Analysis of the Factors Influencing Streaming Video Services'

Business Performance

Ruonan Sun

Department of Mathematics, University of California, Irvine, Irvine, U.S.A.

Keywords: Streaming Video Services, Business Performance, Visualize.

Abstract: People are not satisfied with the limited programs available on cable TV, and with the popularity of the

internet and the common use of electronic devices, as well as the constant technological innovations of video

companies, people can now watch any performance they want in their homes in very high definition. The

video streaming industry is one of the hottest and most profitable industries today. But it's not yet clear when

the big video service media players gained their strong leading position in the market and how they divide up

the mainstream video service media market. Therefore, this paper examines the trends in the number of

subscribers of video streaming platforms with more than 60 million subscribers over the seven years from

2017 to 2023. Through data visualization and data comparison, it is straightforward to see that in the three

years starting in 2017, the number of subscribers grew rapidly, but starting in 2020, some established

platforms started to stagnate as some emerging platforms entered the market and were full of potential. Then

this paper analyzes the reasons behind the trends, like market saturation, the support of technology, users’

demand, social background, and market opportunity.

1 INTRODUCTION

Video streaming service has revolutionized the TV

market. One decade ago, people still needed to watch

programs through cable TV, and radio, rent DVDs or

go to the theater, and their choices were very limited.

Nowadays, with the development of technology,

streaming services area achieved great progress and

become a hot industry. Also, with the improvements

in people's living conditions, electronic devices are

more easily available. People do not need to go to the

theater or rent a TV disk to watch a TV performance.

As long as people have an Internet connection and

electronic devices, whenever and wherever people

want, they just need to switch on their device and

press the button and then can watch their favorite TV

series, shows, and movies and any time, and space.

Streaming services, or more exactly, over-the-top

video services have greatly facilitated people’s lives.

over-the-top video services is also called OTT video

services, meaning access via the Internet or networks

which is independent of those dedicated to the

transmission of programs like cable or radio (Radio-

television and Commission 2011).

OTT services have become an integral part of

people's lives. Statistical data show, that until 2023,

OTT video services have an enormous market, having

more than 3.5 billion global users and continuously

increasing (Stoll 2023). Even in some countries, like

Canada and the United Kingdom, video streaming

service’s penetration rate is 90 percent in terms of

population (Keenan 2023). Also, the global video

streaming market was valued at $455.45 billion in

2022 and $554.33 billion in 2023. Based on

prediction, the number will be increased to $1,902.68

billion by 2030 (Software 2023). So, the video

streaming area is a profitable field and keeps

increasing. Thus, the streaming services industry is

becoming increasingly competitive. To retain and

even gain more users, streaming service providers do

their best to be more competitive and unique and

stand out from the competition to satisfy users’

demands such as higher video quality, more available

programs, and more customizable content.

In this article, several comparisons and contrast of

the business performance of 7 major platforms will be

done by data visualizing the last 7 years' subscriber

data to analyze the impact of some macro-

environment factors in the video streaming industry,

as well as the impact of micro-events on different

streaming platforms.

98

Sun, R.

Analysis of the Factors Influencing Streaming Video Services’ Business Performance.

DOI: 10.5220/0012808600003885

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Analysis and Machine Learning (DAML 2023), pages 98-102

ISBN: 978-989-758-705-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

2 METHOD

While many video platforms have a free trial period,

it if attractive enough then many users will convert to

subscribers. Most of the video streaming service so

far is paid service and have gained profit from it, so

the number of subscribers indicates the overall

business performance, customer loyalty, and even

brand influence of the platform.

The study focuses on current global major video

streaming platforms that have more than 60 million

subscribers (Netflix, Amazon Prime Video, Disney

Plus, Paramount+, Max and Discovery, Tencent

Video, and Iqiyi). The paper wants to know the

number changes of subscribers of these platforms

over the last seven years from 2017 to 2023. The

study visualizes the data by making line graphs of it.

