Does the Blue Economy Resource of Capture Fisheries Generate

Economic Growth? Evidence from Indonesia

Mohamad Egi Destiartono, Firmansyah and Evi Yulia Purwanti

Department Economics, Faculty of Economics and Business, Universitas Diponegoro, 50275, Semarang, Indonesia

Keywords: Blue Economy, Fisheries, Economic Growth.

Abstract: Indonesia is the center of the blue economy resources since the region is located in the Coral Triangle. This

paper is aimed at estimating the relationship between capture fisheries production and economic growth in

Indonesia for the period 1984-2019, by utilizing the extended version of the Solow growth model. The data

were retrieved from the World Development Indicators (WDI). Dynamic and cointegration relationships are

revealed through the application of the autoregressive distributed lags (ARDL)-bounds test model. Also, the

Zivot-Andrew (ZA) test is utilized to identify the presence of unit roots with a structural break. The results

report that variables are stationary at their levels and there is a cointegration nexus among them. Further, the

capture fisheries production is found to have a positive affluence on GDP growth in the long run. Thus, marine

fisheries resources have a notable role as an engine of economic growth. Importantly, the estimated parameters

are robust with the alternative method of DOLS. Following these empirical findings, we advocate for fisheries

stakeholders to jointly define policies and schemes that could augment the productivity level of the capture

fisheries given that it contributes significantly to GDP.

1 INTRODUCTION

The agricultural sectors of fisheries are expected to

have a significant role in fostering inclusive economic

growth in long-coastal countries such as Indonesia.

With around 18,000 islands, the country has a

coastline of 68,075 miles and an exclusive economic

zone of 2.91 million km2, indicating the massive

potential for marine fisheries sectors. It is widely

admitted that Indonesia is the home of marine

biodiversity given that the country is located in the

Coral Triangle (Ceccarelli, Lestari, Rudyanto, &

White, 2022).

There are around 553 coral species and 4,954

marine fish species embodied in Indonesia (Asian

Development Bank, 2014)(Peristiwady, 2021). Those

various types of marine animals indices the blue

economy resources that can be managed by

Indonesians.

The fisheries sectors still account for around

7.06% of the Gross Domestic Product (GDP) and

employ around 6.06% of the workforce. Moreover,

the livelihoods of 2.5 million households are directly

connected to Small-Scale-Fisheries (SSF) activities.

The development of fisheries sectors to increase their

productivity will have a significant impact on coastal

communities. In 2021, the total fisheries production

is around 21.81 million metric tons, consisting of the

traditional small-scale artisanal and the large-scale

commercial.

The fisheries sectors have strategic roles in

fostering economic development through various

pathways. To begin with, fisheries resources support

food security by supplying affordable sources of

nutrition for both rural and urban households that are

poor (Kent, 1997). This role, in turn, affects human

capital.

To this day, the consumption of fish per capita in

Indonesia is around 40 kilograms. (SEAFDEC,

2020). Another benefit is that both marine and

freshwater fisheries are the livelihoods of Indonesian

coastal communities.

The prosperity of fisheries producers and

consumers can depend on the shocks in these sectors.

Last, of all, fisheries commodities have remarkable

roles on foreign exchange through export. It is widely

known that Indonesia’s competitive position in the

global fish market is quite high, one of the global

leading (Oktavilia, Firmansyah, Sugiyanto, &

Rachman, 2019).

Destiartono, M., Firmansyah, . and Purwanti, E.

Does the Blue Economy Resource of Capture Fisheries Generate Economic Growth? Evidence from Indonesia.

DOI: 10.5220/0012646600003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 17-24

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

17

Figure 1: Capture fisheries and total fisheries production for

the period 1980-2021 (billions of metric tons).

Indonesia's fisheries sectors are faced with

numerous problems, despite their vital role. Illegal,

unregulated, and unreported (IUU) fishing activities

are empirical cases that caused Indonesia cannot to

achieve its best optimal level of fish production and

meet sustainable indicators (Ardhani, 2021). The

presence of crimes in the fisheries industry has the

potential to reduce the role of fisheries in the

economy and social security in the long run.

Currently, the contribution of the fisheries to

aggregate national output is relatively low compared

to land-based agriculture such as crops.

Various econometric methods have been used in

numerous studies to estimate the link between

fisheries and economic growth. For instance,

Eyüboğlu & Akmermer (Eyüboğlu & Akmermer,

2023) estimated the dynamic nexus between fisheries

production and economic growth in Turkey by

employing annual data for the period 1990-2019. The

autoregressive distributed lags (ARDL)-bounds

testing is applied. The cointegration relationship is

confirmed. Furthermore, fisheries production

positively affluence on GDP in the long run. In a

similar vein, Rehman et al. (Rehman, Deyuan, Hena,

& Chandio, 2019) explored the role of fisheries on

economic growth in Pakistan from 1970 to 2015 by

performing the ARDL model. The empirical results

represent that aquaculture and capture fisheries are

found to have a significant and cogent impact on GDP

growth which implies that both sectors have

remarkable roles to sustain the economy of Pakistan.

In another research, Jaunky (Jaunky, 2011)

explored the causal linkage between fisheries export

growth and economic growth in the Small Island

Developing States (SIDS) for the period 1980-2002.

