The Challenges Faced by the Information System in the Era of

Industry 4.0 and Their Impact on Information Quality

Fahmi Dwi Suhenda, Anastasya Regina Candra and Rapina Rapina

a

Department of Accounting, Maranatha Christian University, Bandung, Indonesia

Keywords: Internal Control System, Personality Characteristics, Organizational Structure, Business Process Quality.

Abstract: The importance of business process quality is widely recognized, it is a complex concept with significant

weight. When the quality of this process is poor, it has the potential to cause the information system to fail

and, as a result, contribute to a decline in the quality of information. The purpose of this research is to

investigate and assess the impact of internal control systems, personality characteristics, organizational

structure, and business process quality on the quality of the accounting information system, as well as the

impact of accounting information system quality on the overall quality of accounting information. The survey

questionnaire was filled out by 80 participants using purposeful sampling, a non-random sampling technique.

A variance-based structural equation model (SEM) was used to analyze the collected data. SEM is a statistical

method that is commonly used to analyze variable relationships and test hypotheses in complex models. The

research's primary finding contends that the effectiveness of internal control system, personality

characteristics, organizational structure, and business processes significantly and favorably influences the

effectiveness of the quality of accounting information system. The study's second key finding suggests that

the quality of the organization's information system has a significant influence on its overall information

quality.

1 INTRODUCTION

The banking sector must undergo a digital

transformation because the banking world is

undergoing multiple changes, particularly as we reach

the 4.0 era, when banks must now keep up with

technological improvements to remain competitive

(Maulidya, 2021). The digital era is closely linked to

changes in the lifestyle of the Indonesian population,

with technology increasingly facilitating banking.

The absence of real cash in today's world is a notable

difference, as all payments are made using virtual

money (Rapina, 2021).

As indicated by the new Financial Services

Authority Regulation (POJK) No. 12/POJK.03/2021

on the Implementation of Digital Banking Services,

banking services can be improved through digital

banking and capitalizing on opportunities in the

industrial revolution period. The Financial Services

Authority (OJK) has published the regulatory

framework for digital banks, with the head office

functioning as the physical branch and the rest,

a

https://orcid.org/0000-0002-0452-0201

referred to as smart branches, operating online. The

move to digital banking is a vital transformation for

all banking institutions since it requires them to adapt

to changes in human lifestyle, consequently boosting

the quality of banking performance (Maulidya, 2021).

The state-owned banks that are undergoing a digital

banking transformation, such as Mandiri, BNI, BRI,

and BTN, are still striving to enhance their information

systems to enhance integration. This allows for the

creation of clearly understandable information for

management objectives (Kurniawan, 2017).

The problems in Indonesia are characterized by

phenomena related to accounting, particularly the

implementation of accounting information systems.

Occurrence in state-owned banking occurred in 2021

at Bank Mandiri's Mampang Prapatan Branch, where

a frontline embezzled 120 billion (Simanjuntak,

2021). Lax internal controls at the Area level (one

level above the Branch), where there was little

personnel rotation or movement of supervisors and

frontline staff who had worked in the same unit for

four years, were the root cause of this occurrence,

Suhenda, F., Candra, A. and Rapina, R.

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality.

DOI: 10.5220/0012697300003798

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Maritime, Economics and Business International Conference (MEBIC 2023) - Sustainable Recovery: Green Economy Based Action, pages 195-205

ISBN: 978-989-758-704-7

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

195

according to an internal audit. The organizational

culture still tolerated certain individuals sharing

passwords without focusing on security, especially in

the Branch Delivery System (BDS) software. As a

result, staff abused the Accounting Information

System (AIS), lowering its quality. Because the

incident was hushed up, the data at the Branch did not

match what was reported to the Area.

The dominance of BDS (Branch Delivery

System) in the banking sector, especially among

state-owned banks, will be in 2023. However,

because of the enormous data access, each task

performed by BDS takes a long time. For example,

updating the status of delinquent customers from

"current" to "written-off" at the end of each month

takes 5 minutes per client (if there are 50 customers x

5 minutes = 4.5 hours to execute this process). This

takes a significant amount of time and has an impact

on the quality of business processes because it is only

done at the end of the month. Furthermore, BDS

contains a flaw in the input procedure that

necessitates double entry, increasing the danger of

human mistake. This leads to poor information

system quality and inconsistencies between physical

records and BDS software entries.

The phenomenon mentioned above indicates that a

number of factors, such as internal controls (the

inability of the banking institution to implement

internal controls, which results in illicit behaviors like

the sharing of BDS passwords), can affect the quality

of the AIS (Accounting Information System).

Moreover, organizational structure (the organization

already has an adequate organizational structure, but in

the context of the phenomenon above, organizations in

branch offices or in the regions are still not fully

informed in detail regarding the authority possessed by

the board of directors at the head office); personality

characteristics (both subordinate and superior

employees do not yet have the principle that sharing

passwords is a prohibited activity so that it violates the

principle of conscientiousness or prudence); and the

quality of business.

The quality of decision-making processes can be

improved by accounting information as processed

data (Bodhar, 2014; Romney, 2018). Accounting

information is provided to organizational decision-

makers (Considine, 2012). The definition of high-

quality accounting information is that it has features

that make it more useful (O'Brien, 2014). Timeliness,

accuracy, and completeness are characteristics of

high-quality accounting information (Baltzan, 2014;

Romney, 2018).

Internal controls have an impact on the quality of

AIS (Kurniawan, 2017; Rashedi, 2019).

Organizational structure influences the quality of AIS

(Kuraesin, 2016; Wisna, 2015). The quality of business

processes influences the quality of AIS (Sari, 2015).

AIS quality is influenced by AIS quality (Al-Hiyari,

2013; Darma, 2020; Sajady, 2008). The referenced

study's extra variable is "internal controls," and the

population used comprises of all state-owned banking

companies in West Java. The previous study serves as

the main reference journal, and the unique feature is

that an additional variable of the internal control

system serves as an independent variable (Rapina,

2021). Furthermore, the researchers concentrate their

investigation on the AIS of state-owned banks, notably

the BDS or Branch Delivery System.

The researcher determines the following research

limits based on the reasoning above. The AIS in

question is the BDS software version 11.00.00, which

was upgraded on March 15, 2023. The BDS hardware

cannot be updated because of the limitations in the big

data migration process, which could result in

company losses if the data migration process is

unsuccessful. OTIs (Operational Technical

Instructions) are in effect until December 20, 2022.

Employees who run the BDS are the topic of

personality traits. Customers or borrowers are not

included in this study because it is only for personnel

who operate the BDS. The purpose of this study was

to determine how much the internal control system,

personality traits, organizational structure, and

business process quality on the quality of the

accounting information system and its impact on the

quality of accounting information. This study

contributes to factors that can affect the

implementation of accounting information systems,

resulting in quality accounting information.

