A Comprehensive Study of the Effects of User Competence and

Internal Control on the Quality of Accounting Information Systems

Mustamin, Nurul Intawaty, Halim, Fiona Suryawan and Rapina Rapina

Maranatha Christian University, Department of Accounting, Bandung, Indonesia

Keywords: User Competence, Internal Control, Quality of Information System.

Abstract: Information systems have become an important part of business and have been integrated into daily business

activities such as accounting, finance, operations management, marketing, human resource management or

other key business functions, a poor quality information system will have a negative impact on a company or

organization. The goal of this study was to assess the impact of user competence on the quality of information

systems in Indonesian banks, as well as the impact of internal control on the quality of information systems

in Indonesian banks. The sample in this study was selected by random sampling technique which is part of

probability sampling and Partial Least Square-Structural Equation Modeling (PLS-SEM) is used as the data

analysis technique. This study's finding has two major conclusions, first is that User competence has a

significant and positive effect the quality of the banking Information system in Indonesia, and the second

finding is internal control positively and significantly affects the quality of the banking Information system

in Indonesia.

1 INTRODUCTION

The business world is currently developing very

dynamically and with increasingly fierce

competition, companies are required to be able to

maintain their existence by maintaining their

competitive advantage to achieve goals and win the

competition. One way companies can increase their

competitiveness is to focus on information system

technology as a means of enhancing effectiveness and

efficiency. Accounting, finance, operations

management, marketing, human resource

management, and other major business processes

have all been incorporated into information systems,

which have become an integral component of

business (Mardia et.al, 2021). Information System is

a system that can be applied and has an important role

in a company.

The accounting information system differs from

other information systems in that it is exclusively

connected to the accounting function in processing

data about the operations of firm organizations that

have economic worth (Suprihatin et al, 2022).

Accounting information systems are required to

convert accounting data from diverse sources into

accounting information required by various users to

assist in company decision-making. The

characteristics of a quality information system

include flexibility, simplicity of use, system

transparency, and integrity.

The quality of information systems in Indonesia is

still lacking. The example of Bukalapak's financial

statements being recorded incorrectly (Safitri, 2022)

can prove this. Fairuza Ahmad Iqbal, Bukalapak's

Head of Media and communications, stated that there

was a recording error that resulted in the procurement

of IDR 14.3 billion being written down to IDR 14.3

trillion. In this case, it is known that the users

involved in the information system affect the quality

of the information system. Therefore, users must have

the knowledge, expertise, and ability to use the

information system. User capability is one of the

factors that influence the successful implementation

of information systems to produce quality

information (Nisa et al, 2020). The ability of

information system users to operate information

systems is needed so that the system can operate

optimally, this can be seen from how system users run

existing information systems (Robbins Judge, 2013).

Previous research on a manufacturing business in

Bandung city has shown that user capability has a

favorable and substantial impact on the quality of

information systems. The more the capacity of the

Mustamin, ., Intawaty, N., Halim, ., Suryawan, F. and Rapina, .

A Comprehensive Study of the Effects of User Competence and Internal Control on the Quality of Accounting Information Systems.

DOI: 10.5220/0012643600003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 115-122

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

115

user, the higher the quality of the present information

system (Nisa et al, 2020).

As an open system, the information system cannot

be guaranteed to be free of faults or fraud. Internal

control is a method for a system to defend itself

against harmful acts (Basri, 2020). Quoted from

Hasanuddin (2020), the case of breaking into a

customer's account at one of the international private

banks in Indonesia amounting to Rp. 22 billion which

was committed by a bank branch head is one of the

cases which shows that internal control is needed to

guarantee the quality of a product information

system. Previous research explained that internal

control has a significant influence on the quality of

information systems, which means that the better the

implementation of internal control, the better the

quality of information systems, and the worse internal

control, the lower the quality of information systems

(Astria et.al, 2017).

Based on the phenomena discussed, the

information system requires a solution since a low-

quality information system could negatively affect a

firm or organization. The quality of accounting

information on local government in West Java was

the topic of prior studies.The findings of this study

reveal that employee competence has a substantial

influence on the quality of accounting information;

nevertheless, internal control has no significant effect

since risk assessment did not go smoothly. However,

study findings differ in that the internal control

system influences the quality of the information

system; if the internal control system improves, the

quality of the information system improves (Tresyani,

2019). As a result, the purpose of this research is to

establish the impact of internal control and user

capabilities on the quality of financial information

systems, particularly in the banking industry.

