Trends in Financial Management Research in Indonesia:

Bibliometric Analysis

Daris Purba

1a

, Suratman

1b

, Yuliadi

1c

, Yossi Hendriati

1d

and Zara Tania Rahmadi

2e

1

Sekolah Tinggi Ilmu Ekonomi Galileo, Batu Ampar, Batam, Indonesia

2

Institut Bisnis dan Informatika Kosgoro 1957, Lenteng Agung, Jakarta, Indonesia

Keywords: Financial Management, Bibliometric Analysis, Indonesia, Research.

Abstract: The purpose of this research is to analyze the current trends in financial management research in Indonesia.

The aim is to gain insight into the research themes and focus in this field. In this study, bibliometric analysis

is employed, which involves four stages of analysis: defining the research objectives and scope, selecting

bibliometric analysis tools, collecting data, and analyzing the data to reach a conclusion. The data was

collected from the Google Scholar database using the keywords "financial management." Specifically, data

from journals and proceedings published between 2020 and 2022 were analyzed, resulting in 254 data points.

The VOS Viewer Application's performance and network analysis techniques were used to analyze 64 of

those. The findings indicate that financial management research trends in Indonesia strongly focus on the

influence of financial literacy on financial attitudes if data used were primary data and company value and

performance if data used were secondary.

1 INTRODUCTION

There could still be a lack of research in financial

management science in Indonesia. Research in this

field is needed to support economic growth. There

should be a lot of research in this area.

From the observations made, the major themes of

research in the field of financial management in

Indonesia are confirmation of theories or previous

findings with facts that are currently available. The

themes that are often encountered are the effect of

income on profits, the effect of debt on income, and

the like. The majority of research only confirms

existing theories and does not generate new ideas.

There is more research expected to be done on

emerging phenomena in Indonesia. The number of

small and medium enterprises, the growth of

companies and business fields, and companies in

remote areas are phenomena that require further

study. Preliminary observations indicate that these

phenomena are rarely studied.

a

https://orcid.org/0000-0003-4756-8333

b

https://orcid.org/0009-0000-2692-658X

c

https://orcid.org/0009-0004-4686-4194

d

https://orcid.org/0009-0005-7490-3792

e

https://orcid.org/0009-0009-3065-8931

To come to a conclusion about the themes

discussed in financial management in Indonesia,

research is necessary. This study aims to analyze and

conclude this.

2 LITERATURE REVIEW

Baker's research (Baker et al., 2023) shows several

trends in JIFMA (Journal of International Financial

Management and Accounting. The main aspects of

financial management include corporate governance,

equity valuation, foreign equity ownership, cost of

capital, triple-bottom-line disclosure, and managerial

ownership and earnings management. Based on these

themes, it can be inferred that more investigation is

being conducted in the realm of the company's

financial management.

Baker et al. also conducted bibliometric research

in the Global Finance Journal previously. The

conclusion is that the research trend is contained in

Purba, D., Suratman, ., Yuliadi, ., Hendriati, Y. and Tania Rahmadi, Z.

Trends in Financial Management Research in Indonesia (Bibliometric Analysis).

DOI: 10.5220/0012629200003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 111-114

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

111

two clusters; the first is the impact of country-specific

factors on finance such as the impact of financial

ratios, stock price movements, and financial risks; the

second is the impact of macro and microeconomic

factors on stock earnings (Baker et al., 2021)

There is a growing body of research on the impact

of technological advances on financial management

in other studies. Here are the studies in question. A

study using bibliometric study found 4 main themes

dominate research in finance, namely: applications

and settings, critical technologies, digital finance, and

their impact on Companies (Zou et al., 2023).

One of the latest developments in financial

technology is Blockchain. The research on

Blockchain has been reported to be fresh. Blockchain

can allegedly form new patterns and dynamics in

finance (Boakye et al., 2022).

Research in the field of blockchain is on the rise.

The topic of discussion is the impact on financial

institutions, financial applications, regulation, and

cybersecurity. Future research is how to monitor

blockchain implementation, this requires cross-

country analysis using a multi-disciplinary approach

(Patel et al., 2022).

