Intellectual Capital as Sustainable Competitive Advantage in Business

Performance

Prima Aprilyani Rambe

1 a,*

, Azhar Maksum

2

, Erlina

3

and Zulkarnain

4

1

Department of Accounting, Faculty Economic and Business, Universitas Sumatera Utara, Indonesia

2

Department of Accounting, Faculty of Maritime Economic and Business, Universitas Maritim Raja Ali Haji,

Kepulauan Riau, Indonesia

3

Department of Accounting, Faculty of Economic and Business, Universitas Sumatera Utara, Indonesia

4

Faculty of Psychology, Universitas Sumatera Utara, Indonesia

Keywords: Business Performance, Human Capital, Organizational Capital, Relational Capital.

Abstract: The objective was to do an analysis of how intellectual capital could have a competitive advantage for

sustainability business performance in the Riau islands. This research utilized human capital, organizational

capital, and customer capital to create intellectual capital. There were 179 respondents to answered the

questionnaire. The study employed the Partial Least Squares (PLS) method for data analysis. Human,

organizational, and relational capital are the keys to companies achieving competitive advantage and

sustainable business performance. The research findings have resulted in the organization prioritizing human

capital, which has led to a concerted effort to enhance and cultivate employees' knowledge and abilities. It

affected the company's productivity and influenced business performance. Imitating human knowledge and

skill is a difficult task and the most important resource for the company. Meanwhile, organizational capital

and customer capital do not affect the business performance of Riau Island. The COVID-19 pandemic had a

significant impact on several countries, including Indonesia, with a special focus on Riau Island. Most

companies in Riau Island experienced changes in work systems and structures in their business activities.

Intellectual capital is a critical and valuable asset for company innovation and human growth through the

exchange of information. Investment in intellectual capital produces a greater competitive advantage, which

influences the success of an organization. Increased company performance has an influence on business and

economic sustainability, particularly for the inhabitants of the Riau archipelago.

1 INTRODUCTION

It is necessary to balance industrial growth in the Riau

Islands with the contribution of business actors in

promoting and enhancing business performance. The

involvement of commercial entities is manifested in

their investments in the Riau Islands. Riau Island was

ranked in the top ten in Indonesia for foreign and

domestic investment in 2019 and 2020. Riau Islands

are one of the maritime areas that have economic

potential. This can be seen from the increase in

domestic investment and foreign investment in Riau

Island. To observe the presence of Riau Island,

simply refer to the table provided below.

a

https://orcid.org/0000-0001-5037-7621

*

Postgraduate student

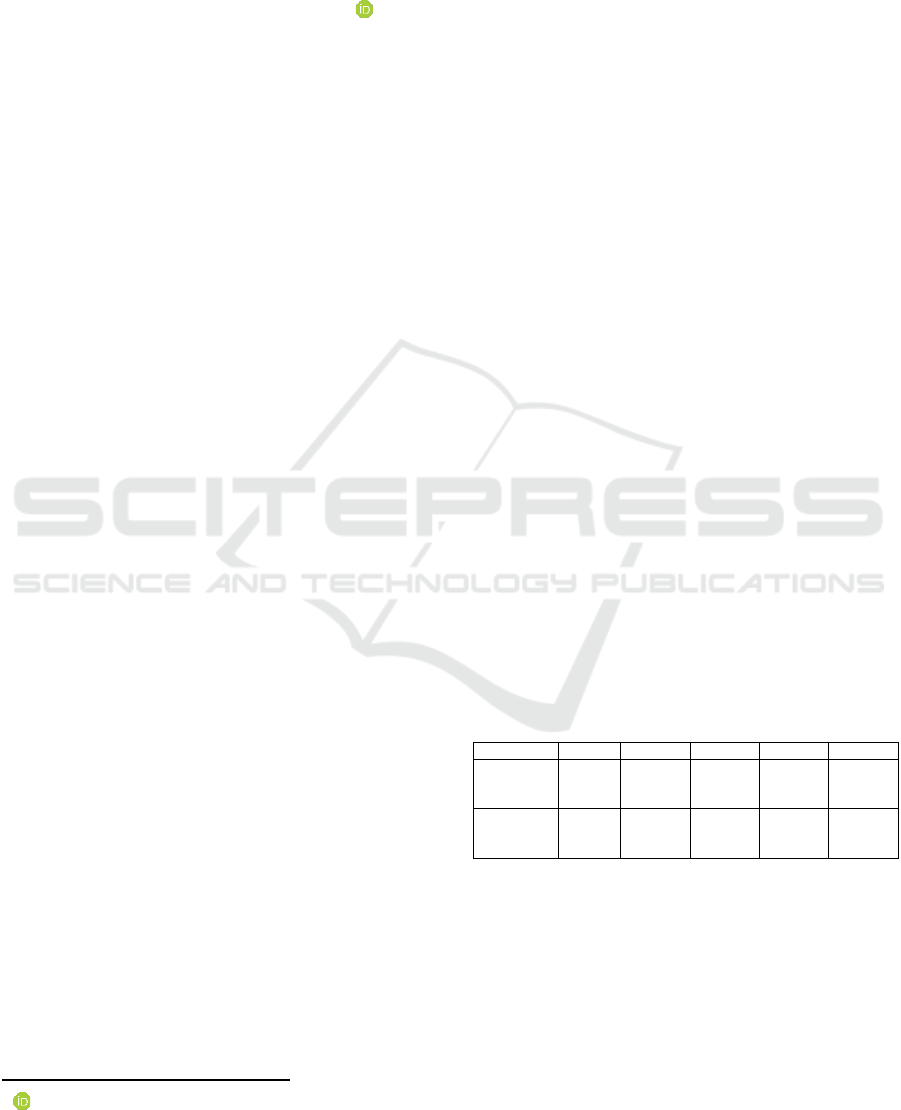

Table 1: Foreign and Domestic Investments.

Description

2017

2018

2019

2020

2021

Foreign

Investment

(million USS)

1.031,5

831,25

1.363,40

1.649,40

1.044,70

Domestic

Investment

(billion Rp)

1.398,0

4.385,98

5.656,40

14.249

9.768,70

source: bps.go.id

The impact of investments in Riau Island has led

to the establishment and growth of many companies

to advance economic development. The company’s

goal for its business activities is to maximize profit

and further expand the business. Companies must

have dynamic capabilities to achieve these goals.

