Customer Churn Prediction: An Empirical Research of

Telecommunications Service Provider in the United States

Yifei Dou

Department of Mathematics, University of Washington Seattle, Seattle, U.S.A.

Keywords: Prediction, Customer Churn, Telecommunications Service.

Abstract: In the competitive landscape of subscription-based industries, like telecommunications services, customer

retention is vital for sustained growth. The dynamic nature of Telecom Industry requires a proactive approach

to address customer churn, which can lead to financial losses and damage to reputation. This research uses

linear regression analysis to predict customer churn within U.S. telecommunications service providers. By

exploring the relationships between customer attributes and churn scores, the study aims to provide actionable

insights for informed decision-making. The methodology involves data collection, hypothesis formulation,

correlation, and constructing a linear regression model. Through meticulous analysis, the study's findings

reveal that longer subscription tenure and extended contracts are associated with lower churn scores,

emphasizing their role in fostering loyalty. Conversely, certain internet service types and higher monthly

charges are linked to elevated churn scores, underscoring the importance of service quality and pricing

considerations. The research contributes to the strategic arsenal of telecommunications providers, equipping

them with a predictive tool to address customer churn and cultivate loyalty.

1 INTRODUCTION

In developed nations, the telecom industry plays a

pivotal role and has seamlessly integrated itself into

the necessities that people need to live. However,

within the landscape of subscription-based business

models, like telecommunications services, ensuring

customer retention stands as a fundamental pillar for

sustained growth. Competition is fierce in the

Telecom market, where customers are presented with

various providers even within a single service

category. The significance of this competition cannot

be underestimated, as even a single instance of

dissatisfaction can prompt a customer to switch

allegiances. The potential repercussions are

substantial, spanning from tangible financial losses to

irreparable damage to reputation. Yet, many telecom

providers concentrate their efforts on acquiring new

customers, inadvertently sidelining the equally crucial

pursuit of nurturing existing ones and capitalizing on

their untapped consumption potential. Reichhold et al.

invalidate this notion by highlighting a positive

correlation between the longevity of a business-

customer relationship and the enterprise's profitability

from its existing clientele (Reichheld et al 2000). This

study notes that just a 5% boost in the customer

retention rate translates to a remarkable 25% to 95%

escalation in the net present value of customers within

the business ecosystem. Therefore, businesses need a

system that can predict customer churn effectively in

the early stages, which is essential for any service

sector. This paper focuses on predicting customer

churn scores within telecommunications service

providers in the United States. This study employs a

versatile statistical method of linear regression to

uncover the underlying patterns and influences on

churn scores. By delving into the nuanced

relationships between customer attributes and churn

scores, this paper intends to provide actionable

insights for informed decision-making.

2 REVIEW OF LITERATURE

According to scholars, customer churn can also be

categorized as customer attrition. It is the tendency of

customers to disengage from a brand or service,

thereby discontinuing their patronage and ceasing to

be paying clients of a particular business (Duan and

Ras 2022). There are many mistakes brands or service

providers can make, ranging from cumbersome

onboarding, where customers do not receive easy-to-

Dou, Y.

Customer Churn Prediction: An Empirical Research of Telecommunications Service Provider in the United States.

DOI: 10.5220/0012802000003885

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Analysis and Machine Learning (DAML 2023), pages 509-514

ISBN: 978-989-758-705-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

509

understand information on product or service usage

and functionalities, to poor communication - such as

providing inadequate feedback or delays when

responding to customer queries. Nevertheless, as

asserted by Payne et al., the reality is that even loyal

customers will not tolerate a brand if they experience

one or several issues with it (Payne and Frow 2016).

