The Effect of M-Banking Security on Interest in Online Shopping in the

Civitas Academica of Maritime Economics and Business Faculty, Raja Ali

Haji Maritime University (UMRAH), Indonesia

Fariz Putra Pratama, Emellia Astuti, Mareskha Tiara Fitri and Inge Lengga Sari Munthe

Faculty of Economics and Business Maritime, Accounting Department, Tanjungpinang, Indonesia

ingemunthe@umrah.ac.id

Keywords: M-Banking, Security, Interest in Shopping Online.

Abstract: The growth of technology seems endless. All aspects of life today cannot be separated from technology. The

world of trade is where one of them comes from, with many traders selling their goods online. Selling online

must, of course, be supported by good service and easy payment. The development of financial technology,

such as m-banking, also contributes to the ease of payment. Not only in terms of convenience, but security is

also a factor that drives interest in online shopping. This research is aimed at determining the impact of m-

banking security on online shopping interest. This research uses a quantitative correlational method with a

sample size of 92 respondents. Data collection techniques use primary data collected through questionnaires.

This research suggests that m-banking security has an effect. significantly influence online shopping interest.

1 INTRODUCTION

The expansion of technology and information is

endless. Technology is omnipresent in every aspect

of life today. The convenience of all human activities

is greatly enhanced by this progress, so technology

cannot be avoided. Technological advances in the

world of commerce also seem not to want to be left

behind by many entrepreneurs whose business is to

sell products or services online because selling online

does not require a physical store that requires rental

fees, Therefore, entrepreneurs can set market

strategies by reducing product prices to make them

cheaper but with good quality. Supporting online

selling requires excellent customer service, such as

selling products in accordance with what is offered

and making the payment process straightforward.

According to (R. D. Irahyani, 2022), In the theory of

consumer behavior, it is explained that consumers

consume to meet a satisfaction, so consumer

satisfaction with our products is the main reason for

increasing interest in online shopping. The emergence

of stimulation after seeing a product is what leads to

buying interest according to (K. Philip, 2013).

Someone becomes interested in buying a product so

that it can be owned. The income of entrepreneurs

will increase with an increase in shopping interest,

which will also have a positive impact on economic

growth. Interest in shopping online is certainly

influenced by the services provided and the ease of

the process. The development of financial

technology, one of which is mobile banking, can also

provide this convenience.

Now that conventional banks have begun to

develop their services into the world of technology and

information, one of the bank's efforts to participate in

the development of technology is to issue a service

known as mobile banking. The purpose of mobile

banking is to make transactions effortless for

customers. The bank developed mobile banking, which

is commonly known as m-banking, to make banking

activities easier for users. M-banking is a bank service

that can be easily accessed via smartphone (O. J.

Keuangan, 2015). Therefore, m-banking can greatly

facilitate customers in making transactions;

transactions can be done very flexibly; there is no need

to come to the bank directly because all things that are

usually done at the bank directly can be done with m-

banking using a smartphone. Of course, with this

development, we will greatly save energy and time by

not having to go to the bank directly.

Despite the convenience of customers making

these transactions, there are certain things to keep in

mind. The use of PINs and mobile numbers in m-

banking can lead to crimes like mobile phone theft,

64

Pratama, F., Astuti, E., Fitri, M. and Munthe, I.

The Effect of M-Banking Security on Interest in Online Shopping in the Civitas Academica of Maritime Economics and Business Faculty, Raja Ali Haji Maritime University (UMRAH), Indonesia.

DOI: 10.5220/0012685700003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 64-68

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

mobile number hijacking, and cloning mobile

numbers. Of course, this raises concerns about

security when using m-banking (O. J. Keuangan,

2015). The interest of customers in choosing m-

banking as a tool to facilitate transaction activities is

definitely impacted by this concern. Customer trust

lies in the security that guarantees transaction

activities. (M. Lallmahamood, 2007). Therefore,

users need a guaranteed security system.

The results of security research have a significant

impact on online buying interest, as tested by (A.

Sutedjo, 2021). According to (R. Furi et al., 2020), it

was found that security affects buying interest, but the

results of research from (I. P. Baskara et al., 2012)

found that security results do not affect purchasing

decisions through social networking sites.

Therefore, based on the background described

above and the differences from the results of previous

research, we chose the title "The Effect of M-Banking

Security on Online Shopping Interest".

