Benefits of the Paylater Payment Method

as a Transaction Tool in E-Commerce

Endyastuti Pravitasari, Sihar Tambun

and Hendi Tri Anggoro

Universitas 17 Agustus 1945 Jakarta, Jl. Sunter Permai Raya, North Jakarta, Indonesia

Keywords: Paylater Payment, E-Commerce, NVivo.

Abstract: The aim of this research is to find out what benefits pay later users get from e-commerce. The research data

sources are online news, YouTube and research articles for 3 years, namely 2021 to 2023. Data sources are

selected based on credibility and suitability of the data to the problem being studied. Data are processed using

NVivo 12 Plus software. There are four stages of data processing, namely data entry, coding, visualisation

and inference. Coding validity was assessed using a triangulation approach. The research results revealed

eight points of benefits of the Paylater payment method as a transaction tool in e-commerce. First, increasing

motivation at work. Second, it satisfies emergency needs. Third, you can buy even if you don't have a credit

card. Fourth, the system is easy to understand. Fifth, the payment terms are more flexible. Sixth, the payment

process is simpler. Seventh, the application requirements are simpler. Eighth, it is easier to pay household

bills. The implications of the research findings can be used by users of the Paylater system. If you want to

gain a better understanding of the benefits of paylater, we recommend that you study these eight benefits. For

people who are not yet familiar with the use of paylater, the results of this research can be used as a reference.

1

INTRODUCTION

Fintech continues to innovate and produce new

products, new techniques for conducting electronic

transactions have been created as a result of the

considerable evolution of fintech (Pravitasari &

Fauziyah, 2023). According to the Financial Services

Authority, the business of digital-based financing

companies, known as paylater financing, has bright

prospects along with the growth of e-commerce

transactions. According to Kredivo & Kata Data

Insight Center's findings, the percentage of Paylater

service users in the market location will increase

significantly from 28.2 percent in 2022 to 45.9

percent in 2023. Kredivo & Kata Data Insight Center

research states that Paylater is now able to overtake

the bank transfer method, as many as 16.2 percent of

consumers choose Paylater as the most frequently

used payment method in the market, while 10.2

percent of consumers choose the bank transfer /

virtual account payment method. These results

explain that the Paylater payment method is now a

step change in the world of technology, especially in

the digital or online business industry.

This study discussed how the COVID-19

pandemic changed consumer behaviour and led to the

emergence of Paylater as a new payment method for

online purchases. Major Indonesian e-commerce

platforms quickly adopted Paylater, which had a

positive impact on online purchasing decisions and

the economic growth of the e-commerce industry.

The results of previous research in relation to the

problem under study, there are several things that

have been achieved. The benefits of a technology are

the positive results or conveniences achieved by the

users of that technology (Davis, 1989). These benefits

take the form of increased productivity, innovation,

quality improvement and cost reduction. If the user

believes that the technology is easy and provides

benefits, then he will use the technology (Asja et al.,

2021). The benefits in this study are to discuss the

benefits of using Paylater.

The difference between this research and previous

research lies in the problems studied and the benefits

of the resulting research. The benefits of this research

can be implemented directly by the community as the

use of Paylater is quite easy to access and the

community needs to be educated on how to use

Paylater so as not to cause problems in the future. The

uniqueness of this research is that it uses data

processed from different sources on the internet. The

coding created comes from different sources, namely

376

Pravitasari, E., Tambun, S. and Anggoro, H.

Benefits of the Paylater Payment Method as a Transaction Tool in E-Commerce.

DOI: 10.5220/0012643200003821

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Seminar and Call for Paper (ISCP UTA ’45 JAKARTA 2023), pages 376-382

ISBN: 978-989-758-691-0; ISSN: 2828-853X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

online news, YouTube and research articles, where

there are no research topics using this data source. It

provides details on the benefits of the Paylater

payment method as a transaction tool in e-commerce,

where these benefits are confirmed from different

sources and their validity is tested using a

triangulation approach.

The purpose of this research is to get answers to

research questions. The benefits and education of

using the Paylater payment method as a transaction

tool in e-commerce. Education on the use of Paylater

for the general public is an important thing to do,

because the public is still not sufficiently educated

about the various benefits of this Paylater technology.

The benefits will be gathered from various sources,

which will then be coded to form a detailed and

systematic concept. This research will create a new

view for the general public about the benefits of

Paylater payment methods and remove the negative

stigma that has been embedded in the public's view of

Paylater payment methods.