Dynamic capabilities involve skills, business

Rambe, P., Maksum, A., Erlina, . and Zulkarnain, .

Intellectual Capital as Sustainable Competitive Advantage in Business Performance.

DOI: 10.5220/0012649800003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 167-177

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

167

processes, work procedures, organizational structure,

government or company rules, decision making, and

work discipline. This ability was a difficult thing to

do for developing and using in a competitive business

(Ginesti et al., 2012).

Business performance discusses the results of

organizational activities or investments over a certain

period, which includes financial and non-

financial/operational performance. Investment

caused many companies to be established and grow,

advancing development and the economy. A

company's growth will result in competition between

companies "highly and tightly". High competition

causes every company to have a competitive

advantage for having unique products and services.

Making the appropriate decisions in business will

determine the enterprise's viability and continuity.

The achievement of business success is contingent

upon the ability to detect, capture, and manage threats

and change reality. Managers must be able to make

and decide the right decisions in their business.

Resource management systems can provide

information needed by companies to make decisions.

Managers could sense and help the company become

more established in the future by restructuring.

The dynamic capability was related to more than

managerial decision-making. The dynamic capability

optimizes business by using emotions to achieve

ultimate goals. This goal sets for winning the

competition in business. The dynamic capability

approach was part of the theory of the Firm. This

approach explains that the company can compete by

managing and empowering its resources. These

resources must be had the uniqueness. The

acquisition of unique resources by companies can be

achieved through learning, research, and

development.

The industrial revolution of 4.0 has changed the

business model in the industrial sector. This change

could improve business performance by up to 20-50

percent higher than before. The 4.0 industry practice

was thought to efficiently boost productivity and

quality. It was impacted to produce innovative

products and services and competitive advantage.

(Asiaei et al., 2018a) stated that companies with

high intellectual capital use a diagnostic and

interactive approach in performance measurement

that ensures a balanced assessment. The study that

was undertaken by (Asiaei et al., 2018a),

Relational/customer capital only affected mission-

based performance in a cooperative company. The

economic and social performance of cooperative

enterprises is influenced by human capital. Structural

or organizational capital did not affect social

performance, but it correlated with human and

relational capital, as well as customer capital.

Research outcomes (Ginesti et al., 2018) concluded

the concept of intellectual capital has been identified

as having a significant effect on measures of most

monetary ratios. Companies that maintain their

reputation tend to use intellectual capital efficiently.

The research results of (Dzenopoljac et al., 2017)

provide ambiguous outcome information.

Organizational and physical capital exert a substantial

influence on revenue and profitability. Human

resources capital influenced market efficiency and

performance.

The Result of (Scafarto et al., 2016) suggested that

Human resources and Innovation capital must be

viewed as interdependent resources within the

intellectual capital component. These interdependent

resources create strategies for coordinating

investments. It produced different resources that

would affect company performance. The research

results (Mention & Bontis, 2013) concluded that

human resources capital had contributed to business

performance in Belgium's banking sector.

Organizational and customer capital did not relate to

business performance. Research conducted by

Komnenic and Pokraj<unk>i<unk> (2012) stated that

the positive relationship seen was solely attributed to

human capital and correlated with performance

measures. According to the findings of (Mehralian et

al., 2012), presence of complex connection between

intellectual resources and monetary performance.

The study of (Campos et al., 2022a) showed that

intellectual resources (human, organizational and

customer capital) has a bearing on financial

outcomes. Furthermore, this only occurs secondarily,

via a chain that acts as a mediator, which may be

represented using the variables dynamic capabilities,

network competence, technical skills, absorptive

capacities, and innovative performance. Research by

Suraj and Bontis in 2012 showed that hypotheses

regarding human, structural, and customer capital

were investigated to examine their effects on business

performance. According to findings, Nigerian

telecoms businesses predominantly majority

prioritized the utilization of customer investment

capital, as demonstrated through the utilization of

market research and the implementation of customer

relationship management strategies, companies may

enhance their overall performance. Based on previous

studies, we can observe inconsistencies in research

results. This research was conducted because of

inconsistent results.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

168

2 THEORETICAL FRAMEWORK

The Concept of the Firm was one of “Neo-Classical”

theories to answer the company and all its problems.

This theory emerged because of the weakness of the

Neo-Classical theory. A firm's theory is a collection

of economic and organizational models that covers

fundamental issues of economics and strategic

management. Fundamental questions about economic

activities and management strategies, such as “Why

did the company exist?; What is the definition of a

demarcation line separating company and

commerce?; How might one of the proprietors run the

company? if proprietor and management disagree on

settling the company's problem?; how to manage the

company to achieve efficiency, and how could the

company continue to grow and develop?; how could

the company develop and maintain its competitive

advantage? (Teece, 2016).

The theory that emerged from companies that take

advantage of complementarity is the dynamic

capability framework. Dynamic capability refers to

the organizational capacity for integrating,

constructing, and adapting both internal and external

resources and assets in a flexible manner, hence

enabling the organization to respond and evolve over

time. The Dynamic Competency Framework is still

not fully developed as a business theory. The dynamic

competency approach is crucial for transaction costs,

business resources, and knowledge. Dynamic

capability not only explained why the company

existed but also explained sustainable growth and

competitive advantage.

The dynamic capability approach provided a

comprehensive overview of the Firm's theory, with a

focus on how to overcome the weaknesses of the

Agency's Theory. This approach emphasizes the roles

and responsibilities of managers in maintaining and

developing an organization’s ability and sustaining

improvement (Teece, 2016). The risk of self-serving

managers' behavior was addressed, but the concern

was with building capabilities and managing certain

assets in the company. Proper incentive systems and

oversight by the board of directors were the thing to

do. Managers and experts gave incentive designs as a

form of appreciation for the innovation and

contribution of workers' creativity (Teece, 2011);

(Bucak et al., 2023).

Dynamic capability's framework identifies

opportunities and threats, and secures the

combination of tangible and intangible assets. The

identification would allow it to meet customer needs

and develop business models that would create a

competitive advantage. The competitive advantage

created must be inimitable because it was a major

factor in maintaining business growth and survival.

Making a competitive advantage involves people and

their capabilities(Teece, 2014).