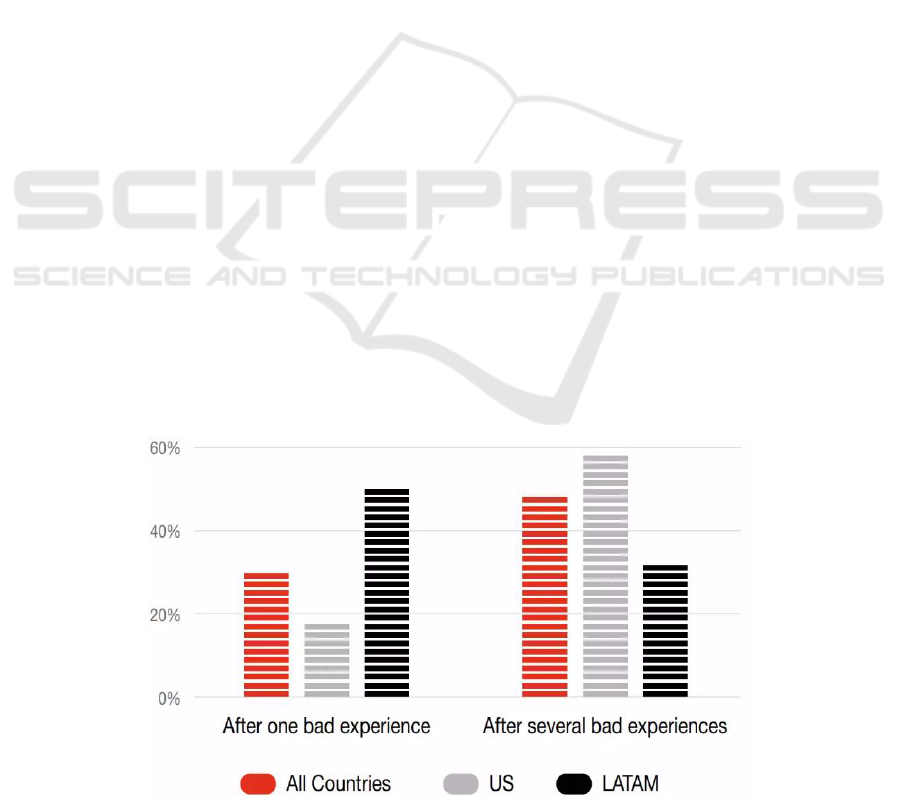

As shown in figure 1, 59 percent of U.S. respondents

who participated in the survey by

PricewaterhouseCoopers noted that they would

abandon a brand or any service after several negative

experiences, and 17 percent of them after just a single

negative experience (Coopers 2018).

Within the context of the telecom industry,

addressing the challenge of customer churn has spurred

scholarly inquiry, with researchers delving into various

facets, including the root causes of churn, strategies for

reclaiming customers, and the construction of

predictive models. Kim and Kwon's investigation has

shed light on the pivotal relationship between the scale

of the network and the churn propensity of telecom

customers (Kim and Kwon 2003). On the other hand,

Lee et al. conducted a comprehensive study exploring

the impact of customer satisfaction and switching costs

on the customer churn phenomenon within French

mobile communications (Lee and Feick 2001). Their

findings illustrate that when customer satisfaction

remains unchanged and switching costs increase

accordingly, customer churn may be less likely (Lee

and Feick 2001).

Delving into the intricate web of churn dynamics,

Ahn et al. discovered key factors influencing customer

churn (Ahn, Han and Lee 2006). Their focus included

monthly internet service provider consumption and

household income as influencing factors for customer

churn rates (Ahn, Han and Lee 2006). Amin et al. also

conducted an in-depth analysis of churn drivers from

the standpoints of enterprises, competitors, and

customers while concurrently proposing strategies for

winning lost customers (Amin et al 2017). This study

figured out the interplay between consumer sentiment,

switching barriers, customer satisfaction, and

customer retention, positing a positive correlation

between customer satisfaction and customer retention.

Advocating for a systematic approach, Davis et al.

emphasize the significance of tracing the root cause of

customer attrition in the quest for effective customer

win-back strategies (Davis and Lemon 2007). Echoing

this sentiment, Nasir posits that understanding the

rationale behind customer churn serves as a pivotal

variable in discerning the viability of customer

reclamation tactics, effectively providing a

fundamental basis for devising successful win-back

approaches (Nasır 2017). Through these scholarly

endeavors, a great understanding of customer behavior

and strategies for enhancing customer retention is

steadily cultivated, empowering businesses to make

well-informed decisions in the quest for sustained

growth while building customer allegiance.