In addition to research on technological

developments' impacts, research on finance also

raises new variables that allegedly improve financial

performance. A study shows that several new

variables are interesting to be used in future research,

such as'stakeholder engagement', 'integrated

reporting', and 'voluntary disclosure'. (Murdayanti &

Khan, 2021).

From the literature review above, it can be

concluded that research trends in financial

management science can be grouped into three

clusters sequentially, namely: the impact of

technological developments, new theories and

variables, old theories and variables.

3 METHOD

This research is about literature. This study aims to

identify previous research related to financial

management by using the keyword 'financial

management'. This study used the Publish or Perish

application to find a list of journals that use the

keyword 'financial management'.

A study concluded Bibliometric technique is an

important research tool for mapping emerging studies

(Khan et al., 2022) From this mapping, research can

be carried out to further develop science.

Data from Publish or Perish is then processed

using the Mendeley application. Journals that do not

match the criteria are then removed from the

database. The criteria were removed because they

were deemed unsuitable for community service

journals, sharia field journals, and non-financial

management journals.

From Mendeley, the data is then processed using

the VOS Viewer application to see the mapping.

From the results of the mapping, analysis, and

conclusions were then drawn.

4 RESULT & DISCUSSION

The results of data processing using VOS viewer

found that those topics that are often discussed and

related to other themes are 'Financial Literacy' and

'Financial Attitudes'. More details are presented in the

following table.

Table 1: Total links for most keywords.

Ke

y

word Links

Profitabilit

y

13

Financial Attitude 23

Financial Literacy 38

SME 19

Financial Performance 18

Com

p

an

y

Value 14

Table 1 shows the number of links from the 6 most

popular keywords. Financial Literacy is the ones with

the most links, amounting to 38 links.

4.1 Result

Network analysis serves to see the relationship

between keywords. The analysis reveals the number

of keywords that appear in research, the relationship

between keywords, and the mapping and clustering of

relationships. For this, a computer application is used

which is the VOS Viewer. The application is used for

mapping and clustering. Mapping and clustering are

complementary to each other. Mapping is used to

visualize network structures in bibliometrics. while

the clustering is not bound to dimensional constraints

(Waltman et al., 2010).

The stage in bibliometric analysis is to look at the

network, overlay, and density taken from article

metadata. A bibliometric network consists of dots and

lines. Points are drawn in circles, while lines depict

relationships between points.

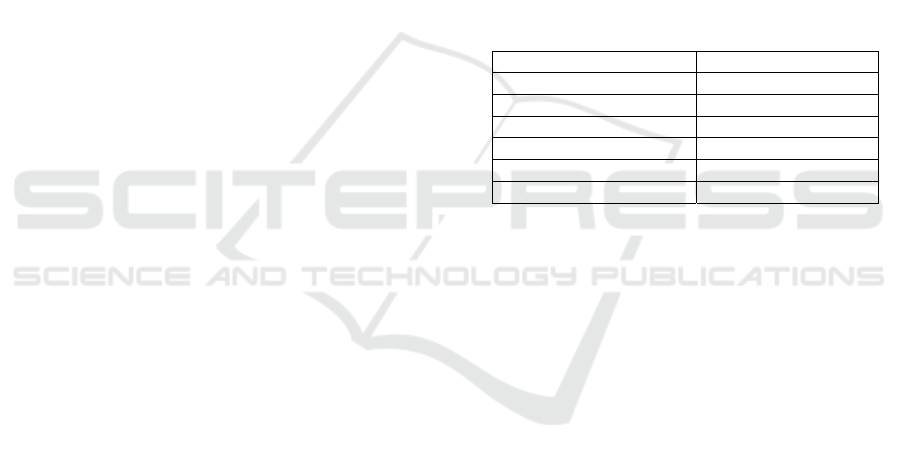

The results of the network analysis can be seen in

the figure in Figure 1.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

112

Figure 1: Network Analysis Result.

The topic that is most talked about is financial

literacy and financial attitudes. Each color in the

analysis network describes its cluster. Data analysis

yielded 14 clusters and 102 keywords. Keyword

clustering is presented in Table 2.

Table 2: Clusters and Keywords.