Dynamic capability's approach emphasizes asset

availability, asset development, asset combinations,

and asset redistribution. Intangible or non-current

assets could not be traded. An example of this asset

was a company that used certain types of knowledge

that could not be patented to potential users. Users

used those assets, i.e., intangible assets, without

obtaining a license. Because assets were not

transferable, business transactions could not occur.

This could encourage companies to choose a business

model that uses technology more than a knowledge-

based business model. Business individuals must

possess assets to conduct business transactions and

sell products by leveraging knowledge to achieve

profitability.

The advantage of a company's dynamic capability

determines how quickly a company's specific

resources can be adapted to the company's needs, that

permanently change every time. Combining specific

resources with the right strategy can create a robust

dynamic capability in the form of competitive

advantage. Companies with a competitive advantage

can compete with other companies because their

products and services create the interests and criteria

of customers. The competitive advantage created will

lead to the development of chances of an

organization's survival (Shih-Yi Chien & Tsai, 2012).

Resource-based theory shows that advantage in

competition and the company's performance resulted

from the company's specific resources and

capabilities that competitors could not imitate easily

Dynamic capability and resources could be essential

factors in creating a sustainable competitive

advantage. The performance of a company would be

better if it had unique traits, such as valuable

resources. Valuable resources were not easily

imitated and replaced, increasing company activities'

efficiency and effectiveness(Theriou, 2002);

(Campos et al., 2022). Resource-based theory

attempts to comprehend the reason why companies

expand and diversify. This theory grew based on

research conducted by Penrose in 1959. Penrose

acknowledged that internal managerial resources

were both the driver and the limit of expansion that

could be carried out by a single company (Lowe &

Teece, 2001; Hamdoun, 2020).

The resource-based theory emphasised essential

resources that maintained the company's market

value, and also, resources were difficult to replicate

for other companies. These resources included

Intellectual Capital as Sustainable Competitive Advantage in Business Performance

169

managerial capabilities, customer relations, brand

reputation, and specific knowledge of a particular

manufacturing process. Resources differed from

competence or ability, which is the ability to mobilize

and combine resources by determining the company's

competence in certain product areas. Companies

collected resources for doing business, which could

be in different product lines or markets. Some of these

resources would maintain excess capacity over the

period because units' products in one area were

inconsistent across the areas (Lowe & Teece, 2001;

Hamdoun, 2020).

The resource-based theory identifies and exploits

strategic capabilities such as resources and

competencies. This capability was an essential source

of competitive advantage in determining a company's

success. Intellectual capital was a competitive

advantage contained in resource-based theory.

Intellectual capital includes employing skilled

workers, owning trademarks, technological know-

how, machines, trade contracts, efficient procedures,

capital, Etc. Crystals and Bontis (2007) and

Wernerfelt (1984) explained that intellectual capital

had dimensions like human resources, and structural

or organizational capital has been recognized as an

essential part of strategic resources(Kengatharan,

2019).

Successful conventional strategic choices and

managerial techniques needed to be improved to reap

competitive advantages in a dynamic environment

showing globalization, technological advancements,

and product life cycle instability. Knowledge-based

theory holds that intellectual capital has significantly

contributed to the creation of sustainable competitive

advantages with lower costs, high innovation and

creativity, efficiency and customer benefits as well.

as the overall performance of the organization

(Kengatharan, 2019).

The global marketplace was constantly changing

to knowledge and technological innovation and

looking for methods or techniques to enhance

competitive advantage. Intellectual capital was

identical to intangible assets and knowledge capital

(Maditinos et al., 2010); (Campos et al., 2022b)

Intellectual resources hold significant importance

thing of an enterprise's investment. Intellectual

capital that has created long-term monetary,

pragmatic, social, and financial performance values

has increased in the corporate market.

Intellectual capital is a potential benefit that

cannot be taken by others or imitated by competitors.

The company's dynamic capability through learning,

research, and development of the company's

resources could be measured by intellectual capital

performance. It could also be related to the

management role. The company's management

continued to motivate workers so that workers

continued to enhance the value of the intellectual

capital company. Companies continuously identify

certain intellectual capital items and categorize this

intellectual capital. The company's investment in

human resources, organizational, and customer

capital was a result of that. The investment's purpose

was to increase the firm’s value and competitiveness.

If the company has invested in intellectual capital, the

company will achieve a higher competitive advantage

than competing companies. Suppose a company

invested in intellectual capital and used it as a

competitive advantage that was difficult for

competitors to imitate. In that case, the company

could improve its business performance and survival.

Kaplan & Norton (1996) assumed the business

performance would experience a positive influence

by measuring critical organizational aspects of

prosperity including intellectual capital (Asiaei et al.,

2018b).

Human resources investment is carried out on an

ongoing and continuous basis to increase the

capability to maintain knowledge as a sustainable

advantage. However, the investment in human

resources is relatively inexpensive over a certain

period. The costs incurred are a burden to the

company. One of these costs includes replacement

costs incurred every time a worker quits or leaves the

company (Olander et al., 2015).

Human resources imply employees' skills to apply

their accumulated knowledge to business problems

(Örnek & Ayas, 2015). Human resources have been

lot of discussed as a critical aspect of sustainable

advantage. Human resources are essential in

explaining performance differences in each company.

Human resources are generally referred to as human

capital. Human capital includes workers' knowledge,

skills, and abilities to provide an economic

company’s value (Scafarto & Dimitropoulos, 2018).

Knowledge-based resources provide insight into the

essential elements of knowledge to establish and

maintain a company's sustained competitive edge in

the long run. The involvement of intellectual

resources is a company resource in innovating and

developing human capital through sharing

knowledge, creating competitive advantage (Sardo &

Serrasqueiro, 2017).

Most researchers consider human capital to be an

important construct of the knowledge capital

component. Research results by (23);(24);(25), and

(Nimtrakoon, 2015), have consistently documented

that human resources on monetary outcomes.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

170

Meanwhile, the results of research carried out by

(Firer & Mitchell Williams, 2003) found a negative

effect of human resources on the stock market as a

measure of a firm's financial performance and overall

productivity as a non-financial performance

measurement (Scafarto & Dimitropoulos, 2018).

H1: The impact of human capital on corporate

performance

Organizational capital was a tangible resource that

reflected the organizational and structural design of

the unique processes and businesses that created

sustainable competitive advantage. Structural or

Organizational capital, which includes capabilities

and knowledge, blends human skills and physical

capital. Venieris et al. argued that conditions of

declining sales and companies have higher capital

took actions by using more unwanted resources.