This study will contribute to the literature on the

influence of information system quality because it

will examine the variables that affect the quality of

financial information systems from internal control

variables and the capabilities of information system

users. The goal of this study was to assess the impact

of user competence on the quality of information

systems in Indonesian banks, as well as the impact of

internal control on the quality of information systems

in Indonesian banks. This research is different from

previous studies because it has not examined all

variables simultaneously in relation to the quality of

the information system in banks.

2 THEORETICAL REVIEW

2.1 Internal Controls

Internal control is a procedure that helps an

organization or corporation achieve operational

efficiency and effectiveness, financial reporting

dependability, asset security, and compliance with

laws, rules, and other requirements (Nugroho et al,

2019). This is also backed by the viewpoint that

internal control is a collection of norms of conduct

produced and accepted by the majority of the

organization's/company's members as a manual for

managing the organization or resolving both internal

and external problems (Syahputra, 2022). Internal

control, then, can be defined as a set of procedures

that are intended to help a business achieve

operational effectiveness and efficiency, financial

reporting accuracy, asset security, and compliance

with laws, rules, and other regulations. Internal

control requires companies to achieve efficiency and

effectiveness. In this study, researchers used an

understanding of efficiency, which said that

efficiency is the amount of output that can be

produced using certain inputs by minimizing wasted

effort or costs (Hafidz, 2022). Companies must

consider efficiency when developing their internal

controls. Effectiveness is a condition that indicates

the success of an organization in achieving a certain

goal by using existing resources with a predetermined

size (Bormasa, 2022).

2.2 User Competence

User competence, according to Wijayanti (2023), is

the ability of each individual, which includes aspects

of knowledge, skills, and individual abilities, to

achieve the expected results. User competence is a

unique/special characteristic that is formed from the

knowledge, expertise, skills, and motivation of an

individual that has a relationship with the successful

performance of the individual which can be seen from

the way of their thinking and behavior (Marjulin,

2019). The same thing was said by Mejia et al (2010)

by defining competence as a characteristic that has

been attached to a person and has a relationship with

the successful performance of a person.

Based on the above understanding, the

competence of users of an information system is a

characteristic of someone who can be seen from the

knowledge, expertise, skills, and motivation of

someone who has a close relationship with the

success of their performance. Therefore the

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

116

dimensions that will be used in this study are the

dimensions of knowledge and expertise.

Knowledge, according to Simbolon (2022), is

information that someone owns. Employee

knowledge also impacts the success or failure of task

implementation; employees with sufficient

knowledge will boost the company's efficiency;

employees with insufficient knowledge will be

difficult to deal with. The quality of the information

system itself is determined by the knowledge of the

personnel who administer it.

In addition to knowledge, users must also have

skills in operating or running programs used in an

information system to determine the quality

produced. The benefits of carrying out a sequence of

activities that are derived from studies and job

experience are referred to as skills (Chaeruddin et al,

2020).

2.3 Quality of Information Systems

This A quality information system is very important

in accounting because it will provide accounting

information from a company that will be used by

internal and external parties of the company.

Suprihatin (2022) states that information systems are

created with the primary purpose of translating

accounting data from numerous sources into

accounting information required by diverse users in

order to reduce risk while making decisions. This is

corroborated by Susanto's (2017) viewpoint.

According to the definition, an accounting

information system is an integration of both physical

and non-physical subsystems/components that are

interconnected and function in harmony to manage

transaction data related to financial issues into quality

financial information.

Based on this understanding, it can be interpreted

that the information system is a process for

processing accounting data into harmoniously

integrated information for managing transaction data

related to financial issues into quality financial

information.

According to Soelistya (2021) integrity is an

activity of uniting smaller components into a system

that functions as one. Integration is needed between

each division within a company to ensure proper

system operation.

Four dimensions can be used to assess the quality

of information from an information system.

information that is correct, relevant, timely, and full

(Susanto, 2017). This is becoming a dimension for

researchers when examining the quality of

information systems.

3 RESEARCH HYPOTHESIS

3.1 The Influence of User Capability on

the Quality of Information Systems

In several previous studies, such as Nisa and Citra

(2020), it has been proven that user ability has an

influence on the quality of information systems.