2 LITERATURE REVIEW

2.1 Interest in Online Shopping

According to (M. Mukhtisar et al., 2021) interest is an

abstract process of the soul which expresses itself in

all modes of activity. Some objects are considered

valuable so that they are known and desired, which

results in a strong desire for something.

The

emergence of stimulation after seeing a product is

what causes a person to become interested in buying

a product to own it, as per (K. Philip, 2013).

According to (Ahmadi dan Hermawan, 2013)

online shopping or e-commerce, involves buying

goods or services from sellers operating via the

internet. Merchants have been trying to set up online

shops and sell products to consumers since the advent

of the internet.

According to (A. Ferdinand, 2006), put forward 4

indicators that influence buying interest as follows:

1. Transactional interest, namely someone who

leads to a product.

2. Referential interest, namely people who

recommend products to others.

3. Preferential interest, to determine someone's

interest which can be described through

behavior that has a primary preference for a

particular product. This can change preferences

if something happens or changes with product

preferences.

4. Explorative interest, describes the behavior of a

person trying to explore a product by seeking

information that supports the positive side of

the product.

2.2 Definition of M-Banking

According to (O. J. Keuangan, 2015), mobile banking

allows customers to carry out banking transactions

using mobile phones. Applications that can be installed

by customers can access mobile banking services

through the SIM (Subscriber Identity Module) menu

and USSD (Unstructured Supplementary Service

Data). Mobile banking is easier to use than SMS

banking, because the customer does not need to

remember the format of the text message sent to the

bank or the banking zip code.

2.3 M-Banking Security System

According to (M. Lallmahamood, 2007) security and

privacy are customer beliefs about the assurance of

business security and the protection of personal

information.

According to (Harahap, A. Khairil,

2009) mobile banking uses 2 types of security

systems, including:

1. Cryptographic system

This system is known as a password system, of

which there are 2 types, namely symmetrical and

asymmetrical. The weakness of the symmetric

cryptography system is that the key can be sent to

the recipient and allows someone else to crack it

halfway. The weakness of the asymmetric

cryptography system is to reduce the amount of

data transfer due to adding code.

2. Firewall System

A firewall is a system that prevents unauthorized

access to protected areas of corporate

workstations. But the firewall system cannot

prevent the entry of viruses or interference by the

company.

According to (R. Arasu dan V. Annamalai, 2017)

security indicators include two things, namely:

a. Security Guarantee

When the security guarantee is acceptable and

meets expectations, customers will be willing to

disclose personal data and buy with a sense of

security because they don't have to worry about

data misuse and perishable data transactions.

b. Data Confidentiality

Data confidentiality is very important because

other people can take your data and cause harm to

the people who have it. Therefore, the

confidentiality of consumer data is very

important.

The Effect of M-Banking Security on Interest in Online Shopping in the Civitas Academica of Maritime Economics and Business Faculty,

Raja Ali Haji Maritime University (UMRAH), Indonesia

65

3 RESEARCH METHODOLOGY

T

he design used in this research is quantitative-

correlational. To identify relationships between two

or more variables without attempting to change them,

quantitative correlation research is utilized. There are

two variables in this research, namely the

independent variable (m-banking security) and the

dependent variable (interest in online shopping). The

UMRAH Faculty of Economics and Maritime

Business was the focus of this research, which

consisted of 1,025 academics. Meanwhile, the sample

collection uses a purposive sampling method based

on certain criteria. The criteria are as follows:

a. M-Banking users

b. UMRAH Maritime Economics and Business

Academic Community

Based on a population of 1,025 and an error rate

of 10%, the number of samples that can be

calculated is as follows:

n =

ଵ.ଶହ

ଵ ା ଵ.ଶହሺ,ଵሻ

మ

n =

ଵ.ଶହ

ଵଵ,ଶହ

n = 91,11

The data collection technique used is primary data

collected through questionnaires. The questionnaire

contains statements related to the research variables

in a 1–5 Likert scale measurement format. Before this

research questionnaire was delivered to respondents,

it had first been tested and declared valid through

validity and reliability tests. After the respondents

were collected, the results of the questionnaire were

tested using the classical assumption test, the

correlation and regression test, and the t test.

