Evaluating the Directional-Weighted Mean Absolute Error in Long

Short-Term Memory Models for Stock Price Prediction

Shuaiting Li

Center for Languages and International Education, University College London, London, United Kingdom

Keywords: Stock Price Prediction, Long Short-Term Memory (LSTM), Directional-Weighted Mean Absolute Error

(D-MAE), Loss Function.

Abstract: In the intricate landscape of financial forecasting, accurate prediction of stock prices remains a pivotal

challenge, demanding continual innovation in modeling techniques. This paper introduces the Directional-

Weighted Mean Absolute Error (D-MAE) as a potential loss function to refine the predictive capabilities of

Long Short-Term Memory (LSTM) models. Leveraging a comprehensive dataset of leading technology firms,

namely Apple Inc., Alphabet Inc., Microsoft Corporation, and Amazon.com, Inc., spanning from January 1,

2012, to September 1, 2023, the research contrasts the performance of D-MAE against conventional loss

functions. D-MAE's uniqueness stems from its ability to weigh prediction errors differentially based on the

accuracy of directional stock price movements, striving for an equilibrium between numerical prediction

precision and the discernment of price trends. Preliminary assessments, utilizing metrics such as accuracy,

precision, recall, and F1-score, offer insights into D-MAE's potential benefits in the realm of stock price

forecasting. This exploration underlines the evolving nature of financial analytics and the pressing need to

integrate innovative methodologies that can capture the nuanced dynamics of global stock markets.

1 INTRODUCTION

The world of finance has been fascinated by the

prospect of predicting stock prices, a challenging task

that carries immense significance for investors,

traders, and financial institutions (Gandhmal and

Kumar 2019). Over the years, this quest for predictive

power has seen significant advancements, thanks to

the rise of machine learning and deep learning

techniques (Chhajer et al 2022 & Ahlawat 2023). In

this paper, we embark on a journey into the realm of

stock price prediction, armed with a comprehensive

dataset encompassing the stock prices of four of the

most influential technology giants in the world: Apple

Inc (AAPL), Alphabet Inc (GOOG), Microsoft

Corporation (MSFT), and Amazon.com, Inc (AMZN).

Spanning from January 1, 2012, to September 1, 2023,

this dataset offers a rich and extensive repository of

historical stock price data.

Stock markets are dynamic ecosystems influenced

by a multitude of factors, including economic

indicators, geopolitical events, and investor sentiment

(Qiu et al 2022). The ability to anticipate market

movements and stock price fluctuations is not only a

scientific endeavor but also a critical component of

investment decision-making. As such, the intersection

of financial markets and machine learning has become

an area of immense interest and promise.

This paper delves into the multifaceted world of

stock price prediction, dissecting the techniques and

methodologies that drive modern financial

forecasting. The heart of our analysis lies in the

examination of various loss functions and their impact

on the performance of a Long Short-Term Memory

(LSTM) model—a type of recurrent neural network

renowned for its prowess in handling sequential data

(Nabipour et al 2020). Our overarching objective is

not merely to predict stock prices with precision but

also to understand and capture the directional

movements of stock prices. This understanding is

paramount, as investors often base their decisions not

solely on price levels but on whether prices are likely

to rise or fall.

To assess the efficacy of our predictive model, we

employ a range of metrics commonly used in

classification problems. These metrics include

accuracy, precision, recall, and the F1-score. By

adopting these criteria, we gain insights into not only

how well our model predicts stock price levels but also

Li, S.

Evaluating the Directional-Weighted Mean Absolute Error in Long Short-Term Memory Models for Stock Price Prediction.

DOI: 10.5220/0012814700003885

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Analysis and Machine Learning (DAML 2023), pages 171-177

ISBN: 978-989-758-705-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

171

its ability to discern whether prices are poised to

ascend or descend.

This paper will comprehensively present the

dataset under scrutiny, elucidate the intricate steps

taken to preprocess the data, shed light on the

architecture of our LSTM model, delve into the

nuances of the diverse loss functions used, and

delineate the evaluation criteria employed to gauge the

model's performance. In the grand scheme of our

exploration, we do not merely seek to predict stock

prices; we strive to decode the essence of stock market

dynamics—a complex interplay of data, human

psychology, and economic forces.