Furthermore, this research is expected to help solve

problems that occur in the field of accounting for

organizations in Indonesia.

2 THEORETICAL REVIEW

2.1 Accounting Information Systems

The Industry 4.0 revolution, also known as the

"cyber-physical system," is a phenomenon that arises

when cyber technology and automation technology

collaborate. This revolution causes major changes in

a variety of industries. Many things have changed as

a result of the birth of this revolution in numerous

areas. What used to require a large personnel for

operations is now replaced by the use of technological

machines (Rashedi, 2019). The internet of things, big

data, augmented reality, cybersecurity, and artificial

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

196

intelligence are examples of technology used in the

Industry 4.0 revolution. AIS is a component of the

Industry 4.0 revolution, and it includes big data and

cybersecurity (Rashedi, 2019).

AIS plays a critical role in providing information

that assists management in developing organizational

strategies to meet an organization's goals. The quality

of an organization's information system can be used

as a indicator of how well it meets its goals, according

to many studies.

The accounting system employed by state-owned

banks, notably the Branch Delivery System (BDS), is

the subject of the investigation. BDS is a computer-

based accounting system that allows banks to execute

financial and non-financial operations online. BDS is

the fundamental operational banking service,

consisting of menus based on transaction codes.

Banking transactions are completed using BDS with

diverse transaction types in major cities.

However, BDS utilization optimization is less

typical in smaller locations due to fewer transactions.

The BDS system is utilized by bank employees for

their daily work activities. Given that BDS is a

critically important system for banking operations,

the manner of utilizing BDS follows specific

procedures or protocols aligned with the policies of

each bank. BDS has the ability to generate accurate

information that can be used by top management for

decision-making to achieve organizational goals.

The researcher will investigate variables that can

boost the performance of BDS, which will result in

high-quality information for decision-makers

according to the above description.

The BDS workflow is comprised of three

(3)processes: (1) the morning process known as

"branch opening," in which the system is activated by

the branch manager or authorized user to allow

normal operations; (2) the daily transaction process,

in which frontliners provide services to customers

under various conditions; and (3) the end-of-day

process, also known as "branch closing," in which the

branch manager is required to physically reconcile the

cash in the vault with the n The branch closing

process can begin after the physical and non-physical

monies are in sync (Cahyaning, 2016).

2.2 Internal Control System in AIS

Quality

ICS is a collection of guidelines and practices intended

to prevent misappropriation of the company's

resources, guarantee the availability of correct

corporate accounting data, and guarantee that all staff

members have followed or implemented management

policies and laws in a proper manner. (Tresyani, 2019).

ICS is a process driven by the board of directors,

management, and employees that aims to ensure that

organizational goals are met (Rashedi, 2019).

The control environment, risk assessment,

information and communication, and monitoring are

the four fundamental components of policies and

procedures designed and implemented by

management to provide reasonable assurance that

control objectives can be met (Tresyani, 2019).

When an organization maintains a system that

generates high-quality information, its goals can be

achieved. The application system must have control

over transaction processing to ensure that internal

control components are implemented. The internal

control system is designed to guarantee the system's

completeness, including detecting input errors and

rejecting requests. It also guarantees that data

processing is in accordance with the desired criteria or

requirements and that the output is suitable for

distribution to senior management (Kurniawan, 2017).

Based on the above description, it can be

concluded that the internal control system has an

impact on the quality of AIS, similar to previous

research (Anuruddha, 2021; Kurniawan, 2017;

Rashedi, 2019).

H1: Internal Control System (ICS) influences the

Quality of AIS.

2.3 Personality Traits in AIS Quality

The behaviors of individuals in their daily activities

are characterized by personality traits that are formed

by various interconnected factors. Every employee

who works in an organization should possess these

traits as they can enhance their abilities in performing

their tasks. One of the tasks carried out in the Industry

4.0 era is the utilization of technology.

The use of technology must be comprehended as

it holds significant importance in the field of

information systems, accomplished by exploring the

role of personality: the Five Factor Model of

Personality (Openness, Agreeableness,

Conscientiousness, Extraversion, and Neuroticism).

The formation of a working team that aligns the

information system with personality types, as

outlined by Lea et al. research, is essential to achieve

optimal performance. (2019), where the Five Factor

Model of Personality can influence information

systems (Rapina, 2021).

Individuals with creativity can identify the

system's current strengths and faults (Simanullang,

2021). When a case needs to be escalated to the next

level of leadership, the system should simply align

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality

197

itself (Pramasella, 2019). Making exact decisions

requires exercising caution while operating the

system (Ernawati, 2019). The system is easy to

socialize for new users who are using it for the first

time. The system's operation should be based on

emotional experiences, developing an anticipating

mindset (Najm, 2019). Individuals must possess the

Five Factor Model of Personality as employees of any

business, particularly in this research environment of

state-owned banking, in order to operate the system

and create quality information. The researcher

restricted the personality traits explored in this study

to those that are necessary for personnel in the

banking industry.

The study conducted by Rapina (2021) explores

the influence of personality traits on the quality of

accounting information systems. Furthermore,

research examining the Five Factor Model of

Personality has been previously investigated by

(Ernawati, 2019; Pramasella, 2019; Simanullang,

2021). According to the second hypothesis of this

study, the quality of AIS is influenced by personality

traits, as described above.

H2: Personality Traits influence the Quality of

AIS.

2.4 Organizational Structure in AIS

Quality

The formal arrangement of duties, responsibilities,

and authority within an organization is called

organizational structure (McShane, 2015). The roles

and responsibilities of persons and groups associated

with the execution and supervision of interrelated

activities aimed at accomplishing organizational

goals are referred to as organizational structure

(Kuraesin, 2016). Organizational structure as having

three dimensions: span of control, centralization, and

formalization (McShane, 2015).

In organizational structure, the number of

employees can influence the system being used, but

managers in the organization must be able to control

these employees so that the system can operate as

intended (Kuraesin, 2016). The center of authority

related to the organizational system belongs to

managers (Kuraesin, 2016). The system's procedures

and rules must be consistent from the head office to

the smallest branches (Ghozali, 2018). With a well-

established organizational structure, it will result in

quality AIS (Kuraesin, 2016).

The creation of information systems requires

consideration of organizational structure as it affects

the implementation of AIS (Kuraesin, 2016). The

organization's structure can improve information

availability by spreading information to multiple

levels, giving employees at the lowest level the

opportunity to contribute to decision-making

(Bodhar, 2014).

According to the preceding definition, the third

hypothesis of this study is that organizational

structure influences the quality of AIS. (Rapina,

2021) did previous research with a random sample of

46 organizations, while (Kuraesin, 2016; McShane,

2015) conducted research revealing the influence of

organizational structure on AIS quality.

