A Feature-Engineered ARIMA-SARIMA Hybrid Model for Stock

Price Prediction

Jialu Luo

Department of Computer Science and Technology, Nanjing University, Nanjing, China

Keywords: Stock Price Prediction, ARIMA, SARIMA, Feature Engineering.

Abstract: Stock price prediction has long been a challenging yet vital task for investors and financial analysts. This

research presents an innovative approach to enhance the accuracy of stock price predictions through the

integration of the Feature-Engineered Auto-regressive Integrated Moving Average (ARIMA) and the

Seasonal Auto-regressive Integrated Moving Average (SARIMA) hybrid model. The experiment and analysis

reveal the superior predictive performance of the ARIMA-SARIMA hybrid model compared to standalone

ARIMA or SARIMA models. By judiciously integrating seasonal and non-seasonal factors, the hybrid model

mitigates the limitations of individual models in capturing the complex dynamics of stock price movements.

This study opens new avenues for advancing stock price prediction models, offering investors and financial

practitioners a valuable tool for making informed decisions in an increasingly complex and dynamic financial

landscape. The fusion of traditional time-series analysis with feature engineering underscores the potential

for more accurate and reliable stock price forecasts, with implications extending beyond financial markets to

broader domains of time-series forecasting and prediction. Nevertheless, the fluctuations in stock prices are

influenced by multiple factors, many of which lie beyond the predictive capability of existing models. Thus,

while the hybrid model exhibits promising results, the author recognizes that further research is warranted to

incorporate a broader spectrum of influential factors.

1 INTRODUCTION

In the ever-evolving landscape of financial markets,

the ability to predict stock prices accurately holds

immense significance for investors, traders, and

financial institutions. The dynamic nature of stock

markets, influenced by myriad factors, presents a

formidable challenge for price forecasting.

Traditional time-series analysis methods, such as the

ARIMA and the SARIMA models, have long been

employed for this purpose. However, the

effectiveness of these models is often hindered by

their limited capacity to capture the multifaceted

dynamics of stock price movements.

Stock price prediction has been identified as an

important but challenging topic in the research area

of time-series analy-sis (Ren et al 2023). Foreseeing

upcoming stock prices is vital not only for making

investment decisions, but also for charting a

company's expansion, selecting strategic partners,

and appraising the firm's financial position. Relying

solely on analysts' personal experiences and intuition

for analysis and judgment, investors are susceptible

to emotional influences, leading to herd behavior and

irrational decision-making, lead-ing to significant

losses (Deng 2019). As a result, to help analysts and

investors make informed decisions about stock

trading, a scientific and effective research process is

needed. The most commonly used tools are IT

systems implementing technical analysis indicators

(Herwartz 2017). Matenczuk et al and Khang et al

have conducted recent research in this domain.

ARIMA and SARIMA are two commonly used

time series analysis methods employed to capture

trend and seasonality in stock price variations. Both

ARIMA and SARIMA include the components such

as auto-regression, differencing, and moving

averages. Furthermore, SARIMA extends its

capabilities by including seasonal auto-regression,

seasonal differencing, and seasonal moving averages.

Thus, SARIMA excels at capturing the seasonal

fluctuations characteristics of time series data.

Feature engineering is a crucial data processing

step that contributes to enhancing the performance

Luo, J.

A Feature-Engineered ARIMA-SARIMA Hybrid Model for Stock Price Prediction.

DOI: 10.5220/0012814600003885

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Analysis and Machine Learning (DAML 2023), pages 47-53

ISBN: 978-989-758-705-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

47

and accuracy of the predictive models. Its objective is

to extract or create notable features from raw stock

price data, reflecting the underlying and dynamic

trends in the stock market. In stock prediction, apart

from the opening price, closing price, the highest and

the lowest prices, there are many other significant

price features.

The Relative Strength Index (RSI), proposed by J.

Welles Wilder, was initially applied in the futures

market and has been widely used in the stock market

for the past two to three decades (Yun and Rui 2022).

Its principle is to assess the relative strength of buyers

and sellers in the financial market through the rise and

fall of the closing price or index over a certain period,

in order to speculate on the potential changes in stock

prices or future trends.

The moving Averages (MAs) represent the

average stock prices over defined periods.

