Green Banking Disclosure, Financial Performance and Profitability:

Evidence from Indonesian Bank

Sugeng Riadi

a

and Erika Anggrayni

Managerial Accounting, Batam State Polytechnic, Ahmad Yani St, Batam, Indonesia

Keywords: Green Banking Disclosure, Financial Performance, Profitability.

Abstract: This research is aimed at determining the impact of various factors-namely, green banking disclosure (as

indicated by the green coin rating indicator), net interest margin, non-performing loans, operating costs, and

operational income the profitability of state-owned banks in Indonesia over an eight-year period (2014–2021),

as gauged by the return on assets. Secondary data, derived from annual reports and sustainability reports

available on the official websites of state-owned banks (Mandiri Bank, BNI Bank, BRI Bank, and BTN Bank),

constitute the basis of this study. The analytical process involves testing the data with classical assumptions

to ensure its suitability for statistical testing. The data is then subjected to multiple linear regression analysis,

followed by hypothesis testing, which involves partial and coefficient determination tests. The statistical

evidence shows that green banking disclosure does not have any noticeable impact on profitability.

Profitability is positively impacted by net interest margin and non-performing loans, while operating costs

and operational income show a negative correlation.

1 INTRODUCTION

Green banking refers to banking institutions' efforts

to promote environmental sustainability. Green

banking practices have been adopted by numerous

foreign banks and financial institutions worldwide,

and some have even included them in their annual

reports. Presently, the adoption of green banking

within domestic banking remains a voluntary

initiative and is not yet mandated (Rahmah & Fitriani,

2016). Therefore, green banking must be widely

implemented to help companies improve their

ecological footprint.

Green banking is a concept that aims to motivate

banking institutions to decrease environmental

pollution and generate environmental advantages

(Setyoko & Wijayanti, 2022). As indicated by the

Green Banking Report referenced in Zaputra, (2021),

banks are not solely concentrated on their financial

obligations for efficiently running their businesses to

maximize shareholder profits, but they also give

precedence to their duty of conserving the environment

and improving the societal welfare of the populace.

A bank's effectiveness depends on its ability to

maintain a high level of profitability. The bank's

a

https://orcid.org/0000-0003-1727-5791

continuous efforts to enhance public trust and manage

surplus funds can lead to this achievement (Azizah,

2021). Profitability, as indicated by its value, correlates

directly with the level of financial performance: higher

profitability scores signify stronger financial

performance, making it a valuable metric for

evaluating financial health (Rachmawati & Jayanti,

2023). The findings from previous research studies

conducted by Gunawan et al., (2022), Anggraini et al.,

(2020), and Saryani, (2013) emphasize a detrimental

effect of operating costs and operational income on

profitability. Sudarsono (2017) investigated and found

a positive correlation between operating costs and

operational income with Return on Assets (ROA),

despite these results being different.

The research findings of Nadi, (2016) and

Gunawan et al., (2022) indicate that Non-Performing

Loans (NPL) exert a negative impact on profitability.

However, these results are in contrast to the

conclusions drawn from Sigid, (2014) study, which

suggests a positive relationship between NPL and

profitability. On the other hand, the research

conducted by Gunawan et al., (2022), Dana, (2019)

and Nadi, (2016) demonstrate a positive correlation

between Net Interest Margin (NIM) and profitability.

128

Riadi, S. and Anggrayni, E.

Green Banking Disclosure, Financial Performance, and Profitability: Evidence from Indonesian Bank.

DOI: 10.5220/0012646700003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 128-135

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Nonetheless, these outcomes stand in opposition to

the outcomes of Saryani, (2013) research, which

asserts a negative influence of NIM on profitability.

Research conducted by Anggraini et al., (2020),

Ratnasari et al., (2021), Saudi, (2021), and Hanif et

al., (2018) collectively suggest that green banking

policies yield a positive impact on profitability.

Nevertheless, the outcomes of this study are at odds

with the research conducted by Rachmawati &

Jayanti, (2023), which concludes that the disclosure

of green banking practices does not exert a significant

influence on profitability.

This research is from the development of

Gunawan et al., (2022) with the title "The Effect of

Operational Costs, Operating Income, Non-

Performing Loans, and Net Interest Margins on the

Profitability of State-Owned Banks Listed on the

Indonesia Stock Exchange in 2009-2018" and Hanif

et al., (2018) with the title "Green Banking on the

Profitability of Islamic Commercial Banks in

Indonesia". The researcher added an extra variable,

Green Banking Disclosure, and incorporated research

data from 2014 to 2021.

The implementation of green banking and its

impact on profitability in the banking sector will be

influenced by this research, which is expected to

contribute to existing references. In this study, the

indicators utilized include the green banking

indicator, specifically the green coin indicator, and

various financial ratios in the banking industry.

