Factors Influencing the Financial Performance of

Islamic Rural Banks in Indonesia

Dedek Sri Wahyuni

1

, Hamdi Agustin

2

, Rahmat Setiawan

3

and Hasby

4

1

Master of Management Program student, Islamic University of Riau, Indonesia

2

Magister Management Program, Islamic University of Riau, Pekanbaru, Indonesia

3

Faculty of Economic and Business, Islamic University of Riau, Pekanbaru, Indonesia

4

Faculty of Economic and Business Student, Islamic University of Riau, Pekanbaru, Indonesia

Keywords: NPF, ROA, SIZE, COVID-19.

Abstract: The purpose of this research is to determine the factors that influence the performance of Islamic rural banks

in Indonesia. The aim of this research is to identify the factors that impact the performance of Islamic rural

banks in Indonesia. It is known that banks in developing countries are more vulnerable to external and massive

threats. Therefore, it is very important to study their performance in the era before and during COVID-19. In

this study, there were 163 companies in the population of BPRS. Because the data was incomplete and not

available on the company's website, the sample could not be taken from all populations. There are 74 datasets

that meet the criteria for sampling because they have the most complete financial reports and have been

published during the 2018-2021 period. The results of the study show that the dummy variable COVID-19

has no effect on the financial performance of Sharia Rural Banks. Covid-19 has not had an impact on BPRS

performance due to the segmentation of BPRS consumers, mostly rural communities who earn income from

agriculture, plantations, and trade. The income of BPRS consumers during the Covid-19 period was not

affected by these efforts. Thus, Covid-19 will not have an impact on the financing that has been distributed

by the BPRS. OCOI and SIZE variables affect financial performance. Meanwhile, the CAR, FDR, and NPF

variables have no impact on the financial performance of Sharia Rural Banks.

1 INTRODUCTION

The consequences of COVID-19 for the banking

industry in developing countries could result in major

problems due to COVID-19 there will be a large

increase in the number of people who default on

loans, withdrawals will be difficult, clients will

withdraw funds in savings to finance basic needs, the

amount of funds loan reserves will decrease, and

demand for new investment will also decrease

(Lagoarde-Segot & Leoni, 2013; Su et al., 2020a,

2020b). Although banks are considered as a tool for

growth in any economy, their importance in

facilitating the activities of emerging and developing

economies has increased manifold due to the role of

banks as providing capital financing in both the short

and long term (Rizvi et al., 2020b). The role and

influence of banks is enormous, especially in

countries where financial regulation is immature due

to weak or non-operating security markets, a lack of

effective and tolerable legal regulation, an absence of

contemporary and important financial instruments,

and know-how. and the novelty does an inadequate

part (Barua, 2020). In addition, banks are very

important in developing and developing countries to

stimulate economic growth. If a bank is in a high-risk

condition, then the process of utilizing existing funds

in the bank will be significantly hampered (Naqvi et

al., 2021; Umar et al., 2021a). As a result, in a country

there will be economic development in developing

countries will suffer (Xie, et al., 2022).

Various literature highlighting the potential

implications of COVID-19 for banks has been carried

out in both developed countries (Cecchetti &

Schoenholtz, 2020) and developing countries (Barua

& Barua, 2021). During the COVID-19 pandemic, the

conditions in the banking sector were very vulnerable

because many debtors from various industrial sectors

were affected by COVID-19, so they experienced

problems in carrying out their obligations (Cecchetti

& Schoenholtz, 2020). This will certainly have an

impact on bank performance. However, in this

104

Wahyuni, D., Agustin, H., Setiawan, R. and Hasby, .

Factors Influencing the Financial Performance of Islamic Rural Banks in Indonesia.

DOI: 10.5220/0012628700003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 104-110

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

condition, banks are still required to continue to

provide good performance because they remember

their important role in carrying out the intermediary

function in various industrial sectors (Hartadinata &

Farihan, 2021).

The following aspects are influenced by this

study's contribution to the literature. First, prior

literature examined the impact of COVID-19 on

macroeconomic prospectives, such as economic

growth (Apergis and Apergis, 2021), International

Trade (Gruszczynski, 2020; Vidya and Prabheesh,

2020), oil price (Mensi et al., 2020; Gharib et al.,

2021), and gold price (Mensi et al., 2020). While at

the firm level, most existing studies focus on the

impact of COVID-19 on a firm’s performance (Fu

and Shen, 2020; Gu et al., 2020; Shen et al., 2020;

Xiong et al., 2020; Škare et al., 2021) and stock

market returns and volatility (Al-Awadhi et al., 2020;

Baek et al., 2020; Zaremba et al., 2020; Harjoto et al.,

2021). The impact of COVID-19 on bank

performance is not widely known (Xiazi and Shabir,

2022).