H3: Organizational Structure influences the

Quality of AIS.

2.5 Business Process Quality in AIS

Quality

Quality of business processes is the interrelated

business activities that result in products or services for

consumers. These processes can be repeated to achieve

optimal outcomes, or they can focus on maximizing a

specific process that is currently occurring (Kuraesin,

2016). The importance of business process quality is in

providing services that are convenient for employees

and don't take up customers' time. The produced

products should align with management's objectives

(Romney, 2018). Business process quality is reflected

in the waiting time for each transaction within the

organization's system. Each task has a different waiting

time based on the complexity of the performed work

(Rapina, 2021).

The information system can be influenced by the

business processes of the organization (Rapina,

2021). The quality of AIS can be enhanced through

existing business processes; a good business process

should be well-structured, and organizational

procedures should be observed based on real-life

occurrences, enabling the business process to be of

high quality.

A successful business process should have

defined objectives, inputs, outputs (within the system

being used), and resource utilization. It includes

multiple operations at various levels and can affect

more than one unit within the firm, compromising the

quality of both the business process and the AIS

(Kuraesin, 2016).

Based on the description above, the fourth

hypothesis of this study is that the quality of business

processes affects the quality of AIS, in line with

previous research (Kuraesin, 2016; Rapina, 2021).

H4: The quality of business processes has an

impact on the quality of AIS.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

198

2.6 Quality of AIS in Accounting

Information Quality

AIS uses a procedure to collect and turn data into

accounting information. Financial information is data

that has been processed to generate the financial AIS

process. (Darma, 2020) defines this process as the

processing of financial accounting information. For

first-time users, the system should be simple to use

(Ahmed, 2019). It should have freedom within its

constraints; a system with constraints that is escalated

to senior management due to exceptions shows

flexibility (Ahmed, 2019). The system's records

should include data that will be subject to audits, and

inputting data once should provide efficient

information, reducing human errors (Tresyani, 2019).

The output should be efficient in terms of time and

user-friendliness. To guarantee confidentiality, the

information should be maintained in a single location

(database), and it should be presented in the form of

diagrams. High-quality accounting information can

be produced by AIS that adheres to the concepts of

usability, adaptability, auditability, and security

(Darma, 2020).

The fifth hypothesis of this study is that the

quality of AIS influences the quality of accounting

information, according to (Ahmed, R., 2019,

McShane, S. G. M. Von., 2015, Rapina, 2021,

Sugiyono., 2014).

H5: The Quality of AIS Affects the Quality of

Accounting Information.

Accounting information that is timely and up to

date is available when needed (Cahyaning, E. K.,

2016). On the other hand, accurate accounting

information is free of inaccuracies and accurately

reflects current conditions (Anuruddha, S., 2021).

The quality of accounting information is a feature that

accounting information must have in order to suit the

needs of users McShane, (S. G. M. Von., 2015).

Accuracy, completeness, and timeliness are all

aspects of information quality. Accuracy,

completeness, and timeliness are all hallmarks of

high-quality information (Considine, 2012). The

quality of information is measured by its timeliness,

accuracy, and completeness (Cahyaning, E. K.,

2016). Quality information as having properties such

as correctness, timeliness, and completeness. The

quality of the information produced by the

information system determines the success of the

information system in SIA. SIA acts as a middleman

or instrument to actualize information, allowing

project managers and staff working at the company's

organizational level to make educated decisions.

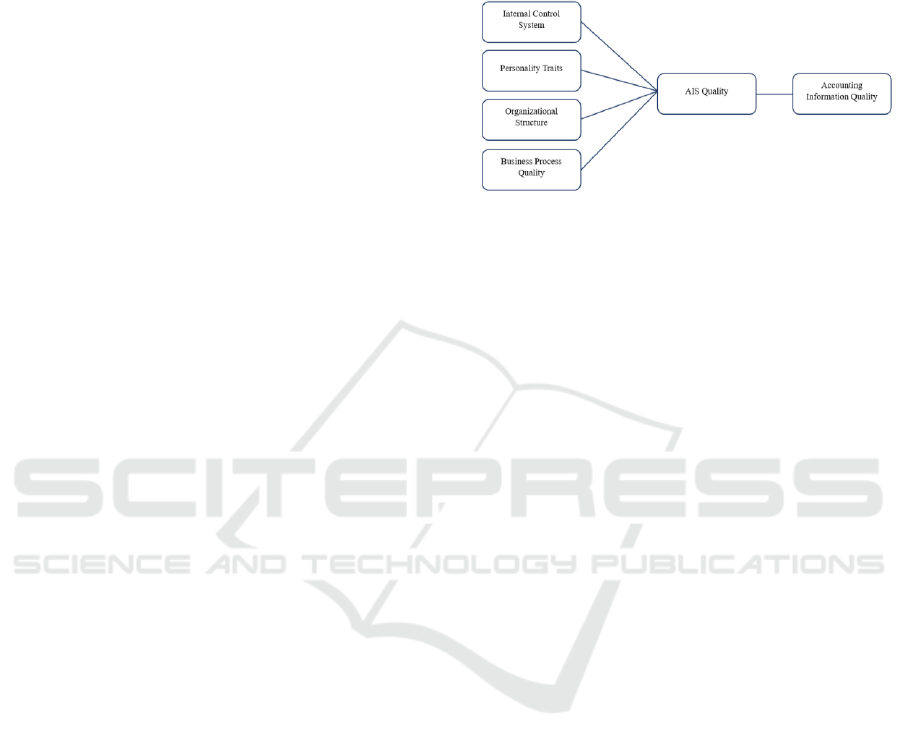

The model or framework of thought is presented

in the following diagram based on the hypotheses

above. This is also a novelty of the research

conducted, because researchers have not found all

variables to be studied together.

Figure 1: Research Model or Framework.

3 RESEARCH METHOD

A data gathering strategy is to provide written

statements to respondents and ask them to answer

truthfully. Online media such as Google Forms or

physical questionnaires given directly to respondents

are utilized to distribute questionnaires. Respondents

in this survey are workers of state-owned banks,

specifically BMRI, BBNI, BBRI, and BBTN.

Because the questionnaire takes the form of

multiple-choice answers that vary (not equidistant

values from 1 to 5), the scale employed for this

research is an interval scale. The respondents were

given statements with numerical values that

corresponded to their levels (Sugiyono, 2014).

Control environment, risk assessment,

information and communication, and monitoring are

the components of the SPI variable. These criteria

were selected because a good control system needs to

have standard operating procedures and procedural

policies in order for a bank-made system to function.