2 LITERATURE REVIEW AND

HYPOTHESES

DEVELOPMENT

According to Pranaditya, (2017), the signal theory

posits that an entity is obligated to furnish signals to

users of financial statements. These signals

materialize in the form of details regarding

managerial endeavors aimed at fulfilling the owner's

aspirations. The signalling theory holds that

shareholders and management are not given equal

access to company information. The act of delivering

signals to external parties encompasses the provision

of precise financial particulars, the alleviation of

uncertainty regarding the company's future prospects,

and the mitigation of information asymmetry

(Triyanto, 2019).

The central idea of legitimacy theory is that an

entity has an intrinsic responsibility to ensure its

operations align with appropriate frameworks and

standards within its social context. This commitment

guarantees that the entity's activities are

acknowledged within legal boundaries (Iqbal, 2020).

The emergence of legitimacy theory is rooted in the

challenge of establishing social cohesion between

entities and their environment, as these entities'

objectives harmonize with prevalent societal values.

An entity gains legitimacy when its conduct and

value system align with the broader social fabric of

the community it operates within Zaputra, 2021. In

the context of legitimacy theory, a company must

consistently demonstrate its adherence to social

norms while conducting its business affairs. Financial

statement disclosures frequently serve as instruments

to attain this objective.

Drawing from prior research findings, specifically

the study conducted by Gunawan et al., (2022), it was

revealed that the correlation between the Non-

Performing Loans to Net Interest Margin ratio

exhibits a positive impact on ROA (Return on

Assets), whereas the Operating Costs to Operational

Income ratio demonstrates a negative influence on

ROA. Additionally, the research conducted by Hanif

et al., (2018) posited that the implementation of green

banking policies has a positive effect on profitability.

Further insights from Sudarsono, (2017)

investigation highlight the affirmative relationship

between Operating costs, operational income, and

ROA. In contrast, Saryani, (2013) study indicated a

negative association between Operating Costs and

Operational Income and ROA, while conversely

noting a positive correlation between NIM and ROA.

The research of Nadi, (2016) underpins the notion

that NPL negatively impacts ROA while NIM

positively contributes to its enhancement. Building

on Dana, (2019), it is reaffirmed that NIM exerts a

favourable influence on ROA.

Research by Anggraini et al., (2020) asserts that

green banking exerts a positive influence on ROA,

while simultaneously highlighting the negative impact

of Operating Costs Operational Income on ROA.

According to the Saudi study of 2021, green banking

and ROA have a positive connection, which is echoed

by this sentiment. However, a distinct perspective

arises from the research conducted by Rachmawati &

Jayanti, (2023), indicating that green banking

disclosure does not significantly affect profitability.

The Impact of Green Banking Disclosure on

Profitability (ROA)

Legitimacy theory states that a company should align

its operations with environmental policies, such as the

go-green program, that are aimed at conserving

nature. Such policies can increase investor confidence

and financial support for the business. This alignment

Green Banking Disclosure, Financial Performance, and Profitability: Evidence from Indonesian Bank

129

is corroborated by the affirmative findings of

Anggraini et al., (2020), Saudi, (2021), and Hanif et

al., (2018) regarding the positive impact of green

banking on profitability. Building upon this theory

and prior research, the first hypothesis is formulated:

H1: Green banking disclosure positively affects

profitability.

The Impact of Net Interest Margin on Profitability

(ROA)

Investors rely on financial performance ratios as

indicators of a company's health. The Net Interest

Margin (NIM) is an informative signal that reflects a

bank's ability to manage interest rate risk. Higher

NIM scores indicate greater contributions to loan

income and effective third-party fund management,

as supported by Amalia & Budhi, (2014). Notably,

the research of Gunawan et al., (2022), Dana, (2019),

and Nadi, (2016) underscores the favourable link

between NIM and profitability. Guided by these

insights, the second hypothesis is posited:

H2: Net Interest Margin has a positive effect on

profitability.

The Impact of Non-Performing Loan on

Profitability (ROA)

The theory of signaling emphasizes that companies

provide financial information signals that aid in

evaluating their performance. The Non-Performing

Loan (NPL) ratio is a crucial indicator of credit risk

control. Elevated NPL values suggest increased credit

risk, potentially reducing interest income and profits,

as noted by Manikam, (2013). The result of Gunawan

et al., (2022), and Nadi, (2016) further substantiate

the adverse impact of NPL on profitability. Drawing

on these foundations, the third hypothesis is

formulated:

H3: Non-Performing Loans have a negative effect

on profitability.

The Impact of Operating Costs Operational

Income on Profitability (ROA)

The company's prospects are conveyed to

management through the use of signals. One such

signal is operating costs and operational income,

which reflect a bank's efficacy and competence in its

operations, which in turn influences profitability. The

research of Yatna, (2019) aligns with this view,

demonstrating the inverse relationship between

Operating Costs Operational Income and ROA. This

sentiment is reaffirmed by Gunawan et al., (2022),

and Saryani, (2013), thereby leading to the

formulation of the fourth hypothesis:

H4: Operating Costs Operational Income

negatively affects profitability.

