliers extreme values in the sales figures. If risk

assessment is necessary, noise and extreme values

should be considered. Some special elements, such as

promotional events, price reductions, climatic

conditions, etc., might be the source

of

outliers.

We

may

offer

a

new

feature

that will draw attention to

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

164

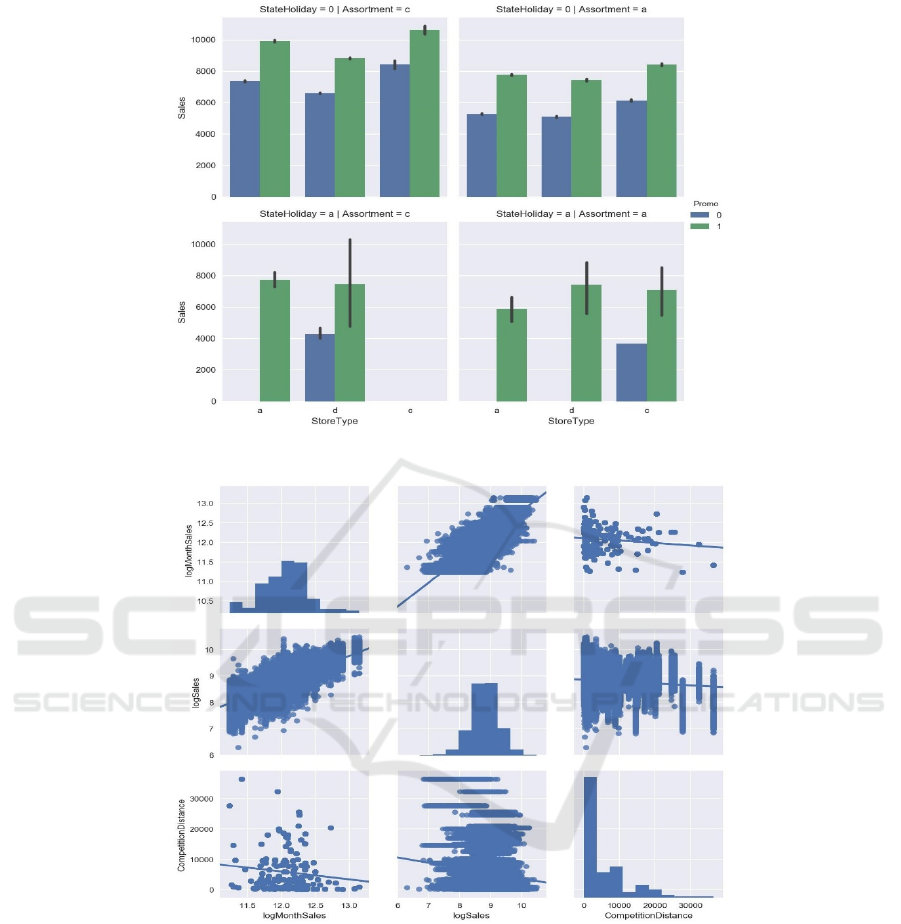

Figure 3: Sales factor charts for total sales.

Figure 4: Plots of the data for the competition distance, sales, and month sales in pairs.

to these specific events and explain the target

variable's remarkable values if they happen

frequently. In this study, we look at how ML

algorithms could be used to predict sales over time.

The effects of ML generalization, the influence of a

single model, and the stacking of many models will all

be taken into account.