Similar research conducted by Endraria (2016) also

concluded that user competence influences the

quality of the information system. Similarly, Ruhul

Fitros (2022) in his research found that information

system quality is significantly influenced by user

competence. The quality of existing information

systems can be affected by implementation errors

caused by employees' lack of knowledge and skills in

the process of applying information systems. Based

on theoretical studies and supported by previous

research, The first hypothesis in this study is:

H1 = User capability has a significant effect on

the quality of information systems.

3.2 The Influence of Internal Controls

on the Quality of Information

Systems

Internal control is critical in an information system;

the greater the internal control, the higher the quality

of an organization's information system (Mulyanti,

2017). Suswandera, Nurhayati, and Halimatusadiah

(2018) found that internal control has a significant

positive impact on improving the quality of

information systems. The research conducted by Nisa

and Citra (2020) found that internal control findings

had an impact on the quality of the information

system. Internal control is a factor that can affect the

quality of information systems; internal control is

required to be utilized as a reference or the application

of restrictions by the firm to reduce the risks that can

develop while using information systems to achieve

company goals. Similar findings were presented by

Kuniawan et al in their research in 2017, stating that

Internal control has an impact on the quality of

information systems, and it is important to have

internal control in order to produce high-quality

information systems.

Based on theoretical studies and supported by

previous research, The second hypothesis in this

study is as below:

H2 = Internal control has a significant effect on the

quality of information systems.

A Comprehensive Study of the Effects of User Competence and Internal Control on the Quality of Accounting Information Systems