According to Bontis (1998), intellectual capital

can only reach its potential if the organization has the

right systems and processes in place. Organizations

possessing robust structural capital would cultivate a

culture that encourages individuals to engage in novel

endeavors, such as learning and failing. The ability to

assess intellectual capital at the organizational

analysis level was facilitated by the existence of

organizational capital, which played a crucial role in

this undertaking. Structural or Organizational capital

was analogous to a corporate structure.

Organizational capital ensures that business activity

achieves and develops its goals (Örnek & Ayas,

2015). Organizational capital had to stay and be left

in the organization when personnel left the

organization. Organizational capital is derived from

the organization's processes and values that reflect the

company's internal and external and its value for

innovation and growth for the future.

Resource-based theory explains that the

ownership of strategic resources gives an

organization a competitive advantage over its

competitors. Valuable resources helped companies to

create unique strategies, take advantage of

opportunities, and mitigate threats. Resources could

not be substituted when the possibility of resources

provided alternative ways of obtaining the benefits.

Scarce resources provided a strategic advantage for

the company. Competitors found that resources were

very hard to duplicate and imitate. Copyrights,

patents, and trademarks are among the legal

protections that pertain to these resources.

If the company tried to compile organizational

knowledge, it would develop structural capital

further. If structural capital grew further, it would

gain a competitive advantage. This competitive

advantage turned into business performance, and the

company had a higher value in business performance

(Bontis et al., 2000); (Ibarra Cisneros & Hernandez-

Perlines, 2018).

Research findings (Komnenic & Pokrajčić, 2012)

showed the relationship between capital structure and

Return on Equity. Companies had a high value of

organizational capital for development because the

investment saw an enhancement in intangible

resources. The research of (Sharabati et al., 2010)

showed there was sufficient and supportive evidence

in Jordanian pharmaceutical companies that the

management of intellectual capital such as human,

structural/organizational, and relational/customer

resource capital effectively affects enterprise

performance (Komnenic & Pokrajčić, 2012) showed

that only structural capital positively influenced

Return on Equity (ROE) for measuring financial

performance (Mention & Bontis, 2013) showed that

structural/organizational and customer capital were

adversely correlated with business performance.

H2: The impact of organizational capital on corporate

performance is evident.

Miller (1999) concluded that organizations could

be compared closely by creating relational or

customer capital indicators. Duffy (2000), the

measurement of relationship or customer capital as

the role customers play in an organization's current

and future revenue. It emphasized the need for a new

economic environment and the transition from a

customer-centric to a product-centric economy.

(Hosseini & Owlia, 2016)

The element of intellectual capital that is most

widely recognized is customer resource capital.

Relationship capital or customer capital can be easily

and quickly measured with financial metrics.

However, this factor is considered to be the worst

element of intellectual capital. Effective customer or

relationship capital management is intricately to a

precise and discerning assessment of knowledge,

customer interaction, and the conveyed value (Örnek

& Ayas, 2015).

Every business activity carried out by the

company has customer capital or a relationship with

the customers. The concept in question functions as a

conduit connecting human resources and

organizational capital. Relational or Customer capital

arose because customers conducted business

transactions with the company. Relational capital is

based on knowledge hidden in the external

relationships of a firm. (Relationships between

customers, suppliers, government, or related

industries) (Örnek and Ayas, 2015). The primary

topic of relational capital is knowledge about

Intellectual Capital as Sustainable Competitive Advantage in Business Performance

171

channels of marketing and customer relationships

(Bontis, 1998).

Documented studies and evidence empirical have

confirmed the significance of intellectual property for

customer/relational capital in establishing a

sustainable competitive edge, enhancing overall

performance, and maximizing investment return

(RO() more as a measure of financial performance

(Hosseini & Owlia, 2016). It was the concept of

Resource-based theory. Resource’s theory explains

how necessary specific resources. Resources

maintained the company's market value, and other

resources were hard to imitate for other companies.

These resources included managerial capabilities,

customer relations, brand reputation, and knowledge

of specific manufacturing processes (Lowe & Teece,

2001).

Research (Hosseini & Owlia, 2016) tried to find

indicators for relational or structural capital. They

understood how to measure and manage relational or

customer capital. Companies identified and measured

relational or customer capital indicators that pose a

much lower threat from competitors who steal power

in their relationships with stakeholders.(Thi Mai Anh

et al., 2019) Results demonstrated relational capital

can enhance the process of information

dissemination, and benefits/risks as companies work

together to innovate. (Mubarik et al., 2016) showed

that the quality of relational or customer capital was

essential for client loyalty in Pakistan’s

pharmaceutical sector. Customer satisfaction turned

out to have the most significant impact on the loyalty

of their attitudes and behavior. Research by (Asiaei et

al., 2018b) showed that human and relational or

customer capital contributed to explaining the

company's performance using mission-based

performance.

The performance of individual tasks exhibited a

favorable correlation with annual training, value

added per employee, and the quality of customer

relationships within the domain of human resources

and relational capital.

H3: The impact of customer capital on corporate

performance

3 RESEARCH METHODOLOGY

3.1 Population

Constituents of the population were the symptoms or

units researchers will study (Priyono, 2016). All items

in any question field constitute the population (C. R.

Kothari, 2004). The population was a whole group of

entities that could be people, events, or objects with

specific characteristics related to the research

problem. This research population was all companies

located on the Riau Islands.

3.2 Sample

The sample was chosen from the population under

study in order to estimate or predict the degree of

dissemination of anonymous information, situations,

or results about the larger group. The sample was a

subgroup of the research population that had an

interesting to be studied (Kumar, 2011). The sample

of this study is big and middle-companies located in

the Riau Islands. There are 179 companies spread

across the Riau Islands. Respondents in this study are

Chief Financial Officers. The Chief Financial Officer

is one of the middle managers tasked with

determining the efficacy of the organization.