The benefits of the results of this research can be

used by the general public out there. The public can

from now on increase their self-education by knowing

the various advantages of Paylater payment methods

from different platforms on the Internet. Paylater users

can use the information from this research as a basis

for increasing their knowledge about Paylater

payment methods. Paylater users can learn a lot from

the results of this study, such as how to manage their

finances. This is a basic thing that can help in

managing daily life and avoiding self-defeating waste.

2

LITERATUR REVIEW

The term paylater comes from the words "pay", which

means to pay, and "later", which means later. In

general, paylater is a payment method that offers

instalments without the need to use a credit card. The

digital company in question will initially cover the

payment when a product is purchased (Amira, 2021).

This Paylater payment system is actually nothing

new. Most people are more familiar with this paylater

system than with the credit system. At present, the

Paylater payment method is becoming more and more

popular among the public due to its convenience in

various types of transactions, especially with the

promotions and cashbacks offered by Paylater service

providers. Here are some basic principles of Paylater

payments. First, buy now, pay later: Consumers can

buy goods or services without paying directly at the

time of purchase. They make the payment at some

point in the future, usually in a few weeks or

months.Second, no or low interest: Some paylater

services offer a period during which no interest is

charged if payments are made on time. However, if

payment is late, some interest or fees may be charged.

Third, a quick application process: Paylater services

often have an easy and quick application process,

especially when compared to traditional loans from

banks or financial institutions. Fourth, payment

flexibility: Consumers can choose how much they

pay in each payment period, although there is usually

a minimum amount that must be paid. Fifth, the

importance of financial discipline: Using paylater

requires discipline in personal financial management

as there are risks if payments are not made on time.

Late payments can result in additional charges. In

Indonesia alone, the paylater feature has been

facilitated by various companies ranging from banks,

fintech P2P lending and others. Meanwhile, the

marketplace providing Paylater services should work

with OJK to ensure its safety. Paylater itself is now an

alternative to buying something you want. However,

users must remain careful and pay the Paylater bill on

time, because if it is late, it will affect iDeb SLIK if

you want to apply for a mortgage to buy a house.

While Sari (2021) emphasises the effect of

Paylater on the impulsive buying behaviour of

Indonesian e-commerce users, Damayanti (2022)

finds that the influence of benefits is the most

important factor in the interest in using Paylater.

However, Khasanah (2022) questions the compliance

of Paylater transactions with Islamic law. Using

Shopee Paylater, Aprianto (2023) emphasises even

more the benefits of convenience and perceived

benefits when making purchasing decisions. All of

these studies suggest that Paylater can offer benefits

such as flexibility and convenience, but they also

raise moral and legal questions.

3

METHODS

This research uses a qualitative research method with

a systematic literature review approach. The literature

reviewed came not only from research articles, but

also from various online sources. The data sources

used come from YouTube, online news, research

articles and other social media. Data sources must

come from credible sources, both YouTube channels,

online news and other sources. Data will be searched

using keywords relevant to the research question. The

consideration of using these data is due to the

availability of adequate data on the internet and easy

access (Hafidhah & Yandari, 2021). The selected data

sample consists of data published for the last three

Benefits of the Paylater Payment Method as a Transaction Tool in E-Commerce

377

years, namely 2021 to 2023. NVivo 12 Plus software

was used to process the data. This software was

chosen because it is able to produce coding

visualisation images and the way the software is used

is very user friendly (Tambun & Sitorus, 2023).

There are four stages that are carried out in the

data processing process with NVivo, namely the data

entry stage, the coding stage, the visualisation stage

and the conclusion stage (Sitorus & Tambun, 2023).

In the first stage, data entry uses two methods, namely

internal data entry and external data. Internal data is

data that is entered into NVivo without the use of an

internet connection. This data is usually data that is

already available on a laptop, such as research

articles. Meanwhile, external data is data whose input

process into NVivo uses an internet connection, the

data input process using the ncapture for nvivo

facility. Examples of external data from the internet

include YouTube, online news and various social

media. The second step is to code the data according

to the answers to the research questions. Coding is a

simple word or phrase that is the answer to a research

question. At this stage, content analysis is carried out,

which is the stage of understanding the words or

phrases in the research data (Tambun, 2021).

