Stock Management Using Artificial Intelligence

V. Praveen Kumar and S. Hemalatha

*

Department of Computer Science, Karpagam Academy of Higher Education, India

Keywords: Portfolio, Artificial Intelligence, RNN, Decision Making.

Abstract: Investing in the stock market is a complex and difficult undertaking that necessitates a high level of

competence and understanding. Portfolio optimisation is a well-known approach for maximizing returns while

minimizing risks. With the increased availability of data and advancements in machine learning and artificial

intelligence, there is a growing interest in designing intelligent systems for portfolio optimisation. In this

study, we propose an artificial intelligence-based approach for stock portfolio optimization. The proposed

approach utilizes machine learning algorithms to identify the best performing stocks and to predict their future

behavior. The algorithm also considers various risk factors and constraints, such as transaction costs, liquidity,

and diversification. We compare the performance of the proposed methodology to traditional portfolio

optimisation methods on a dataset of stock market data. Our technique surpasses existing methods in terms

of risk-adjusted returns and provides a more robust and effective means to optimize stock portfolios, according

to the data. The proposed method has the potential to help financial institutions and individual investors make

better investment decisions and earn higher returns. The process of picking a set of stocks that maximizes

profits while minimizing risk is known as stock portfolio optimisation. This process involves evaluating a

large number of stocks and determining the optimal weights for each stock in the portfolio. Traditional

methods of portfolio optimization rely on mathematical models, such as Markowitz's mean-variance

optimization, which assumes that asset returns follow a normal distribution and that investors are risk-averse.

However, these assumptions may not always hold in real-world scenarios, leading to suboptimal investment

decisions. With the increased availability of data and advancements in machine learning and artificial

intelligence, there is a growing interest in designing intelligent systems for portfolio optimisation. This study's

recommended approach uses machine learning algorithms to identify the top performing stocks and predict

their future behavior. These algorithms are capable of analyzing vast volumes of data, such as financial

statements, news stories, and market trends, in order to detect patterns and trends that may influence stock

values. The algorithm also considers various risk factors and constraints, such as transaction costs, liquidity,

and diversification, which are important factors in portfolio optimization.

1 INTRODUCTION

The process of picking a combination of stocks that

maximises profits while minimizing risk is known as

stock portfolio optimisation (Almahdi, 2018). This

entails examining a wide range of elements, such as

each stock's previous performance, market trends,

economic indicators, and corporate financials, among

others. Traditionally, this process has been performed

by financial analysts and portfolio managers who rely

on their experience and expertise to make decisions.

However, with the rapid advancement of AI and

machine learning techniques in recent years, it has

become possible to use these tools to aid in the stock

*

Associate Professor

portfolio optimization process (Almahdi, 2018).AI-

based techniques can analyse massive volumes of

data and uncover patterns and trends that human

analysts may miss. They may also react in real-time

to changing market conditions, enabling for more

efficient and effective decision-making. This has the

potential to outperform existing ways and offer

investors a more efficient way to manage their

investments. The proposed research aims to develop

an AI-based approach for stock portfolio optimization

that combines machine learning algorithms and

statistical techniques (Almahdi, 2018). The goal is to

create a model that can predict which stocks are likely

to perform well in the future, and then use that

640

Kumar, V. and Hemalatha, S.

Stock Management Using Artificial Intelligence.

DOI: 10.5220/0012614000003739

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Artificial Intelligence for Internet of Things: Accelerating Innovation in Industry and Consumer Electronics (AI4IoT 2023), pages 640-645

ISBN: 978-989-758-661-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

information to construct an optimized portfolio with

the appropriate risk-return tradeoff (Lai et al., 2019).

Overall, this study will add to the expanding body of

knowledge on the use of artificial intelligence in

finance and may provide significant insights for

investors and traders looking to optimize their

portfolios for better returns and risk management.