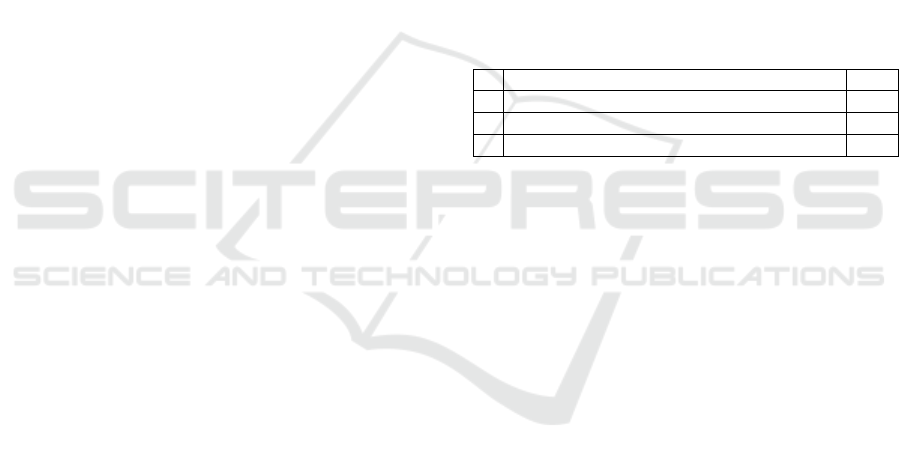

Table 2: Data Collection.

No

Description

Total

1.

Questionnaire Accepted

179

2

Questionnaire not returned

(34)

3

The questionnaire can be processed

145

3.3 Variable Measurement

Two variables were used in this study. Business

performance is the endogen variable and intellectual

capital is the exogen variable. Business performance

was measured by using financial and non-financial

performance indicators. Intellectual capital was

measured using human, organizational, and customer

capital. The process of data collecting is typically

facilitated through the use of questionnaires.

Measurement of the variables of this study using a

Likert scale with five scales. The Partial Least Square

(PLS) technique was employed for data analysis.

Partial Least Squares is an equation model for

structural equation modeling (SEM) based on

components or variations (Erlina et al., 2018) and

(Astrachan et al., 2014). Partial Least Squares

analysis typically includes two constituting

submodels: measurement models and structural

models (Ghozali & Latan, 2015).

A measurement model was utilized for testing the

validity construct and reliability instrument. The

extracted mean-variance (AVE) was used to test the

validity of the structure with a value greater than 0.6.

Utilizing Cronbach's alpha, one can assess the

dependability of the device with a value greater than

0.7. The structural model is evaluated using R

2

for the

dependent structure, the path coefficient value, or the

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

172

t-value for each path to check the significance level

between the structures within the framework of the

structural paradigm. R square is used to measure the

changes variability from exogenous to endogenous

factors. The higher the R

2

value, the better the

prediction model of the proposed research model.

4 ANALYSIS

4.1 Questionnaire

The respondents of this study described all

respondents from the selected sample. One hundred

seventy-nine respondents should answer all the

questionnaires. However, only 145 persons

responded to the questionnaire, and 34 persons still

needed to respond or answer the questionnaire sent.

4.2 Test Results of Data Instruments

The table below shows that the value of all variables

is more significant than 0.50 because it is feared. It

can be decided that all variables meet the criteria of

validity’s discriminant.

Table 3: Discriminant Validity.

Variables

Average Variance

Extracted (AVE)

Criteria

Business

Performance

0.616

Valid

Human Capital

0.537

Valid

Customer Capital

0.526

Valid

Organizational

Capital

0.6

Valid

The average value of the extraction variance

(AVE) for each character, the value of the appropriate

model, must be greater than 0.5. It showed that a good

model.

Table 4: Cronbach’s Alpha.

Variables

Composite Reliability

Criteria

Business

Performance

0.926

Reliable

Human Capital

0.952

Reliable

Customer Capital

0.947

Reliable

Organizational

Capital

0.956

Reliable

In addition to the construct validity test, the

construct dependency test was also carried out, and

analyzed by Cronbach. Assemble was reliable if

Cronbach occurred above 0.70 (Ghozali & Latan,

2015). The following was Cronbach’s value of each

variable in this study.

The table above explains that each variable had a

Cronbach alpha value above 0.70. The construct is

very reliable.

Structural model evaluated the independent

variables using R-Square for and t-test and significant

structural path parameter coefficients. Table 5 below

shows the R-square value as follows:

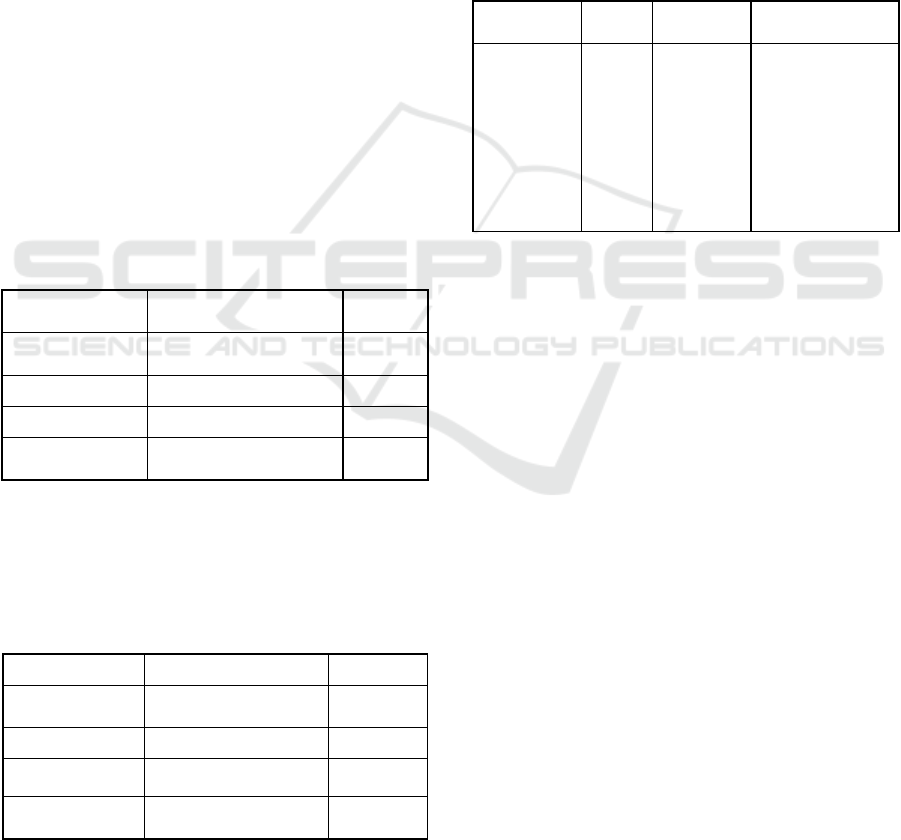

Table 5: R- Square Coeficient.