Specifically for the coding process for YouTube data

sources or social media sources in the form of videos,

the coding is done after there is a transcript of the

YouTube or video content. The analysis is carried out

by making a transcript, then the coding process is

carried out (Salahudin et al., 2020). The third step is

to create a coding visualisation. A coding

visualisation is a collection of codings that form an

image. Coding images are linked to different data

sources. This coding picture is analysed in the process

of drawing research conclusions. The fourth stage is

the determination of research conclusions. Research

conclusions are answers to research questions. The

answer is seen in the coding. Coding is considered to

have strong validity if the coding is confirmed by

different data sources. Coding validity is strong if it

is confirmed at least three times by different data

sources. This principle is a measure of coding validity

using the triangulation method (Natow, 2020).

Furthermore, the codings are sorted from the most

confirmed to the least confirmed coding. These

codings are used as answers to the research questions

and as research conclusions.

4

RESULTS AND DISCUSSION

This research produces several references consisting

of 2 Youtube, 5 online news and 4 research articles.

The coding process was carried out using NVivo 12

Plus software.

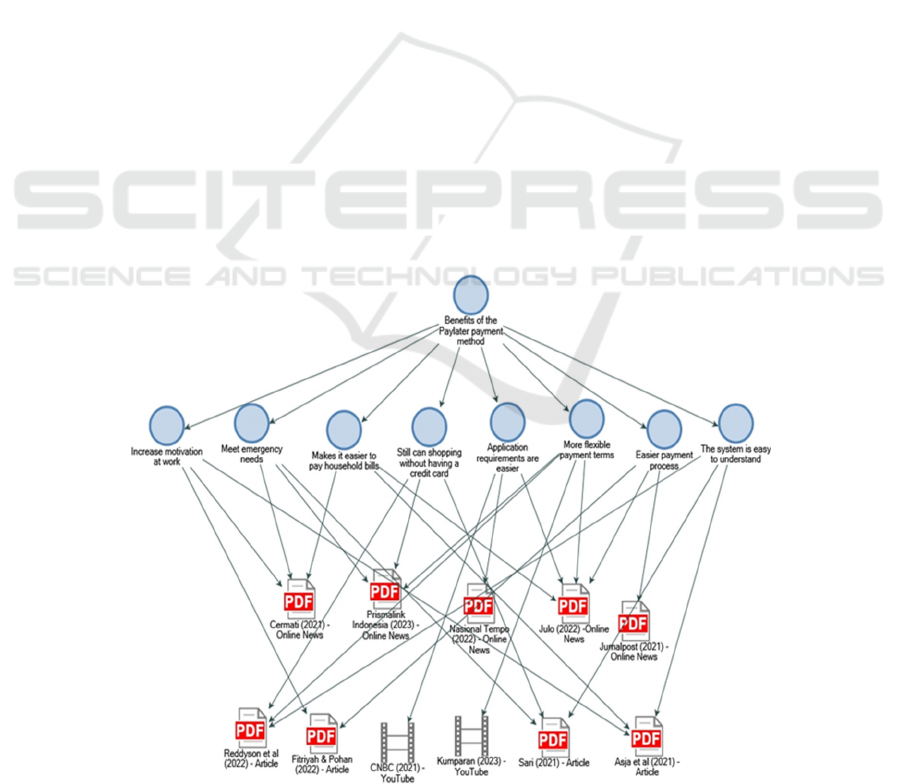

There are eight valid codings, confirmed at least

three times in the data sources studied. Below is a

visualisation of the resulting coding.

Figure 1: NVivo Result.

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

378

Table 1: Coding Results.

No. Coding Intensity Reference

1 Increase motivation at work 3

Prismalink Indonesia (2023) – Online news

Cermati (2021) – Online news

Fitri

y

ah & Pohan

–

Online news

2 Meet emergency needs 3

Cermati (2021) – Online news

Prismalink Indonesia – Online news

As

j

a et al (2021)

–

Online news

3 Makes it easier to pay

household bills

3

Cermati (2021) – Online news

Asja et al (2021) – Online news

Julo (2022)

–

Online news

4 Still can shopping without

having credit card

3

Reddyson et al (2022) – Article

Prismalink Indonesia (2023) – Online news

Sari (2021) – Article

5 Application requirements are

easier

3

CNBC (2021) – Youtube

Nasional Tempo (2022) – Online news

Julo (2022)

–

Online news

6 More flexibels payment terms 4

Reddyson et al (2022) – Article

Prismalink Indonesia (2023) – Online news

Kumparan (2023) – Youtube

Julo (202)

–

Online news

7 Easier payment process 3

Reddyson et al (2022) – Article

Julo (2022) – Online news

Jurnal post (2021)

–

Online news

8 The system is easy to

understand

3

Reddyson et al (2022) – Online news

Sari (2021) – Article

As

j

a et al (2021) - Article

All coding in Figure 1 is in response to the

research question. The coding results from the

content analysis of the various data examined. The

coding process uses the features available in the

NVivo 12 Plus software. Below is a summary table

and the intensity of each coding produced.

