Digital Transaction Model in Micro, Small, and Medium Enterprises

(MSMEs) to Target Millenial Generation Consumers in

Yogyakarta, Indonesia

Lastri Anggi Fani

1

and Zakiyah Mawaddah

2

1

Economics and Business Maritime Faculty, Raja Ali Haji Maritime University,

Dompak Main Road, Tanjungpinang, Indonesia

2

Information Technology and Business Faculty, AKPRIND Technology and Science Institute,

Kalisahak Street,Yogyakarta, Indonesia

Keywords: Digital Transaction, TAM, TPB, Millenials.

Abstract: The current millennial generation is the majority generation in Indonesia, this generation has characteristics

that are accustomed to using digital technology. This generation is undoubtedly responsible for driving the

growth of Micro, Small and Medium Enterprises (MSMEs). This study aims to understand the factors that

significantly influence the adoption of digital transactions in micro, small, and medium enterprises

(MSMEs) in the millennial consumer generation in Yogyakarta. This study combines the TAM (Technology

Acceptance Model), TPB (Theory of Planned Behaviour) and transaction costs which include the variables

of perceived ease of use, perceived risk, subjective norms, and transaction costs. In this research, CFA

(Confirmatory Factor Analysis) is utilized. The study utilizes a quantitative research design that utilizes

primary data obtained through questionnaire distribution. The questionnaires collected in this study were

100 respondents. The sampling method used was purposive sampling. The data was analyzed with SPSS 25

using multiple regression analysis techniques. Data testing in this study used the T test and F test. The

results of the T test by comparing the T-calculated value with the T-Table showed that the variables

perceived of use, transaction costs and subjective norms had an influence on the dependent variable, namely

adoption, while the variable perceived risk had no influence on the adoption variable. Then, using the F test,

the results showed that all independent variables had a simultaneous influence on the dependent variable.

The results show that reduced transaction costs, perceived ease of use, and the role of peer influence are

factors that significantly influence Micro, Small and Medium Enterprises (MSMEs) in adopting digital

transactions. Meanwhile, the perceived risk factors for using technology do not significantly affect MSMEs

in adopting digital transactions.

1 INTRODUCTION

In Indonesia, the current millennial generation is the

majority generation. Based on The National

Socioeconomic Survey (SUSENAS) in 2017, it is

known that the number of millennials is currently

around 33.75% of the total population in Indonesia

or around 88 million people. The millennial

generation is the generation born between 1980 and

2000 (Central Agency of Statistics, 2018).

The millennial generation is a generation that is

accustomed to using digital technology. This

generation drives innovation in the digital payment

industry. It is known that 98% of millennials use

smartphones and 97% of them actively use social

media (Mamanaova, 2019). The preference of 65%

of millennials is to use their phones to make

payments for certain products or services

(Mamanaova, 2019). The reason why millennials

use cellphones is that they believe it is more

comfortable, saves time, and provides more options

(Visa, 2016). The use of digital wallets allows a

business to expand market reach and attract the

attention of consumers and is one of the strategies in

an effort to face competition between similar

products and businesses (Erlina, 2021). The focus

for several industries, particularly the Small, Micro,

and Medium Enterprises industry, is on this.

58

Fani, L. and Mawaddah, Z.

Digital Transaction Model in Micro, Small, and Medium Enterpeises (MSMEs) to Target Millenial Generation Consumers in Yogyakarta, Indonesia.

DOI: 10.5220/0012643500003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 58-63

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Apart from that, the reason why many consumers

use digital transactions is also supported by

circumstances that require them to be more cashless.

According to Bagas (2021), which cites

Neurosensum, the pandemic in Indonesia has

resulted in an increase in the number of digital

wallet users over the past year. Neurosensum data

indicates that the growth of digital wallet users has

increased by 44 percent. The pandemic in Indonesia

has forced people to comply with the rules limiting

direct social contact and maintaining physical

distance from each other, so that the existence of

digital wallets can support people in implementing

these rules.