It clearly shows the general and gradual trend in the

number of subscribers over time, as well as a change

in the growth rate. Also, the comparison is made by

visualizing different platforms' data in a single chart.

To reflect the impact of the emergence of new

platforms on the market as well as their change in

market share, this paper has also done a market share

pie chart comparison.

3 RESULTS AND DISCUSSION

3.1 Result

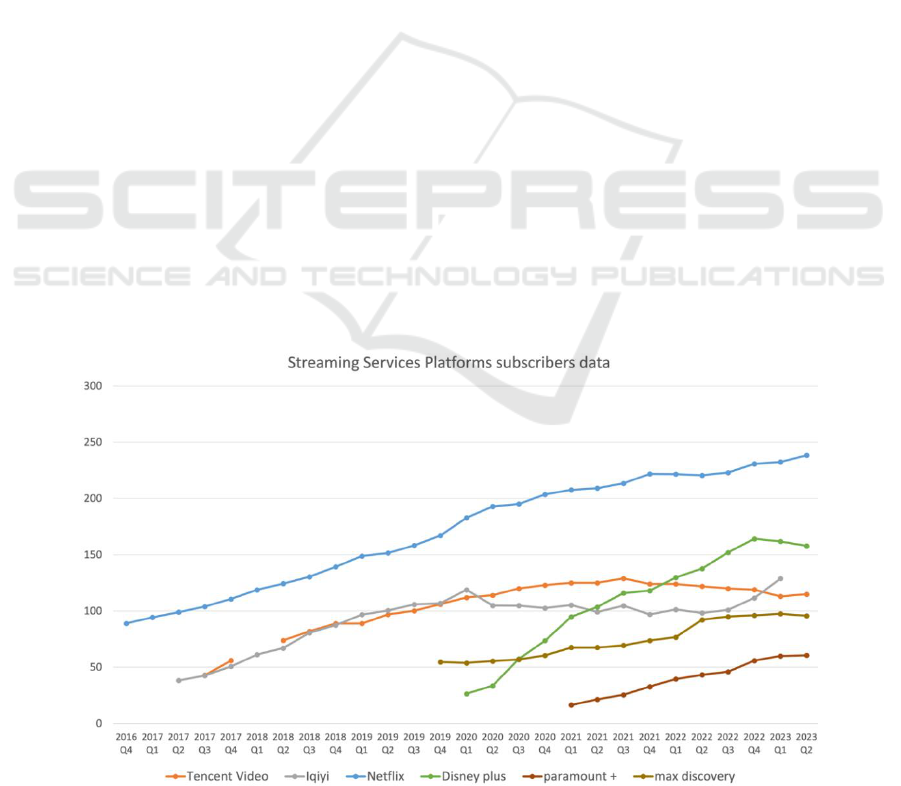

In Figure 1, all the data are collected from the

platform company official quarterly financial report

that shows global platform subscribers. The chart

clearly shows that between 2017 and 2020, there were

only a few video streaming platforms that existed in

the early market such as Netflix, Tencent Video, and

Iqiyi, the number of subscribers grew very rapidly

year by year, but the increase slowed down and even

tends to decline between 2020 and 2023, but there is

still a huge base of user numbers. During this time,

many emerging video streaming providers which are

growing extremely rapidly such as Disney Plus,

Paramount+, Max, and Discovery have entered the

market.