3 RESEARCH METHODS

The research approach employed by the author in this

study is quantitative research. This approach utilizes

descriptive statistical techniques to delve into specific

social phenomena characterized by distinct attributes,

elucidated through various variables and indicators.

The study's target population consists of state-owned

banks that have been listed on the Indonesian Stock

Exchange (IDX) between the years 2014 and 2021.

The entire population encompasses four state-owned

banking entities; BNI, BRI, BTN, and Mandiri banks.

For sampling purposes, a purposive sampling

technique was adopted, guided by specific criteria.

These criteria stipulated that selected banks must

qualify as State-Owned Enterprises (BUMN) in

Indonesia and must possess comprehensive and

available financial reports spanning the designated

study period (2014-2021).

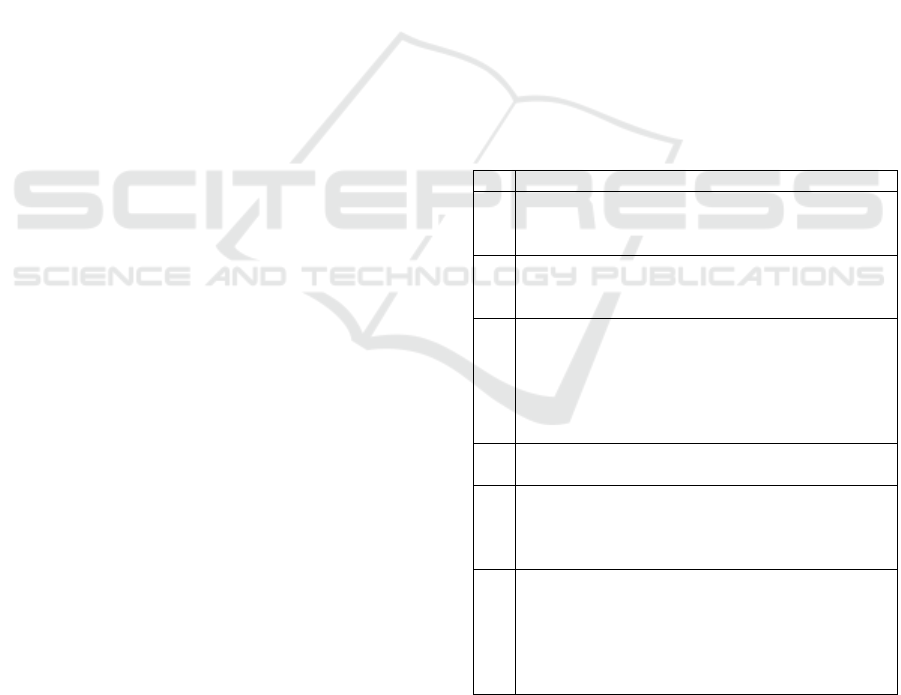

Table 1: Green Coin Ratings Indicator.

No

Indicator

1

Green Rewards:

a. Recognition/Awards

b. Certification

2

Carbon Emission:

a. Development of Bio fuels

b. b. Electricity Usage

3

Green Building:

a. Energy Conservation

b. Efficient Water Usage

c. Waste Management

d. Strengthening Connection with Nature

e. Building Renovation

4

Reuse, Recycle, and Refurbish: Waste Upcycling

into Products

5

Paper Work/Paperless:

a. Smartphone App Usage

b. ATM, Debit, Credit Card Utilization

c. c. Computerized Programs

6

Green Investment:

a. Implementation of Water and Air Projects

b. Use of Environmentally Friendly Input

Materials

c. Low-Carbon Technologies

d. Alternative Energy Usage

Measurement of Operational Variables

Green banking is implemented through the

examination of the yearly financial reports of state-

owned banks. The analytical process employs

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

130

indicators that are relevant to green banking practices.

The formulation employed to quantify Green Banking

within this study is as follows (Hanif et al., (2018).

𝐺𝐵 = 𝑇𝑜𝑡𝑎𝑙 𝑏𝑎𝑛𝑘𝑠 𝑖𝑛 𝑡ℎ𝑒 𝑎𝑝𝑝𝑙𝑖𝑐𝑎𝑡𝑖𝑜𝑛 𝑜𝑓/𝐺𝑅𝐼 (1)

The subsequent indicators are encompassed

within the table 1 for Green Coin Rating (Hanif et al.,

2018):

The generation of net interest income by bank

management's effective oversight of productive

assets is known as Net Interest Margin (Khairunnisa,

2012). A higher NIM signifies a more substantial

contribution from credit-related earnings, coupled

with a diminished prevalence of non-performing

loans. This corelation indicates proficient

management of external funds (Amalia & Budhi,

2014):

𝑁𝐼𝑀 = 𝑁𝑒𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐼𝑛𝑐𝑜𝑚𝑒/𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑣𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 (2)

Non-Performing Loans, represents a ratio that

depicts a bank's competence in managing credit

allocation fraught with adversity, issues, and adverse

outcomes. The composition of the total financing

attributed to long-term funding is gauged through

Non-Performing Loans. A NPL ratio exceeding 5% is

poised to exert an influence on the bank's solvency

(Amalia & Budhi, 2014):

𝑁𝑃𝐿 = 𝐵𝑎𝑑 𝐷𝑒𝑏𝑡/𝑇𝑜𝑡𝑎𝑙 𝐶𝑟𝑒𝑑𝑖𝑡 (3)

The efficiency ratio, denoted as Operating Costs

Operational Income, serves as a gauge for assessing a

bank's adeptness in overseeing operational expenses.