Then, the dimensions of personality traits, namely

openness, agreeableness, conscientiousness,

extraversion, and neuroticism, were selected because

these five personalities are related to one another,

making it very appropriate for employees who

operate the system to form these five personality

traits. Then the dimensions of the organizational

structure are span of control, centralization and

formalization, the reason for choosing these

dimensions is because banking is a company that has

clear responsibilities and authorities so that clear

tasks will result from the company's organizational

structure. Then the dimension of the business process

quality variable is the length of time waiting, the

reason for choosing this dimension is because a

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality

199

system that runs work programs properly is a system

that minimizes waiting time. Then the reason the

researcher chose the flexibility dimension in the SIA

quality variable is because the BDS system can be

escalated to the leadership to determine policies, and

timeliness, data accuracy and data completeness as

one of the principles of information to facilitate

decision makers.

Table 1: Operationalization of Variables.

Variable

Dimension

Indicator

Internal Control

System

Meilani (2017)

Control Environment

Management Control

Division of taks

Authority

Responsibility

Risk Assesment

Procedure Policy

Information &

Communication

Standard Operating

Procediure

Monitoring

Review

Personality Traits

Barnet et al. (2015)

Openness

Openness to New

Experience

Agreeableness

Avoid Conflict

Conscientiousness

Caution in carrying

out an action

Extraversion

Interaction with

others

Neuroticism

Negative Emotional

Expérience

Organizational

Structure

Mc Shane, et al.

(2015)

Control Range

Controllable

Centralization

Centralized

Organizational

Activities

Formalization

Development Process

Notice

Business Process

Quality

Romney & Steinbart

(2018)

Long Waiting Time

No long waits

Just one time input

Work just got easier

Minimizing human

error

AIS Quality

Romney & Steinbart

(2018)

Utility

Processing

Information

Output

Optimizing Resouces

Improve the

Performance

Ease of Use

It is useful

Flexsibility

Flexsibility

Auditability

Auditability

Security

Hardware

Accounting

Information Quality

Baltzan (2014)

On Time

Real Time

Accurate

Tested

Complete

Output

SEM PLS is a data analysis method that the author

uses to analyze the relationship between variables

(Sugiyono, 2014). The outer model consists of a

validity test using convergent validity > 0.7, it is said

to be high, as well as the average variance extracted

(AVE) value and communality value > 0.5 (Ghozali,

2018), then discriminant validity can be seen from the

measurement of the cross loading factor with the

construct and comparison of average variance

extracted (AVE) roots with latent variable correlations

(Ghozali, 2018). After that, the reliability test used

Cronbach's alpha > 0.6 (Ghozali, 2018). The

relationship between the independent and dependent

variables is examined using a t test (hypothesis testing)

that is carried out both partially by Suiyono (2014).

4 RESEARCH FINDINGS

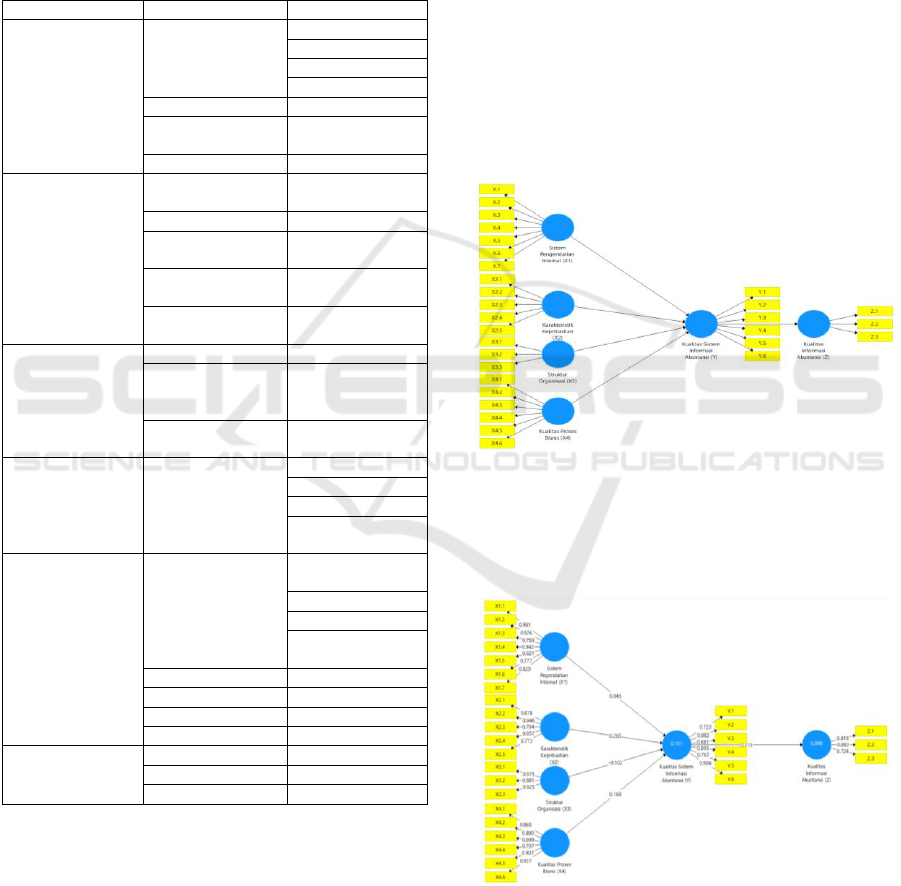

There are 30 manifest variables with 6 latent variables

including Internal Control Systems, Personality

Characteristics, Organizational Structure, and

Business Process Quality (X); AIS Quality (Y) and

Accounting Information Quality (Z), with the help of

smartPLS 3 with the following model.

Figure 2: Research Model.

The PLS Algorithm menu in the image below is

then used to provide the calculation results for the

whole bootstrapped model.

Figure 3: Complete PLS Algorithm Research Model.

Additionally, two validity tests must be

performed: convergent validity and discriminant

validity.