3 METHODOLOGY

3.1 Data Collection and Preprocessing

The foundation of this study lies in a dataset sourced

from the Kaggle dataset (IBM dataset). Specifically,

telco customer churn data has been selected as the

focal point to predict customer churn within the

United States-based telecommunication service

provider. This dataset comprises 7043 observations

and encompasses various variables, capturing

demographic details, subscription specifics, contact

Figure 1: When do consumers stop interacting with brands they love (Picture credit: Original).

DAML 2023 - International Conference on Data Analysis and Machine Learning

510

information, service usage, and churn-related

attributes. However, the features chosen for this study

have been curated to encompass those demonstrating

potential influence on churn outcomes, including:

• Tenure Months: This feature reveals the time a

customer has subscribed to the service, which

may correlate with loyalty and the likelihood of

churn.

• Internet Service: By categorizing internet service

types into DSL, Fiber Optic, Cable, or None, this

classification inherently captures the impact of

internet service on user satisfaction and the

consequent likelihood of churn.

• Contract: This categorical variable denotes the

contract type of customers, namely Month-to-

Month, One Year, or Two Year, which could

play a pivotal role in churn prediction and might

significantly impact customer retention rates.

• Monthly Charge: As a key determinant of the

overall customer expense, the monthly charge

can potentially sway customers' decisions to stay

or leave.

• Churn Score: A continuous variable quantifying

churn likelihood, calculated via IBM SPSS

Modeler incorporating multiple factors. This

comprehensive metric serves as the bedrock for

predictive analysis.

Before analysis, a rigorous preprocessing phase

was undertaken to guarantee data quality and

suitability. This included identifying and treating

missing values, encoding categorical variables, and

conducting exploratory data analysis to identify

potential outliers and anomalies.

3.2 Hypothesis Formulation

In line with the research objectives, specific

hypotheses were formulated to guide the investigation

into the relationships between customer attributes and

churn scores. The hypotheses include:

• Hypothesis 1: Customers with longer tenure

months are expected to exhibit lower churn

scores, indicating higher loyalty.

• Hypothesis 2: Different types of internet service

will be associated with distinct churn scores,

with Fiber Optic service potentially leading to

higher churn scores.

• Hypothesis 3: Increasing monthly charges will

correspond to higher churn scores, suggesting

that cost considerations influence customer

attrition.

• Hypothesis 4: Contract type will impact churn

scores, with longer-term contracts (One Year,

Two Year) leading to lower churn scores.

3.3 Model Development

The research employs linear regression analysis to

elucidate the associations between customer attributes

and churn scores. Linear regression is chosen for its

suitability in modeling continuous outcomes, making

it apt to predict churn scores—a continuous variable

ranging from 0 to 100. The theoretical underpinning

of this model takes the form of a linear equation. As

shown in:

+++

++=

ContracteChMonthly

ServiceInternetMonthsTenureScoreurnC

43

210

arg

h

()

Where:

• Churn Score: The predicted churn score reflects

the estimated likelihood of customer churn.

• β₀: The intercept term representing the churn

score when all predictor variables are zero.

• β₁ to β₄: The coefficients attributed to each

predictor variable, indicating the magnitude of

influence on churn scores.

• Tenure Months: The duration of customer

subscription impacting the baseline churn score.

• Internet Service: The categorical variable

encodes different internet service modes,

contributing to churn score variations.

• Monthly Charge: The monthly financial

commitment of customers, influencing churn

score fluctuations.

• Contract: The categorical variable representing

contract types affecting the churn score.

The model's predictive prowess and explanatory

power are rigorously assessed through F-Statistic and

R-squared (R²) metrics. The F-Statistic gauges the

significance of the model, while the R² metric

quantifies the proportion of churn score variability

explained by the model.

4 RESULTS AND DISCUSSION

4.1 Descriptive Statistics and

Correlations

As shown in table 1, the descriptive statistics provide

insights into the central tendencies and variability of

the variables. Churn scores vary from 5 to 100, with

an average of around 58.7, indicating a moderate

likelihood of churn. Customers' tenure ranges from 0

to 72 months, averaging approximately 32.4 months.

Monthly charges span from 18.25 to 118.75, with an

average of about 64.76, suggesting a wide range of

pricing plans. The contract variable's mean of 1.69

Customer Churn Prediction: An Empirical Research of Telecommunications Service Provider in the United States

511

indicates a prevalence of month-to-month contracts.