Cluste

r

Keywor

d

1

(red)

IDX, corporate governance rating, JCI,

financial management decisions, rupiah

exchange rate, leverage, liquidity, stock

liquidity, literature review, company value,

growth, stock return, solvency, interest rate,

inflation rate, company size

2

(Dark

green)

Socioeconomic demography, fintech,

lifestyle hedonism, Generation Y, spiritual

intelligence, financial literacy, personal

financial management, practice model, future

orientation, payment gateway, financial

learnin

g

, financial

b

ehavio

r

, income level

3

(Dark

blue)

assets, manufacturing industry, information,

financial performance, asset management,

profit management, working capital

management, working capital, bond ratings,

manufacturing companies, transportation

sector com

p

anies,

p

rofitabilit

y

, financial ratios

4

(yellow)

Survey analysis, family farmers, welfare,

financial management, digital marketing,

accountin

g

p

ractices, MSMEs.

5

(Dark

purple)

Employee class, personality, MSME actors,

financial knowledge, financial behavior of

workers, financial management behavior,

attitude, financial attitude

6 (Light

b

lue)

Lifestyle, millennials, self-control, locus of

control, students, income,

b

ehavio

r

7

(orange)

EPS, share price, NPM, ROA, ROE, literature

study

8 (light

p

ur

p

le

)

Covid-19, innovation, family economy,

financial mana

g

ement

p

ractices

9 (light

p

ink)

Investment interest, investment motivation,

return perception, risk perception.

10 (dark

p

ink)

GPA, gender, management students

11(light

g

reen

)

Financial self-efficacy, locus of control, parental

income, financial mana

g

ement

b

ehavio

r

12 Di

g

ital marketin

g

, fashion, businessmen

13 Concept, scope, goals, and principles

14 Famil

y

environment, colle

g

e learnin

g

Table 2 above gives an explanation of the

characteristics of each cluster. Cluster 1 is related to

the Company's finances. Cluster 2 is related to

financial management in Generation Y. Cluster 3 is

related to financial management in the Company's

accounting. Cluster 4 is related to the use of financial

management in the community, especially in the

farming community. Cluster 5 deals with finances for

employees. Cluster 6 is a finance cluster in the

millennial generation. Cluster 7 relates to financial

ratios in the company. Cluster 8 is related to finances

during COVID-19. Cluster 9 deals with investment,

risk, and return. Cluster 10 is related to students,

GPA, Batch, and finance. Cluster 11 deals with

personal finances on a person-by-person basis.

Cluster 12 is related to digital marketing. Cluster 13

concepts, scope, objectives, and principles. Cluster 14

is related to the family environment and learning in

universities.

The cluster shown in Table 2 explains that

research trends in Indonesia when referring to the

conclusions of literature studies then fall into the

group of old theories research using classical

variables.