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

200

4.1 Convergent Validity

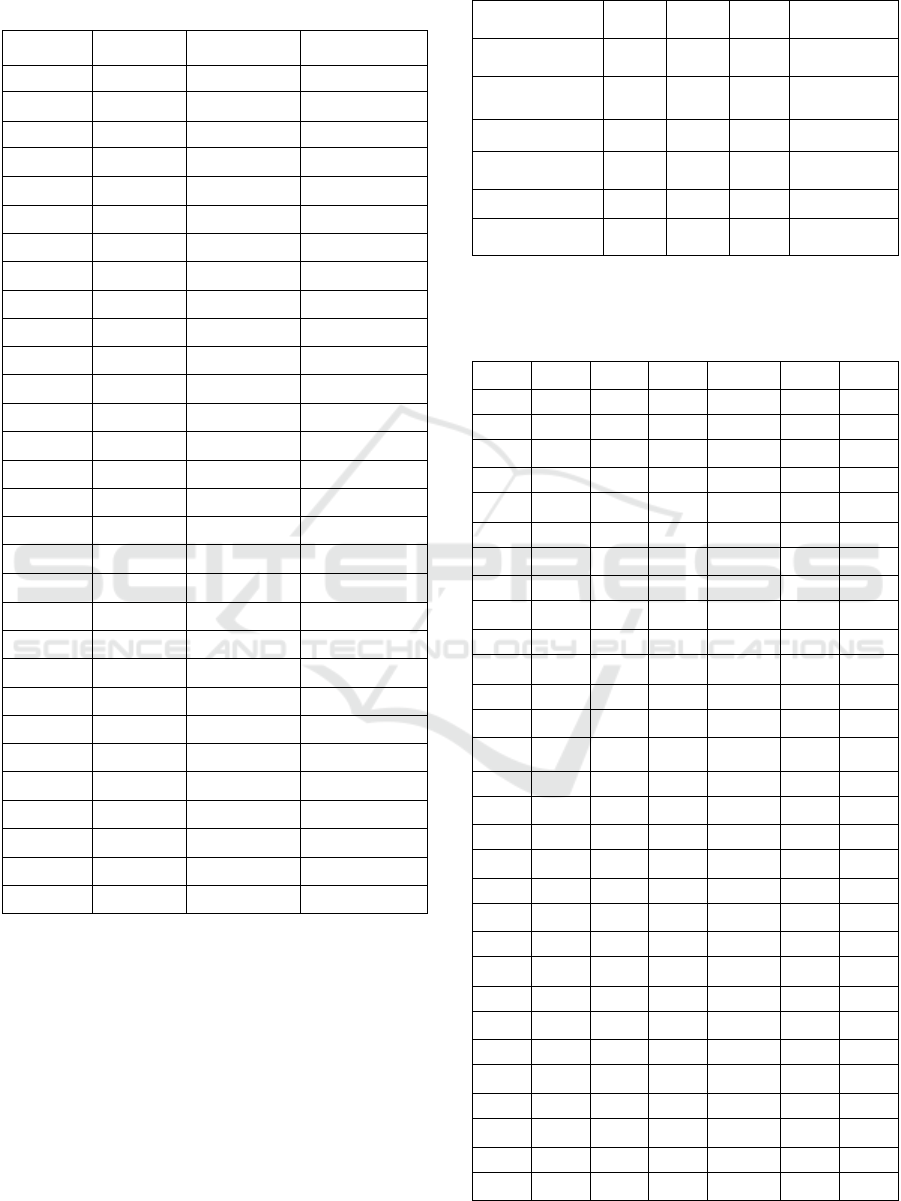

Table 2: Loading Factor.

Manifest

Variable

Loading

Factor

Standard Value

Conclusion

SPI_1

0.981

0.700

Valid

SPI_2

0.976

0.700

Valid

SPI_.3

0.759

0.700

Valid

SPI_4

0.942

0.700

Valid

SPI_.5

0.921

0.700

Valid

SPI_6

0.777

0.700

Valid

SPI_.7

0.820

0.700

Valid

KK_1

0.878

0.700

Valid

KK_2

0.946

0.700

Valid

KK_3

0.794

0.700

Valid

KK_4

0.857

0.700

Valid

KK_5

0.773

0.700

Valid

SO_1

0.975

0.700

Valid

SO_2

0.981

0.700

Valid

SO_3

0.925

0.700

Valid

KPB_1

0.865

0.700

Valid

KPB_2

0.880

0.700

Valid

KPB_3

0.899

0.700

Valid

KPB_4

0.797

0.700

Valid

KPB_5

0.907

0.700

Valid

KPB_6

0.917

0.700

Valid

KSIA_1

0.723

0.700

Valid

KSIA_2

0.882

0.700

Valid

KSIA_3

0.881

0.700

Valid

KSIA_4

0.893

0.700

Valid

KSIA_5

0.767

0.700

Valid

KSIA_6

0.906

0.700

Valid

KSI_1

0.818

0.700

Valid

KSI_2

0.883

0.700

Valid

KSI_3

0.721

0.700

Valid

According to the chart above, all 30 manifest

variables are determined to have good validity

because the loading factor value is higher than the

standard value (Sugiyono, 2014).

All variables are deemed to be legitimate because

the AVE value and composite reliability of the 6 (six)

latent variables are both > 0.5 (Ghozali, 2018).

Table 3: Average Variance Extracted and Composite

Reliability.

Latent Variable

AVE

CR

Standard

Value

Conclusion

Internal Control

System

0.786

0.962

0.500

Valid

Personality

Characteristics

0.726

0.929

0.500

Valid

Struktur Organisasi

0.923

0.973

0.500

Valid

Business Process

Quality

0.772

0.953

0.500

Valid

AIS Quality

0.714

0.937

0.500

Valid

Accounting

Information Quality

0.658

0.852

0.500

Valid

4.2 Discriminant Validity

Table 4: Croos Loading Factor.

Items

SPI

KK

SO

KPB

KSIA

KIA

SPI_1

0.981

0.040

0.016

0.123

0.061

-0.087

SPI_2

0.976

0.058

0.052

0.149

0.099

-0.058

SPI_3

0.759

0.011

-0.015

0.079

-0.026

-0.103

SPI_4

0.942

0.121

0.070

0.165

0.056

-0.133

SPI_5

0.921

-0.014

0.038

0.060

0.029

-0.203

SPI_6

0.777

-0.027

-0.001

0.122

0.004

-0.067

SPI_7

0.820

-0.013

0.016

0.093

0.017

-0.025

KK_1

-0.087

0.878

0.363

0.062

0.155

0.323

KK_2

-0.058

0.946

0.264

0.060

0.313

0.181

KK_3

-0.103

0.794

0.182

-0.023

0.197

0.089

KK_4

-0.133

0.857

0.394

0.029

0.115

0.285

KK_5

-0.203

0.773

0.231

0.036

0.123

0.208

SO_1

-0.067

0.061

0.975

-0.118

-0.034

0.080

SO_2

-0.025

0.099

0.981

-0.065

-0.034

0.047

SO_3

0.323

-0.026

0.925

-0.125

-0.014

0.064

KPB_1

0.181

0.056

0.123

0.865

0.061

0.084

KPB_2

0.089

0.029

0.149

0.880

0.116

0.074

KPB_3

0.285

0.004

0.079

0.899

0.073

0.084

KPB_4

0.208

0.017

0.165

0.797

0.214

0.074

KPB_5

0.080

0.155

0.060

0.907

0.184

0.148

KPB_6

0.047

0.313

0.122

0.917

0.184

0.084

KSIA_1

0.064

0.197

0.093

0.016

0.723

0.043

KSIA_2

0.084

0.115

0.062

0.052

0.882

0.264

KSIA_3

0.074

0.123

0.060

-0.015

0.881

0.148

KSIA_4

0.084

-0.034

-0.023

0.070

0.893

0.084

KSIA_5

0.074

-0.034

0.029

0.038

0.767

0.043

KSIA_6

0.148

-0.014

0.036

-0.001

0.906

0.264

KSI_1

0.084

0.061

-0.118

0.016

0.214

0.818

KSI_2

0.043

0.116

-0.065

0.363

0.184

0.883

KSI_3

0.264

0.073

-0.125

0.264

0.184

0.724

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality

201

It may be deduced that the indicators used to measure

latent variables have complied with the requirements

since the CLF value of the manifest variable is higher

than the CLF values of the other manifest variables,

or in other words, the numbers in the yellow shading

are greater than the numbers in the blue shading.