Internet service shows a mean of 1.873, suggesting

Fiber Optic is the dominant choice, followed by DSL.

The Correlation analysis shown in table 2 reveals

relationships among variables. For instance, Tenure

Months' exhibits a negative correlation of -0.22 with

'Churn Score,' indicating that as the length of

subscription ('Tenure Months') increases, the

likelihood of churn ('Churn Score') tends to decrease.

Additionally, a slight positive correlation of 0.13

between 'Monthly Charges' and 'Churn Score' suggests

that higher monthly charges might contribute to a

higher propensity to churn. The correlation between

'Contract' and 'Churn Score' is -0.26, implying that

customers with longer-term contracts have lower

churn scores, aligning with the concept of contract-

based loyalty (Parahoo et al 2007). Meanwhile,

'Internet Service' displays a negligible correlation with

'Churn Score,' indicating a weak negative relationship

between the type of Internet service and churn

likelihood."

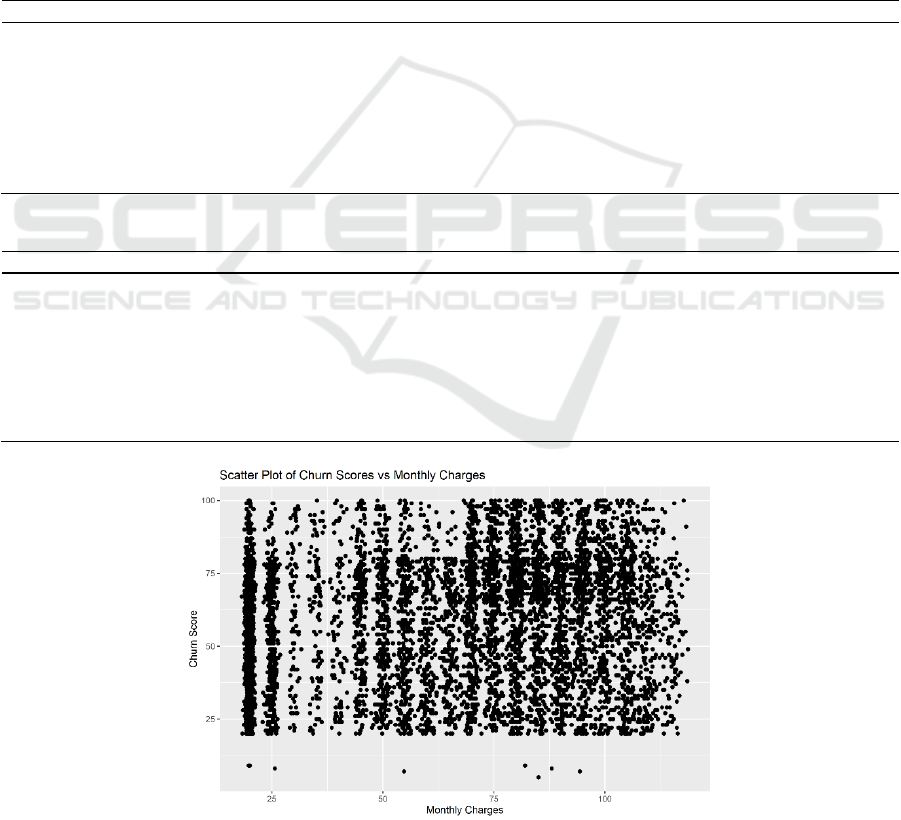

The scatter plot presented in Figure 2 showcases

the relationship between 'Tenure Months' and 'Churn

Score' within the dataset. Notably, there appears to be

a general trend of decreasing churn scores as 'Tenure

Months' increases, suggesting a potential negative

correlation between these two variables. This visual

representation provides an initial insight into the

potential influence of customer tenure on churn

likelihood."

Table 1: Descriptive Statistics.

Churn Score

Tenure Months

Monthly Charges

Contract

Internet Service

Min.

5.0

0.00

18.25

1.00

1.000

1

st

Qu.

40.0

9.00

35.50

1.00

1.000

Median

61.0

29.00

70.35

1.00

2.000

Mean

58.7

32.37

64.76

1.69

1.873

3

rd

Qu.

75.0

55.00

89.85

2.00

2.000

Max.