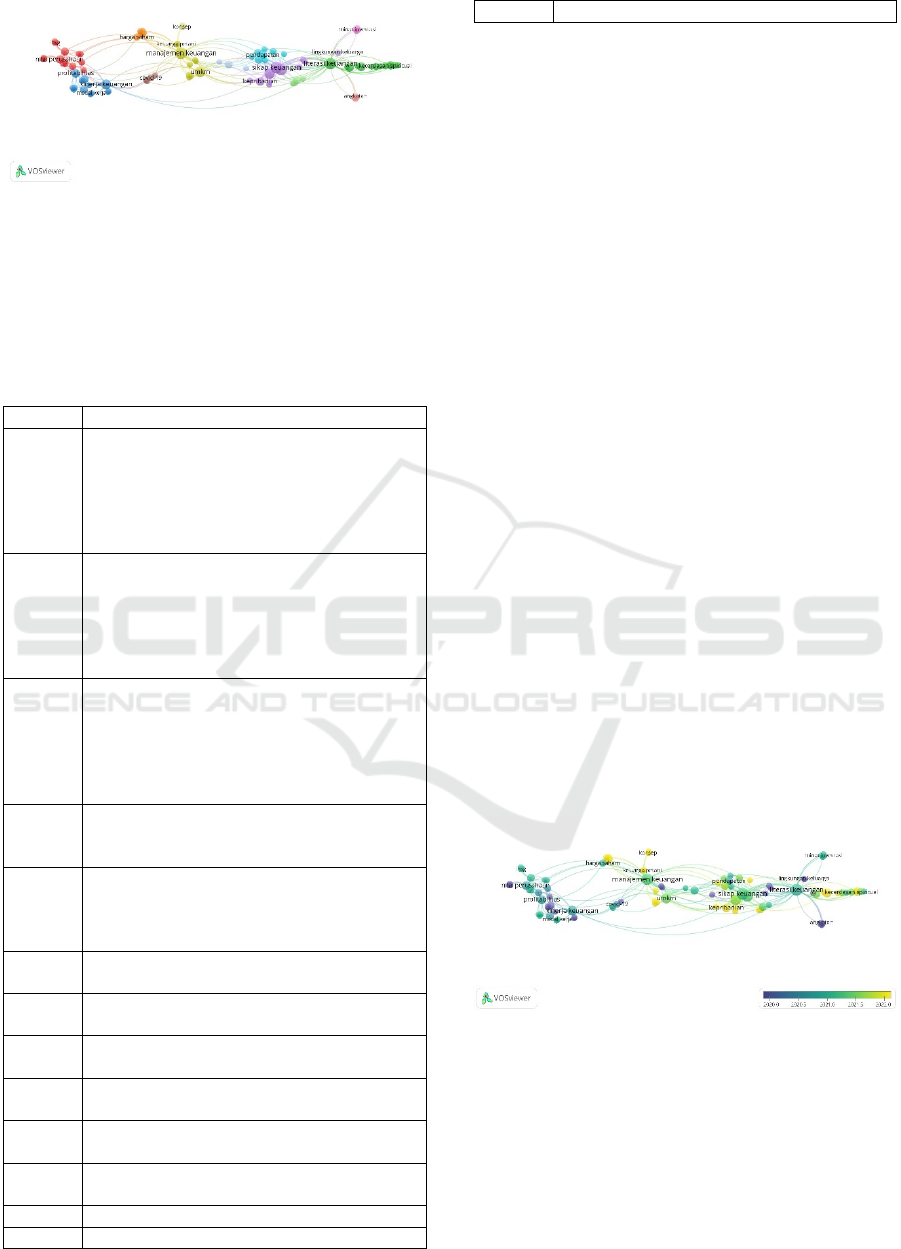

In addition to showing research clusters, network

analysis methods can also show research trends.

Using VOS Viewer, network analysis can show

trends that have become research topics from year to

year. The study pulled data from 2020 to 2022, or

over 3 years. Figure 2 shows the colors of each topic.

The bright color indicates that the research is new,

and is approaching 2022. The dark color indicates that

the study is an old study that is approaching 2020.

Figure 2: Overlay Visualization.

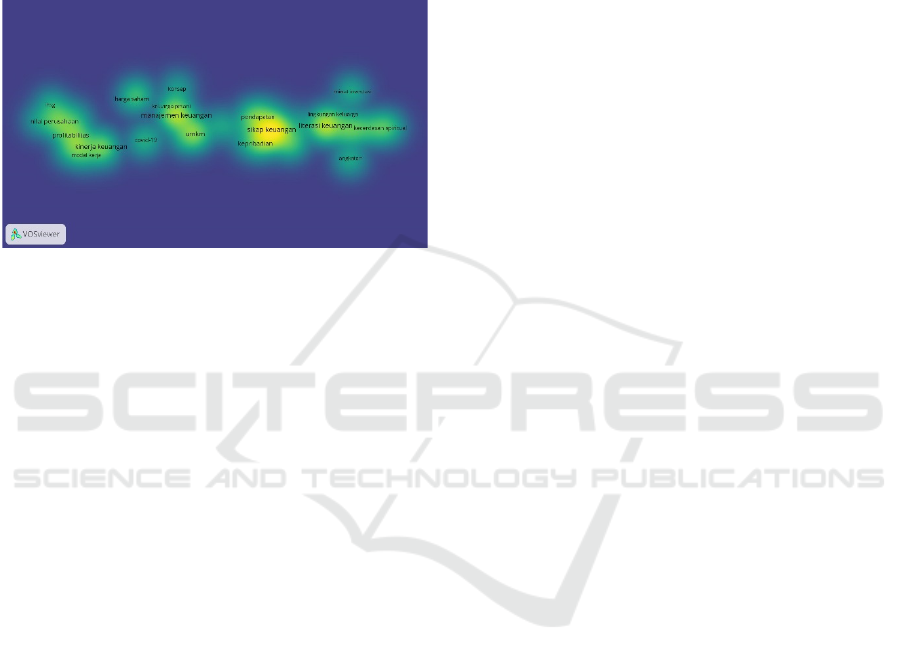

The Company's value and performance were

widely talked about in 2020. The topic of discussion

in 2022 is financial attitudes and financial literacy.