As we traverse through this analysis, it becomes

evident that the choice of a loss function wields a

profound influence on the predictive capabilities of

our model. Each loss function, whether it is the

traditional Mean Squared Error (MSE), Mean

Absolute Error (MAE), the relative error-centric Mean

Absolute Percentage Error (MAPE), or the innovative

Differenced Mean Absolute Error (D-MAE), carries

its own set of strengths and limitations. In the ever-

shifting landscape of stock price prediction, where

both numeric accuracy and directional insights are

paramount, the selection of an appropriate loss

function emerges as a critical decision.

Furthermore, our investigation reveals that the

performance of our model varies across different

stocks, reflecting the idiosyncrasies of each company's

stock price behavior. This underscores the importance

of tailoring predictive models to suit the specific

characteristics of individual stocks—a lesson that

resonates with investors and financial analysts alike.

In the continuously evolving realm of stock price

prediction, our findings underscore the pivotal role

played by loss functions in achieving optimal results.

As technology advances and data availability

continues to expand, the potential for more accurate

and insightful stock price predictions remains on a

promising trajectory. The confluence of machine

learning and finance holds the promise of unveiling

new horizons in understanding and forecasting

financial markets—an endeavor that continues to

captivate the financial world.

2 METHOD

2.1 Dataset

The author utilizes stock price data from four

prominent technology corporations: Apple Inc.

(AAPL), Alphabet Inc. (GOOG), Microsoft

Corporation (MSFT), and Amazon.com, Inc (AMZN).

This dataset was collected from Yahoo Finance and

covers the time span from January 1, 2012, to

September 1, 2023 (Yahoo 2023). The selected dataset

comprises a total of 11,740 rows and 7 columns of

data. A few illustrative examples from this dataset are

presented in table 1.

2.2 Dataset Pre-Processing

The close price of the stock is selected as the sole input

feature and prediction target for this study. To

facilitate the modeling process, the close price data is

subjected to scaling using a Min-Max scaler, resulting

in values normalized between 0 and 1. This scaling

ensures that the data is within a consistent range for

the LSTM model (Huang 2022).

Table 1: Examples in the Dataset.

Date

Open

High

Low

Close

Adj Close

Volume

company_name

2023-08-18

131.6199951

134.0700073

131.1499939

133.2200012

133.2200012

48469400

AMAZON

2023-08-21

133.7400055

135.1900024

132.7100067

134.6799927

134.6799927

41442500

AMAZON

2023-08-22

135.0800018

135.6499939

133.7299957

134.25

134.25

32935100

AMAZON

2023-08-23

134.5

135.9499969

133.2200012

135.5200043

135.5200043

42801000

AMAZON

2023-08-24

136.3999939

136.7799988

131.8300018

131.8399963

131.8399963

43646300

AMAZON

2023-08-25

132.4700012

133.8699951

130.5800018

133.2599945

133.2599945

44147500

AMAZON

2023-08-28

133.7799988

133.9499969

131.8500061

133.1399994

133.1399994

34108400

AMAZON

2023-08-29

133.3800049

135.1399994

133.25

134.9100037

134.9100037

38646100

AMAZON

2023-08-30

134.9299927

135.6799927

133.9199982

135.0700073

135.0700073

36137000

AMAZON

2023-08-31

135.0599976

138.7899933

135

138.0099945

138.0099945

58781300

AMAZON

DAML 2023 - International Conference on Data Analysis and Machine Learning

172

The entire dataset is then divided into two distinct

segments. The initial 80% of the data is designated as

the training dataset, which serves as the foundation for

training the LSTM model. The remaining 20% of the

data is allocated as the testing dataset, which remains

untouched during training and is reserved for

evaluating the model's predictive performance.

2.3 Algorithm

In this paper, an LSTM (Long Short-Term Memory)

model is selected as a representative model to

demonstrate the impact of various loss functions on the

results of stock price predictions. LSTM network is a

recurrent neuron network. It is widely adopted in

research areas connected to sequential data (Houdt et

al 2020 & Cohen 2020). In this project, the author's

model consists of two LSTM layers with 128 and 64

units, respectively, and two Dense layers with 25 units

and 1 unit, respectively.

2.4 Loss Funtions

Mean Squared Error (MSE) is a widely used metric for

evaluating predictive models. It quantifies the average

squared difference between predicted and actual

values. MSE emphasizes larger errors due to the

squaring operation, making it useful for penalizing

significant deviations from the true values.