Micro, Small, and Medium Enterprises

(MSMEs) contribute 60.5 percent to the Gross

Domestic Product (GDP), 96.9 percent employment,

and 16.6 percent exports (Ministry of Cooperatives

and SMEs of the Republic of Indonesia, 2023).

Currently, the number of MSMEs in Indonesia is

around 60 million (Ministry of Cooperatives and

SMEs of the Republic of Indonesia, 2023). Table 1

below were criteria’s for MSMEs according to Law

of the Republic of Indonesia Number 8 of 2003.

Table 1: MSMEs Criteria by Capital and Sales.

Business

Scale

Capital (IDR) Sales (IDR)

Micro up to 50 billion up to 300 billion

Small up to 500 billion up to 2.5 million

Mediu

m

u

p

to 2.5 million u

p

to 50 million

In Yogyakarta, the number of Micro, Small and

Medium Enterprises (MSMEs) was 344,293 units

(Bappeda.jogjaprov.go.id., 2023). Based on the type

of business, there are 326.114 units of Micro, 16.069

units of Small and 2,110 units of Medium

Enterprises (Bappeda.jogjaprov.go.id., 2023). Based

on location, Bantul Regency has 87.429 units,

Gunungkidul has 54.306 units, Kulon Progo has

36.298 units, Sleman has 114.609 units, and

Yogyakarta City has 32.917 units (Bappeda.

jogjaprov.go.id., 2023).

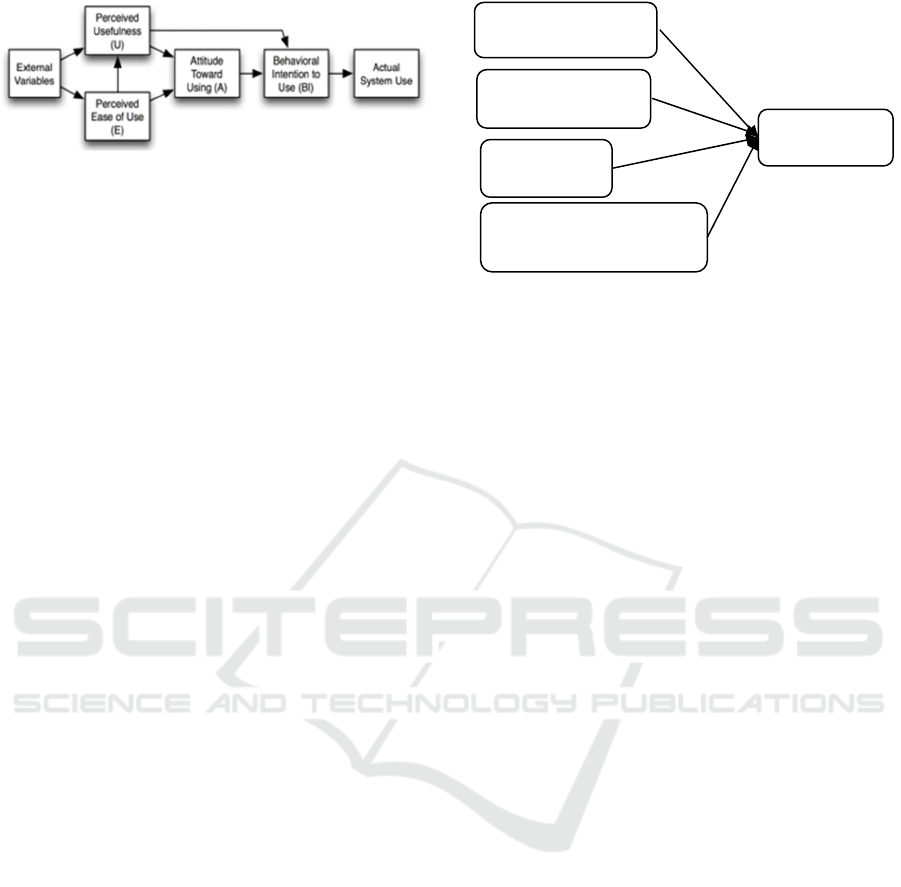

The Technology Acceptance Model (TAM) and

Theory of Planned Behavior (TPB) are two factors

that can influence MSMEs to adopt digital

transactions. TAM is a model based on perceptions

of digital transaction adoption (Davis et al., 1989).