The system Generalized Method of Moment (GMM)

and Fully Modified OLS (FMOLS) were applied. The

empirical finding noted that fisheries export has a

positive impact on GDP growth. Further, an empirical

case in Nigeria by Oyakhilomen & Zibah

(Oyakhilomen & Zibah, 2013) reported there is no

causal connection between Fishery Production Index

(FDI) and per capita GDP. In addition, Sugiawan et al.

(Sugiawan, Islam, & Managi, 2019) reported there is a

one-way causal linkage. Initially, economic growth

causes the depletion of marine ecosystems.

Nonetheless, after a certain level of per capita income,

i.e., 3827 USD, economic growth has a beneficial

affluence on the sustainability of marine ecosystems.

More recently, Ilyas et al. (Ilyas et al., 2021)

examined the role of agriculture sub-sectors of

fisheries, livestock, and crops on economic growth in

Pakistan over the period 1987-2017 by employing the

Johansen cointegration test and Vector Autoregressive

(VAR) model. The results indicate that there is a long-

term relationship and significant impact of all

agricultural sub-sectors on economic growth, which

implies that boosting agricultural sector performance is

beneficial for Pakistan's economy.

Although the notion hypothesis of agriculture

(incl. fishery sector)-led economic growth is widely

discussed and confirmed; still, the empirical findings

of the role of capture fisheries on economic growth in

Indonesia using econometric models are not evident,

giving room for scholars to fill the gap. Hence, the

reasons and novelties are proposed as follows: this

paper aims to examine the dynamic short- and long-

run linkages between capture fisheries and economic

growth by adopting the extended version of the Solow

growth model.

To the best author’s knowledge, this angle of

research is not yet proven. We employ the ARDL-

bounds testing method due to its ability to generate

both short- and long-run parameters, as well as a

cointegration model. In addition, the breakpoint unit

root test is applied to check the order of integration

and ensure that the ARDL is proper to be employed.

2 RESEARCH METHODOLOGY

2.1 Data and Variables

This paper applied time series from 1984 to 2019 to

estimate the relationship between capture fisheries

and economic growth in Indonesia. Following

previous studies (Hassan, Xia, Latif, Huang, & Ali,

2020) (Africa, 2020) and the Solow growth model,

this research included the additional control variables

namely population growth, gross capital formation,

and inflation rates with the aim of handling omitted

variables bias. All the series used were retrieved from

the World Development Indicators (WDI).

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

18

Capture fisheries production (metric tons) growth

is the explanatory variable. The figure reflects the

increase in the volume of fish catches that are landed

annually. Economic growth is the explained variable

and it is proxied by Gross Domestic Product (GDP)

(current USD) growth. The monetary value added to

final goods and services within a country is known as

GDP. Next, Gross Capital Formation (GFC) growth

is used as a proxy for capital accumulation in the

Solow growth model. The GFC includes outlays on

additions to the assets of the economy plus net

changes in the level of inventories and it is based on

constant local currency (constant 2010 USD).

Furthermore, we consider population growth to be

a proxy for human capital growth. Last, of all,

inflation rates are measured by the yearly increase

rate of the GDP implicit deflator. This figure shows

the rate at which prices change in the economy as a

whole. All the regressors used in this paper are

expected to have a positive influence on GDP growth,

except for inflation rates.

2.2 Model Specification

The relationship between economic growth and its

determinants can be expressed as an equation (Eq.)

according to the Solow growth model. (1):

Y

t =

F(K,L

t

)

(1)

Eq. (1) above depicts that rill per capita income

(Y) is a function of capital (K) and labour (L). Further,

this paper modified the Solow growth model by

incorporating the role of natural resources, i.e., the

blue economy source of fisheries, and other related

variables.

Y

t =

F(K,L

t

N

t

I

t

) (2)

where N and I depict the natural resource and

additional variables that affect rill per capita income.

Following the Solow growth theory and previous

studies (Alharthi & Hanif, 2020) (Ilyas et al., 2021), an

empirical model in this paper is specified as Eq. (3).

GDP

t =

0

+

1

FISH

t

+

2

C

t

+

3

P

t

+

4

I

t

+

t

(3)

where GDP and FISH represent economic growth and

capture fisheries production growth. C, P, and I depict

the additional control variables, i.e., population

growth, gross capital formation growth, and inflation

rates.

0

is the constant term.

1

…

4

are coefficients.

The subscript t indices yearly series. Last, of all,

t

is

the error term.

2.3 Unit Root Test

The ARDL model demands that all variables in the

second order are stationary. Hence, this research

examined the order of integration thru the unit root

test developed by Zivot & Andrews (1992). The Z-A

test is capable of confirming the presence of unit roots

with a structural break. Previous studies have

employed the ZA test given its ability to determine

the breakpoint (Usman, Iorember, & Olanipekun,

2019) (Liu, Amin, Rasool, & Zaman, 2020)

(Agboola, Bekun, Osundina, & Kirikkaleli, 2022).

The null hypothesis that series have a unit root with

drift is proposed. Conversely, the alternative

hypothesis is that there is a stationary series with a

one-year break in the level.

2.4 ARDL-Bounds Testing

The ARDL-bounds testing was applied with the aim

of estimating the impact of marine fisheries on

economic growth since this method offers several

advantages as follows: (a) it produces short- and long-

run coefficients; (b) it includes cointegration test; (c)

it declines the issues of endogeneity by plugging

sufficient lags for dependent and independent

variables; (d) it gives robust estimates in the case of

small samples; (e) it is appropriate to be applied either

variable are , , or mixed order of integration

(Nathaniel & Bekun, 2020) (Ridzuan, Marwan,

Khalid, Ali, & Tseng, 2020).