4 RESULTS AND DISCUSSION

4.1 Result

4.1.1 Classic Assumption Test

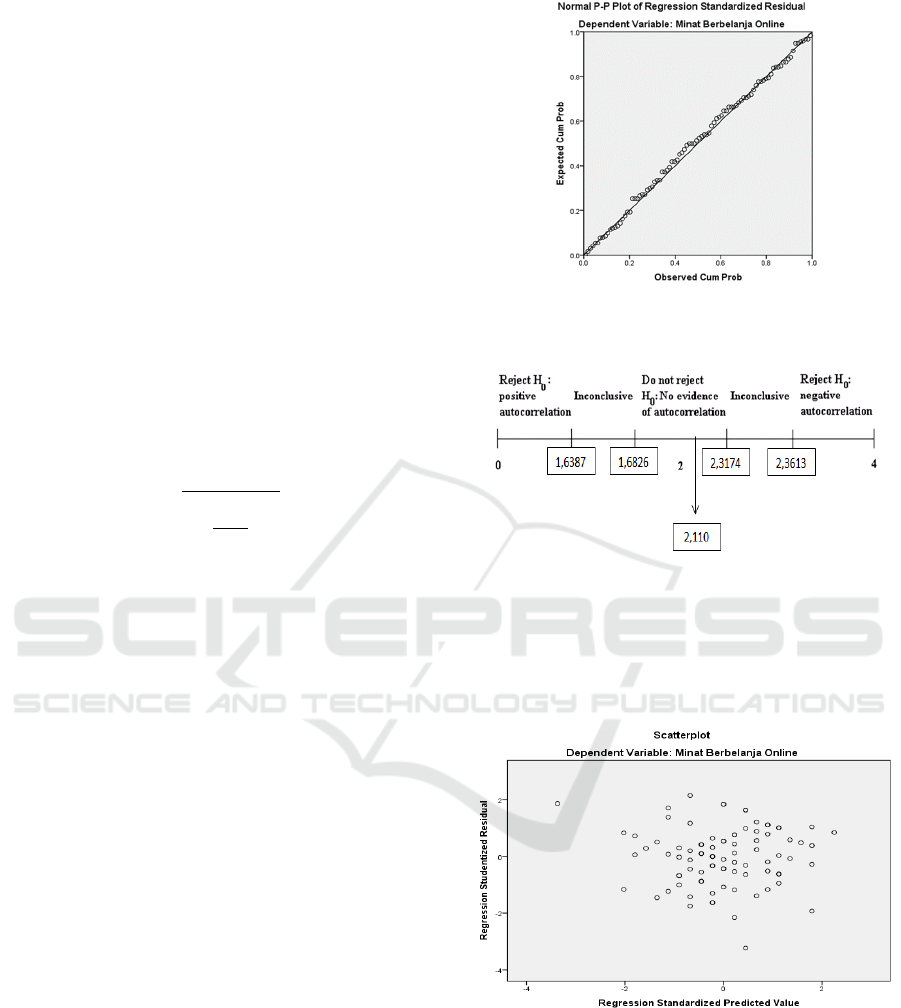

Normality Residual Test

In the residual normality test using a graph showing

the residuals are normal, the points on the graph

spread along a line following a diagonal line.

Figure 1.

Autocorrelation

Figure 2.

The Durbin-Watson autocorrelation test is in the area

of "no evidence of autocorrelation" or there is no

autocorrelation.

Heteroscedasticity

Figure 3.

This test showed no heteroscedasticity. The spreading

points in the result are irregularly patterned and

spread below and above the number 0 on the Y-axis.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