Variable

R-square

Adjusted R-

square

Description

Business

Performance

0.464

0.453

46.4% of Business

Performance

variables can be

explained by

intellectual capital

variables while

53.6% are

influenced by other

variables.

Next, the coefficient of the path estimation study

method is carried out in this research. The research

theory test is related to this analysis. In general, the

research hypothesis is approved if the absolute

superiority of the t-table > 1.96, the proposed research

hypothesis following whether the coefficient is

positive or negative in sign. The t-test is designed to

assess the extent to which the independent factors

have a statistically significant impact on the

dependent variable. The results of the assumed model

are in Table 6. The following will be explained

below: Next, the coefficient of the path estimation

study method is carried out in this research. The

research theory test is related to this analysis. In

general, the research hypothesis is approved if the

absolute superiority of the t-table > 1.96, the proposed

research hypothesis following whether the coefficient

is positive or negative in sign. The t-test is designed

to assess the extent to which the independent factors

have a statistically significant impact on the

dependent variable. The results of the assumed model

are in Table 6. The following will be explained

below:

Intellectual Capital as Sustainable Competitive Advantage in Business Performance

173

Table 6: Research Hypothesis.

Variables

Original

sample

(O)

Sample

mean

(M)

Standard

Deviation

(STDEV)

T- Statistics

(|O/STDEV|)

P-

Values

Human Capital

-> Business

Performance

0.676

0.660

0.138

4.736

0,000

Customer

Capital ->

Business

Performance

0.051

0.071

0.129

0.391

0.696

Organizational

Capital ->

Business

Performance

-0.043

-0.034

0.122

0.356

0.722

The influence of variable relationships, as in

Table 6, can be explained as follows:

1. Impact of human capital on business performance

The influence of human capital on business

performance is substantial, as evidenced by a T-

statistic value of 4.736, which exceeds the critical

value of 1.96, and a p-value of 0.000, which is less

than the significance level of 0.05. The original

sample estimate exhibits a positive value of 0.676,

indicating a positive direction of effect from the

independent variable of human capital on the

dependent variable of business performance is

positive.

2. The impact of Organizational capital on Business

Performance

The impact of organizational capital on company

performance is found to be statistically unimportant,

as indicated by a T-statistic value of 0.356, which is

less than the critical value of 1.96, and a p-value of

0.722, which is greater than the significance level of

0.05. The initial estimated value is -0.043, indicating

a negative relationship between Organizational

capital and business performance.

3. Effect of Customer capital on business

performance

Based on the T-statistic value of 0.391 < 1.96 and the

p-value of 0.696 > 0.05, it can be concluded that there

is no significant impact of customer capital on

business performance. Based on the positive initial

sample estimate value of 0.051, it can be concluded

that the customer capital variable exerts a positive

influence on business performance.

5 DISCUSSION

The findings of this study indicate that there exists a

positive and statistically significant relationship

between human capital and company performance

indicators. This outcome is consistent with the results

of research undertaken by (Chen et al., 2005); (Clarke

et al., 2011); (Maditinos et al., 2011), and

(Nimtrakoon, 2015) consistently report financial

performance that is enhanced by human capital. The

concept of a knowledge-based resource view

recognizes the importance of intellectual resource

investment because long-term competitive advantage

and value generation of an organization are impacted

by its knowledge assets. The acquisition of

intellectual capital is vital for corporate innovation

and human development through knowledge sharing

(Sardo & Serrasqueiro, 2017). In today's knowledge

business era, continuous investment in human

resources is required to augment capabilities and

sustain a competitive edge, particularly inside

knowledge-intensive environments (Chatterjee,

2017). Nevertheless, the investment is a considerable

expense obliged to the company. This includes

replacement expenses accrued each time the worker

leaves the Company (Olander et al., 2015). This is

evident from the findings of this study: learning and

education indicators that an organization

demonstrates a significant commitment to enhancing

and cultivating the knowledge and abilities of its

personnel via dedicated time and effort. This can be

seen in its effect on company productivity.

Meanwhile, Organizational capital has no effect

and is not significant on business performance. This

finding aligns with previous research (Asiaei et al.,

2018b), showing the impact of relational capital

appears to be limited to mission-based performance,

while human capital has an influence on both aspects

of business performance. The performance of social

cooperatives is not influenced by organizational

capital. The results of research (Mention & Bontis,

2013) concluded contribution of human capital to

company performance within the banking sector is

evident. There was no discernible correlation between

organizational and customer capital and business

performance. Research conducted (7) stated that only

human resources positively related to company

performance measurement. The findings of the

research undertaken for each indication, that the

company's recruitment program needs to be more

comprehensive to recruit the best candidates. The

company might need help determining the

appropriate budget for research and development.

This may be due to the unfavorable economic

conditions in Indonesia due to the COVID-19

outbreak, which has impacted all of the company's

business activities.

The impact of customer capital on corporate

performance is negligible and lacks significance. This

study is consistent with the results of studies carried

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

174

out by (Mention & Bontis, 2013), concluding that

human capital contributed to business performance in

the banking sector. Organizational and customer

capital was not related to business performance.

Research conducted (Komnenic & Pokrajčić, 2012)

stated that only human resources positively related to

company performance measurement. One indicator

of customer capital showed the lowest value of the

strategic alliance. It showed that companies only

worked on a joint project with a few other

organizations. However, companies maintained long-

term relationships with suppliers.

6 CONCLUSION

The resource-based theory has demonstrated the

relationship between competitive advantage and

corporate performance resulting from the company's

specific resources and capabilities that competitors

could not easily imitate. Resources and capabilities

could be essential factors of sustainable competitive

advantage and superior company performance if they

had specific characteristics. Valuable resources,

increasing efficiency, and effectiveness could not be

easily imitated perfectly and substituted (Campos et

al., 2022b).

Intellectual capital was the potential advantage

that could not be taken by others or imitated by

competitors. The company's dynamic capability

through learning, research, and development of the

company's resources could be measured by

intellectual capital performance. It also must be

connected to the role of management. Management

should motivate employees to have ways to increase

intellectual capital’s value. The company identified

intellectual capital items and then categorized and

invested in human, organizational, and customer

capital. The purpose of investing in intellectual

capital was in order to add value to the company. If

the company has already invested in intellectual

capital (human capital, organizational capital, and

customer capital), the company will achieve a higher

competitive advantage. If intellectual capital was

used in the right direction and the company advanced

its elements of intellectual capital, not separately and

independently. However, as interrelated topics,

intellectual capital could succeed in business

performance.