TAM aims to track how users react to digital

transactions, whether they accept or reject them.

TAM is a model that focuses on two main factors

that influence technology adoption: perceived

usefulness and perceived ease of use.

Perceived usefulness is the user's belief that a

technology will improve their performance, while

perceived ease of use is the user's belief that a

technology is easy to learn and use. TAM has been

validated as an effective model for predicting the

adoption of digital transactions by MSMEs in

several studies.

TPB explains individual behaviour based on

attitudes, social norms and the ease or difficulty of

doing it (Ajzen, 2001). Human behaviour

(individual) is formed from the presence of certain

motivations. The TPB is a more comprehensive

model that includes three factors that influence

human behavior: attitudes, social norms, and

perceived behavioral control. Attitudes are the user's

positive or negative feelings about a technology,

social norms are the perceived pressure from others

to use or not use the technology, and perceived

behavioural control is the user's belief that they have

the ability to use the technology. TPB has been

shown to be a reliable model for predicting MSMEs'

adoption of digital transactions in a number of

studies.

2 LITERATURE REVIEW

2.1 Technology Acceptance Model

The Technology Acceptance Model (TAM) was a

theory adapted from Theory of Reasoned Action

(TRA) and developed by Davis et al. (1989). TAM

is the most widely applied technology acceptance

methodology for business units (Wu, 2009). TAM

has two specific factors, namely Perceived

Usefulness (PU) and Perceived Ease of Use (PEU)

(Davis et al., 1989).

PU, namely someone who believes that

adopting technology can provide benefits, increase

performance and productivity, and efficiency (Davis

et al., 1989). PEU, someone believes that using

digital transactions is something that is easy to do

and does not require much effort to do (Davis et al.,

1989). PU and PEU are factors that influence

attitudes towards use (Attitude Toward Using/ATU),

namely a person's attitude towards technology

acceptance, namely the adoption of digital transact-

tions. This attitude will lead to Behavioural Intention

to Use (BI), namely a person's desire to adopt digital

transactions and finally Actual system use.

Digital Transaction Model in Micro, Small, and Medium Enterpeises (MSMEs) to Target Millenial Generation Consumers in Yogyakarta,

Indonesia

59

Figure 1: Theory Acceptance Model.

2.2 Theory of Planned Behaviour

Theory of Planned Behavior is a theory that

developed from TRA. TPB explains about human

behaviour (Ajzan & Madden, 1989). The existence

of a certain behavioural intention (intention to do

something) is the basis of human behavior. Factors

that influence behavioural intention, namely attitude,

subjective and perceived behavioural control.

Subjective norms are social norms or

surrounding norms that are felt by humans to do or

not to do behaviour (Ajzen, 1991). In this case,

social factors become the cause of the formation of

certain behaviours. For example, one of MSMEs

adopts digital transactions due to the influence of

other MSMEs who use digital technology in their

transactions, which attracts consumer interest.

Behavioural intention/BI means that the person

concerned has the intention to take action, in this

case, namely to accept technology. The stronger a

person's intention, the more likely the person is

expected to try the behaviour, the more likely the

behaviour will be carried out (Ajzen and Madden,

1986: Ajzen, 1991). For example, in this study, the

intention of MSMEs to adopt high-digital

transactions eventually led to their adoption.

Perceived behavioural control, namely the ease or

difficulty that someone feels in doing something.

TPB is then refined by adding trust and

perceived risk (Mazzocchi et al., 2005). Perceived

risk is the potential for loss when users use digital

transactions in their transactions (Mazzocchi et al.,

2005).