The bank's management's performance improved

when the Operating Costs Operational Income ratio

decreased (Amalia & Budhi, 2014).

𝐵𝑂𝑃𝑂 = 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠/𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 (4)

4 RESULT AND DISCUSSION

Descriptive Statistics

The population data for this study comprises state-

owned banking enterprises, totalling four companies,

namely BNI, BRI, BTN, and Mandiri banks, all of

which have been listed on the IDX for an eight-year

period. Presented below is a table illustrating the

outcomes of the descriptive statistical tests:

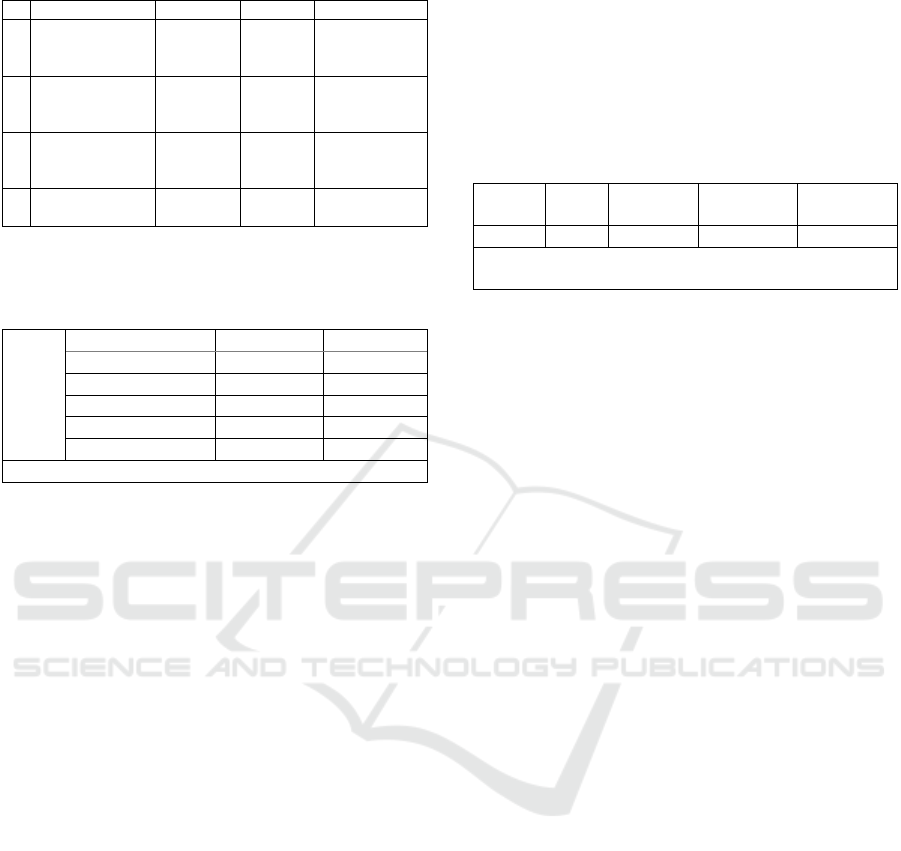

Table 2: Result of Descriptive Statistical Test.

Descriptive Statistics

N

Min

Max

Mean

Std.

Deviation

Green

Banking

32

.19

1.00

.7628

.18418

NIM

32

3.06

8.51

5.6659

1.37419

NPL

32

.40

2.96

1.1984

.69795

BOPO

32

64.98

98.12

76.3753

9.19871

ROA

32

.13

4.73

2.4337

1.14029

Valid N

(listwise)

32

The variable Green Banking (X1), as evaluated

through ROA, demonstrates a range from a minimum

of 0.19 to a maximum of 1.00, with an average Green

Banking score of 0.7628. The accompanying table

provides data related to green banking, showing a

standard deviation of 0.18418. On the other hand, the

variable Net Interest Margin (X2), assessed using

ROA, reveals a range from a minimum of 3.06 to a

maximum of 8.51, with an average of 5.6659. The

standard deviation for NIM data is 1.37419.