100.0

72.00

118.75

3.00

3.000

Table 2: Correlation Matrix.

Churn Score

Tenure Months

Monthly Charges

Contract

Internet Service

Churn Score

1.000000

-0.224987

0.133754

-0.262566

-0.022149

Tenure Months

-0.224987

1.000000

0.247900

0.671607

-0.030359

Monthly

Charges

0.133754

0.247900

1.000000

-0.074195

-0.323260

Contract

-0.262566

0.671607

-0.074195

1.000000

0.099721

Internet

Service

-0.022149

-0.030359

-0.323260

0.099721

1.000000

Figure 2: Scatter Plot (Picture credit: Original).

DAML 2023 - International Conference on Data Analysis and Machine Learning

512

4.2 Linear Regression Results

Table 3: Residuals.

Min

1Q

Median

3Q

Max

Residuals

-54.951

-16.448

-2.419

15.743

49.951

Table 4: Coefficients.

Estimate

Std. Error

T value

Pr(> | t |)

(Intercept)

58.576640

1.176264

49.799

<2e-16

Tenure Months

-0.157767

0.014628

-10.785

<2e-16

Monthly Charges

0.130967

0.009276

14.118

<2e-16

Contract

-3.422196

0.419323

-8.161

3.9e-16

Internet Service

1.306760

0.350031

3.733

0.000191

Gender Male

0.170166

0.487277

0.349

0.726937

The study linear equation is thus given in:

++

+=

ContracteChMonthly

ServiceInternetMonthsTenureScoreurnC

422.3-arg131.0

307.1158.0-h

0

()

As shown in Table 3 and Table 4, the linear regression

model offers insights into the relationships between

predictor variables and churn scores:

• Tenure Months (β₁): The negative coefficient of

-0.157767 indicates that, on average, for every

additional month of tenure, the churn score

decreases by 0.157767. This implies that longer

subscription periods are associated with

increased loyalty and reduced churn likelihood.

• Internet Service (β₂): The positive coefficient of

1.306760 suggests that customers using certain

internet service types (e.g., Fiber Optic) tend to

have higher churn scores, potentially due to

service quality issues. Customers with Fiber

Optic service might be more likely to consider

alternatives.

• Monthly Charge (β₃): The positive coefficient of

0.130967 signifies that for every unit increase in

monthly charge, the churn score increases by

0.130967. This suggests that higher monthly

charges might lead to a higher propensity to

churn, emphasizing the need for a balance

between cost and perceived value.

• Contract (β₄): The negative coefficient of -

3.422196 highlights that customers with longer-

term contracts (One Year, Two Years) exhibit

lower churn scores. This aligns with the notion

that extended contracts foster loyalty and

mitigate churn risks.

4.3 Hypothesis Testing

The hypotheses formulated were subjected to

hypothesis testing:

• Hypothesis 1: The p-value for Tenure Months

(β₁) is < 0.001, which is less than the significance

level (α = 0.05). Therefore, there is evidence to

reject the null hypothesis. Customers with longer

tenure months do indeed exhibit lower churn

scores, signifying higher loyalty.

• Hypothesis 2: The p-value for Internet Service

(β₂) is less than 0.001, providing strong evidence

to reject the null hypothesis. Different internet

service types are associated with distinct churn

scores, with Fiber Optic service potentially

leading to higher churn scores.

• Hypothesis 3: The p-value for Monthly Charge

(β₃) is 0.000191, indicating evidence to reject the

null hypothesis. An increase in monthly charges

does correspond to higher churn scores,

suggesting cost considerations influence

customer attrition.

• Hypothesis 4: The p-value for Contract (β₄) is

less than 0.001, allowing for rejecting the null

hypothesis. Contract type does impact churn

scores, with longer-term contracts leading to

lower churn scores.

4.4 Model Performance Evaluation

The model's predictive performance was evaluated

using the F-statistic and R-squared (R²). The obtained

F-statistic of 154.3, with an associated p-value < 2.2e-

16, signifies the model's overall statistical

significance. This suggests that the model collectively

can explain a substantial amount of the variability

observed in churn scores. The R² value of 0.09818,

while modest, indicates that approximately 9.8% of

the variability in churn scores is accounted for by the

predictor variables in the model.