Based on the research results and arguments

above, the researchers drew subsequent conclusions

about intellectual capital. Human capital has strongly

influenced business performance in companies on

Riau Island. Meanwhile, organizational and

Customer capital have not influenced business

performance in companies on Riau Island. The

limitations of this study are that researchers only use

the dimensions of financial and non-financial

performance to measure a company's business

performance.

First, the authors thank the Ministry of Education

and Culture, Research and Technology for the

doctoral dissertation research grant. Second, the

authors would like to thank my dissertation

supervisor for correcting and commenting on my

doctoral dissertation, Prof. Dr. Azhar Maksum,

M.Ec.Ac., Ak., CA., CMA., CPA; Prof.Erlina, SE.,

M.Si., Ph.D., Ak, CA, CMA, CRSA, CPA, and Dr.

Zulkarnain, Ph.D., Psikolog. Third, I would like to

thank the institution where I studied the doctoral

program, Universitas Sumatera Utara, and the

institution where I worked, Universitas Maritim Raja

Ali Haji, Tanjungpinang, Kepulauan Riau.

REFERENCES

Asiaei, K., Jusoh, R., & Bontis, N. (2018a). Intellectual

capital and performance measurement systems in Iran.

Journal of Intellectual Capital, 19(2), 294–320.

https://doi.org/10.1108/JIC-11-2016-0125

Asiaei, K., Jusoh, R., & Bontis, N. (2018b). Intellectual

capital and performance measurement systems in Iran.

Journal of Intellectual Capital.

https://doi.org/10.1108/JIC-11-2016-0125

Astrachan, C. B., Patel, V. K., & Wanzenried, G. (2014). A

comparative study of CB-SEM and PLS-SEM for

theory development in family firm research. Journal of

Family Business Strategy, 5(1), 116–128.

https://doi.org/10.1016/j.jfbs.2013.12.002

Bontis, N. (1998). Intellectual capital: an exploratory study

that develops measures and models. Management

Decision. https://doi.org/10.1108/00251749810204142

Bontis, N., William Chua Chong, K., & Richardson, S.

(2000). Intellectual capital and business performance in

Malaysian industries. Journal of Intellectual Capital.

https://doi.org/10.1108/14691930010324188

Bucak, U., Mollaoğlu, M., & Dinçer, M. F. (2023). Port

personnel recruitment process based on dynamic

capabilities: port managers’ priorities vs customer

evaluations. Maritime Business Review, 8(3), 238–254.

https://doi.org/10.1108/MABR-01-2022-0003

Campos, S., Dias, J. G., Teixeira, M. S., & Correia, R. J.

(2022a). The link between intellectual capital and

business performance: a mediation chain approach.

Journal of Intellectual Capital, 23(2), 401–419.

https://doi.org/10.1108/JIC-12-2019-0302

Campos, S., Dias, J. G., Teixeira, M. S., & Correia, R. J.

(2022b). The link between intellectual capital and

business performance: a mediation chain approach.

Intellectual Capital as Sustainable Competitive Advantage in Business Performance

175

Journal of Intellectual Capital, 23(2), 401–419.

https://doi.org/10.1108/JIC-12-2019-0302

Chatterjee, J. (2017). Strategy, human capital investments,

business-domain capabilities, and performance: a study

in the global software services industry. Strategic

Management Journal.

https://doi.org/10.1002/smj.2505

Chen, M. C., Cheng, S. J., & Hwang, Y. (2005). An

empirical investigation of the relationship between

intellectual capital and firms’ market value and

financial performance. Journal of Intellectual Capital.

https://doi.org/10.1108/14691930510592771

Clarke, M., Seng, D., & Whiting, R. H. (2011). Intellectual

capital and firm performance in Australia. Journal of

Intellectual Capital, 12(4).

https://doi.org/10.1108/14691931111181706

C.R.Kothari. (2004). Research Methodology: Methods and

Techniques (Second Rev). New Age International (P).

Dzenopoljac, V., Yaacoub, C., Elkanj, N., & Bontis, N.

(2017). Impact of intellectual capital on corporate

performance: evidence from the Arab region. Journal

of Intellectual Capital, 18(4), 884–903.

https://doi.org/10.1108/JIC-01-2017-0014

Erlina, Tarigan, Z. A., Mulyani, S., Maksum, A., & Muda,

I. (2018). The role of conflict of interest in improving

budget quality in local government. International

Journal of Civil Engineering and Technology, 9(9),

696–707.

Firer, S., & Mitchell Williams, S. (2003). Intellectual

capital and traditional measures of corporate

performance. Journal of Intellectual Capital.

https://doi.org/10.1108/14691930310487806

Ghozali, I., & Latan, H. (2015). Partial Least Squares

Konsep, Metode dan Aplikasi Menggunakan Program

WARPPLS 4.0. Badan Penerbit Universitas

Diponegoro.

Ginesti, G., Caldarelli, A., & Zampella, A. (2018).

Exploring the impact of intellectual capital on company

reputation and performance. Journal of Intellectual

Capital, 19(5), 915–934. https://doi.org/10.1108/JIC-

01-2018-0012

Ginesti, G., Caldarelli, A., Zampella, A., Sharabati, A. A.

A., Jawad, S. N., Bontis, N., F-Jardón, C. M., Martos,

M. S., Nasir, M. A., Morgan, J., Celenza, D., Rossi, F.,

Usoff, C. A., Thibodeau, J. C., Burnaby, P., Molodchik,

M. A., Jardon, C. M., Bykova, A. A., Maditinos, D., …

Roos, G. (2012). Testing the relationship between

intellectual capital and a company’s performance:

Evidence from South Africa. Journal of Intellectual

Capital, 19(1), 212–237.

https://doi.org/10.1108/14691930910996670

Hamdoun, M. (2020). The antecedents and outcomes of

environmental management based on the resource-

based view: A systematic literature review. In

Management of Environmental Quality: An

International Journal (Vol. 31, Issue 2, pp. 451–469).