3 HYPOTHESES AND

FRAMEWORK

Figure 2 displays the theoretical model linking the

Technology Acceptance Model (perceived ease of

use) (Davis, 1989), Theory of Planned Behaviour

(subjective norms, perceived risk (Ajzen, 1991),

transaction cost (Dodgson et al., 2015), and adoption

of digital transactions.

Figure 2: Research Framework.

Users prefer applications or technology that are

easy to use because there is no need to spend

excessive effort. Excessive effort can drain the

resource. According to theory Davis (1989), an

application or technology perceived to be easier to

use than another is more likely to be used. In this

study, the respondents are MSMEs, they focused on

profit and minimazed costs. Learning a new

application or technology definitely costs a lot of

money, so people will choose to use something that

is easier to use. We hypothesise as follows:

H1: Perceived ease of use positively influences the

adoption of digital transactions.

No user likes risk, especially if the risk has a

negative impact on the company and consumers.

Choosing an application or technology must be more

careful. Users will choose and use applications or

technology that have minimal risk. We hypothesise

as follows:

H2: Perceived risk positively influences the

adoption of digital transactions.

According to (Ajzen, 1991), the role of social

pressure or peer influence in the adoption of

technology has had mixed results. Conley and Udry

(2010) found that peer exposure had a positive

impact on technology adoption. The study above

shows that companies can be influenced by the

actions of others to adopt technology. Companies

will not want to be left behind in adopting

technology that can bring in many profits and

consumers. We hypothesise as follows:

H3: Subjective norms positively influence the

adoption of digital transactions.

The primary objective of companies, particularly

MSMEs, in adopting digital transactions is to

decrease transaction costs. Digital transactions also

provide many benefits, according to Dodgson et al.

Perceived Ease

of Use

Perceived Risk

Subjective

N

orms

Transaction Cost

Adoption

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

60

(2015) that digital transactions have the potential to

offer opportunities for revenue growth, reduce the

costs of handling cash, and startup costs to provide

new opportunities for economic and social

entrepreneurship. We hypothesise as follows:

H4: Transaction costs positively influence the

adoption of digital transactions.

There are many considerations when companies

adopt digital transactions. The more benefits a

company receives, the more likely it is to adopt

digital transactions. Ease of using technology, low

risk, low transaction costs can be obtained by users

by adopting digital transactions, we hypothesise as

follows:

H5: Perceived ease of use, perceived risk,

subjective norms, and transaction costs

simultaneously positively influence the adoption of

digital transactions.

4 RESULT AND DISCUSSION

4.1 Method and Data Collection Result

Confirmatory factor analysis (CFA) is a research

technique that tests if the proposal structure model

can explain the data collected. CFA is based on the

assumption that the data collected can be represented

by several laten factors, which cannot be observed

directly. CFA is multivariate analysis method used

to test or confirm a hypothesis model (hair et al.,

2019)

. The data we use in this research is primary,

namely by distributing questionnaires to

respondents. After distributing the questionnaire to

the respondents, the total number of questionnaires

filled out was 100. Thus, the quantity of

questionnaires that can be processed is 100. These

questionnaires were analysed using Multiple

Regression Analysis (MRA) with SPSS 25.