117

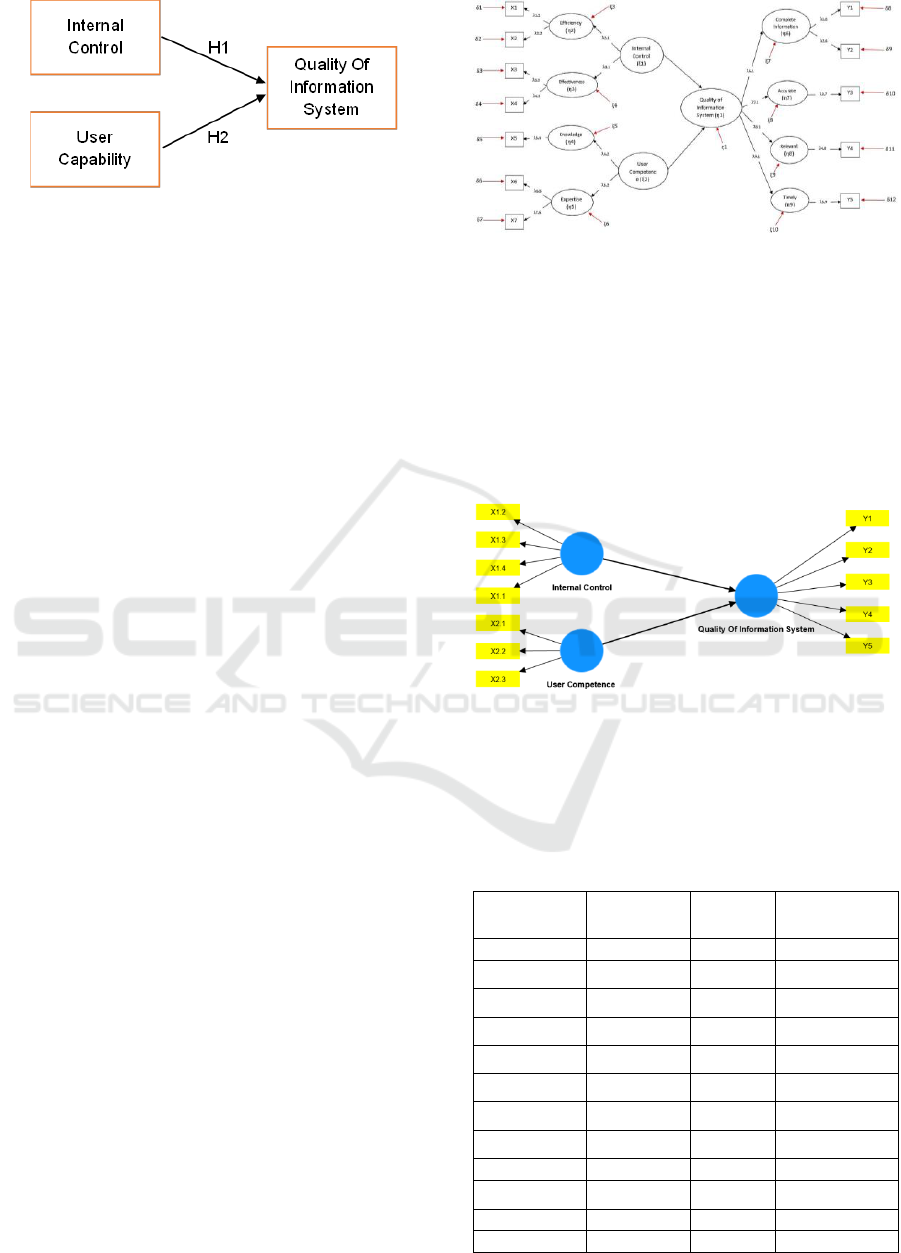

Figure 1: Research Model and Framework

4 RESEARCH METHODS

The quantitative research method was applied in this

investigation. The quantitative research method is a

type of research in which the specifications are

methodical, planned, and explicitly structured from

the beginning of the research design to the end. This

is consistent with Sugiyono (2019), who stated that

positive philosophy-based research procedures are

used to evaluate certain populations or samples, data

collection involves research tools, and data analysis

is quantitative or statistical with the goal of testing

predetermined hypotheses. This study used a

structured questionnaire as a data collecting tool.

Indicator measurement uses a Likert scale.

The population of 107 banking industries is the

unit of analysis in this study, which is public banking

registered with the Financial Services Authority

(OJK) in 2022. The sample for this study was chosen

through a random sampling technique, which is a type

of probability sampling. Random sampling is a

method of gathering samples from a population at

random, without consideration for the strata within

that population (Sugiyono, 2019).

The data analysis technique employed is the

Partial Least Square-Structural Equation Modeling

(PLS-SEM), which tests the hypothesis using the

route analysis test on primary data gathered from

surveys and questionnaire distribution. SEM is a

statistical modeling technique that can be used for

cross-sectional, linear, and general statistical

modeling, and it encompasses factor analysis, route

analysis, and regression. SEM is a multivariate

analysis approach used to create and test statistical

models, most of which are causal models (Usman et

al, 2020). Partial least squares (PLS) is an alternative

approach to analysis based on variation to Structural

Equation Modeling (SEM) (Usman et al, 2020).

PLTS has the advantage of not requiring assumptions

and can be estimated with a small sample size.

Figure 2: Path Diagram for Combination of Measurement

and Structural Models.