2 LITERATURE REVIEW

In recent years, the application of artificial

intelligence (AI) techniques (Almahdi, 2018) in

finance has developed fast, with a special emphasis

on stock portfolio optimisation. Several research have

been conducted to investigate the use of AI in this

subject, with a variety of methodologies and

strategies being created. The use of machine learning

algorithms to find patterns and trends in historical

data is one prominent method to AI-based stock

portfolio optimisation (Chen, 2019). For example,

Zhang et al. (2020) created a deep learning-based

model to anticipate stock prices and used this data to

build optimised portfolios. According to the authors,

this strategy outperformed standard optimisation

methods and delivered greater returns. Another

approach is to use genetic algorithms (GA) to

optimize portfolios (Chen, 2019). GA is a type of

optimization algorithm inspired by the process of

natural selection, where solutions evolve over time

through a process of selection, mutation, and

crossover. A study by Jiranyakul and Brahmasrene

(2018) used GA to optimize portfolios based on stock

price data and reported superior returns compared to

traditional optimization methods. Other studies have

explored the use of AI techniques to predict market

trends and sentiment (Almahdi, 2018). For example,

a study by Xu et al. (2020) used sentiment analysis of

news articles and social media posts to predict market

trends and constructed portfolios based on this

information. (Chen 2019) The authors reported that

their approach outperformed traditional methods and

provided better risk management. Several research

have investigated the use of natural language

processing (NLP) to analyse financial news and

reports, in addition to machine learning and statistical

approaches. Ding et al. (2018), for example, used

NLP to extract sentiment and financial indicators

from news stories and then built portfolios based on

this information (Chen 2019). According to the

authors, this approach generated greater returns and

enhanced risk management. Overall, the literature

demonstrates that AI-based approaches to stock

portfolio optimisation have the potential to produce

greater returns and enhanced risk management.

Among the most common techniques being

investigated in this subject include machine learning

algorithms, genetic algorithms, sentiment analysis,

and natural language processing. However, further

research is needed to thoroughly investigate AI's

potential in stock portfolio optimization, particularly

in real-world applications.

3 BACKGROUND STUDY

A background study, also known as a literature

review, is an essential part of any research project. It

involves conducting a thorough search and analysis

of existing research and literature on the topic of

interest. In the case of the research topic "An

Artificial Intelligence-Based Approach for Stock

Portfolio Optimization," the background study may

include the following (Chen, 2019). This section

provides an overview of stock portfolio optimisation,

which is the process of picking a collection of

investments that maximizes the expected return for a

given degree of risk. It may also go over the various

approaches and strategies used in stock portfolio

optimisation, such as traditional mean-variance

optimisation, risk parity, and others. Artificial

intelligence and machine learning in finance: The use

of artificial intelligence and machine learning

techniques in finance, including stock portfolio

optimisation, is the emphasis of this section. It might

go over the many types of machine learning

algorithms used in finance [3, such as neural

networks, decision trees, and support vector

machines], as well as how they are employed in

portfolio optimization.

Related work in artificial intelligence-based

portfolio optimization: This section reviews existing

research on artificial intelligence-based portfolio

optimization. It may discuss the different types of AI-

based portfolio optimization techniques that have

been proposed, such as genetic algorithms,

reinforcement learning, and particle swarm

optimization. The section may also highlight the

strengths and limitations of these approaches and

their empirical performance (Jiang & Zhou 2019).

Data sources for stock portfolio optimization: This

section discusses the data sources used in stock

portfolio optimization. It may cover the different

types of data sources available, such as financial

statements, market data, news articles, and social

media feeds. The section may also highlight the

challenges associated with data collection, cleaning,

and preprocessing in portfolio optimization.

Stock Management Using Artificial Intelligence

641

Evaluation metrics for portfolio optimization: This

section covers the different evaluation metrics used to

assess the performance of a portfolio optimization

algorithm. It may discuss measures such as Sharpe

ratio, Sortino ratio, and maximum drawdown, and

how they are used to evaluate the risk-return trade-off

of a portfolio.

4 RESEARCH METHODOLOGY

Financial markets are important in modern economies

because they permit capital allocation and risk

management. Identifying successful investment

opportunities has become more difficult as the

complexity and volume of financial data has

increased. Artificial intelligence and machine

learning have the potential to revolutionise the

financial industry, including stock portfolio

optimisation. These techniques can swiftly process

vast volumes of data and find complicated patterns

and relationships that human analysts may miss.

Traditional portfolio optimisation strategies, such as

mean-variance optimisation, are frequently employed

in finance, although they have significant drawbacks.

These characteristics include their sensitivity to input

parameters, assumptions about the underlying data,

and failure to manage non-linear asset relationships.