4.1 Increase Motivation at Work

Users of the Paylater application believe that when

they make a decision to use Paylater, they gain a

perception of its benefits. Perceived benefit is a

person's belief in the process of making a decision,

where if a person has a sense of belief that the

Paylater technology system will be useful, they will

use the system. Perceived usefulness is the extent to

which the subject believes that a Paylater technology

system is able to enhance the performance level of its

users (Asja et al., 2021). If a Paylater user is lazy at

work or wants to quit his job, then Paylater can be a

reminder of the Paylater user's bills and dependents.

If not, the user of Paylater can be subject to late fees,

which can increase the user's bill even more (Cermati,

2021).

4.2 Meet Emergency Needs

Paylater is like an emergency fund provided by other

parties to help you in an urgent situation or

emergency. Paylater should only be used for

emergency purposes, for example, you are laid off,

there is no severance pay and you have financial

problems.Paylater services can be a helper to finance

daily needs, such as buying food, paying bills and

others (Cermati, 2021).Paylater can also be useful

when there are some household needs that are

urgently unmet. For example, there is a shortage of

different types of equipment in the house because

they are too old or damaged. Then Paylater can

provide a solution to this problem by providing

Benefits of the Paylater Payment Method as a Transaction Tool in E-Commerce

379

alternative payments so that the household needs of

Paylater users can be met immediately (Sari, 2021).

4.3 Still Can Shopping Without Having

Credit Card

Nowadays there are many applications that already

have Paylater features, such as GoPaylater. Shopee

Paylater (SPaylater), Ovo Paylater, Traveloka

Paylater and many more. GoPaylater can be used

when entering the payment method menu when using

features on the Gojek application according to the

limit set by the application (Reddyson et al.,

2022).Not everyone has access to or wants to use a

credit card.Paylater provides an option for those who

do not have a credit card to still be able to transact

online or offline.This opens up wider access to

customers of different consumers (Sebastian,

2023).Paylater is an alternative payment method that

uses an online instalment system without the need for

a credit card. Several platforms are currently starting

to adopt this cardless credit instalment technology. In

2023, Paylater can be used by the public on several

online shopping platforms, ticket and hotel bookings,

and online transportation (Sari, 2021).

4.4 The System is Easy to Understand

In Indonesia, the use of Paylater is very widespread

because the process of activating the Paylater feature

is easy. In addition, the Paylater feature has been

integrated into e-commerce, so that transactions can

be made without having to switch to another platform.

Although there are already several instalment

providers in Indonesia, such as home credit, credit

plus, etc., consumers do not need to come to the store

to shop and apply for instalments (Reddyson et al.,

2022).Perceived ease of use is the action of an

individual who believes that using a particular

technology can reduce his or her effort in doing

something. In the research conducted here, this

dimension refers to the extent to which users feel that

the paylater technology is easy to use and simple

(Sari, 2021).

4.5 Flexibels Payment Terms

One of the main advantages of Paylater is the

flexibility of payment. Customers can enjoy the

product or service immediately without having to pay

immediately. This gives customers room to organise

bill payment according to the user's time period and

income cycle (Sebastian, 2023). When using Paylater,

the payment period of the bill from the usage system

makes it easy for Paylater users to determine the

payment deadline, so that users can satisfy their

primary needs first without feeling burdened by their

Paylater bills (Kumparan, 2023). Therefore, with

flexible payment features, the influence of Paylater

users grows because the features offered by Paylater

benefit more users and the effect of this influence

creates satisfaction on the part of Paylater users

(Darwin, 2021).

4.6 Easier Payment Process

Ease of payment is one of the features offered by

paylater. A person's belief that if they use the system,

their effort to do something will be reduced. Payment

methods such as the easy-to-use Gopaylater support

the Gojek and Tokopedia platforms, which are widely

used by Indonesians (Fitriyah & Hotman Tohir

Pohan, 2023). This convenience is one of the

influences for consumers in making purchase

decisions. Perceived convenience refers to the extent

to which users feel that Gopaylater technology is easy

to use. The level of public online consumption is

increasing every day. Therefore, the convenience

provided by the Paylater system can make it

convenient for users to complete the payment process

without leaving home (Wahyuningtias, 2019).