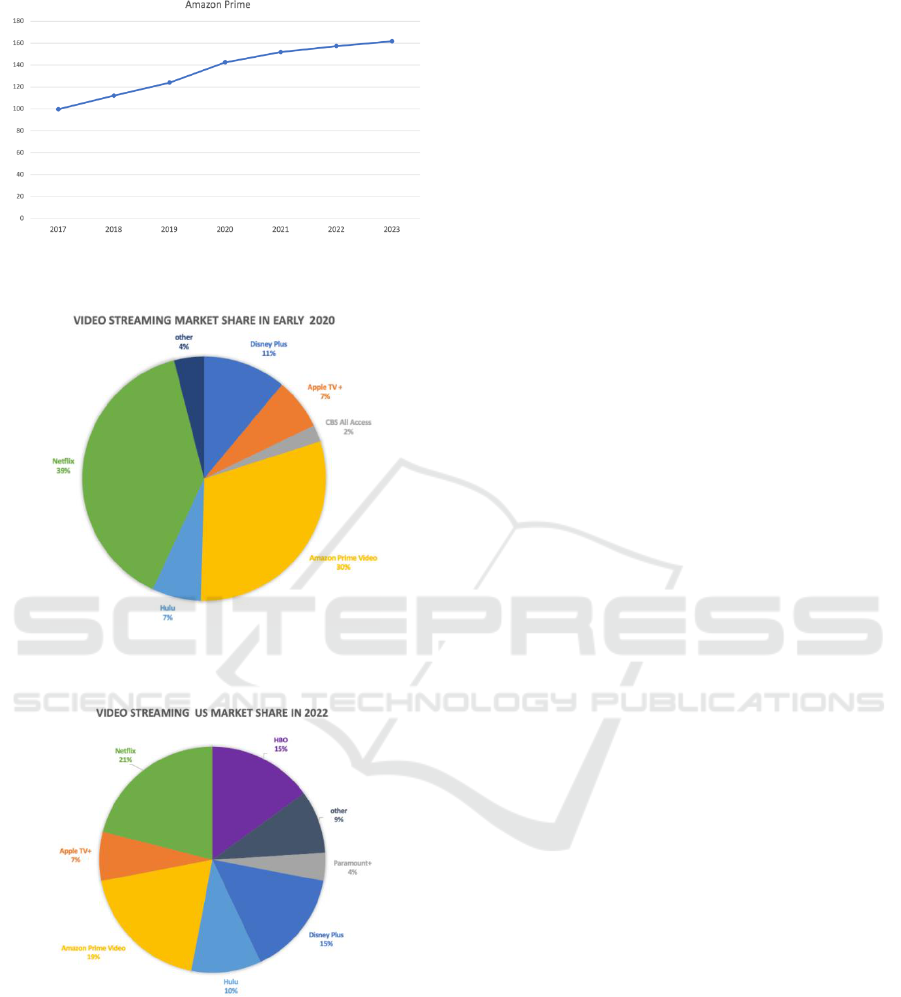

Data in Fig. 2 is collected on the change in the

number of Amazon Prime users in the United States

over seven years from 2017 to 2023. Since U.S.

Amazon Prime users make up 74% of the total

number of users worldwide, it is very representative

to study the change in the number of U.S. users

(Woodward 2023). It can be seen from Figure2 that

Amazon Prime Video (Woodward 2023), as a

streaming platform that entered the market early and

has been in the market for a long time, also developed

beamingly between 2017 and 2020, but slowed down

in the latter three years.

The comparison between Figure 3 and Figure 4 is

remarkable (Yujin 2020 & Susic, 2023). It is clear to

see that in the earlier years, Netflix and Amazon

Prime were the major holders of the market but with

the entry of newer platforms into the market, they are

not what they used to be and the market has become

more diverse.

Figure 1: Line chart showing the timely change of subscribers numbers of 6 major platforms in millions.

Analysis of the Factors Influencing Streaming Video Services’ Business Performance

99

Figure 2: Line chart showing the timely change of Amazon

Prime subscribers numbers in the US in millions.

Figure 3: Pie chart showing major streaming platforms and

their proportion in the market share before pandemic.

Figure 4: Pie chart showing major streaming platforms and

their proportion in US market share after the pandemic.

3.2 Discussion

The main factors for the changes in the market for

streaming service platforms are based on different

technological environments, social environments, and

competitive environments.