Mean Absolute Error (MAE) is a is a widely used

metric for evaluating predictive models. It quantifies

the average squared difference between predicted and

actual values. MSE emphasizes larger errors due to the

squaring operation, making it useful for penalizing

significant deviations from the true values.

Mean Absolute Percentage Error (MAPE) is a

percentage-based measure of error. It is suitable for

comparing the accuracy of models across different

datasets. It is capable when the scale of the data varies

as it is scale independent.

Directional-Weighted Mean Absolute Error (D-

MAE) is a percentage-based measure of error. It is

suitable for comparing the accuracy of models across

different datasets. It is capable when the scale of the

data varies as it is scale independent.

2.5 Evaluation Criteria

While stock price predictions are essentially a

regression problem, it is crucial to note that,

particularly in the short term, investors' decisions are

often influenced more by the directional movements of

stock prices than the precise price figures (Ochiai and

Nacher 2014). Therefore, the author employs a range

of evaluation criteria typically associated with

classification problems to assess the model's

performance in predicting whether stock prices will

rise or fall.

Accuracy is calculated by dividing the number of

correct predictions of stock price movements (both

rising and falling) by the total number of predictions

made. It provides a percentage representing the

proportion of accurately predicted directional

movements in stock prices, indicating the model’s

capacity to anticipate stock price trends.

Precision provides an assessment of the model's

prediction risk. It is calculated by dividing the number

of true positive predictions (correctly predicted rising

stock prices) by the total number of predicted rising

stock prices. A higher precision indicates a lower risk

of false alarms in predicting upward stock price

movements, highlighting the model's reliability in

identifying positive trends.

Recall reflects the model's ability to seize

opportunities in predicting rising stock prices. It is

calculated by dividing the number of true positive

predictions (correctly predicted rising stock prices) by

the total number of actual rising stock prices. A higher

recall indicates the model's effectiveness in capturing

genuine upward stock price movements and

maximizing the potential for identifying positive

trends.

The F1-score is a comprehensive metric that

balances the precision and recall of the model's

predictions. It is calculated by taking the harmonic

mean of precision and recall. The F1-score provides a

single value that combines the model's ability to

accurately identify positive trends (precision) and its

capacity to seize opportunities (recall). A higher F1-

score signifies a well-balanced performance in

predicting rising stock prices while minimizing the risk

of false alarms.

Evaluating the Directional-Weighted Mean Absolute Error in Long Short-Term Memory Models for Stock Price Prediction