5 RESEARCH RESULTS

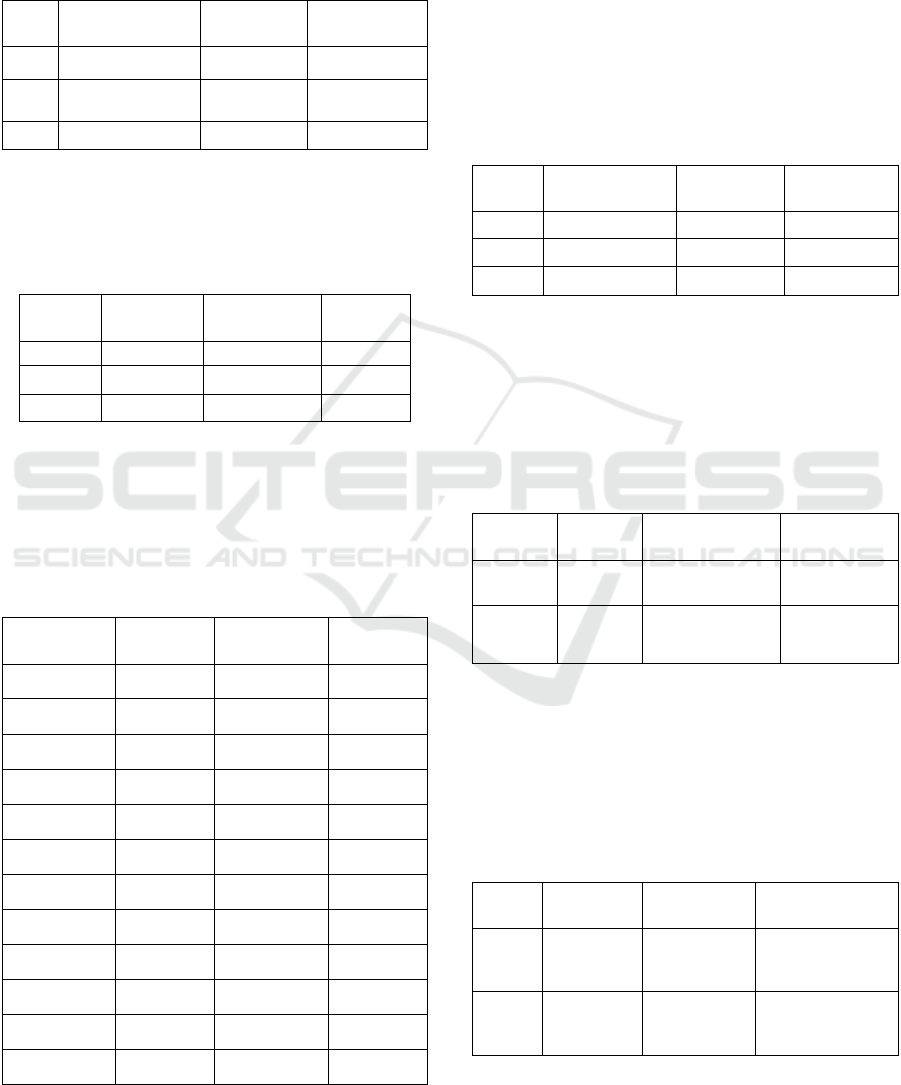

There are 2 independent variables which are denoted

by X1 (Internal Control), X2 (User Competence), and

Y (Quality of Information system), by using

SMartPLS the research model is obtained as follows

Figure 3: Research Model, via Smart PLS.

The tests to be carried out are Convergent Validity

and Discriminant Validity tests.

5.1 Convergent Validity

Table 1: Outer Loading.

Variable

Outer

Loading

Standard

Value

Information

X1.1 <- X1

0.744

0.700

High/Valid

X1.2 <- X1

0.831

0.700

High/Valid

X1.3 <- X1

0.789

0.700

High/Valid

X1.4 <- X1

0.821

0.700

High/Valid

X2.1 <- X2

0.742

0.700

High/Valid

X2.2 <- X2

0.846

0.700

High/Valid

X2.3 <- X2

0.753

0.700

High/Valid

Y1 <- Y

0.811

0.700

High/Valid

Y2 <- Y

0.863

0.700

High/Valid

Y3 <- Y

0.861

0.700

High/Valid

Y4 <- Y

0.751

0.700

High/Valid

Y5 <- Y

0.776

0.700

High/Valid

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

118

The value of the Outer Loading variable in the table

above is more than 0.700, indicating that the data

utilized can be considered valid sample size (Irwan

Khaeyna, 2015).

Table 2: Average Variance Extracted (AVE).

Average Variance

Extracted (AVE)

Standard

Value

Information

X1

0.617

0.500

Valid

X2

0.647

0.500

Valid

Y

0.655

0.500

Valid

Based on the table data above, the Average Variance

Extracted (AVE) value is above 0.500, which means

the data used is valid (Irwan Khaeyna, 2015).

Table 3: Fornell Larcker.

X1

X2

Y

X1

0.785

0.671

0.688

X2

0.671

0.804

0.777

Y

0.688

0.777

0.809

By using the Fornell Larcker, based on the results of

the table above, the root value of the AVE variable is

greater than the correlation between the other

variables. This indicates that the overall discriminant

validity evaluation is fulfilled.

Table 4: Cross Loading.

X1

X2

Y

X1.1

0.776

0.533

0.547

X1.2

0.744

0.512

0.523

X1.3

0.831

0.419

0.472

X1.4

0.789

0.615

0.599

X2.1

0.523

0.821

0.647

X2.2

0.469

0.742

0.534

X2.3

0.616

0.846

0.683

Y1

0.517

0.609

0.753

Y2

0.517

0.609

0.811

Y3

0.623

0.696

0.863

Y4

0.621

0.706

0.861

Y5

0.485

0.542

0.751

According to the Cross Loading results in the table

above, the correlation of the loading value of each

item to the construct is greater than the cross loading

value. This signifies that the discriminant validity

evaluation has been completed (Irwan Khaeyna,

2015).

Furthermore, the Cronbach Alpha value can be

used to measure the reliability. Because the Cronbach

Alpha value in the table below is more than 0.700, it

can be claimed that all variables are reliable

(Febrianawati, 2018).

Table 5: Cronbach Alpha.