Additionally, the test that needs to be run is a

reliability test called Cronbach's alpha.

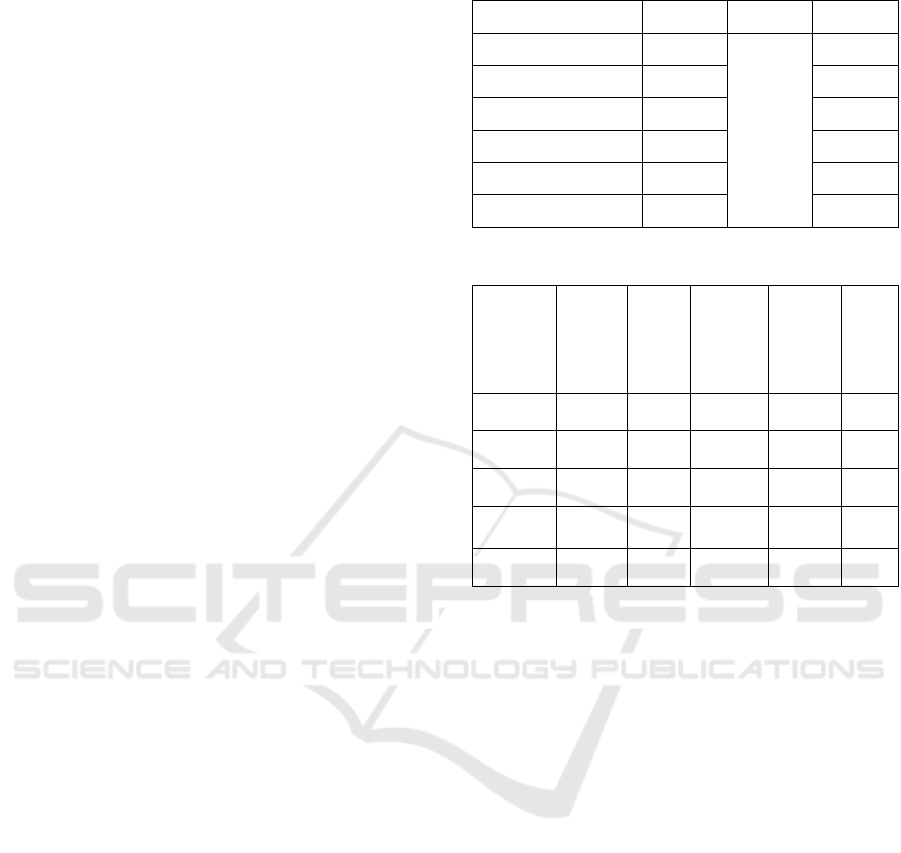

The Cronbach's alpha value of the 6 (six) variables

is greater than 0.7, meaning that all latent variables

are reliable. Since the ke-6 (six) variation's nilai

cronbach's alpha is more than 0.7, all previous

variations are now reliable.

Criterion I:

H

0

: SPI / KK / SO / KPB does not affect AISQ or

AISQ does not affect AIQ

H

1

: SPI / KK / SO / KPB affect AISQ or AISQ affects

AIQ

Criterion II:

Reject H

0

: P Values are smaller than the significance

level of 0.05 (5%).

Criterion III:

Reject H

0

: t stat. greater than t table.

The value of the t table is 1.989, and the t statistics

and P values can be used to assess if the factors under

research have an influence or have the opposite effect.

As a result, the hypothesis testing's conclusion is as

follows.

a. Internal Control System's t Statistics value for AIS

Quality is 6.532 > 1.989, and the p value is 0.000

< 0.05 (5%). The conclusion that the Internal

Control System can affect AIS Quality follows

from the rejection of H

0

.

b. Personality Characteristics' t Statistics value in

relation to AIS Quality is 2.717 > 1.989, and the

p-value is 0.007 < 0.05. H

0

is therefore rejected,

proving that personality traits can affect AIS

quality.

c. The organizational structure's t statistics value for

AIS quality is 6.605 > 1.989, and the p value is

0.000 < 0.05. Inferring that Organizational

Structure can affect AIS Quality, H

0

is therefore

rejected.

d. The Business Process Quality t Statistics value for

SIA Quality is 6.873 > 1.989, and the p values are

0.000 < 0.05. Thus, H

0

is refuted, confirming the

conclusion that Business Process Quality can

affect AIS Quality.

e. The p value is 0.002 < 0.05 and the t Statistics value

of the AIS Quality towards Information System

Quality is 3.043 > 1.989. In light of H

0

's rejection,

it may be concluded that AIS Quality can affect

Information System Quality.

Table 5: CA.

Latent

Variable

CA

Standard

Value

Conclusion

Internal Control System

0.969

Must be

greater than

0.700

Reliable

Personality Characteristics

0.907

Reliable

Organizational Structure

0.961

Reliable

Business Process Quality

0.945

Reliable

AIS Quality

0.921

Reliable

Accounting Information

Quality

0.756

Reliable

Table 6: t-Test.

Information

t

Statistics

t Tabel

Results

P Values

Results

SPI →

KSIA

6.532

1.989

H

0

is

rejected

0.000 <

0.05

Sig.

KK →

KSIA

2.717

1.989

H

0

is

rejected

0.007 <

0.05

Sig.

SO →

KSIA

6.605

1.989

H

0

is

rejected

0.000 <

0.05

Sig.

KPB →

SIA

6.873

1.989

H

0

is

rejected

0.000 <

0.05

Sig.

KSIA

→ KIA

3.043

1.989

H

0

is

rejected

0.002 <

0.05

Sig.

5 DISCUSSION

5.1 Internal Control System Towards

AID Quality

Based on the data processing results above, H

0

is

rejected because the obtained p values are greater

than the calculated t value (6.532 > 1.989), indicating

that the Internal Control System (ICS) influences AIS

quality, which is consistent with previous research by

(Anuruddha, 2021; Kurniawan, 2017; Rashedi, 2019;

Tresyani, 2019). The goals of the organization can be

achieved when high-quality information is produced

by upholding a system that was put in place by the

organization to make sure that internal control

components are integrated into the application

system. As a result, control over transaction

processing is required. Internal control systems are

designed to guarantee the system's completeness by

preventing or detecting input errors, which can result

in the system rejecting such requests. Furthermore,

they ensure that data processing was carried out in

accordance with the desired criteria or requirements,

and that the outputs are suitable for distribution to top

management (Kurniawan, 2017).