In 2017, cable TV was expensive and had only

fixed channels with more commercials, and people

were starting to get bored with it. It is undeniable that

platforms such as Netflix, Amazon, and others have

brought the new service of streaming to the forefront

of people's minds. They changed the way people

watch TV shows. People did not need to watch

advertisements and wait, and there were tons of

programs and movies in the playlist. Thus many

families transfer their cable subscriptions to

streaming services (Blomeley 2021).

After making people aware of video streaming

services, different platforms have chosen different

strategies. For example, Tencent TV and Iqiyi are the

local Chinese video providers who have focused on

the features of China's large population base. So, they

created unprecedented talent shows, like Idol

producer and Producer 101, to appeal to the local

Chinese audience. Based on data, producer 101

received more than 4.3 billion views in total, which

shows a huge success (Jing 2018). While Netflix

chose a very different strategy for expanding the

market. It began to open overseas and international

markets. It works with local companies to provide

content that is more tailored to the preferences of local

people, adds more languages, optimizes its content

library, and works with device manufacturers and

Internet service providers to provide a better user

experience (Barros 2022).

However, the development of platforms cannot

succeed without the development of technology. As

mentioned above, OTT services, including video

streaming services, rely heavily on the open Internet

to deliver content to end users. As broadband

networks continue to evolve, more video content that

needs larger volumes can be presented to users (Lee

et al 2021). Platforms are also constantly improving

their technology to enhance the user experience. For

example, they are improving the delivery chain

technology, which allows users to watch higher-

quality videos by improving the shooting, pipeline

transmission, and high-resolution display (Rehman

2019). Between 2017 and 2020, streaming media is

still in a period of growth.

As shown in Fig. 3 above, only several streaming

platforms are dividing up the entire video streaming

market, so each platform is very profitable, with a

huge and continually soaring number of subscribers.

In the chart, in 2020 many established streaming

leaders will start to stagnate, but at the same time,

many new platforms will join the market. At the

beginning of 2020, the sudden onset of the epidemic

swept across the globe, with many countries

beginning to lockdown and people had to stay at home.

Offline entertainment venues are all closed,

DAML 2023 - International Conference on Data Analysis and Machine Learning

100

traditional movie theaters can't meet the demand for

entertainment. Watching online video programs has

become one of the few recreation people can do. In

the UK, adults spend 40% of their waking hours in

front of a screen during lockdown (Ahead 2023).

Many movie and video companies seized this

opportunity. They released their streaming platform.

Major media companies such as Paramount, HBO,

and Discovery, for example, have developed their

own streaming video services. The streaming wars (a

term used to describe the intense business practices in

the streaming service market) are beginning to be

fought. Companies engage in a variety of behaviors to

make themselves profitable. Fig.1 shows that

Paramount+, Max & discovery, and Disney Plus are

the more dominant platforms in the streaming wars.

This is inextricably linked to their original content.

Companies that have been established in television

for decades have enough content to air on their

platforms. Paramount owns Nickelodeon's content,

and HBO Max owns dozens of shows and movies

from Warner Bros. and Studio Ghibli (Blomeley

2021). For example, Disney retrieved all Marvel-

related content and all animations from Netflix (Yujin

2020). But Netflix is also trying to maintain its strong

position in the streaming market by creating

blockbuster franchises like Star Wars (Blomeley

2021). Many brands have also chosen to work on their

prices, either lowering prices to keep themselves

competitive or raising prices to make themselves

more profitable per user. Netflix's early success

through the integration of content from different

media channels, in the context of the streaming media

war, Netflix’s advantage is no longer obvious, need to

find another way out (Blomeley 2021).

But streaming companies need to make trade-offs

to maximize their profit. For example, to attract more

subscribers, Netflix started producing original content.