173

3 RESULT

3.1 Pre-Processed Data

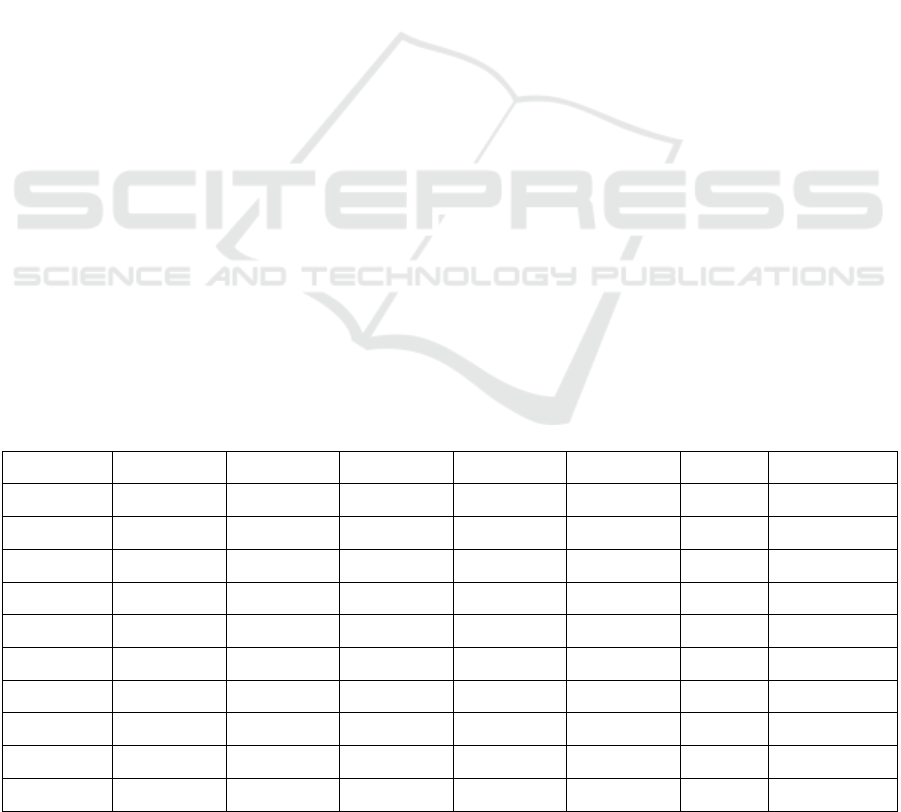

The dataset is split into a training set and a test set with

a ratio of 4:1. For all four companies, the closing price

rose gradually before reaching a peak by the end of the

year 2021, after which strong fluctuation can be

observed. Fig. 1 provides a brief insight into the dataset

division.

Figure 1: Sub datasets for training and testing (Credit:

Original).

Then the author employed a Min-Max scaler to

normalize all the training data to between 0 and 1,

which is the consistent range for LSTM model. After

applying the scaler, data preserves most of their

features.

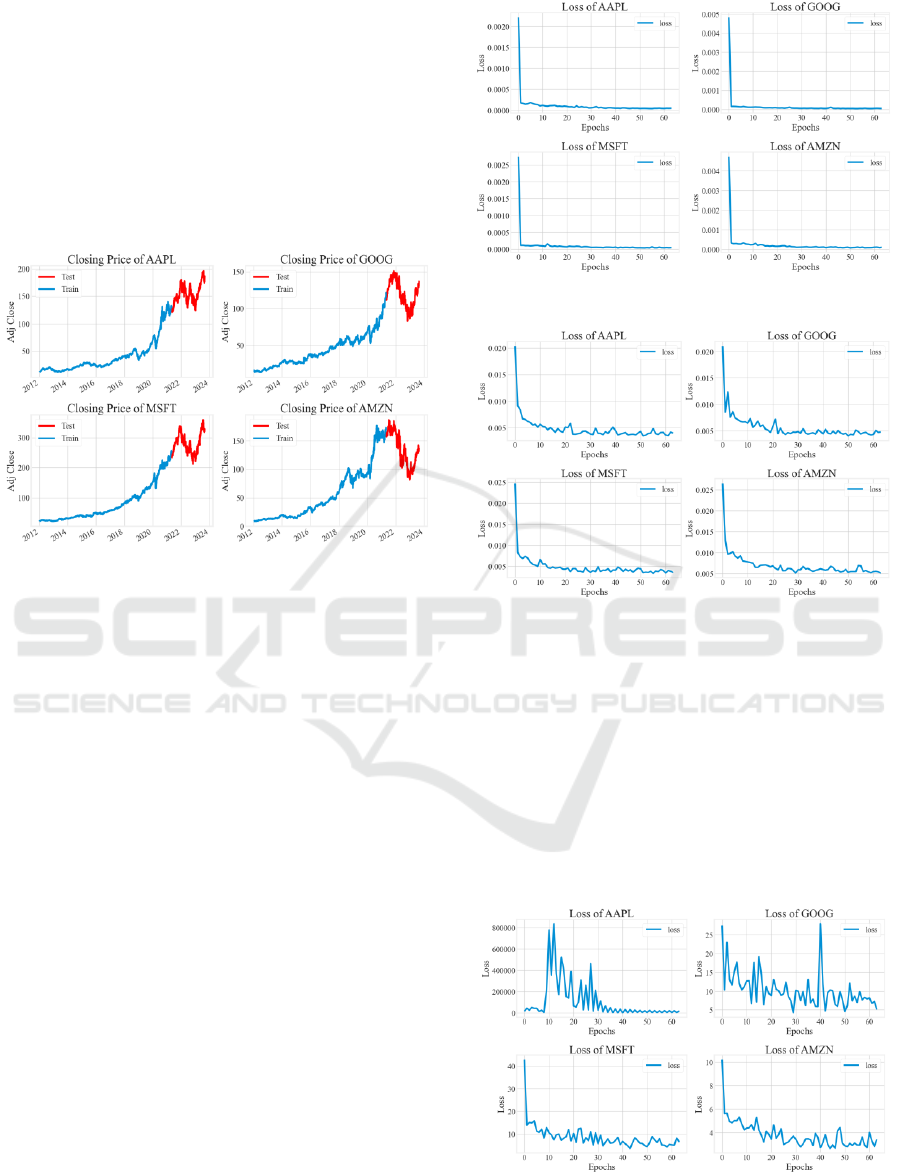

3.2 The Training Process of the Models

The LSTM model is trained for 64 epochs on the batch

size of 32. The model’s performance varies

significantly with different loss function. In most

cases the model converges after 64 epochs.