The variable Non-Performing Loan (X3), as

measured by ROA, has a range from a minimum of

0.40 to a maximum of 2.96, with an average of

1.1984. The standard deviation for NPL data is

0.69795. In contrast, the variable Operating Costs

Operational Income (X4), also assessed via ROA, has

a range from a minimum of 64.98 to a maximum of

98.12, with an average of 76.3753. The standard

deviation for the Operating Costs Operational Income

data is 9.19871. As for the Return on Assets (Y)

variable, the data indicates a minimum value of 0.13,

a maximum value of 4.73, and an average of 2.4337,

with a standard deviation of 1.14029.

Classical Assumption Testing

In order to identify classic assumption problems in a

linear regression model, it is necessary to perform a

set of classic assumption tests. This research utilizes

several classic assumption tests, encompassing tests

for normality, multicollinearity, autocorrelation, and

heteroscedasticity. Presented below is a table

illustrating the outcomes of the classic assumption

tests:

Green Banking Disclosure, Financial Performance, and Profitability: Evidence from Indonesian Bank

131

Table 3: Classical Assumption Test

No

Test

Tools

Sig.

Results

1

Normality

Kolmogorov

-Smirnov

0,13

The data follows

a normal

distribution

2

Multicollinearity

Tolerance/V

IF

0,8/

1,1

There is no

evidence of

multicollinearity

3

Autocorrelation

Durbin

Watson

DW>DU

dan

DW<4-DU

Autocorrelation

is absent

4

Heteroscedasticity

Scatter Plot

Spread

Heteroscedasticit

y is not observed

Hypothesis Testing

Table 4: Hypothesis Test Results (T-Test).

1

Model

t

Sig.

(Constant)

12.322

.000

Green Banking

.208

.837

NIM

8.826

.000

NPL

3.568

.001

BOPO

-13.937

.000

a. Dependent Variable: ROA

Regarding the t-test results conducted above, it is

observed that the significance value for the green

banking variable is 0.837, which exceeds the

conventional threshold of 0.05. Furthermore, the

computed t value is less than the critical t-table value:

0.208<2.052. Consequently, this leads to the rejection

of the hypothesis. The interpretation suggests that

green banking does not have a discernible impact on

ROA.

Conversely, in the case of the NIM variable, the

significance value is 0.000, falling below the 0.05

threshold, and the computed t value surpasses the

critical t-table value: 8.826>2.052. Consequently, the

hypothesis is upheld, indicating that NIM indeed

exerts a positive influence on ROA.

Similarly, the significance value for the NPL

variable is 0.001, which falls below the 0.05

threshold, and the computed t value exceeds the

critical t-table value: 3.568>2.052. The hypothesis

has been refuted, which indicates that NPL has a

positive impact on ROA. Likewise, for the Operating

Costs Operational Income variable, the significance

value is 0.000, which is less than 0.05, and the

computed t value is lower than the critical t-table

value: -13.937<2.052. The hypothesis is confirmed,

indicating that ROA is negatively impacted by

Operating Costs Operational Income.

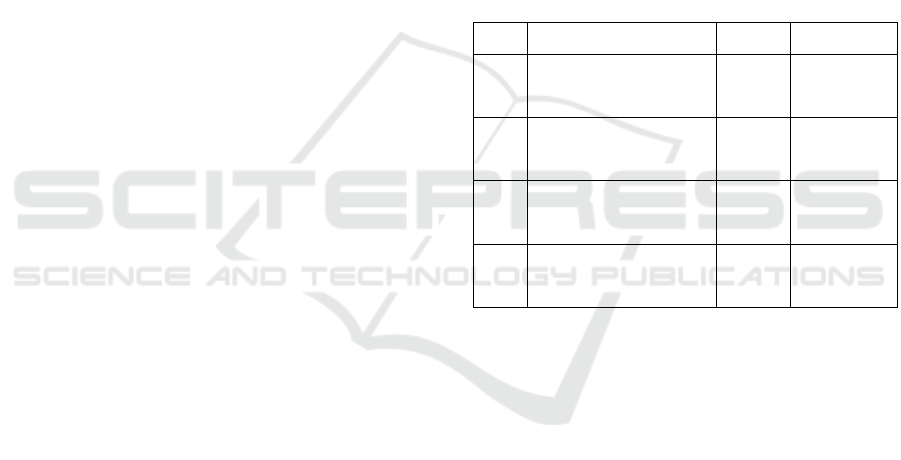

Determination Coefficient Test

The coefficient of determination test is utilized to

assess the accuracy of regression analysis. The

coefficient of determination ranges between 0 and 1

(0 ≤ R

2

≥ 1). A value of 1 signifies that the

independent variable almost entirely accounts for the

information regarding the dependent variable. In

simpler terms, a higher (R

2

) percentage indicates a

stronger relationship of the independent variable with

the dependent variable (Amalia & Budhi, 2014):

Table 5: Result of Determination Coefficient.