Incorporating MA features assists the model in

recognizing price trends, price fluctuations, and

providing insights into stock market movements.

Stochastic Oscillator indicators gauge how stock

prices relate to the high-est and lowest prices over a

given period. Introducing it as an external feature

helps the model identify the strength of price trends

and potential turning points.

Effective design and selection of features through

feature engineering are critical components of

successful stock price prediction models.

In this paper, the author introduces a trained

ARIMA-SARIMA hybrid model using data processed

through feature engineering and comprehensively

evaluates this hybrid model.

2 METHOD

2.1 Data Source

The data was obtained from Yahoo Finance, and in

practical usage, the ‘yfinance’ library was used to

fetch the opening price, highest price, lowest price,

and closing price for each day within the period from

January 1, 2012, to September 12, 2023. The author

used 90% of data spanning nearly a decade as the

training set and reserved 10% for the testing set.

Additionally, calculations were made for the 5-day

moving average (MA5), 10-day moving average

(MA10), 20-day moving average (MA20), Relative

Strength Index (RSI), and Stochastic Oscillator (SO)

for each day. Table 1 and Table 2 below present some

examples from the dataset (the table data is for AMZN

stock data).

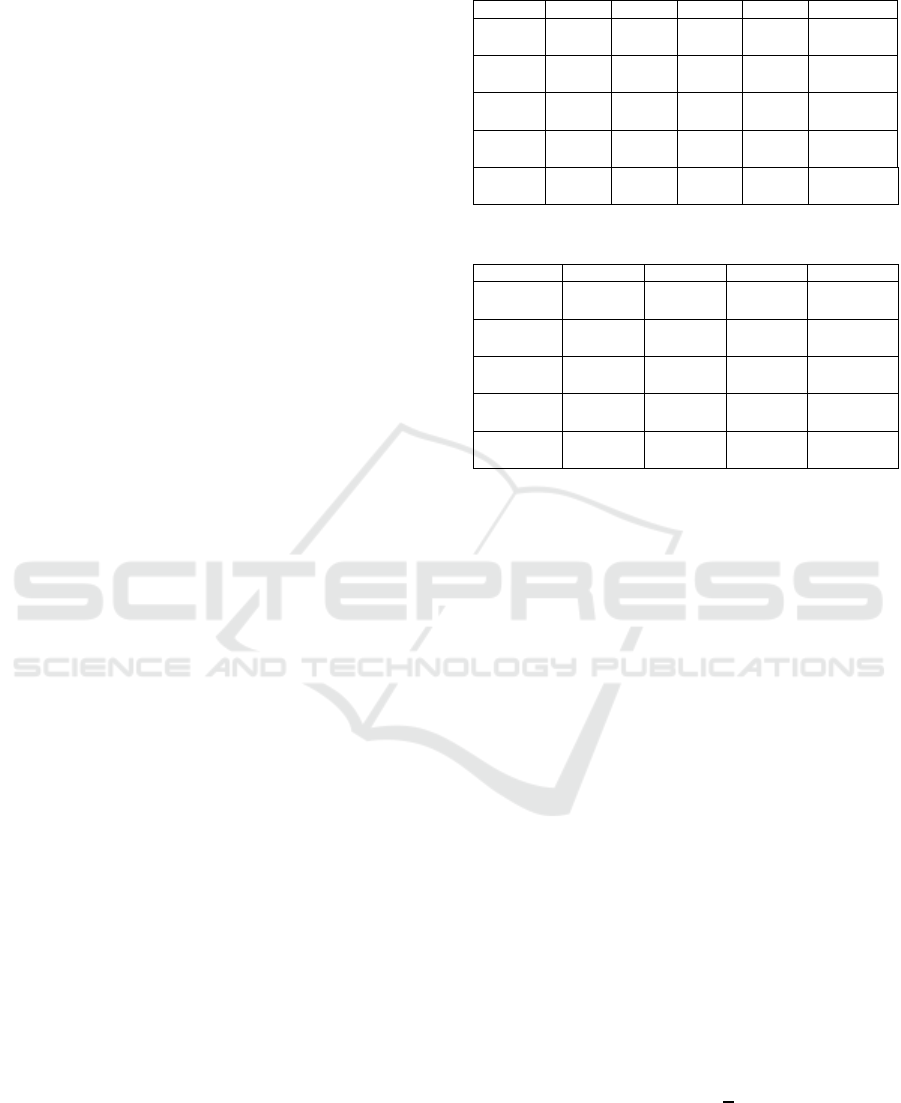

Table 1: Some Examples in The Dataset.