With MSE as loss function and ADAM as

optimizer, the model fitted well on the train data. On

datasets of all four stocks, the model shows sign of

convergence within 30 epochs. The figure for loss

dropped rapidly in the initial few epochs, after which

the loss figure remained stable. The training history

with MSE is illustrated in Fig. 2.

Compared to MSE, when using MAE as loss

function, the model converges slower in a few initial

epochs, and the fluctuation in the loss figure is more

noticeable. In all four cased, the model shows signs of

convergence within 40 epochs. The training history

with MAE is illustrated in Fig. 3.

Figure 2: Fitting process with MSE (Credit: Original).

Figure 3: Fitting process with MAE (Credit: Original).

In the fitting process with MAPE as loss function,

stronger fluctuation in the figure for loss can be clearly

observed. On datasets consisting of stock price of

Apple Inc, Microsoft and Amazon, the model

eventually shows sign of convergence while on the

data of Google, the fluctuation is so strong that no clear

sign of convergence can be observed. It is also

noteworthy that although the model converges on the

data of Apple Inc, the loss is too high after convergence

for the predictions to be plausible. The training history

with MAPE can be found in Fig. 4.

Figure 4: Fitting process with MAPE (Credit: Original).

DAML 2023 - International Conference on Data Analysis and Machine Learning

174

The fitting process with D-MAE follows similar

pattern to that with MAE. The model shows signs of

convergence within 40 epochs. The training history

with D-MAE can be found in Fig. 5.

Figure 5: Fitting process with D-MAE (Credit: Original).