2 PREDICTIVE MODELS OF

ARTIFICIAL INTELLIGENCE

As part of their study, we looked at past shop sales

information of the "Rossmann Store Sales" Kaggle

competition. Such numbers show shop sales for

Rossmann. The calculations relied primarily on the

following Packages numpy, pandas, sea born, sklearn,

matplotlib, and eras. The research was carried out

using

Jupyter Notebook. The sales time series in

Sales Prediction Through Time Series Analysis with Machine Learning

165

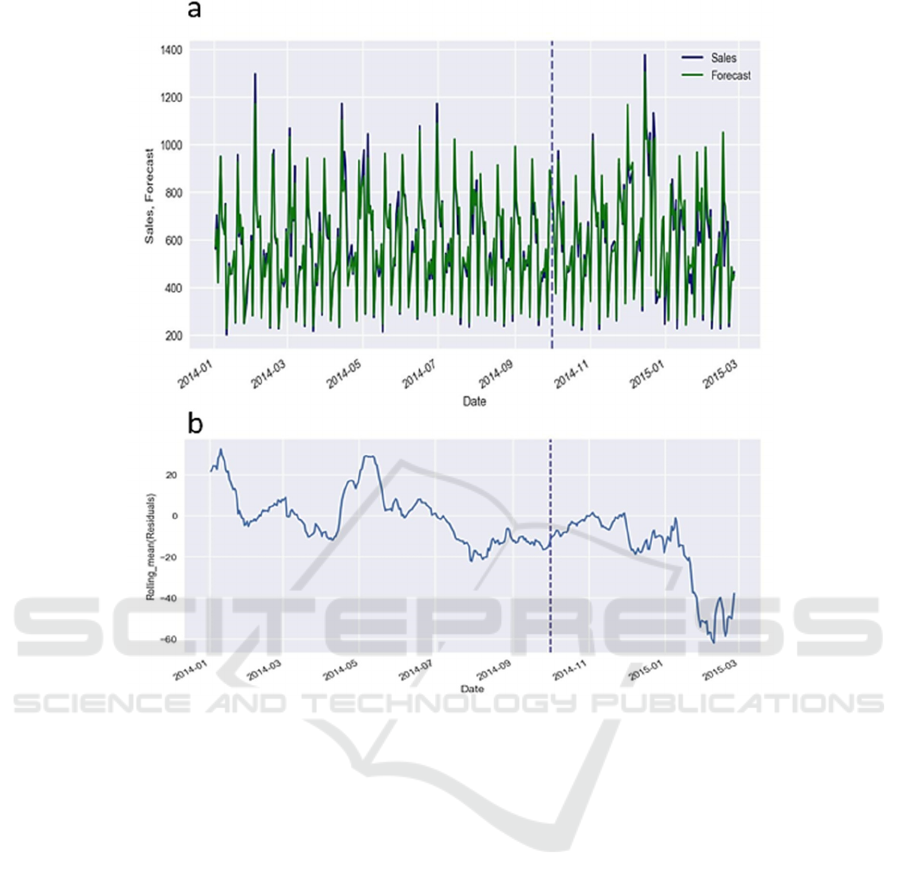

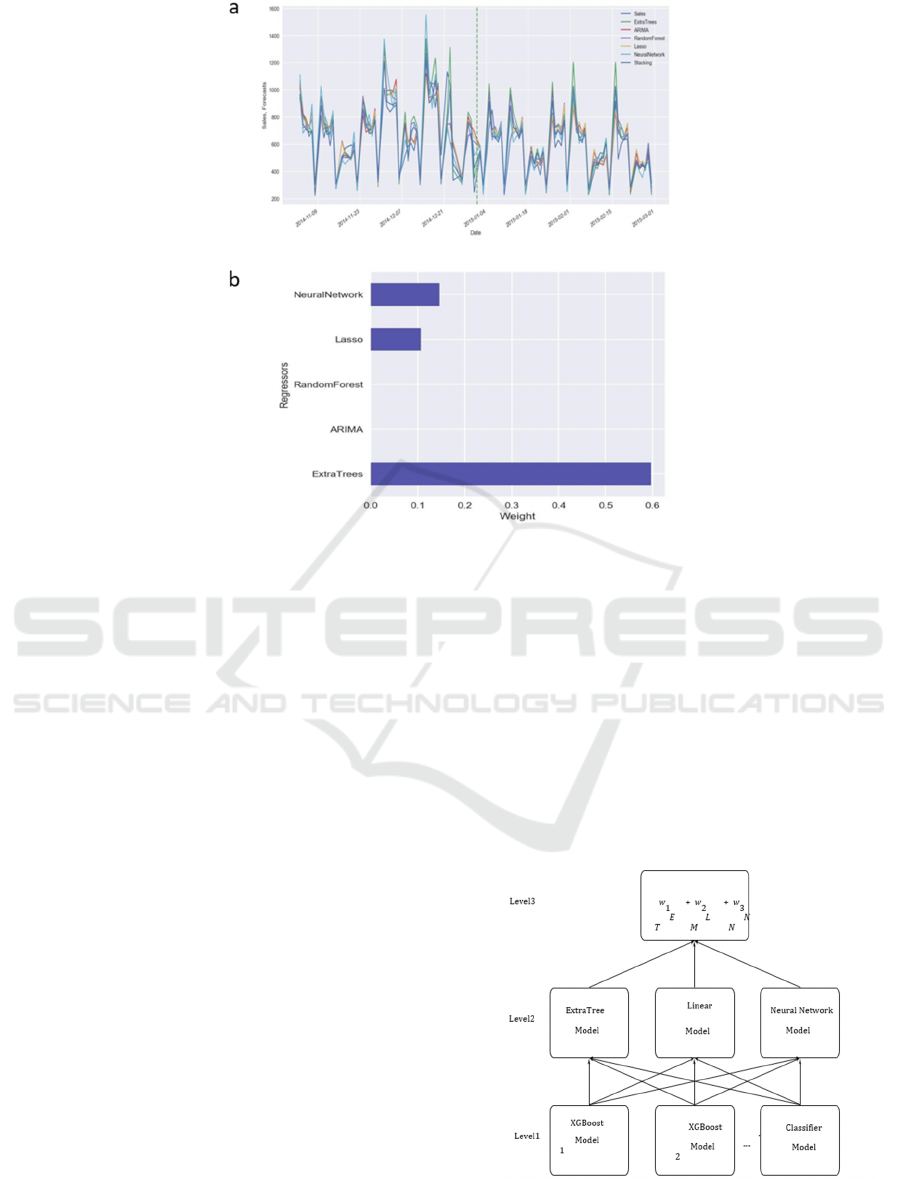

Figure 5: (a) Forecasting of sales with a 3.9% train set error and an 11.6% validation set error 5(b) Feature significance.

Figure 1 are typical; the numbers are standardized

to arbitrary units. The first step in our advanced

analysis process was to analyses sales distributions

and visualizes the data using different pair plots.

Identifying connections and the factors that influence

revenue is useful. The outcomes of the data

exploration are displayed in Figures 2–4. The fact that

almost all machine-learning techniques are limited to

being with use of stationary data is one of their unique

characteristics. If there is a little pattern, we may use

linear regression also on confirmation set to identify

bias. Let's take the supervised machine learning into

consideration when employing sales previous time

series. We had used Random Forest method to the

research study. We utilized the categorical variables

of the promo, every-day, month day, and month as

variables. We used one-hot decoding for categorical

features, which involved replacing one category

factor with n binary variables, somewhere n is the

number of categorical variables' distinct standards.

The projection for such Figure 5a displays sales time

- series data. The projections for Figure 5 depicts the

time - series data of sales. The characteristic

significance is portrayed in Fig. 5b. We employed a

relative mean absolute error (MAE), which is defined

as error = MAE/mean 100%, for error estimate.

Whenever the prediction is expected to be lower or

higher than real values, we may see bias in the

prediction, which is a consistent (stable) under- or

overestimation of revenue. Whenever non-stationary

sales are subjected to machine learning techniques,

this frequently manifests itself. On the validation set,

we may use linear regression to carry out the bias

correction. The efficiency of an exercise dataset and

an authentication set must be distinguished from one

another. It could be extremely high on the exercise set

but significantly lower on the authentication set. In

ML algorithms, the number of rounds is largely

determined by how reliable is the “validation set”.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