Further, the ARDL is proper to be applied when

the empirical model combines variables in growth

and level (Tinoco-Zermeño, Venegas-Martínez, &

Torres-Preciado, 2014). Following Pesaran et al.

(Pesaran, Shin, & Smith, 2001), the ARDL () model

can be specified as Eq. (1).

(4)

where Δ is the first difference operator. For simplicity,

the additional control variables of C, P, and I are jointly

presented by X.

and

denote the dynamic short and

long-run parameters. B points out the optimal lag

length for each variable. The presence of cointegration

among variables was estimated by the Bounds test and

the null hypothesis of no level relationship is proposed.

The null and alternative hypotheses of the

cointegration test can be written as follows:

Does the Blue Economy Resource of Capture Fisheries Generate Economic Growth? Evidence from Indonesia

19

H

0

: δ

1

= δ

2

= δ

3

=

0

(5)

H

0

: δ

1

≠ δ

2

≠ δ

3

≠

0

(6)

Two critical values are considered in the bound

test, namely lower, , and upper, , critical

values. The cointegration relationship is confirmed if

the calculated -statistic > . There is no

cointegration relationship if -statistic < and

inconclusive result if < -statistic < .

Assumed there is cointegration among variables, the

error correction equation can be written as Eq.

(7)

where the ECM parameter of is supposed to be

varied from -1 to 0. denotes the pace of adjustment

toward a long-run equilibrium in response to shocks

in the short run.

3 RESULT AND DISCUSSION

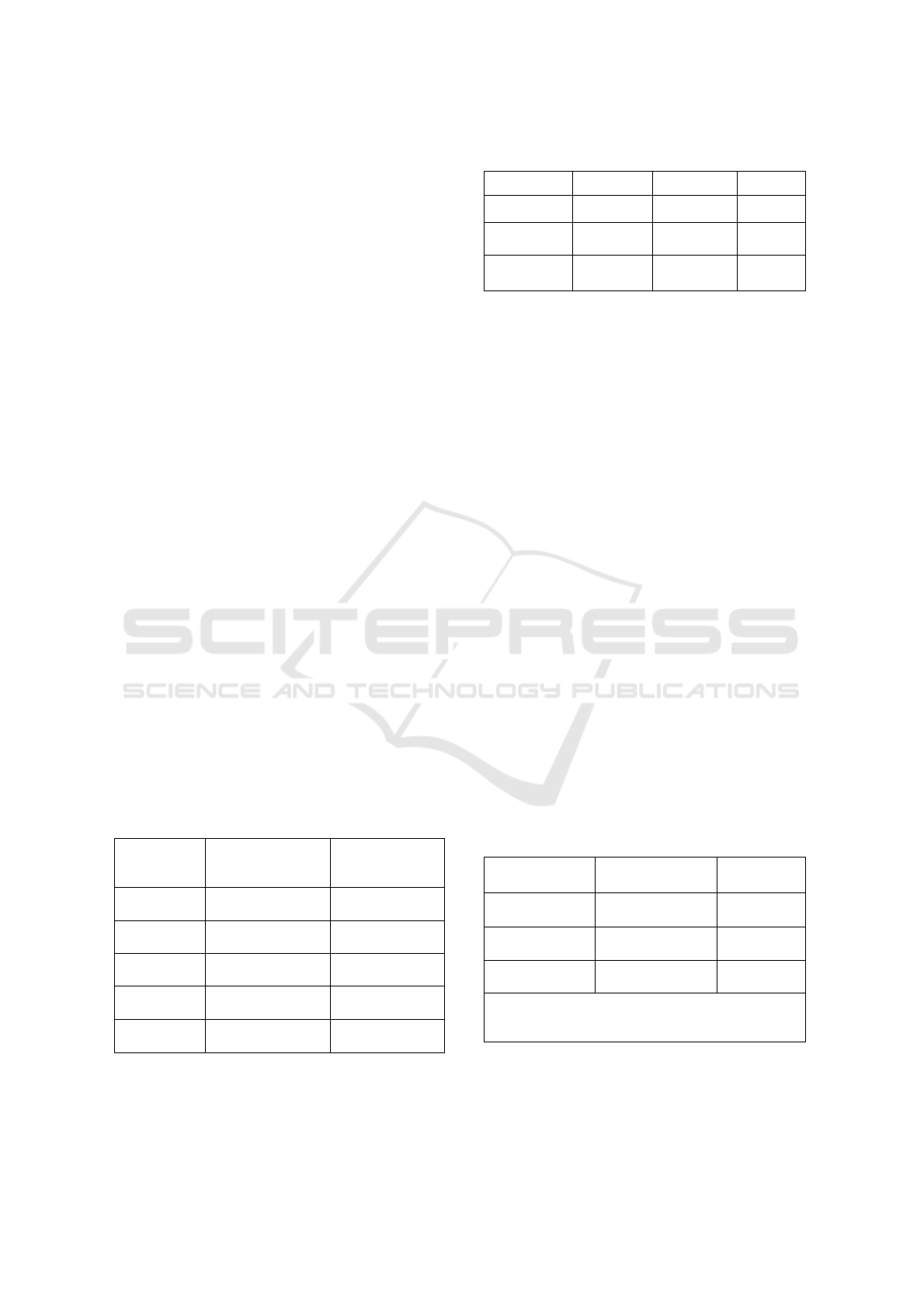

Table 1 displays the empirical findings for the

stationary test with a structural break to initiate the

discussion. We present both models with or without a

linear trend. The ZA test depicts that all variables

used, i.e., GDP

t

, FISH

t

, C

t

, P

t

, and I

t

, are stationary at

their levels. Hence, they are integrated of order 0,

. Since there are none of the single variables that

are stationary at the second difference; therefore, the

ARDL-bounds testing approach is proper to be

applied to estimate the dynamic relationship.