Understanding the financial performance of all

Sharia Rural Banks or Sharia People's Financing

Banks (BPRS) in Indonesia is absolutely necessary

(Wasiaturrahma et al., 2020). This is because several

previous studies have separately analyzed BPR and

BPRS, such as Muhari and Hosen (2014) and Hartono

et al. (2008) and Septianto and Widiharih (2010).

Researchers who examined the impact of convid -19

on Islamic banks in Indonesia are Ichsan et al (2020),

Azhari & Rofini (2020), Hasan (2020), Efendi &

Harian (2020), Tahlina (2020), Ilhami & Thamrin

(2020 ), Fitriani (2020), Rahmawati et al. (2021). The

performance analysis of Sharia Rural Banks in

Indonesia has been limited by research specializing in

it.

To our knowledge, there is not enough empirical

evidence to support the impact of the pandemic on the

banking sector's performance. The impact of the

Covid-19 pandemic on the performance of the

banking sector has not been examined by any

empirical study to date. From the studies that have

been carried out, it turns out that there is still limited

research on the impact of COVID-19 on the Sharia

Rural Banks in Indonesia, so this research needs to be

done. Therefore, this study contributes to analyzing

the influence of COVID-19 on the performance of

Islamic rural banks in Indonesia. This paper attempts

to identify the impact of the COVID-19 pandemic on

Sharia Rural Banks' financial performance in

Indonesia. This study is an attempt to explore the

implications of the COVID-19 pandemic for the

banking industry in Indonesia. External and massive

threats are more likely to affect banks in developing

countries, as we already know. Therefore, it is very

important to study their performance in the era before

and during COVID-19, especially in Sharia Rural

Banks in Indonesia. The findings in this study offer

valuable implications for banking sector regulation in

Indonesia.

2 LITERATURE REVIEW

BPRS is one of the Islamic banking financial

institutions, whose operational pattern follows sharia

principles or Islamic muamalah. BPRS was

established based on Law no. 7 of 1992 concerning

government regulation (PP) No. 72 of 1992 the bank

is based on the principle of profit sharing. In article 1

paragraph 4 of Law No. 10 of 1998 concerning

changes to Law no. 7 of 1992 concerning banking, it

is stated that BPRS are banks that carry out business

activities based on sharia principles which in their

activities do not provide services in payment traffic.

Before being referred to as an Islamic People's Credit

Bank (BPRS), it was also called At-Tamwil as-Sya'bi

Alislami, namely a bank that conducts business

activities conventionally or based on sharia principles

which in its business activities do not provide services

in payment traffic. Law Number 21 of 2008 regarding

sharia banking defines sharia people's credit banks as

sharia people's financing banks.

Guidelines for the relationship between owners

and management are based on Agency Theory in

Islamic Perspective. Figure 1 shows Islamic sharia is

a guideline for principals (owners) and agencies

(management) in cooperating with companies. Thus,

all actions and policies of principals and agencies

must be based on Islamic sharia. The principle of

agent contract in the Islamic perspective is based on

the ASIFAT concept, namely: Akhidah (obedience to

Allah Ta'ala), Siddiq (true), Fathanah (intelligent),

Amanah (honest/trustful) and Tabligh

(communicative).

Basically, BPRS are banks that carry out business

activities based on Sharia principles, but their

activities do not provide payment traffic services as

in commercial banks. Intermediation is carried out by

raising funds from parties who have excess funds to

those who need funds.

BPRS, as Islamic financial institutions, can

provide financial services similar to those offered by

Islamic commercial banks. In Indonesia, the

development of Islamic banking is based on two

considerations. The first is that the market coverage

is very large in Indonesia, where consumers choose

Factors Influencing the Financial Performance of Islamic Rural Banks in Indonesia

105

not to use conventional banking services because they

prefer to follow Sharia rules. Second, the Islamic

banking system can be implemented as an alternative

to restructuring programs with the help of the

Indonesian government's initiative.

Islamic People's Financing Bank (BPRS) is one of

the Islamic banking financial institutions whose

operational pattern follows Sharia principles or

Islamic Muamalah. Islamic people's financing banks

were established as an active step in the context of

restructuring the Indonesian economy as outlined in

various financial, monetary and banking packages in

general, and specifically to fill opportunities for

conventional bank policies in setting interest rates

(rate of interest). Profit-sharing banking system or

Islamic banking system is widely known.