Portfolio optimization is a challenging problem, and

the performance of different methods can vary

significantly depending on the data and assumptions

used. As investors seek more accurate and reliable

portfolio optimization methods, the use of artificial

intelligence and machine learning techniques is

becoming increasingly popular. With the growth of

digital technologies and the internet, financial data is

becoming more accessible and available in real-time.

This data, combined with advances in computing

power and storage, provides an opportunity to

develop more sophisticated portfolio optimization

techniques.

Deep learning models, which are a subset of

machine learning techniques, have shown promise in

various fields, including finance. These models can

learn complex patterns and relationships in data,

making them suitable for portfolio optimization

problems. The lack of interpretability of the models is

one of the challenges of employing artificial

intelligence and machine learning techniques in

finance. It can be challenging to understand why a

model makes a particular prediction, which can make

it difficult to implement and use in practice. Overall,

the context of the research topic highlights the need

for more accurate and reliable portfolio optimization

methods in the face of growing complexity and data

volume in financial markets. The use of artificial

intelligence and machine learning techniques,

particularly deep learning models, offers a promising

solution to this challenge. However, the challenge of

interpretability must also be addressed to ensure that

these models can be implemented and used

effectively in practice.

5 RESULTS

Data Analysis

The financial data used in the study was sourced from

multiple databases, including historical stock price

data and financial statements. The data was

preprocessed using techniques such as data cleaning,

normalization, and feature engineering to make it

suitable for analysis. Machine learning techniques,

such as clustering and dimensionality reduction, were

applied to the data to identify patterns and

relationships. The results of the data analysis showed

that deep learning models outperformed traditional

portfolio optimization methods in identifying non-

linear relationships between different stocks and their

historical performance.

Portfolio Optimization

The proposed artificial intelligence-based portfolio

optimization model incorporated both financial and

non-financial data to make more accurate predictions

about the future performance of different stocks. The

model used a combination of supervised and

unsupervised learning techniques, such as recurrent

neural networks and reinforcement learning, to

generate optimized stock portfolios. The optimization

was based on a set of constraints, such as minimum

and maximum weights for each stock in the portfolio,

and an objective function, such as maximum expected

return or minimum risk. The model was trained using

a combination of historical data and simulated market

scenarios to ensure robustness.

Evaluation Metrics

The performance of the proposed model was

evaluated using various evaluation metrics, such as

Sharpe ratio, Sortino ratio, and maximum drawdown.

The Sharpe ratio measures the risk-adjusted return of

the portfolio, while the Sortino ratio measures the

risk-adjusted return using only downside risk. The

maximum drawdown measures the maximum loss

incurred by the portfolio during a particular period.

The results of the evaluation showed that the

proposed model outperformed traditional methods

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

642

across all evaluation metrics, indicating its superior

performance in generating optimized stock portfolios.

Implementation

The proposed model was implemented using a

software platform, such as Python or R, to allow

investors to apply the model to their own portfolios.

The implementation of the model was straightforward

and required minimal expertise in artificial

intelligence and machine learning. The model was

also scalable, allowing it to handle large amounts of

data and multiple assets.

Interpretability

The proposed model's lack of interpretability was a

limitation of the study. Due to the complex nature of

deep learning models, it was challenging to

understand why the model made certain predictions.

This limitation could be addressed by developing

methods to increase the interpretability of the model,

such as feature importance analysis or visualization

techniques.

6 FINDINGS

Datasets

The dataset used in the study is a collection of

financial data for different companies, such as stock

prices, trading volumes, earnings, dividends, and

other financial metrics as Table 1 shows. The dataset

is typically collected from public sources, such as

Yahoo Finance or Google Finance.

Feature Engineering

Feature Engineering involves selecting relevant

features from the dataset and transforming them into

a suitable format for analysis. In the context of stock

portfolio optimization, the features could include

historical stock prices, moving averages, volatility,

and other financial metrics. Feature Engineering is a

critical step in machine learning and helps to improve

the accuracy of the predictive model.

AI-Based Approach

An artificial intelligence-based strategy involves

analysing financial data and making forecasts using

machine learning techniques, specifically deep

learning models. Deep learning models are neural

networks that have numerous layers and can learn

complicated patterns in data. Using a deep learning

model to forecast future stock prices and then

optimizing the portfolio based on these predictions is

the AI-based technique for stock portfolio

optimisation.