This can also be seen in the Density Visualization in

Figure 3.

The type of data used affects research trends, as

suggested by trend analysis. If the type of data is

secondary data, then the research theme is on the

Trends in Financial Management Research in Indonesia (Bibliometric Analysis)

113

value and performance of the Company. If the type of

data is primary data, then the research theme is on

financial attitudes and financial literacy.

Using the data on the number of keyword links in

Table 1, it can be seen that financial literacy is the one

with the most links. Thus, it can be concluded that in

general, financial management research in Indonesia

uses primary data rather than secondary data as

previously discussed.

Figure 3: Density Visualization.

4.2 Discussion

From the results of the study, it was found that the

research trend in the field of financial management is

focused on the topics of financial attitudes and

financial literacy. These topics are widely researched

using influence tests. A title for research could be The

Influence of Financial Literacy on Financial Attitudes

in Object X.

This kind of research is just research that confirms

previous research. Research like this does not lead to

new findings or studies. This may be due to the rise

of quantitative research using regression tests among

students and lecturers.

The comparison between review literature taken

from abroad is quite different. In the literature review

discussed above, it is known that international

research trends are on the topic of blockchain, how to

create a secure system, how to monitor it, and how it

impacts the existing financial system. This research is

indeed needed at this time considering the widespread

use of blockchain as a transaction tool.

5 CONCLUSION

The trend in research in the field of financial

management is in research on company value and

performance and influences of financial literacy on

financial attitudes. The kind of research that does not

produce new findings but only confirms the results of

research from one object to another.

It is suspected that trends on financial

management research in Indonesia depends on the

type of data used. The value and performance of the

company is the theme if the data used is secondary. If

the data is primary data then the theme is attitudes and

financial literacy.

This research recommends to financial

management scientists to look the trends that exist

internationally which are currently on the theme of

technological impact and new variables in the

financial field.

REFERENCES

Baker, H. K., Kumar, S., & Goyal, K. (2023). Publication

trends in the Journal of International Financial

Management and Accounting: A retrospective review.

Journal of International Financial Management and

Accounting, 34(2), 131–161. https://doi.org/10.1111

/jifm.12176

Baker, H. K., Kumar, S., & Pandey, N. (2021). Thirty years

of the Global Finance Journal: A bibliometric analysis.

Global Finance Journal, 47, 100492.

https://doi.org/https://doi.org/10.1016/j.gfj.2019.100492

Boakye, E. A., Zhao, H., & Ahia, B. N. K. (2022). Emerging

research on blockchain technology in finance; a

conveyed evidence of bibliometric-based evaluations.

The Journal of High Technology Management Research,

33(2), 100437. https://doi.org/10.1016/j.hitech.2022.

100437

Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A.

(2022). A bibliometric review of finance bibliometric

papers. Finance Research Letters, 47, 102520.

https://doi.org/https://doi.org/10.1016/j.frl.2021.102520

Murdayanti, Y., & Khan, M. N. A. A. (2021). The

development of internet financial reporting

publications: A concise of bibliometric analysis.

Heliyon, 7(12), e08551. https://doi.org/10.1016/j.hel

iyon.2021.e08551

Patel, R., Migliavacca, M., & Oriani, M. E. (2022).

Blockchain in banking and finance: A bibliometric

review. Research in International Business and

Finance, 62, 101718. https://doi.org/10.1016/j.rib

af.2022.101718

Waltman, L., van Eck, N. J., & Noyons, E. C. M. (2010). A

unified approach to mapping and clustering of

bibliometric networks. Journal of Informetrics, 4(4),

629–635. https://doi.org/10.1016/j.joi.2010.07.002

Zou, Z., Liu, X., Wang, M., & Yang, X. (2023). Insight into

digital finance and fintech: A bibliometric and content

analysis. Technology in Society, 73, 102221.

https://doi.org/10.1016/j.techsoc.2023.102221

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

114