66

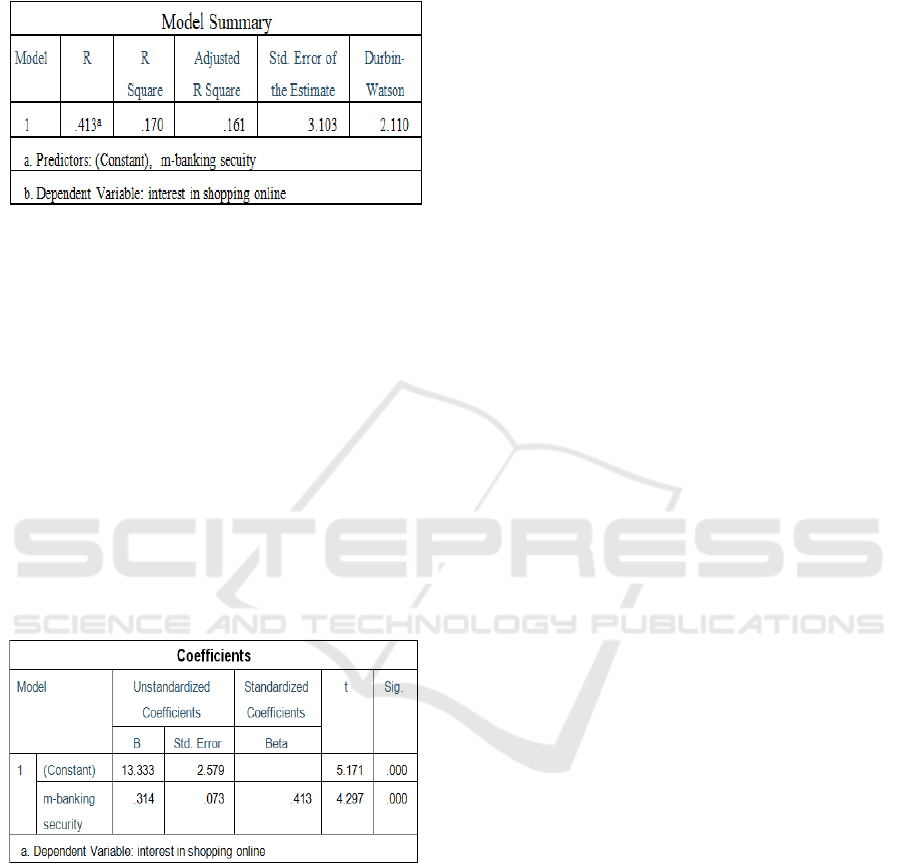

4.1.2 Regression Analysis

Coefficient of Determination

Figure 4.

The output of the summary model found an R number

of 0.413, and the R number found a sufficient

relationship between m-banking security variables

and shopping interest. Then, for R Square, it was

found that the contribution of the influence of m-

banking security variables on online shopping interest

was 0.170, or 17%, while the remaining 83% of other

variables were not contained in this model. Then in

the adjusted R square, we found a value of 0.161,

which shows the influence of the independent

variable on the dependent variable by 16.1%. Then,

in the standard error of the estimate, the value is

3.3103. So 3,103 errors in predicting online shopping

interest.

T Test

Figure 5.

The output generated from the coefficient table using

a simple linear regression equation with 1

independent variable is Y = 13.333 + 0.314X, and if

the m-banking security value is 0, then the interest in

online shopping is 13.333. Then for every increase in

m-banking security by one unit, it will increase online

shopping interest by 0.314 units and also from this

coefficient table, a t test was carried out, where the

results obtained were: if the value of t calculating m-

banking security is greater than the t table

(4.297>1.9867) and the significance is less than 0.05

(0.000 < 0.05), then Ho is rejected, so we can

conclude that m-banking security affects online

shopping interest.

4.2 Discussion

Based on the test results above:

Trusted security services, maintained personal data,

ease of knowing security measures, and concern for

the importance of m-banking service security are all

responsible for the influence. This makes users feel

comfortable while shopping, and a sense of comfort

can increase interest in shopping online.

This influence is also caused by the way this

online shopping payment is done without meeting

directly with the seller, and to use the payment

method, users must enter personal data. Without

strong payment security, this is very prone to data

leakage. If that happens, of course, interest in

shopping online will decrease. The increase in

interest in online shopping requires strong m-banking

security, which will also strengthen economic

growth.

The results of this study support previous research

by Sutedjo, A. S. (2021) and Furi, ., R., Hidayati, N.,

&; Asiyah, S. (2020), which showed that security

partially affects online shopping interest. However

this contradicts research conducted by Baskara, I. P.,

Hariyadi, G. T. (2012), showing different results that

security has no effect on online purchasing decisions.

5 CONCLUSION

The correlation between m-banking security and

online shopping interest is 0.413% according to the

output. The coefficient value between m-banking

security and shopping interest has a sufficient

relationship. So if m-banking security increases,

interest in online shopping will also increase, and vice

versa. And based on the calculated t value of m-

banking security which is greater than the t table

(4.297>1.9867) and the significance is less than 0.05

(0.000 <0.05) so we can conclude that m-banking

security influences online shopping interest in the

civitas academic of the faculty of maritime economics

and business.