The COVID-19 pandemic has caused income

from disbursing financing to decrease. COVID-19

has a drawback in that income is lost due to lack of

sales, but expenses must still be made. In Indonesia,

the spread of the Coronavirus has weakened the

performance and capacity of Islamic banks,

especially for debtors. The weak performance of

debtors can increase the risk of financing, which

could disrupt banking and the financial stability of

Islamic banking.

COVID-19 has become the focus of great

attention for the State of Indonesia because of the

problems it continues to cause, there are many losses

due to COVID-19 which have an impact on the

Indonesian economy.

The economic development of a country basically

aims to achieve social welfare through rapid

economic growth and fair distribution of income.

During the COVID-19 pandemic, the economy was

hit, all businesses experienced a slowdown, including

BPRS.

3 RESEARCH METHODOLOGY

This study is focused on a BPRS company that has

been registered with the Financial Services Authority

(OJS) and has financial data from 2018-2021. The

sampling method is based on a purposive sampling

method based on a technique based on certain criteria.

The population of BPRS in this study was 163

companies. Because the data was incomplete and not

available on the company's website, the sample could

not be taken from all populations. so that there are 74

data or 296 observations that meet the criteria for

being sampled because they have the most complete

financial reports and have been published in the 2018-

2021 period. The dependent variable used in this

study is the Return On Assets (ROA). Following past

studies of Sufian and Habibullah (2009) and Sufian

and Noor Mohamad Noor (2012), Agustin et al.

(2018), Fajri et al. (2022), Hassan et al. (2022) we

used bank performance as a dependent variable that

is a proxy of return on asset. COVID-19 is a dummy

variable for the time period since COVID-19 stroke

(Caporalea et al, 2017; Fajri et al., 2022)

The data analysis technique uses using multiple

regression model. To test the hypothesis in this study

is as follows:

𝑅𝑂𝐴 = 𝛼 + 𝛽1𝐷𝐶𝑜𝑣𝑖𝑑 + 𝛽2𝐶𝐴𝑅 + 𝛽3𝐹𝐷𝑅

+ 𝛽4𝑁𝑃𝐹 + 𝛽5𝑂𝐶𝑂𝐼 + 𝛽6𝑆𝐼𝑍𝐸

Notes:

ROA = return on assets

DCOVID = Dummy COVID-19 (1 for 2020 and

2021 and 0 for the other years)

CAR = Capital Adequacy Ratio

FDR = Financing to Deposit Ratio

NPF = Non Performing Financing ratio

OCOI = Operating Costs to Operating Income ratio

SIZE = Logarithm of total assets

4 RESULT AND DISCUSSION

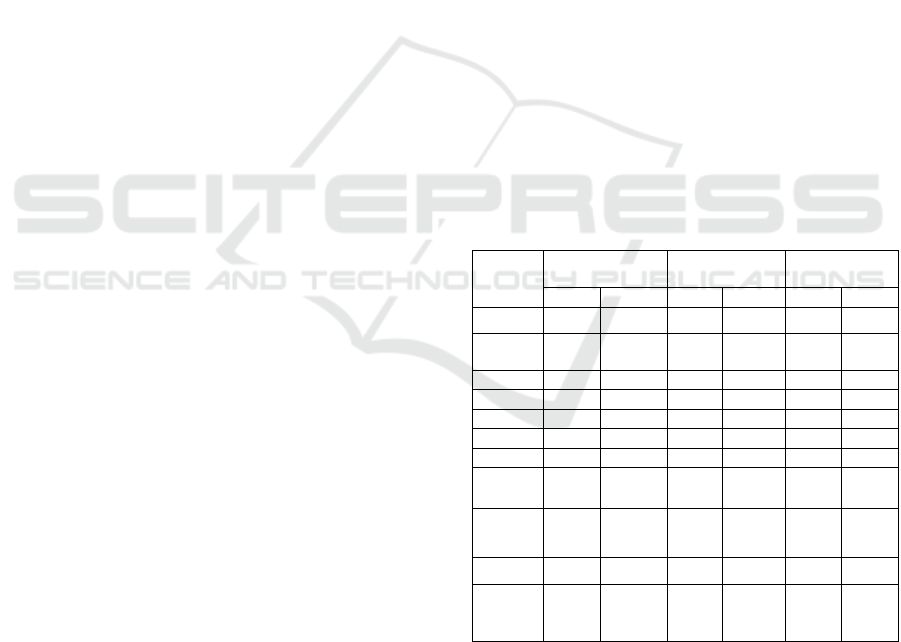

Table 1: Multiple Regression Result.