4.2 Demographic Characteristics of

Respondents

After collecting the data, it is processed to observe

the demographic characteristics of the respondents,

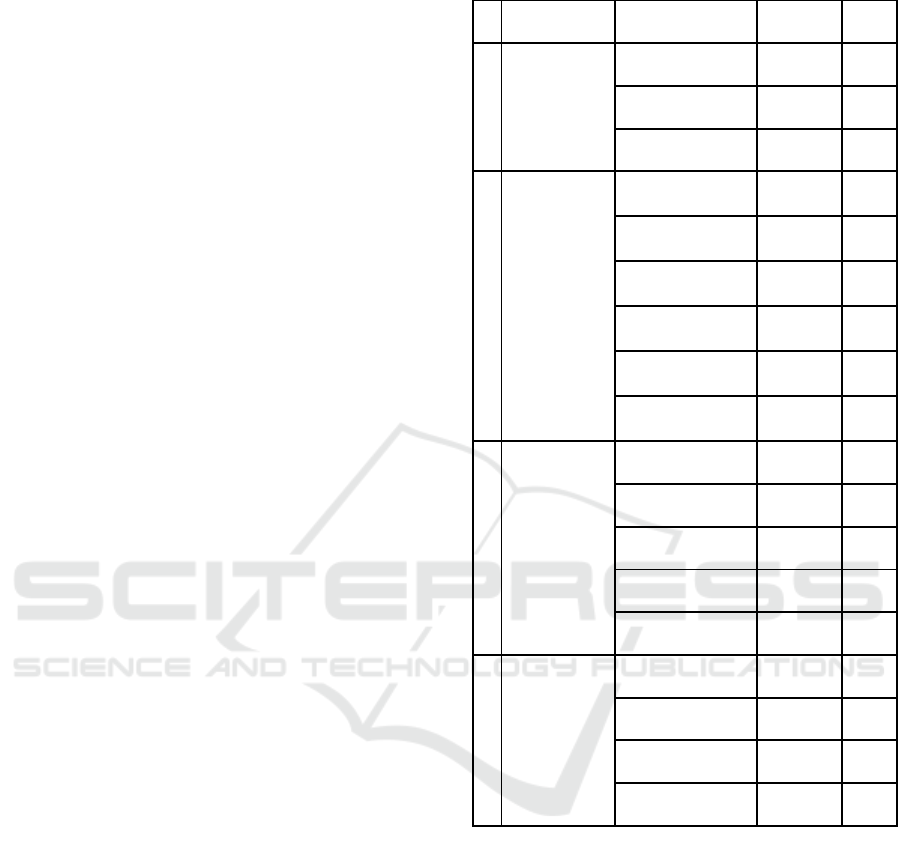

which are presented in Table 2 as follows.

Table 2: Characteristics of respondents.

No Characteristics Category

Quantit

y

(%)

1. Gender Man 72 72%

Woman 28 28%

Total 100 100%

2.

Aged <25 years old

16 16%

25-30 years old

8 8%

31-35 years old

49 49%

36-40 years old

10 10%

>40 years old

17 17%

Total

100 100%

3.

Duration of

MSMEs

Establishme

nt

1-3 years 21 21%

4-7 years 52 52%

8-10 years 11 11%

>10

y

ears 16 16%

Total 100 100%

4.

Type of

MSMEs

Micro business 17 17%

Small Business 56 56%

Medium Business 27 27%

Total 100 100%

Based on Table 2, it can be seen that the total

number of respondents was 100 respondents with the

majority being male with total 72 respondents (72%)

and the majority of the MSMEs have been

established for 4-7 years, comprising 52 respondents

(52%). The most types of MSMEs are small

business totalling 56 (56%).

4.3 Hypothesis Testing

The hypothesis testing carried out in this study was

testing Multiple Regression Analysis (MRA) using

the SPSS 25 application. The multiple regression

analysis test consisted of two tests, the T-test and F-

test.

Digital Transaction Model in Micro, Small, and Medium Enterpeises (MSMEs) to Target Millenial Generation Consumers in Yogyakarta,

Indonesia

61

4.3.1 T- Test

Table 3: Table of T-Test Result.

Variable T-Table Calculated

T-value

Sig.

Perceived ease of

use

8.620 1.985

0.00

Perceive

d

risk -0,135 1.985 0.893

Transaction cost 3.888 1.985 0.00

Subjective norms 7.295 1.985 0.00

Dependent variable: Adoption

The sig value for testing X1 (perceived of use) to Y

(adoption) is 0.00 <0.05 and the t-count value is

8.620 > t table 1.985, so it can be concluded that H1

is accepted which means there is an influence

between X1 (perceived of use) on Y (adoption).