Cronbach Alpha

Standard

Value

Information

X1

0.793

0.700

Reliable

X2

0.727

0.700

Reliable

Y

0.867

0.700

Reliable

The next test is hypothesis testing. Hypothesis testing

was carried out to see if there was an influence from

X1 on Y and X2 on Y. Based on the following table,

the P values of X1 and X2 are smaller than 0.05 so it

can be concluded that X1 has an influence on Y, and

X2 also has an influence on Y.

Table 6: P Value.

P Value

Standard Value

Information

X1->Y

0.005

< 0.05

X1 has an

Effect on Y

X2->Y

0.000

< 0.05

X2 has an

Effect on Y

The next test is hypothesis testing. Hypothesis testing

was carried out to see if there was an influence from

X1 on Y and X2 on Y. Based on the following table,

the P values of X1 and X2 are smaller than 0.05 so it

can be concluded that X1 has an influence on Y, and

X2 also has an influence on Y.

Table 7: Cross Loading.

T Statistics

Standard

Value

Information

X1->Y

2.781

> 1.96

X1 has a

Significant Effect

on Y

X2->Y

6.345

> 1.96

X2 has a

Significant Effect

on Y

A Comprehensive Study of the Effects of User Competence and Internal Control on the Quality of Accounting Information Systems

119

Furthermore, to see whether variables X1 and X2

have a positive or negative effect on variable Y, it can

be seen through the value of the Original Sample.

Table 8: Cross Loading.

Original Sample

Information

X1->Y

0.303

Positively

Influence

X1->Y

X2->Y

0.574

Positively

Influence

X2->Y

Through the table above, the value of the Original

Sample X1 on Y is positive, so X1 has a positive

effect on Y, as well as the value of the Original

Sample X2 on Y which is positive, so X2 also has a

positive effect on Y. This means that if X1 or X2

increases, Y will increase as well.

6 DISCUSSION

Based on the discussion mentioned above, it appears

that the first hypothesis is accepted. To improve the

quality of information systems, banks must increase

user competence because it has a significant and

positive influence on them. This conclusion is

supported by previous research conducted by Nisa &

Citra (2020) which showed that the ability of users

has a positive and significant influence on the quality

of information systems. Information systems are

intended to improve decision-making by streamlining

procedures and providing important insights. The full

potential of users who are proficient in using these

systems can be realized by making educated

judgments and reaping the benefits of these systems.

Competent users are more likely to enter trustworthy

and correct data into information systems. The overall

quality of the provided information can be lowered by

erroneous analysis and incorrect conclusions caused

by wrong or missing data.

If an information system's users are familiar with

its features, they can use it more effectively and finish

tasks faster. With higher productivity and quicker

answers to company demands, this enhanced

efficiency also benefits businesses. Competent users

can discover and repair technical problems or

mistakes, thereby reducing downtime and

interruptions. They may also troubleshoot small

issues without the need for expert assistance.

Advanced users may frequently change and adjust

information systems to better meet their individual

needs. This adaptability can lead to more specialized

and effective solutions that satisfy specific company

objectives. The common user may not be aware of a

variety of features and capacities that many

information systems have.

Competent users are more likely to investigate

and make use of these features, increasing the value

they get out of the system. Understanding data

security best practices is essential for user

competency. Competent users are more likely to

adhere to security measures, lowering the risk of data

breaches and illegal access to sensitive data.

Competent users can save companies both time and

money by requiring less training. Training sessions

can include more complex subjects, which will help

users improve their abilities and system competency.

Users have a more favorable experience when they

are skilled and can properly use the technology. As a

consequence, the information system and its overall

performance have increased user satisfaction. The

functioning, user interface, and features of an

information system are often better understood by

competent users who are often better positioned to

give constructive input. This input may be used to

create enhancements and updates that will improve

the system's quality over time.

The second hypothesis is also supported by the

study findings, which reveal that internal control has

a considerable and favorable impact on the quality of

information systems. Banks must strengthen their

internal controls in order to increase the quality of

their information systems. The quality of information

systems is affected by internal control, as explained

in Treyani (2019)'s previous research. Internal

controls contribute to the accuracy and integrity of

data in information systems. Organizations can

prevent unwanted access, data tampering, or mistakes

that might jeopardize the quality of the information

being processed and stored by instituting checks and

balances.