Variable

Commont Effect

Model

Random Effect

Model

Fixed Effect

Model

Coef.

p-value

Coef.

p-value

Coef.

p-value

Constant

-7.053

0.287

-7.053

0.287

-7.053

0.846

DCOVID

-0.149

0.875

-0.149

0.875

-0.149

0.870

CAR

0.011

0.594

0.011

0.594

0.011

0.627

FDR

-0.008

0.380

-0.008

0.380

-0.008

0.245

NPF

-0.086

0.150

-0.086

0.149

-0.086

0.507

OCOI

-0.014

** 80.006

-0.014

0.006 ***

-0.014

0.158

SIZE

0.632

*0.076

0.632

0.077*

0.632

0.540

R-squared

0.060

0.060

0.339

Adjusted

R-squared

0.041

0.041

0.098

Prob>F

0.006

0.006

0.029

Total of

observatio

n

296

296

296

This study revealed no multicollinearity in the

regression model because the correlation between the

independent variables was less than 0.8 (<unk>0.8).

There is no regression model for the

heteroscedasticity of the Glejser test because the

independent variable is not significant to the absolute

residual (prob > 0.05). The results of data processing

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

106

also show that there is no autocorrelation because the

Durbin Watson value is 2,365 which is between 1 and

3.

The coefficient of DCOVID pandemic is not

significant. This result does not support Almonifi et

al. The 2021 researcher discovered that COVID-19

had a negative impact on Islamic banks in Saudi

Arabia. Such a low impact is caused by the nature of

Islamic Bank which is based on an interest-free

system and avoiding toxic assets that hugely

influence the performance of mainstream Banks in

the middle of crisis Hassan et al., (2020). The

existence of Profit and loss sharing (PLS) system in

the Islamic Bank also minimizes the effect suffered

by the Islamic Bank as the return for investors is

determined by the profit gained (Chapra, 2011).

Covid-19 has not had an impact on BPRS

performance due to the segmentation of BPRS

consumers, mostly rural communities who earn

income from agriculture, plantations, and trade.

These efforts did not have an impact on reducing the

income of BPRS consumers during the Covid-19

period. Thus, Covid-19 will not have an impact on the

financing that has been distributed by the BPRS.

CAR has no effect on ROA. The results of this

study are in line with the research of Rifai & Suyono,

(2019), Azizah & Manda, (2021), Wahyudi, (2020),

and (Gunawan et al., 2020). There is no effect of CAR

on profitability because banks are very careful in

investing their funds so that the CAR value is in

accordance with the provisions, so that banks

minimize the distribution of funds from their capital.

Furthermore, Bank Indonesia's regulations require a

minimum CAR value of 8%. The size of the capital

does not determine the size of the profit generated, if

the bank is careful in distributing its funds, then CAR

will not affect profitability even though the bank has

capital and a high CAR ratio.

FDR has no effect on ROA. The higher the FDR,

the less likely banks are to achieve high profitability.

This shows that the function of the BPRS to channel

financing has not been properly carried out in all the

BPRS studied. This research is in line with the

research of Rahmawati et al., (2021), (Gunawan et al.,

2020), Rifai & Suyono, (2019) and Astuti (2022).

NPF has no effect on ROA. This is possible

because the non-performing financing of Islamic

banks in Indonesia during the study period was not so

large in nominal value. This is also made possible by

the bank's prudent channeling of funds to the public

during the current pandemic. This research is in line

with the research of Karim & Hanafia, (2020),

Gunawan et al., (2020) and Gusmawanti et al., 2020).

OCOI has a negative effect on ROA. Any increase

in operating costs that is not followed by an increase

in operating income will result in reduced profit

before tax and a decrease in ROA. The operational

cost ratio is used to measure the level of efficiency

and ability of a bank to carry out its operational

activities. The smaller this ratio is, the more efficient

the operational costs incurred by the bank, so that the

possibility of the bank being in troubled condition is

also reduced. The greater the OCOI, the smaller the

bank's ROA, because the profit earned by the bank is

also small. This shows that the increase in the bank's

OCOI ratio indicates an increase in the proportion of

operating expenses to operating income received by

the bank, thus if operating costs increase it will reduce

profit before tax which will ultimately reduce ROA at

the bank concerned, by thus the greater the OCOI, the

smaller the bank's ROA, because the profit earned by

the bank is also small. The presence or occurrence of

inefficiencies in operational performance at Islamic

commercial banks is reflected by this. The results of

this study are in line with the research of Azizah &

Manda, (2021), Yuliana and Listari (2021), Hasibuan

et al (2021) and Astuti (2022).

SIZE has a positive effect on ROA. A bigger

bank has a better performance. A big bank has low

fees because there are economies of scale. In addition,

a large bank can diversify its income source by taking

advantage of various types of investment

opportunities. For example, a large bank can take on

a riskier project or provide a larger loan to a company.