4.7 Application Requirements Are

Easier

The requirements for activating Paylater are

relatively simple. Compared to credit cards, the

requirements and submission of the Paylater function

are much simpler with similar functions and benefits.

Many Paylater services can be applied for with just a

few personal documents (Tempo.co, 2022). The

simplicity of the registration process is a new

experience for users of the Paylater feature. It is not

uncommon for users to want to apply for a loan

similar to Paylater, but the conditions required of the

user are too many, which makes the user feel

uncomfortable (CNBC, 2021).

4.8 Makes It Easier to Pay Household

Bills

If someone does not have a credit card or a digital

wallet, then paylater can be an alternative to pay your

household bills and daily (Cermati, 2021). The

convenience and benefits offered in using Paylater

can meet the needs of the needs that we often enjoy

every day, so people need a good understanding of

Paylater services so that users can avoid bills that are

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

380

wrapped around, this effect can lead to negative

perceptions of using the Paylater system. If the

Paylater system can be used wisely, it can help people

meet their needs (Asja et al., 2021).

5

CONCLUSIONS

The results of this study have provided answers to the

research questions posed at the beginning. There are

eight points of benefits that can help the users of the

payment system so that it can be an alternative and

solution for the community in meeting their daily

needs. The eight benefits are: increased motivation at

work, meeting emergency needs, being able to shop

even if you don't have a credit card, the system is easy

to understand, the payment period is more flexible,

the payment process is easier, the application

requirements are simpler, making it easier to pay

household bills. The results of this study can be used

by paylater users to inform and educate themselves

about the functions and benefits of paylater, so that

they can avoid various types of conflicts or problems.

The research recommends eight benefits to become a

wise paylater user or user in the technological era

where the paylater process can be easily activated by

the general public.

Suggestions for further research that could build

on the existing benefits of placing financial inclusion

include examining how Paylater affects the ability of

underbanked or unbanked populations to access e-

commerce and whether it can close the financial

inclusion gap. Examining the psychological aspects

of using Paylater by examining how it affects impulse

purchases and whether it encourages responsible

spending by conducting surveys or interviews with

Paylater users to gain insight into their decision-

making processes. and finally, analysing the impact

of Paylater on the average order value (AOV) in e-

commerce by comparing the average order value

(AOV) of transactions made with Paylater versus

traditional payment methods or monitoring changes

in AOV.

REFERENCES

Amira, K. (2021). Pengertian Paylater: Keuntungan,

Kerugian, dan Cara Menggunakannya.

https://www.gramedia.com/literasi/pengertian-

paylater/

Aprianto, J.D., & Hadibrata, B. (2023). The Effect of

Benefits, Convenience, Risk, Income on Purchase

Decisions Using Shopee Paylater. Dinasti International

Journal of Management Science.

Asja, H. J., Susanti, S., & Fauzi, A. (2021). Pengaruh

Manfaat, Kemudahan, dan Pendapatan terhadap Minat

Menggunakan Paylater: Studi Kasus Masyarakat di

DKI Jakarta. Jurnal Akuntansi, Keuangan, Dan

Manajemen, 2(4), 309–325.

https://doi.org/10.35912/jakman.v2i4.495

Cermati. (2021). 6 Manfaat Paylater , Salah Satunya Bantu

Jaga Cash Flow 2 . Transaksi Pembayaran Lebih

Mudah dan. https://www.cermati.com/artikel/6-

manfaat-paylater-salah-satunya-bantu-jaga-cash-flow

CNBC. (2021). Mengenal untung dan rugi Paylater vs

Kartu kredit.

https://youtu.be/IcvSkWcXVsE?si=8zsWFHF1PZXni

2-P

Damayanti, S., Durachmanm Y., Khudzaeva, E. Factors

Analysis of Interest in Using Pay Later in E-commerce

Applications Using Principal Component Analysis and

Maximum Likelihood Estimation Methods. (2022). 10th

International Conference on Cyber and IT Service

Management (CITSM), Yogyakarta, Indonesia, 2022,

pp. 1-8, doi: 10.1109/CITSM56380.2022.9936014.

Darwin. (2021). 7 Manfaat Paylater Bagi Penggunanya.

https://www.julo.co.id/blog/manfaat-paylater

Davis, F. D. (1989). 249008. Perceived Usefuness,

Perceived Ease of Use and User Acceptance of

Information Technology, 13(3), 1–23.