The squid game brought 4.38 million new subscribers

to Netflix (ÇEKEBİLİR 2021). But at the same time,

Netflix spent 21.4million to produce this opera (Clark

2021). Apple TV+ costs 6 billion to produce high-

quality content (Leswing 2019). The original series

was undoubtedly an attraction to users, but companies

still have to make a prediction and trade-offs between

the investment and the return. And companies also

need to make a good trade-off between subscription

price increases and the profit they can achieve.

According to the survey, it was found that 49% of

users would cancel their video streaming subscription

if the price went up (Susic 2023). If the price increase

leads to higher profits per subscriber, but results in the

loss of a large number of subscribers, it will be a lose-

lose situation.

4 CONCLUSION

A visualization of the subscriber’s data shows that the

streaming industry boomed in the early years because

of technological advances or because people were

tired of the limitation of cable TV. At the beginning of

2020, with the impact of the pandemic, the video

streaming service market reached its peak, and many

companies entered the industry and started competing.

These companies demonstrated the uniqueness of the

brand by taking back its movie rights, creating

original content, or offering customized services,

making each platform inimitable. Some movie studio

companies seem to have a better edge on the

competition than Netflix, and Amazon Prime Video

which are more like a movie program library. Thus,

these previous streaming leaders should find their

ways to reinforce their position.

However, it's easy to see through the charts that

while the number of subscribers to some of the older

streaming platforms has been declining in recent

years, the overall market, that is, the sum of

subscribers to all of the platforms, has been increasing

- that is, the market as a whole has been continuing to

steadily thrive. While brands continue to innovate and

increase their uniqueness, the industry continues to

progress, providing users with services that make

them more satisfied.

REFERENCES

C. Radio-television and T. Commission, “Results of the

fact-finding exercise on the over-the-top programming

services,” October 2011.

J. Stoll, “Video streaming worldwide – statistics & facts,”

Statista, August, 2023.

M. Keenan, “Top OTT statistics: market, live streaming,

OTT apps, advertising,” uscreen, September 2023.

H. Software, “Video streaming market size, share& covid-

19 impact analysis, by component (software and content

delivery services), by channel ( satellite TV, cable TV,

Internet protocol television (IPTV), and OTT

streaming), by vertical (education/ e-learning,

healthcare, government, sports/ esports, gaming,

enterprise and corporate, auction and bidding, fitness&

lifestyle, music& entertainment, and others

(transportation)), and regional forecast, 2023-2030,”

Fortune business insights, May 2023.

M. Woodward, “Amazon prime statistics: subscribers,

usage & revenue 2023,” Search logistics, July 2023.

A. Blomeley, “The rise of streaming platforms: more shows,

more money, more problems,” The crimson white, June

2021.

Analysis of the Factors Influencing Streaming Video Services’ Business Performance

101

L. Yujin, “The streaming war during the covid-19

pandemic,” Arts management & technology laboratory,

December 2020.

P. Susic, “30+ video streaming services market share,

subscribers, growth (data 2023),” Headphones addict,

February 2023.

C. Jing, “Produce 101 begins a wave of interest in Chinese

idol groups,” Pandaily, July 2018.

I. Barros, “Netflix’s international expansion strategy,”

Synergos, 2022.

S. Lee, S. Lee, H. Joo, “Examining factors influencing early

paid over-the-top video streaming market growth: a

cross-country empirical study,” MDPI, 2021.

A. Rehman, “How technology is improving the video

streaming experience,” Forbes, January 2019.

T. ahead, “The unassailable rise of Netflix”, ACCA, August

2023.

İ. ÇEKEBİLİR, “Squid game frenzy lures new subscribers

to Netflix,” Aljazeera, October 2021.

T. Clark, “Netflix reportedly spent $21 million on ‘Squid

game,’ its all-time biggest hit. Here’s how that

compares to other show budgets,” Business insider,

October 2021.

K.Leswing, “Apple is spending $6 billion on original shows

and trying to beat Disney + to market, reports FT,”

CNBC, C 2019.

DAML 2023 - International Conference on Data Analysis and Machine Learning

102