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

202

5.2 Personality Characteristics

Towards AID Quality

Based on the data processing results above, H

0

is

rejected since the acquired p values are more than the

calculated t value (2.717 > 1.989), showing that AIS

Quality influences Personality Characteristics. This is

consistent with prior studies which found that

personality traits measured using the Five-Factor

Model of personality (OACEN) can influence AIS

quality (Ernawati, 2019; Najm, 2019; Pramasella,

2019; Simanullang, 2021). The Five-Factor Model of

personality can be utilized to create a quality

accounting information system. The task of reviewing

all aspects of employment is not fully accommodated

by the banking company's accounting information

system (AIS) application. The reason for this

situation is that only the person responsible for

examining input results from other departments is

conducting the re-examination. The work outcomes

are only authorized by a supervisor when a customer,

for example, opens a new account through customer

service or transfers money through a teller.

Individuals in positions higher than the supervisor,

such as branch managers, do not participate in

approving the operations of customer service or teller,

despite the fact that they all perform the same duty as

users of the accounting information system.

Furthermore, the installed accounting information

system (AIS) does not adequately accommodate to

the strong and diligent desire to understand the

accounting information system. Customer service and

tellers, for example, should have a strong and

conscientious motivation to master the application of

accounting information systems. It has been found

that the accounting information system used by the

vast majority of commercial banks is frequently

updated in other areas, like the consumer card

division, necessitating constant adjustment on the part

of users. The workflow is hampered by these updates,

which frequently make users tired of learning. Based

on the description given, it can be inferred that the

higher the quality of the accounting information

system is, the more personality traits it can

accommodate.

5.3 Organizational Structure Towards

AID Quality

Based on the data processing results above, H

0

is

rejected since the acquired p values are more than the

calculated t value (6.605 > 1.989), showing that

Organizational Structure impacts AIS Quality. This is

congruent with the findings that organizational

structure is an important factor to consider when

creating information systems (Sari, 2015; Yanti,

2022). The adoption of AIS is influenced by

organizational structure because it improves

information availability by dispersing it across

multiple levels within an organization. This allows

employees at lower levels to participate in decision-

making. The accounting information system (AIS)

has not been able to fully incorporate job

specialization into the organizational framework.

Using an accounting information system requires

breaking down procedures into a list of necessary

actions. The bulk of commercial banks clearly divide

work across separate departments. The functions of a

customer support agent and a teller are distinct, and

they cannot switch roles. There is a physical barrier

between the customer service area and the teller area,

and the programs they use have different passwords

depending on whether they are a teller or a customer

care representative. Furthermore, it is well recognized

that the accounting information system (AIS)

application has not accommodated employees'

relevant responsibilities based on their

specializations. The reason for this is that most

commercial banks still use distinct programs for

branch offices, retail risk divisions, commercial

divisions, and consumer card divisions. As a result,

the accounting information system has been unable to

provide the essential data automatically when

generating reports. Manually combining data from

several accounting information system programs

used across various divisions is still necessary for

some reports to be created.

5.4 Business Process Quality Towards

AIS Quality

Based on the data processing results above, H

0

is

rejected since the acquired p values are more than the

calculated t value (6.873 > 1.989), showing that

process quality can influence AIS quality. The

findings that business procedures can influence

information systems (Rapina, 2021) are similar to this

one. The quality of AIS can be enhanced by the

existing business processes, which should be well-

structured and monitored based on real-world events

to ensure the quality of business processes. The

appropriate processing time is reflected in the AIS

application. This is due to data retrieval delays from

the AIS application, as they compete for processing

time with the Central and Eastern Indonesia regions.

Longer processing durations result from the

increasing amount of data extracted. The processing

timeframes of the accounting information system

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality

203

application support other actions, like inter-branch

fund transfers. There are two transfer options: LLG

(Lalu Lintas Giro) and RTGS (Real Time Gross

Settlement), and both forms of transfers arrive at the

target bank on the same day, though at a different

charge. Waiting times also fluctuate between

commercial banks, depending on their rules. For

example, the needed waiting time in the accounting

information system application for opening new

client accounts ranges from 5 minutes to up to 20

minutes. This is dependent on how the accounting

information system application handles client data

entry, especially when consumers are asked

confirmation questions ranging from simple to

sophisticated queries.

5.5 AIS Quality Towards Accounting

Information Quality

Based on the data processing results above, H

0

is

rejected since the acquired p values are more than the

calculated t value (3.043 > 1.989), indicating that

accounting information quality is influenced by AIS

quality. This is consistent with previous study who

found a link between AIS quality and accounting

information quality (Abidin, 2021; Darma, 2020;

Rapina, 2021; Sari, 2015; Tresyani, 2019). An AIS

that adheres to criteria such as usability, adaptability,

auditability, and security can generate high-quality

accounting data. In other words, AIS quality can

influence accounting information quality based on

these characteristics.

The accounting information system (AIS)

application has not been fully developed due to the

challenges in commercial banks in obtaining

information from multiple functional areas.

Integration, for example, has not been realized in the

credit card and loan divisions. For example, if a

customer has a business loan for billions of rupiah and

then wishes to apply for a credit card, they must do so

as a new customer because their identity cannot be

traced inside the credit card section. In other words,

the accounting information system applications that

are now in use in banking have not been integrated

nicely with other departments.

6 CONCLUSION

Based on the theory that has been described, the

research hypothesis, and the results of the study, it is

known that:

1. The effectiveness of accounting information

systems is significantly impacted by internal

control systems. The phenomenon that

exemplifies this has been reported by

(Simanjuntak, 2021), involving the

misappropriation of 120 million dollars in client

funds by frontline. A high-quality AIS can be

attained when the internal control system is built

to ensure the completeness that is inherent in the

system itself, for example, by protecting against

or identifying input errors and refusing such

requests. Additionally, it guarantees that data

processing adheres to the necessary standards or

criteria and that the output is appropriate for

presenting to upper management.

2. Personality characteristics have a big impact on

how well accounting information systems work.

(Simanjuntak, 2021) describes a phenomenon in

which some people continue to share passwords

without thinking about security, particularly

when it comes to the Branch Delivery System

(BDS) software. Employee misuse of the

Accounting Information System (AIS) therefore

reduced the system's quality. The information at

the Branch did not match what was reported to

the Area since the incident was kept quiet. The

Five-element Model of Personality (OACEN),

which each element has a distinct function that

can enhance the quality of AIS, is something

that banks should teach their employees in.