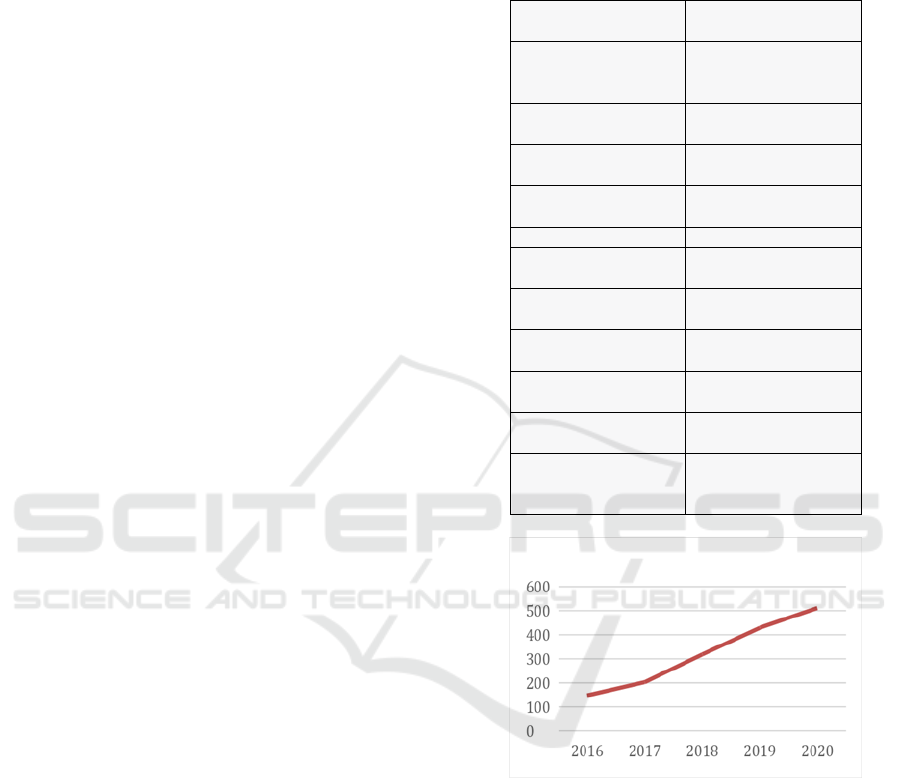

Table 1.