Model

R

R Square

Adjusted R

Square

Std. Error of

the Estimate

1

.990a

.980

.977

.17311

a. Predictors: (constant), BOPO, Green Banking, NPL,

NIM

Based on the table above, the coefficient value of

R Square (R

2

) is 0.980 or 98%. This indicates that the

combined impact of Green Banking, NIM, NPL, and

Operating Costs to Operational Income variables on

ROA is substantial, accounting for 98%.

Profitability (Return on Assets) is Positively

Influenced by the Disclosure of Green Banking

Practices

The initial hypothesis was tested and the results

indicate that green banking has no impact on

profitability. The outcomes of the hypothesis testing

reveal a significance value of 0.837, which is greater

than 0.05, and the calculated t-value is less than the

critical t-table value of 0.208 < 2.052. This suggests

that there is no significant influence between green

banking and profitability in state-owned banks in

Indonesia from 2014 to 2021.

The findings of this study are reinforced by the

research conducted by Nanda & Bihari, (2012).

Banks have tried to implement green banking

practices, but they have not been successful in

improving company profitability. This substantiates

the conclusion that there is no significant correlation

between green banking and profitability.

The outcomes of this study align with prior

research conducted by Rachmawati & Jayanti,

(2023), indicating the absence of an impact from

green banking disclosure on profitability. The

banking sector has a relatively low level of green

banking data disclosure, which averages around 70%

of the total green banking disclosure indicators.

However, the conclusions of this study contrast with

those of Hanif et al., (2018), who suggest that green

banking, as proxied by Green Coin Ratings (GCR),

has a favourable influence on profitabilitys.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

132

Profitability (Return on Assets) is Positively

Influenced by Net Interest Margin (NIM)

The results of hypothesis testing demonstrate a

positive impact on profitability. Upon examining the

test results, with a significance value of 0.000,

indicating a value less than 0.05, and a positive

coefficient of 8.826, it can be inferred that Net

Interest Margin has a positive impact on the

profitability of state-owned banks in Indonesia from

2014 to 2021. This underscores the fact that both

favourable and unfavourable financial performances

of banks are affected by their capacity to generate

profits. Enhancing the NIM ratio results in an

augmentation of the bank's financial performance.

This study corroborates the findings of previous

research conducted by Gunawan et al., (2022), Dana,

(2019), and Nadi, (2016), all of which affirm the

positive influence of Net Interest Margin (NIM) on

profitability. Nonetheless, the conclusions drawn

from this study diverge from the research conducted

by Pranaditya, (2017), which posits a negative impact

of NIM on profitability.

Profitability (Return on Assets) is Adversely

Influenced by Non-Performing Loans (NPL)

The hypothesis testing results indicate a positive

impact on profitability. Based on the findings from

the hypothesis testing, which show a significance

value of 0.001, lower than 0.05, and a positive

coefficient of 3.568, it can be concluded that there is

a positive relationship between Non-Performing

Loans and the profitability of state-owned banks in

Indonesia from 2014 to 2021. The presence of bad

loans leads to a decrease in bank efficiency, which

ultimately results in inefficiency due to the inability

to repay loan principal and interest. As the magnitude

of bad loans increases, the likelihood of the bank

incurring losses rises, consequently lowering

profitability.

This study aligns with the findings of Sigid,

(2014) research, which establishes a positive

relationship between the NPL ratio and profitability.

Nadi's 2016 research asserts that NPL has a negative

impact on profitability, but this study's conclusions do

not support this claim.

The Profitability (Return on Assets) is Adversely

Affected by Both Operating Costs and Operating

Income

The outcomes of hypothesis testing indicated a

detrimental impact on profitability. Drawing from the

results of hypothesis testing, which exhibit a

significance value of 0.000, less than 0.05, and a

negative coefficient of 13.937, it can be deduced that

there exists a negative correlation between Operating

Costs to Operational Income ratio and profitability in

Indonesian state-owned bank companies spanning

from 2014 to 2021. This suggests that improved

operational efficiency within a bank leads to more

profits for the company, which in turn improves the

bank's financial performance.

This study aligns with the findings of research

conducted by Gunawan et al., (2022), Anggraini et

al., (2020), and Saryani, (2013), all of which assert a

negative impact of the Operating Costs to Operational

Income ratio on profitability. However, the

conclusions derived from this study are at odds with

Sudarsono, (2017) research, which asserts a positive

influence of the Operating Costs to Operational

Income ratio on profitability, as measured by Return

on Assets (ROA).

Table 6: Summarize Research Conclusion.

No

Hypothesis

Sig.

Results

1

Effect of Green Banking

Disclosure on

Profitability (ROA)

0,837

No influence

2

Effect of NIM on

Profitability (ROA)

0,000

There is a

positive

influence

3

Effect of NPL on

Profitability (ROA)

0,001

There is a

positive

influence

4

Effect of BOPO on

Profitability (ROA)

0,000

There are

negative

influences

5 CONCLUSIONS

Drawing upon the outcomes of an extensive study

investigating the interplay between green banking

disclosure, financial performance, and banking

profitability within Indonesia's state-owned banks

spanning the period of 2014 to 2021, the empirical

evidence derived from hypothesis testing reveals a

notable absence of any discernible impact stemming

from green banking practices on the bottom-line

profitability. This absence of effect can be attributed

to the prevailing scenario of relatively modest green

banking data disclosure within the banking sector,

with an average attainment of merely 70% across the

entirety of the green banking disclosure indicators.