Table 1: The Z-A test results.

Statistic

(intercept)

Statistic

(intercept &

trend)

GDP

-6.0279**

(0.0103)

-5.9519**

(0.0309)

FISH

-7.1150**

(0.0153)

-7.1557**

(0.0139)

C

-5.4993*

(0.0589)

-5.5329**

(0.0340)

P

-6.4612***

(0.0001)

-4.9732***

(0.0003)

I

-6.1687***

(0.0074)

-6.7129**

(0.0300)

Note: *, ** and *** represent significance at 10%, 5% and

1% levels; p-values are in parentheses.

Table 2: The optimal lag selection.

Methods

(0)

(1)

(2)

AIC

14.2046

9.016687*

9.5117

SC

14.4291

10.36348*

11.9808

HQ

14.2812

9.475981*

10.3537

Note: *depicts the optimal lag length.

3.1 Optimal Lag Selection

The dynamic ARDL coefficients are sensitive in

regard to the number of lags chosen. This paper

considers the optimal lag selection by information

criteria to ensure that the ARDL equation is well

established. As shown in Table 2, all approaches, i.e.,

AIC, SC, and HQ, depict that the optimal lag order is

one. Therefore, the ARDL in this research selects the

maximum lag order of one. Based on the automatic

lag structure selection of SC, the ARDL () is

the most proper model.

3.2 Co-Integration Test

The presence of a long-run relationship among

variables is investigated by the Bound test and the

outcomes are exhibited in Table 2. There is a

cointegration connection given that the -statistic is

higher than the upper bounds critical value at a 1%

level. The findings indicate that GDP growth, capture

fisheries production growth, gross capital formation

growth, inflation rates, and population growth all

move towards long-run equilibrium. In other words,

the long-run relationship among variables used in this

paper is not spurious. Thus, it is meaningful to

interpret the estimated coefficients.

Table 3: Co-integration test results.

Sign.