166

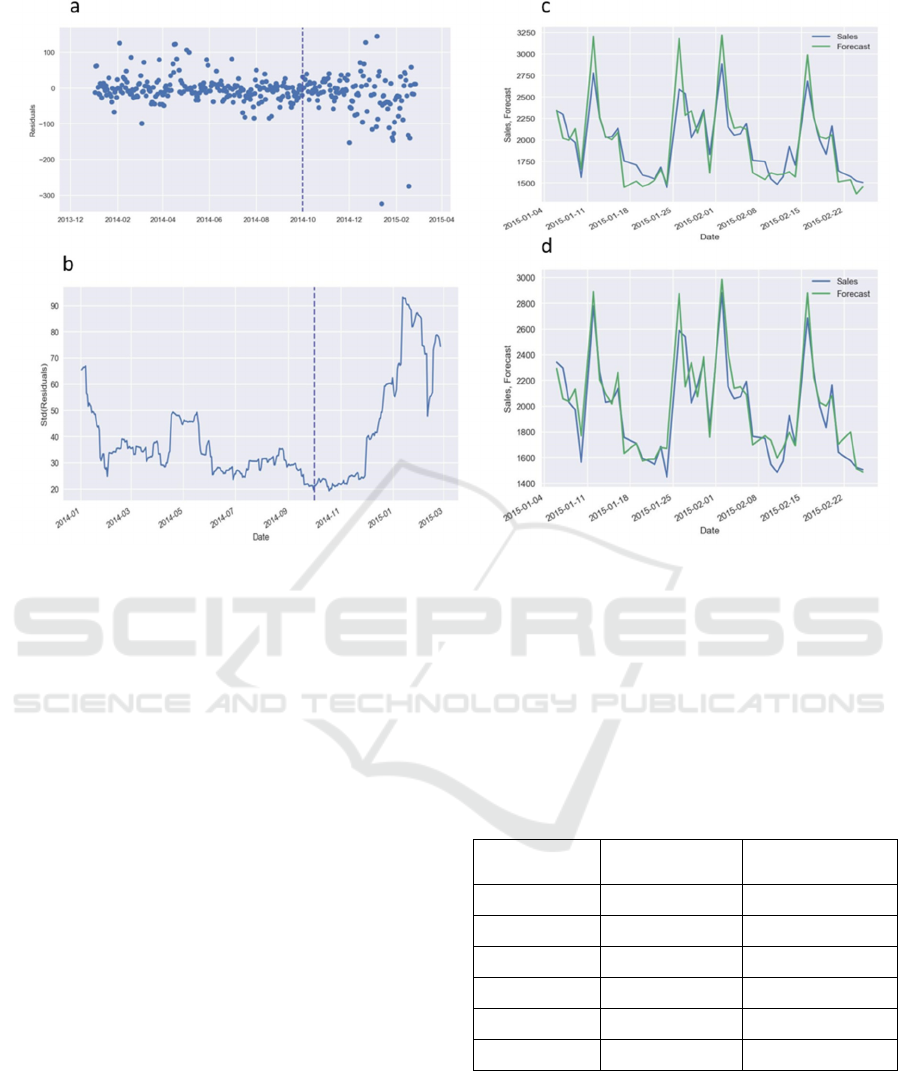

Figure 6: (a) Forecasting of sales with a 3.9% train set error and an 11.6% validation set error 5(b) Residuals' continuing mean

(c) and(d) sales forecast's standard deviation.

3 THE IMPACT

GENERALIZATION IN

MACHINE LEARNING

As a result of ML generality, a regression method

may detect trends that exist among all firms or

commodities. If the sales have stated trends,

generalization allows us all to acquire more detailed

results that really are unaffected to auctions noise. We

employed more of the following characteristics in the

machine-learning generalization research study

compared to the last research study: school and state

holidays, shop selection, and average market

valuation for a certain span of time, according to

historical information. Figure 10 depicts the

prediction for statistical information with a large time

horizon (3 years) for a particular store, whereas

Figure 6d depicts prediction for past records with a

short horizon (4 days) for the exact same store. In

cases of short period intervals, we dismiss obtain

extra precise answers. Whenever we introduce a new

service or shop, it is essential that we are able to make

predictions, even with a relatively limited amount of

past sales figures, thanks to the influence of machine

learning generalization. In command to allow for

transitory operations, such as the procedure of

product cannibalization, where new items replace

existing goods, we may apply professional

corrections whenever predicting the sales of brand-

new items by increasing the forecast by a time-

dependent coefficient.

Table 1: Many models' forecasting errors.

Validation Error

Out-of-Sample

Error

Model

13.6% 11.3% Neural Network

13.4% 11.5% Lasso

13.6% 11.9% Random Forest

13.8% 11.4% ARIMA

14.6% 13.9% Extra Tree

12.6% 10.2% Stacking

Sales Prediction Through Time Series Analysis with Machine Learning

167

Figure 7: (a) Time series forecasting utilising several models on the authentication sets (b) Repressor weight stacking.

4 STACKING OF

MACHINE-LEARNING

MODELS

The findings from many prediction models

containing various feature sets should be combined

into one. The outcomes of the assumptions made on

the testing dataset are considered input in such a

method repressors of models for the following level

we may take into account a linear model, such as the

following level model, or a different type of machine

learning technique, such as random woodland or

neural networks. It is crucial to note that for the

scenario of time series calculation, we cannot apply a

traditional cross-validation method. Instead, we

obligation use period excruciating to rift a sequential

statistics set into exercise and testing sets, by the

supervised learning falling during the first period

retro and the validation data falling within the second.

Prediction of time - series data on the procedures for

assessing derived using various models are displayed

in Figure 7a&b. The out-of-sample set and the

validation set, that are not utilized during model the

following is required, are divided by a vertical dotted

line in Figure 7a &b Stacked errors may be calculated

using the out-of-sample set in equation (1).

Y=w1ET+w2LM+w3NN (1)

Where ET= extra tree model, LM =Linear model,

NN= neural network model,

The linear model with Lasso regularisation treats

predictions made on the endorsement gangs as

repressors. The results of the second-level Lasso

deterioration model are shown in Figure 7b. Only

three models (Extra Tree, Lasso, and Neural

Network) from the initial level contain coefficients

that are not zero. The outcomes may change if

alternative models play a more significant role in

predicting for various situations of sales datasets.