Internal control is a corporate policy process that

is influenced by the board of directors, management,

and other employees of a company. This was done to

ensure confidence about a number of

accomplishments, including operational performance

and efficiency, financial report correctness, and

compliance with applicable rules. The effectiveness

of internal control affects the quality of accounting

information systems because the effectiveness of

internal control is perceived to be weak by the parts

that utilize it, particularly in inventory control, and

there is still a lack of data security.

The auditability of information systems is

improved by a strong internal control architecture.

The quality of information given can be enhanced by

auditors checking controls to ensure that procedures

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

120

are sound and reliable. The protection of information

systems against cyber assaults and breaches requires

the use of internal controls. They develop procedures

for encrypting data, managing access, and other

security measures that guarantee the integrity and

confidentiality of the system's data. Effective internal

controls aid in the simplification of procedures within

the information system. Organizations can increase

data processing efficiency and speed by reducing

superfluous stages and automating regular tasks,

resulting in higher-quality outputs.

Internal controls are in place to ensure that

information is processed and reported as soon as

possible. This is especially vital for decision-making,

since current and accurate information is essential for

making educated decisions that contribute to the

overall quality of corporate operations. Internal

controls often involve monitoring and feedback

methods. The ability to identify system flaws and

opportunities for improvement enables businesses to

make iterative improvements that improve system

quality over time.

7 CONCLUSION

The validity of various findings was demonstrated by

testing two hypotheses: the impact of user

competence on information system quality and the

impact of internal control on information system

quality.

1. User competence has a large and beneficial

influence on the quality of the information system.

Thus, to improve the quality of the information

system at the Bank, it is necessary to carry out

trainings that support the competence of the User.

To enhance user competence should provide

structured and planned training for users of

information systems. Adjust training to suit the

level of knowledge and skills of users, from basic

to advanced. Ensure that the training material

includes an in-depth understanding of the features

of the information system, its usage patterns, and

best practices in its use. Consider repetitive

training and advanced training to help users

deepen their understanding over time.

2. This study also revealed that internal control has

a significant and positive influence on the quality

of information systems, implying that banks must

strengthen their internal controls in order to

increase and improve the quality of information

systems. To enhance internal control in the use of

information systems must carry out a thorough

assessment of the risks associated with the

information system, identifying potential threats

to data security, information integrity, and

possible regulatory violations. Determine the

possible impact of each identified risk. This helps

in determining priorities and resources to be

allocated to address the risk. Implement designed

controls into information systems and related

business processes. Make sure that each control is

enabled and works as expected. Improving

internal control is a continuous effort involving

various aspects of the organization. With a

structured approach and a high awareness of the

importance of managing risk and security, you can

ensure that your information system operates with

a better level of control.

REFERENCES

R T Mardia, A Karim, M Ismail, 2021. Sistem

Informasi Akuntansi Dan Bisnis (Yayasan Kita

Menulis, Medan.)

Suprihatin, N Sri, 2022. Sistem Informasi Akuntansi

2 (Penerbit Qiara Media, Purworejo.)

K Safitri, 2022. LapKeu Bukalapak SalCat, Akuisisi

Rp 14,3 M Ditulis Rp 14,3 T (Kompas.com)

https://money.kompas.com/read/2022/03/25/113

000126/laporan-keuangan-bukalapak-salah-catat-

akuisisi-rp-143-miliar-ditulis-rp-143.

A A Nisa, Citra, V, Nisa, 2020. Pengaruh

Kemampuan Pengguna dan Pengendalian Internal

Terhadap Kualitas Sistem Informasi Akuntansi

pada Salah Satu Perusahaan Manufaktur di Kota

Bandung. The 11th Industrial Research Workshop

and National Seminar.

S P Robbins, T A Judge, 2013. Organizational

Behaviour, 12 (Salemba Empat.)

Y M Basri, 2020. Kontrol Thd Kecurangan dlm SA

Berbasis Komp. Jurnal Akuntansi & Investasi,

1(1).

D Hasanuddin, 2020. Kasus Maybank Tunjukan

Lemahnya Pengawasan Internal Bank, Anis: OJK

Perlu Lakukan Mediasi (Tribunnews.com)

https://wartakota.tribunnews.com/2020/11/15/kas

us-maybank-tunjukan-lemahnya-pengawasan-

internal-bank-anis-ojk-perlu-lakukan-mediasi .

I Astria, E Halimatusadiah, N Nurhayanti, 2017.

Pengaruh Kompetensi Pengguna, PI thd Kualitas

SIA (Survey pada Bank Syariah di Kota

Bandung). Jurnal Akuntansi 3(2).