Other than that sig value. for testing X2

(perceived risk) to Y (adoption) is 0.893 > 0.05 and

the t-count is -0.135 <t table 1.985. So, it can be

concluded that hypothesis H2 is rejected, which

means that there is no effect of perceived risk on

adoption Y.

The Sig. value for testing X3 (transaction cost)

on Y (adoption) is 0.00 <0.05 and the t-count value

is 3.888 > t table 1.985, so it can be concluded that

H3 is accepted which means there is an influence

between X3 (transaction cost) on Y (adoption).

The Sig. value for testing X4 (subjective norm)

on Y (adoption) is 0.00 <0.05 and the t-count value

is 7.295 > t table 1.985, so it can be concluded that

H4 is accepted which means there is an influence

between X4 (subjective cost) on Y (adoption).

4.3.2 F-Test

Table 4: Table of F-Test Result.

T- Table Calculated

T-Value

Sig.

2.47

222.941 .000

Based on the output above it is known that the

significance value for the influence of X1, X2, X3

and X4 simultaneously on Y is 0.000 <0.50 and the

calculated F value is 222.941 > F table 2.47, so it

can be concluded that H5 is accepted which means

there is an influence of X1, X2, X3 and X4

simultaneously against Y.

4.3.3 Coefficient of Determination

Table 5: Table of Coef. Determination.

R-Value R Square Adjusted R

Square

Std. Error

of the

Estimate

0.951 0.904 0.900 0.235

Based on the output above, it is known that the R

Square value is 0.904, this means that the

simultaneous influence of X1, X2, X3 and X4 on the

Y variable is 90.4% and the other 9.6% is influenced

by other variables not examined in this study.

4.4 Result

This research aims to test hypotheses and analyze

the influence of digital transaction models on micro,

small, and medium enterprises (MSMEs) to target

millennial generation consumers in Yogyakarta,

Indonesia. The analysis of hypothesis 1 shows that

perceived ease of use is a factor in adoption. This is

because individual users find it easy to use and do

not need to spend a lot of time learning it, according

to Davis, Bagozzi and Warshaw (1989) who state

that PEOU (Perceived Ease of Use) positively

influences the intention to use information

technology.

In research conducted by Anjali and Ranjani

(2020), it was stated that perceived ease of use

influences the intention to adopt digital transactions

among Indian micro businesses. This is because

micro, small and medium enterprises (MSMEs)

usually have limited resources and do not have many

staff, resulting in limited services provided by the

workforce to customers, in this case the use of

technology is highly recommended because it can

increase effectiveness and efficiency.

The results of hypothesis 2 prove that perceived

risk does not influence adoption. This means that

consumers, namely the millennial generation,

assume that the risks associated with implementing

digital transactions in their activities of buying

something at micro, small and medium enterprises

(MSMeS) can still be borne, apart from that,

consumers who decide to use digital transactions

feel increasingly accustomed to adoption. People

should become familiar with technology that

involves digital transactions to make them

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

62

comfortable using it and ensure that the risks are not

excessive. This is also in line with previous research

such as research conducted by Kim and Malhotra

(2005) which found that perceived risk did not have

a significant influence on the use of information

technology.

Hypothesis 3's findings demonstrate the

influence of transaction costs on adoption.

Transaction costs are costs incurred to carry out

transactions both commercial and non-commercial.

These costs can be direct costs, such as commission

fees, administration, and shipping costs, or indirect

costs, such as time and labor costs. So transaction

costs have a significant influence on adoption

because low transaction costs can encourage

technology adoption, while high transaction costs

can be an obstacle to technology adoption.