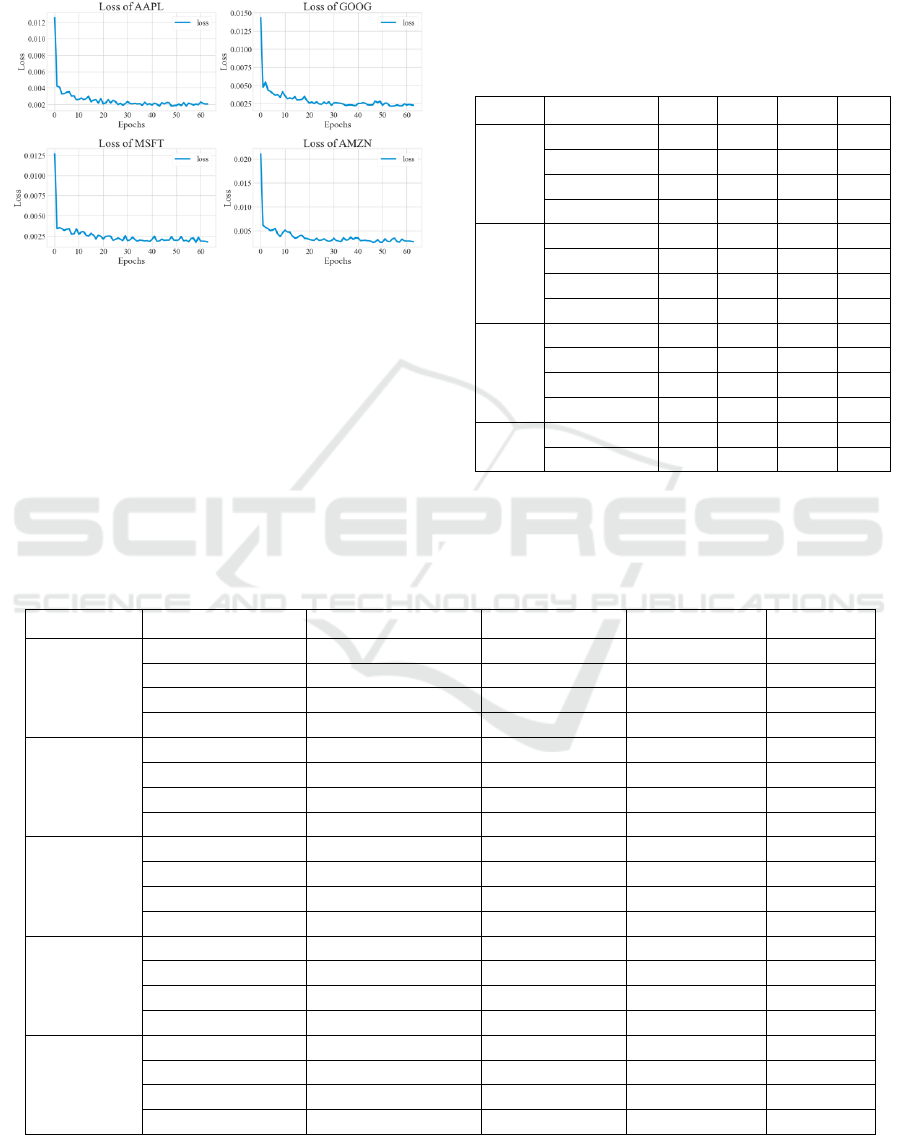

3.3 Performance Evaluation

The author defines the directional movement of stock

prices as follows. If the stock price on day i is higher

than or equal to that on day i+1, then the movement of

day i is downward, and is a negative event. Otherwise,

the trend is upward and it is a positive event. If a

prediction matches the actual directional movement,

the event is defined as true. If predicted and actual

trend don’t match, the event is defined as false.

Then the author calculated the number of four kind

of events, TN (true negative), TP (true positive), FN

(false negative) and FP (false positive), on four

different stocks using four different loss functions

respectively. A brief insight of the data can be found

in table 2.

Table 2: Number of Four Events.

Stock

Loss function

TN

TP

FN

FP

AAPL

MSE

212

243

67

64

MAE

152

268

126

40

MAPE

0

284

302

0

D-MAE

94

292

186

14

GOOG

MSE

197

251

85

53

MAE

141

268

148

29

MAPE

132

263

154

37

D-MAE

219

207

69

91

MSFT

MSE

275

139

21

151

MAE

226

213

68

79

MAPE

98

279

191

18

D-MAE

282

86

6

212

AMZN

MSE

94

292

186

14

MAE

219

207

69

91

The author calculates the accuracy, precision, recall

and F1-score in each case according to those criteria

stated before. Specific data is shown in table 3.

Table 3: Specific Data for Four Functions.

Stock

Loss function

Accuracy

Precision

Recall

F1-score

AAPL

MSE

0.776451

0.791531

0.783871

0.787682

MAE

0.716724

0.87013

0.680203

0.763533

MAPE

0.484642

1

0.484642

0.652874

D-MAE

0.658703

0.954248

0.610879

0.744898

GOOG

MSE

0.764505

0.825658

0.747024

0.784375

MAE

0.697952

0.902357

0.644231

0.751753

MAPE

0.674061

0.876667

0.630695

0.733612

D-MAE

0.726962

0.694631

0.75

0.721254

MSFT

MSE

0.706485

0.47931

0.86875

0.617778

MAE

0.749147

0.729452

0.758007

0.743455

MAPE

0.643345

0.939394

0.593617

0.72751

D-MAE

0.627986

0.288591

0.934783

0.441026

AMZN

MSE

0.658703

0.954248

0.610879

0.744898

MAE

0.726962

0.694631

0.75

0.721254

MAPE

0.742321

0.833898

0.706897

0.765163

D-MAE

0.757679

0.802817

0.726115

0.762542

Average

MSE

0.740188

0.74844

0.763661

0.736765

MAE

0.72792

0.817053

0.718622

0.759422

MAPE

0.607509

0.776163

0.660934

0.638755

D-MAE

0.721416

0.821399

0.698472

0.748464

Evaluating the Directional-Weighted Mean Absolute Error in Long Short-Term Memory Models for Stock Price Prediction

175

4 DISCUSSION

The results elucidate the capabilities of the LSTM

model in forecasting stock prices, specifically

emphasizing the pivotal role of the loss function in

shaping predictive outcomes. Our evaluation, covering

accuracy, precision, recall, and F1-score, offers a

panoramic view of the model's prowess in discerning

the directional tendencies of stock prices.