Emerald Group Holdings Ltd.

https://doi.org/10.1108/MEQ-12-2019-0280

Heinzelmann, R. (2016). Making up performance: The

construction of “performance” in venture capital firms’

portfolios. Qualitative Research in Accounting and

Management, 13(4), 445–471.

https://doi.org/10.1108/QRAM-09-2015-0078

Hosseini, M., & Owlia, M. S. (2016). Journal of Intellectual

Capital Capital Information. Journal of Intellectual

Capital, 17(4).

Ibarra Cisneros, M. A., & Hernandez-Perlines, F. (2018).

Intellectual capital and Organization performance in the

manufacturing sector of Mexico. Management

Decision, 56(8), 1818–1834.

https://doi.org/10.1108/MD-10-2017-0946

Kengatharan, N. (2019). A knowledge-based theory of the

firm: Nexus of intellectual capital, productivity and

firms’ performance. International Journal of

Manpower, 40(6), 1056–1074.

https://doi.org/10.1108/IJM-03-2018-0096

Komnenic, B., & Pokrajčić, D. (2012). Intellectual capital

and corporate performance of MNCs in Serbia. Journal

of Intellectual Capital.

https://doi.org/10.1108/14691931211196231

Kumar, R. (2011). Research Methodology: A Step-by-step

Guide for Beginners. In (Third Edit). SAGE.

Lowe, R. A., & Teece, D. J. (2001). Diversification and

Economies of Scope. International Encyclopedia of the

Social & Behavioral Sciences, 3574–3578.

https://doi.org/10.1016/b0-08-043076-7/04263-7

Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G.

(2011). The impact of intellectual capital on firms’

market value and financial performance. Journal of

Intellectual Capital.

https://doi.org/10.1108/14691931111097944

Maditinos, D., Šević, Ž., & Tsairidis, C. (2010). Intellectual

capital and business performance: An empirical study

for the Greek listed companies. European Research

Studies Journal.

Mehralian, G., Rajabzadeh, A., Sadeh, M. R., & Rasekh, H.

R. (2012). Intellectual capital and corporate

performance in Iranian pharmaceutical industry.

Journal of Intellectual Capital, 13(1), 138–158.

https://doi.org/10.1108/14691931211196259

Mention, A. L., & Bontis, N. (2013). Intellectual capital and

performance within the banking sector of Luxembourg

and Belgium. Journal of Intellectual Capital.

https://doi.org/10.1108/14691931311323896

Mubarik, S., Govindaraju, C., & Devadason, E. S. (2016).

Relational capital quality and client loyalty: firm-level

evidence from pharmaceuticals,Pakistan. The Learning

Organization, 23(1).

https://doi.org/http://dx.doi.org/10.1108/TLO-05-

2015-0030

Nimtrakoon, S. (2015). The relationship between

intellectual capital, firms’ market value and financial

performance: Empirical evidence from the ASEAN.

Journal of Intellectual Capital.

https://doi.org/10.1108/JIC-09-2014-0104

Olander, H., Hurmelinna-Laukkanen, P., & Heilmann, P.

(2015). Human resources – strength and weakness in

protection of intellectual capital. Journal of Intellectual

Capital. https://doi.org/10.1108/JIC-03-2015-0027

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

176

Örnek, A. Ş., & Ayas, S. (2015). The Relationship between

Intellectual Capital, Innovative Work Behavior and

Business Performance Reflection. Procedia - Social

and Behavioral Sciences.

https://doi.org/10.1016/j.sbspro.2015.06.433

Priyono. (2016). Metode Penelitian Kuantitatif. In Zifatama

Publishing.

Sardo, F., & Serrasqueiro, Z. (2017). A European empirical

study of the relationship between firms’ intellectual

capital , financial performance and market value.

Journal of Intellectual Capital, 18(4), 771–788.

https://doi.org/10.1108/JIC-10-2016-0105

Scafarto, V., & Dimitropoulos, P. (2018). Human capital

and financial performance in professional football: the

role of governance mechanisms. Corporate

Governance (Bingley), 18(2), 289–316.

https://doi.org/10.1108/CG-05-2017-0096

Scafarto, V., Ricci, F., & Scafarto, F. (2016). Intellectual

capital and firm performance in the global agribusiness

industry: The moderating role of human capital.

Journal of Intellectual Capital, 17(3).

https://doi.org/10.1108/JIC-11-2015-0096

Sharabati, A. A. A., Jawad, S. N., & Bontis, N. (2010).

Intellectual capital and business performance in the

pharmaceutical sector of Jordan. Management

Decision. https://doi.org/10.1108/00251741011014481

Shih-Yi Chien, & Tsai, C.-H. (2012). Dynamic capability,

knowledge, learning, and firm performance. Journal of

Organizational Change Management, 25(3), 434–444.

https://doi.org/http://dx.doi.org/10.1108/09534811211

228148 Downloaded

Suraj, O. A., & Bontis, N. (2012). Managing intellectual

capital in Nigerian telecommunications companies.

Journal of Intellectual Capital, 13(2), 262–282.

https://doi.org/10.1108/14691931211225724

Teece, D. J. (2011). Human Capital, Capabilities, and the

Firm: Literati, Numerati, and Entrepreneurs in the

Twenty-First-Century Enterprise. In The Oxford

Handbook of Human Capital (Issue June 2018).

https://doi.org/10.1093/oxfordhb/9780199532162.003.

0022

Teece, D. J. (2014). A dynamic capabilities-based

entrepreneurial theory of the multinational enterprise.

Journal of International Business Studies, 45(1), 8–37.

https://doi.org/10.1057/jibs.2013.54

Teece, D. J. (2016). The Palgrave Encyclopedia of Strategic

Management. The Palgrave Encyclopedia of Strategic

Management, 1–10. https://doi.org/10.1057/978-1-349-

94848-2

Theriou, N. G. (2002). A Theoretical Framework

Contrasting the Resource-Based Perspective. Cossma,

3(1), 24–25.

Thi Mai Anh, N., Hui, L., Khoa, V. D., & Mehmood, S.

(2019). Relational capital and supply chain

collaboration for radical and incremental innovation:

An empirical study in China. Asia Pacific Journal of

Marketing and Logistics, 31(4), 1076–1094.

https://doi.org/10.1108/APJML-10-2018-0423

Intellectual Capital as Sustainable Competitive Advantage in Business Performance

177