The results of hypothesis 4 also prove that there

is an influence between subjective norms on

adoption. Subjective norms are a person's perception

of what others expect of them when adopting a

technology. Subjective norms have an influence on

technology adoption because they can increase the

intention to use a technology. Research conducted

by Herniyati, et.al. (2022) found that subjective

norms have a positive influence on the intention to

use the figma application. The research results show

that the higher the subjective norm, the higher the

intention to use the figma application.

5 CONCLUSIONS

Based on the results of the research that has been

done, it can be concluded that perceived ease of use

has a positive effect on the adoption of digital

transactions (hypothesis 1) and the perceived risk

variable does not affect the adoption of digital

transactions. Besides that, transaction costs have an

influence on the adoption of digital transactions

(hypothesis 3) and subjective costs also have an

influence on the adoption of digital transactions

(hypothesis 4) then from the research it is also

known that simultaneously there is an influence

between variables X1, X2, X3 X4 on Y (Adoption).

REFERENCES

Ajzen, I. (1991). The theory of planned behavior.

Organizational Behavior and Human Decision

Processes, 50(2), 179-211. https://doi.org/10.1016/074

9-5978(91)90020-T.

Anjali and Ranjani. (2020). Adoption of Digital

Transaction Model by Micro Enterprises to Target

Millenials in India: An Exploratory Study. Social

Business. Vol. 10, No. 4, pp. 411-434 https://

doi.org/10.1362/204440820X15813359568318.

Bagas, F. (2021). Research: Digital wallet consumers in

Indonesia increase, what do they use most?

https://nextren.grid.id/read/012582036/riset-konsumen

-dompet-digital-di-indonesia-naik-most-dipakai-apa?

page=all.

Conley, T., & Udry, C. (2010). Learning about a New

Technology: Pineapple in Ghana. American Economic

Review, 100(1), 35-69. https://doi.org/10.1257/

aer.100.1.35.

Davis, F.D. et al. (1989), “User acceptance of computer

technology: A comparison of two theoretical models”,

Management Science, 35(8), 982-1003.

Dodgson, M., Gann, D., Wladawsky-Berger, I., Sultan, N.,

& George, G. (2015). Managing digital money.

Academy of Management Journal, 58(2), 325-333.

https://doi.org/10.5465/ amj.2015.4002.

Erlina, E. (2021). Analysis of Marketing Strategy in

Increasing Consumer Attractiveness. Digital

Repository. Retrieved from http://repository.iain

purwokerto.ac.id/eprint/10364.

Hair, J. F. Jr., Black, W.C., Babin, B.J., dan Anderson,

R.E., (2019). Multivariate Data Analysis, Eight

Edition, New Jersey: Pearson Prentice Hall.

Kim, S. S., Malhotra, N. K., & Narasimhan, S. (2005).

Research Note—Two Competing Perspectives on

Automatic Use: A Theoretical and Empirical

Comparison. Information Systems Research, 16(4),

418–432. doi:10.1287/isre.1050.0070.

Mamonaova, Y. (2019, January 10). How Millennials Are

Reshaping The Digital Payments Landscape [Blog

site]. Ikajo. Retrieved from https://ikajo.com/blog/

millennials-digital-payments-trends.

Mazzocchi, M., Lobb, A.E., & Traill, B.W. (2005). Causal

Model Estimation Results. TRUSTProject Deliverable

No. 9. Florence, Italy: Florence University Press.

VISA (2016, July). Understanding the millennial mind-set

and what it means for payments in the GCC. VISA

Performance Solutions. Retrieved 8.10.2019 from

https://usa.visa.com/dam/VCOM/global/partner-with-

us/documents/millennial-digital-payment-trends-in-gc

c.pdf.

Wu, J. H., & Wang, S.C. (2005). What drives mobile

commerce? An empirical evaluation of the revised

technology acceptance model. Information &

management, 42(5), 719-729. https://doi.org/10.1016/

j.im.2004.07.00.

Digital Transaction Model in Micro, Small, and Medium Enterpeises (MSMEs) to Target Millenial Generation Consumers in Yogyakarta,

Indonesia

63