3. Although the company already has a suitable

organizational structure, branch offices and

regional organizations are still mostly unaware

of the exact authority that the head office's board

of directors possesses in light of the

aforementioned situation. Additionally, the

establishment of a distinct organizational

structure in banking will lead to identical

policies and guidelines throughout the entire

system, from the main office to the tiniest

branches.

4. The quality of during business operations has a

big influence on the caliber of accounting

information systems. on the quality of business

processes (the lengthy write-off procedure,

which can only be finished at the end of the

month, suggesting that BDS is already

overworked) (this proves that business

processes in banking are inadequate). This study

also demonstrates that process quality is one

factor affecting AIS quality. A system that

completes tasks as soon as it is practical is

considered efficient, based on process quality

metrics such as waiting time for the system.

5. The quality of accounting information is

significantly impacted by the quality of the

MEBIC 2023 - MARITIME, ECONOMICS AND BUSINESSINTERNATIONAL CONFERENCE

204

accounting information system. Accordingly,

this data must meet the AI quality standards for

accuracy, timeliness, and completeness.

REFERENCES

Abidin, S. G. C. Y. (2021). Pengaruh Efektivitas Proses

Bisnis dan Komitmen Organisasi terhadap Kualitas

Sistem Informasi Akuntansi. JAFTA, 3(1).

Ahmed, R. (2019). The impact of Accounting Information

Systems’ Quality on Accounting Information Quality.

ResarchGate.

Al-Hiyari, A. M. N. K. N. A. J. M. E. H. M. (2013). Factors

that affect accounting information system

implementation and accounting information quality: A

survey in University Utara Malaysia. American Journal

of Economics, 3(1), 27–31.

Anuruddha, S. (2021). Influence the Quality of Accounting

Information Systems and the Effectiveness of Internal

Control on Public Financial Reporting Quality; an

Empirical Sturdy. ResearchGate.

Baltzan, P. (2014). Business Driven Information Systems

(3rd ed.). McGraw.

Bodhar, G. H. H. W. S. (2014). Accounting Information

Systems (11th ed.). Pearson Education.

Cahyaning, E. K. (2016). Evaluasi Penerimaan Sistem

Informasi Teknologi Branch Delivery System di

Kalangan Perbankan. Accounting and Business

Information Systems Journal, 4(1).

Considine, B. P. A. O. K. S. D. L. M. (2012). Accounting

Information Systems (4th ed.). John Wiley & Sons

Australia Ltd.

Darma, J. S. G. H. (2020). Pengaruh Kualitas Sistem

Informasi Akuntansi terhadap Kualitas Informasi

Akuntansi. JIMEA, 4(1).

Ernawati, R. G. R. D. E. (2019). Pengembangan Karakter

Siswa Sma Berdasarkan The Big Five Factor Of

Personality Dalam Memberikan Layanan Bimbingan

Karir. Jurnal Selaras Kajian Bimbingan Dan Konseling

Serta Psikologi Pendidikan., 2(2).

Ghozali, I. (2018). Aplikasi Analisis Multivariete Dengan

Program SPSS 25 (9th ed.). Universitas Diponegoro.

Kuraesin, A. D. (2016). Influence Organizational Structure

on the Quality of Accounting Information Systems.

Research Journal Finance and Accounting, 7(2).

Kurniawan, A. P. M. (2017). Pengaruh Pengendalian

Internal terhadap Kualitas Sistem Informasi Akuntansi

serta dampaknya terhadap Kualitas Informasi

Akuntansi. STAR-STudy & Accounting Research, 14.

Maulidya, G. P. (2021). Perbankan Dalam Era baru Digital:

Menuju Bank 4.0. Proceeding Seminar Bisnis, 5.

McShane, S. G. M. Von. (2015). Organizational Behavio

(17th ed.). McGraw-Hill.

Najm, N. A. (2019). Big Five Traits: A Critical Review.

Gadjah Mada International Journal of Busniness, 21(2).

O’Brien, J. A. M. G. M. (2014). Sistem Informasi

Manajemen. Salemba Empat.

Pramasella, F. (2019). Hubungan Antara Lima Besar Tipe

Sifat Kepribadian Dengan Kesepian Pada Mahasiswa

Rantau. Psikoborneo, 7(3).

Rapina, H. A. N. N. (2021). Analisis Hambatan Kualitas

Sistem Informasi Akuntansi Perbankan di Era Industri

4.0. Ekuitas: Jurnal Ekonomi Dan Keuangan.

Rashedi, H. D. T. (2019). How Influence the Accounting

Information Systems Quality of Internal Control on

Financial Reporting Quality. ResearchGate.

Romney, M. B. S. P. J. (2018). Sistem Informasi Akuntansi

(13th ed.). Salemba Empat.

Sajady, H. D. M. N. H. (2008). Evaluation of The

Effectiveness of Accounting Information Systems.

International Journal of Information Science and

Technology, 6(2).

Sari, N. Z. M. (2015). The Effect Business Process to

Quality of Accounting Information Systems with

Survey in BUMN Industrial Strategis in Bandung

Indonesia. International Journal of Trend in Research

and Development, 2(1).

Simanjuntak, L. E. E. (2021). 15 Tahun Jadi Buron,

Pembobol Bank Mandiri Rp 120 Miliar Ditangkap!

Baca artikel detiknews, “15 Tahun Jadi Buron,

Pembobol Bank Mandiri Rp 120 Miliar Ditangkap!”

selengkapnya https://news.detik.com/berita/d-

5642279/15-tahun-jadi-buron-pembobol-bank-

mandiri-rp-120-miliar-ditangkap. Detik.Com.

Simanullang, T. (2021). Pengaruh Tipe Kepribadian the Big

Five Model Personality Terhadap Kinerja Karyawan.

Jurnal Manajemen Pendidikan Dan Ilmu Sosial

(JMPIS), 2(2).

Sugiyono. (2014). Metode Penelitian Kuantitatif,

Kualitatif, dan R&D. Alfabeta.

Tresyani, T. (2019). Pengaruh Sistem Pengendalian

Internal Terhadap Kualitas Sistem Informasi Akuntansi

Yang Berdampak Pada Kualitas Informasi Akuntansi

(Survei Pada Satuan Kerja perangkat Daerah Kota

Bandung). Doktoral Dissertation, Universitas

Komputer Indonesia.

Wisna, N. (2015). Organizational Culture and its Impact on

the Quality of Accounting Information Systems.

Journal of Theoretical and Applied Information

Technology, 85(2).

Yanti, R. E. P. C. W. (2022). Factor Affecting the Quality

of Accounting Information: The Role of Accounting

Information Systems. Jurnal Riset Akuntansi

Kontemporer, 14(1).

The Challenges Faced by the Information System in the Era of Industry 4.0 and Their Impact on Information Quality

205