Date

Open

Close

High

Low

OS

2012-

01-31

9.7000

9.7220

9.7815

9.4850

91.043502

2012-

02-01

8.6905

8.9730

8.9975

8.6000

30.448928

2012-

02-02

8.9825

9.0860

9.0970

8.8400

39.673493

2012-

02-03

9.1415

9.3840

9.3950

9.0945

63.999984

2012-

02-06

9.3140

9.1570

9.3280

9.1460

45.469344

Table 2: Supplements.

Date

MA5

MA10

MA20

RSI

2012-01-

31

9.630800

9.554950

9.251400

66.748001

2012-02-

01

9.547400

9.505050

9.252475

50.469639

2012-02-

02

9.431400

9.441400

9.263000

54.914276

2012-02-

03

9.354500

9.425150

9.288175

57.422250

2012-02-

06

9.264400

9.410400

9.289500

51.620500

2.2 Feature Engineering

Feature engineering in the ARIMA and SARIMA

model primarily focuses on data preprocessing and

transformation to make time series data suitable for

the model. These preprocessing steps enhance the

model's accuracy and robustness, but they typically do

not involve traditional feature extraction or selection

processes because the ARIMA and SARIMA model

does not utilize explicit features. Instead, it relies on

the autocorrelation and moving average properties of

the data for forecasting.

The opening price, closing price, highest price, and

lowest price for each day can be easily retrieved.

Therefore, for the processing of these four features, it

is only necessary to perform some simple data

cleaning by removing data with NaN values and data

that are outliers.

During model training, the author considered not

only the four key features mentioned above but also

introduced external factors such as RSI, MA5, MA10,

MA20, and the stochastic oscillator as influences on

the model.

The MA5, MA10, and MA20 are derived from the

following calculation formula, where MA(P, N)

represents the N-day simple moving average of P. The

formula is:

(1)

During the data preprocessing stage, a 14-day time

window was chosen to calculate the RSI, which was

subsequently used as an external influencing factor for

DAML 2023 - International Conference on Data Analysis and Machine Learning

48

training the model. To calculate RSI, the first step is

to calculate Relative Strength (RS):

(2)

Then, calculate the Relative Strength Index

(RSI):

(3)

The stochastic oscillator, also known as the KD

indicator, is typically described using %K and %D.

The value of %K is cal-culated using the following

formula, where the ‘

’ re-presents the

minimum of the daily lowest stock prices within the

%K time interval, and ‘

’ represents the maxi-

mum of the daily highest stock prices within the %K

time interval:

(4)

Typically, the K value is used to calculate the D

value. It's common to use a 3-day simple moving

average. The formula is:

(5)

During the training of ARIMA and SARIMA

models, the decision to difference the aforementioned

data is determined based on the model parameters.

2.3 Model Selection

The author trained a hybrid stock price prediction

model based on ARIMA and SARIMA using the

processed data. During the training of the hybrid

model, the author employed an automatic parameter

selection function and chose the SARIMA model with

the minimum AIC and the ARIMA model with the

mini-mum BIC, respectively.

2.3.1 ARIMA Model

ARIMA model is a sophisticated and accurate

algorithm proposed by Box and Jenkins for analysing

and forecasting time series data (Shali 2013). In the

ARIMA model, AR stands for autoregressive, I

stands for differencing, and MA stands for moving

average. The AR model captures data with long-term

historical trends and utilizes them for predictions

while the MA model is more suitable for handling

time series data with transient, abrupt changes, or

high noise levels.

The ARIMA model forecasts the future by

exploring autocorrelations between historical data

through methods such as differencing. During model

training, ARIMA relies on three crucial parameters:

p, q, and d, representing the characteristics of its three

constituent parts.

Parameter p represents the characteristic of the

AR component, which determines that the observed

values in the autoregressive model are a linear

combination of the previous p values. Its

mathematical expression with the feature p is as

follows:

(6)

Parameter d represents the characteristic of the I

com-ponent, which represents the order of

differencing.