Lower

Upper

0.10

2.460

3.460

0.05

2.947

4.088

0.01

4.093

5.532

F-stat = 74.128

k = 4

Actual sample size = 35

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

20

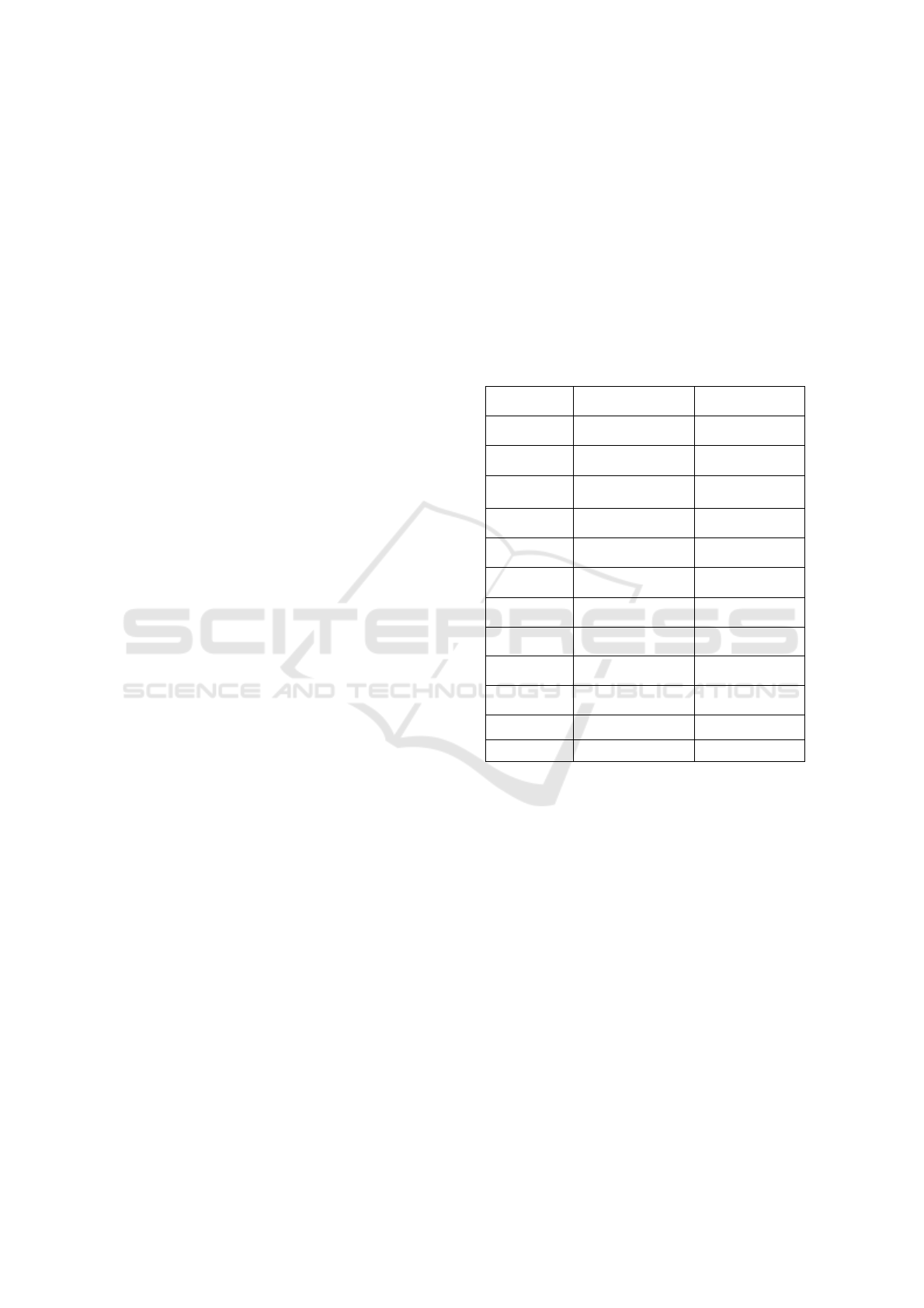

3.3 The ARDL Estimates

The dynamic short- and long-run of ARDL estimates

are presented in Table 4. The increase in the

production of caught fish has a positive effect (0.251)

on GDP growth at a significant level of 5% in the long

run. Thus, an increase in capture fisheries production

has a beneficial affluence on economic growth. This

finding aligns with previous research in Pakistan and

Turkey (Rehman et al., 2019), (Eyüboğlu &

Akmermer, 2023). The hypothesis of agriculture-led

economic growth in a coastal developing country is

confirmed by this finding because fisheries resources

are considered part of the agricultural sector. In other

words, the blue economy resources of fisheries

commodities are essential in order to support the

economic development in Indonesia.

A positive connection between capture fisheries

and GDP implies that the fisheries sectors have

remarkable roles in the economy. It is widely known

that fisheries commodities contribute to the national

income through several pathways; food supply,

livelihoods, and exports. Therefore, it is beneficial for

Indonesia to enhance the productivity levels of its

marine fisheries. For notes, policies that have the

feasibility to enhance marine fish production can be

enforced as follow: (a) improving fisheries

governance; (b) fishing port advancement; (c)

improving fish processing industry; (d) human

resource development; (e) integrated fishing ports

and industrial estates; (f) attracting local and foreign

investment; (g) precautionary management to decline

risks of ecosystem collapse; (h) conservation of

remaining blue economic resources; and (i) coastal

ecosystem management (McClanahan, Allison, &

Cinner, 2015), (Wijayanto, Wibowo, & Setiyanto,

2021), (Kurohman, Wijayanto, & Jayanto, 2020).

For the additional variables, the estimated long-

run coefficient of gross capital formation growth is

found to be positive, i.e., 0.04162, and significant at

a 5% level. This finding supports the Solow growth

model. Also, this result aligns with previous studies

in Malaysia and South Asia (Solarin & Shahbaz,

2015) (Sahoo & Dash, 2012). Moreover, we found

that the long coefficient of population growth is

positive (2.036) and it is significant at a 5% level.

This result supports the hypothesis of the Solow

growth model.

Population growth, which represents labor,

contributes to the economy by providing production

factors. This finding also aligns with previous

research in Nigeria by Tartiyus et al. (Tartiyus,

Dauda, & Peter, 2015). For note, Wilmoth et al.

(Wilmoth, Menozzi, & Bassarsky, 2022) the

affluence of population growth in both production

and consumption sectors will be more effective if

followed by an increase in per capita income. Last, of

all, inflation rates have a negative and significant

relationship related to GDP growth.

Therefore, it can be said that the rise in inflation

rates from 1984 to 2019 hinders the growth of national

output. This result is consistent with previous articles

in the case of Ethiopia (Wollie, 2018), Nigeria

(Adaramola & Dada, 2020), and Tanzania (Moore,

2013).

Table 4: The short- and long-run ARDL coefficients.

Variables

Coefficients

Long-run

model

FISH

0.25125**

(0.12099)

C

0.04162**

(0.01937)

P

2.03646**

(0.85743)

I

-0.30435***

(0.03014)

Short-run

model

∆FISH

-0.01046

(0.08797)

∆C

0.04055**

(0.01728)

∆P

27.11456**

(10.10388)

∆I

-0.29651***

(0.03269)

Constant

4.18069***

(1.05842)

ECM

-0.97424***

(0.07215)

R-square

0.942972

Adj. R-square

0.939408

Note: p-value is the parentheses; ∆ depicts the first

difference operator; ** and *** denote significant at 5%

and 1% levels.

The estimated parameters of captured fisheries

and ECM are our main focus for short-term analysis.

The outcomes denote that the relationship between

marine fisheries production and GDP growth is not

evident. Hence, the role of fisheries as an engine of

economic growth is only validated in the long run.

Nonetheless, the ECM is found to have a negative

sign (-0.97424) as expected and it is significant at a

1% level. This finding implies that shock in the short

run will be adjusted around 97% within a year toward

long-run equilibrium. The significance and negative

sign of the ECM also corroborates the presence of

cointegration relationship.

Does the Blue Economy Resource of Capture Fisheries Generate Economic Growth? Evidence from Indonesia

21

Table 5: Diagnostics test results.