Based on the second hypothesis, the hypothesis

test results demonstrate a significant and positive

correlation between Net Interest Margin and

profitability. This underscores the pivotal role of the

bank's profit generation capability in shaping both

Green Banking Disclosure, Financial Performance, and Profitability: Evidence from Indonesian Bank

133

favourable and unfavourable financial performance

trajectories. The shown positive impact implies that

an increase in the NIM ratio directly leads to an

improvement in the bank's overall financial

performance.

Regarding the third hypothesis, the outcomes of

the hypothesis testing reveal a favourable correlation

between Non-Performing Loans and profitability. In

this context, bad credit leads to a decline in bank

efficiency, which results in inefficiency caused by

failure to meet loan principal and interest obligations.

The escalating magnitude of non-performing loans

directly accentuates the likelihood of the bank

incurring losses, thereby inversely impacting

profitability by causing a reduction in its value.

Regarding the fourth hypothesis, the results of

hypothesis testing indicate a detrimental impact of the

Operating Costs to Operational Income ratio on

profitability. This signifying that when the bank's

operational endeavours are executed with heightened

efficiency, the resultant profits accrued by the

institution are poised to exhibit greater magnitudes,

thereby catalysing a consequential enhancement in

the bank's overall financial performance.

Limitations and Suggestions

The study's limitations are due to its reliance on green

banking and green investment indicators, resulting in

a significantly limited sample size. Consequently, the

scope of the researchers' conclusions is confined

solely to banking entities. To enhance the study's

breadth, forthcoming scholars could incorporate a

more comprehensive array of Indonesian banking

institutions, with a specific focus on Regional

Development Banks. Moreover, these researchers

might explore alternative methodologies, such as the

Green Banking Disclosure Index (GBDI) devised

(Bose et al., 2017) to fortify their investigative

framework.

REFERENCES

Amalia, P. S., & Budhi, S. (2014). Pengaruh CAR, NPL,

BOPO, LDR dan NIM Terhadap Profitabilitas pada

Perbankan. Jurnal Ilmu Dan Riset Manajemen, 8(7), 1–

20.

Anggraini, D., Aryani, D., & Prasetyo, I. B. (2020).

Analisis Implementasi Green Banking Dan Kinerja

Keuangan Terhadap Profitabilitas Bank Di Indonesia

(2016-2019). JBMI (Jurnal Bisnis, Manajemen, Dan

Informatika), 17(2), 141–161.

https://doi.org/10.26487/jbmi.v17i2.11264

Azizah, N. U. R. (2021). Pengaruh Kinerja Keuangan Dan

Ukuran Perusahaan Terhadap Financial Distress Pada

Perusahaan Sub Sektor Pembiayaan Yang Terdaftar

Pada Bursa Efek Indonesia ….

http://repository.teknokrat.ac.id/3635/%0Ahttp://repos

itory.teknokrat.ac.id/3635/3/b218411093.pdf

Bose, S., Khan, H. Z., Rashid, A., & Islam, S. (2017). What

drives green banking disclosure ? An institutional and

corporate governance perspective.

https://doi.org/10.1007/s10490-017-9528-x

Dana, N. L. P. S. I. M. (2019). Pengaruh Loan To Deposit

Ratio, Net Interest Margin dan Inflasi terhadap

Profitabilitas. 8(11), 6509–6532.

Gunawan, D., Soleh, J., & Adrianto, N. (2022). Pengaruh

Biaya Operasional Pendapatan Operasional, Non-

Performing Loan, dan Net Interest Margin terhadap

Profitabilitas Bank BUMN yang terdaftar di BEI tahun

2009-2018. 2(2), 209–218.

Iqbal, F. (2020). Analisis Pengaruh Green Banking

Terhadap Profitabilitas Pada Bank Umum Syariah di

Indonesia. 1–82.

http://dx.doi.org/10.1016/j.encep.2012.03.001

Khairunnisa, A. (2012). Pengaruh Loan To Deposit Ratio,

Biaya Operasional Pendapatan Operasional dan Net

Interest Margin terhadap Profitabilitas Perusahaan

Perbankan yang terdafar di Bursa Efek Indonesia.

12(September), 165–183.

Manikam, J., & Syafruddin, M. (2013). Analisis Pengaruh

Capital Adequacy Ratio (CAR), Net Interest Margin

(NIM), Loan To Deposit Ratio (LDR), Non Performing

Loan (NPL) dan BOPO Terhadap Profitabilitas Bank

Persero di Indonesia Periode 2005-2012 (Doctoral

dissertation, Fakultas Ekonomika dan Bisnis).