Parameter q represents the characteristic of the

MA component, which describes the lag values of the

error terms used in the model (i.e., the values from the

previous q periods). Its mathematical expression with

the feature q is as follows:

(7)

As a result, the formula for the ARIMA model can

be expressed as:

(8)

2.3.2 SARIMA Model

The SARIMA and ARIMA models are both

traditional time series forecasting models. The

difference is that SARIMA takes seasonal factors into

account in addition to what ARIMA does. It has three

non-seasonal parameters, namely p, q, and d, and four

seasonal parameters denoted as P, Q, D, and s. The

non-seasonal parameters are defined similarly to the

ARIMA model mentioned earlier.

When defining a SARIMA model, the lag

operator B is introduced. Equation (9) represents the

lag operator B acting at the time

, which is

equivalent to shifting

by one-time step, resulting in

.

(9)

Once defined the lag operator B can be used to

express the differencing operation by a formula:

(10)

Now, define a lag operator polynomial:

(11)

With the above definitions, it is easy to derive

simplified descriptions for ARIMA and SARIMA.

The simplified description of ARIMA is as follows:

(12)

The simplified description of SARIMA (p, d,

q)

is as follows:

(13)

A Feature-Engineered ARIMA-SARIMA Hybrid Model for Stock Price Prediction

49

2.3.3 Parameter Selection Criteria

When determining the parameters of the ARIMA-

SARIMA hybrid model, suitable parameters can be

found by observing the ACF, PACF, and EACF plots,

as well as by computing the values of AIC and BIC.

In this article, the parameters are determined using the

AIC and BIC evaluation criteria.

The AIC and BIC serve distinct purposes. While

the AIC aims to approximate models to match real-

world situations, the BIC strives to identify the best-

fit model. BIC tends to favour relatively simpler

models and imposes a strong penalty on model

complexity. On the other hand, AIC emphasizes

model fit, which is often beneficial for time series

data with clear seasonality and trends, making it more

suitable for SARIMA models. By choosing a

combination of ARIMA (with the lowest BIC) and

SARIMA (with the lowest AIC), it is possible to

better adapt to different types of time series data.

When training the ARIMA-SARIMA hybrid

model, the main objective is to minimize the values

of AIC and BIC by selecting different parameters.

Smaller values of AIC and BIC indicate higher model

fitness, which correspondingly leads to improved

prediction accuracy. The ARIMA model can handle

relatively stationary data more effectively, while the

SARIMA model excels at capturing seasonality and

trends. The author used the ‘auto_arima’ function

from the ‘pmdarima’ library for automatic parameter

selection.

2.4 Evaluation Criteria

2.4.1 Residual Analysis

Residuals are the differences between model

predictions and actual observed values. Conducting

residual analysis helps assess whether the model can

capture the underlying structure in the data and

whether the residuals meet model assumptions, such

as independence and constant variance.

(14)

2.4.2 Rolling Forecast

Apply the model to the first-time point in the test set

to make the initial prediction. Then, add the observed

value to the training set and retrain the model. Repeat

this process until all time points in the test set have

been predicted. Calculate the prediction error for each

time point and assess the model's performance.

2.4.3 Cross-Validation

Divide the time series data into k folds, and for each

fold, use it as the test set while the remaining folds

serve as the training set. Fit an ARIMA-SARIMA

model on each fold and make predictions on the test

set. Calculate the prediction error for each fold.