Tests

P-value

Jarque-berra

0.488783

a

0.6191

Breusch-godfrey

1.412013

b

0.2412

Glejser

1.333848

b

0.5133

Note: the power of a shows the calculated JB-value; the

power of b depicts the calculated F-statistic.

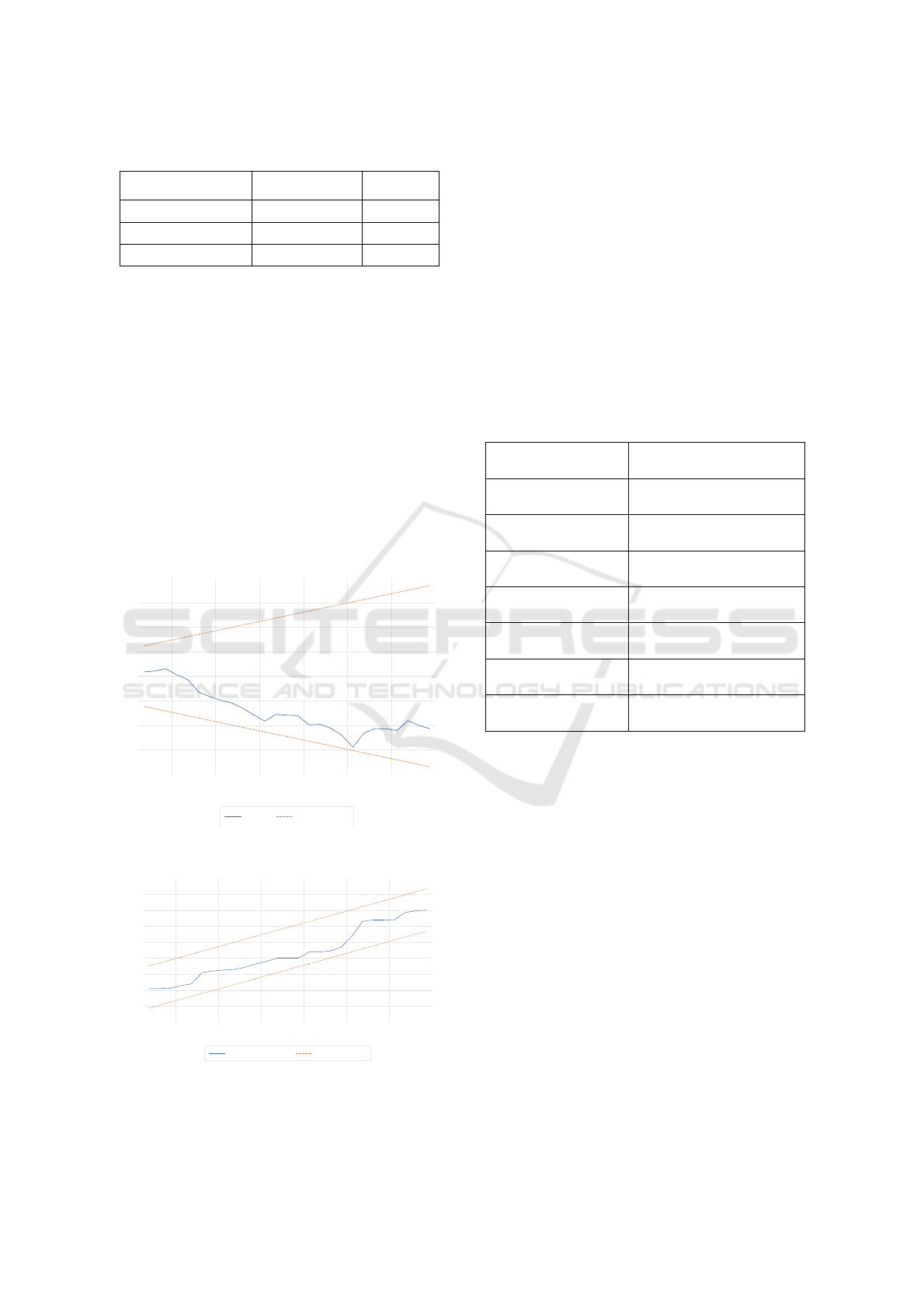

3.4 Diagnostic and Stability Test

The estimated model's reliability was ensured by a

package of diagnostic and stability tests performed by

this paper. As shown in Table 4, Fig. 2, and Fig. 3, the

Jarque-Berra, Breusch-Pagan serial LM, and Glejser

tests point out results as follows: residuals are

normally distributed; there is no problem of serial

correlation; and there is no issue of

heteroscedasticity. Moreover, the CUSUM and

CUSUMQ tests depict that the estimated parameters

are consistent given that the red plots are within the

critical value at a 5% level.

-16

-12

-8

-4

0

4

8

12

16

94 96 98 00 02 04 06 08 10 12 14 16 18

CUSUM 5% Significance

Figure 2: Plots of CUSUM recursive residuals.

-0.4

-0.2

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

94 96 98 00 02 04 06 08 10 12 14 16 18

CUSUM of Squares 5% Significance

Figure 3: Plots of CUSUMSQ recursive residuals.