The result of this study is in line with research

conducted by Abduh and Issa (2018), Watuseke et.al

(2019), Sanusi and Zulaikha (2019), Rahman et.al

(2020), Dan and Anh (2020) and Fithriyanto (2021)

but it is different from the result of research by

Supiyadi and Nugraha (2018) and Farooq et.al.

(2021).

5 CONCLUSION

The results of data processing show that Covid-19

will not have an impact on the financing that has been

distributed by the BPRS. OCOI and SIZE variables

affect financial performance. Meanwhile, the CAR,

FDR and NPF variables have no effect on the

financial performance of Sharia Rural Banks. Covid-

19 has not had an impact on BPRS performance due

to the segmentation of BPRS consumers, mostly rural

communities who have income from agriculture,

plantations and trade. The income of BPRS

consumers during the Covid-19 period was not

affected by these efforts. OCOI has a negative effect

Factors Influencing the Financial Performance of Islamic Rural Banks in Indonesia

107

on ROA show that Any increase in operating costs

that is not followed by operating income will result in

reduced profit before tax and will result in ROA. The

operational cost ratio is used to measure the level of

efficiency and ability of a bank to carry out its

operational activities. The smaller this ratio, the more

efficient the operational costs incurred by the bank so

that the possibility of a bank in a troubled condition

also becomes smaller. SIZE has a positive effect on

ROA show that a bigger bank has a better

performance. A big bank has low fees because there

are economies of scale

REFERENCES

Abduh, M., & Issa, M. S. (2018). Financial crisis and

determinants of profitability in islamic and

conventional banks: the study of Kuwait banking

industry. IQTISHADIA, 11(1), 1-26.doi:

10.21043/iqtishadia.v10i2.2863

Agustin, H., Indrastuti, S., Tanjung, A.R., & Said, M.

(2018). Ownership structure and bank performance.

Banks and Bank Systems, 13(1), 80-87

Agustin, H, Rahman, F. A., & Jamil, P.C. (2020). A Critical

Islamic perspective towards agency theory.

International Journal of Economics, Business and

Management Research, 4(08), 43-50

Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., and

Alhammadi, S. (2020). Death and contagious infectious

diseases: impact of the COVID-19 virus on stock

market returns. J. Behav. Exp. Financ. 27:100326. doi:

10.1016/j.jbef.2020.100326

Almonifi, Y. S. A., Rehman, S. ul, & Gulzar, R. (2021). The

COVID-19 Pandemic Effect on the Performance of the

Islamic Banking Sector in KSA: An Empirical Study of

Al Rajhi Bank. International Journal of Management,

12(4), 533–547.

https://doi.org/10.34218/IJM.12.4.2021.045

Almonifi, Y. S. A., Rehman, S. ul, & Gulzar, R. (2021). The

COVID-19 Pandemic Effect on the Performance of the

Islamic Banking Sector in KSA: An Empirical Study of

Al Rajhi Bank. International Journal of Management,

12(4), 533–547.

https://doi.org/10.34218/IJM.12.4.2021.045

Apergis, E., and Apergis, N. (2021). The impact of COVID-

19 on economic growth: evidence from a Bayesian

panel vector autoregressive (BPVAR) model. Appl.

Econ. 53, 6739–6751. doi:

10.1080/00036846.2021.1946479

Astuti, R.P. (2022). Pengaruh CAR, FDR, NPF, Dan BOPO

Terhadap Profitabilitas Perbankan Syariah. Jurnal

Ilmiah Ekonomi Islam, 8(03), 3213-3223

Azhari, A, R., & Rofiul, W. (2020). Analisis Kinerja

Perbankan Syariah: Studi Masa Pandemi Covid-19.

Jurnal Ekonomi Syariah Indonesia, Vol.10, No.2,96-

102

Azizah, A., & Manda, G.S (2021). Pengaruh Car Dan Bopo

Terhadap Return on Assets Bank Umum Syariah Tahun

2015-2019. Jurnal Ekonomi Manajemen Perbankan,

3(2), 79-88

Baek, S., Mohanty, S. K., and Glambosky, M. (2020).

COVID-19 and stock market volatility: an industry

level analysis. Financ. Res. Lett. 37:101748. doi:

10.1016/J. FRL.2020.101748

Barua, Bipasha, & Barua, Suborna. (2021). COVID-19

implications for banks: evidence from an emerging

economy. SN Business & Economics, 1(1), 1-28.

Barua, S. (2020). COVID-19 pandemic and world trade:

Some analytical notes. http://dx.doi.

org/10.2139/ssrn.3577627

Caporale, G. M., Lodh, S., & Nandy, M. (2017). The

performance of banks in the MENA region during the

global financial crisis. Research in International

Business and Finance, 42, 583–590

Cecchetti, Stephen G, & Schoenholtz, Kermit L. (2020).