3 RESULT

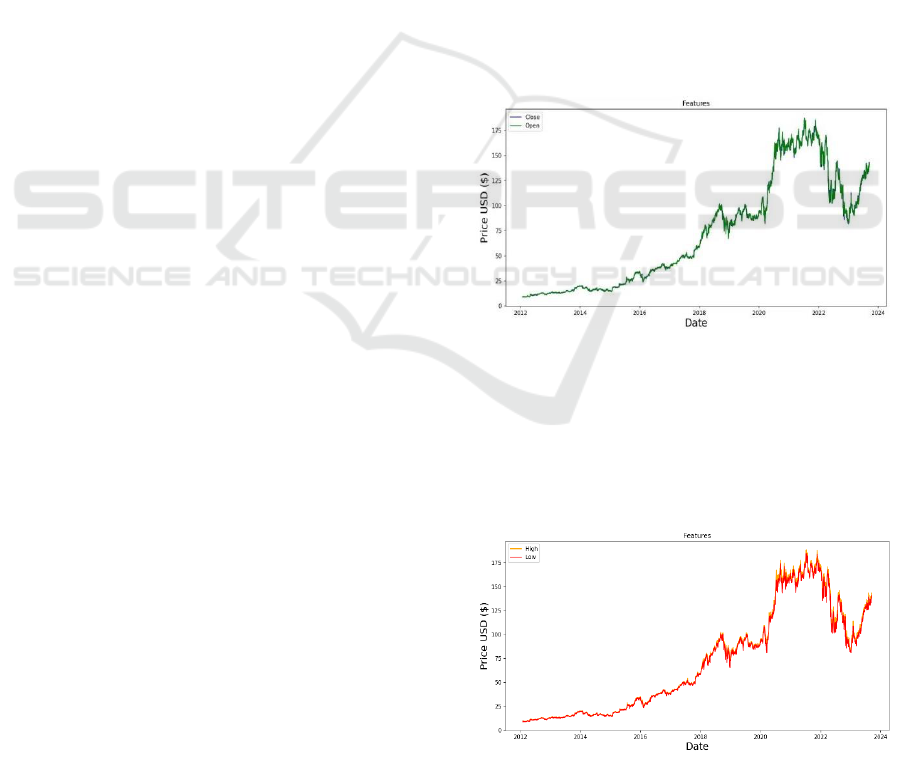

3.1 Feature Visualization

The following charts illustrate some of the key features

of Amazon (AMZN) stock over the past decade. In this

context, the closing price was chosen as the primary

feature, with RSI, SO, MA5, MA10, and MA20 being

considered as external influencing factors. The

opening and closing prices shown in Figure 1 were

extracted from data obtained from Yahoo Finance. A

simple data cleaning process was performed, removing

entries with NaN values and outliers.

Figure 1: The daily closing price and opening prices of

Amazon stock. (Picture credit: Original).

The daily highest and lowest prices shown in Fig.

2 were also extracted from data obtained from Yahoo

Finance. A simple data cleaning process was also

performed, removing entries with NaN values and

outliers.

Figure 2: The daily highest price and lowest prices of

Amazon stock. (Picture credit: Original).

DAML 2023 - International Conference on Data Analysis and Machine Learning

50

The data for these three features shown in Fig. 3

are calculated using the formula mentioned earlier in

the paper.

Figure 3: The daily moving average for the last five days,

ten days, and twenty days (MA5, MA10, MA20) of

Amazon stock. (Picture credit: Original).

The RSI shown in Fig. 4 below is calculated with

a time window of 14 periods.

Figure 4: The daily RSI of Amazon stock. (Picture credit:

Original).

In the Stochastic Oscillator visualization chart

(Fig. 5), the Main (%K) is represented as the blue solid

line, while the Signal (%D) is represented as the red

dots. The %K period is the period used in the

calculation of the oscillation indicator, with a default

value of 5.

Figure 5: The daily Stochastic Oscillator of Amazon stock.

(Picture credit: Original).