3.5 Robustness Check

Following Hadi & Chung (Hadi & Chung, 2022) and

Guan et al. (Guan, Kirikkaleli, Bibi, & Zhang, 2020),

this paper employed the dynamic OLS (DOLS)

developed by Stock & Watson (Stock & Watson,

1993) for the robustness check of the long-run

parameters. As shown in Table 6, the estimated

coefficient of capture fisheries production growth in

the DOLS method is consistent with previous

findings in the ARDL-Bounds testing. In this result,

it is concluded that blue economic resources play a

significant role in marine fisheries production as a

contributor to economic growth.

Table 6: DOLS estimates.

Variables

Coefficients

FISH

0.421553***

(0.164746)

C

8.069757*

(4.361412)

P

1.104130

(1.100320)

I

-0.260790***

(0.028311)

Constant

4.894521***

(0.993151)

R-square

0.937676

Adj. R-square

0.902062

Note: * and *** denote significance at 10 and 1% levels.

4 CONCLUSION

The present paper aims to estimate the linkage

between capture fisheries and economic growth in

Indonesia between 1984 and 2019, using the

extension version of the Solow growth model. The

order of integration and dynamic connections can be

checked using breakpoint unit root and ARDL-

Bounds testing. All the variables used are stationary

at their level and there is a cointegration relationship

among them. The results denote that capture fisheries

production growth has a beneficial role on GDP

growth since its sign is positive and significant in the

long run. Thus, it can be noted that the blue economy

resources, i.e., marine fisheries, are an engine of

growth. Moreover, it is favourable and pivotal for

Indonesia to augment the productivity of its capture

fisheries sector given that it significantly advances

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

22

GDP. For the record, the empirical finding is robust

with the alternative method such as DOLS.

REFERENCES

Adaramola, O. A., & Dada, O. (2020). Impact of inflation

on economic growth: Evidence from Nigeria.

Investment Management and Financial Innovations,

17(2), 1–13.

https://doi.org/10.21511/imfi.17(2).2020.01

Africa, S. (2020). Causality E ff ects among Gross Capital

Formation , Unemployment and Economic Growth in

South Africa.

Agboola, M. O., Bekun, F. V., Osundina, O. A., &

Kirikkaleli, D. (2022). Revisiting the economic growth

and agriculture nexus in Nigeria: Evidence from

asymmetric cointegration and frequency domain

causality approaches. Journal of Public Affairs, 22(1).

https://doi.org/10.1002/pa.2271

Alharthi, M., & Hanif, I. (2020). Impact of blue economy

factors on economic growth in the SAARC countries.

Maritime Business Review, 5(3), 253–269.

https://doi.org/10.1108/MABR-01-2020-0006

Ardhani, I. (2021). Indonesia and The Criminalization of

Illegal, Unregulated, and Unreported Fishing in The

Global Level. Jurnal Hubungan Internasional, 9(2),

165–177. https://doi.org/10.18196/jhi.v9i2.10374

Asian Development Bank. (2014). State of the Coral

Triangle: Indonesia.

Ceccarelli, D. M., Lestari, A. P., Rudyanto, & White, A. T.

(2022). Emerging marine protected areas of eastern

Indonesia: Coral reef trends and priorities for

management. Marine Policy, 141, 105091.

https://doi.org/https://doi.org/10.1016/j.marpol.2022.1

05091

Eyüboğlu, S., & Akmermer, B. (2023). The Relationship

between Economic Growth and Fisheries Production in

Türkiye. Aquaculture Studies, 24(2).

https://doi.org/10.4194/AQUAST1017

Guan, J., Kirikkaleli, D., Bibi, A., & Zhang, W. (2020).

Natural resources rents nexus with financial

development in the presence of globalization: Is the

“resource curse” exist or myth? Resources Policy,

66(January 2020), 101641.

https://doi.org/10.1016/j.resourpol.2020.101641

Hadi, S. N., & Chung, R. H. (2022). Estimation of Demand

for Beef Imports in Indonesia: An Autoregressive

Distributed Lag (ARDL) Approach. Agriculture, 12(8),

1212. https://doi.org/10.3390/agriculture12081212

Hassan, S. T., Xia, E., Latif, K., Huang, J., & Ali, N. (2020).

Another Look at the Nexus Among Energy

Consumption, Natural Resources, and Gross Capital

Formation: Evidence from Pakistan. Natural Resources

Research, 29(4), 2801–2812.

https://doi.org/10.1007/s11053-019-09607-0

Ilyas, F., Gillani, D. Q., Yasin, M., Iqbal, M. A., Javed, I.,

Ahmad, S., & Nabi, I. (2021). Impact of Livestock and

Fisheries on Economic Growth: An Empirical Analysis

from Pakistan. Sarhad Journal of Agriculture, 38(1),

160–169.

https://doi.org/10.17582/journal.sja/2022/38.1.160.169

Jaunky, V. C. (2011). Fish exports and economic growth:

The case of SIDS. Coastal Management, 39(4), 377–

395. https://doi.org/10.1080/08920753.2011.589210

Kent, G. (1997). Fisheries, food security, and the poor.

Food Policy, 22(5), 393–404.

https://doi.org/https://doi.org/10.1016/S0306-

9192(97)00030-4

Kurohman, F., Wijayanto, D., & Jayanto, B. B. (2020). The

strategy of capture fisheries development in Pamekasan

regency, Madura Island. AACL Bioflux, 13(5), 2816–

2827.

Liu, Y., Amin, A., Rasool, S. F., & Zaman, Q. U. (2020).