T Tresyani, 2019. Pengaruh Sistem Pengendalian

Internal Thd Kualitas SIA Yang Berdampak Pada

Kualitas Informasi Akuntansi (Survei Pada

A Comprehensive Study of the Effects of User Competence and Internal Control on the Quality of Accounting Information Systems

121

Satuan Kerja perangkat Daerah Kota Bandung),

Universitas Komputer Indonesia, Bandung.)

W Nugroho, Kristanto, 2019. Pengaruh SIA Dan

Sistem Pengendalian Internal Thd Kinerja

Karyawan Kspps Bmt Al Fataa Kabupaten

Pemalang, Jurnal Akuntansi Dan Sistem

Teknologi Informasi.

O Syahputra, 2022. The Effect Of IC And Quality Of

AIS On Quality Information On Pt. Pandu Siwi

Sentosa (Pandu Logistics), Enrichment: Journal

of Management, 12(2).

F Hafidz, Muhammad Fikru Rizal, 2022. Analisis

Efisiensi Fasilitas Kesehatan (UGM PRESS,

Yogyakarta.)

M F Bormasa, 2022. Kepemimpinan Dan Efektivitas

Kerja (CV. Pena Persada. Jawa Tengah,.)

Ir. F I Wijayanti, 2023. Entrepreneurship! Marketing!

Dalam Bisnis (Elex Media Komputindo, Jakarta.)

Marjulin, 2019. Pengaruh Kompetensi Pengguna

Thd Kualitas SIA Survei Bumn di Aceh, Jurnal

Ekonomi Dan Bisnis, 21(2).

K G Mejia, B B David, L C Robert, 2010. Managing

Human Resources, 6 (Pearson Education,

Canada.)

Dr S Simbolon,S. E. , M. Si. , CIMBA., 2022.

Manajemen SDM Dlm Meningkatkan Kinerja

Karyawan (CV. Bintang Semesta Media,

Yogyakarta.)

A Chaeruddin, I Hartaningtyas, V Alicia, 2020.

Sumber daya manusia : pilar utama kegiatan

operasional organisasi (CV Jejak (Jejak

Publisher), Yogyakarta.)

A Susanto, 2017. Sistem Informasi Akuntansi :

pemahaman konsep secara terpadu (Linggar Jaya,

Bandung.)

Dr. Ir. D Soelistya, M. M, CPHCM, CHRMP., 2021.

Kepemimpinan Strategis (Nizamia Learning

Center, Sidoarjo.)

Endraria, 2016. User Competence and Influence on

The Quality of Accounting Information System.

Journal of Theoretical and Applied Information

Technology 86(1).

R Fitrios, 2022. How Information Technologi and

User Competense Affect the Quality if

Accounting Information Through the Quality of

AIS. Quality – Access to Success 23(187)

Y Mulyanti, 2017. Pengaruh TI dan Pengendalian

Internal Thd Kualitas SIA, Jurnal Akuntansi,

Audit dan Sistem Informasi Akuntansi

Sugiyono, 2019. Metode Penelitian Kuantitatif,

Kualitatif, Dan Kombinasi (Mixed Methods)

(Alfabeta.)

O Usman, T Monoarfa, M Marsofiyati, 2020. E-

Banking and M-banking effects on customer

satisfaction, Accounting, 6(6)

Irwan, A Khaeryna, 2015. Metode Partial Least

Square (PLS) dan Terapannya (studi kasus:

Analisis Kepuasan Pelangga terhadap Layanan

PDAM Unit Camming Kab. Bone), Jurnal

Teknosains 9(1).

Y Febrianawati, 2018. Uji Validitas dan Reliabilitas

Instrumen Penelitian Kuantitatif. Jurnal Tarbiyah:

Jurnal Ilmiah Kependidikan, 7(1).

M A Suswandera, N Nurhayati, E Halimatusadiah,

2018. Pengaruh Gaya Kepemimpinan dan

Pengendalian Internal Terhadap Kualitas Sistem

Informasi Akuntansi (Survey pada Bank Umum

Konvensional di Kota Bandung). Prosiding

Akuntansi 4(2).

A Kurniawan, M Purwanti, 2017. Pengaruh

Pengendalian Internal Terhadap Kualitas Sistem

Informasi Akuntansi dan Dampaknya Terhadap

Kualitas Informasi Akuntansi, 17(2)

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

122