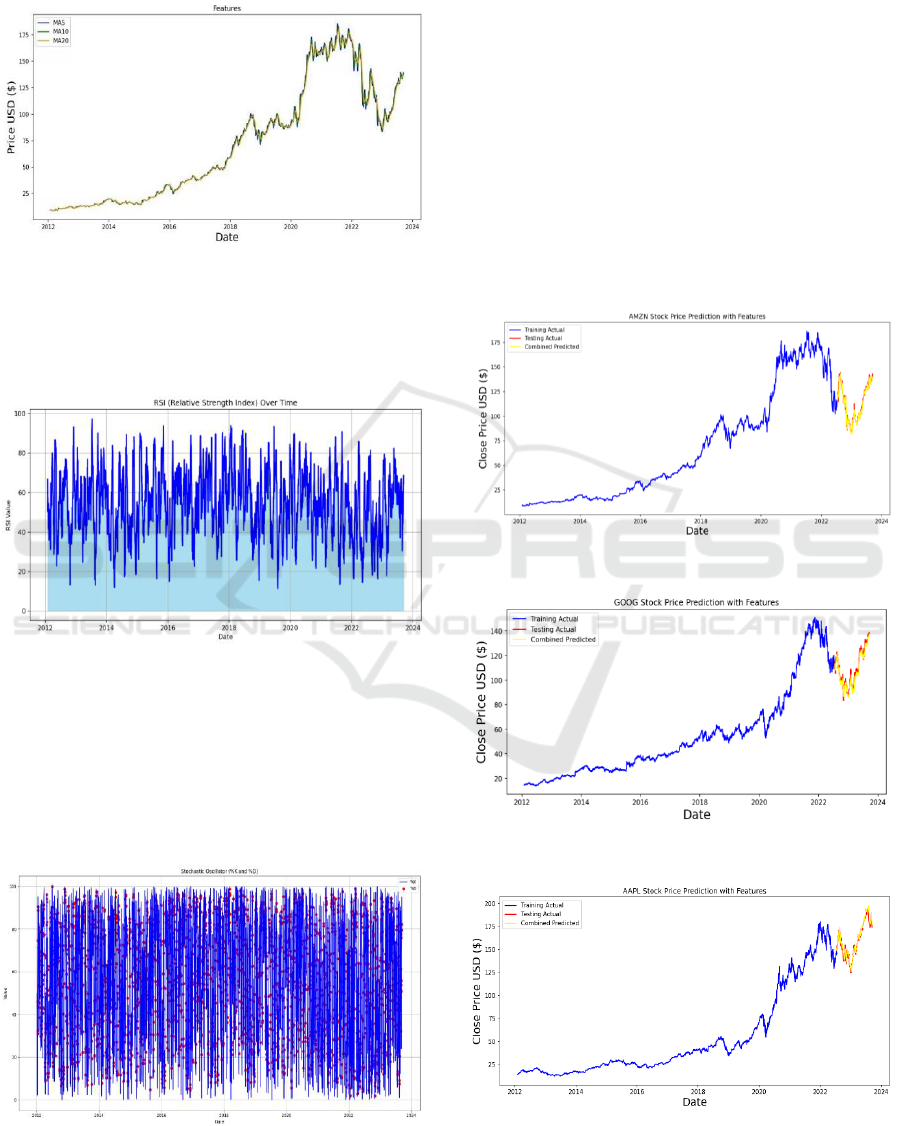

3.2 Predict Results

From Fig. 6, Fig. 7, and Fig. 8, it can be observed that

the ARIMA-SARIMA hybrid model achieves high

accuracy in predictions and does so within a very short

execution time. The results shown in the figure below

are based on a dataset obtained from the ‘yfinance’

library, which includes the daily opening, closing,

highest, and lowest stock prices of the respective

company over the past decade. After completing the

data preprocessing mentioned in this article, the data

was used for training and testing the hybrid model.

And 90% of the data was used as the training set, while

the remaining 10% was used as the test set. The red

curve represents the actual data of the test set, while

the yellow curve represents the results predicted by the

model.

Figure 6: AMZN Stock Price Prediction. (Original).

Figure 7: GOOG Stock Price Prediction. (Original).

Figure 8: AAPL Stock Price Prediction. (Original).

A Feature-Engineered ARIMA-SARIMA Hybrid Model for Stock Price Prediction

51

3.3 Evaluation

Fig. 9 displays the residual plot of the hybrid model,

demonstrating properties such as zero mean and

randomness. Fig. 9 depicts the residuals obtained

from the predictions for AMZN stock.

Figure 9: Residuals of ARIMA-SARIMA Model. (Picture

credit: Original).

The Mean Squared Error (MSE) of the hybrid

model obtained through rolling forecasting and cross-

validation is consistently less than 2.21. The author

conducted numerous model training for the AMZN

stock and calculated the average MSE from each

iteration. The average MSE of the hybrid model is

2.1914293478806233.

Under otherwise identical conditions, the average

MSE for predictions using a single ARIMA model i

s 2.579234434378756, and for a single SARIMA mo

del, it is 2.3328237024728707.

4 DISCUSSION

Numerous models have been developed in the

financial literature to predict return and volatility, but

the ARIMA model is the most widely used, which was

published by Arnerić & Poklepović in 2016 (Arnerić

et al 2014). Nevertheless, the ARIMA-SARIMA

hybrid model outperforms single ARIMA or

SARIMA models in terms of predictive capability.