5 CONCLUSION

In the ever-evolving telecommunications landscape,

where customer churn can significantly impact

business sustainability, the ability to predict customer

attrition emerges as a strategic imperative. This

research embarked on an empirical journey to predict

customer churn scores within a prominent United

States-based telecommunications service provider.

The intricate relationships between customer

Customer Churn Prediction: An Empirical Research of Telecommunications Service Provider in the United States

513

attributes and churn scores were illuminated through

the lens of linear regression analysis.

The findings reveal that subscription tenure,

internet service type, monthly charges, and contract

duration all contribute to the intricate tapestry of

customer churn. Longer tenure and extended contracts

were found to correlate with lower churn scores,

underscoring their role in fostering loyalty.

Conversely, certain internet service types and higher

monthly charges were associated with elevated churn

scores, highlighting the need for service quality and

pricing considerations.

However, this study is not without its limitations.

The linear regression model used in this study, while

effective, may oversimplify the complex relationships

between various factors contributing to customer

churn. Additionally, some factors like Payment

Method, Tech Support, or Online Security that might

affect the results are not considered in the research.

This may lead to an error in the study.

Future research could explore more sophisticated

predictive models or machine learning algorithms that

can capture non-linear relationships and interactions

between variables. Moreover, comparative studies

involving multiple service providers across different

geographical locations could provide more

comprehensive insights into customer churn patterns.

The linear regression model's adeptness in

predicting churn scores, coupled with the insights

derived, equips telecom providers with actionable

intelligence for crafting targeted retention strategies.

By leveraging this predictive tool, providers can

mitigate churn risks and bolster customer loyalty,

thereby navigating the dynamic telecommunications

landscape with acumen. This study serves as a

steppingstone towards more advanced predictive

models and broader comparative studies in the future.

REFERENCES

F. Reichheld, R. G. Markey Jr, and C. Hopton, “The loyalty

effect-the relationship between loyalty and profits”.

European business journal, vol. 12, no. 3, pp. 134, 2000.

Y. Duan, and Z. W. Ras, “Recommendation system for

improving churn rate based on action rules and

sentiment mining”. International Journal of Data

Mining, Modelling and Management, vol. 14, no. 4, pp.

287-308, 2022.

A. Payne, and P. Frow, “Customer relationship

management: Strategy and implementation”. In The

Marketing Book. Routledge, pp. 439-466, 2016.

PricewaterhouseCoopers. “Experience is everything:

Here’s how to get it right”. 2018.

H. S. Kim, and N. Kwon, “The advantage of network size

in acquiring new subscribers: a conditional logit

analysis of the Korean mobile telephony market”.

Information economics and policy, vol 15, no. 1, pp. 17-

33, 2003.

J. Lee, and L Feick, “The impact of switching costs on the

customer satisfaction ‐ loyalty link: mobile phone

service in France”. Journal of services marketing, vol.

15, no. 1, pp. 35-48. 2001.

J. H. Ahn, S. P. Han, and Y. S. Lee, “Customer churn

analysis: Churn determinants and mediation effects of

partial defection in the Korean mobile

telecommunications service industry”.

Telecommunications policy, vol. 30, no. 10-11, pp.

552-568, 2006.

A. Amin, S. Anwar, A. Adnan, M. Nawaz, K. Alawfi, A.

Hussain and K. Huang, “Customer churn prediction in

the telecommunication sector using a rough set

approach”. Neurocomputing, vol. 237, pp. 242-254,

2017.

L. M. Davis, and K. N. Lemon, “The wow factor: Creating

value through win-back offers to reacquire lost

customers”. Journal of Retailing, vol. 83, no. 1, pp. 47-

64, 2007.

S. Nasır, “Customer retention strategies and customer

loyalty”. In Advertising and Branding: Concepts,

Methodologies, Tools, and Applications. pp. 1178-

1201. 2017.

S. K. Parahoo, J. M. Aurifeille, and S. K. Sobhee,

“Contractual loyalty: leveraging partnerships to achieve

customer loyalty in global markets”. Globalization and

Partnerships: Features of Business Alliances and

International Cooperation, 2007.

DAML 2023 - International Conference on Data Analysis and Machine Learning

514