Figure.8: 2019 IEEE Forecasting sales period series by a

multilevel machine learning model Reprinted with

approval from Bohdan Pavlyshenko.

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

168

The mistakes on the out-of-sample set and the

validation set are displayed in Table 1. These findings

demonstrate that the stacking method may increase

accuracy for both the validation and the output data.

Some businesses submit their analytical

challenges for data science contests, such as those at

Kaggle (2018), in order to get insights and discover

fresh strategies. Grupo Bimbo Inventory Demand was

one of these contests. This competition's aim

remained to estimate inventory demand. I remained

an associate of the outstanding team, "The Slippery

Appraisals," that won this tournament. Our winning

solution's specifics may be found in (Chen et al.

2016). Our response is stranded in a three-level model

(Figure 8). We employed several solitary models at

the first level, the mainstream of which were built

using XG Boost machine learning process. For the

second level of layering, the Extra Tree modeling as

well as the linear regression model from of the Python

scikit-learn package are utilized, in addition to the

model of neural networks were used. On the third

level, the outcomes since the second level are added

by weights. The most important of the numerous

additional structures we created founded upon be

around the target mutable with its interruptions when

group by various morals. Anil et al. (2023) has further

information. (Kaggle et al.2018) contains a

straightforward R script with a ML model.

5 CONCLUSIONS

We inspected various ML approaches for period

series forecasting during our investigation study.

Deterioration instead of period series examination

would be the improved method aimed at foreseeing

sales. Regression models may typically produce

better results for forecasting demand than time-series

techniques. Intended for machine learning

procedures, productivity on the corroboration

established is a decisive criterion aimed at indicating

the right numeral of restatements. ML generalization

has the impact of identifying patterns crossways the

whole dataset. When there are few past sales data

aimed at an exact sales Time series, like the launch of

a new store or product, this effect can be used to

forecast sales. Several expected numbers from the

authentication set remain used as contribution

repressors aimed at the ensuing level replicas in the

loading strategy. Quality may be increased by using

piling to account aimed at dissimilarities in the results

from numerous models through many sets of

strictures on the out-of-sample data sets and

validation.

REFERENCES

Mentzer, J. T. and Moon, M. A. (2004). Sales Forecasting

Management: A Demand Management Approach. Sage

Publication, Inc. DOI: https://doi.org/10.41

35/9781452204444

Taieb, S.B., Bontempi, G., Atiya, A.F., and Sorjamaa, A.

(2012). A review and comparison of strategies for

multi-step ahead time series forecasting based on the

NN5 forecasting competition. Expert Syst. Appl., 39,

7067–7083.

Graefe, A., Armstrong, J. S., Jones, R. J., Jr., and Cuzán, A.

G. (2014). Combining forecasts: An application to

elections. Int. J. Forecast, 30, 43–54.

Gomes, H. M., Barddal, J. P., Enembreck, F., Bifet, A.

(2017). A survey on ensemble learning for data stream

classification. ACM Comput. Surv. (CSUR), 50, 1-23.

Pavlyshenko, B. (2018). Using Stacking Approaches for

Machine Learning Models. In Proceedings of the 2018

IEEE Second International Conference on Data Stream

Mining & Processing (DSMP). IEEE, 255–258.

Kaggle (2018). Competition ’Grupo Bimbo Inventory

Demand’ Bimbo XG Boost R Script LB: 0.457.

Available online: https://www.kaggle.com/ bpavlyshen

ko/bimbo-xgboost-r-script-lb-0-457 (accessed on 3

November 2018).

Anil, G. A., Shankar, C. R., Santosh, B. P., Rajendra, G. A.

and Thorat, B. D. (2023). Sales Forecasting Using

Machine Learning Techniques. International Research

Journal of Modernization in Engineering Technology

and Science, 1882-1885.

Ensafi, Y., Amin, S. H., Zhang, G. and Shah, B. (2020).

Time-series forecasting of seasonal items sales using

machine learning – A comparative analysis.

International Journal of Information Management Data

Insights, 2(1), 1-10.

Shafali, C., Vikas, S. and Pardeep, G. (2021). Role of

manufacturing process in waste reduction and

contribution in environmental sustainability,”

International conference on recent innovation and

interdisciplinary research, 150-157, 2021.

K. Kumar, A. Kumar and Promila (2020). Inventory

Control Policy for Imperfect Production Process on

Various Demand and Fuzzy Nature: Latest Trend,

International Journal of Trade & Commerce-IIARTC,

9(1), 148-158

Sales Prediction Through Time Series Analysis with Machine Learning

169