This indicates that in stock prediction, there is a

combination of seasonal and non-seasonal factors.

However, the author reckons that hybridizing ARIMA

and SARIMA models might be a somewhat

adventurous endeavor. The hybrid model in this paper

precisely complements the seasonal factors that

ARIMA lacks with SARIMA and compensates for the

non-seasonal factors that SARIMA overlooks with

ARIMA. Through the assumed research and empirical

simulation analysis of the aforementioned quantitative

environment, the hybrid model proposed in the paper

yielded relatively favorable results in specific trading

contexts. This suggests that employing tools for

quantitative trading offers certain advantages.

Quantitative trading, due to its reliance on the rapid

and robust computational capabilities of computers,

holds an absolute advantage in market breadth

analysis (Li and Xia 2023). However, the factors

influencing stock price trends in the actual market are

intricate and diverse. Therefore, if various political

and economic factors affecting the stock market are

considered alongside technical indicators as input

variables, better results may be obtained (Agrawal et

al 2013).

5 CONCLUSION

The stock price prediction model has been effectively

deployed using the aforementioned techniques, with

feature engineering emerging as a crucial step in

enhancing prediction accuracy for this regression

problem. In an effort to enhance stock price prediction

accuracy, this study aspires to introduce a fresh

perspective. Nonetheless, given the multitude of

factors influencing stock prices, the current model's

performance may not be entirely satisfactory. To

enhance the model's effec-tiveness, future research

should consider incorporating a wider array of factors.

REFERENCES

S. Ren, X. Wang, X. Zhou, Y. Zhou, “A novel hybrid model

for stock price forecasting integrating Encoder Forest

and Informer,” Expert Systems with Applications,

Volume 234, 2023, 121080, ISSN 0957-4174,

https://doi.org/10.1016/j.eswa.2023.121080.

F.X. Deng, “Application of LSTM Neural Network in Stoc

k Price Trend Prediction,” Master's thesis, Guangdong

University of Foreign Studies, 2019, https://kns.cnki.n

et/kcms2/article/abstract?v=InnWydrwIfKm2Z35Pntd

CsfBawT604FUNihTlaJLVNqnhwfaWN2kRbqki1Rd

MbUheTK2Jlwt62CDDuzq1y4XMGZfX6rsdojNBX4

W5a9KbSVOrrjLI6JZT74wL9yytntgCzw4WYEVzXo

=&uniplatform=NZKPT&language=CHS.

H. Herwartz, “Stock return prediction under GARCH — An

empirical assessment,” International Journal of

Forecasting, vol. 33, pp. 569-580, 2017.

W. Budiharto, “Data science approach to stock prices

forecasting in Indonesia during Covid-19 using Long

Short-Term Memory (LSTM),” Journal of Big Data,

vol. 8, 2021.

J. Pomponi, S. Scardapane, and A. Uncini, “Structured

Ensembles: an Approach to Reduce the Memory

Footprint of Ensemble Methods,” Neural Networks,

vol. 144, pp. 407-418, 2021.

Y. Yun and Y. Rui, “Application Validity Test of RSI Indi

cator in Bond Trading Decision,” Modern Business, no

DAML 2023 - International Conference on Data Analysis and Machine Learning

52

36, pp. 123-126, 2022, https://doi.org/10.14097/j.cnki.

5392/2022.36.023.

Shali, “Research on Regional Electricity Consumption

Forecasting Method Based on ARIMA Model and

Regression Analysis,” Master's thesis, Nanjing

University of Science and Technology, 2013.

J. Arnerić, T. Poklepović, and Z. Aljinović, “GARCH based

artificial neural networks in forecasting conditional

variance of stock returns,” Croatian Operational

Research Review, vol. 5, pp. 329-343, 2014.

X. Li and H. Xia, “Research on Stock Price Regression

Prediction Based on Machine Learning Algorithms,”

Science and Technology Information, no. 14, pp. 227-

231, 2023.

J. Agrawal, V.S. Chourasia, and A.K. Mittra, “State-of-the-

Art in Stock Prediction Techniques,” International

Journal of Advanced Research in Electrical, Electronics

and Instrumentation Energy, vol. 2, pp. 1360-1366,

2013.

A Feature-Engineered ARIMA-SARIMA Hybrid Model for Stock Price Prediction

53