The role of agriculture and foreign remittances in

mitigating rural poverty: Empirical evidence from

Pakistan. Risk Management and Healthcare Policy, 13,

13–26. https://doi.org/10.2147/RMHP.S235580

McClanahan, T., Allison, E. H., & Cinner, J. E. (2015).

Managing fisheries for human and food security. Fish

and Fisheries, 16(1), 78–103.

https://doi.org/https://doi.org/10.1111/faf.12045

Moore, P. D. (2013). Impact of inflation on economic

growth: A Case Study of Tanzania. Asian Journal of

Empirical Research, 3(4), 363–380.

https://doi.org/10.1038/253011b0

Nathaniel, S. P., & Bekun, F. V. (2020). Environmental

management amidst energy use, urbanization, trade

openness, and deforestation: The Nigerian experience.

Journal of Public Affairs, 20(2).

https://doi.org/10.1002/pa.2037

Oktavilia, S., Firmansyah, Sugiyanto, F. X., & Rachman,

M. A. (2019). Competitiveness of Indonesian fishery

commodities. IOP Conference Series: Earth and

Environmental Science, 246(1).

https://doi.org/10.1088/1755-1315/246/1/012006

Oyakhilomen, O., & Zibah, R. G. (2013). Fishery

production and economic growth in Nigeria: Pathway

for sustainable economic development. Journal of

Sustainable Development in Africa, 15(2), 99–109.

Peristiwady, T. (2021). Ichthyological Research and

Biodiversity of Marine Fishes in Indonesia. IOP

Conference Series: Earth and Environmental Science,

789(1). https://doi.org/10.1088/1755-

1315/789/1/012009

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds

testing approaches to the analysis of level relationships.

Journal of Applied Econometrics, 16(3), 289–326.

https://doi.org/10.1002/jae.616

Rehman, A., Deyuan, Z., Hena, S., & Chandio, A. A.

(2019). Do fisheries and aquaculture production have

dominant roles within the economic growth of

Pakistan? A long-run and short-run investigation.

British Food Journal, 121(8), 1926–1935.

https://doi.org/10.1108/BFJ-01-2019-0005

Ridzuan, N. H. A. M., Marwan, N. F., Khalid, N., Ali, M.

H., & Tseng, M. L. (2020). Effects of agriculture,

renewable energy, and economic growth on carbon

dioxide emissions: Evidence of the environmental

Does the Blue Economy Resource of Capture Fisheries Generate Economic Growth? Evidence from Indonesia

23

Kuznets curve. Resources, Conservation and

Recycling, 160(January), 104879.

https://doi.org/10.1016/j.resconrec.2020.104879

Sahoo, P., & Dash, R. K. (2012). Economic growth in South

Asia: Role of infrastructure. The Journal of

International Trade & Economic Development, 21(2),

217–252. https://doi.org/10.1080/09638191003596994

SEAFDEC. (2020). Fishery Statistical Bulletin of

Southeast Asia 2020.

Solarin, S. A., & Shahbaz, M. (2015). Natural gas

consumption and economic growth: The role of foreign

direct investment, capital formation and trade openness

in Malaysia. Renewable and Sustainable Energy

Reviews, 42, 835–845.

https://doi.org/https://doi.org/10.1016/j.rser.2014.10.0

75

Stock, J. H., & Watson, M. W. (1993). A Simple Estimator

of Cointegrating Vectors in Higher Order Integrated

Systems. Econometrica, 61(4).

https://doi.org/https://doi.org/10.2307/2951763

Sugiawan, Y., Islam, M., & Managi, S. (2019). Global

Marine Fisheries with Economic Growth. In Wealth,

Inclusive Growth, and Sustainability (1st ed., p. 48).

Routledge.

Tartiyus, E. H., Dauda, M. I., & Peter, A. (2015). Impact of

population growth on economic growth in Nigeria

(1980-2010). IOSR Journal Of Humanities And Social

Science, 20(4), 115–123.

Tinoco-Zermeño, M. Á., Venegas-Martínez, F., & Torres-

Preciado, V. H. (2014). Growth, bank credit, and

inflation in Mexico: Evidence from an ARDL-bounds

testing approach. Latin American Economic Review,

23(1). https://doi.org/10.1007/s40503-014-0008-0

Usman, O., Iorember, P. T., & Olanipekun, I. O. (2019).

Revisiting the environmental kuznets curve (EKC)

hypothesis in india: The effects of energy consumption

and democracy. Environmental Science and Pollution

Research, 26(13), 13390–13400.

https://doi.org/10.1007/s11356-019-04696-z

Wijayanto, D., Wibowo, B. A., & Setiyanto, I. (2021). The

strategy of capture fisheries development in rembang

regency. AACL Bioflux, 14(3), 1786–1800.

Wilmoth, J., Menozzi, C., & Bassarsky, L. (2022). Why

population growth matters for sustainable

development. Policy Brief No. 130.

Wollie, G. (2018). The Relationship between Inflation and

Economic Growth in Ethiopia. Budapest International

Research and Critics Institute (BIRCI-Journal) :

Humanities and Social Sciences, 1(3), 264–271.

https://doi.org/10.33258/birci.v1i3.73

Zivot, E., & Andrews, D. W. K. (1992). Further Evidence

on the Great Crash, the Oild-Price Shock, and Unit-

Root Hypothesis. Journal of Business & Economic

Statistics, 10(3), 251–270.

https://doi.org/https://doi.org/10.2307/1391541

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

24