Nadi, L. (2017). Analisis Pengaruh CAR, NPL dan NIM

Terhadap Profitabilitas Perbankan Yang Terdaftar Di

Bursa Efek Indonesia. Jurnal Ilmiah Akuntansi

Universitas Pamulang, 4(2), 268496.

Nanda, S., & Bihari, S. C. (2012). Profitability in banks of

India : an impact study of implementation of green

banking. 6(3), 217–225.

Ningsih, N. W., Hanif, H., & Iqbal, F. (2020). Green

Banking Terhadap Profitabilitas Bank Umum Syariah

Di Indonesia. Fidusia: Jurnal Keuangan Dan

Perbankan, 3(2).

Ariyanti, I., Paramita, P. D., & Pranaditya, A. (2017).

Pengaruh CAR, NPF, NIM, BOPO, dan DPK terhadap

Profitabilitas dengan FDR Sebagai Variabel

Intervening (Studi Kasus Perbankan Umum Syariah

Tahun 2011-2014). Journal Of Accounting, 3(3).

Rachman, A. A., & Saudi, M. H. (2021). Green Banking

And Profitability ( Banks Registered On The Sri-Kehati

Index In Indonesia Stock Exchange 2015 - 2019 ).

12(8), 473–486.

Rachmawati, S., & Jayanti, D. (2023). Pengaruh Human

Capital , Green Banking Disclosure dan Likuiditas

terhadap Profitabilitas. 20(1), 1–15.

Rahmah, D. A., & Fitriani, D. (2016). Analisa Penerapan

Green Banking Pada PT Bank Negara Indonesia,Tbk.

Academia.Edu.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

134

Rahman, A., & Zaputra, R. (2021). Pengaruh Implementasi

Green Banking , Corporate Social Responsibility

terhadap Nilai Perusahaan pada Perusahaan Perbankan

yang terdaftar di BEI. Jurnal Ekonomi, Bisnis,

Manajemen Dan Akuntansi, 18(2), 36–59.

Ratnasari, T., Surwanti, A., & Pribadi, F. (2021).

Implementation of green banking and financial

performance on commercial banks in indonesia.

International Symposia in Economic Theory and

Econometrics, 28(March 2021), 323–336.

https://doi.org/10.1108/S1571-038620210000028018

Saryani, D. (2015). Analisis Capital Adequacy Ratio, Non-

Performing Loan, Net Interest Margin, Biaya

Operasional, Loan to Deposit Ratio, Ukuran

Perusahaan terhadap Profitabilitas Bank Umum di

Indonesia yang Terdaftar pada Bursa Efek

Indonesia. Journal Of Accounting, 1(1).

Saudi, A. A. R. M. H. (2021). Bank Terdaftar Pada Indeks

Sri-Kehati Di Bursa Efek Indonesia 2015 - 2019 ) Laba

/ Rugi Setelah Taksiran Pajak - Bank Umum Kinerja

Bank Umum. 12(8), 473–486.

Setyoko, S. S., & Wijayanti, R. (2022). Green Banking Dan

Kinerja Bank: Mekanisme Corporate

Governance. Eqien-Jurnal Ekonomi Dan Bisnis, 10(1),

502-512.

Sigid, A. (2014). Analisis Pengaruh Kredit dan Non-

Performing Loan (NPL) Terhadap Profitabilitas pada

Bank Umum Milik Pemerintah (Studi Kasus : PT.Bank

Rakyat Indonesia, (Persero) Tbk. Periode Tahun 2011-

2013).

Sudarsono, H. (2017). Analisis Pengaruh Kinerja Keuangan

terhadap Profitabilitas Bank Syariah di Indonesia.

Economica: Jurnal Ekonomi Islam, 8(2), 175–203.

https://doi.org/10.21580/economica.2017.8.2.1702

Triyanto, A. A. N. D. N. (2019). Pengaruh Kinerja

Lingkungan dan Pengungkapan Lingkungan Terhadap

Profitabilitas Perusahaan (Studi Empiris Pada

Perusahaan Pertambangan yang Terdaftar di BEI Tahun

2015-2017). JASa (Jurnal Akuntansi, Audit, Dan

Sistem Informasi Akuntansi), 3(1), 14–26.

Yatna, T. A. dan C. N. (2019). Pengaruh Non-Performing

Loan, Loan to Deposit Ratio, Net Interest Margin,

Biaya Operasional Pendapatan Operasional dan Capital

Adequacy Ratio terhadap Profitabilitas Bank Umum

Konvensional Buku 4 Periode 2012-2016. 4(1), 133–

144.

Zaputra, A. R. R. (2021). Pengaruh Implementasi Green

Banking, Corporate Social Responsibility terhadap

Nilai Perusahaan pada Perusahaan Perbankan yang

terdaftar di BEI. 18(2), 36–59.

Green Banking Disclosure, Financial Performance, and Profitability: Evidence from Indonesian Bank

135