Fitriyah, D. N., & Hotman Tohir Pohan. (2023). Pengaruh

Penggunaan Gopaylater Terhadap Perilaku Impulse

Buying Pengguna E-Commerce Di Jakarta. Jurnal

Ekonomi Trisakti, 3(1), 1025–1034.

https://doi.org/10.25105/jet.v3i1.16003

Hafidhah, H., & Yandari, A. D. (2021). Training Penulisan

Systematic Literature Review dengan Nvivo 12 Plus.

Madaniya, 2(1), 60–69.

https://doi.org/10.53696/27214834.39

Khasanah, R.P., & Ridwan, M. (2022). Tinjauan Hukum

Islam tentang Transaksi E-Commerce Aplikasi Shopee

dengan Metode Paylater. Jurnal Indragiri Penelitian

Multidisiplin.

Kumparan. (2023). Beli barang Pakai paylater,Bikin

untung atau buntung? (2023).

https://youtu.be/skr3WqfK158?si=B7HmfC_TMYFl-

gIW

Natow, R. S. (2020). The use of triangulation in qualitative

studies employing elite interviews. Qualitative

Research, 20(2), 160–173.

https://doi.org/https://doi.org/10.1177/1468794119830

07

Pravitasari, Endyastuti & Fauziyah, Annisa. (2023). The

Influence of Lifestyle, Perceived Convenience, And

Promotion on The Decision to Use Quick Response

Code Indonesian Standard (QRIS). Return : Study of

Management, Economic and Bussines. 2. 784-794.

10.57096/return.v2i8.131.

Reddyson, R., Franky, F., Leonardy, L., Yeng, H., &

Leonardo, V. (2022). Pengaruh Fitur Paylater terhadap

Sifat Belanja yang Konsumtif pada Remaja di Kota

Batam. Jurnal Ecodemica : Jurnal Ekonomi

Benefits of the Paylater Payment Method as a Transaction Tool in E-Commerce

381

Manajemen Dan Bisnis, 6(2), 261–268.

https://doi.org/10.31294/eco.v6i2.13092

Salahudin, S., Nurmandi, A., & Loilatu, M. J. (2020). How

to Design Qualitative Research with NVivo 12 Plus for

Local Government Corruption Issues in Indonesia?

Jurnal Studi Pemerintahan.

https://doi.org/10.18196/jgp.113124

Sari, R. (2021). Pengaruh Penggunaan Paylater Terhadap

Perilaku Impulse Buying Pengguna E-Commerce di

Indonesia. Jurnal Riset Bisnis Dan Investasi, 7(1), 44–

57. https://doi.org/10.35313/jrbi.v7i1.2058

Sebastian, A. (2023). Paylater : Definisi dan 5 Manfaat

bagi Pelanggan. https://prismalink.co.id/definisi-dan-

manfaat-paylater/

Sitorus, R. R., & Tambun, S. (2023). Challenges, Strategies

and Qualifications of Auditors In The Society 5.0 Era.

JRAK, 15(2), 228–240.

https://doi.org/10.23969/jrak.v15i2.7183

Tambun, S. (2021). Peningkatan Kemampuan Melakukan

Riset Kualitatif dengan Menggunakan Software NVivo

12 PLus di LAN Pusat Pelatihan dan Pengembangan

dan Kajian Desentralisasi dan Otonomi Daerah di

Samarinda. Jurnal Pemberdayaan Nusantara, 1(2), 1–

9.

Tambun, S., & Sitorus, R. R. (2023). Pelatihan Aplikasi

NVivo untuk Riset Kualitatif Bidang Akuntansi kepada

Para Peneliti di Universitas Dhyana Pura. Joong-Ki:

Jurnal Pengabdian Masyarakat, 2(1), 129–138.

https://doi.org/https://doi.org/10.56799/joongki.v2i1.1

298

Tempo.co. (2022). Gunakan Fitur Paylater, Ini

Manfaatnya.

https://nasional.tempo.co/read/1592772/gunakan-fitur-

paylater-ini-manfaatnya

Wahyuningtias, A. L. (2019). Pengaruh Paylater dalam

Konsumsi Konsumen. https://jurnalpost.com/pengaruh-

paylater-dalam-konsumsi-konsumen/27777/

ISCP UTA ’45 JAKARTA 2023 - THE INTERNATIONAL SEMINAR AND CALL FOR PAPER (ISCP) UTA ’45 JAKARTA

382