Contagion: Bank runs and COVID-19. Economics in

the Time of COVID-19, 77-80

Chapra, M. U. (2011). The Global Financial Crisis: Can

Islamic Finance Help? Islamic Economics and Finance,

135–142.

Dan, N.N.M., & Anh, Y.T. (2020). Determinants of bank

profitability empirical evidence from Vietnamese

commercial banks in the periods of 2013 To 2018.

Journal of social science research, 15, 176-184. DOI:

https://doi.org/10.24297/jssr.v15i.8745

Effendi, I & Hariani, P. (2020). Dampak Covid-19

Terhadap Bank Syariah. Ekonomikawan,Vol. 20, No.2,

221-230

Fajri, M. N., Muhammad, A.B., Umam, K., Putri, L. P., &

Ramadhan, M. A. (2022). The effect of covid-19 and

sectoral financing on Islamic Bank profitability in

Indonesia. Journal of Islamic Economic Laws, 5(1), 38-

60

Farooq, M., Khan, S., Siddiqui, A. A., Khan, M. T., &

Khan, M. K. (2021). Determinants of profitability: a

case of commercial banks in Pakistan. Humanities &

Social Sciences Reviews, 9(2), 01-13.

https://doi.org/10.18510/hssr.2021.921

Fithriyanto N. (2021). The Determinant Factors of Bank

Profitability in Indonesia. Working paper Electronic

copy available at: https://ssrn.com/abstract=3736551

Fitriani, P. D. (2020). Analisis Komparatif Bank Umum

Syariah Pada Masa Pandemi Covid-19. Jurnal Ilmu

Ekonomi dan Studi Pembangunan, Vol.20, No. 2, 113-

124

Fu, M., and Shen, H. (2020). COVID-19 and corporate

performance in the energy industry. Energy Res. Lett.

1:12967. doi: 10.46557/001c.12967

Gharib, C., Mefteh-Wali, S., Serret, V., and Ben Jabeur, S.

(2021). Impact of COVID-19 pandemic on crude oil

prices: evidence from Econophysics approach. Res.

Policy 74:102392. doi:

10.1016/j.resourpol.2021.102392

Gruszczynski, L. (2020). The CoviD-19 pandemic and

international trade: temporary turbulence or paradigm

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

108

shift? Eur. J. Risk Regulat. 11, 337–342. doi:

10.1017/err.2020.29

Gu, X., Ying, S., Zhang, W., and Tao, Y. (2020). How do

firms respond to COVID-19? First evidence from

Suzhou, China. Emerg. Mark. Financ. Trade 56, 2181–

2197. doi: 10.1080/1540496X.2020.1789455

Gunawan, I., Purnamasari, E. D., & Setiawan, B. (2020).

Pengaruh CAR, NPF, FDR, dan BOPO terhadap

Profitabilitas (ROA) pada Bank Syariah Bukopin

Periode 2012-2018. Jurnal Manajemen SDM,

Pemasaran, Dan Keuangan, 1(1), 11–36.

http://doi.org/xxxx/xxxx

Gusmawanti, A., Supaijo, S., Iqbal, M., & Fasa, M. I.

(2020). The Nexus Between FDR, NPF, BOPO Toward

Profitability Of Indonesian Islamic Bank. Al-Amwal:

Jurnal Ekonomi Dan Perbankan Syari’ah, 12(2), 167–

180. https://doi.org/10.24235/amwal.v12i2.7155

Harjoto, M. A., Rossi, F., Lee, R., and Sergi, B. S. (2021).

How do equity markets react to COVID-19? Evidence

from emerging and developed countries. J. Econ. Bus.

115:105966. doi: 10.1016/J.JECONBUS.2020.105966

Hartadinata, OS., & Farihah, E. (2021). Indonesian go

public bank performance: before and during covid-19.

Berkala Akuntansi dan Keuangan Indonesia, 06, 111-

131.

Hartono, I., Djohar, S., & Daryanto, H.K. (2008). Analisis

efisiensi Bank Perkreditan Rakyat di Wilayah

Jabodetabek dengan Pendekatan data envelopment

analysis. Jurnal Manajemen & Agribisnis, 5(2), 52–63.

Hasan, Z. (2020). The Impact of Covid-19 on Islamic

Banking in Indonesia During the Pandemic Era. Journal

of Entrepreneurship and Bussiness, Vol.8, No.2, 19-32

Hasibuan, A.F., Falahuddin, & Ulva, H. (2021). Pengaruh

Bopo, FDR Dan Npf Terhadap Profitabilitas (ROA)

Pada Bank Syariah Periode 2009-2019. Jurnal el-

Amwal, 4(1), 1-12

Hassan, M. K., Rabbani, M. R., & Ali, M. A. M. (2020).