4.1 Evaluation of Loss Functions

The study's chosen gamut of loss functions—Mean

Squared Error (MSE), Mean Absolute Error (MAE),

Mean Absolute Percentage Error (MAPE), and

Differenced Mean Absolute Error (D-MAE)—reveal

diverse impacts on the model's forecasting acumen:

MSE and MAE: Revered as classical loss

functions, both MSE and MAE underscore numerical

prediction accuracy concerning stock price values.

However, their potential to accurately map directional

nuances remains under question.

MAPE: Emphasizing relative error, MAPE

appears less adept for tasks demanding high precision,

such as stock prediction, primarily due to its

susceptibility to extreme values.

D-MAE: Emerging as a potential frontrunner, D-

MAE is custom-tailored to enhance traditional MAE by

factoring in the intricacies of stock price directionality,

thus demonstrating a commendable balance between

numerical accuracy and trend discernment.

4.2 Distinct Stock Performances

A closer observation of individual stocks—AAPL,

GOOG, MSFT, and AMZN—unveils distinct

predictive patterns. These patterns are likely driven by

the inherent market behaviors unique to each

company, emphasizing the need for tailored models or

strategies when predicting for specific stocks.

4.3 Comparative Analysis and Insights

The juxtaposition of different loss functions brings to

light the criticality of this choice in achieving superior

predictive results. While traditional loss functions like

MSE and MAE depict a decent performance,

specialized ones like D-MAE manifest an edge in

balancing prediction accuracy with trend identification.

4.4 Future Directions

Navigating the intricate maze of stock price

predictions necessitates an in-depth understanding of

various loss functions and their implications. As we

stride forward, research endeavors should pivot

towards exploring avant-garde loss functions and

refining model architectures, keeping pace with the

ever-evolving financial market landscape.

5 CONCLUSION

The endeavor to predict stock price movements is a

challenging and multifaceted process, given the

intricacies of global financial markets. By utilizing an

LSTM model and exploring the effects of different loss

functions on its predictive performance, this study has

shed light on the importance of selecting an

appropriate loss function. While traditional loss

functions like MSE and MAE provide reasonable

results, specialized loss functions such as D-MAE

emerge as better-suited for capturing the nuances of

stock price directionality. As financial markets

continually evolve, research in this realm should

remain iterative and adaptive, continually optimizing

algorithms and methodologies to improve prediction

accuracy and inform strategic investment decisions.

REFERENCES

D. P. Gandhmal and K. Kumar, “Systematic analysis and

review of stock market prediction techniques,”

Computer Science Review, vol. 34, p. 100190, 2019.

P. Chhajer, M. Shah, and A. Kshirsagar, "The applications

of artificial neural networks, support vector machines,

and long–short term memory for stock market

prediction," Decision Analytics Journal, vol. 2, p.

100015, 2022.

S. Ahlawat, Reinforcement Learning for Finance: Solve

Problems in Finance with CNN and RNN Using the

TensorFlow Library. Berkeley, CA: Apress L. P., 2023.

Y. Qiu, Y. Ren, and T. Xie, "Global factors and stock market

integration," International Review of Economics &

Finance, vol. 80, pp. 526–551, 2022.

M. Nabipour et al., "Deep learning for stock market

prediction," Entropy, vol. 22, no. 8, p. 840, 2020.

Yahoo Finance, "Download historical data in Yahoo

Finance," 2023. [online].

Available:https://help.yahoo.com/kb/SLN2311.html.

[Accessed : 07-Nov-2023]

L. Huang, Normalization Techniques in Deep Learning.

CA: Springer International Publishing, 2022.

G. V. Houdt, C. Mosquera and G. Napoles, “A review on

the long short-term memory model”, Artif Intell Rev 53,

pp. 5929-5955, 2020.

DAML 2023 - International Conference on Data Analysis and Machine Learning

176

S. Cohen, "Overview of advanced neural network

architectures," in Artificial Intelligence and Deep

Learning in Pathology. Elsevier, 2020, pp. 41–56.

T. Ochiai and J. C. Nacher, "Volatility-constrained

correlation identifies the directionality of the influence

between Japan’s Nikkei 225 and other financial

markets," Physica A, vol. 393, pp. 364–375, 2014.

Evaluating the Directional-Weighted Mean Absolute Error in Long Short-Term Memory Models for Stock Price Prediction

177