REFERENCES

R. D. Irahyani, “Pengaruh Penggunaan Mobile Banking

(M-Banking) Terhadap Tingkat Kepuasan Nasabah

Pada Generasi Milenial Yang Menjadi Nasabah Di

The Effect of M-Banking Security on Interest in Online Shopping in the Civitas Academica of Maritime Economics and Business Faculty,

Raja Ali Haji Maritime University (UMRAH), Indonesia

67

Bank Konvensional (Studi Kasus Pada Mahasiswa

Pengguna M-Banking Di Universitas Yang Ada Di

Malang)”. Jurnal Ilmiah Mahasiswa FEB, 10 (2),

(2022).

K. Philip, A.Gary. “Prinsip-prinsip Pemasaran, Edisi ke –

12”. Penerbit Erlangga. (2013).

R. Ramadhan, & S. Herianingrum, “Persepsi Kemudahan

Penggunaan, Persepsi Kredibilitas, dan Persepsi Harga

Terhadap Niat Nasabah Menggunakan Layanan Mobile

Banking (Studi Kasus Pada Bank Syariah Mandiri

Surabaya)”. Jurnal Ekonomi Syariah Teori Dan

Terapan, 4 (6), (2017).

O. J. Keuangan. “Bijak Ber-eBanking”. Otoritas Jasa

Keuangan.(2015).

M. Lallmahamood “An Examination of Individual ’ s

Perceived Security and Privacy of the Internet in

Malaysia and the Influence of This on Their Intention

to Use E-Commerce : Using An Extension of the

Technology Acceptance Model”. Journal of Internet

Banking and Commerce, 12(3), (2007).

A. Sutedjo, “Analisis Pengaruh Kepercayaan, Keamanan,

Serta Persepsi Risiko Terhadap Minat Beli Konsumen

Belanja Online Shopee”. Jurnal Kewirausahaan,

Akuntansi Dan Manajemen Tri Bisnis, 3 (2), 165–178,

(2021).

R. Furi, N. Hidayati, & S. Asiyah, “Pengaruh Keamanan,

Kemudahan, Kepercayaan dan Pengalaman Berbelanja

terhadap Minat Beli Onlinepada Situs Jual Beli

Shopee”. Jurnal Riset Manajemen, 96–109, (2020).

I. P. Baskara, & G. T. Hariyadi, “Keputusan Pembelian

Melalui Situs Jejaring Sosial (Social Networking

Websites) (Studi Pada Mahasiswa di Kota Semarang)”.

Jurnal Manajemen Fakultas Ekonomi Dan Bisnis

Universitas Dian Nuswantoro, 2011, 1–15, (2012).

M. Mukhtisar, I. R. R. Tarigan, & E. Evriyenni, “Pengaruh

Efisiensi, Keamanan Dan Kemudahan Terhadap Minat

Nasabah Bertransaksi Menggunakan Mobile Banking

(Studi Pada Nasabah Bank Syariah Mandiri Ulee

Kareng Banda Aceh)”. Jihbiz: Global Journal of

Islamic Banking and Finance., 3 (1), 56. (2021).

Ahmadi dan Hermawan. “EBusiness & E-Commerce”.

Yogyakarta: Andi. (2013).

A. Ferdinand, “Metode Penelitian Manajemen: Pedoman

Penelitian untuk Penulisan Skripsi, Thesis dan Disertasi

Ilmu Manajemen”, Badan Penerbit Universitas

Diponegoro, (2006).

Harahap, A. Khairil. “Perlindungan Hukum Nasabah Bank

dalam Cyber Crime terhadap Internet Banking

Dikaitkan dengan UU No.11 Tahun 2008 tentang

Transaksi Informasi dan Transaksi Elektronik”.

Universitas Sumatera Utara. (2009).

R. Arasu dan V. Annamalai, “Web Services and e-

Shopping Decisions: A Study on Malaysian e-

Consumer”, Special Issue on: Wireless Information

Networks & Business Information System,. Ijca, 1 (1),

54–60, (2017).

Purwanto dan S. D. Ratih. “Metode Penelitian Kuantitatif”.

(2017).

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

68