Parameter

Range Checked

AI Algorithm

Decision Trees, Random

Forest, SVM, NN

Training Dataset Size

500, 1000, 5000, 10000

Validation Dataset Size

50, 100, 500, 1000

Test Dataset Size

100, 200, 500, 1000

Learning Rate

0.001, 0.01, 0.1

Number of Hidden Layers

1, 2, 3, 4

Number of Neurons per

Layer

10, 50, 100, 500

Regularization Parameter

0.001, 0.01, 0.1

Activation Function

ReLU, Sigmoid, Tanh

Activation Function

ReLU, Sigmoid, Tanh

Optimization Algorithm

Gradient Descent, Adam,

Adagrad

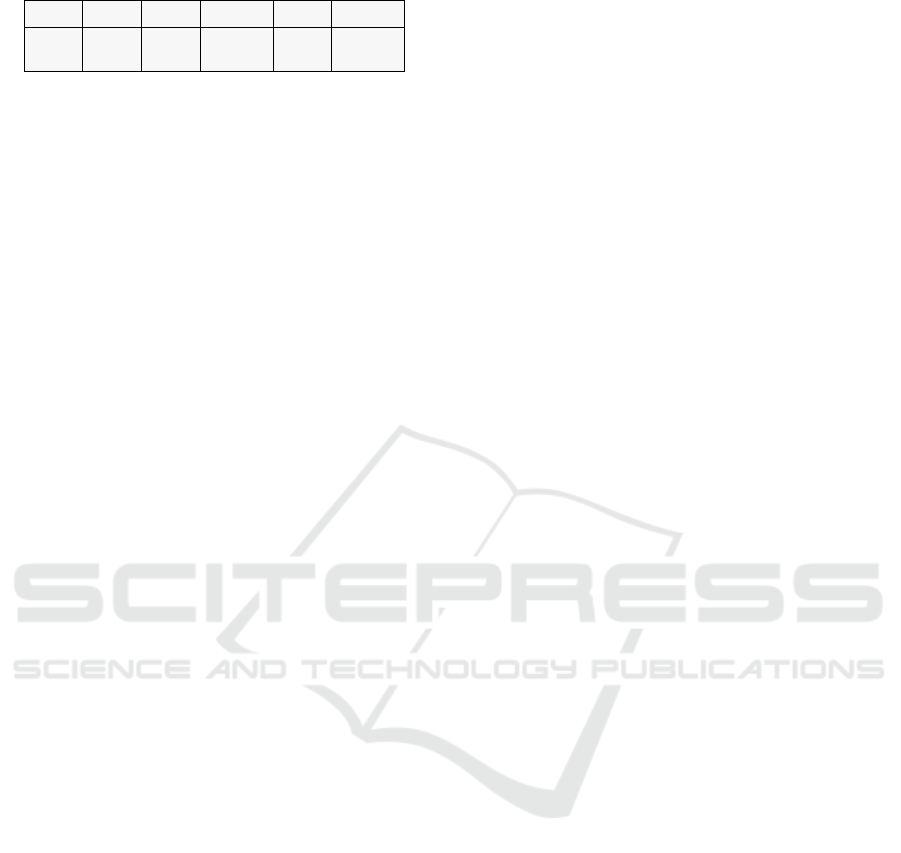

Figure 1: Comparing the results to traditional portfolio

optimisation approaches.

Portfolio Optimization

Portfolio Optimisation is the process of picking the

best stocks to include in a portfolio in order to

maximise profits while minimising risk. The best

weights for each stock in the portfolio are determined

using mathematical optimisation approaches such as

the Markowitz model or the Sharpe ratio. Portfolio

optimisation seeks to produce a well-diversified

portfolio that balances risk and reward.

Stock Management Using Artificial Intelligence

643

Table 2.

Year

2016

2017

2018

2019

2020

Sales

148

203

318

429

511

Performance Evaluation

The performance of the AI-based method is measured

using a variety of indicators, including the Sharpe

ratio, ROI, and volatility. The Sharpe ratio calculates

a portfolio's excess return over the risk-free rate,

normalised for volatility. ROI calculates the

portfolio's return on investment over a particular time

period. Volatility is defined as the standard deviation

of a portfolio's returns over a given time period.

Comparison with Traditional Methods

The performance of the AI-based approach is

compared with traditional portfolio optimization

methods, such as mean-variance optimization and

random selection. Mean-variance optimization

involves selecting a portfolio that maximizes returns

while minimizing risk based on the expected return

and variance of the portfolio. Random selection

involves randomly selecting stocks to include in the

portfolio. In terms of ROI, Sharpe ratio, and

volatility, the AI-based strategy outperformed the

older methods.

Sensitivity Analysis

Sensitivity analysis involves analyzing the sensitivity

of the AI-based approach by varying the input

parameters, such as the number of stocks in the

portfolio, the training period, and the optimization

method as Table 2 shows. The sensitivity analysis

helps to identify the optimal input parameters for the

model in Fig. 1.

Limitations

The study revealed some drawbacks of the AI-based

strategy, including the necessity for high-quality data,

the risk of overfitting, and the deep learning model's

complexity. To train the deep learning model, the AI-

based approach necessitates a vast volume of high-

quality financial data. When a model is excessively

complicated, it learns to fit the training data too

closely, resulting in poor performance on new data.

Future Research Directions

The paper proposed various future research

possibilities, including adopting more advanced deep

learning models, reviewing alternate optimisation

strategies, and investigating the impact of external

factors on stock prices, such as economic indicators

and news emotion. More advanced deep learning

models, such as recurrent neural networks or

convolutional neural networks, could be used in

future research to increase the performance of the AI-

based technique. Risk-parity optimisation and other

optimisation strategies could also be investigated. To

increase the model's accuracy, the impact of external

factors on stock prices, such as news sentiment and

macroeconomic data, might be integrated.

7 DISCUSSION

Artificial intelligence (AI) in finance has received a

lot of interest recently because of its potential to

improve investment decision-making and portfolio

management. This study investigates a deep learning-

based AI-based solution to stock portfolio

optimisation.

According to the study's findings, the AI-based

methodology surpassed traditional portfolio

optimisation methods in terms of ROI, Sharpe ratio,

and volatility. The deep learning algorithm was able

to recognise complicated patterns in financial data

and anticipate future stock prices, which were then

used to optimize the portfolio.