Challenges for the Islamic Finance and banking in post

COVID era and the role of Fintech M. Kabir Hassan 1,

Mustafa Raza Rabbani 2 and Mahmood Asad Mohd.

Ali 3. Journal of Economic Cooperation and

Development, 41(3), 93–116.

Hassan, M. K., Karim, M. S., Lawrence, S., & Risfandy, T.

(2022). Weathering the COVID-19 storm: The case of

community banks. Research in International Business

and Finance, 60, 1-24

Ichsan, R. N., Yusuf, S., & Sitompul. I. (2021).

Determinant of Sharia Bank’s Financial Performance

during the Covid-19 Pandemic. BIRCI Journal, Vol.4,

No.1, 298-309

Ilhami & Thamrin. H (2021). Analisi Dampak Covid-19

terhadap Kinerja Keuangan Perbankan Syariah di

Indonesia. Jurnal Tabbaru’: Islamic Banking and

Finance, Vol.4, No.1, 37-45

Karim, A., & Hanafia, F. (2020). Analisis CAR, BOPO,

NPF, FDR, NOM, Dan DPK Terhadap Profitabilitas

(ROA) Pada Bank Syari’ah Di Indonesia. Target: Jurnal

Manajemen Bisnis, 2(1), 36–46.

https://doi.org/10.30812/target.v2i1.697

Lagoarde-Segot, T., & Leoni, P. L. (2013). Pandemics of

the poor and banking stability. Journal of Banking &

Finance, 37(11), 4574–4583.

https://doi.org/10.1016/j.jbankfin.2013.04. 004

Mensi, W., Sensoy, A., Vo, X. V., and Kang, S. H. (2020).

Impact of COVID-19 outbreak on asymmetric

multifractality of gold and oil prices. Res. Policy

69:101829. doi: 10.1016/j.resourpol.2020.101829

Muhari, S., & Hosen, M.N. (2014). Tingkat Efisiensi BPRS

di Indonesia: Perbandingan Metode SFA dengan DEA

dan Hubungannya Dengan CAMEL. Jurnal Keuangan

Dan Perbankan, 18 (2), 307–328.

Naqvi, S. A. A., Shah, S. A. R., Anwar, S., & Raza, H.

(2021). Renewable energy, economic development, and

ecological footprint nexus: Fresh evidence of

renewable energy environment Kuznets curve (RKC)

from income groups. Environmental Science and

Pollution Research International, 28(2), 2031–2051.

Rahman, H., Yousaf, M.W., & Tabassum, N. (2020). Bank-

Specific and macroeconomic determinants of

profitability: a revisit of pakistani banking sector under

dynamic panel data approach. International of Journal

Financial Studies, 8(42), 1-19.

doi:10.3390/ijfs8030042

Rahmawati, Salim & Priyono. (2021). Analisis Komparatif

Kinerja Keuangan Bank Syariah Sebelum Dan Saat

Pandemi Covid-19 (Studi Pada Bank Syariah Yang

Terdaftar Di OJK). e-Jurnal Manajemen, Vol.10,

No.10, 1-11

Rifai, F., & Suyono, N. A. (2019). Pengaruh Capital

Adequacy Ratio, Non Performing Financing, Financing

To Deposit Ratio Dan Net Operating Margin Terhadap

Profitabilitas Bank Syariah (Studi Empiris Pada Bank

Umum Syariah Dan Unit Usaha Syariah Yang Terdaftar

Di Otoritas Jasa Keuangan Perio. Journal of Economic,

Business and Engineering, 1(1), 150–160

Rizvi, S. K. A., Yarovaya, L., Mirza, N., & Naqvi, B.

(2020b). The impact of COVID-19 on valuations of

non-financial European firms.

http://dx.doi.org/10.2139/ssrn.3705462

Sanusi, M., & Zulaikha, S. (2019). The impact of bank-

specific and macroeconomic variables on profitability

of Islamic rural bank in Indonesia. Jurnal Ilmiah

Ekonomi Islam, 5(03), 317-325. DOI:

http://dx.doi.org/10.29040/jiei.v5i3.635

Septianto, H., & Widiharih, T., 2010. Analisis efisiensi

Bank Perkreditan Rakyat di Kota Semarang dengan

Pendekatan data envolepment analysis. Media

Statistika, 3 (1), 41–48.

Shen, H., Fu, M., Pan, H., Yu, Z., and Chen, Y. (2020). The

impact of the COVID-19 pandemic on firm

performance. Emerg. Mark. Financ. Trade 56, 2213–

2230. doi: 10.1080/1540496X.2020.1785863

Škare, M., Soriano, D. R., and Porada-Rochoń, M. (2021).