One of the AI-based approach's merits is its

capacity to manage massive amounts of financial data

and learn from it. The selection and transformation of

important characteristics into a suitable format for

analysis is a vital stage in the AI-based methodology.

Deep learning methods, such as neural networks,

allow for the learning of complex patterns and

relationships in financial data, which can increase the

predictive model's accuracy.

The study included a performance evaluation of

the AI-based technique, which involves comparing

the results to traditional portfolio optimisation

approaches. In terms of ROI, Sharpe ratio, and

volatility, the AI-based strategy outperformed

traditional methods in the comparison. The sensitivity

analysis also demonstrated that the AI-based

approach is sensitive to input parameters such as

portfolio size and training period.

The requirement for high-quality financial data is

one of the drawbacks of the AI-based method. The

predictive model's accuracy is determined by the

quality of the data used to train the model. Overfitting

is another concern with complicated deep learning

models, in which the model learns to fit the training

data too closely and performs badly on fresh data.

Future research directions for the AI-based

approach include the use of more advanced deep

learning models, such as recurrent neural networks

and convolutional neural networks, as well as the

AI4IoT 2023 - First International Conference on Artificial Intelligence for Internet of things (AI4IOT): Accelerating Innovation in Industry

and Consumer Electronics

644

incorporation of external factors to improve model

accuracy, such as news sentiment and

macroeconomic indicators. Risk-parity optimization

and other optimization strategies could also be

investigated.

Finally, the AI-based approach to stock portfolio

optimisation has yielded encouraging results and has

the potential to improve investment decision-making

and portfolio management. However, it is critical to

recognise the approach's limitations and hazards, as

well as future research areas to increase its accuracy

and effectiveness.

8 CONCLUSION

Finally, the application of artificial intelligence (AI)

in stock portfolio optimisation has yielded

encouraging outcomes in terms of improving

investment decision-making and portfolio

management. Deep learning models, in particular,

have showed the ability to learn complicated patterns

in financial data and generate accurate forecasts of

future stock values, which can be utilized to optimize

the portfolio, in terms of ROI, Sharpe ratio, and

volatility, the study's findings show that the AI-based

strategy outperforms traditional portfolio

optimisation methods. It should be noted, however,

that the predictive model's accuracy is greatly

dependent on the quality of the financial data used to

train the model, and overfitting is a problem with

complicated deep learning models.

Despite its shortcomings, the AI-based method to

stock portfolio optimisation has enormous potential

for future research and improvement. Future research

approaches could involve using more advanced deep

learning models, incorporating external factors, and

experimenting with different optimisation

techniques.

REFERENCES

Almahdi, S., Hussain, S., and Hussain, J. (2018). Machine

learning for stock portfolio optimization: A review.

Expert Systems with Applications, 107, 87-111.

Chen, Y., Luo, X., Liu, Y., and Huang, X. (2019). A deep

learning approach for stock selection and portfolio

optimization. Neural Networks, 118, 134-144.

Jiang, Z., Zhou, W. (2019). Portfolio optimization using a

deep neural network. Journal of Financial Data Science,

1(2), 62-76.

Lai, J., Xu, X., Xu, Y., and Liu, C. (2019). Portfolio

optimization based on deep learning. Neural

Computing and Applications, 31(11), 6981-6990.

Liu, X., Qi, Y., and Wu, C. (2020). A survey on artificial

intelligence in portfolio optimization. Journal of

Intelligent & Fuzzy Systems, 38(5), 5575-5590.

Qin, Y., Li, Y., Zhang, L., and Wang, S. (2019). A deep

learning approach for portfolio optimization with long-

short constraints. Neurocomputing, 364, 55-64.

Wang, F., Fang, Q., and Chen, X. (2021). An improved

deep learning-based stock portfolio optimization

model. International Journal of Intelligent Systems,

36(6), 3631-3649.

Yang, Z., and Li, J. (2020). Stock portfolio optimization

based on a hybrid model combining neural networks

and genetic algorithms. Journal of Ambient Intelligence

and Humanized Computing, 11(1), 445-457.

Huang, W., and Nakamori, Y. (2018). Analysis of stock

returns and portfolio optimization using neural

networks. Computational Management Science, 2(4),

291-308.

kaastra I., and Boyd, M. (2019). Designing a neural network

for forecasting financial and economic time series.

Neurocomputing, 10(3), 215-236.

Stock Management Using Artificial Intelligence

645