Impact of COVID-19 on the travel and tourism

industry. Technol. Forecast. Soc. Chang. 163:120469.

doi: 10.1016/J.TECHFORE.2020.120469

Su, C.-W., Huang, S.-W., Qin, M., & Umar, M. (2021a).

Does crude oil price stimulate economic policy

uncertainty in BRICS? Pacific-Basin Finance Journal,

Factors Influencing the Financial Performance of Islamic Rural Banks in Indonesia

109

66, 101519. https://doi.

org/10.1016/j.pacfin.2021.101519

Su, C.-W., Khan, K., Umar, M., & Zhang, W. (2021b).

Does renewable energy redefine geopolitical risks?

Energy Policy, 158, 112566.

https://doi.org/10.1016/j.enpol.2021.112566

Sufian, F. (2011). Profitability of the Korean banking

sector: Panel evidence of bank-specific and

macroeconomic determinants. Journal Economics and

Management, 7(1), 43-72.

Sufian, F., & Habibullah, M. S. (2010). Assessing the

impact of financial crisis on bank performance

empirical evidence from Indonesia. ASEAN Economic

Bulletin, 27( 3), 245-62.

Sufian, F., & Habibullah, M. S. (2012). Globalizations and

bank performance in China. Research in International

Business and Finance, 26, 221-239.

Supiyadi, D., & Nugraha, M. A. (2018). The Determinants

of Bank Profitability: Empirical evidence from

Indonesian Sharia Banking Sector. 1st International

Conference on Economics, Business,

Entrepreneurship, and Finance (ICEBEF 2018),

Jakarta-Indonesia

Tahlani, H. (2020). Tantangan Perbankan Syariah dalam

Menghadapi Pandemi Covid-19. Madani Syariah,

Vol.3, No.2, 92-113

Umar, M., Ji, X., Kirikkaleli, D., & Alola, A. A. (2021a).

The imperativeness of environmental quality in the

United States transportation sector amidst biomass-

fossil energy consumption and growth. Journal of

Cleaner Production, 285, 124863.

https://doi.org/10.1016/j.jclepro. 2020.124863

Vidya, C. T., and Prabheesh, K. P. (2020). Implications of

COVID-19 pandemic on the global trade networks.

Emerg. Mark. Financ. Trade 56, 2408–2421. doi:

10.1080/1540496X.2020.1785426

Wahyudi, R. (2020). Analisis Pengaruh CAR, NPF, FDR,

BOPO dan Inflasi terhadap Profitabilitas Perbankan

Syariah di Indonesia: Studi Masa Pandemi Covid-19.

At-Taqaddum, 12(1), 13.

https://doi.org/10.21580/at.v12i1.6093

Wasiaturrahma, Sukmana, R., Ajija, S.R, & Salama, S.C.,

& Hudaifah, A. (2020). Financial performance of rural

banks in Indonesia: A two-stage DEA approach.

Heliyon 6 (2020), 1-9.

Watuseke, C., Worang, F., & Tielung, M. (2019).

Determinants of bank profitability in Indonesia (case

study of Indonesian commercial banks listed in idx

period 20102015). Jurnal EMBA, 7(1), 211 – 220.

Xiazi, X., & Shabir, M. (2022). Coronavirus pandemic

impact on bank performance. Front. Psychol. 13,. 1-14

doi: 10.3389/fpsyg.2022.1014009

Xie, H., Chang, H., Hafeez, M & Saliba, C. (2022).

COVID-19 post-implications for sustainable banking

sector performance: evidence from emerging Asian

economies. Economic Research-Ekonomska

Istraživanja, 35(1), 4801–4816.

https://doi.org/10.1080/1331677X.2021.2018619

Xiong, H., Wu, Z., Hou, F., and Zhang, J. (2020). Which

firm-specific characteristics affect the market reaction

of Chinese listed companies to the COVID-19

pandemic? 56, 2231–2242. doi:

10.1080/1540496X.2020.1787151,

Yuliana, I. R., & dan Listari, S. (2021). Pengaruh CAR,

FDR, Dan BOPO Terhadap ROA Pada Bank Syariah

Di Indonesia. Jurnal Ilmiah Akuntansi Kesatuan, 9(2),

309-334

Zaremba, A., Kizys, R., Aharon, D. Y., and Demir, E.

(2020). Infected markets: novel coronavirus,

government interventions, and stock return volatility

around the globe. Financ. Res. Lett. 35:101597. doi:

10.1016/j.frl.2020.101597

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

110